Insurance is the transfer of information

Home » Trend » Insurance is the transfer of informationYour Insurance is the transfer of images are ready. Insurance is the transfer of are a topic that is being searched for and liked by netizens today. You can Get the Insurance is the transfer of files here. Get all free images.

If you’re searching for insurance is the transfer of images information related to the insurance is the transfer of interest, you have visit the ideal blog. Our site frequently gives you suggestions for downloading the highest quality video and picture content, please kindly hunt and find more informative video articles and graphics that fit your interests.

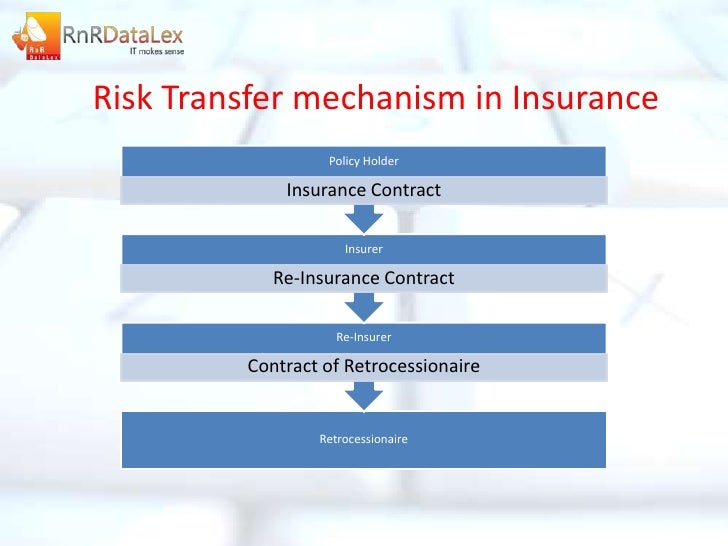

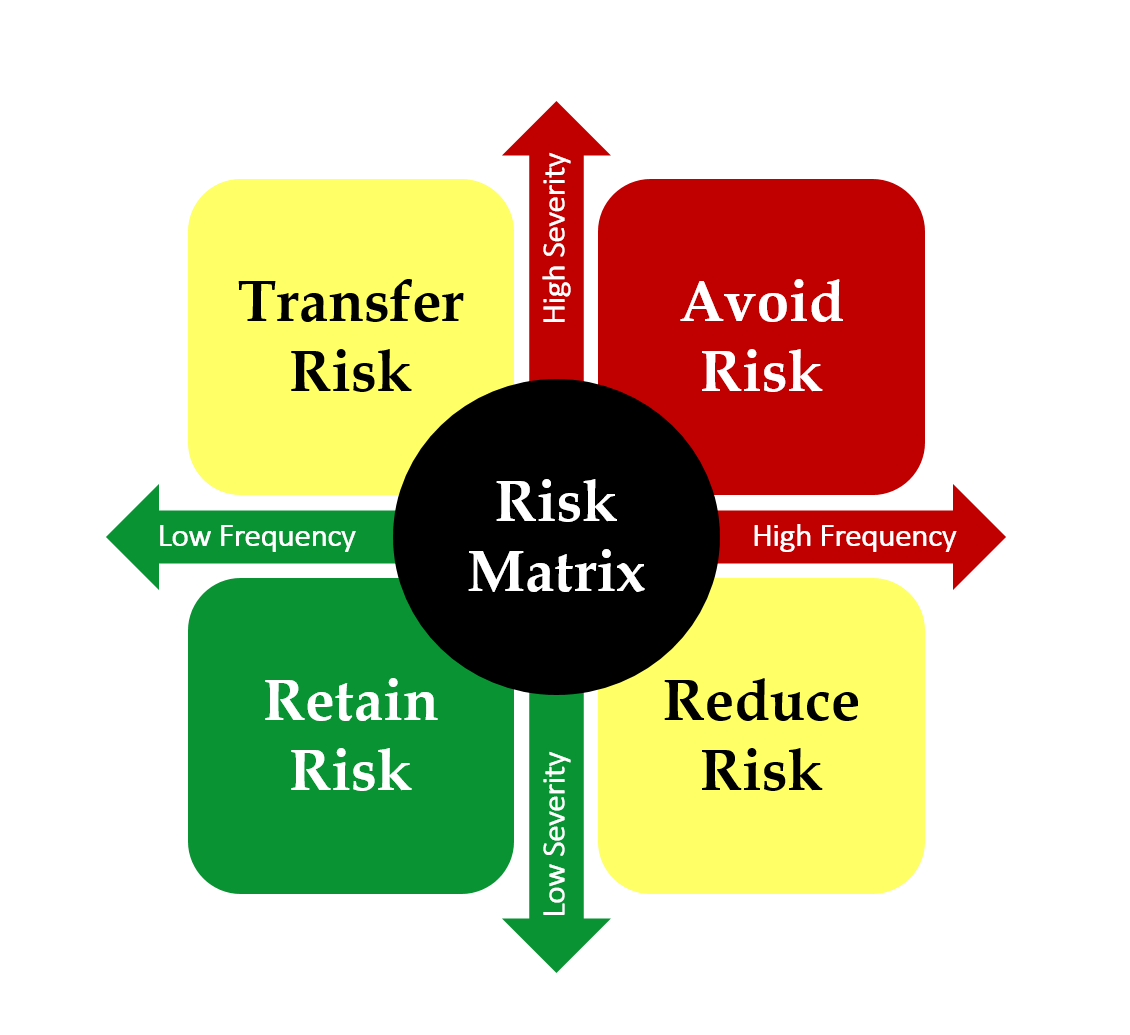

Insurance Is The Transfer Of. A life insurance policy is a type of financial contract between an individual person and the insurer. As we said, it is very important that you transfer the car insurance from your name as soon as the vehicle is sold off. The process of transferring the car insurance policy from the name of the seller of the car to the buyer is called car insurance transfer. The most common scenario for such a transaction would be when a person wishes to transfer a certain insurance coverage they have on their vehicle to another vehicle.

An Easy Guide to Transfer Car Insurance before Selling it From slideshare.net

An Easy Guide to Transfer Car Insurance before Selling it From slideshare.net

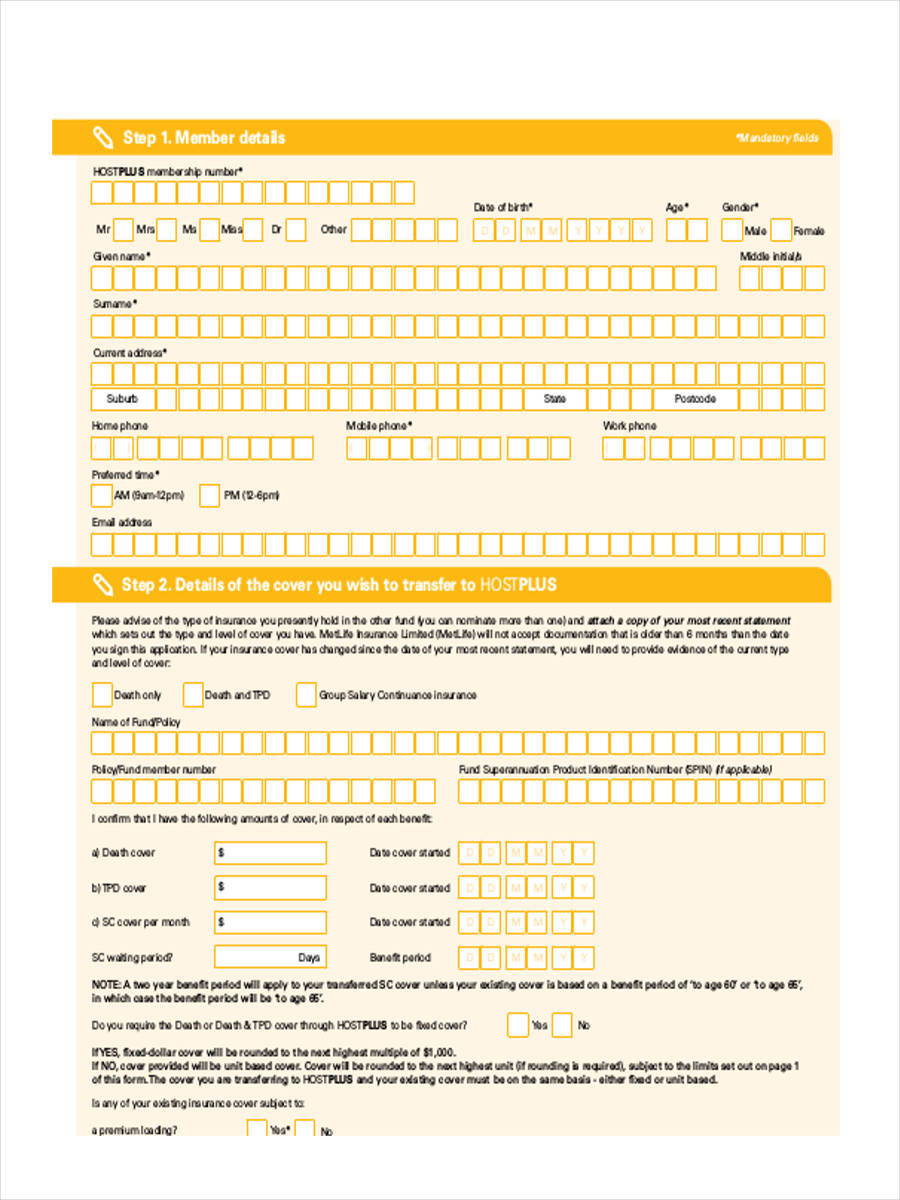

Transfer of the car insurance policy. Insurance transfer is the method of transferring insurance from one individual to another. The practice of selling and transferring a life insurance policy to a third party is restricted in most canadian provinces. The transition period, when accounts, assets, technology and employees of the selling agency transfer to the buyer, is just as important. As per section 157 of the motor vehicle act, 1988, the person who sells the car is responsible for ensuring the transfer of the existing car insurance policy to the new owner of the car. Fixed tpd cover will reduce gradually from age 61 to zero at age 65,.

A copy of the registration certificate/form 29.

Here are a few reasons why transfer of bike or car insurance required: You cannot transfer your life insurance policy from one company to another. While negotiating the sale and purchase of an independent insurance agency is a challenging process, the work does not end when the papers are signed. The transfer should be carried out within 14 days of the sale of the car. Though many types of life insurance policies and coverage exist, in general, a life insurance policy obligates an insurance company to pay the beneficiaries of the policy a certain amount of money when the. Transferring your car insurance is the easiest way to protect a new vehicle, but this does require that you notify your insurance company ahead of time.

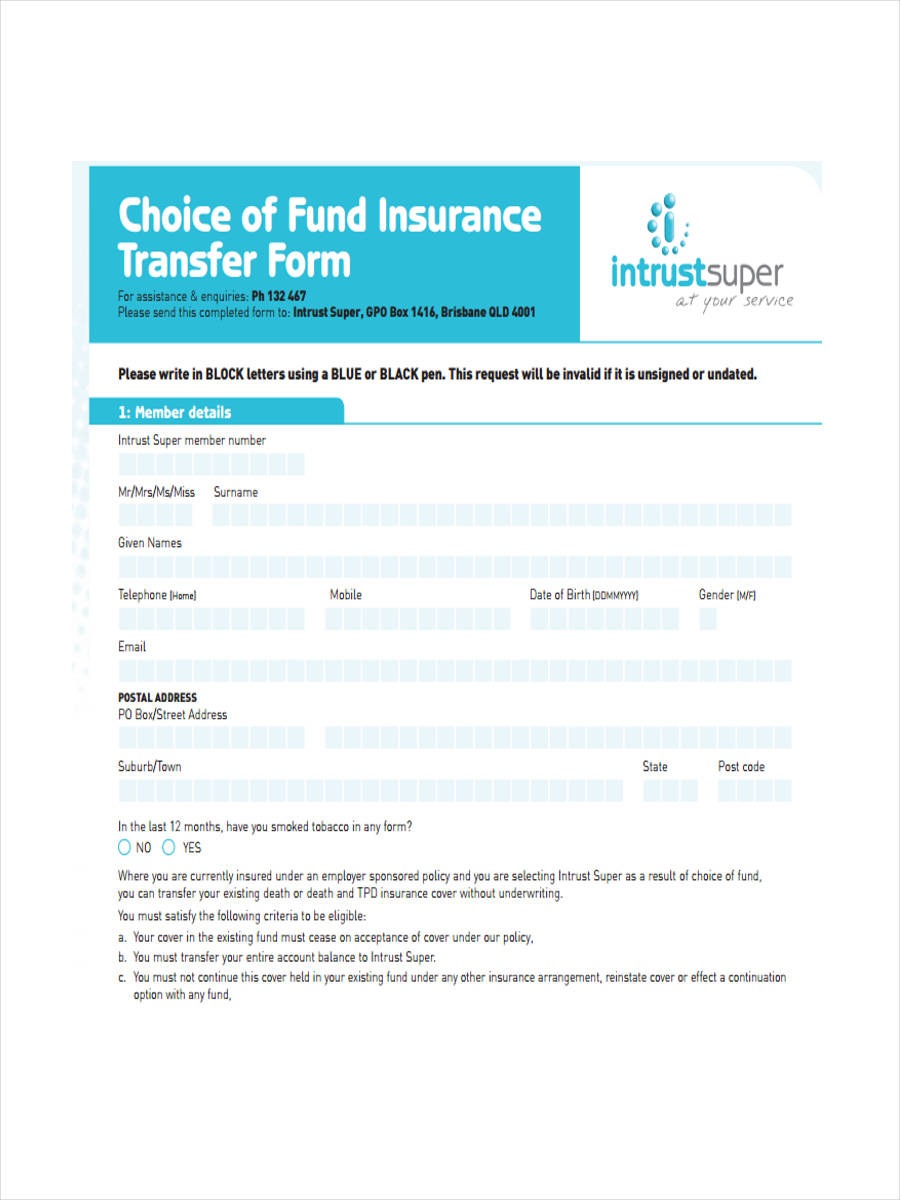

Source: sampleforms.com

Source: sampleforms.com

The previous owner can also face hassles if the. The previous owner can also face hassles if the. It’s imperative that the process of insurance ownership transfer is completed along with the transfer of vehicle ownership. Depending on the cost, you may choose a. A portable health insurance policy offers the flexibility of not remaining bound to the insurer from whom you initially bought the policy.

Source: insightinsuranceservices.blogspot.com

Source: insightinsuranceservices.blogspot.com

As per section 157 of the motor vehicle act, 1988, the person who sells the car is responsible for ensuring the transfer of the existing car insurance policy to the new owner of the car. While negotiating the sale and purchase of an independent insurance agency is a challenging process, the work does not end when the papers are signed. Along with the sale of the car to (—), the insurance policy that the vehicle holds shall also pass on to him. Initiate the transfer of your motor insurance policy by contacting your insurance provider within the stipulated time period of 14 days. As per section 157 of the motor vehicle act, 1988, the person who sells the car is responsible for ensuring the transfer of the existing car insurance policy to the new owner of the car.

Source: beta.cholainsurance.com

Source: beta.cholainsurance.com

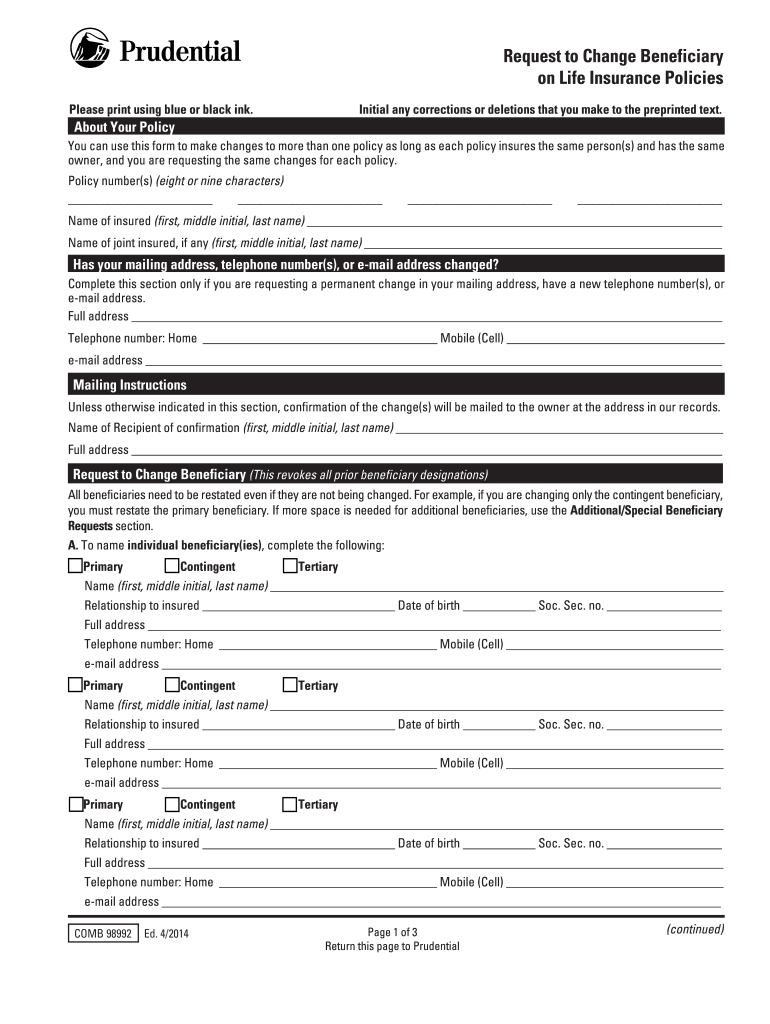

The most common scenario for such a transaction would be when a person wishes to transfer a certain insurance coverage they have on their vehicle to another vehicle. Vehicle insurance is very important so as to cover the vehicle from an unforeseen accident. This written application for the transfer of name is to be submitted within 14 days from the transfer date to the insurance company for ensuring the necessary changes. Transferring the ownership of a life insurance policy is complicated and may involve tax implications. Insurance transfer is the method of transferring insurance from one individual to another.

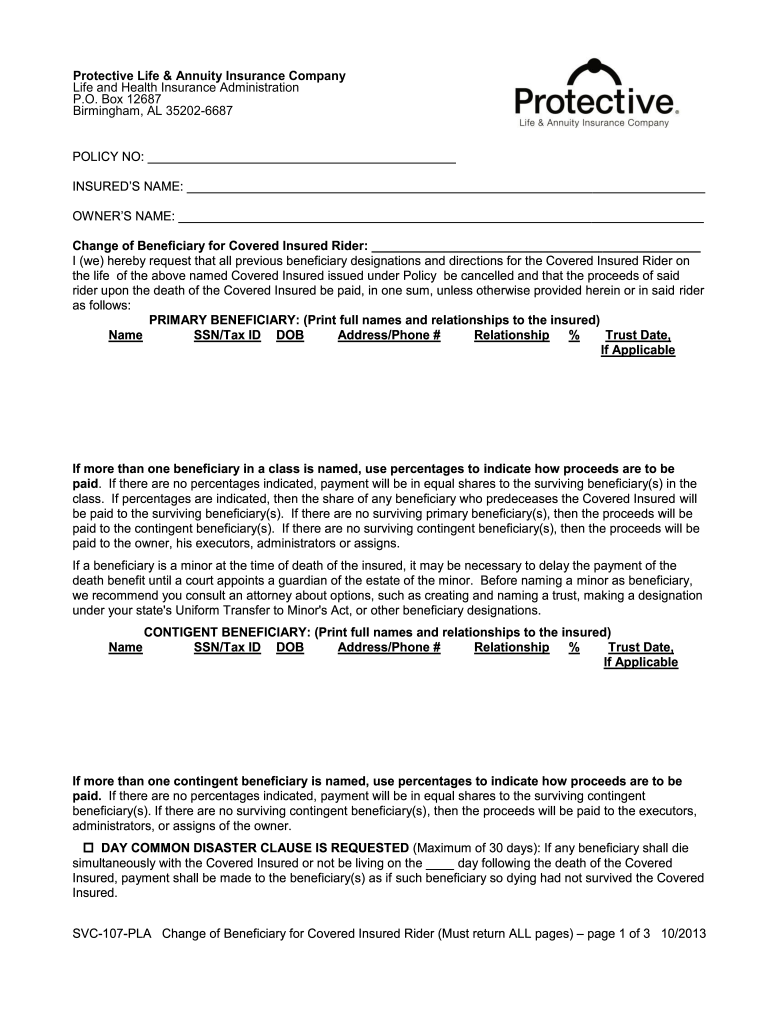

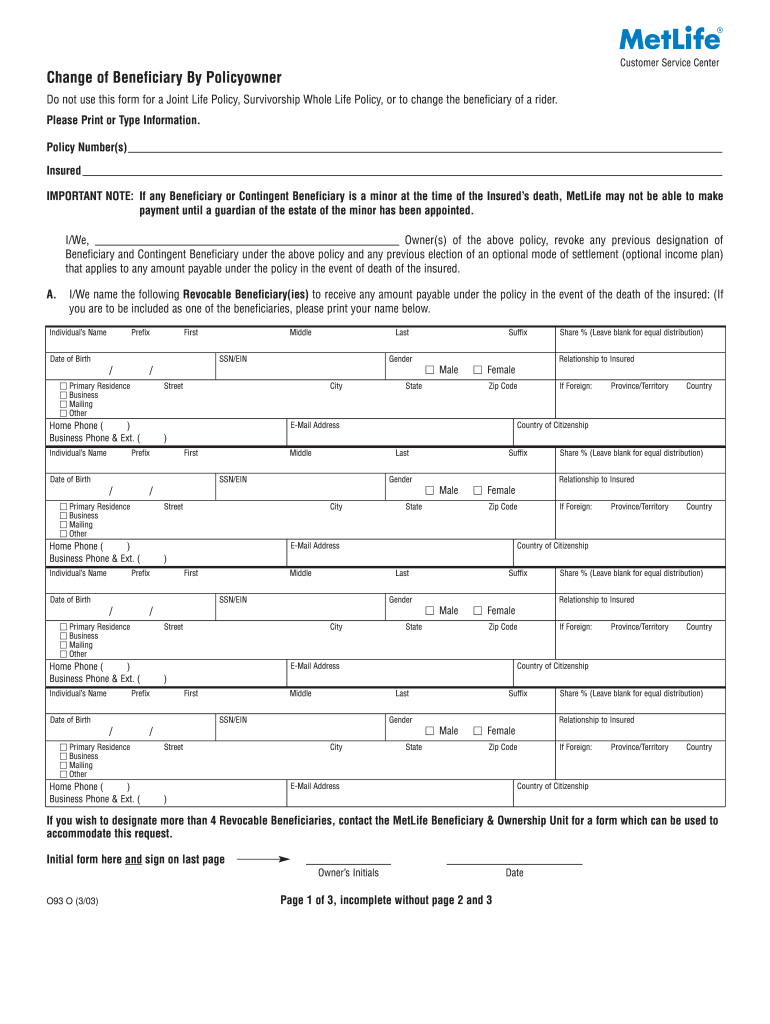

Source: signnow.com

Source: signnow.com

Health insurance portability is an option through which a policyholder can change the current insurance company and avail better services or possibly better health insurance policy from another insurance company. It’s imperative that the process of insurance ownership transfer is completed along with the transfer of vehicle ownership. A copy of the registration certificate/form 29. A portable health insurance policy offers the flexibility of not remaining bound to the insurer from whom you initially bought the policy. Initiate the transfer of your motor insurance policy by contacting your insurance provider within the stipulated time period of 14 days.

Source: slideshare.net

Source: slideshare.net

Inspection report from the insurance company. Transferring your car insurance is the easiest way to protect a new vehicle, but this does require that you notify your insurance company ahead of time. ¡ death certificate and legal heir certificate would be required in addition to the above mentioned documents for transfer of insurance on account of demise of insured. You cannot transfer your life insurance policy from one company to another. The transfer should be carried out within 14 days of the sale of the car.

Source: sageoakfinancial.com

Source: sageoakfinancial.com

This only reduces the financial burden. Transferring your car insurance is the easiest way to protect a new vehicle, but this does require that you notify your insurance company ahead of time. To do so, you should first inform the insurance company about your intention of selling the car and the initiation of transfer of ownership. The previous owner can also face hassles if the. The transition period, when accounts, assets, technology and employees of the selling agency transfer to the buyer, is just as important.

Source: lockinloan.com

Source: lockinloan.com

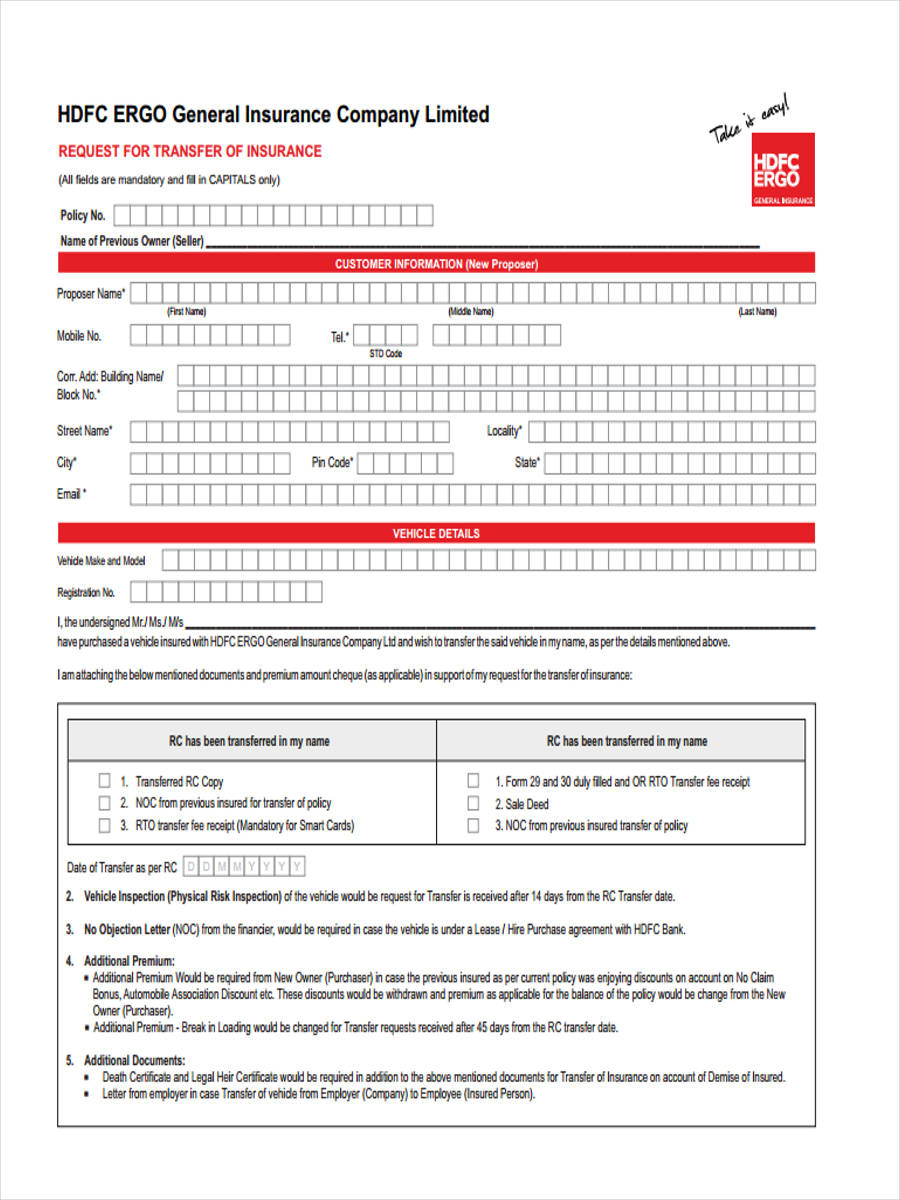

Inspection report from the insurance company. This letter is regarding the transfer of insurance from (—) to (—) for the car holding the model (—) and vehicle number (—). Fixed tpd cover will reduce gradually from age 61 to zero at age 65,. 1 hdfc ergo general insurance company limited request for transfer of insurance The insurance company will not indemnify damage to the vehicle or yourself within the first 14 days from the date of purchase, if the insurance isn’t transferred in the name of the new owner.

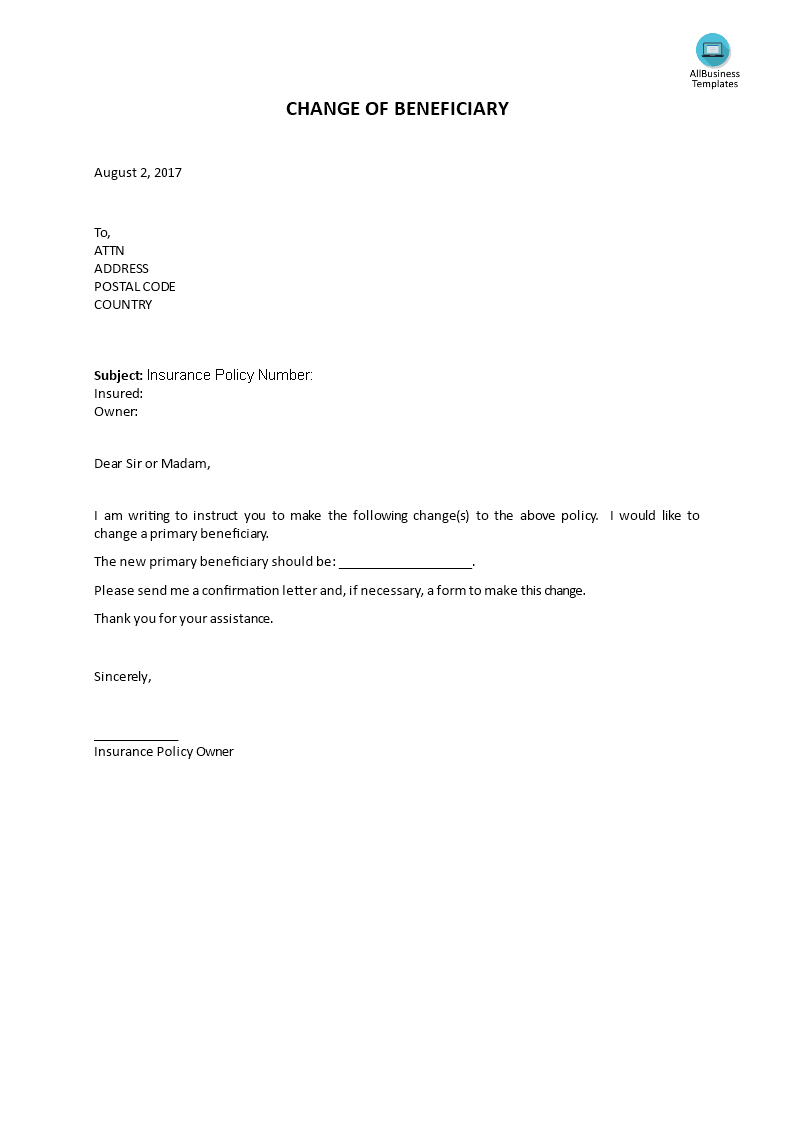

Source: allbusinesstemplates.com

Source: allbusinesstemplates.com

While negotiating the sale and purchase of an independent insurance agency is a challenging process, the work does not end when the papers are signed. Health insurance portability is an option through which a policyholder can change the current insurance company and avail better services or possibly better health insurance policy from another insurance company. This only reduces the financial burden. It is the process of transferring a car insurance policy from its existing holder to another party, who holds the ownership rights to such vehicle. This written application for the transfer of name is to be submitted within 14 days from the transfer date to the insurance company for ensuring the necessary changes.

Source: sampleforms.com

Source: sampleforms.com

It is the process of transferring a car insurance policy from its existing holder to another party, who holds the ownership rights to such vehicle. You cannot transfer your life insurance policy from one company to another. Insurance transfer is the method of transferring insurance from one individual to another. Vehicle insurance is very important so as to cover the vehicle from an unforeseen accident. However, the no claim bonus accumulated in your comprehensive insurance policy should be transferred to your name by letting the insurer know about the sale of your car.

Source: sampleforms.com

Source: sampleforms.com

Transfer of the car insurance policy. Insurance transfer is the method of transferring insurance from one individual to another. The previous owner can also face hassles if the. While negotiating the sale and purchase of an independent insurance agency is a challenging process, the work does not end when the papers are signed. What is car insurance transfer?

Source: slideshare.net

Source: slideshare.net

As per section 157 of the motor vehicle act, 1988, the person who sells the car is responsible for ensuring the transfer of the existing car insurance policy to the new owner of the car. Once the insurance company knows of the transfer of ownership, it can help you with the transfer of insurance also. As we said, it is very important that you transfer the car insurance from your name as soon as the vehicle is sold off. Vehicle insurance is very important so as to cover the vehicle from an unforeseen accident. 1 hdfc ergo general insurance company limited request for transfer of insurance

Source: wellsfinancialpartners.com

Source: wellsfinancialpartners.com

Initiate the transfer of your motor insurance policy by contacting your insurance provider within the stipulated time period of 14 days. Here are a few reasons why transfer of bike or car insurance required: Transfer of the car insurance policy. Once the insurance company knows of the transfer of ownership, it can help you with the transfer of insurance also. Vehicle insurance is very important so as to cover the vehicle from an unforeseen accident.

Source: comparepolicy.com

Source: comparepolicy.com

Fixed tpd cover will reduce gradually from age 61 to zero at age 65,. Health insurance portability is an option through which a policyholder can change the current insurance company and avail better services or possibly better health insurance policy from another insurance company. A portable health insurance policy offers the flexibility of not remaining bound to the insurer from whom you initially bought the policy. The previous owner can also face hassles if the. ¡ death certificate and legal heir certificate would be required in addition to the above mentioned documents for transfer of insurance on account of demise of insured.

Source: icaagencyalliance.com

Source: icaagencyalliance.com

Transferring your car insurance is the easiest way to protect a new vehicle, but this does require that you notify your insurance company ahead of time. It’s imperative that the process of insurance ownership transfer is completed along with the transfer of vehicle ownership. Depending on the cost, you may choose a. This only reduces the financial burden. As we said, it is very important that you transfer the car insurance from your name as soon as the vehicle is sold off.

Source: signnow.com

Source: signnow.com

You cannot transfer your life insurance policy from one company to another. This only reduces the financial burden. Also, according to the ruling of the apex court, the deemed insurance policy transfer under the motor vehicles act (mva) section 157 doesn�t apply in other types of risks. ¡ death certificate and legal heir certificate would be required in addition to the above mentioned documents for transfer of insurance on account of demise of insured. The previous owner can also face hassles if the.

Source: irdaic34.blogspot.com

Source: irdaic34.blogspot.com

You cannot transfer your life insurance policy from one company to another. The set of rules laid down in the motor vehicles act, 1988 necessitate the transfer of the insurance policy in the name of the new buyer in order to safeguard its benefits. Along with the sale of the car to (—), the insurance policy that the vehicle holds shall also pass on to him. The process to transfer insurance should start along with the process to transfer ownership. Here are a few reasons why transfer of bike or car insurance required:

Source: signnow.com

Source: signnow.com

It is the process of transferring a car insurance policy from its existing holder to another party, who holds the ownership rights to such vehicle. This only reduces the financial burden. The process to transfer insurance should start along with the process to transfer ownership. ¡ letter from employer in case transfer of vehicle from employer (company) to employee (insured person). Transferring the ownership of a life insurance policy is complicated and may involve tax implications.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

As we said, it is very important that you transfer the car insurance from your name as soon as the vehicle is sold off. Along with the sale of the car to (—), the insurance policy that the vehicle holds shall also pass on to him. As we said, it is very important that you transfer the car insurance from your name as soon as the vehicle is sold off. 1 hdfc ergo general insurance company limited request for transfer of insurance However, the no claim bonus accumulated in your comprehensive insurance policy should be transferred to your name by letting the insurer know about the sale of your car.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance is the transfer of by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.