Insurance investment management information

Home » Trending » Insurance investment management informationYour Insurance investment management images are available. Insurance investment management are a topic that is being searched for and liked by netizens today. You can Get the Insurance investment management files here. Get all royalty-free photos.

If you’re looking for insurance investment management pictures information linked to the insurance investment management topic, you have pay a visit to the ideal blog. Our site always provides you with hints for viewing the highest quality video and picture content, please kindly search and find more informative video articles and graphics that fit your interests.

Insurance Investment Management. Due to the scale of investments on an insurance company’s balance sheet and the impact of investment results on Due to the scale of investments in an insurance company’s balance sheet and. Investment management insurance policy is a single comprehensive policy covering investment managers, investment advisors and investment funds for their potential liability against their director/officer for wrongful act while managing investment funds and potential civil liability while performing investment advisory and management services. Securities and investment insurance helps protect investment managers, investment advisors and other investment businesses that face their own unique risks.

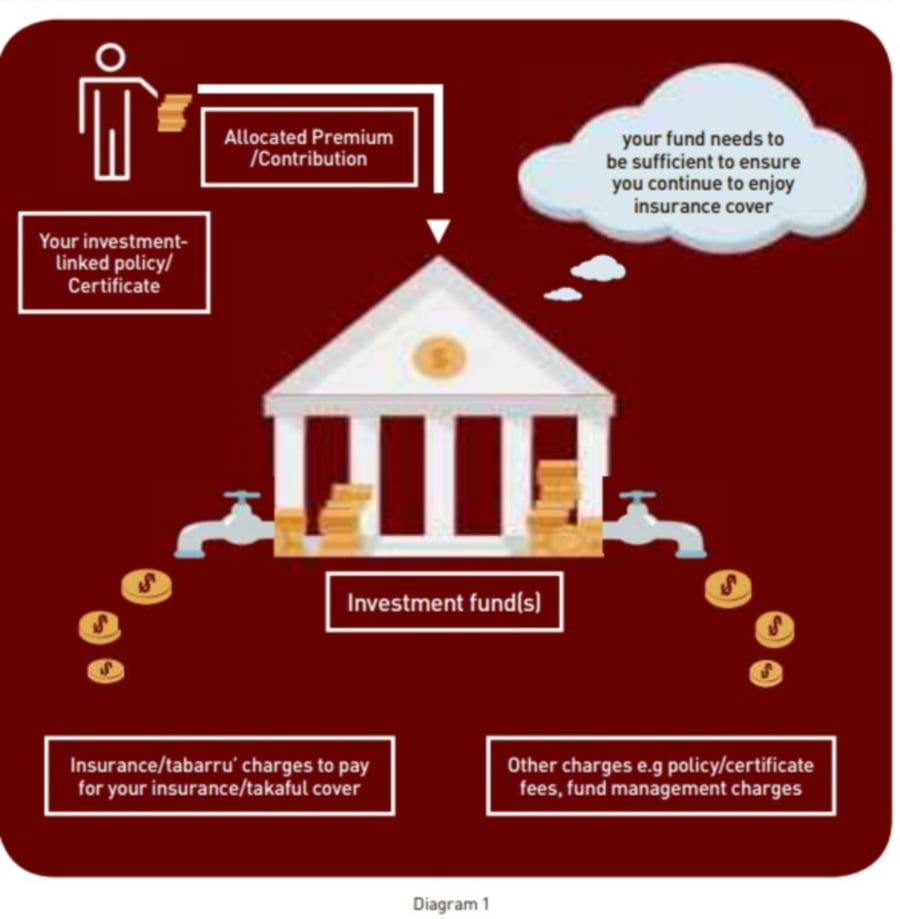

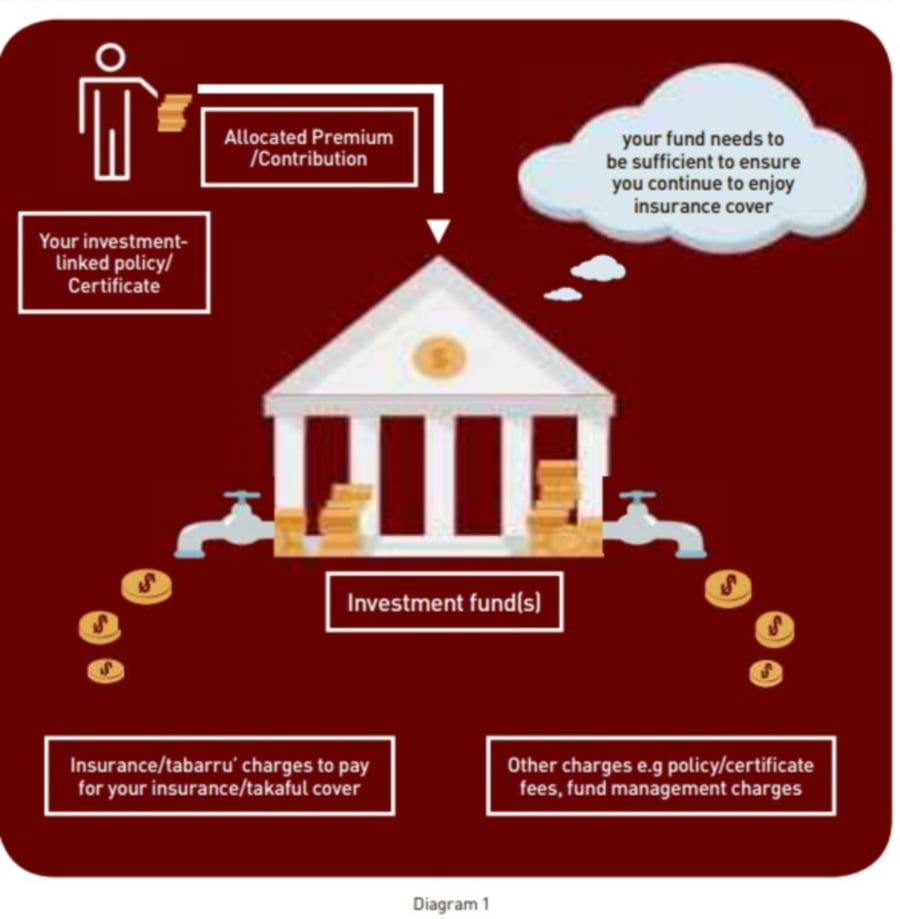

Managing your investmentlinked life insurance policy From nst.com.my

Managing your investmentlinked life insurance policy From nst.com.my

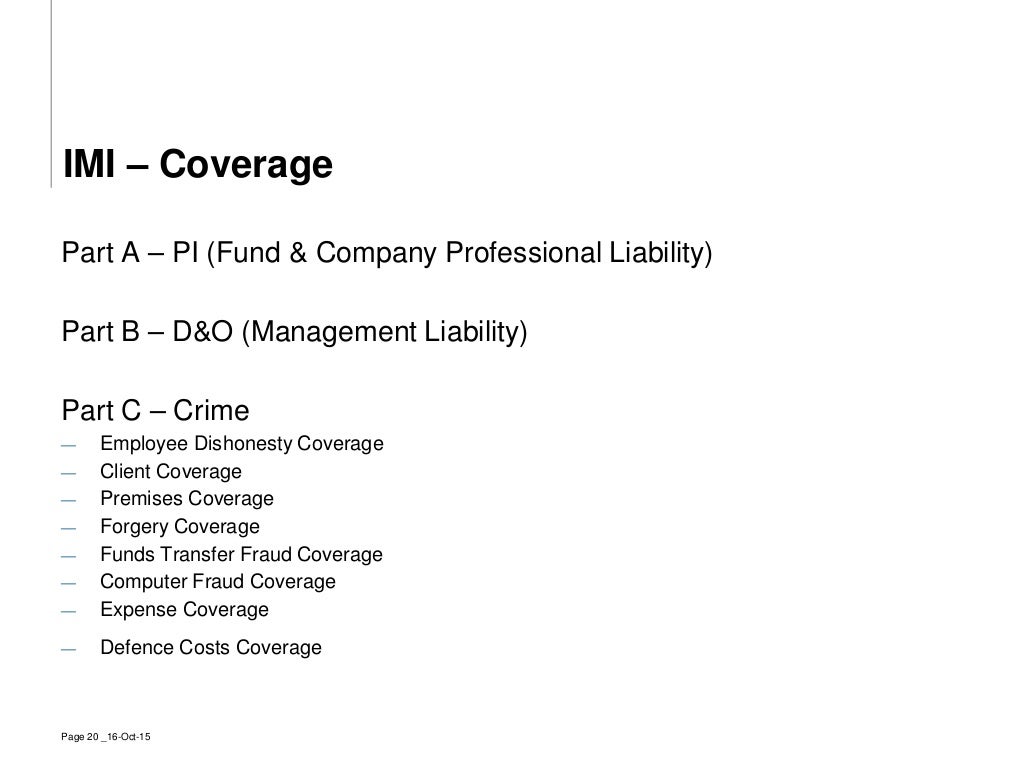

In this issue, elizabeth gillam , head of eu government relations and public policy, examines the solvency ii review and asks whether the changes go far enough. Imi policies combine directors & officers, professional indemnity and crime covers into one policy, therefore bridging any gaps in claims from these areas. Investment management insurance policy is a single comprehensive policy covering investment managers, investment advisors and investment funds for their potential liability against their director/officer for wrongful act while managing investment funds and potential civil liability while performing investment advisory and management services. Due to the scale of investments in an insurance company’s balance sheet and. Securities and investment insurance helps protect investment managers, investment advisors and other investment businesses that face their own unique risks. • broad definition of director or officer including modularde facto director, natural person

Success in a constantly evolving market requires an investment manager with a flexible approach.

Their performance is in stark contrast to that of large and small iims, which have seen annual net income growth of more Their performance is in stark contrast to that of large and small iims, which have seen annual net income growth of more than 20 percent, thanks to prescient. Our investment management insurance (imi) policy is designed to protect investment managers, investment advisors and the funds managed against management and professional liabilities arising from the provision of investment services. Their performance is in stark contrast to that of large and small iims, which have seen annual net income growth of more Provides protection for the investment manager, managed investment scheme, responsible entity and the compliance committee; The insurance investment management solution supports easy management of financial assets, generation of investments’ accounting entries and regulatory compliance.

Source: sabrefinancial.net

Source: sabrefinancial.net

This policy can also cover direct Imi policies combine directors & officers, professional indemnity and crime covers into one policy, therefore bridging any gaps in claims from these areas. Investment management insurance (imi) has been specifically designed for the needs of investment management firms and fund managers. Investment management refers to the handling of financial assets and other investments by professionals for clients, usually by devising strategies and executing trades within a portfolio. The last issue of the insurance investment management insights for 2021 has just been published, keeping you in the know about the latest developments affecting the insurance industry.

Source: schroders.com

Source: schroders.com

This policy can also cover direct Broad definition of ‘investment services’ extends to persons for whom the responsible entity is accountable; Helping insurance firms manage their investments. Imi policies combine directors & officers, professional indemnity and crime covers into one policy, therefore bridging any gaps in claims from these areas. The last issue of the insurance investment management insights for 2021 has just been published, keeping you in the know about the latest developments affecting the insurance industry.

Source: clearwater-analytics.com

Source: clearwater-analytics.com

The insurance investment management solution supports easy management of financial assets, generation of investments’ accounting entries and regulatory compliance. Investment management insurance companies generally recognize the importance of separating the responsibility for managing their insurance businesses, from that of managing the investments backing their reserves and capital. S ensible wealth management is a fee based registered investment adviser that allows individuals to potentially benefit from one single, fiduciary relationship for comprehensive insurance and investment advice. Due to the scale of investments on an insurance company’s balance sheet and the impact of investment results on Imi policies combine directors & officers, professional indemnity and crime covers into one policy, therefore bridging any gaps in claims from these areas.

Source: slideshare.net

Source: slideshare.net

Success in a constantly evolving market requires an investment manager with a flexible approach. Since the financial crisis, midsized insurance investment managers (iims) — those with us$100 billion to $500 billion in assets under management — have struggled to increase revenues, even as margins have declined. Learn more about how you can protect your investment business with the hartford and get a free quote today. Insurance companies generally recognise the importance of separating the responsibilities for managing their insurance businesses from managing the investments backing their reserves and capital. In this issue, elizabeth gillam , head of eu government relations and public policy, examines the solvency ii review and asks whether the changes go far enough.

Source: nst.com.my

Source: nst.com.my

Since the financial crisis, midsized insurance investment managers (iims) — those with us$100 billion to $500 billion in assets under management — have struggled to increase revenues, even as margins have declined. Investment management insurance (imi) has been specifically designed for the needs of investment management firms and fund managers. Their performance is in stark contrast to that of large and small iims, which have seen annual net income growth of more The insurance investment management solution supports easy management of financial assets, generation of investments’ accounting entries and regulatory compliance. In this issue, elizabeth gillam , head of eu government relations and public policy, examines the solvency ii review and asks whether the changes go far enough.

Source: youtube.com

Learn more about how you can protect your investment business with the hartford and get a free quote today. Since the financial crisis, midsized insurance investment managers (iims) — those with us$100 billion to $500 billion in assets under management — have struggled to increase revenues, even as margins have declined. Investment management refers to the handling of financial assets and other investments by professionals for clients, usually by devising strategies and executing trades within a portfolio. S ensible wealth management is a fee based registered investment adviser that allows individuals to potentially benefit from one single, fiduciary relationship for comprehensive insurance and investment advice. F eeedge is the firm�s commitment to offering clients attractive management fees based on client individual needs and portfolio.

Source: slideserve.com

Source: slideserve.com

This policy can also cover direct Their performance is in stark contrast to that of large and small iims, which have seen annual net income growth of more Success in a constantly evolving market requires an investment manager with a flexible approach. Due to the scale of investments on an insurance company’s balance sheet and the impact of investment results on Investment management refers to the handling of financial assets and other investments by professionals for clients, usually by devising strategies and executing trades within a portfolio.

Source: youtube.com

Source: youtube.com

• broad definition of director or officer including modularde facto director, natural person Investment management refers to the handling of financial assets and other investments by professionals for clients, usually by devising strategies and executing trades within a portfolio. In this issue, elizabeth gillam , head of eu government relations and public policy, examines the solvency ii review and asks whether the changes go far enough. The insurance investment management solution supports easy management of financial assets, generation of investments’ accounting entries and regulatory compliance. Covers all past or present subsidiaries as well as all directors, officers or employees

Source: youtube.com

Source: youtube.com

Broad definition of ‘investment services’ extends to persons for whom the responsible entity is accountable; Broad definition of ‘investment services’ extends to persons for whom the responsible entity is accountable; Learn more about how you can protect your investment business with the hartford and get a free quote today. • broad definition of director or officer including modularde facto director, natural person Their performance is in stark contrast to that of large and small iims, which have seen annual net income growth of more than 20 percent, thanks to prescient.

Source: uk.allianzgi.com

Source: uk.allianzgi.com

What is investment management insurance? The last issue of the insurance investment management insights for 2021 has just been published, keeping you in the know about the latest developments affecting the insurance industry. What is investment management insurance? Our investment management insurance (imi) policy is designed to protect investment managers, investment advisors and the funds managed against management and professional liabilities arising from the provision of investment services. Investment management insurance policy is a single comprehensive policy covering investment managers, investment advisors and investment funds for their potential liability against their director/officer for wrongful act while managing investment funds and potential civil liability while performing investment advisory and management services.

Source: systemic-rm.com

Source: systemic-rm.com

S ensible wealth management is a fee based registered investment adviser that allows individuals to potentially benefit from one single, fiduciary relationship for comprehensive insurance and investment advice. Aig’s investment management insurance policy is tailored to respond to claims frequently encountered by investment managers, responsible entities, investment trusts or funds and their professionals, as well as directors and officers of these entities. What is investment management insurance? Imi policies combine directors & officers, professional indemnity and crime covers into one policy, therefore bridging any gaps in claims from these areas. • broad definition of director or officer including modularde facto director, natural person

Source: asiabriefing.com

Source: asiabriefing.com

Success in a constantly evolving market requires an investment manager with a flexible approach. Broad definition of ‘investment services’ extends to persons for whom the responsible entity is accountable; Due to the scale of investments in an insurance company’s balance sheet and. Registration open for sustainable investment summit 2022. What is investment management insurance?

Source: indiamart.com

Source: indiamart.com

Helping insurance firms manage their investments. S ensible wealth management is a fee based registered investment adviser that allows individuals to potentially benefit from one single, fiduciary relationship for comprehensive insurance and investment advice. Due to the scale of investments in an insurance company’s balance sheet and. Investment management insurance policy is a single comprehensive policy covering investment managers, investment advisors and investment funds for their potential liability against their director/officer for wrongful act while managing investment funds and potential civil liability while performing investment advisory and management services. Provides protection for the investment manager, managed investment scheme, responsible entity and the compliance committee;

Source: slideshare.net

Source: slideshare.net

In this issue, elizabeth gillam , head of eu government relations and public policy, examines the solvency ii review and asks whether the changes go far enough. This policy can also cover direct Due to the scale of investments in an insurance company’s balance sheet and. Covers all past or present subsidiaries as well as all directors, officers or employees Registration open for sustainable investment summit 2022.

Source: slideshare.net

Source: slideshare.net

What is investment management insurance? What is investment management insurance? Insurance companies generally recognise the importance of separating the responsibilities for managing their insurance businesses from managing the investments backing their reserves and capital. This policy can also cover direct Due to the scale of investments in an insurance company’s balance sheet and.

Source: pinterest.com

Source: pinterest.com

Asset allocation and management llc (aam) is an sec registered investment advisor dedicated to managing investment portfolios across asset classes with a focus on generating income.we have served the insurance industry since 1982. Due to the scale of investments on an insurance company’s balance sheet and the impact of investment results on As for insurance investment management, mcpherson says companies are already aware of their role to price and manage risks, and offer security to both their policyholders and society more broadly. S ensible wealth management is a fee based registered investment adviser that allows individuals to potentially benefit from one single, fiduciary relationship for comprehensive insurance and investment advice. Investment management insurance (imi) has been specifically designed for the needs of investment management firms and fund managers.

Source: slcmanagement.com

The insurance investment management solution supports easy management of financial assets, generation of investments’ accounting entries and regulatory compliance. S ensible wealth management is a fee based registered investment adviser that allows individuals to potentially benefit from one single, fiduciary relationship for comprehensive insurance and investment advice. Registration open for sustainable investment summit 2022. Investment management insurance policy is a single comprehensive policy covering investment managers, investment advisors and investment funds for their potential liability against their director/officer for wrongful act while managing investment funds and potential civil liability while performing investment advisory and management services. Investment management insurance (imi) has been specifically designed for the needs of investment management firms and fund managers.

Source: hk.allianzgi.com

Source: hk.allianzgi.com

Registration open for sustainable investment summit 2022. Investment management insurance (imi) has been specifically designed for the needs of investment management firms and fund managers. Since the financial crisis, midsized insurance investment managers (iims) — those with us$100 billion to $500 billion in assets under management — have struggled to increase revenues, even as margins have declined. Registration open for sustainable investment summit 2022. Broad definition of ‘investment services’ extends to persons for whom the responsible entity is accountable;

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insurance investment management by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.