Insurance companies determine risk exposure by Idea

Home » Trend » Insurance companies determine risk exposure by IdeaYour Insurance companies determine risk exposure by images are available. Insurance companies determine risk exposure by are a topic that is being searched for and liked by netizens today. You can Get the Insurance companies determine risk exposure by files here. Find and Download all royalty-free photos.

If you’re looking for insurance companies determine risk exposure by images information related to the insurance companies determine risk exposure by interest, you have come to the right blog. Our site frequently provides you with hints for seeking the highest quality video and picture content, please kindly hunt and find more informative video articles and graphics that match your interests.

Insurance Companies Determine Risk Exposure By. Most of this actuarial information is complex, proprietary, and not generally available to the public. 1 insurers pool risks by accepting a large number of policyholders that have a low risk of incurring losses. In risk transfer, losses are actually transferred to a third party, such as an insurance company. This appetite or attraction for risk depends on a multitude of factors, in particular:

Insurance companies aren’t covering cell phone and WiFi From nexusnewsfeed.com

Insurance companies aren’t covering cell phone and WiFi From nexusnewsfeed.com

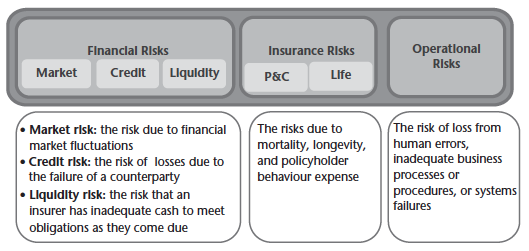

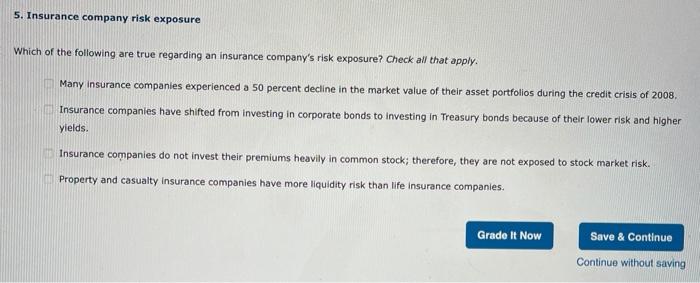

In general, companies can take two approaches to calculating risk exposure, a quantitative approach and a qualitative one. Insurance and reinsurance companies do not all share the same vision of risk, with guidelines varying considerably from one company to another. In exchange for transferring this risk, the individual or business pays the insurance company a premium. Termwhich of these are considered to be events or conditions that increase the chances of an insured�s loss? Most of these formulas, though, are some variation of what is known as the pure premium method. People with higher loss exposure have the tendency to purchase insurance more often than those at average risk.

Measuring and managing catastrophe risk introduction property insurance companies have been concerned with the risk of catastrophic loss and have used mapping as a method to control their exposure since the 1800s when insurance companies were hit by fires in major cities (boston, chicago and philadelphia).

In business, risk exposure is often used to rank the probability of different types. Since enterprise risk management is a key current concept today, the enterprise risk map of. Let’s look at the quantitative approach first, then the qualitative approach. The actuaries at large insurers use complicated risk models and many factors to determine exposure. A loss exposure is a possibility of loss, it is more specifically, the possibility of financial loss that a particular entity or organization faces as a result of a particular peril striking a particular thing that you have assigned value to. In business, risk exposure is often used to rank the probability of different types.

Source: lockton.com

Source: lockton.com

In exchange for transferring this risk, the individual or business pays the insurance company a premium. Exposure rating is a method used to calculate risk exposure in a reinsurance treaty without the reinsurer having previous exposure to the. The actuaries at large insurers use complicated risk models and many factors to determine exposure. In general, companies can take two approaches to calculating risk exposure, a quantitative approach and a qualitative one. All forms of insurance determine exposure through risk pooling and the law of large numbers.

Source: voxeu.org

Source: voxeu.org

All forms of insurance determine exposure through risk pooling and the law of large numbers. All forms of insurance determine exposure through risk pooling and the law of large numbers. Most of this actuarial information is complex, proprietary, and not generally available to the public. In exchange for transferring this risk, the individual or business pays the insurance company a premium. This appetite or attraction for risk depends on a multitude of factors, in particular:

These different formulas are why results vary widely when you receive quotes from multiple insurance companies. Law of large numbers and risk pooling. Each insurance company has its own proprietary formula to help determine its risk or exposure, which results in your premium. Perils can also be referred to as the accident itself. Risk pooling and the law of large numbers.

Source: pinterest.com

Source: pinterest.com

Risk pooling and the law of large numbers. Loss is the unintentional decrease in the value of an asset due to a peril. In business, risk exposure is often used to rank the probability of different types. Insurance companies determine risk exposure by which of the following? A loss exposure is a possibility of loss, it is more specifically, the possibility of financial loss that a particular entity or organization faces as a result of a particular peril striking a particular thing that you have assigned value to.

Source: circlecitysnark.blogspot.com

Source: circlecitysnark.blogspot.com

These different formulas are why results vary widely when you receive quotes from multiple insurance companies. Insurance companies determine risk exposure by which of the following? Understanding how insurance companies calculate risk helps you game the system. Which of these are considered to be events or conditions that increase the chances of an insured�s loss? Insurers make money by taking advantage of two statistical concepts:

Source: nexusnewsfeed.com

Source: nexusnewsfeed.com

Insurance and reinsurance companies do not all share the same vision of risk, with guidelines varying considerably from one company to another. Different insurance companies will have their own ways of calculating risk exposures and it will vary for different types of insurance. When an insurer issues an insurance contract, it agrees to assume the risks described in the policy in exchange for a premium. All forms of insurance determine exposure through risk pooling and the law of large numbers. These different formulas are why results vary widely when you receive quotes from multiple insurance companies.

![[Solved] While attempting to measure its risk exposure for [Solved] While attempting to measure its risk exposure for](https://ikmshukuk.netlify.app/img/placeholder.svg)

Which of these are considered to be events or conditions that increase the chances of an insured�s loss? Humans are really bad at calculating probability and risk. Insurance and reinsurance companies do not all share the same vision of risk, with guidelines varying considerably from one company to another. The size of the identified risks per risk groups, whereby the risk size of a particular risk group is defined by a larger number of individual risks. Insurers make money by taking advantage of two statistical concepts:

Source: pinterest.com

Source: pinterest.com

Insurance and reinsurance companies do not all share the same vision of risk, with guidelines varying considerably from one company to another. Casinos make money because we individually believe that. Your company be listed as an additional insured on the liability policies of the facility, organization or licensor. When an insurer issues an insurance contract, it agrees to assume the risks described in the policy in exchange for a premium. Insurance companies risk evaluation procedures takes into account the cost of risk and the ability of the company to underwrite it.

Source: insurewithpetra.com

Source: insurewithpetra.com

Let’s look at the quantitative approach first, then the qualitative approach. Insurance and reinsurance companies do not all share the same vision of risk, with guidelines varying considerably from one company to another. Measuring and managing catastrophe risk introduction property insurance companies have been concerned with the risk of catastrophic loss and have used mapping as a method to control their exposure since the 1800s when insurance companies were hit by fires in major cities (boston, chicago and philadelphia). Insurance companies risk evaluation procedures takes into account the cost of risk and the ability of the company to underwrite it. Risk exposure is a measure of possible future loss (or losses) which may result from an activity or occurrence.

Source: pl.icourban.com

Source: pl.icourban.com

Risk pooling and the law of large numbers. Perils can also be referred to as the accident itself. Risk exposure in any business or an investment is the measurement of potential future loss due to a specific event or business activity and is calculated as the probability of the even multiplied by the expected loss due to the risk impact. Measuring and managing catastrophe risk introduction property insurance companies have been concerned with the risk of catastrophic loss and have used mapping as a method to control their exposure since the 1800s when insurance companies were hit by fires in major cities (boston, chicago and philadelphia). Law of large numbers and risk pooling.

Source: circlecitysnark.blogspot.com

Source: circlecitysnark.blogspot.com

Most insurance today is a form of risk transfer. Probably the most important step in the risk management process is the identification or finding of. Casinos make money because we individually believe that. Most insurance today is a form of risk transfer. Humans are really bad at calculating probability and risk.

Source: slowmotion-kirppis.blogspot.com

Source: slowmotion-kirppis.blogspot.com

In risk transfer, losses are actually transferred to a third party, such as an insurance company. Risk pooling and the law of large numbers. Which of these are considered to be events or conditions that increase the chances of an insured�s loss? People with higher loss exposure have the tendency to purchase insurance more often than those at average risk. Understanding how insurance companies calculate risk helps you game the system.

Source: pl.icourban.com

Source: pl.icourban.com

Termwhich of these are considered to be events or conditions that increase the chances of an insured�s loss? These different formulas are why results vary widely when you receive quotes from multiple insurance companies. Most of these formulas, though, are some variation of what is known as the pure premium method. In business, risk exposure is often used to rank the probability of different types. Which of these are considered to be events or conditions that increase the chances of an insured�s loss?

The calculation of probability related to a particular event resulting in loss to the firm is an integral. Most of this actuarial information is complex, proprietary, and not generally available to the public. The insurance companies assess the amount of their overall exposure at the level of the company as a whole, i.e. These different formulas are why results vary widely when you receive quotes from multiple insurance companies. How to calculate risk exposure.

Source: circlecitysnark.blogspot.com

Source: circlecitysnark.blogspot.com

In business, risk exposure is often used to rank the probability of different types. In general, companies can take two approaches to calculating risk exposure, a quantitative approach and a qualitative one. Insurers make money by taking advantage of two statistical concepts: When an insurer issues an insurance contract, it agrees to assume the risks described in the policy in exchange for a premium. 1 insurers pool risks by accepting a large number of policyholders that have a low risk of incurring losses.

Source: intechrisk.com

Source: intechrisk.com

Risk is defined as the potential for loss. When an insurer issues an insurance contract, it agrees to assume the risks described in the policy in exchange for a premium. In exchange for transferring this risk, the individual or business pays the insurance company a premium. † sponsorship liability † general liability How to calculate risk exposure.

Source: pl.icourban.com

Source: pl.icourban.com

Most of these formulas, though, are some variation of what is known as the pure premium method. † sponsorship liability † general liability When an insurer issues an insurance contract, it agrees to assume the risks described in the policy in exchange for a premium. These different formulas are why results vary widely when you receive quotes from multiple insurance companies. Insurance companies determine risk exposure by which of the following?

Source: centor.co.uk

Source: centor.co.uk

Most of this actuarial information is complex, proprietary, and not generally available to the public. All forms of insurance determine exposure through risk pooling and the law of large numbers. This appetite or attraction for risk depends on a multitude of factors, in particular: Different insurance companies will have their own ways of calculating risk exposures and it will vary for different types of insurance. Risk evaluation is an essential function of an insurance company involving the company’s actuaries and risk managers who assess the quality of risk, the likelihood of its occurrence and the cost to policy owners.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insurance companies determine risk exposure by by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.