Insurance companies primarily reduce an individual s risk by information

Home » Trend » Insurance companies primarily reduce an individual s risk by informationYour Insurance companies primarily reduce an individual s risk by images are ready in this website. Insurance companies primarily reduce an individual s risk by are a topic that is being searched for and liked by netizens now. You can Download the Insurance companies primarily reduce an individual s risk by files here. Find and Download all free photos.

If you’re searching for insurance companies primarily reduce an individual s risk by pictures information linked to the insurance companies primarily reduce an individual s risk by keyword, you have pay a visit to the right blog. Our site frequently gives you suggestions for downloading the highest quality video and picture content, please kindly search and locate more enlightening video content and images that match your interests.

Insurance Companies Primarily Reduce An Individual S Risk By. Terms in this set (86) insurance companies (known as insurers or carriers) manufacture and sell insurance coverage in the form of insurance policies or contracts of insurance. The problem of ________ occurs when those most likely to get large insurance payoffs are the ones who want to purchase insurance the most. Introduction to the risks faced by insurance companies: (except when buying lottery tickets.) large organizations:

Insurance and its Essential Role to Play in the Life of an From thecheaperinsurance.com

Insurance and its Essential Role to Play in the Life of an From thecheaperinsurance.com

O spreading that risk across many individuals. This is because the insurance company in order to minimize the risk in their portfolio performs quantitative risk analysis. A) maximum loss they may sustain. The law allows banks, insurance companies, and investment firms to do business as single financial entities for the first time since the great depression. Terms in this set (86) insurance companies (known as insurers or carriers) manufacture and sell insurance coverage in the form of insurance policies or contracts of insurance. C) insurance premium they pay.

O transporting that risk forward in time.

C)spreading that risk across many individuals. The insurance is a form of risk management. Glb also imposed new privacy requirements on all financial institutions, defined to include insurance companies. Convertible adjustable preferred stock (caps) is a hybrid form of preferred stock. In reality, the risk assumed by the insurer is smaller in total than the The law allows banks, insurance companies, and investment firms to do business as single financial entities for the first time since the great depression.

Source: revisi.net

Source: revisi.net

This is because the insurance company in order to minimize the risk in their portfolio performs quantitative risk analysis. B) expected loss they may sustain. Unmanned drones are an insurance technology tool that will be utilized more by carriers in 2021. The problem of ________ occurs when those most likely to get large insurance payoffs are the ones who want to purchase insurance the most. Life insurance is a policy that combines protection against premature death with a savings account either as cash value or as investments in stocks, bonds, and money market mutual funds.

Source: opptrends.com

Source: opptrends.com

This is because the insurance company in order to minimize the risk in their portfolio performs quantitative risk analysis. The location of the structure in a particular flood hazard area designated on the firm, as well as the structure’s Insurance companies primarily reduce an individual’s risk by: In reality, the risk assumed by the insurer is smaller in total than the Reinsurers play a major role for insurance companies as they allow the latter to help transfer risk, reduce capital requirements, and lower claimant payouts.

Source: fineloans.co.za

Source: fineloans.co.za

Here is an essay on the risks faced by insurance companies. A) maximum loss they may sustain. Hence it allows insurer to identify which types of insurance are profitable and which are not. People buy insurance policies as a form of risk management in order to reduce the consequences of a potential future loss. Generally, households or firms with insurance make regular payments, called premiums.the insurance company prices these premiums based on the probability of certain events occurring among a pool of people.

Source: thesouthcottagency.com

Source: thesouthcottagency.com

O transporting that risk forward in time. Convertible adjustable preferred stock (caps) is a hybrid form of preferred stock. B) expected loss they may sustain. In reality, the risk assumed by the insurer is smaller in total than the Glb also imposed new privacy requirements on all financial institutions, defined to include insurance companies.

Source: newsofthenorth.net

Source: newsofthenorth.net

Introduction to the risks faced by insurance companies: O transporting that risk forward in time. Terms in this set (86) insurance companies (known as insurers or carriers) manufacture and sell insurance coverage in the form of insurance policies or contracts of insurance. Health insurance is provided primarily by life/health insurers but is also sold by some property/casualty insurers. Over larger gambles individuals tend to be risk averse.

Source: coverlink.com

Source: coverlink.com

The dividend payout is set at a. Introduction to the risks faced by insurance companies: Question 3 1 p which of the following actions does not help reduce risk? Spreading that risk across many individuals. We might conclude, therefore, that if an insurer sells n policies to n individuals, it assumes the total risk of the n individuals.

Source: commercemates.com

Source: commercemates.com

C)spreading that risk across many individuals. Unmanned drones are an insurance technology tool that will be utilized more by carriers in 2021. Convertible adjustable preferred stock (caps) is a hybrid form of preferred stock. People buy insurance policies as a form of risk management in order to reduce the consequences of a potential future loss. A)transporting that risk forward in time.

Source: revisi.net

Source: revisi.net

Transporting that risk forward in time. Insurance companies primarily reduce an individual�s risk by: Private life insurance companies provide insurance for these perils, and individuals voluntarily decide whether or not to buy their products. Over larger gambles individuals tend to be risk averse. Transporting that risk forward in time.

Source: issuu.com

Source: issuu.com

(1) the risks are small relative to the organization’s size. (except when buying lottery tickets.) large organizations: Most individuals with average wealth and good education tend to be risk neutral over small gambles. People buy insurance policies as a form of risk management in order to reduce the consequences of a potential future loss. Convertible adjustable preferred stock (caps) is a hybrid form of preferred stock.

Source: thecheaperinsurance.com

Source: thecheaperinsurance.com

Convertible adjustable preferred stock (caps) is a hybrid form of preferred stock. O transporting that risk forward in time. Spreading that risk across many individuals. It is primarily used to transfer risks of loss in exchange for payment of certain amount known as premium. We might conclude, therefore, that if an insurer sells n policies to n individuals, it assumes the total risk of the n individuals.

Source: insurancesamadhan.com

Source: insurancesamadhan.com

(1) the risks are small relative to the organization’s size. Glb also imposed new privacy requirements on all financial institutions, defined to include insurance companies. A)transporting that risk forward in time. C) insurance premium they pay. The problem of ________ occurs when those most likely to get large insurance payoffs are the ones who want to purchase insurance the most.

Source: choiceplusbenefits.com

Source: choiceplusbenefits.com

Here is an essay on the risks faced by insurance companies. O spreading that risk across many individuals. A) maximum loss they may sustain. Insurance companies primarily reduce an individual�s risk by: The insurance is a form of risk management.

Source: einsurance.com

Source: einsurance.com

Therefore, an insurer needs to consider a wide range of possible risks and the outcome that may affect the current and future financial position. Insurance companies primarily reduce an individual’s risk by: Reinsurance companies, or reinsurers, are companies that provide insurance to insurance companies. A)transporting that risk forward in time. Private life insurance companies provide insurance for these perils, and individuals voluntarily decide whether or not to buy their products.

Source: etrustedadvisor.com

Source: etrustedadvisor.com

Private life insurance companies provide insurance for these perils, and individuals voluntarily decide whether or not to buy their products. A) maximum loss they may sustain. Reinsurers generate revenue by identifying and accepting policies that they believe are. C) insurance premium they pay. O transporting that risk forward in time.

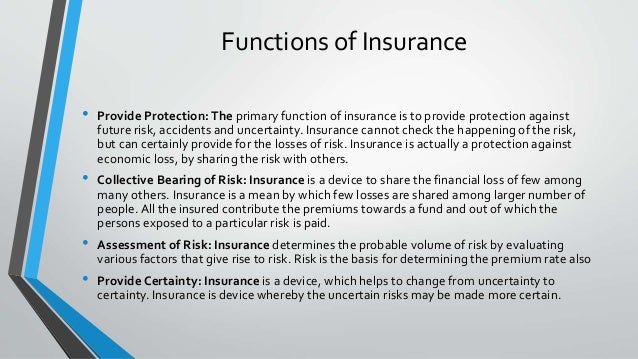

Source: slideshare.net

Source: slideshare.net

Spreading that risk across many individuals. Generally, households or firms with insurance make regular payments, called premiums.the insurance company prices these premiums based on the probability of certain events occurring among a pool of people. The insurer company is engaged in the business of selling the insurance, (willing to accept the risk) the person desirous of purchasing the insurance (willing to transfer the risks). Spreading that risk across many individuals. All of these are available on an individual and a group basis.

Source: thebalance.com

Source: thebalance.com

Insurance is a method that households and firms use to prevent any single event from having a significant detrimental financial effect. Life insurance is a policy that combines protection against premature death with a savings account either as cash value or as investments in stocks, bonds, and money market mutual funds. Terms in this set (86) insurance companies (known as insurers or carriers) manufacture and sell insurance coverage in the form of insurance policies or contracts of insurance. The insurance is a form of risk management. O spreading that risk across many individuals.

Source: paisabazaar.com

Source: paisabazaar.com

Over larger gambles individuals tend to be risk averse. Health insurance is provided primarily by life/health insurers but is also sold by some property/casualty insurers. Unmanned drones are an insurance technology tool that will be utilized more by carriers in 2021. Private life insurance companies provide insurance for these perils, and individuals voluntarily decide whether or not to buy their products. All of these are available on an individual and a group basis.

Source: ahip.org

Source: ahip.org

A)transporting that risk forward in time. Banks, insurance companies, firms tend to be risk neutral. The dividend payout is set at a. Insurance is a method that households and firms use to prevent any single event from having a significant detrimental financial effect. Unmanned drones are an insurance technology tool that will be utilized more by carriers in 2021.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance companies primarily reduce an individual s risk by by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.