Insurance depreciation information

Home » Trend » Insurance depreciation informationYour Insurance depreciation images are available. Insurance depreciation are a topic that is being searched for and liked by netizens today. You can Get the Insurance depreciation files here. Get all free images.

If you’re looking for insurance depreciation pictures information linked to the insurance depreciation interest, you have pay a visit to the ideal site. Our website always provides you with suggestions for refferencing the maximum quality video and image content, please kindly hunt and locate more informative video content and images that match your interests.

Insurance Depreciation. Depreciation is a decrease in the book value of fixed assets. Methods for calculating depreciation can vary by insurance provider. The cost to replace it with a (23). Depreciation affects how much you’ll be reimbursed when you make a car insurance claim.

What is zero depreciation auto insurance? From carinsurancecomparison.com

What is zero depreciation auto insurance? From carinsurancecomparison.com

One way to determine depreciation is to divide the cost of an asset, minus its. Under most insurance policies, claim reimbursement begins with an initial payment for the actual cash value (acv) of your damage, or the value of the damaged or destroyed item (s) at the time of the loss. In this method, instead of purchasing securities, an insurance policy is purchased for an amount equal to the cost of replacement of asset. Generally, home insurance policyholders must keep documentation that they made any necessary repairs to the item they are claiming recoverable depreciation for, or that they claim they have maintained. In many cases, the useful life of an item is estimated, then the value of that item is reduced by a fraction of that life for each year, all the way down to zero. This is known as recoverable depreciation.

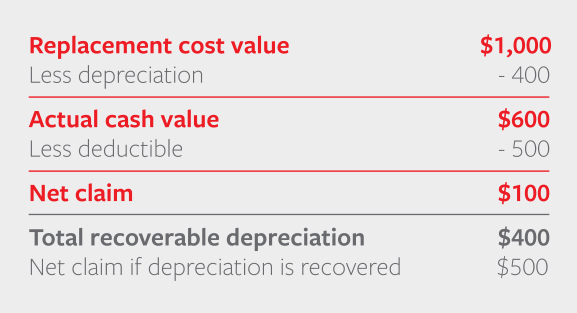

Recoverable depreciation is the difference between a property’s replacement cost value (i.e.

Insurance companies generally base the recoverable depreciation estimate with a calculation of the total cost divided by the estimated lifespan, so for each year that you own the computer, its value will depreciate by $400. Under most insurance policies, claim reimbursement begins with an initial payment for the actual cash value (acv) of your damage, or the value of the damaged or destroyed item (s) at the time of the loss. Following are the 3 principal features of depreciation: When your insurance policy covers replacement costs, it means that some or all of your depreciation can be claimed. This loss in value is commonly known as depreciation. Depreciation is a decrease in the book value of fixed assets.

Source: indianauto.com

Source: indianauto.com

Insurance claims tools and databases. The battery will probably depreciate much more rapidly than a traditional vehicle or. The depreciation guide document should be used as a general guide only; And this is not only with a car, but the same also goes for your mobile, laptop, bike and any other assets. Recoverable depreciation is the difference between a property’s replacement cost value (i.e.

Source: carinsurancecomparison.com

Source: carinsurancecomparison.com

Insurance claims tools and databases. This is known as recoverable depreciation. Recoverable depreciation is the depreciated value of a home or item that can be claimed by the home insurance policyholder. There are many (1) this personal property depreciation guide suggests life expectancy and depreciation rates for individual items in a variety of categories such as. Insurance companies generally base the recoverable depreciation estimate with a calculation of the total cost divided by the estimated lifespan, so for each year that you own the computer, its value will depreciate by $400.

Source: policyboss.com

Source: policyboss.com

Since insurance is designed to put you back in the same position you were in just before a loss, your insurer will likely use one of two calculations to determine the amount you’ll be reimbursed for your lost or damaged vehicle: Recoverable depreciation is the difference between an insured item’s actual cash value (acv) and its replacement cost value (rcv). When insuring your home and belongings, you will see two terms: The insurance company agrees to pay a lump sum in return for a sum known as premium to be paid at the beginning of every year. Both covers help you get more out of your car insurance plan.

Source: claimlypublicadjustment.com

Source: claimlypublicadjustment.com

Depreciation affects how much you’ll be reimbursed when you make a car insurance claim. One way to determine depreciation is to divide the cost of an asset, minus its. Depreciation in insurance is the loss of value of a car with time, as each part of the car wears out with tiin checkingme, the value of your car also diminishes. The battery will probably depreciate much more rapidly than a traditional vehicle or. Under most insurance policies, claim reimbursement begins with an initial payment for the actual cash value (acv) of your damage, or the value of the damaged or destroyed item (s) at the time of the loss.

Source: coverfox.com

Source: coverfox.com

There are many variables which can affect an item�s life expectancy that should be taken into consideration when determining actual cash value. Insurance companies generally base the recoverable depreciation estimate with a calculation of the total cost divided by the estimated lifespan, so for each year that you own the computer, its value will depreciate by $400. A homeowners insurance policy is a contract that agrees to provide coverage for your house and the contents of your house. Acv and rcv.acv stands for actual cash value, and rcv means replacement cost value.acv is the value of your item as it is today (including depreciation), while rcv covers the cost to replace it at retail price.the difference between rcv and acv is the recoverable. In this method, instead of purchasing securities, an insurance policy is purchased for an amount equal to the cost of replacement of asset.

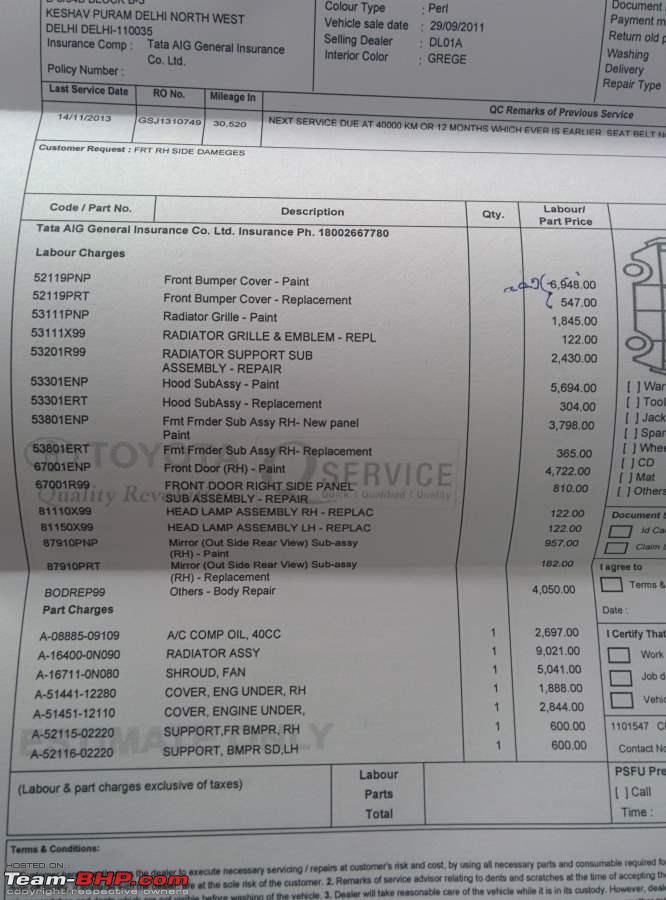

Source: team-bhp.com

Source: team-bhp.com

Both covers help you get more out of your car insurance plan. Generally, home insurance policyholders must keep documentation that they made any necessary repairs to the item they are claiming recoverable depreciation for, or that they claim they have maintained. In this method, instead of purchasing securities, an insurance policy is purchased for an amount equal to the cost of replacement of asset. The same depreciation schedule might not go true for the battery. This is known as recoverable depreciation.

Source: hubinsurancehunter.ca

Source: hubinsurancehunter.ca

When your insurance policy covers replacement costs, it means that some or all of your depreciation can be claimed. Since insurance is designed to put you back in the same position you were in just before a loss, your insurer will likely use one of two calculations to determine the amount you’ll be reimbursed for your lost or damaged vehicle: Under most insurance policies, claim reimbursement begins with an initial payment for the actual cash value (acv) of your damage, or the value of the damaged or destroyed item (s) at the time of the loss. Own damage insurance vs zero depreciation car insurance. Once you repair or replace the damaged property, though, some policies will.

Source: slideshare.net

Source: slideshare.net

In case of a claim, the insurance. When you file a claim for covered damages on an insured property, insurance policies may only pay for its actual cash value at the time. Recoverable depreciation is the difference between a property’s replacement cost value (i.e. Both covers help you get more out of your car insurance plan. Depreciation is an ongoing process until the end of the life of assets.

Source: brokerlink.ca

Source: brokerlink.ca

The depreciation guide document should be used as a general guide only; Recoverable depreciation is the depreciated value of a home or item that can be claimed by the home insurance policyholder. It overlooks the diminished value of the property due to depreciation of its market cost, damage, or wear and tear. Insurance claims tools and databases. The cost to replace it with a (23).

Source: indianauto.com

Source: indianauto.com

In case of a claim, the insurance. The battery will probably depreciate much more rapidly than a traditional vehicle or. Insurance policy method of calculating depreciation. The depreciation guide document should be used as a general guide only; Depreciation insurance, or zero depreciation coverage, is a provision in a property insurance policy that covers the actual value of the property prior to the loss of value it experiences over time.

Source: healthnewsreporting.com

Source: healthnewsreporting.com

Own damage insurance vs zero depreciation car insurance. When insuring your home and belongings, you will see two terms: Depreciation involves loss of value of assets due to the passage of time and obsolescence. Basis depreciation chart as mentioned above for calculation. When you file a claim for covered damages on an insured property, insurance policies may only pay for its actual cash value at the time.

Source: imbillionaire.net

Source: imbillionaire.net

Following are the 3 principal features of depreciation: Depreciation affects how much you’ll be reimbursed when you make a car insurance claim. Most homeowners insurance policies provide replacement cost coverage on an insured dwelling. This is known as recoverable depreciation. It overlooks the diminished value of the property due to depreciation of its market cost, damage, or wear and tear.

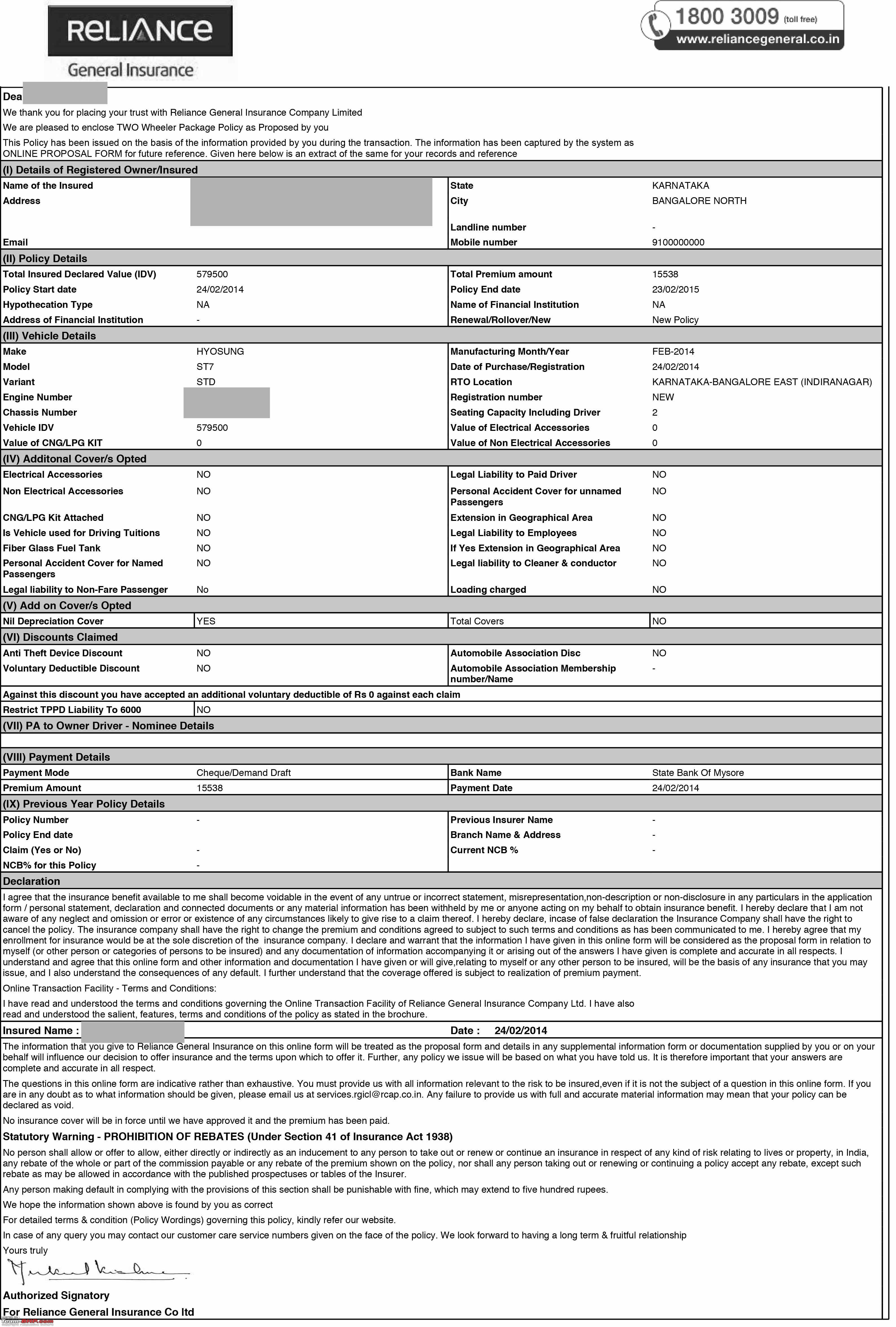

Source: team-bhp.com

Source: team-bhp.com

Recoverable depreciation is the difference between a property’s replacement cost value (i.e. And this is not only with a car, but the same also goes for your mobile, laptop, bike and any other assets. This is known as recoverable depreciation. Insurance claims tools and databases. If you have replacement cost coverage included on your policy, you may be able to.

Source: ipartnercc.icicilombard.com

Depreciation involves loss of value of assets due to the passage of time and obsolescence. Basis depreciation chart as mentioned above for calculation. When you file a claim for covered damages on an insured property, insurance policies may only pay for its actual cash value at the time. The battery will probably depreciate much more rapidly than a traditional vehicle or. Idv value is the basis on which premium is calculated.

Source: team-bhp.com

Source: team-bhp.com

Both covers help you get more out of your car insurance plan. This is known as recoverable depreciation. In case of a claim, the insurance. Recoverable depreciation is the dollar amount difference between your roof’s cash value and its replacement value. If you have replacement cost coverage included on your policy, you may be able to.

Source: jphealthygalore.blogspot.com

Source: jphealthygalore.blogspot.com

In this method, instead of purchasing securities, an insurance policy is purchased for an amount equal to the cost of replacement of asset. The exact way your insurance company will calculate recoverable depreciation could vary from the way another insurance company would calculate it. And this is not only with a car, but the same also goes for your mobile, laptop, bike and any other assets. If you have replacement cost coverage included on your policy, you may be able to. Recoverable depreciation is the difference between an insured item’s actual cash value (acv) and its replacement cost value (rcv).

Source: houstonremodeling.com

Source: houstonremodeling.com

In this method, instead of purchasing securities, an insurance policy is purchased for an amount equal to the cost of replacement of asset. In this method, instead of purchasing securities, an insurance policy is purchased for an amount equal to the cost of replacement of asset. Depreciation in insurance is the loss of value of a car with time, as each part of the car wears out with tiin checkingme, the value of your car also diminishes. Depreciation insurance, or zero depreciation coverage, is a provision in a property insurance policy that covers the actual value of the property prior to the loss of value it experiences over time. The insurance company agrees to pay a lump sum in return for a sum known as premium to be paid at the beginning of every year.

Source: servpromiltonbraintree.com

Source: servpromiltonbraintree.com

Insurance claims tools and databases. The depreciation guide document should be used as a general guide only; If depreciation is recoverable in the policy, the owner may claim those. Methods for calculating depreciation can vary by insurance provider. Insurance companies use recoverable depreciation to prevent insurance claim fraud.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insurance depreciation by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.