Insurance contract definition information

Home » Trending » Insurance contract definition informationYour Insurance contract definition images are available. Insurance contract definition are a topic that is being searched for and liked by netizens today. You can Find and Download the Insurance contract definition files here. Download all free images.

If you’re searching for insurance contract definition pictures information related to the insurance contract definition interest, you have come to the ideal site. Our site frequently gives you suggestions for seeking the highest quality video and picture content, please kindly hunt and find more informative video content and graphics that match your interests.

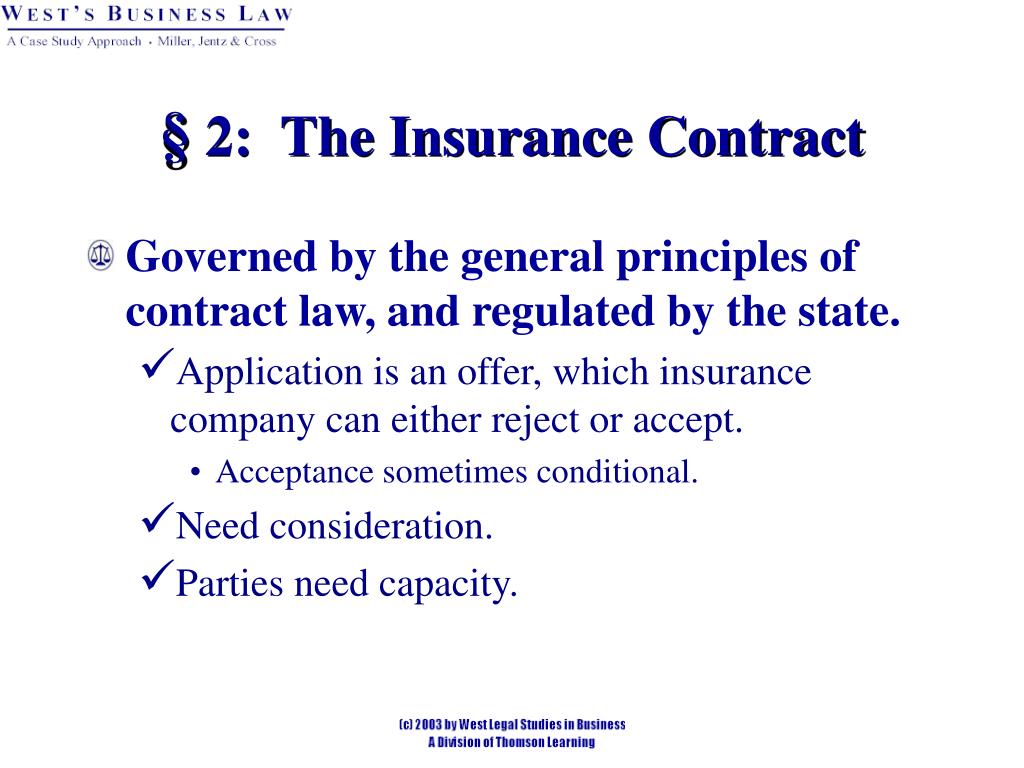

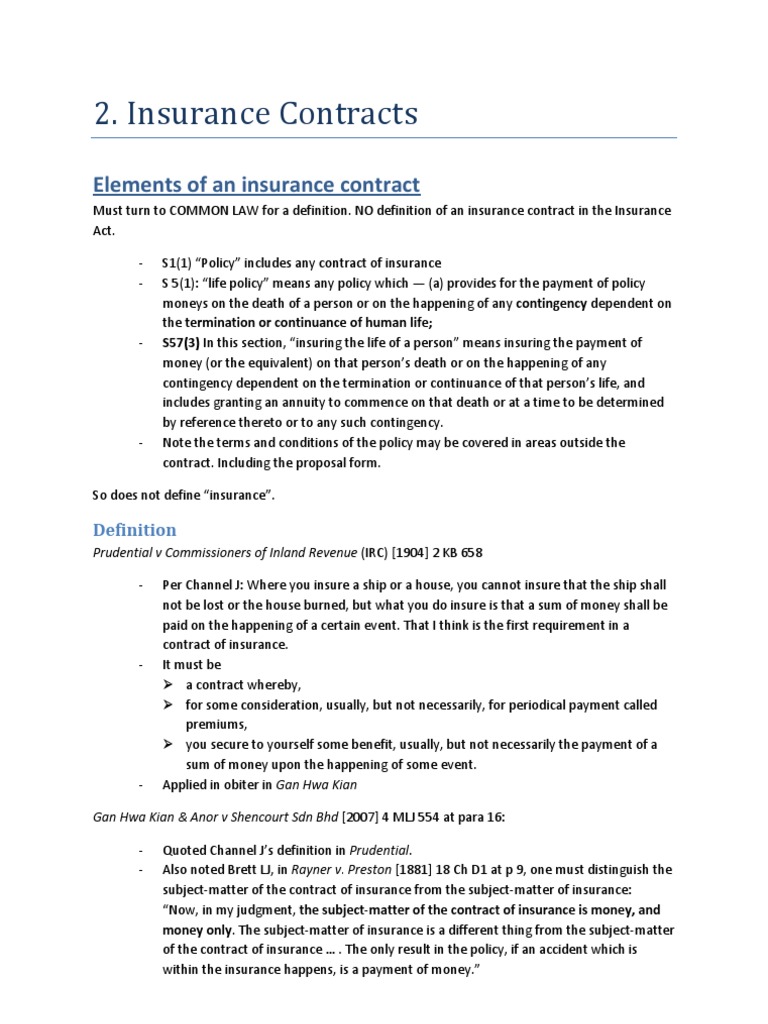

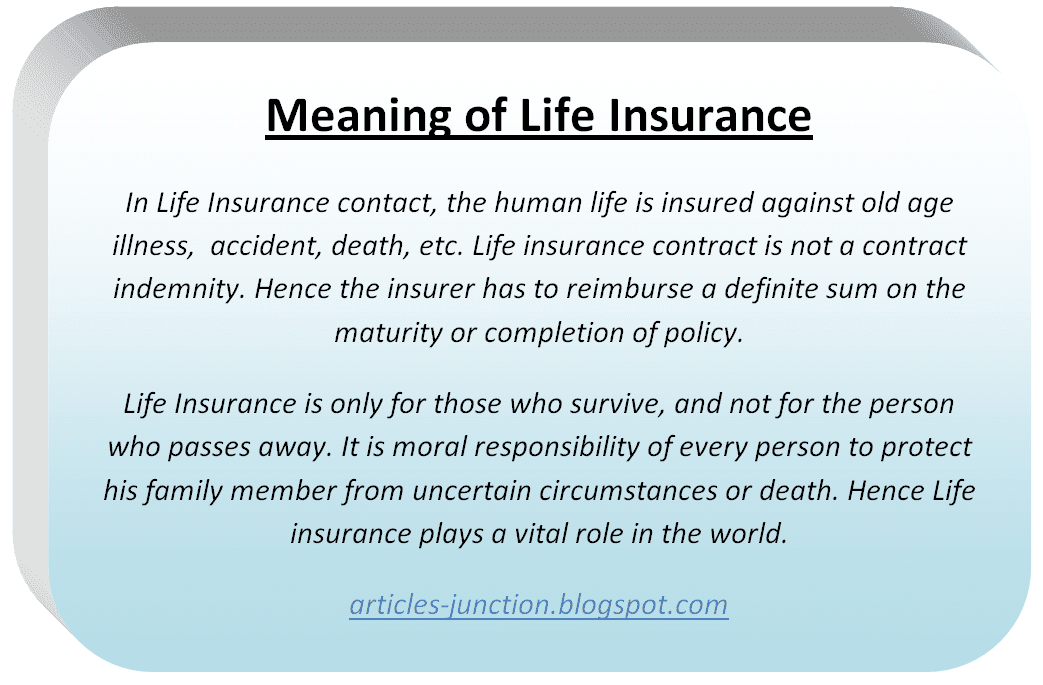

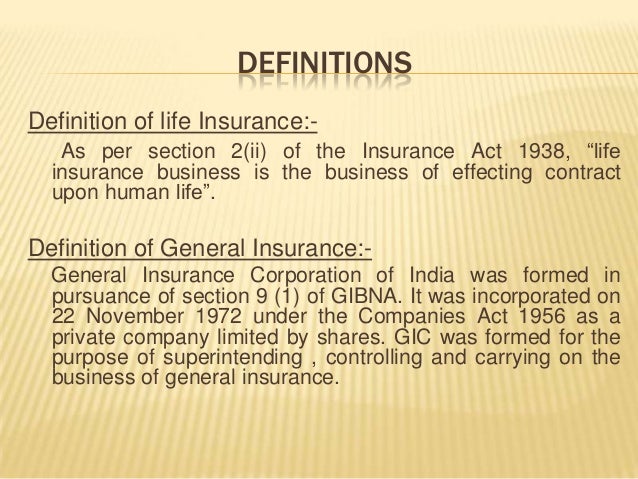

Insurance Contract Definition. An arrangement or agreement that. The parties must have a legal capacity to contract; Insurance may be defined as a contract between two parties whereby one party called insurer undertakes, in exchange for a fixed sum called premiums, to pay the other party called insured a fixed amount of money on the happening of a certain event. Definition of an insurance contract.

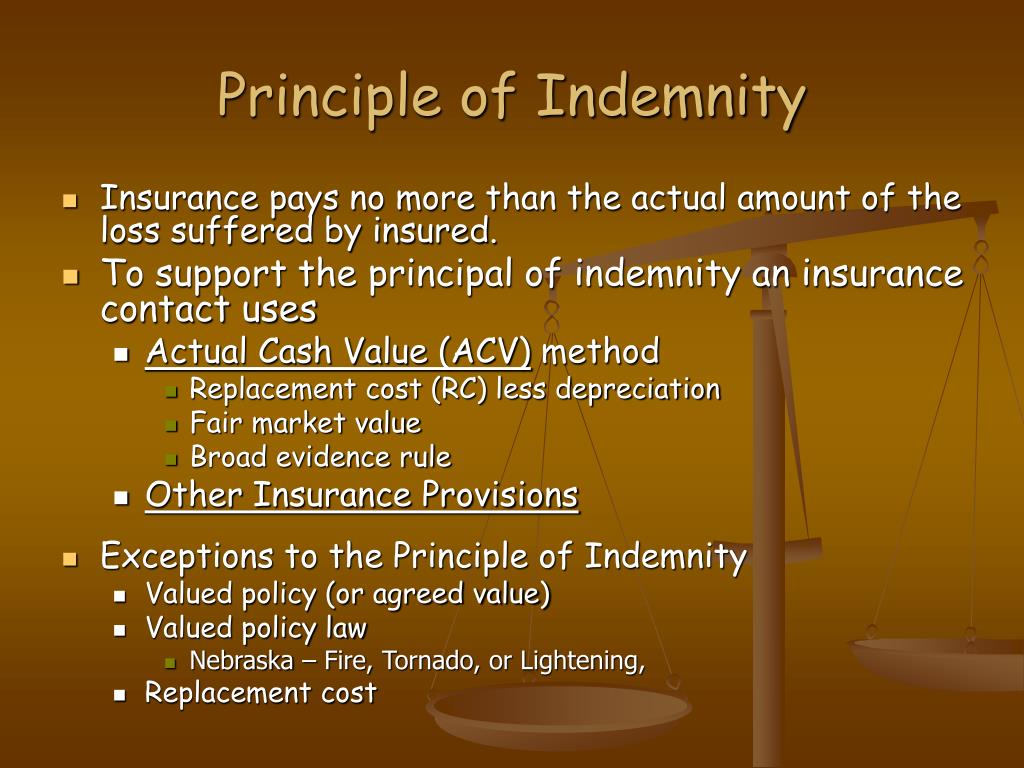

PPT 6. Legal Principles in Insurance Contracts From slideserve.com

PPT 6. Legal Principles in Insurance Contracts From slideserve.com

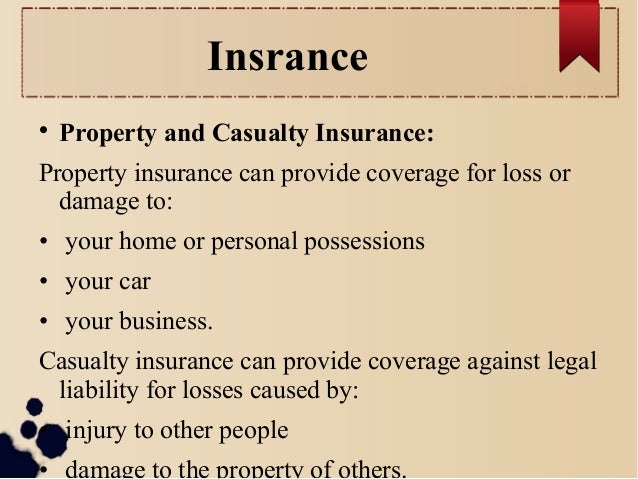

Insurance may be defined as a contract between two parties whereby one party called insurer undertakes in exchange for a fixed sum called premium to pay the other party called An insurance contract may be defined as an agreement between two parties whereby one party is called an insurer and the other is called insured. An arrangement or agreement that. Insurance policies are a form of contract. Definition of an insurance contract. The act, business, or system of insuring.

A means of being insured.

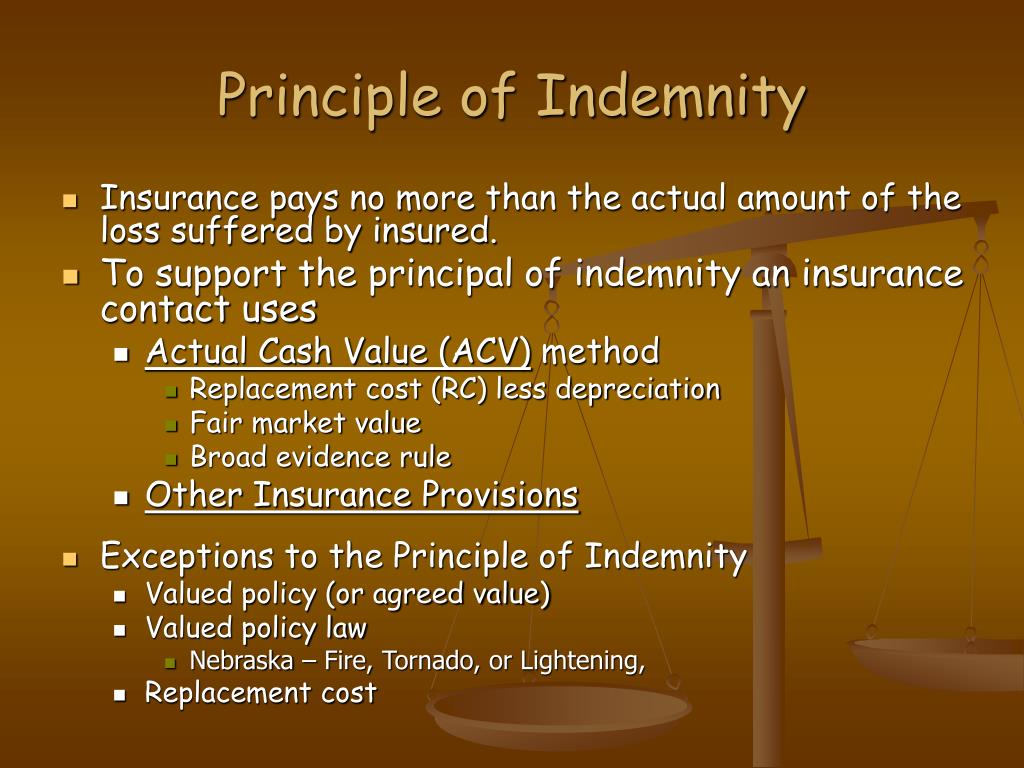

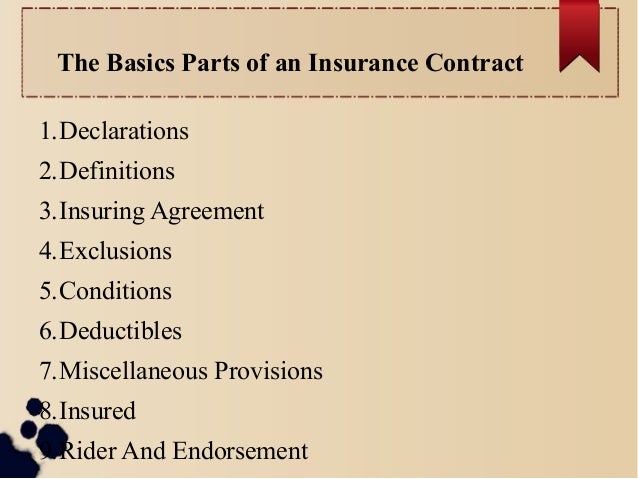

Central to any insurance contract is the insuring agreement, which specifies the risks covered, the limits of the policy, and the term of the policy. An insurance contract is a contract under which one party (the insurer) accepts significant insurance risk from another party (the policyholder) by agreeing to compensate the policyholder if a specified uncertain future event (the insured event) adversely affects the policyholder. A contract under which one party (the insurer) accepts significant insurance risk from another party (the policyholder) by agreeing to. Insurance may be defined as a contract between two parties whereby one party called insurer undertakes in exchange for a fixed sum called premium to pay the other party called A means of being insured. An arrangement or agreement that.

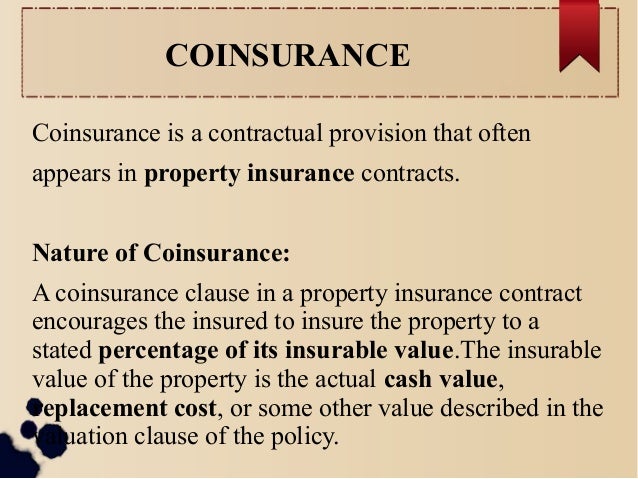

Source: slideshare.net

Source: slideshare.net

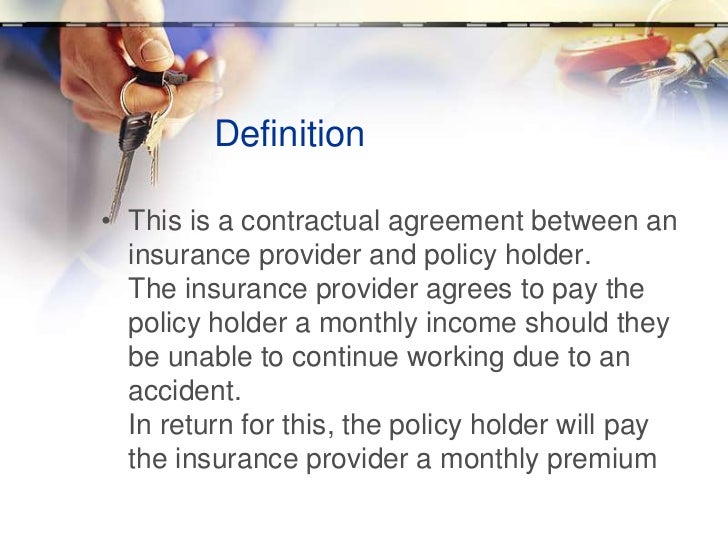

Contract — an agreement between two or more parties exhibiting the following necessary characteristics: Contractual liability insurance protects against liabilities that the policyholder has assumed from entering into a contract of any nature. Insurance policies are a form of contract. A contract under which one party (the issuer) accepts significant insurance risk from another party (the policyholder) by agreeing to compensate the policyholder if a specified uncertain future event (the insured event) adversely affects the policyholder. The insurer which is the insurance company undertakes, in exchange of fixed premium to pay the insured fixed amount of money on the happening of a certain event.

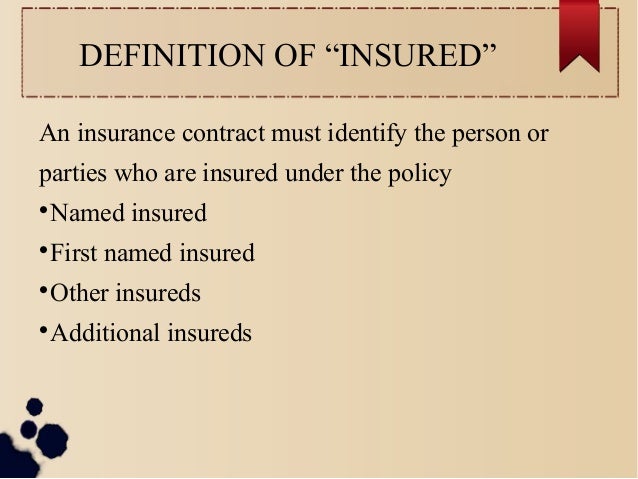

Source: slideshare.net

Source: slideshare.net

A means of being insured. There must be evidence of a meeting of minds between the insurer and the insured; Insurance may be defined as a contract between two parties whereby one party called insurer undertakes in exchange for a fixed sum called premium to pay the other party called An insurance contract is a legal agreement that spells out the responsibilities of both the insurance company and the insured, as well as the specific conditions of coverage and the policy term and cost. However, the courts have provided useful guidance in the form of descriptions of contracts of.

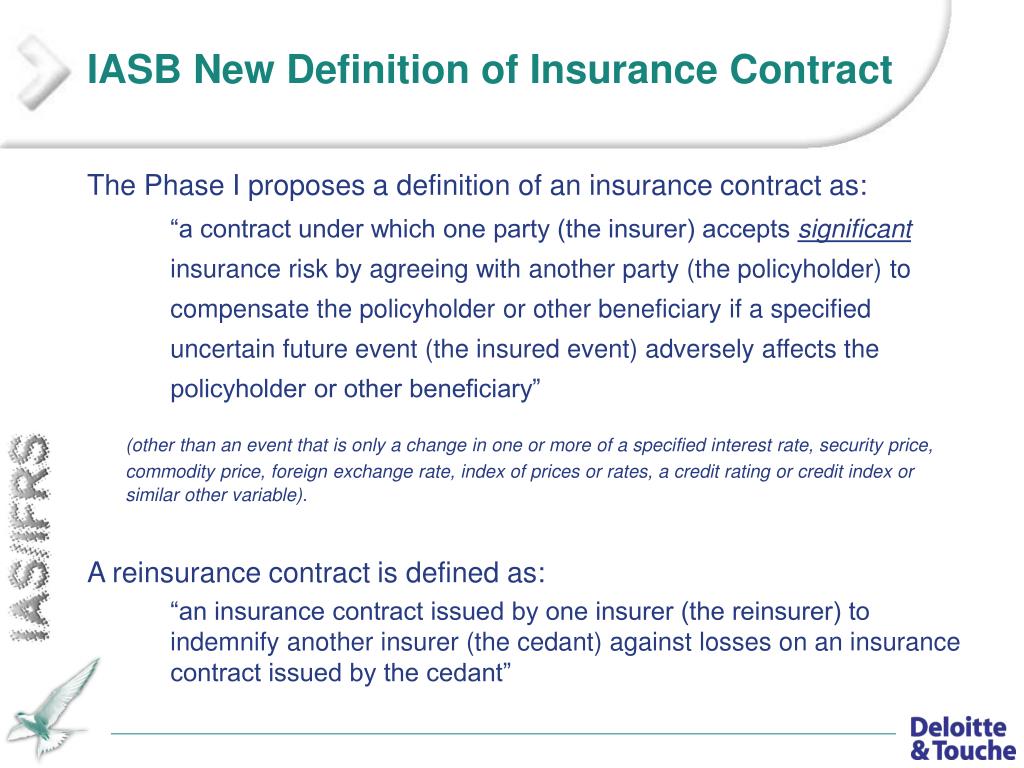

Source: slideserve.com

Source: slideserve.com

The elements of an insurance contract are the standard conditions that must be satisfied or agreed upon by both parties of the contract (the insured and the insurance company). A contract under which one party (the issuer) accepts significant insurance risk from another party (the policyholder) by agreeing to compensate the policyholder if a specified uncertain future event (the insured event) adversely affects the policyholder. In other cases, the deviation shall be Insurance may be defined as a contract between two parties whereby one party called insurer undertakes in exchange for a fixed sum called premium to pay the other party called Contract — an agreement between two or more parties exhibiting the following necessary characteristics:

Source: mymuseandmore.blogspot.com

Source: mymuseandmore.blogspot.com

Central to any insurance contract is the insuring agreement, which specifies the risks covered, the limits of the policy, and the term of the policy. The act, business, or system of insuring. Insurance is a contract, represented by a policy, in which an individual or entity receives financial protection or reimbursement against losses from an insurance company. The act, business, or system of insuring. A means of being insured.

Source: slideshare.net

Source: slideshare.net

An arrangement or agreement that. It must be for a legal purpose; In general, an insurance contract must meet four conditions in order to be legally valid: Insurance contracts synonyms, insurance contracts pronunciation, insurance contracts translation, english dictionary definition of insurance contracts. An insurance contract may be defined as an agreement between two parties whereby one party is called an insurer and the other is called insured.

Source: slideshare.net

Source: slideshare.net

In terms of insurance, these are the fundamental conditions of the insurance contract that bind both parties, validate the policy, and make it enforceable by law. An insurance contract may be defined as an agreement between two parties whereby one party is called an insurer and the other is called insured. There must be evidence of a meeting of minds between the insurer and the insured; Insurance contract synonyms, insurance contract pronunciation, insurance contract translation, english dictionary definition of insurance contract. Contract — an agreement between two or more parties exhibiting the following necessary characteristics:

Nor, because of the dynamic nature of insurance business, is it ever likely to do so. It must be for a legal purpose; There must be evidence of a meeting of minds between the insurer and the insured; Mutual assent, competent parties, a valid consideration, and legal subject matter. Insurance may be defined as a contract between two parties whereby one party called insurer undertakes, in exchange for a fixed sum called premiums, to pay the other party called insured a fixed amount of money on the happening of a certain event.

![Chapter 1[definition and nature of insurance] Chapter 1[definition and nature of insurance]](https://image.slidesharecdn.com/chapter1definitionandnatureofinsurance-150912031826-lva1-app6891/95/chapter-1definition-and-nature-of-insurance-16-638.jpg?cb=1442027945) Source: slideshare.net

Source: slideshare.net

Contractual liability insurance protects against liabilities that the policyholder has assumed from entering into a contract of any nature. The elements of an insurance contract are the standard conditions that must be satisfied or agreed upon by both parties of the contract (the insured and the insurance company). Mutual assent, competent parties, a valid consideration, and legal subject matter. The policyholder or its designated beneficiary if a specified uncertain future event (the insured event) adversely affects the policyholder. Definition of an insurance contract.

Source: slideserve.com

Source: slideserve.com

An ‘insurance contract’ is defined in ifrs 17 as: However, the courts have provided useful guidance in the form of descriptions of contracts of. The act, business, or system of insuring. An insurance contract is a legal agreement that spells out the responsibilities of both the insurance company and the insured, as well as the specific conditions of coverage and the policy term and cost. The elements of an insurance contract are the standard conditions that must be satisfied or agreed upon by both parties of the contract (the insured and the insurance company).

Source: slideshare.net

Source: slideshare.net

An arrangement or agreement that. An ‘insurance contract’ is defined in ifrs 17 as: Ifrs 17 clarifies that, apart from. The insurance contract refers and they are attached to the contract or the person who concluded the contract with the insurer was informed about them before conclusion of the contract. A contract (insurance policy) in which the insurer (insurance company) agrees for a fee (insurance premiums) to pay the insured party all.

Source: canonprintermx410.blogspot.com

Source: canonprintermx410.blogspot.com

A contract (insurance policy) in which the insurer (insurance company) agrees for a fee (insurance premiums) to pay the insured party all. To meet the requirement of legal purpose, the. The law provides no exhaustive definition of a contract of insurance. Insurance policies are a form of contract. Nor, because of the dynamic nature of insurance business, is it ever likely to do so.

Source: canonprintermx410.blogspot.com

A contract under which one party (the issuer) accepts significant insurance risk from another party (the policyholder) by agreeing to compensate the policyholder if a specified uncertain future event (the insured event) adversely affects the policyholder. The policyholder or its designated beneficiary if a specified uncertain future event (the insured event) adversely affects the policyholder. An insurance contract is a contract under which one party (the insurer) accepts significant insurance risk from another party (the policyholder) by agreeing to compensate the policyholder if a specified uncertain future event (the insured event) adversely affects the policyholder. The insurer which is the insurance company undertakes, in exchange of fixed premium to pay the insured fixed amount of money on the happening of a certain event. An insurance contract is a legal agreement that spells out the responsibilities of both the insurance company and the insured, as well as the specific conditions of coverage and the policy term and cost.

Source: canonprintermx410.blogspot.com

Nor, because of the dynamic nature of insurance business, is it ever likely to do so. Contract — an agreement between two or more parties exhibiting the following necessary characteristics: A contract under which one party (the issuer) accepts significant insurance risk from another party (the policyholder) by agreeing to compensate the policyholder if a specified uncertain future event (the insured event) adversely affects the policyholder. An insurance contract is a document representing the agreement between an insurance company and the insured. The elements of an insurance contract are the standard conditions that must be satisfied or agreed upon by both parties of the contract (the insured and the insurance company).

Source: slideshare.net

Source: slideshare.net

An insurance contract is a contract under which one party (the insurer) accepts significant insurance risk from another party (the policyholder) by agreeing to compensate the policyholder if a specified uncertain future event (the insured event) adversely affects the policyholder. Insurance policies are a form of contract. The elements of an insurance contract are the standard conditions that must be satisfied or agreed upon by both parties of the contract (the insured and the insurance company). An ‘insurance contract’ is defined in ifrs 17 as: An insurance contract is a contract under which one party (the insurer) accepts significant insurance risk from another party (the policyholder) by agreeing to compensate the policyholder if a specified uncertain future event (the insured event) adversely affects the policyholder.

Source: slideshare.net

Source: slideshare.net

An arrangement or agreement that. The act, business, or system of insuring. Definition of an insurance contract. Insurance is a contract, represented by a policy, in which an individual or entity receives financial protection or reimbursement against losses from an insurance company. The insurer which is the insurance company undertakes, in exchange of fixed premium to pay the insured fixed amount of money on the happening of a certain event.

Source: canonprintermx410.blogspot.com

However, the courts have provided useful guidance in the form of descriptions of contracts of. What is contractual liability insurance? Insurance may be defined as a contract between two parties whereby one party called insurer undertakes in exchange for a fixed sum called premium to pay the other party called In terms of insurance, these are the fundamental conditions of the insurance contract that bind both parties, validate the policy, and make it enforceable by law. An insurance contract is a legal agreement that spells out the responsibilities of both the insurance company and the insured, as well as the specific conditions of coverage and the policy term and cost.

Source: insurance-info-center.blogspot.com

Source: insurance-info-center.blogspot.com

Insurance may be defined as a contract between two parties whereby one party called insurer undertakes, in exchange for a fixed sum called premiums, to pay the other party called insured a fixed amount of money on the happening of a certain event. Insurance is a contract, represented by a policy, in which an individual or entity receives financial protection or reimbursement against losses from an insurance company. A contract (insurance policy) in which the insurer (insurance company) agrees for a fee (insurance premiums) to pay the insured party all. The parties must have a legal capacity to contract; An arrangement or agreement that.

Source: slideserve.com

Source: slideserve.com

A contract under which one party (the insurer) accepts significant insurance risk from another party (the policyholder) by agreeing to. The elements of an insurance contract are the standard conditions that must be satisfied or agreed upon by both parties of the contract (the insured and the insurance company). Fsa factsheet for all firms is a contract of insurance defined in law? A contract under which one party (the insurer) accepts significant insurance risk from another party (the policyholder) by agreeing to. A means of being insured.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insurance contract definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.