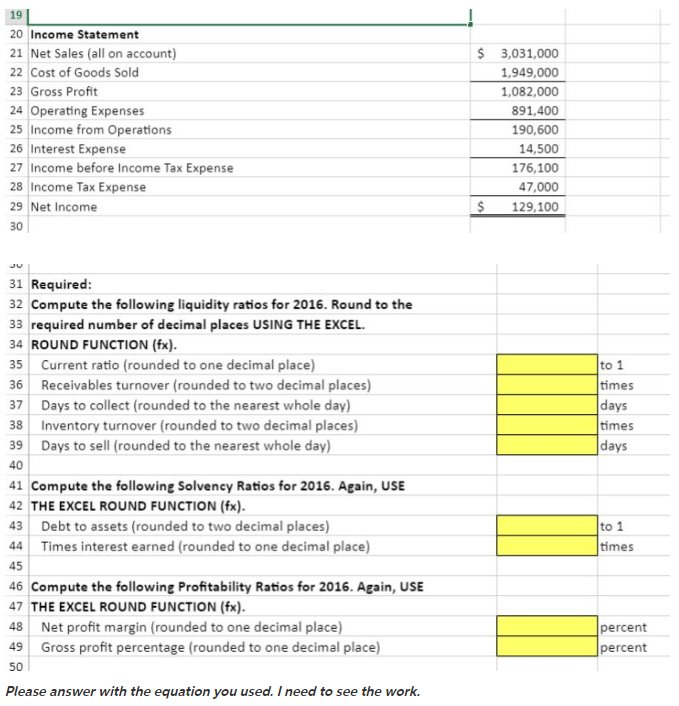

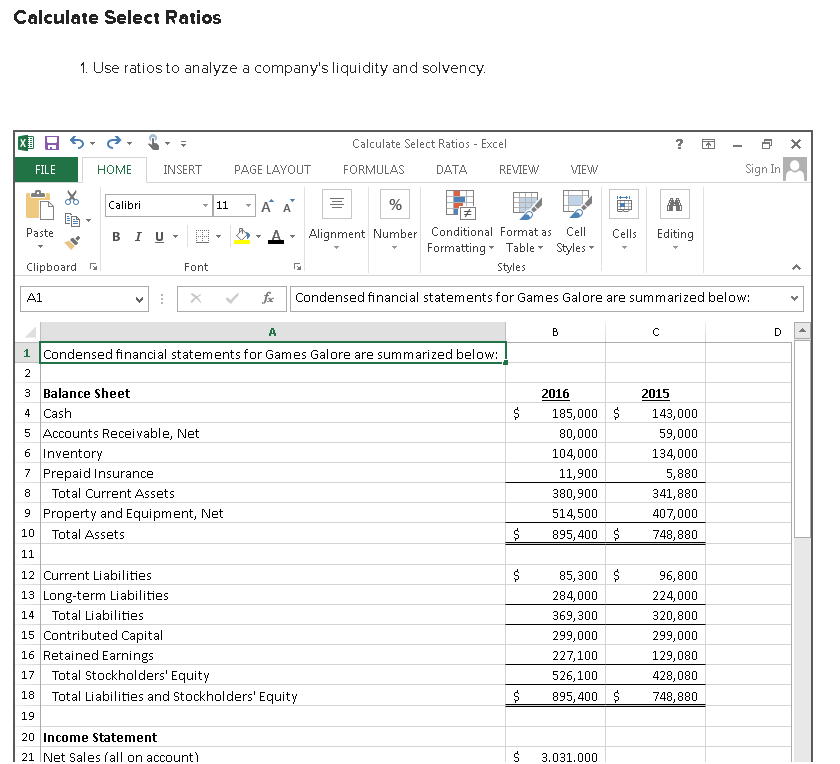

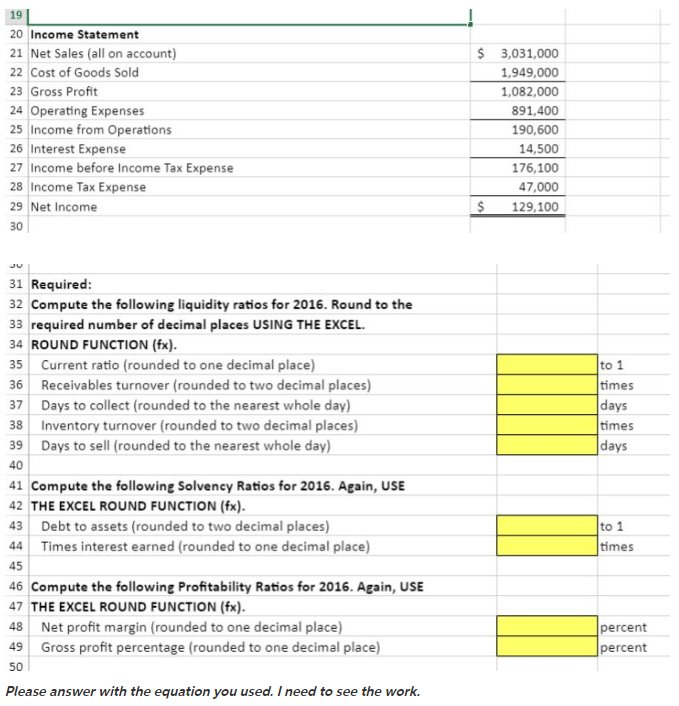

Insurance company liquidity ratio information

Home » Trending » Insurance company liquidity ratio informationYour Insurance company liquidity ratio images are ready in this website. Insurance company liquidity ratio are a topic that is being searched for and liked by netizens today. You can Get the Insurance company liquidity ratio files here. Download all free vectors.

If you’re searching for insurance company liquidity ratio pictures information related to the insurance company liquidity ratio topic, you have pay a visit to the ideal blog. Our website frequently provides you with hints for refferencing the highest quality video and picture content, please kindly search and locate more enlightening video content and graphics that match your interests.

Insurance Company Liquidity Ratio. Liquidity ratios determine how quickly a company can convert the assets and use them for meeting the dues that arise. This ratio is a type of liquidity ratio that measures the financial strength of a company. In the insurance regulatory information system (iris), liabilities to liquid assets and agent�s balances to surplus are monitored. The normal quick ratio for a company is 1.

Solvency Ratio Insurance Formula From zadishqr.blogspot.com

Solvency Ratio Insurance Formula From zadishqr.blogspot.com

That insurer is now going to have to find more money than it. This ratio is a type of liquidity ratio that measures the financial strength of a company. Current liquidity is the ratio of the total amount of cash and other ready resources or cash equivalents to the total liabilities of an insurance company. Our intension was to do some ratio analysis and interpret of those analyses and comparing. Liquidity ratios determine how quickly a company can convert the assets and use them for meeting the dues that arise. Absolute liquid assets/total current liabilities.

Median (recommended) average financial ratio

The normal quick ratio for a company is 1. What is a good liquidity ratio for an insurance company? 04 may 2017 1 2 3. This note examines the changes in the liquidity management at banks and nonbank financial firms in the united states that occurred following the proposal of the liquidity coverage ratio (lcr) requirement in 2010 and its finalization in 2014. Average industry financial ratios for u.s. Liquidity ratio — a measurement of key financial variables that impact an insurer�s ability to pay claims.

Source: forward4him.blogspot.com

Source: forward4him.blogspot.com

Generally, we take 2:1 as an ideal liquidity ratio for an insurance companybut it may vary from company to company. Liquidity ratios determine how quickly a company can convert the assets and use them for meeting the dues that arise. In the insurance industry, the overall liquidity ratio is described as. The higher the ratio, the easier is the ability to clear the debts and avoid defaulting on payments. China life insurance current ratio for the three months ending september 30,.

Source: forward4him.blogspot.com

Source: forward4him.blogspot.com

1.0 introduction 1.1 objective of the report as a course requirement of risk management & insurance, we are making this report. Company is willing to take. Current liquidity is the ratio of the total amount of cash and other ready resources or cash equivalents to the total liabilities of an insurance company. The quick liquidity ratio is a measure of an insurance company’s ability to easily meet its obligations. The higher the ratio, the easier is the ability to clear the debts and avoid defaulting on payments.

Source: zadishqr.blogspot.com

Source: zadishqr.blogspot.com

That insurer is now going to have to find more money than it. Ratio analysis of the insurance company. The overall liquidity ratio is calculated by. Insurance claims following a catastrophe. An abnormally high ratio means the company holds a large amount of liquid assets.

Source: noticias.mapfre.com

Source: noticias.mapfre.com

For example, a quick ratio of 1.5 for an insurance company shows that the company has $1.5 of liquid assets available to cover each $1 of its current liabilities. 04 may 2017 1 2 3. It is a gauge of financial strength. The insurance industry’s elephant in the room gareth sutcliffe and sam tufts, ey 04 may 2017. Property insurers are likely to have quick liquidity ratios greater than 30 percent, while liability insurers may have ratios above 20 percent.

Source: slideshare.net

Source: slideshare.net

Company is willing to take. If this ratio is less than. Liquidity management strategies for insurance companies: The insurance industry’s elephant in the room gareth sutcliffe and sam tufts, ey 04 may 2017. Absolute liquid assets/total current liabilities.

Liquidity ratio — a measurement of key financial variables that impact an insurer�s ability to pay claims. That insurer is now going to have to find more money than it. The overall liquidity ratio is calculated by. Liquidity ratios, profitability ratios, stock market value. Ratio analysis is used to evaluate various aspects of a company’s operating and financial performance such as its efficiency, liquidity, profitability and.

Source: forward4him.blogspot.com

Source: forward4him.blogspot.com

Imagine an insurer that has covered a lot of property and then there is a hurricane. The insurance industry’s elephant in the room gareth sutcliffe and sam tufts, ey 04 may 2017. For example, a quick ratio of 1.5 for an insurance company shows that the company has $1.5 of liquid assets available to cover each $1 of its current liabilities. Average industry financial ratios for u.s. The most severe liquidity stress scenario faced by life insurers is a mass surrender of policies that arise due to a loss in the confidence of the financial strength of a firm.

Source: la-banda-de-new-york.blogspot.com

Source: la-banda-de-new-york.blogspot.com

Liquidity ratios good liquidity helps an insurance company to meet policyholder’s obligations promptly. For example, if a company’s cash ratio was 8.5, investors and analysts may consider that too high. In this report we have analyzed five years data of four different insurance companies. For example, a quick ratio of 1.5 for an insurance company shows that the company has $1.5 of liquid assets available to cover each $1 of its current liabilities. Trading ratio (ctr), noc, roa, and opm on the market value of the stock, while there was an impact of the roe on the market value of the stock in jordanian insurance companies.

Source: chegg.com

Source: chegg.com

Insurance claims following a catastrophe. Ratio analysis is used to evaluate various aspects of a company’s operating and financial performance such as its efficiency, liquidity, profitability and. 04 may 2017 1 2 3. Generally, we take 2:1 as an ideal liquidity ratio for an insurance company but it may vary. Liquidity management strategies for insurance companies:

Source: napkinfinance.com

Source: napkinfinance.com

Generally, we take 2:1 as an ideal liquidity ratio for an insurance company but it may vary. A measurement of a company’s capacity to pay for its liabilities with its assets. Liquidity ratios determine how quickly a company can convert the assets and use them for meeting the dues that arise. This was experienced by life insurance company equitable life when it received an adverse legal ruling by the house of lords on its guaranteed annuity liabilities in 2001. In the insurance industry, the overall liquidity ratio is described as.

Source: forward4him.blogspot.com

Capital structure ratios include debt to equity and debt to asset ratios, and liquidity ratios include coverage ratios and solvency ratios. Liquidity management strategies for insurance companies: Insurance claims following a catastrophe. Average industry financial ratios for u.s. It is a gauge of financial strength.

Source: 1investing.in

Source: 1investing.in

It is also commonly used to picture out the relationship of both the current liabilities and current assets of the company. A measurement of a company’s capacity to pay for its liabilities with its assets. This note examines the changes in the liquidity management at banks and nonbank financial firms in the united states that occurred following the proposal of the liquidity coverage ratio (lcr) requirement in 2010 and its finalization in 2014. Company is willing to take. Property insurers are likely to have quick liquidity ratios greater than 30 percent, while liability insurers may have ratios above 20 percent.

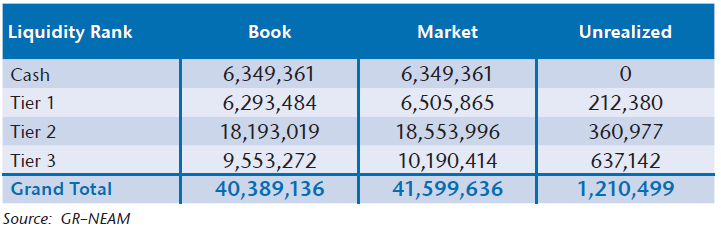

Source: neamgroup.com

Source: neamgroup.com

04 may 2017 1 2 3. The most severe liquidity stress scenario faced by life insurers is a mass surrender of policies that arise due to a loss in the confidence of the financial strength of a firm. The liquidity coverage ratio and corporate liquidity management. Current and historical current ratio for china life insurance (lfc) from 2010 to 2021. An insurer’s liquidity depends upon the degree to which it can satisfy its financial obligations by holding cash and investments that are sound, diversified and liquid or through operating cash flows.

Source: frasespollovers.blogspot.com

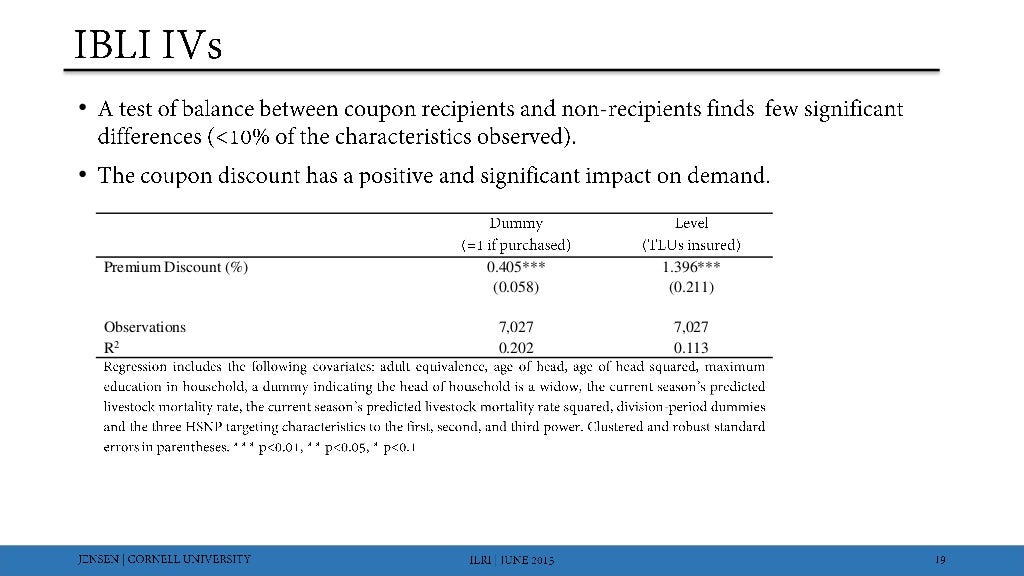

Median (recommended) average financial ratio Introduction analysis of financial statements is a tool to interpret the statements and determine the The insurance industry’s elephant in the room gareth sutcliffe and sam tufts, ey 04 may 2017. In the insurance industry, the overall liquidity ratio is described as. Average industry financial ratios for u.s.

Source: forward4him.blogspot.com

Source: forward4him.blogspot.com

The normal quick ratio for a company is 1. Average industry financial ratios for u.s. This note examines the changes in the liquidity management at banks and nonbank financial firms in the united states that occurred following the proposal of the liquidity coverage ratio (lcr) requirement in 2010 and its finalization in 2014. A measurement of a company’s capacity to pay for its liabilities with its assets. Trading ratio (ctr), noc, roa, and opm on the market value of the stock, while there was an impact of the roe on the market value of the stock in jordanian insurance companies.

Source: forward4him.blogspot.com

Source: forward4him.blogspot.com

This was experienced by life insurance company equitable life when it received an adverse legal ruling by the house of lords on its guaranteed annuity liabilities in 2001. Imagine an insurer that has covered a lot of property and then there is a hurricane. Ratio analysis of the insurance company. Generally, we take 2:1 as an ideal liquidity ratio for an insurance company but it may vary. 04 may 2017 1 2 3.

Source: investopedia.com

Source: investopedia.com

Our intension was to do some ratio analysis and interpret of those analyses and comparing. An insurer’s liquidity depends upon the degree to which it can satisfy its financial obligations by holding cash and investments that are sound, diversified and liquid or through operating cash flows. Capital structure ratios include debt to equity and debt to asset ratios, and liquidity ratios include coverage ratios and solvency ratios. That insurer is now going to have to find more money than it. Liquidity coverage ratio which liquidity measures are included in the group liquidity policy?

Source: paisahealth.in

Source: paisahealth.in

Capital structure ratios include debt to equity and debt to asset ratios, and liquidity ratios include coverage ratios and solvency ratios. The quick liquidity ratio is a measure of an insurance company’s ability to easily meet its obligations. Company is willing to take. It is a measure of the ability of an insurer to respond to substantial claims against it on the policies that it has written. This ratio is a type of liquidity ratio that measures the financial strength of a company.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance company liquidity ratio by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.