Insurance fund definition Idea

Home » Trend » Insurance fund definition IdeaYour Insurance fund definition images are ready. Insurance fund definition are a topic that is being searched for and liked by netizens today. You can Download the Insurance fund definition files here. Download all royalty-free photos and vectors.

If you’re looking for insurance fund definition images information connected with to the insurance fund definition interest, you have come to the right site. Our website always provides you with suggestions for seeking the highest quality video and image content, please kindly search and locate more informative video content and graphics that fit your interests.

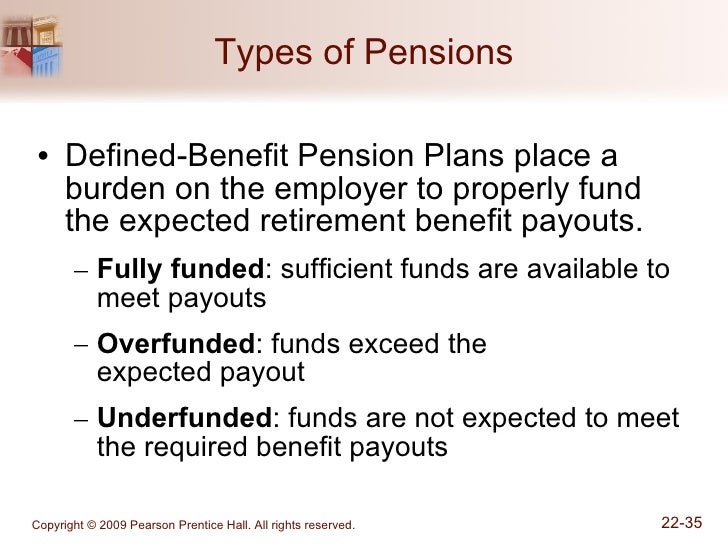

Insurance Fund Definition. Also, insurance provides employment opportunity to people. An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter. Funds are amounts of money that are available to be spent , especially money that is. There are two types of pension funds.

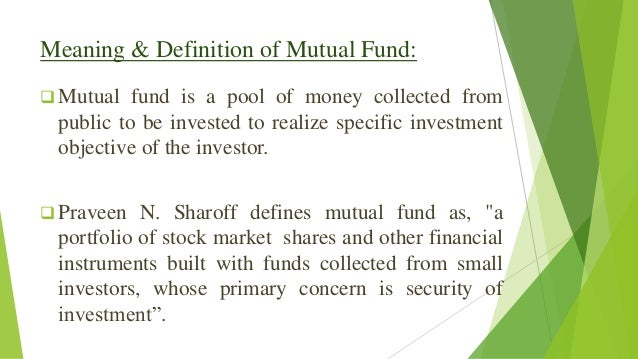

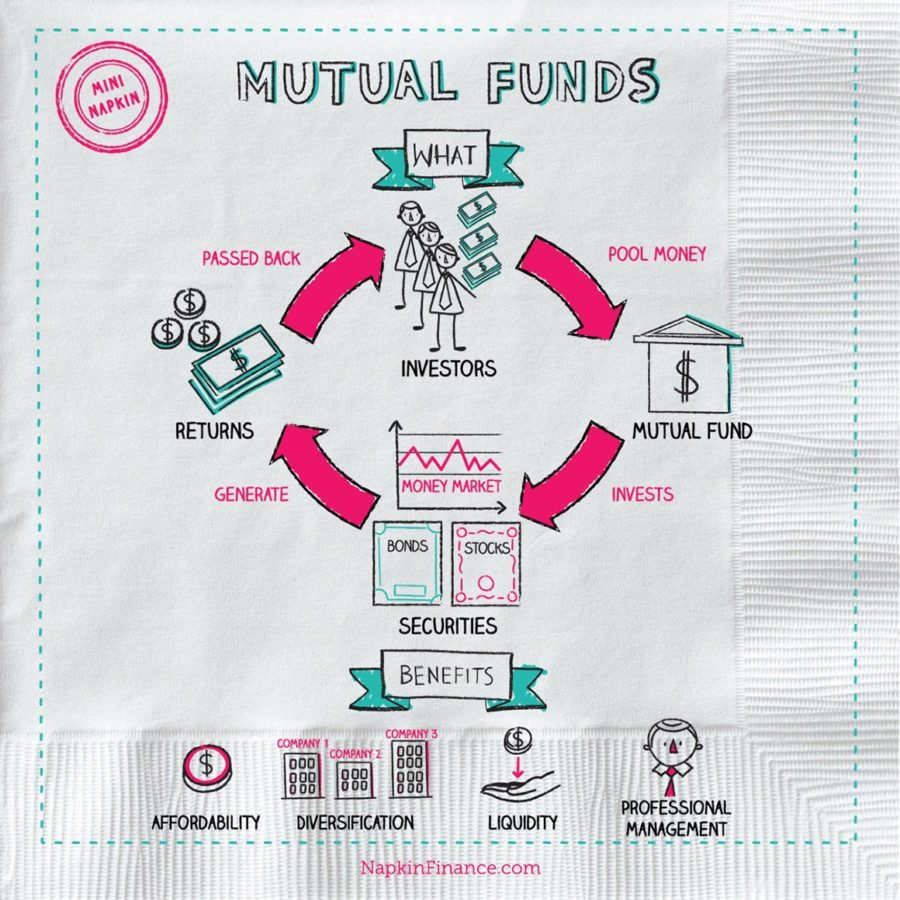

Mutual Funds Definition Types of Mutual Fund and Brief From allbankingalerts.com

Mutual Funds Definition Types of Mutual Fund and Brief From allbankingalerts.com

Bank insurance fund (bif) is a unit of the federal deposit insurance corporation (fdic) that provides deposit insurance for banks excluding thrifts. This fund is at the disposal of the president. Insurance fund means the farm credit insurance fund. Insurance fraud may entail a person filing a false insurance claim altogether, or exaggerating their damages , injuries or other losses in order to receive benefits. Contingency fund is created as an imprest account to meet some urgent or unforeseen expenditure of the government. In case of any shortfall, the employer must pay the difference.

’ means the farm credit insurance fund maintained by the insurance corporation pursuant to section 5.60 of the act.

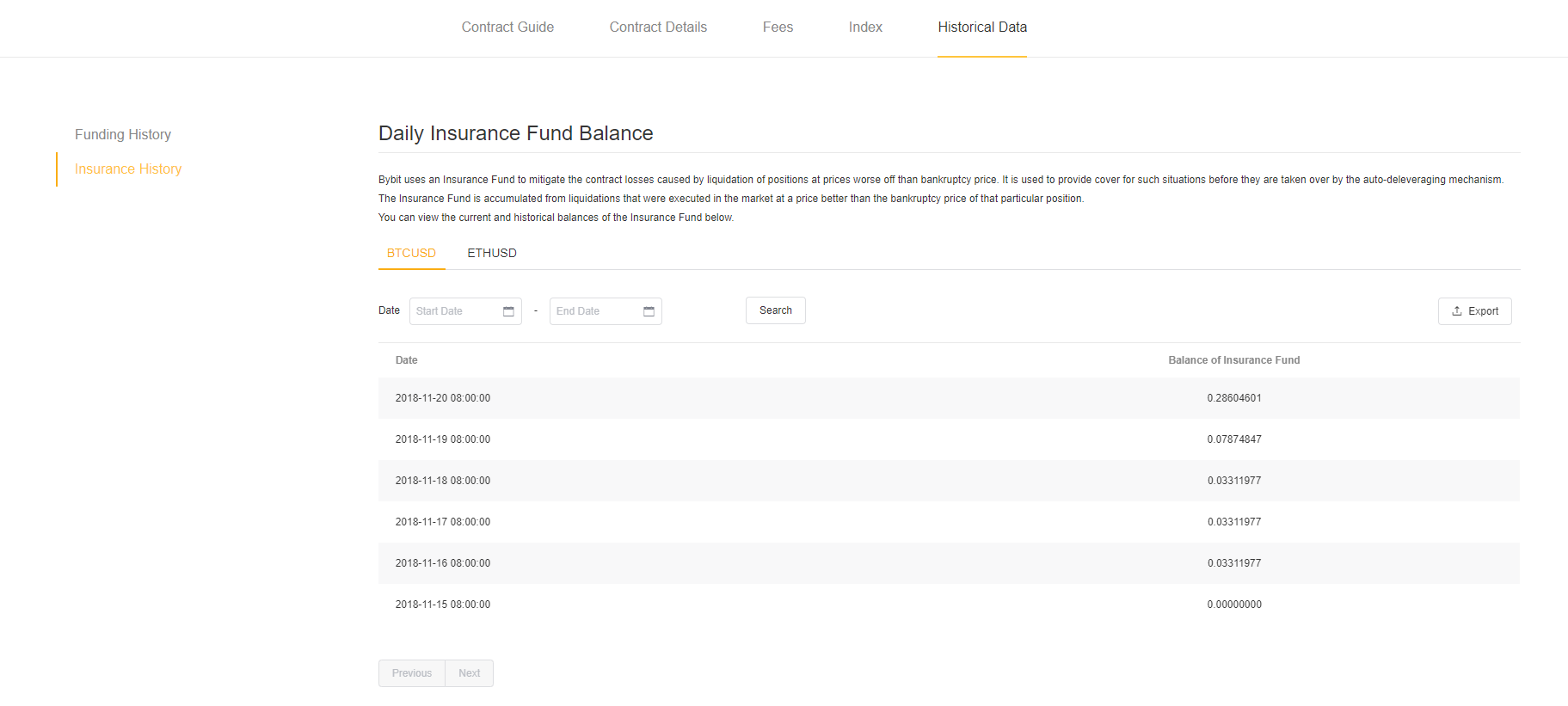

Individuals are only able to invest in the idfs through private placement life insurance (“ppli”) or variable annuity (“ppva. There are two types of pension funds. Any expenditure incurred from this fund requires a subsequent approval. However, the life insurance companies pay particular attention to the details of the tax risks with these products and expect indemnities and other protections in their side letters. In case of any shortfall, the employer must pay the difference. Insurance fund definition the insurance fund is a common fund on bybit that acts as the first line of defense against contract loss.

Source: slideshare.net

Source: slideshare.net

In case of any shortfall, the employer must pay the difference. This fund was constituted by the government under article 267 of the constitution of india. Any expenditure incurred from this fund requires a subsequent approval. All types of life assurance and insurers pension plans, both single. (d) the negotiations with the life insurance companies resemble the negotiations a manager might have with any significant investors in the manager’s other funds;

Source: allbankingalerts.com

Source: allbankingalerts.com

An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter. This includes all national banks and state banks that choose to. A person or entity who buys insurance is. There are two types of pension funds. As insurance funds are invested in various projects like water supply, power and roads etc, it contributes to the overall economic growth of the nation.

Source: slideserve.com

Source: slideserve.com

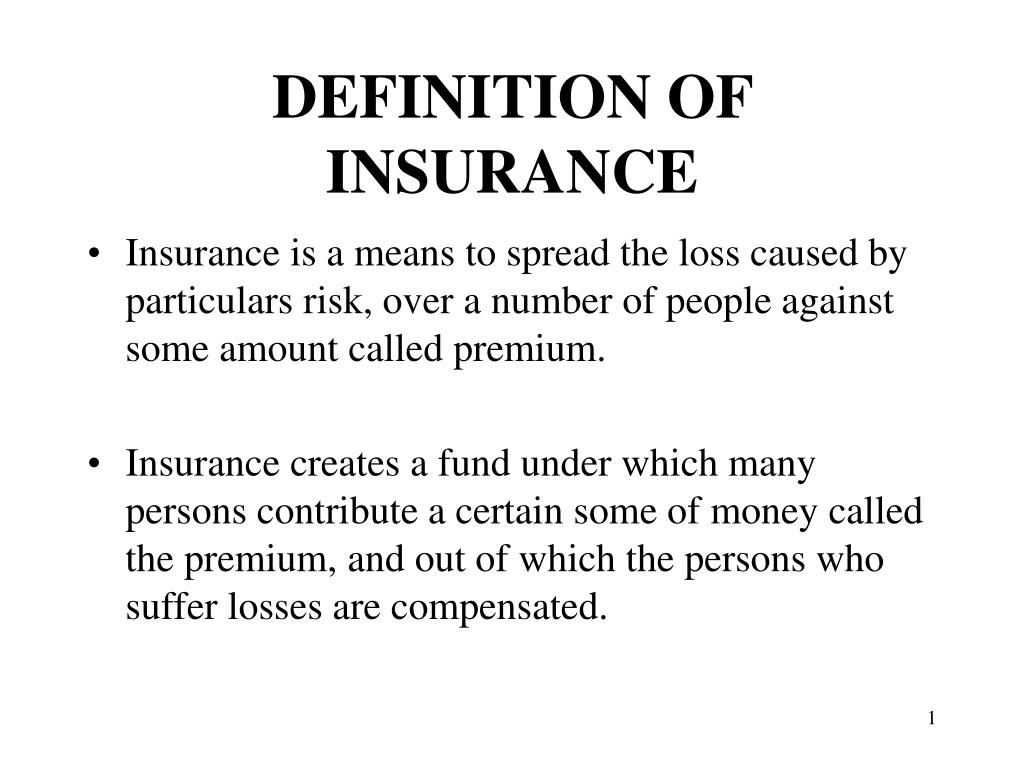

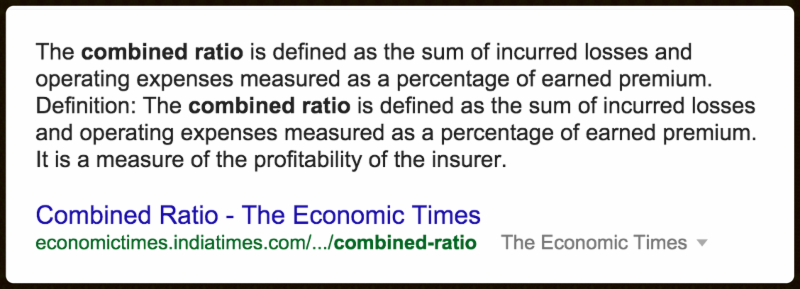

It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. The payout depends on how well the fund does. Why do we need an insurance fund? The federal fund administered by the federal deposit insurance corporation, which insures the deposits of individuals who invest at banks that are members of the federal reserve system. Bank insurance fund (bif) a unit of the federal deposit insurance corporation (fdic) that provides deposit insurance for banks excluding thrifts.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Insurance is a means of protection from financial loss. The federal fund administered by the federal deposit insurance corporation, which insures the deposits of individuals who invest at banks that are members of the federal reserve system. Any expenditure incurred from this fund requires a subsequent approval. Insurance fraud may entail a person filing a false insurance claim altogether, or exaggerating their damages , injuries or other losses in order to receive benefits. | meaning, pronunciation, translations and examples 言語 翻訳者

Source: thebalance.com

Source: thebalance.com

Insurance fraud may entail a person filing a false insurance claim altogether, or exaggerating their damages , injuries or other losses in order to receive benefits. Bank insurance fund (bif) a unit of the federal deposit insurance corporation (fdic) that provides deposit insurance for banks excluding thrifts. ’ means the farm credit insurance fund maintained by the insurance corporation pursuant to section 5.60 of the act. Why do we need an insurance fund? This fund was constituted by the government under article 267 of the constitution of india.

Source: zadishqr.blogspot.com

Source: zadishqr.blogspot.com

In case of any shortfall, the employer must pay the difference. The federal fund administered by the federal deposit insurance corporation, which insures the deposits of individuals who invest at banks that are members of the federal reserve system. Insurance fund means the farm credit insurance fund. This includes all national banks and state banks that choose to. Insurance fraud may entail a person filing a false insurance claim altogether, or exaggerating their damages , injuries or other losses in order to receive benefits.

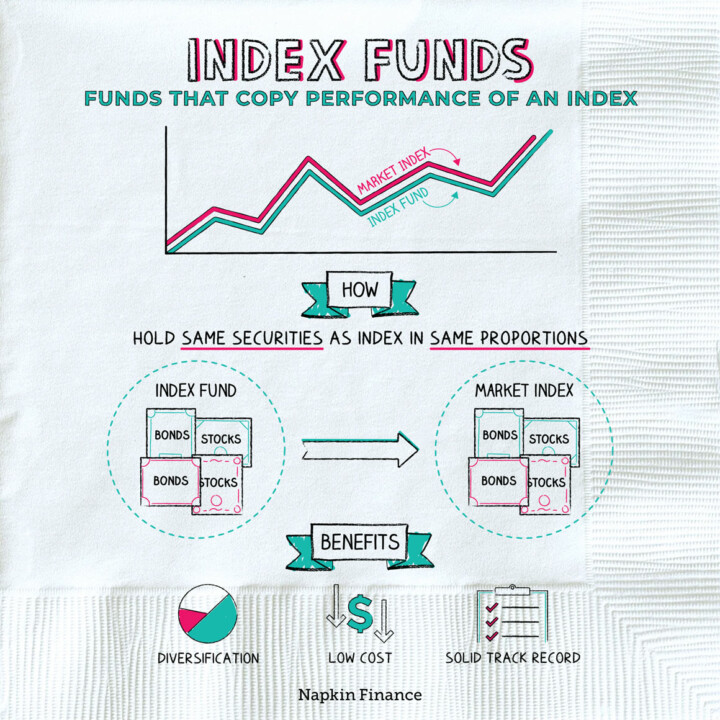

Source: napkinfinance.com

Source: napkinfinance.com

Insurance is a means of protection from financial loss. An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter. Invest in direct mutual funds & new fund offer (nfo) discover 5000+ schemes. This fund is at the disposal of the president. (d) the negotiations with the life insurance companies resemble the negotiations a manager might have with any significant investors in the manager’s other funds;

Source: slts.in

Source: slts.in

Insurance fund definition the insurance fund is a common fund on bybit that acts as the first line of defense against contract loss. B the state of having such protection. The second, the defined contribution plan, is the familiar 401 (k) plan. However, the life insurance companies pay particular attention to the details of the tax risks with these products and expect indemnities and other protections in their side letters. A person or entity who buys insurance is.

The nif is used to pay for social security benefits such as state retirement pensions and for the nhs via the government. In case of any shortfall, the employer must pay the difference. The first, the defined benefit pension fund, is what most people think of when they say pensions. the retiree receives the same guaranteed amount. Bank insurance fund (bif) is a unit of the federal deposit insurance corporation (fdic) that provides deposit insurance for banks excluding thrifts. However, the life insurance companies pay particular attention to the details of the tax risks with these products and expect indemnities and other protections in their side letters.

Source: investopedia.com

Source: investopedia.com

This includes all national banks and state banks that choose to. Insurers that offer these contracts are mainly found in the uk and british isles offshore financial centres. As insurance works on risk transfer mechanism, it promotes risk control activity. B the state of having such protection. The first, the defined benefit pension fund, is what most people think of when they say pensions. the retiree receives the same guaranteed amount.

Source: fashionblogbyalexis.blogspot.com

Source: fashionblogbyalexis.blogspot.com

This includes all national banks and state banks that choose to. A the act, system, or business of providing financial protection for property, life, health, etc., against specified contingencies, such as death, loss, or damage, and involving payment of regular premiums in return for a policy guaranteeing such protection. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. Individuals are only able to invest in the idfs through private placement life insurance (“ppli”) or variable annuity (“ppva. The federal fund administered by the federal deposit insurance corporation, which insures the deposits of individuals who invest at banks that are members of the federal reserve system.

Source: acronymsandslang.com

Source: acronymsandslang.com

This includes all national banks and state banks that choose to. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. Life insurance fund or “life fund” means the fund to which the receipts of an insurer in respect of his life insurance business are carried and from which payments in respect of that business are made; Bank insurance fund (bif) is a unit of the fdic that provides insurance protections for banks that are not classified as a savings and loan association. There are two types of pension funds.

Source: jobstreetus.com

Source: jobstreetus.com

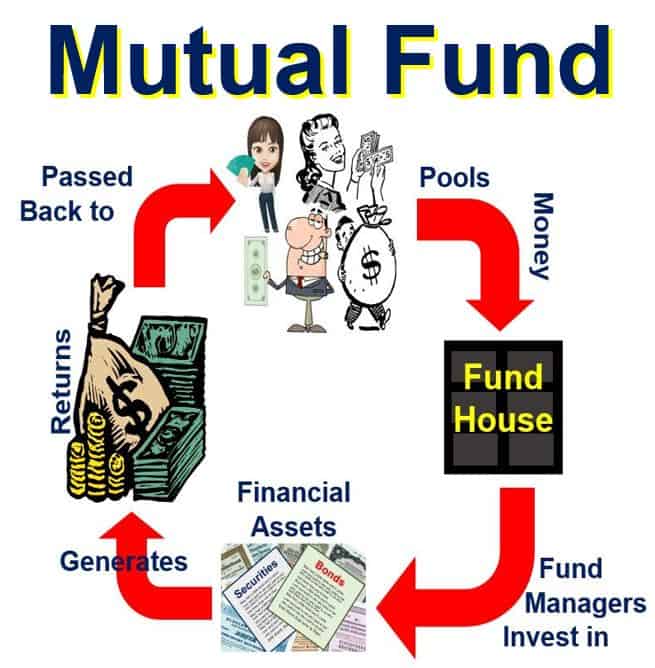

As insurance funds are invested in various projects like water supply, power and roads etc, it contributes to the overall economic growth of the nation. Invest in direct mutual funds & new fund offer (nfo) discover 5000+ schemes. In these funds, the fund manager has to ensure that the fund generates enough return to cover the retirement benefits of the pensioner. Funds are amounts of money that are available to be spent , especially money that is. Insurance fund means the farm credit insurance fund.

Source: es.slideshare.net

Source: es.slideshare.net

Invest in direct mutual funds & new fund offer (nfo) discover 5000+ schemes. This fund was constituted by the government under article 267 of the constitution of india. This includes all national banks and state banks that choose to. In these funds, the fund manager has to ensure that the fund generates enough return to cover the retirement benefits of the pensioner. As insurance funds are invested in various projects like water supply, power and roads etc, it contributes to the overall economic growth of the nation.

Source: napkinfinance.com

Source: napkinfinance.com

Why do we need an insurance fund? Insurers that offer these contracts are mainly found in the uk and british isles offshore financial centres. Also, insurance provides employment opportunity to people. In case of any shortfall, the employer must pay the difference. An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter.

Source: dhanvarshaindia.com

Source: dhanvarshaindia.com

All types of life assurance and insurers pension plans, both single. Bank insurance fund (bif) a unit of the federal deposit insurance corporation (fdic) that provides deposit insurance for banks excluding thrifts. An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter. Bank insurance fund (bif) is a unit of the fdic that provides insurance protections for banks that are not classified as a savings and loan association. The federal fund administered by the federal deposit insurance corporation, which insures the deposits of individuals who invest at banks that are members of the federal reserve system.

Source: medium.com

Source: medium.com

The payout depends on how well the fund does. Life insurance fund or “life fund” means the fund to which the receipts of an insurer in respect of his life insurance business are carried and from which payments in respect of that business are made; Any expenditure incurred from this fund requires a subsequent approval. Invest in direct mutual funds & new fund offer (nfo) discover 5000+ schemes. Insurance fund definition the insurance fund is a common fund on bybit that acts as the first line of defense against contract loss.

Source: referenceinsurance.blogspot.com

Source: referenceinsurance.blogspot.com

The first, the defined benefit pension fund, is what most people think of when they say pensions. the retiree receives the same guaranteed amount. | meaning, pronunciation, translations and examples 言語 翻訳者 The first, the defined benefit pension fund, is what most people think of when they say pensions. the retiree receives the same guaranteed amount. The federal fund administered by the federal deposit insurance corporation, which insures the deposits of individuals who invest at banks that are members of the federal reserve system. A the act, system, or business of providing financial protection for property, life, health, etc., against specified contingencies, such as death, loss, or damage, and involving payment of regular premiums in return for a policy guaranteeing such protection.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insurance fund definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.