Insurance for financial planners information

Home » Trending » Insurance for financial planners informationYour Insurance for financial planners images are available. Insurance for financial planners are a topic that is being searched for and liked by netizens now. You can Download the Insurance for financial planners files here. Find and Download all free photos and vectors.

If you’re searching for insurance for financial planners images information linked to the insurance for financial planners interest, you have pay a visit to the ideal blog. Our site always provides you with hints for downloading the maximum quality video and picture content, please kindly hunt and locate more informative video content and images that fit your interests.

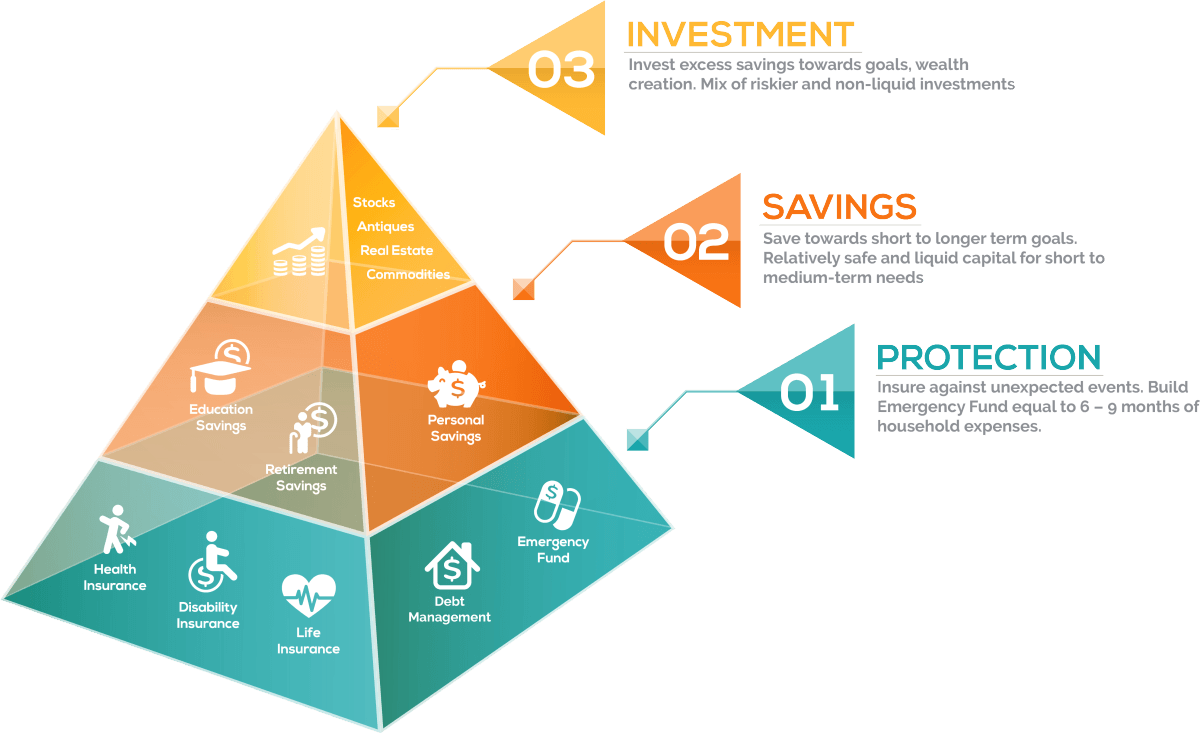

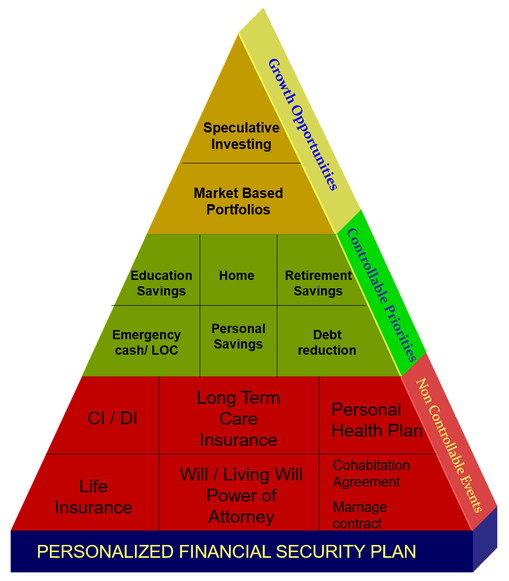

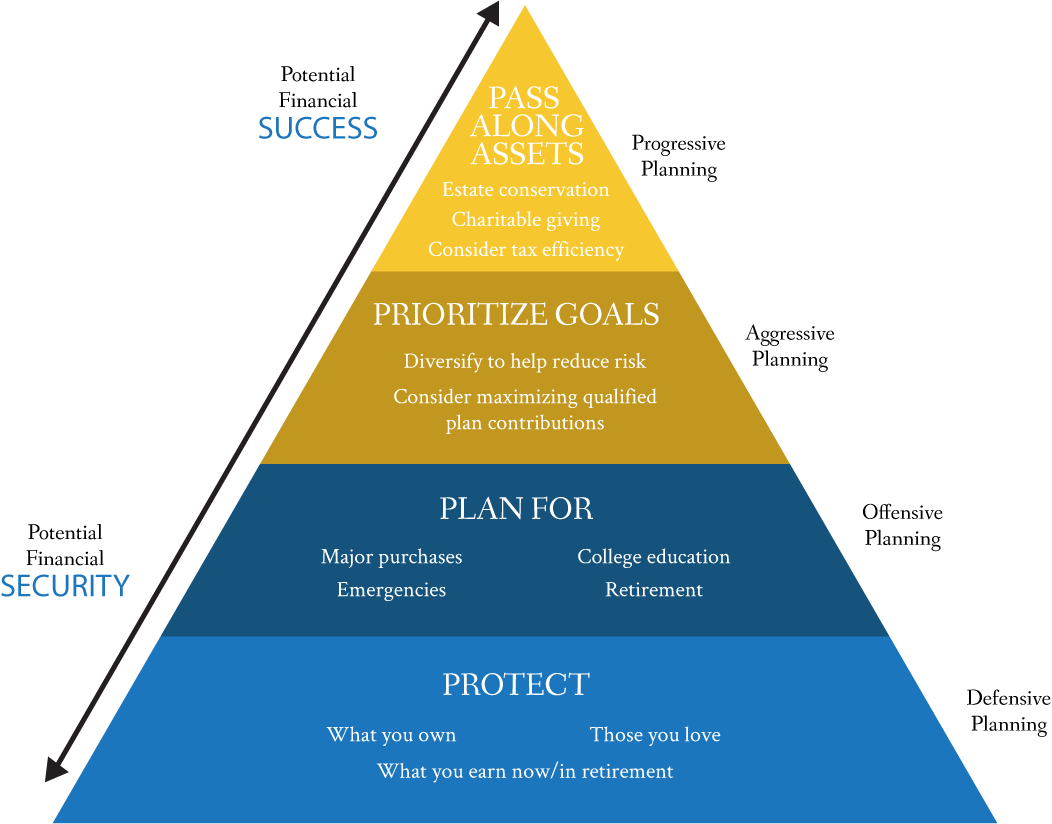

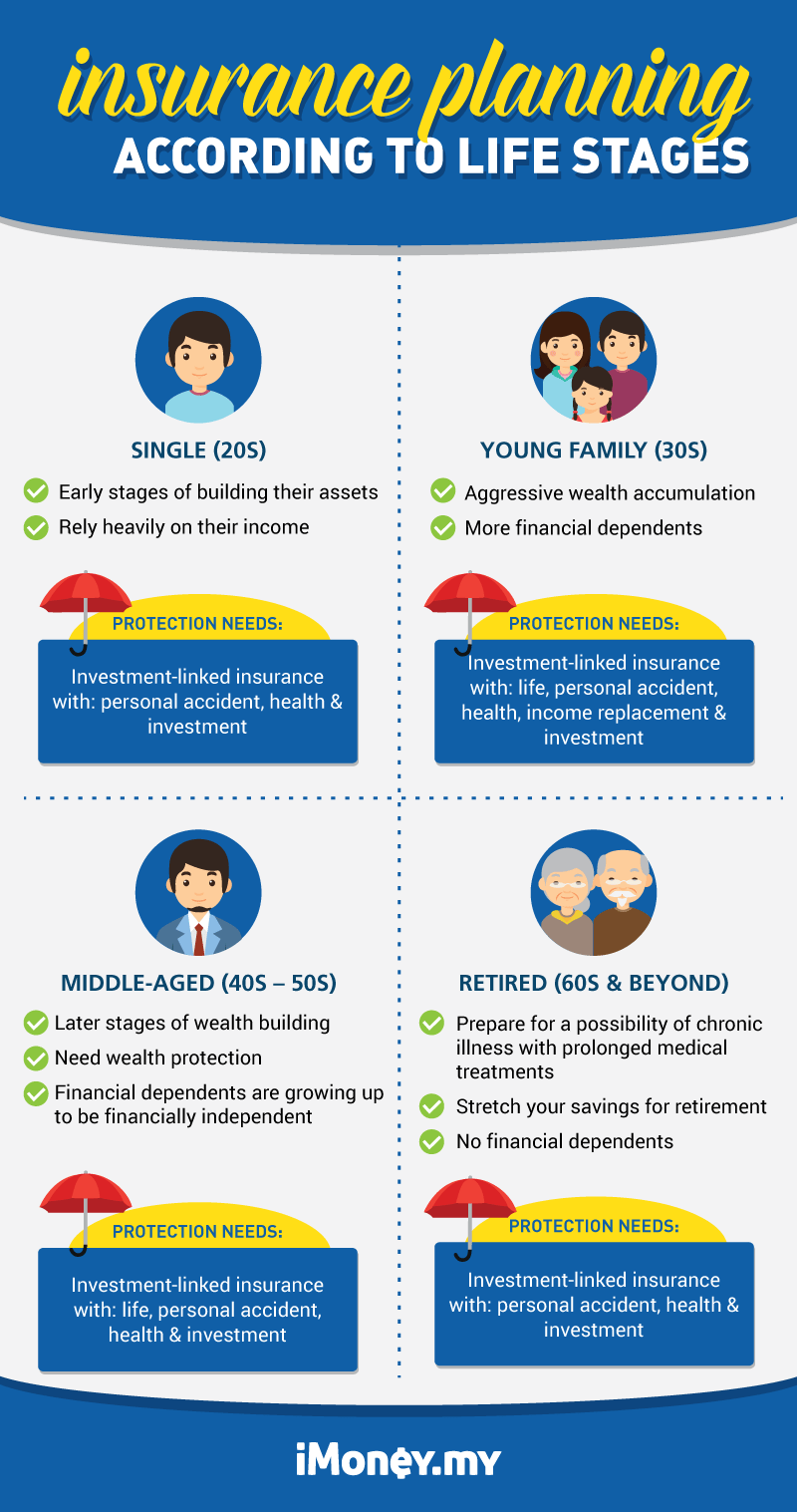

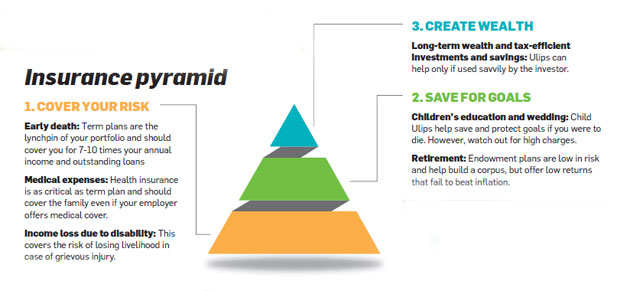

Insurance For Financial Planners. Insurance planning is an integral part of wealth management. Most people do not need life insurance forever. The fiduciary standard) across all. Professional indemnity insurance for accountants protects you and your accounting firm in the event of a client’s legal action against you due to professional negligence, errors, and omissions.

Individual Planning From gennuso.com

Individual Planning From gennuso.com

Cpa insurance also protects you against employees suing you, loss of income, and auto accidents. But people with a high net worth or those with lifelong dependents might still need life insurance well into their 60s, 70s, 80s, and beyond. Evaluate property and casualty policies (home, auto, umbrella, etc) to ensure limits of liability are sufficient to. As a financial planner, your job responsibilities revolve around giving advice and guidance. There is a need for the industry to speak. Financial planners (arguably the kings of using acronyms) operate in a highly regulated and changing environment that is one of the most complex, time consuming industries in which to provide insurance broking services.

Whether you have a single secretary or an office full of financial planners, you are required by law to provide workers comp insurance.

I had been with winsure financial planners since 2016 & they helped me plan for my future based on my current savings and recommended the right funds to invest. If i gotten winsure financial planners 10 years back i should already have achieved more than 60% of my goals. Capacity up to $2.5 million on any one claim. The median cost of workers’ compensation insurance for investment advisors and financial planners is less than $40 per month, or $450 annually. Financial planners (arguably the kings of using acronyms) operate in a highly regulated and changing environment that is one of the most complex, time consuming industries in which to provide insurance broking services. Cpa insurance also protects you against employees suing you, loss of income, and auto accidents.

Source: pinterest.com

Source: pinterest.com

The financial planning industry changed quite substantially since i arrived on scene a little over 10 years ago. Whether you have a single secretary or an office full of financial planners, you are required by law to provide workers comp insurance. If tragic events like death, disability or critical illness strike, insurance can protect you and your family from undue hardship. There is a need for the industry to speak. If i gotten winsure financial planners 10 years back i should already have achieved more than 60% of my goals.

Source: soleraam.com

Source: soleraam.com

As a financial planner, your job responsibilities revolve around giving advice and guidance. The financial planners and insurance brokers association (fpiba) is the voice of the insurance and investment profession. There is a need for the industry to speak. In that time, much of the regulatory shifts seek to establish new standards (e.g. Capacity up to $2.5 million on any one claim.

Source: crossroadsfinancial.ca

Source: crossroadsfinancial.ca

Financial planners recommend that clients buy term life insurance because it allows them to accomplish two goals: Your professional indemnity policy should cover you for negligence, fraud or dishonesty by directors, employees and other representatives of the licensee. The financial planners and insurance brokers association (fpiba) is the voice of the insurance and investment profession. It also protects against risks faced by any small business, such as injuries and property damage. As a financial planner, your job responsibilities revolve around giving advice and guidance.

Source: assante.com

Capacity up to $2.5 million on any one claim. When it comes to commercial insurance for financial planners, the first coverage you should consider for your policy is professional liability insurance. As a cornerstone of your comprehensive financial planning process, insurance helps account for the risks that you cannot afford to bear yourself. In that time, much of the regulatory shifts seek to establish new standards (e.g. Workers compensation pays your employee�s medical expenses if they are ever injured at work.

Source: njcpablog.com

Source: njcpablog.com

Protect your financial planning business with acquire insurance. Do note, pet insurance is also dependent on preexisting health conditions, breed, and where you live. The financial planners and insurance brokers association (fpiba) is the voice of the insurance and investment profession. In that time, much of the regulatory shifts seek to establish new standards (e.g. This coverage will protect you against negligence and.

Source: gennuso.com

Source: gennuso.com

Financial planning is a holistic, collaborative process designed to uncover your individual values, feelings towards money, and goals—so that you and your financial planner can work together to achieve those goals and put you on the path towards living your best life. Evaluate property and casualty policies (home, auto, umbrella, etc) to ensure limits of liability are sufficient to. As you approach retirement, you’ll ideally have more savings, fewer dependents and financial obligations, and less overall debt. Financial planning is a holistic, collaborative process designed to uncover your individual values, feelings towards money, and goals—so that you and your financial planner can work together to achieve those goals and put you on the path towards living your best life. The financial planners and insurance brokers association (fpiba) is the voice of the insurance and investment profession.

Source: johnsoninsurancebp.com

Source: johnsoninsurancebp.com

Capacity up to $2.5 million on any one claim. Financial planning is a holistic, collaborative process designed to uncover your individual values, feelings towards money, and goals—so that you and your financial planner can work together to achieve those goals and put you on the path towards living your best life. Professional indemnity insurance for accountants protects you and your accounting firm in the event of a client’s legal action against you due to professional negligence, errors, and omissions. The financial planning industry changed quite substantially since i arrived on scene a little over 10 years ago. The fiduciary standard) across all.

Source: moneyshield.ca

Source: moneyshield.ca

Financial planners recommend that clients buy term life insurance because it allows them to accomplish two goals: 10, 15, 20, 25, or 35 years) at affordable rates that are much less expensive than whole life policies with lifelong coverage. Insurance planning is an integral part of wealth management. Saving money and creating financial security. Do note, pet insurance is also dependent on preexisting health conditions, breed, and where you live.

Source: wisdomtimes.com

Source: wisdomtimes.com

Whether you have a single secretary or an office full of financial planners, you are required by law to provide workers comp insurance. As part of your wealth management analysis, our financial advisors will: To even obtain insurance for her pet, our charleston financial planner, laura, was required to submit recent medical bloodwork. This coverage will protect you against negligence and. Professional indemnity insurance for accountants protects you and your accounting firm in the event of a client’s legal action against you due to professional negligence, errors, and omissions.

Source: hudsonfoster.co.uk

Source: hudsonfoster.co.uk

We’ve highlighted some of the most pertinent business insurance coverages certified financial planners should consider, along with a few examples of how these coverages might be applicable to your business. The median cost of workers’ compensation insurance for investment advisors and financial planners is less than $40 per month, or $450 annually. A financial planner’s insurance advice: There is a need for the industry to speak. Insurance planning is an integral part of wealth management.

Source: aboutinsurance.sg

Source: aboutinsurance.sg

Workers compensation pays your employee�s medical expenses if they are ever injured at work. As part of your wealth management analysis, our financial advisors will: Professional indemnity insurance for accountants protects you and your accounting firm in the event of a client’s legal action against you due to professional negligence, errors, and omissions. Cpa insurance also protects you against employees suing you, loss of income, and auto accidents. Insurance is essential to any comprehensive financial plan.

Source: aliarausch.com

Source: aliarausch.com

We’ve highlighted some of the most pertinent business insurance coverages certified financial planners should consider, along with a few examples of how these coverages might be applicable to your business. If tragic events like death, disability or critical illness strike, insurance can protect you and your family from undue hardship. These policies include professional indemnity, management liability and cyber insurance. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small financial planners ranges from $47 to $59 per month. Financial planners recommend that clients buy term life insurance because it allows them to accomplish two goals:

Source: mwfis.com

Source: mwfis.com

There is a need for the industry to speak. As part of your wealth management analysis, our financial advisors will: The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small financial planners ranges from $47 to $59 per month. There is a need for the industry to speak. Workers compensation pays your employee�s medical expenses if they are ever injured at work.

Source: imoney.my

Source: imoney.my

Financial planners (arguably the kings of using acronyms) operate in a highly regulated and changing environment that is one of the most complex, time consuming industries in which to provide insurance broking services. The financial planners and insurance brokers association (fpiba) is the voice of the insurance and investment profession. To even obtain insurance for her pet, our charleston financial planner, laura, was required to submit recent medical bloodwork. 10, 15, 20, 25, or 35 years) at affordable rates that are much less expensive than whole life policies with lifelong coverage. Most people do not need life insurance forever.

Source: mikefralick.com

Source: mikefralick.com

Whether you have a single secretary or an office full of financial planners, you are required by law to provide workers comp insurance. Defence costs in addition to the limit of indemnity for the first $500,000. A financial planner’s insurance advice: Most people do not need life insurance forever. I had been with winsure financial planners since 2016 & they helped me plan for my future based on my current savings and recommended the right funds to invest.

Source: economictimes.indiatimes.com

Source: economictimes.indiatimes.com

When it comes to commercial insurance for financial planners, the first coverage you should consider for your policy is professional liability insurance. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small financial planners ranges from $47 to $59 per month. Whether you have a single secretary or an office full of financial planners, you are required by law to provide workers comp insurance. Protect your financial planning business with acquire insurance. The financial planners and insurance brokers association (fpiba) is the voice of the insurance and investment profession.

Source: pngkit.com

Source: pngkit.com

Cpa insurance also protects you against employees suing you, loss of income, and auto accidents. Capacity up to $2.5 million on any one claim. Financial planners (arguably the kings of using acronyms) operate in a highly regulated and changing environment that is one of the most complex, time consuming industries in which to provide insurance broking services. When it comes to commercial insurance for financial planners, the first coverage you should consider for your policy is professional liability insurance. Cpa insurance also protects you against employees suing you, loss of income, and auto accidents.

Source: markdelgadoblog.blogspot.com

Source: markdelgadoblog.blogspot.com

If tragic events like death, disability or critical illness strike, insurance can protect you and your family from undue hardship. Although, if you’re a financial planner looking for more information on insurance, then you’ve come to the right place! Financial planners recommend that clients buy term life insurance because it allows them to accomplish two goals: Financial planners (arguably the kings of using acronyms) operate in a highly regulated and changing environment that is one of the most complex, time consuming industries in which to provide insurance broking services. Financial planner and investment advisor insurance helps protect your decisions, such as management of retirement funds.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance for financial planners by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.