Insurance fraud investigation techniques Idea

Home » Trending » Insurance fraud investigation techniques IdeaYour Insurance fraud investigation techniques images are available. Insurance fraud investigation techniques are a topic that is being searched for and liked by netizens today. You can Find and Download the Insurance fraud investigation techniques files here. Download all free photos and vectors.

If you’re looking for insurance fraud investigation techniques images information related to the insurance fraud investigation techniques interest, you have visit the ideal blog. Our website frequently provides you with suggestions for seeing the maximum quality video and picture content, please kindly search and find more enlightening video content and graphics that match your interests.

Insurance Fraud Investigation Techniques. This may seem like the most basic technique of a private investigator, but it will always be their most crucial, particularly when investigating insurance fraud. This information will be used for further research. Insurance fraud is common in fraud/legal attribute. Life insurance fraud, for example, is usually perpetrated at the point of making the application for life insurance, and is best detected by the agent’s instincts or the.

Fraud360 issue 1 2016 by CRI Middle East LLC Issuu From issuu.com

Fraud360 issue 1 2016 by CRI Middle East LLC Issuu From issuu.com

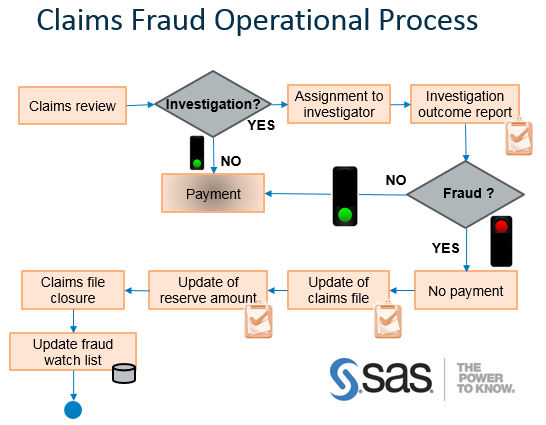

Investigating insurance fraud involves a collaborative effort between the insurance crime bureau, insurance companies and their internal insurance fraud investigation units as the nodal point for crime being. Insurance fraud can come in two forms: An organization need to implement proper systems and processes to detect frauds at an early stage or even before it occurs. During an initial meeting, the person launching the investigation should explain why they suspect fraud has taken place. Our insurance fraud analytics engine uses multiple techniques (automated business rules, embedded ai and machine learning methods, text mining, anomaly detection and network link analysis) to automatically score millions of claims records in real time or in batch. Forensic auditing is a blend of accounting, auditing and investigative skills.

Fraud detection consists of the following techniques.

Summarize contract amount by vendor and compare vendor summaries for several years to determine if a single vendor is winning most bids. An insurance fraud investigation is performed to find out if false claims are being submitted. This may seem like the most basic technique of a private investigator, but it will always be their most crucial, particularly when investigating insurance fraud. Gearing up for data management. Surveillance tools & equipment’s 3. Techniques has resulted in varying degrees of success.

Source: issuu.com

Source: issuu.com

Fraud detection consists of the following techniques. An investigation report should include facts and analysis of the evidence, a determination and recommendations for corrective action. The purpose of this handbook is to introduce to criminal investiga tors, on a broad scale, an investigative tool, a seventh basic investigative technique, used primarily in the investigation of violations of the federal income tax laws. An insurance fraud investigation is performed to find out if false claims are being submitted. (1) hard frauds and (2) soft frauds.

Source: lifestylegroup.co.uk

Gearing up for data management. The credit fraud model[4] suggested a insurance fraud, credit card fraud, classification technique with fraud/legal attribute, and a telecommunications fraud, and check forgery are some of clustering followed by a classification technique with no the main types of fraud. Forensic auditing is a technique to legally determine whether accounting transactions are in consonance with various accounting, auditing and legal requirements and eventually determine whether any fraud has taken place. Tests used to discover this fraud: Your fraud investigation report should be simple, factual and limited by the scope of your investigation.

Source: entrevistaeouvido.blogspot.com

Source: entrevistaeouvido.blogspot.com

During an initial meeting, the person launching the investigation should explain why they suspect fraud has taken place. An investigation report should include facts and analysis of the evidence, a determination and recommendations for corrective action. Leave that up to the appropriate authorities instead. Surveillance tools & equipment’s 3. Summarize contract amount by vendor and compare vendor summaries for several years to determine if a single vendor is winning most bids.

Source: ethozgroup.com

Source: ethozgroup.com

Your fraud investigation report should be simple, factual and limited by the scope of your investigation. An insurance fraud investigation is a type of fraud investigation that centers around attempts to benfit from decietful claims. Surveillance tools & equipment’s 3. Dale marshall an insurance fraud investigator may investigate claims of disability. Fraud in insurance is done by intentional deception or misrepresentation for gaining shabby benefit in the form of showing false expenditures and claim.

Source: secureforensics.com

Source: secureforensics.com

Tests used to discover this fraud: Data mining tools and techniques can be used to detect fraud in large sets of insurance claim data. In doing so, the veil of corporate entity is Fraud detection consists of the following techniques. Learn what the risks of fraud are in the insurance industry, who commits fraud and why, indicators, detection techniques, investigation procedures, interview techniques and recourse available to the insurer.

Source: london-privatedetectives.co.uk

Source: london-privatedetectives.co.uk

Fraud detection consists of the following techniques. Use a private investigator to safeguard your insurance privileges. What is an insurance fraud investigation? An insurance fraud investigation is a type of fraud investigation that centers around attempts to benfit from decietful claims. Private investigators use many different surveillance techniques to catch a suspect accused of insurance fraud including, background check:

Source: pinterest.com

Source: pinterest.com

Data mining tools and techniques can be used to detect fraud in large sets of insurance claim data. Learn what the risks of fraud are in the insurance industry, who commits fraud and why, indicators, detection techniques, investigation procedures, interview techniques and recourse available to the insurer. This information will be used for further research. Seeking compensation for false or inflated claims is illegal, dangerous, and raises the price of insurance for everyone. Basically, the merchant borrows money and agrees to pay it back with

Source: njm.com

Source: njm.com

A hard fraud occurs when an accident, injury, or theft is contrived or premeditated to obtain money from. Before an investigation begins, the investigator should first work to gather all facts from the client. You will examine the role of the special investigation unit (siu) in insurance fraud management and control. Fraud in insurance is done by intentional deception or misrepresentation for gaining shabby benefit in the form of showing false expenditures and claim. Dale marshall an insurance fraud investigator may investigate claims of disability.

Source: blogs.sas.com

Source: blogs.sas.com

A private investigator needs to know all relevant information about the suspect. Forensic auditing is a technique to legally determine whether accounting transactions are in consonance with various accounting, auditing and legal requirements and eventually determine whether any fraud has taken place. Gearing up for data management. However, avoid drawing legal conclusions; You will examine the role of the special investigation unit (siu) in insurance fraud management and control.

Source: warreninfinance.com

Source: warreninfinance.com

Insurance fraud can come in two forms: Insurance fraud investigations are usually conducted when an adjuster has doubts about the case that they are evaluating. However, avoid drawing legal conclusions; During an initial meeting, the person launching the investigation should explain why they suspect fraud has taken place. A hard fraud occurs when an accident, injury, or theft is contrived or premeditated to obtain money from.

![]() Source: beaconintlgroup.com

Source: beaconintlgroup.com

Life insurance fraud, for example, is usually perpetrated at the point of making the application for life insurance, and is best detected by the agent’s instincts or the. Fraud detection consists of the following techniques. Data is the most valuable commodity for detecting and preventing insurance fraud. Forensic auditing is a blend of accounting, auditing and investigative skills. This is probably the most important step in a private investigator’s process.

Source: the-news-update212361.blogspot.com

Source: the-news-update212361.blogspot.com

Your fraud investigation report should be simple, factual and limited by the scope of your investigation. Summarize contract amount by vendor and compare vendor summaries for several years to determine if a single vendor is winning most bids. Fraud detection consists of the following techniques. According to the coalition against insurance fraud, an estimated $80 billion is paid out. Techniques has resulted in varying degrees of success.

Source: gii-pii.com

Source: gii-pii.com

An insurance fraud investigation is performed to find out if false claims are being submitted. Forensic auditing is a technique to legally determine whether accounting transactions are in consonance with various accounting, auditing and legal requirements and eventually determine whether any fraud has taken place. Dale marshall an insurance fraud investigator may investigate claims of disability. During an initial meeting, the person launching the investigation should explain why they suspect fraud has taken place. Forensic auditing is a blend of accounting, auditing and investigative skills.

Source: righteyedetective.com

Source: righteyedetective.com

Surveillance tools & equipment’s 3. The purpose of this handbook is to introduce to criminal investiga tors, on a broad scale, an investigative tool, a seventh basic investigative technique, used primarily in the investigation of violations of the federal income tax laws. Leave that up to the appropriate authorities instead. Gearing up for data management. You will examine the role of the special investigation unit (siu) in insurance fraud management and control.

Source: inform-software.com

Source: inform-software.com

A private investigator needs to know all relevant information about the suspect. Tests used to discover this fraud: Seeking compensation for false or inflated claims is illegal, dangerous, and raises the price of insurance for everyone. In doing so, the veil of corporate entity is Unfortunately, information silos are still prevalent in the insurance industry.

Source: entrevistaeouvido.blogspot.com

Source: entrevistaeouvido.blogspot.com

Unfortunately, information silos are still prevalent in the insurance industry. Our insurance fraud analytics engine uses multiple techniques (automated business rules, embedded ai and machine learning methods, text mining, anomaly detection and network link analysis) to automatically score millions of claims records in real time or in batch. Summarize contract amount by vendor and compare vendor summaries for several years to determine if a single vendor is winning most bids. Data is the most valuable commodity for detecting and preventing insurance fraud. A private investigator needs to know all relevant information about the suspect.

Source: authorstream.com

Source: authorstream.com

There are a number of different methods of insurance fraud detection, often based on the type of insurance fraud being attempted. Surveillance tools & equipment’s 3. An insurance fraud investigation is performed to find out if false claims are being submitted. (1) hard frauds and (2) soft frauds. An organization need to implement proper systems and processes to detect frauds at an early stage or even before it occurs.

Source: pinterest.com

Source: pinterest.com

This information will be used for further research. Basically, the merchant borrows money and agrees to pay it back with This tool, if properly applied, can greatly enhance the Your fraud investigation report should be simple, factual and limited by the scope of your investigation. A true history of fraud wo uld have to start in 300 b.c., when a greek merchant name hegestratos took out a large insurance policy known as bottomry.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insurance fraud investigation techniques by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.