Insurance facts india information

Home » Trending » Insurance facts india informationYour Insurance facts india images are ready in this website. Insurance facts india are a topic that is being searched for and liked by netizens now. You can Get the Insurance facts india files here. Get all free photos and vectors.

If you’re looking for insurance facts india pictures information related to the insurance facts india keyword, you have pay a visit to the ideal blog. Our website always provides you with hints for refferencing the maximum quality video and image content, please kindly surf and find more enlightening video articles and graphics that match your interests.

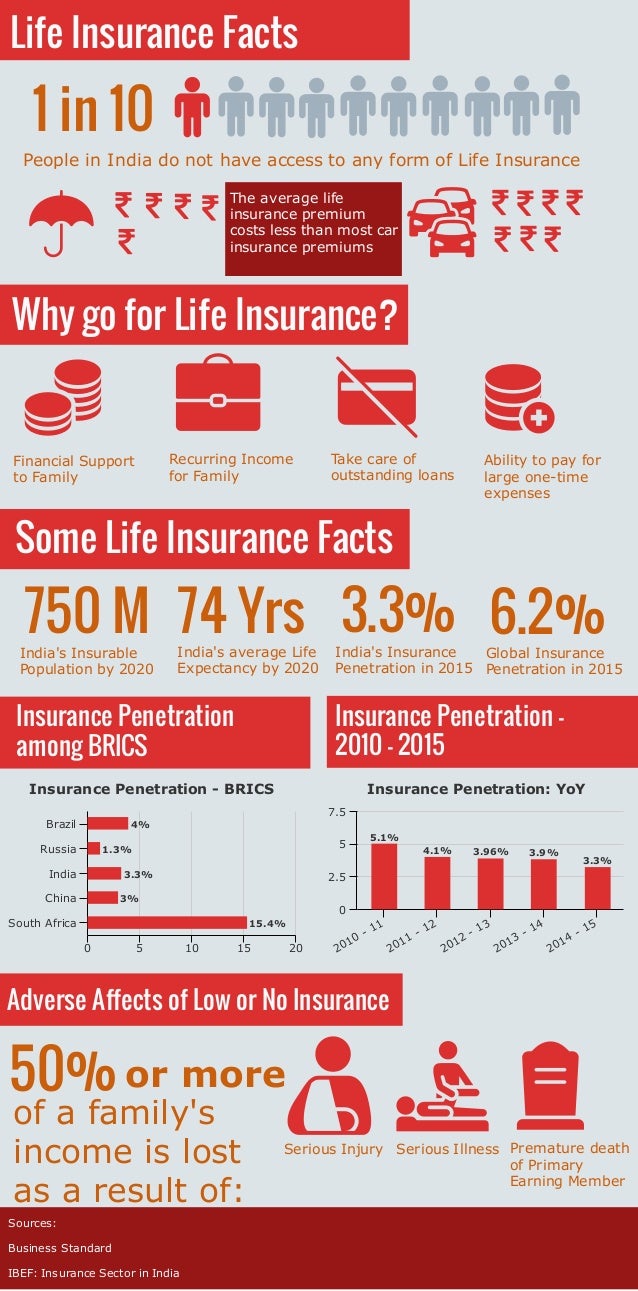

Insurance Facts India. The life insurance industry is expected to increase at a cagr of 5.3% between 2019 and 2023. However, this meant microsoft would have had to an exorbitant amount for the photo, as delivery services declined to ship the film since it cost more than. For the vehicles registered under zone a, higher premiums compared to vehicles cars registered under zone b. There a many life insurance companies in india and each offer various life insurance products.

Lic of India Life insurance facts, Life insurance From pinterest.com

Lic of India Life insurance facts, Life insurance From pinterest.com

Moreover, the insurance sector in india is expected to reach us$ 280 billion by the year 2020. However, during the same period, the global life insurance premium expanded by 3.2 per cent. In life insurance business, india ranked 9th among the 156 countries, for which data are published by swiss re. The life insurance industry is expected to increase at a cagr of 5.3% between 2019 and 2023. This policy will cover the cost of repairing the damage caused to your property and to its belongings. Interesting, weird and quite possibly useless insurance facts history of insurance many people believe that insurance, a method of equitably transferring and distributing risk, started with lloyds (the “world’s specialist insurance market”) in the late 1600’s, as a means of funding and securing the risk of trading vessels as they set out on their journeys to the new.

A minimum of 24 hours’ hospitalisation is mandatory for insurance claims.

In life insurance business, india ranked 9th among the 156 countries, for which data are published by swiss re. You agree to an insurance policy at the time of policy purchase. While mumbai, delhi, chennai, bangalore, kolkata, pune, ahmedabad and hyderabad, falls under zone a, the rest of india falls under zone b. The insurance industry of india has 57 insurance companies; A minimum of 24 hours’ hospitalisation is mandatory for insurance claims. However, during the same period, the global life insurance premium expanded by 3.2 per cent.

Source: timesofindia.indiatimes.com

Source: timesofindia.indiatimes.com

If you have agreed to. When microsoft bought all rights to photographer charles o’rear’s famous “bliss” photo, aka the windows xp wallpaper, they requested to have the original film. Insurance definition types benefits features india. This growth can be attributed to the demand for electric cars. You can buy a home insurance that covers either the property structure or the belongings or both, depending upon your needs.

Source: imbillionaire.net

Source: imbillionaire.net

There a many life insurance companies in india and each offer various life insurance products. This growth can be attributed to the demand for electric cars. The life insurance industry is expected to increase at a cagr of 5.3% between 2019 and 2023. The insurance industry of india has 57 insurance companies; The insurance industry in india is a pool of insurance companies hedging insurance seekers against risk through the means of insurance contracts.

Source: pinterest.com

Source: pinterest.com

Lic started with 5 zonal offices,33 divisional offices and 212 branch offices. The general insurance sector is growing at an 18% rate; The share of indian life insurance. The emotional and psychological loss can never be compensated, but at least the financial loss can be compensated with insurance. It is the minimum mandatory requirement for all motorised vehicle owners, as per the motor vehicles act of 1988.

Source: pinterest.com

Source: pinterest.com

In terms of insurance density, india’s overall density stood at us$ 78 in fy21. This policy will cover the cost of repairing the damage caused to your property and to its belongings. The life insurance industry is expected to increase at a cagr of 5.3% between 2019 and 2023. This growth can be attributed to the demand for electric cars. India�s share in global life insurance market was 2.73 per cent during 2019.

Source: pinterest.com

Source: pinterest.com

This growth can be attributed to the demand for electric cars. The insurance industry in india was expected to reach us$ 280 billion by 2020. You can buy a home insurance that covers either the property structure or the belongings or both, depending upon your needs. The life insurance industry is expected to increase at a cagr of 5.3% between 2019 and 2023. Lic started with 5 zonal offices,33 divisional offices and 212 branch offices.

Source: in.pinterest.com

Source: in.pinterest.com

Moreover, the insurance sector in india is expected to reach us$ 280 billion by the year 2020. The life insurance industry is expected to increase at a cagr of 5.3% between 2019 and 2023. The life insurance industry is expected to increase at a cagr of 5.3% between 2019 and 2023. While mumbai, delhi, chennai, bangalore, kolkata, pune, ahmedabad and hyderabad, falls under zone a, the rest of india falls under zone b. Lic started with 5 zonal offices,33 divisional offices and 212 branch offices.

Source: in.pinterest.com

Source: in.pinterest.com

You agree to an insurance policy at the time of policy purchase. The insurance industry in india is a pool of insurance companies hedging insurance seekers against risk through the means of insurance contracts. The government spending on healthcare has increased to 1.4 % of gdp in 2018. Many insurance companies have started providing cover for chemotherapy, radiotherapy, eye surgery, dialysis, etc. The life insurance industry is expected to increase at a cagr of 5.3% between 2019 and 2023.

Source: blogs.lexisnexis.com

Source: blogs.lexisnexis.com

It is the minimum mandatory requirement for all motorised vehicle owners, as per the motor vehicles act of 1988. The general insurance sector is growing at an 18% rate; A minimum of 24 hours’ hospitalisation is mandatory for insurance claims. Having a personal health insurance rules out this dependence. Insurance fact #5 | an insurance policy exists for death by excessive laughter at a movie theater.

Source: pinterest.com

Source: pinterest.com

The common myth that hospitalisation is mandatory for any claim through insurance, is no more a prerequisite. In terms of insurance density, india’s overall density stood at us$ 78 in fy21. Important facts to know about car insurance policy in india according to a report, the automobile industry in india is seeing a steady growth in 2022. You agree to an insurance policy at the time of policy purchase. Indians were charged an extra premium for insurance policies until 1823, in india;

Source: firstpost.com

Source: firstpost.com

There a many life insurance companies in india and each offer various life insurance products. Many insurance companies have started providing cover for chemotherapy, radiotherapy, eye surgery, dialysis, etc. When microsoft bought all rights to charles o’rear’s iconic ‘bliss’ photo, depicting green hills and a blue sky, they wanted the original film. You can buy a home insurance that covers either the property structure or the belongings or both, depending upon your needs. There a many life insurance companies in india and each offer various life insurance products.

Source: pinterest.com

Source: pinterest.com

The insurance sector in india is majorly divided into two categories: In terms of insurance density, india’s overall density stood at us$ 78 in fy21. Health insurance saw a complete transformation in 2020; While mumbai, delhi, chennai, bangalore, kolkata, pune, ahmedabad and hyderabad, falls under zone a, the rest of india falls under zone b. Due to the limited financial assistance, premiums for such policies also tend to be low.

Source: generalinsurancefacts.blogspot.com

Source: generalinsurancefacts.blogspot.com

While mumbai, delhi, chennai, bangalore, kolkata, pune, ahmedabad and hyderabad, falls under zone a, the rest of india falls under zone b. There a many life insurance companies in india and each offer various life insurance products. Interesting, weird and quite possibly useless insurance facts history of insurance many people believe that insurance, a method of equitably transferring and distributing risk, started with lloyds (the “world’s specialist insurance market”) in the late 1600’s, as a means of funding and securing the risk of trading vessels as they set out on their journeys to the new. The insurance sector in india is majorly divided into two categories: The life insurance industry is expected to increase at a cagr of 5.3% between 2019 and 2023.

Source: pinterest.com

Source: pinterest.com

Having a personal health insurance rules out this dependence. The insurance industry in india was expected to reach us$ 280 billion by 2020. If you have agreed to. Many insurance companies have started providing cover for chemotherapy, radiotherapy, eye surgery, dialysis, etc. In terms of insurance density, india’s overall density stood at us$ 78 in fy21.

Source: pinterest.com

Source: pinterest.com

Having a personal health insurance rules out this dependence. 10 fun facts about insurance. The general insurance sector is growing at an 18% rate; The common myth that hospitalisation is mandatory for any claim through insurance, is no more a prerequisite. While mumbai, delhi, chennai, bangalore, kolkata, pune, ahmedabad and hyderabad, falls under zone a, the rest of india falls under zone b.

Source: pinterest.com

Source: pinterest.com

The common myth that hospitalisation is mandatory for any claim through insurance, is no more a prerequisite. For the vehicles registered under zone a, higher premiums compared to vehicles cars registered under zone b. While mumbai, delhi, chennai, bangalore, kolkata, pune, ahmedabad and hyderabad, falls under zone a, the rest of india falls under zone b. A minimum of 24 hours’ hospitalisation is mandatory for insurance claims. You agree to an insurance policy at the time of policy purchase.

Source: slideshare.net

Source: slideshare.net

Important facts to know about car insurance policy in india according to a report, the automobile industry in india is seeing a steady growth in 2022. Due to the limited financial assistance, premiums for such policies also tend to be low. 1) buying an insurance policy is agreeing to a contract. If you have agreed to. The insurance sector in india is majorly divided into two categories:

Source: slideshare.net

Source: slideshare.net

Insurance is the most effective risk management tool which can protect individuals and businesses from financial risks arising out of various contingencies. The insurance industry in india was expected to reach us$ 280 billion by 2020. The plethora of available life insurance products can be overwhelming to shortlist such huge. It is the minimum mandatory requirement for all motorised vehicle owners, as per the motor vehicles act of 1988. Insurance fact #5 | an insurance policy exists for death by excessive laughter at a movie theater.

Source: pinterest.com

Source: pinterest.com

The contract is an agreement between the insurer and the insured in which the payment of the former guarantee for an uncertain event against a premium paid by the insured regularly. The share of indian life insurance. Insurance definition types benefits features india. The emotional and psychological loss can never be compensated, but at least the financial loss can be compensated with insurance. However, the overall insurance reach in india still remains low.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insurance facts india by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.