Insurance guarantor meaning Idea

Home » Trending » Insurance guarantor meaning IdeaYour Insurance guarantor meaning images are available in this site. Insurance guarantor meaning are a topic that is being searched for and liked by netizens today. You can Get the Insurance guarantor meaning files here. Download all free photos and vectors.

If you’re searching for insurance guarantor meaning pictures information connected with to the insurance guarantor meaning topic, you have come to the right site. Our website always provides you with hints for seeking the maximum quality video and image content, please kindly surf and find more enlightening video content and images that fit your interests.

Insurance Guarantor Meaning. What is the meaning of an insurance guarantor? Guarantors sometimes appear on insurance contracts and also provide a sort of insurance themselves. Most likely, it can allow for borrowing more and receiving a better interest rate. Tender bonds, performance guarantees, and repayment guarantees.

What Is a Guarantor? What You Need to Know If You�re a From realtor.com

What Is a Guarantor? What You Need to Know If You�re a From realtor.com

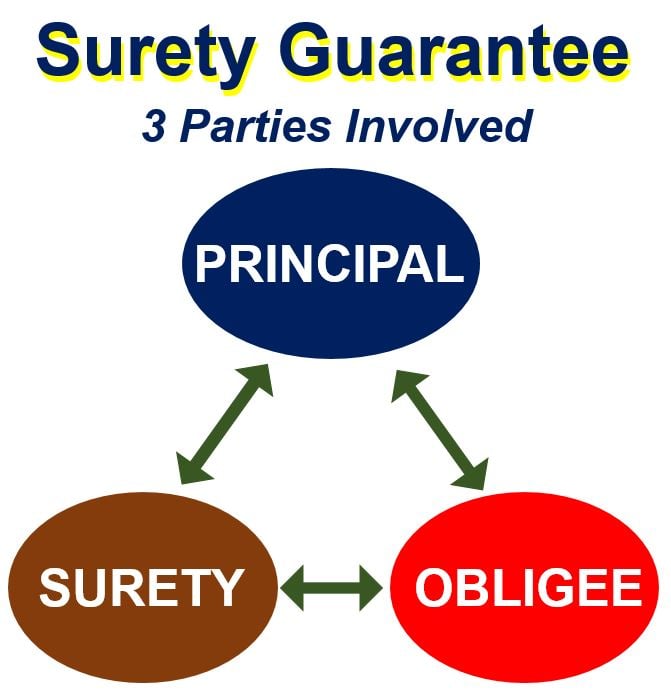

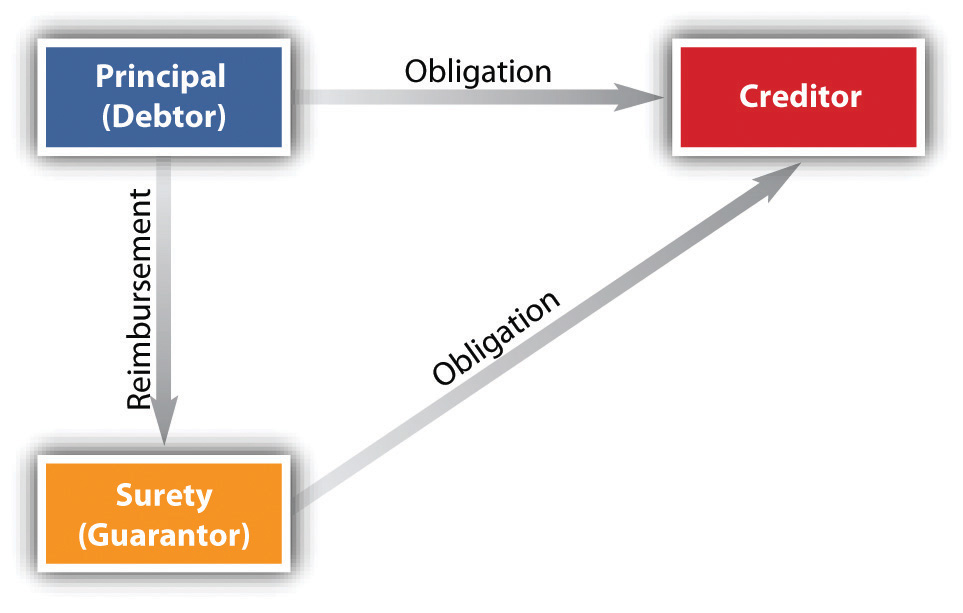

Tender bonds, performance guarantees, and repayment guarantees. The guarantor is the person or entity financially responsible for the bill. An agreement by a third party to be responsible for the performance of a contracting party. An insurance guarantor person or entity that assures that the promises given by one party to the other party will be kept. Through the issue of a surety bond, a surety company is in effect the guarantor. A guarantor (orresponsible party) is the person held accountable for the patient’s bill.

Through the issue of a surety bond, a surety company is in effect the guarantor.

• the guarantor is not the insurance subscriber, the husband, or the head of household. Personal guarantees have long been a fact of life for business owners seeking a commercial loan, but this doesn’t lessen the risk associated with signing them. The guarantor is the person or entity financially responsible for the bill. The health insurance company is a guarantor of sorts (if you have a fully insured plan) but there may also be other carriers backing them up. Guarantors don�t always guarantee the entire amount of a liability. One, such as a person or corporation, that makes or gives a promise, assurance, or pledge typically relating to quality,.

Source: investopedia.com

Source: investopedia.com

States, usually does not include mortgages or certain. By doing so, the business owner (also known as a guarantor) is responsible for satisfying the loan terms in the event of the business’ liquidation. See uniform rules for contract guarantees; Having a guarantor means that the loan or agreement has a higher chance of being approved and much more quickly. What is the meaning of an insurance guarantor?

Source: healthnautica.com

Source: healthnautica.com

Uniform rules for demand guarantees. This is a big difference with a surety and means that the guarantor cannot invoke the exceptions of the principal debtor based on the underlying contract. There are three major types of contract guarantee: Financial guarantees act like insurance policies, guaranteeing a form of debt will be paid if the borrower defaults. Most likely, it can allow for borrowing more and receiving a better interest rate.

Through the issue of a surety bond, a surety company is in effect the guarantor. An insurance guarantor can be described as a neutral third party in an agreement that has endorsed the contract. There are three major types of contract guarantee: Tender bonds, performance guarantees, and repayment guarantees. A guarantor (orresponsible party) is the person held accountable for the patient’s bill.

Source: realtor.com

Source: realtor.com

See uniform rules for contract guarantees; On the other hand, a performance guarantee ensures payment or any compensation in the event of inadequate or delayed performance by the party to the contract. Who needs an insurance guarantor? With self funded health insurance your employer or union is the guarantor and they may have reinsurance in place to back them. Who is the guarantor for insurance?

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Financial guarantee insurance may cover different types of loans, but, in most u.s. • the guarantor is always the patient, unless the patient is a minor or an incapacitated adult. An insurance policy covering a lender from liability resulting from the failure of the borrower to repay the loan. Who is the guarantor for insurance? Most likely, it can allow for borrowing more and receiving a better interest rate.

Source: dreamstime.com

Source: dreamstime.com

The guarantor would be obliged to make the payments on behalf of the borrower. One, such as a person or corporation, that makes or gives a promise, assurance, or pledge typically relating to quality,. Guarantors don�t always guarantee the entire amount of a liability. See uniform rules for contract guarantees; Guarantors sometimes appear on insurance contracts and also provide a sort of insurance themselves.

Source: saylordotorg.github.io

Source: saylordotorg.github.io

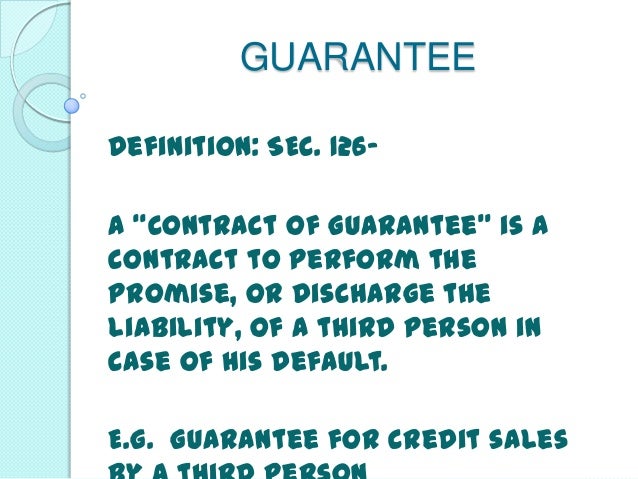

A guarantee is a promise of performance to a beneficiary in the event that the person who would normally provide a service or good fails to do so. A guarantee is an independent, abstract own commitment of the insurer or bank that is separate from the main obligation. Having a guarantor means that the loan or agreement has a higher chance of being approved and much more quickly. There are a few different instances when someone might need. A guarantor (orresponsible party) is the person held accountable for the patient’s bill.

Source: 8steps.net

Source: 8steps.net

Through the issue of a surety bond, a surety company is in effect the guarantor. — an insurance guarantor person or entity that assures that the promises given by one party to the (9). A fidelity guarantee as issued by the insurers is a contract of insurance and also a contract of guarantee to which the general principles of insurance apply. A guarantor is a third party in a contract who promises to pay for certain liabilities if one of the other parties in the contract defaults on their obligations. • the guarantor is always the patient, unless the patient is a minor or an incapacitated adult.

Source: slideshare.net

Source: slideshare.net

On the other hand, a performance guarantee ensures payment or any compensation in the event of inadequate or delayed performance by the party to the contract. The who and how of insurance guarantors change depending on what kind of policy you’re referring to, such as: Guarantors sometimes appear on insurance contracts and also provide a sort of insurance themselves. A guarantee inserts a third party into a legal agreement to provide an extra layer of protection for the beneficiary. With self funded health insurance your employer or union is the guarantor and they may have reinsurance in place to back them.

Source: myinsuranceshark.com

Source: myinsuranceshark.com

Personal guarantees have long been a fact of life for business owners seeking a commercial loan, but this doesn’t lessen the risk associated with signing them. A guarantor is a third party in a contract who promises to pay for certain liabilities if one of the other parties in the contract defaults on their obligations. An insurance guarantor can be described as a neutral third party in an agreement that has endorsed the contract. What is the meaning of an insurance guarantor? Financial guarantee insurance may cover different types of loans, but, in most u.s.

Source: canonprintermx410.blogspot.com

Source: canonprintermx410.blogspot.com

In short, a guarantor is a person or organization that provides a guarantee of payment or other contractual fulfillment. An insurance guarantor person or entity that assures that the promises given by one party to the other party will be kept. Tender bonds, performance guarantees, and repayment guarantees. States, usually does not include mortgages or certain. One, such as a person or corporation, that makes or gives a promise, assurance, or pledge typically relating to quality,.

Source: dreamstime.com

Source: dreamstime.com

Who is the guarantor for insurance? This is a big difference with a surety and means that the guarantor cannot invoke the exceptions of the principal debtor based on the underlying contract. A guarantee is a promise of performance to a beneficiary in the event that the person who would normally provide a service or good fails to do so. A guarantee is an independent, abstract own commitment of the insurer or bank that is separate from the main obligation. But if, for some reason, the first party fails to fulfill the promises, the guarantor should shoulder the liabilities.

An insurance guarantor can be described as a neutral third party in an agreement that has endorsed the contract. An insurance guarantor can be described as a neutral third party in an agreement that has endorsed the contract. States, usually does not include mortgages or certain. There are three major types of contract guarantee: An agreement by a third party to be responsible for the performance of a contracting party.

Source: dreamstime.com

Source: dreamstime.com

With self funded health insurance your employer or union is the guarantor and they may have reinsurance in place to back them. An agreement by a third party to be responsible for the performance of a contracting party. Therefore, the party or person guarantees that whatever promises made by the first party will be fulfilled. An insurance guarantor can be described as a neutral third party in an agreement that has endorsed the contract. A fidelity guarantee as issued by the insurers is a contract of insurance and also a contract of guarantee to which the general principles of insurance apply.

Source: dreamstime.com

Source: dreamstime.com

Guarantors sometimes appear on insurance contracts and also provide a sort of insurance themselves. There are three major types of contract guarantee: States, usually does not include mortgages or certain. A guarantor is a third party in a contract who promises to pay for certain liabilities if one of the other parties in the contract defaults on their obligations. In short, a guarantor is a person or organization that provides a guarantee of payment or other contractual fulfillment.

Source: mgtblog.com

Source: mgtblog.com

— an insurance guarantor person or entity that assures that the promises given by one party to the (9). See uniform rules for contract guarantees; Financial guarantees act like insurance policies, guaranteeing a form of debt will be paid if the borrower defaults. It may also cover losses from a decrease in interest rates to the detriment of the lender. This is a big difference with a surety and means that the guarantor cannot invoke the exceptions of the principal debtor based on the underlying contract.

Source: slideshare.net

Source: slideshare.net

In these situations, the customer�s bank might guarantee the customer�s payment, meaning that the bank will pay the vendor if the customer does not. Having a guarantor means that the loan or agreement has a higher chance of being approved and much more quickly. Guarantees can be financial contracts, where. There are a few different instances when someone might need. • the guarantor is always the patient, unless the patient is a minor or an incapacitated adult.

Source: dreamstime.com

Source: dreamstime.com

The cost for medical services that insurance companies believe are appropriate throughout the geographic area or community. There are three major types of contract guarantee: In these situations, the customer�s bank might guarantee the customer�s payment, meaning that the bank will pay the vendor if the customer does not. By doing so, the business owner (also known as a guarantor) is responsible for satisfying the loan terms in the event of the business’ liquidation. • the guarantor is always the patient, unless the patient is a minor or an incapacitated adult.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insurance guarantor meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.