Insurance legacy systems Idea

Home » Trend » Insurance legacy systems IdeaYour Insurance legacy systems images are available. Insurance legacy systems are a topic that is being searched for and liked by netizens today. You can Download the Insurance legacy systems files here. Find and Download all free photos and vectors.

If you’re searching for insurance legacy systems images information related to the insurance legacy systems topic, you have visit the ideal site. Our site always provides you with hints for seeking the maximum quality video and image content, please kindly surf and locate more informative video articles and graphics that match your interests.

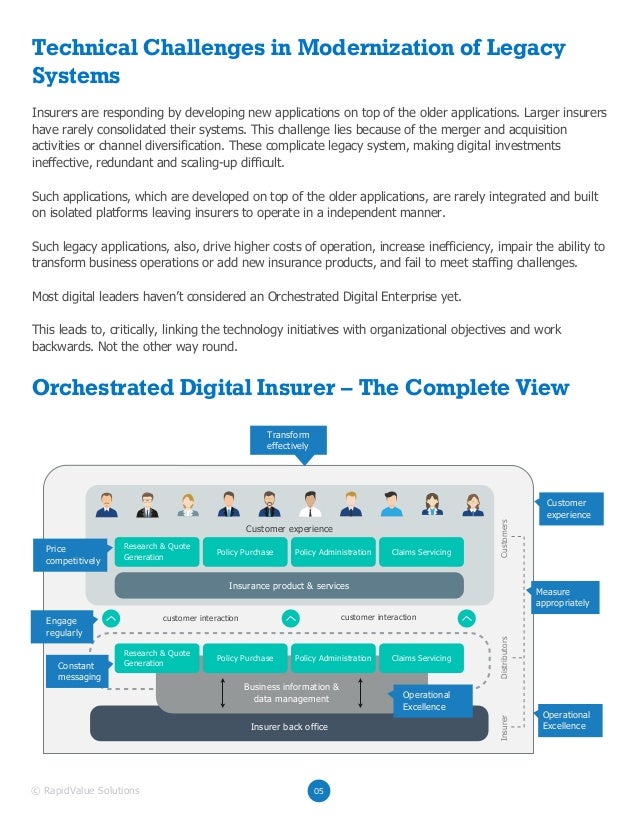

Insurance Legacy Systems. We call it “modern legacy,” and it’s even more dangerous to an insurer’s wellbeing, not just because the technology is aging, or unsupported, but because it forces insurers to focus inward and invest time, money and effort on workarounds and patches rather than innovation. Other areas of impact include customer communications and forms management, and ability to deliver effective business This legacy infrastructure has proven to be relatively. On average, maintaining legacy systems makes up 70% of organizations� it budgets.

Legacy systems don�t have to inhibit innovation From insuranceblog.accenture.com

Legacy systems don�t have to inhibit innovation From insuranceblog.accenture.com

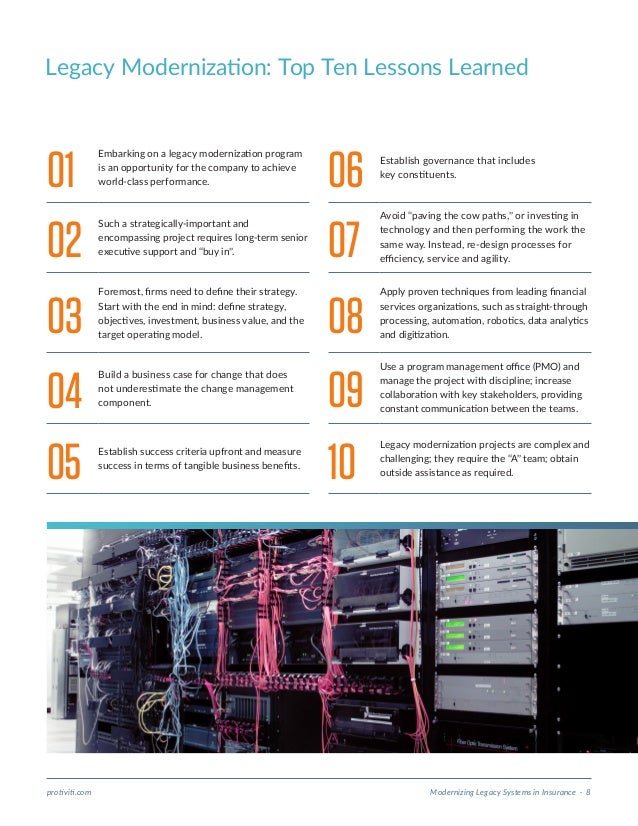

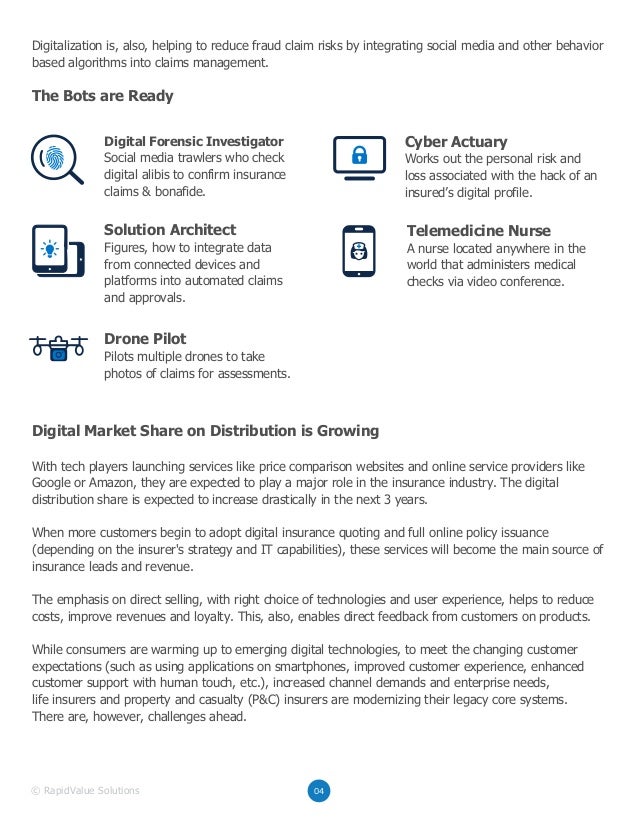

Utilizing modern technology is a vital part of achieving these goals, and there are many avenues for an insurer to explore. Relying on legacy systems puts companies at risk for a multitude of challenges such as keeping up with changing customer expectations, a volatile regulatory environment, data security concerns and. Insurers rely heavily on their legacy systems. For large insurers who have replaced components of their legacy systems, most report a qualitative difference in the way their business functions and their ability to address challenges, not just a quantitative difference in costs or speed. 3.) hesitancy to embrace cloud computing: Pwc and ignatica a perspective on modernising insurance legacy systems.

Legacy systems are a significant drag on speed to market, customer service, and insights 4 nearly all insurers interviewed reported that legacy systems greatly inhibit their speed to market for new products.

Insurers have relied on these systems for years, and for good reason. Your insurance legacy system is aging. Utilizing modern technology is a vital part of achieving these goals, and there are many avenues for an insurer to explore. Legacy systems are a significant drag on speed to market, customer service, and insights 4 nearly all insurers interviewed reported that legacy systems greatly inhibit their speed to market for new products. As the most popular requirement identified from a group Timeworn legacy systems require increased maintenance, which drive up costs, while specialist operating knowledge is at risk of being lost as the workforce ages and retires.

Source: insuranceblog.accenture.com

Source: insuranceblog.accenture.com

The systems we now consider to be “legacy” (i.e. Innovation platforms who have hundreds of rest apis allow insurance companies of all sizes to pick supplementary technology partners from an a la carte menu to meet their particular appetite today or tomorrow. Utilizing modern technology is a vital part of achieving these goals, and there are many avenues for an insurer to explore. Timeworn legacy systems require increased maintenance, which drive up costs, while specialist operating knowledge is at risk of being lost as the workforce ages and retires. For large insurers who have replaced components of their legacy systems, most report a qualitative difference in the way their business functions and their ability to address challenges, not just a quantitative difference in costs or speed.

Source: slideshare.net

Source: slideshare.net

Utilizing modern technology is a vital part of achieving these goals, and there are many avenues for an insurer to explore. Relying on legacy systems puts companies at risk for a multitude of challenges such as keeping up with changing customer expectations, a volatile regulatory environment, data security concerns and. Utilizing modern technology is a vital part of achieving these goals, and there are many avenues for an insurer to explore. Other areas of impact include customer communications and forms management, and ability to deliver effective business This legacy infrastructure has proven to be relatively.

Source: slideshare.net

Source: slideshare.net

Timeworn legacy systems require increased maintenance, which drive up costs, while specialist operating knowledge is at risk of being lost as the workforce ages and retires. On average, maintaining legacy systems makes up 70% of organizations� it budgets. Excel, cobol or vb6) have been relied on by insurance carriers for decades. Over half (55%) of insurers surveyed believe the complexity of their systems is the primary barrier to achieving a scv. Insurance companies embark on legacy system transformations to decrease operation costs, drive product innovation, create efficiencies, improve customer experience, and generate new revenue sources.

Source: slideshare.net

Source: slideshare.net

The client is among the largest global providers of insurance, annuities, and employee benefit programs and a fortune 500 company with a revenue of more than $50 billion (2018). On average, maintaining legacy systems makes up 70% of organizations� it budgets. Legacy thinking, legacy processes and, most definitely, legacy systems. Timeworn legacy systems require increased maintenance, which drive up costs, while specialist operating knowledge is at risk of being lost as the workforce ages and retires. Now there’s a new type of legacy system emerging.

Source: slideshare.net

Source: slideshare.net

Excel, cobol or vb6) have been relied on by insurance carriers for decades. The consultancy’s insurance redefined report, which surveyed 42 insurance executives across six asia pacific countries, finds “legacy it and infrastructure” is considered the “biggest hurdle in reinventing the insurance business for the future”. Insurers rely heavily on their legacy systems. Utilizing modern technology is a vital part of achieving these goals, and there are many avenues for an insurer to explore. Insurance companies embark on legacy system transformations to decrease operation costs, drive product innovation, create efficiencies, improve customer experience, and generate new revenue sources.

Source: insurancetimes.co.uk

Source: insurancetimes.co.uk

The systems we now consider to be “legacy” (i.e. We call it “modern legacy,” and it’s even more dangerous to an insurer’s wellbeing, not just because the technology is aging, or unsupported, but because it forces insurers to focus inward and invest time, money and effort on workarounds and patches rather than innovation. Insurers have relied on these systems for years, and for good reason. Internal hurdles such as legacy systems are the biggest roadblocks to insurance innovation, oliver wyman says. Now there’s a new type of legacy system emerging.

Source: slideshare.net

Source: slideshare.net

Over half (55%) of insurers surveyed believe the complexity of their systems is the primary barrier to achieving a scv. Excel, cobol or vb6) have been relied on by insurance carriers for decades. For many carriers, these systems are seen as tried and true. Now there’s a new type of legacy system emerging. Legacy systems are computer systems, both hardware and software, that remain in use despite noticeable aging or a slide toward obsolescence.

Source: slideshare.net

Source: slideshare.net

Relying on legacy systems puts companies at risk for a multitude of challenges such as keeping up with changing customer expectations, a volatile regulatory environment, data security concerns and. 3.) hesitancy to embrace cloud computing: These systems are expensive to install and continue to hold valuable data, which is why many insurance companies are hesitant to adopt change. We call it “modern legacy,” and it’s even more dangerous to an insurer’s wellbeing, not just because the technology is aging, or unsupported, but because it forces insurers to focus inward and invest time, money and effort on workarounds and patches rather than innovation. Legacy systems are a significant drag on speed to market, customer service, and insights 4 nearly all insurers interviewed reported that legacy systems greatly inhibit their speed to market for new products.

Source: slideshare.net

Source: slideshare.net

Insurance claims software systems are critical and can hold vital information that was acquired over the life of the company. We call it “modern legacy,” and it’s even more dangerous to an insurer’s wellbeing, not just because the technology is aging, or unsupported, but because it forces insurers to focus inward and invest time, money and effort on workarounds and patches rather than innovation. One that transforms your health insurance business into a versatile. Other areas of impact include customer communications and forms management, and ability to deliver effective business Pwc and ignatica a perspective on modernising insurance legacy systems.

Source: slideshare.net

Source: slideshare.net

It may crash in the future. Over half (55%) of insurers surveyed believe the complexity of their systems is the primary barrier to achieving a scv. A legacy system can cause a myriad of problems, such as exorbitant maintenance costs, data silos that prevent integration between systems, lack of compliance to governmental regulations, and reduced security. As the most popular requirement identified from a group This legacy infrastructure has proven to be relatively.

Source: slideshare.net

Source: slideshare.net

Over half (55%) of insurers surveyed believe the complexity of their systems is the primary barrier to achieving a scv. Your insurance legacy system is aging. One that transforms your health insurance business into a versatile. Legacy insurance companies rarely have staff with experience and expertise in cloud computing, and therefore are hesitant to embrace it. This cost will only keep increasing as legacy systems continue to age.

Source: slideshare.net

Source: slideshare.net

Insurance claims software systems are critical and can hold vital information that was acquired over the life of the company. Insurance companies embark on legacy system transformations to decrease operation costs, drive product innovation, create efficiencies, improve customer experience, and generate new revenue sources. It may crash in the future. Utilizing modern technology is a vital part of achieving these goals, and there are many avenues for an insurer to explore. For many carriers, these systems are seen as tried and true.

Source: slideshare.net

Source: slideshare.net

It may crash in the future. It may crash in the future. Other areas of impact include customer communications and forms management, and ability to deliver effective business Insurers rely heavily on their legacy systems. These systems are expensive to install and continue to hold valuable data, which is why many insurance companies are hesitant to adopt change.

Source: insuranceblog.accenture.com

Source: insuranceblog.accenture.com

Many insurers still rely on complex, legacy it systems that keep large amounts of big data siloed across the organisation, thereby preventing them from gaining actionable customer insights. The systems we now consider to be “legacy” (i.e. Timeworn legacy systems require increased maintenance, which drive up costs, while specialist operating knowledge is at risk of being lost as the workforce ages and retires. This cost will only keep increasing as legacy systems continue to age. As the most popular requirement identified from a group

Source: slideshare.net

Source: slideshare.net

One that transforms your health insurance business into a versatile. For many carriers, these systems are seen as tried and true. But legacy systems can be expensive and frustrating to maintain. Other areas of impact include customer communications and forms management, and ability to deliver effective business Legacy thinking, legacy processes and, most definitely, legacy systems.

Source: slideshare.net

Source: slideshare.net

Now there’s a new type of legacy system emerging. Insurers have relied on these systems for years, and for good reason. One that transforms your health insurance business into a versatile. The procedure to integrate your existing legacy insurance claims system, data, and information into a new system that includes new business processes can become an it conundrum. The systems we now consider to be “legacy” (i.e.

Source: slideshare.net

Source: slideshare.net

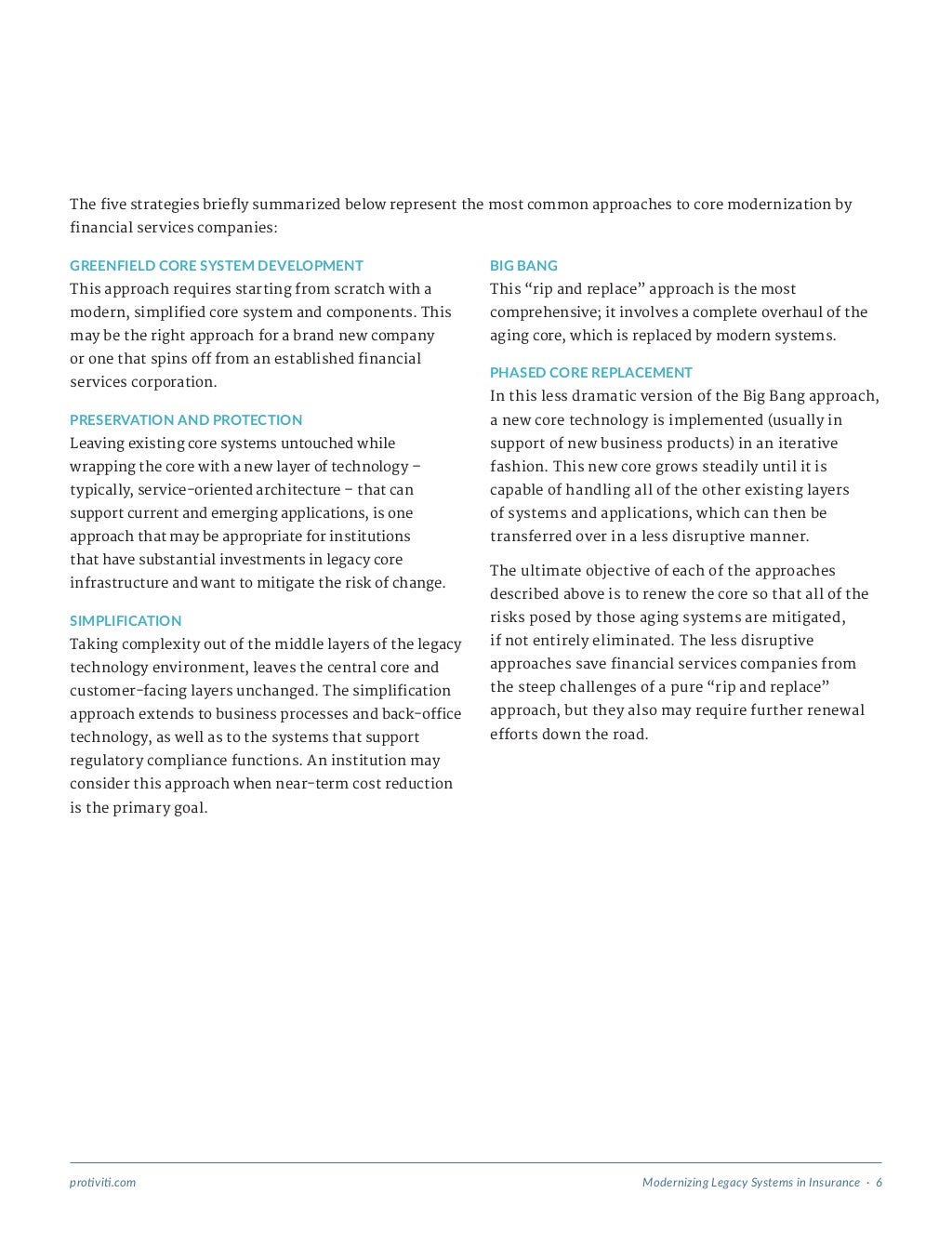

Timeworn legacy systems require increased maintenance, which drive up costs, while specialist operating knowledge is at risk of being lost as the workforce ages and retires. As the most popular requirement identified from a group Timeworn legacy systems require increased maintenance, which drive up costs, while specialist operating knowledge is at risk of being lost as the workforce ages and retires. Innovation platforms who have hundreds of rest apis allow insurance companies of all sizes to pick supplementary technology partners from an a la carte menu to meet their particular appetite today or tomorrow. Legacy systems and modernization core systems strategy for policy administration systems when considering the options to modernize the pas solution, surveyed insurers nearly universally (95 percent of respondents) replied that product and servicing fit were crucial requirements (figure 2).

Source: insuranceblog.accenture.com

Source: insuranceblog.accenture.com

These issues eventually outweigh the convenience of continuing to use an existing legacy system. Instead of spending years implementing costly legacy systems, why not opt for speedier software? Legacy insurance system modernization reduce the cost and risk of legacy system modernization investments amid considerable competition and increasing demands to enhance business productivity, insurance companies today face mounting pressure to improve services to policyholders and intermediaries whilst reducing costs. Utilizing modern technology is a vital part of achieving these goals, and there are many avenues for an insurer to explore. Legacy systems and modernization core systems strategy for policy administration systems when considering the options to modernize the pas solution, surveyed insurers nearly universally (95 percent of respondents) replied that product and servicing fit were crucial requirements (figure 2).

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance legacy systems by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.