Insurance interest meaning Idea

Home » Trend » Insurance interest meaning IdeaYour Insurance interest meaning images are available in this site. Insurance interest meaning are a topic that is being searched for and liked by netizens today. You can Find and Download the Insurance interest meaning files here. Find and Download all free vectors.

If you’re searching for insurance interest meaning pictures information linked to the insurance interest meaning interest, you have come to the right blog. Our website frequently provides you with hints for seeing the highest quality video and picture content, please kindly hunt and find more informative video articles and graphics that match your interests.

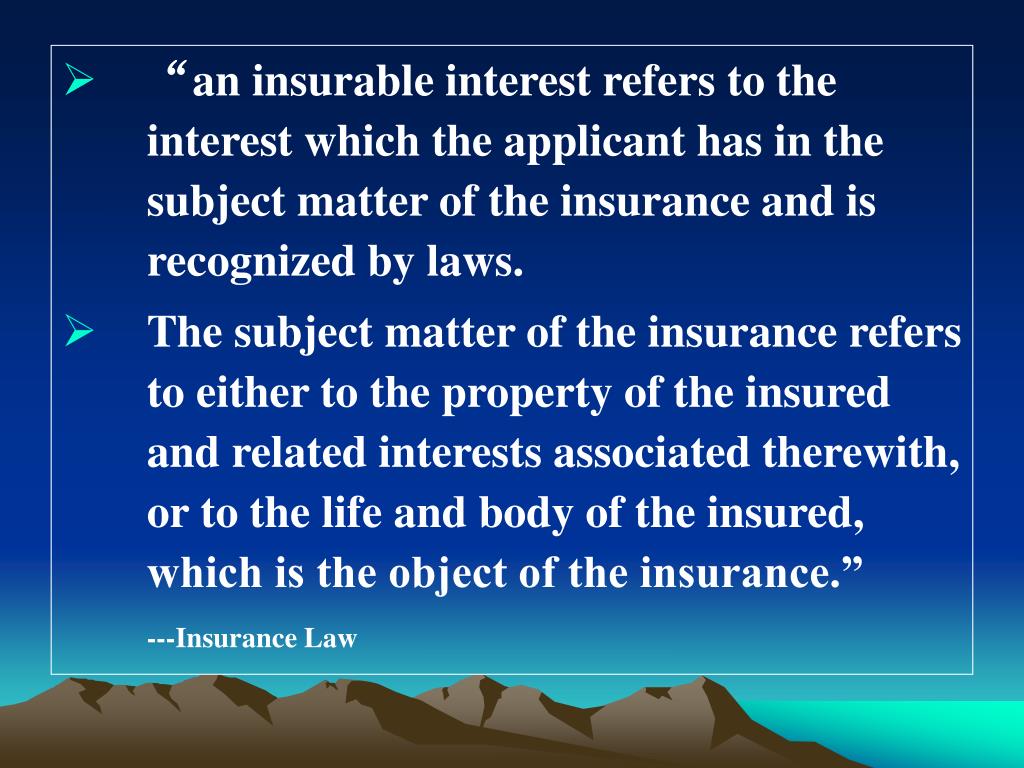

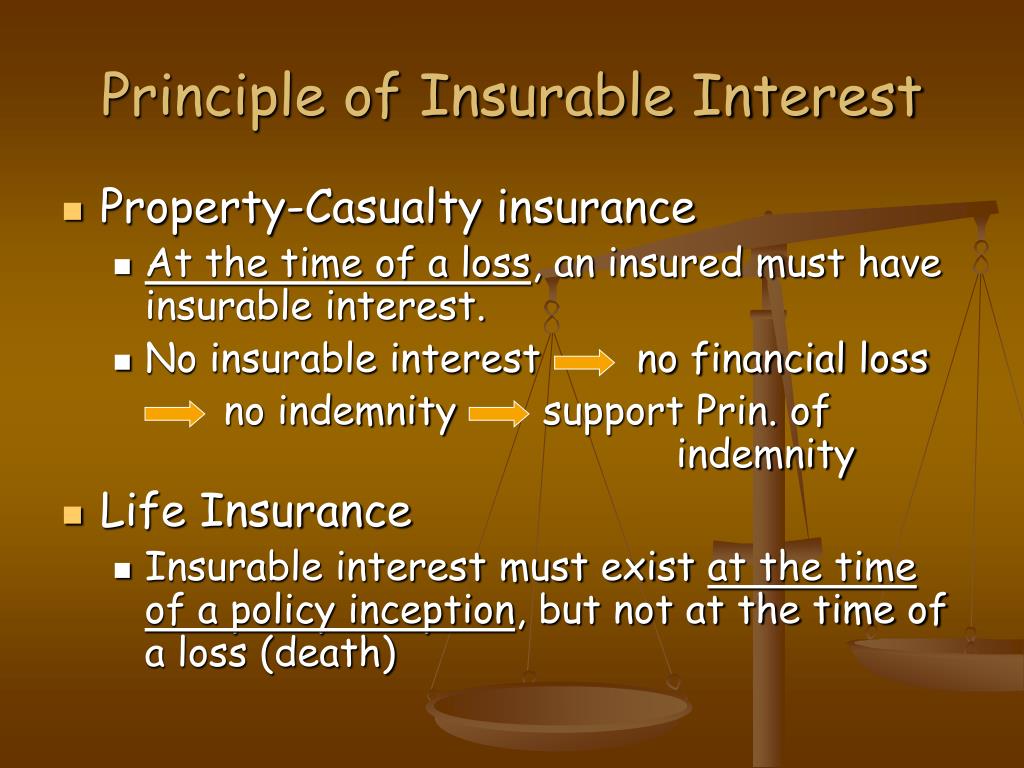

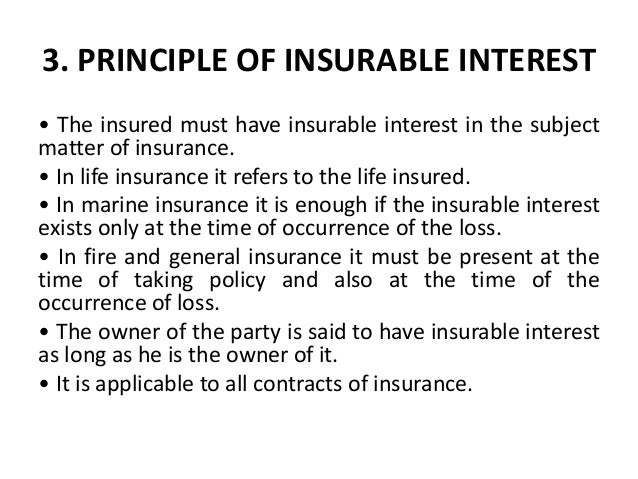

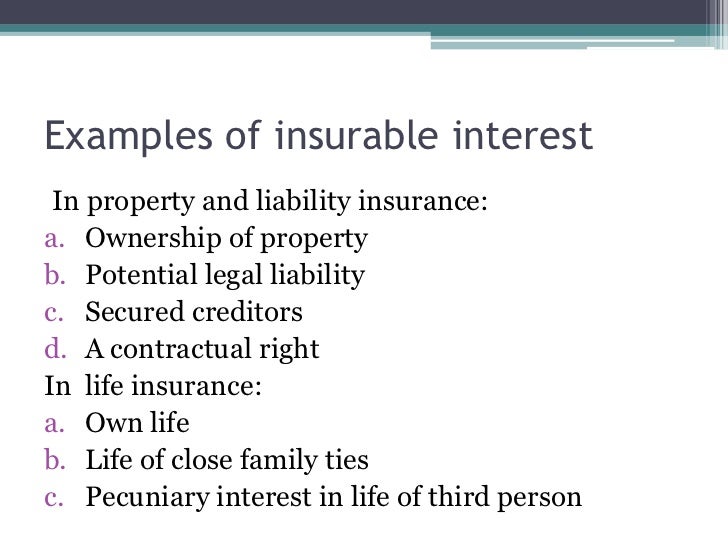

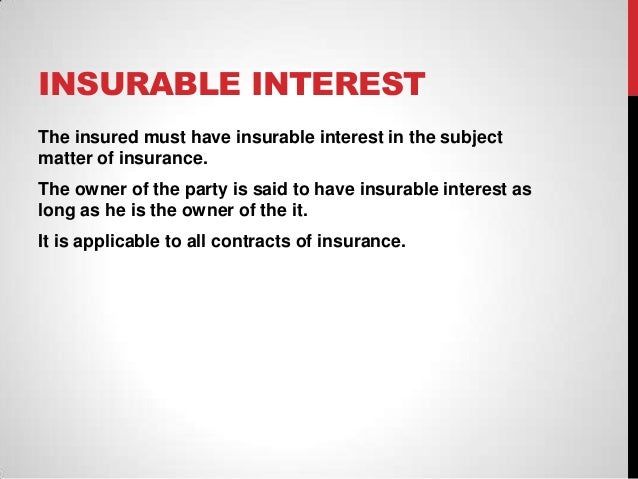

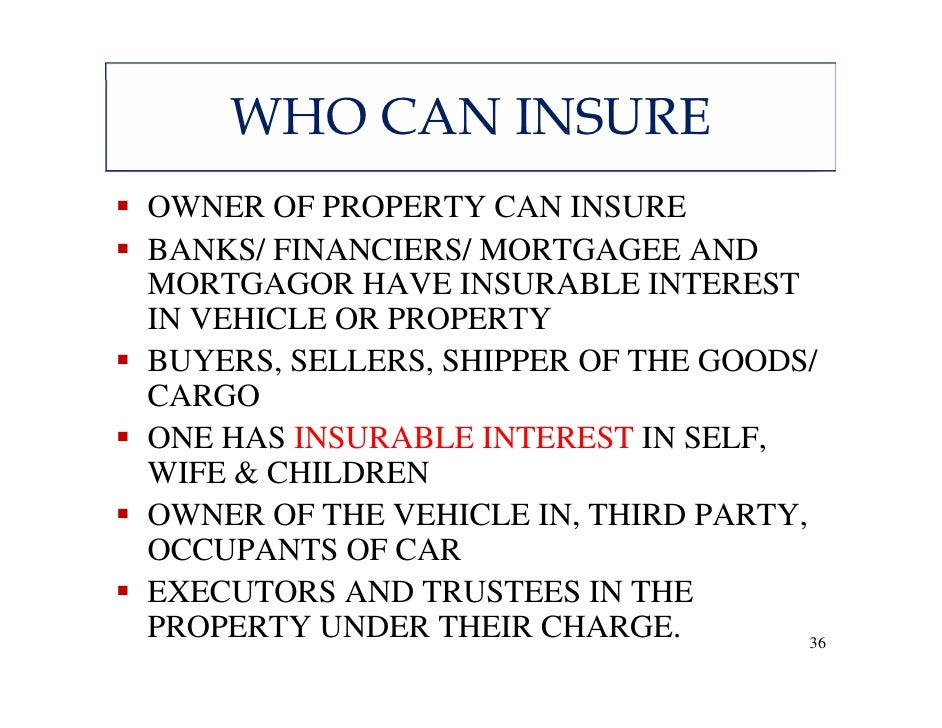

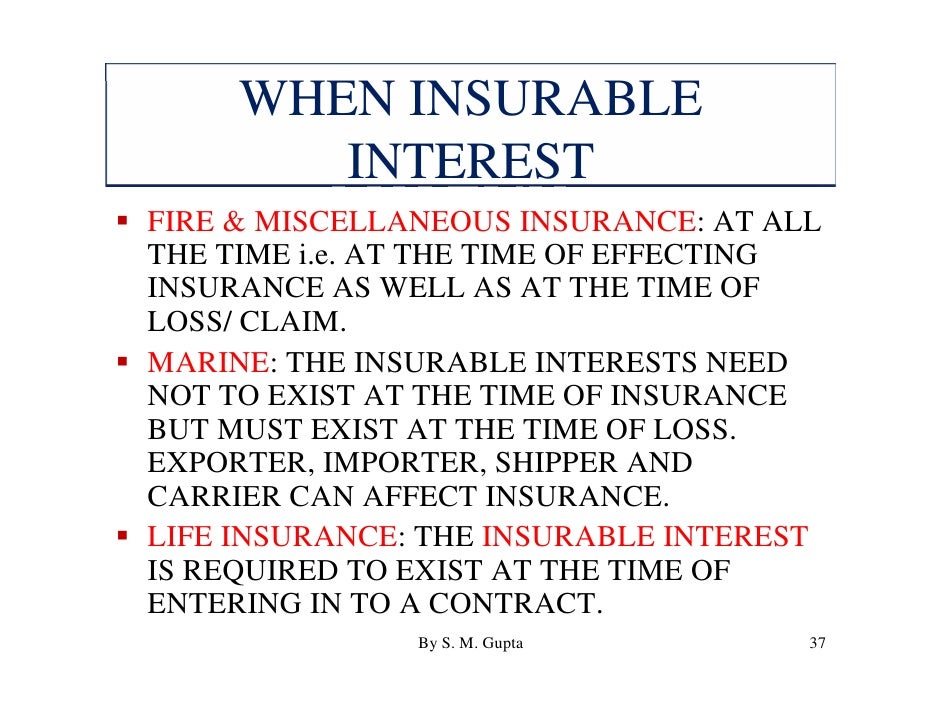

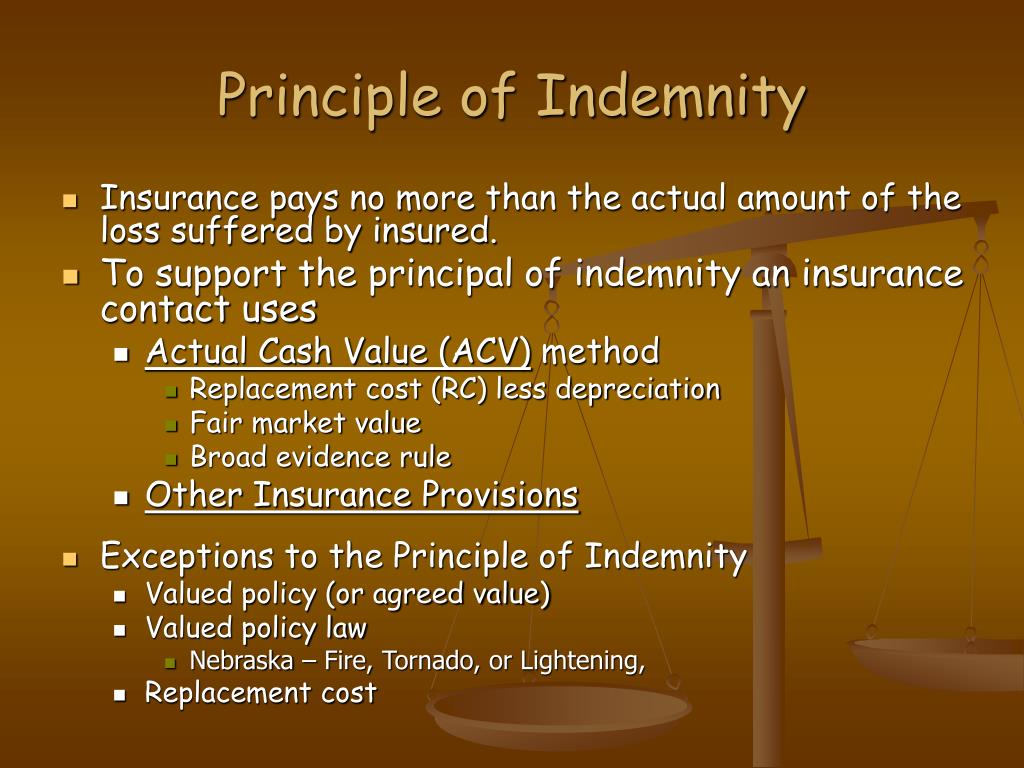

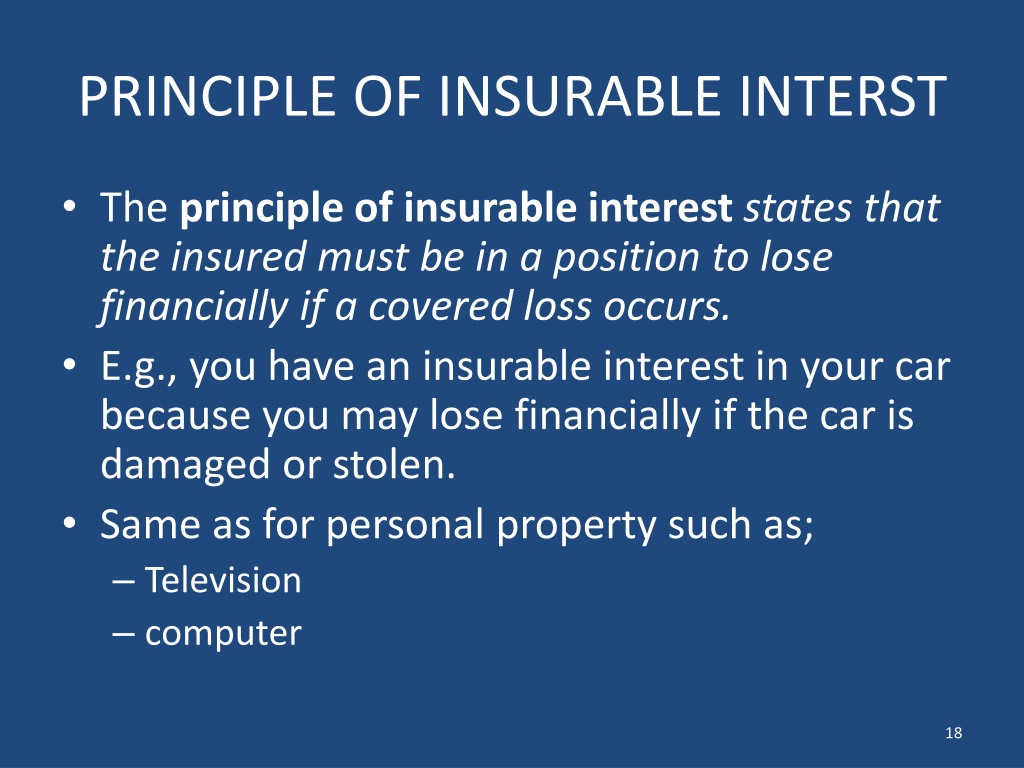

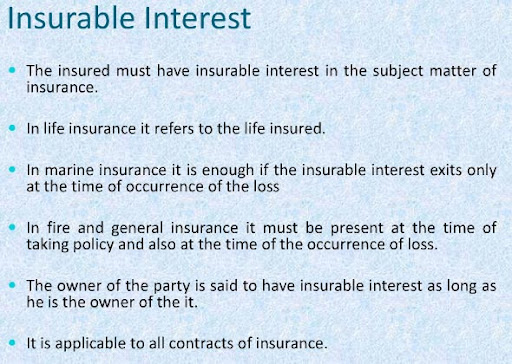

Insurance Interest Meaning. If there is any change made in the policy of the insuree (any modification or cancellation) of the policy, the party who has been labeled as. Meaning and principles of insurance forms an important part of the general awareness section of various competitive exams. Insurable interest exists to prevent the moral hazard individuals have from taking out insurance policies for the wrong reasons. In insurance terminology, additional interest means an uninsured or insured third party that is named in the insurance policy as having an interest in the insurance policy of the holder.

PPT Chapter Three The Principle of Insurable Interest From slideserve.com

PPT Chapter Three The Principle of Insurable Interest From slideserve.com

The person taking an insurance policy must have an insurable interest in the property or life insured. Least expensive alternative treatment (leat): It may also mean the interest of a beneficiary of a life insurance policy to prove need for the proceeds, called the insurable interest doctrine. On your renters insurance policy, an additional interest simply means a party that will be notified of any changes to your policy. That means at the time of purchase she had $75,000 of insurable interest in the home. The concept of insurable interest is fundamental to commercial property insurance.

Insurable interest is no longer strictly an element of life.

Stacey bought a new house in 2015. Insurable interest is a requirement for the issuance of an insurance policy, making it legal, valid and protecting against intentionally harmful acts. Working interest owners bear all of the costs and liabilities associated with leasing, drilling, producing, and operating a well but share in only part of the production revenue from. The theory behind ‘noting an interest’ was that without suitable insurance cover, a property would be considered a risk to a lender. Meaning and principles of insurance forms an important part of the general awareness section of various competitive exams. Insurable interest refers to the right of property to be insured.

Source: slideserve.com

Source: slideserve.com

Insurable interest refers to the right of property to be insured. In fact, before the promulgation of certain acts by english parliament, it was not. If there is any change made in the policy of the insuree (any modification or cancellation) of the policy, the party who has been labeled as. While this party is made aware of changes, they do not receive any coverage whatsoever. Insurable interest can be an object which, if damaged or destroyed, would result in financial hardship for the policyholder.

Source: articles-junction.blogspot.com

Source: articles-junction.blogspot.com

On your renters insurance policy, an additional interest simply means a party that will be notified of any changes to your policy. An additional interest has a vested “interest” in the item or property being insured but has no actual ownership of it. That means at the time of purchase she had $75,000 of insurable interest in the home. Insurable interest is almost a legal right to insure. The term insurable interest refers to a person�s financial interest in insured property.

Source: slideshare.net

Source: slideshare.net

If the property were to be destroyed by fire or flood for example, and there was no suitable insurance cover in place, then the asset in which the lender had invested would be at best reduced in value, or at. Insurable interest can be an object which, if damaged or destroyed, would result in financial hardship for the policyholder. In insurance law, you can only buy insurance for something or someone in which you have an insurable interest. An additional interest has a vested “interest” in the item or property being insured but has no actual ownership of it. General insurance is meant to ease the distress of a unexpected events, and it’s not intended to be used as a means to bet on, or profit on insurance proceeds from the unfortunate circumstances of others.

Source: slideshare.net

Source: slideshare.net

1 it represents a person�s financial investment or economic stake in the subject of insurance. Insurable interest is defined as the reasonable concern of a person to obtain insurance for any individual or property against unforeseen events such as death, losses, etc. Entities not subject to financial loss from an event do not have an insurable interest and cannot purchase an insurance policy to cover that event. 1 it represents a person�s financial investment or economic stake in the subject of insurance. They are often used interchangeably, but they refer to different parties.

Source: slideserve.com

Source: slideserve.com

Some insurers, however, use the term interchangeably. That means at the time of purchase she had $75,000 of insurable interest in the home. It must be the one insuring who has an insurable interest in the life of the person he is insuring, and of course, it goes without saying that one has an insurable interest in his own life and health. In insurance terminology, additional interest means an uninsured or insured third party that is named in the insurance policy as having an interest in the insurance policy of the holder. In insurance law, you can only buy insurance for something or someone in which you have an insurable interest.

Source: slideserve.com

Source: slideserve.com

A person is expected to have reasonable interest in a longer life for himself, his family, business and hence is in need of acquiring insurance for these. While this party is made aware of changes, they do not receive any coverage whatsoever. Insurable interest is a requirement for the issuance of an insurance policy, making it legal, valid and protecting against intentionally harmful acts. Working interest owners bear all of the costs and liabilities associated with leasing, drilling, producing, and operating a well but share in only part of the production revenue from. It may also mean the interest of a beneficiary of a life insurance policy to prove need for the proceeds, called the insurable interest doctrine.

Source: slideshare.net

Source: slideshare.net

The theory behind ‘noting an interest’ was that without suitable insurance cover, a property would be considered a risk to a lender. Simply put, an additional interest will be notified only about changes in the status. Thus, a person has an insurable interest in their own life, their family, their property, and their business. In insurance law, you can only buy insurance for something or someone in which you have an insurable interest. Knowing about insurance and its principles is important especially for candidates appearing for insurance exams such as lic, nicl, niacl and irda.

Source: slideserve.com

Source: slideserve.com

A right, benefit, or advantage arising out of property that is of such nature that it may properly be indemnified. Least expensive alternative treatment (leat): Interest rates are a key parameter for insurance operations. In insurance law, you can only buy insurance for something or someone in which you have an insurable interest. The term insurable interest refers to a person�s financial interest in insured property.

Source: slideshare.net

Source: slideshare.net

While this party is made aware of changes, they do not receive any coverage whatsoever. Interest rates are a key parameter for insurance operations. The types of changes the additional interest will be notified of typically include cancellations, lapses in coverage, or renewals. Insurable interest refers to the right of property to be insured. Insurable interest exists to prevent the moral hazard individuals have from taking out insurance policies for the wrong reasons.

Source: ppt-online.org

Source: ppt-online.org

Interest rates are a key parameter for insurance operations. Stacey bought a new house in 2015. The person taking an insurance policy must have an insurable interest in the property or life insured. On your renters insurance policy, an additional interest simply means a party that will be notified of any changes to your policy. Insurable interest is almost a legal right to insure.

Source: slideshare.net

Source: slideshare.net

In insurance terminology, additional interest means an uninsured or insured third party that is named in the insurance policy as having an interest in the insurance policy of the holder. Knowing about insurance and its principles is important especially for candidates appearing for insurance exams such as lic, nicl, niacl and irda. However, sustained low interest rates are negative for all insurers, as fixed income investments are an important earnings stream. It must be the one insuring who has an insurable interest in the life of the person he is insuring, and of course, it goes without saying that one has an insurable interest in his own life and health. Insurable interest is the basis of all insurance policies.

Source: slideshare.net

Source: slideshare.net

Least expensive alternative treatment (leat): If the property were to be destroyed by fire or flood for example, and there was no suitable insurance cover in place, then the asset in which the lender had invested would be at best reduced in value, or at. ‘insurable interest’ insurance is a. However, sustained low interest rates are negative for all insurers, as fixed income investments are an important earnings stream. The types of changes the additional interest will be notified of typically include cancellations, lapses in coverage, or renewals.

Source: onlineessay262.web.fc2.com

Source: onlineessay262.web.fc2.com

In the law of insurance, the insured must have an interest in the subject matter of his or her policy, or such policy will be void and unenforceable since it will be regarded as a form of gambling. General insurance is meant to ease the distress of a unexpected events, and it’s not intended to be used as a means to bet on, or profit on insurance proceeds from the unfortunate circumstances of others. An additional interest, in the context of insurance, refers to an uninsured third party named in an insurance policy as having an interest in being notified if the policy is ever canceled or modified. A right, benefit, or advantage arising out of property that is of such nature that it may properly be indemnified. Working interest owners bear all of the costs and liabilities associated with leasing, drilling, producing, and operating a well but share in only part of the production revenue from.

Source: slideshare.net

Source: slideshare.net

On your renters insurance policy, an additional interest simply means a party that will be notified of any changes to your policy. In insurance law, you can only buy insurance for something or someone in which you have an insurable interest. Insurable interest is a requirement for the issuance of an insurance policy, making it legal, valid and protecting against intentionally harmful acts. It must be the one insuring who has an insurable interest in the life of the person he is insuring, and of course, it goes without saying that one has an insurable interest in his own life and health. If there is any change made in the policy of the insuree (any modification or cancellation) of the policy, the party who has been labeled as.

Source: slideserve.com

Source: slideserve.com

Insurable interest is the basis of all insurance policies. Knowing about insurance and its principles is important especially for candidates appearing for insurance exams such as lic, nicl, niacl and irda. Insurable interest is no longer strictly an element of life. The concept of insurable interest is fundamental to commercial property insurance. The interest that a person has in something such as a particular property or another individual, which means that the person would suffer a loss should that property or individual be harmed.

Source: slideserve.com

Source: slideserve.com

Insurable interest is defined as the reasonable concern of a person to obtain insurance for any individual or property against unforeseen events such as death, losses, etc. Knowing about insurance and its principles is important especially for candidates appearing for insurance exams such as lic, nicl, niacl and irda. Insurable interest is a requirement for the issuance of an insurance policy, making it legal, valid and protecting against intentionally harmful acts. Entities not subject to financial loss from an event do not have an insurable interest and cannot purchase an insurance policy to cover that event. Simply put, an additional interest will be notified only about changes in the status.

Source: kalyan-city.blogspot.com

Source: kalyan-city.blogspot.com

In insurance law, you can only buy insurance for something or someone in which you have an insurable interest. Some insurers, however, use the term interchangeably. If there is any change made in the policy of the insuree (any modification or cancellation) of the policy, the party who has been labeled as. Entities not subject to financial loss from an event do not have an insurable interest and cannot purchase an insurance policy to cover that event. Therefore, insurable interest is often.

Source: ppt-online.org

Source: ppt-online.org

Entities not subject to financial loss from an event do not have an insurable interest and cannot purchase an insurance policy to cover that event. They are often used interchangeably, but they refer to different parties. In the law of insurance, the insured must have an interest in the subject matter of his or her policy, or such policy will be void and unenforceable since it will be regarded as a form of gambling. Entities not subject to financial loss from an event do not have an insurable interest and cannot purchase an insurance policy to cover that event. An additional interest, in the context of insurance, refers to an uninsured third party named in an insurance policy as having an interest in being notified if the policy is ever canceled or modified.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance interest meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.