Insurance linked securities market information

Home » Trending » Insurance linked securities market informationYour Insurance linked securities market images are ready. Insurance linked securities market are a topic that is being searched for and liked by netizens now. You can Download the Insurance linked securities market files here. Download all free photos.

If you’re searching for insurance linked securities market images information connected with to the insurance linked securities market keyword, you have come to the ideal site. Our site frequently gives you hints for refferencing the maximum quality video and picture content, please kindly surf and find more informative video content and images that fit your interests.

Insurance Linked Securities Market. They allow investors such as pension funds and hedge funds to take the place of reinsurers on certain classes of business, primarily property catastrophe. Was it the end of 1992 when the Ils value is influenced by an insured loss event underlying the security. Bonds that pay out when catastrophe strikes are rising in popularity,” the economist, october 5, 2013.

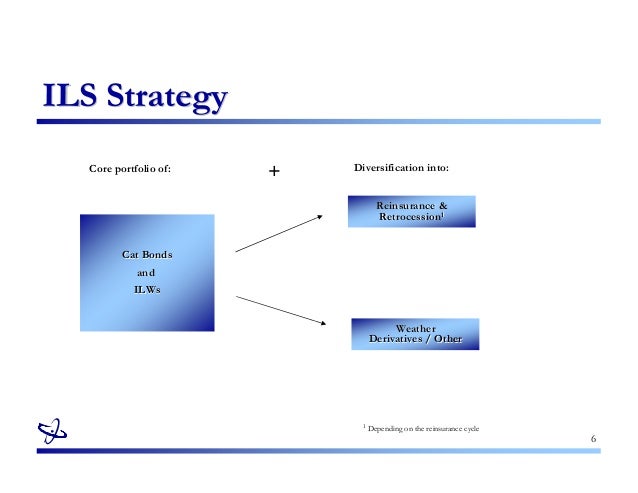

Introduction aux Insurance Linked Securities Diego Wauters From slideshare.net

Introduction aux Insurance Linked Securities Diego Wauters From slideshare.net

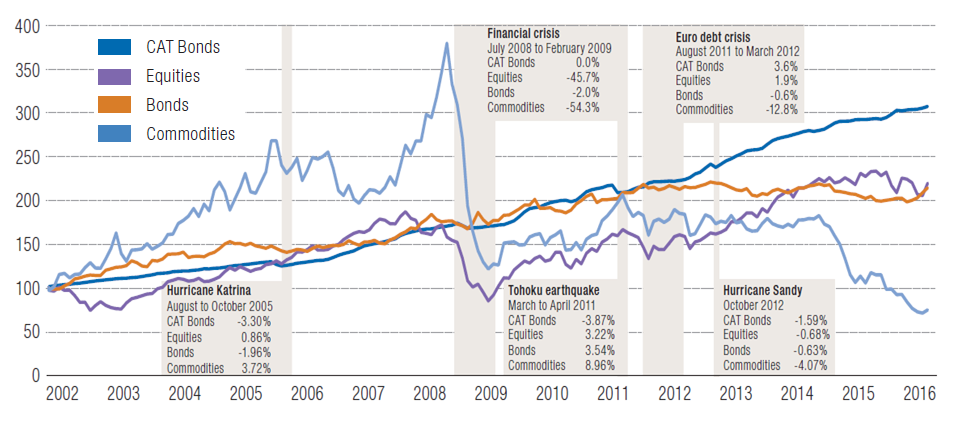

January and february were marked by tightening spreads as the sector was flush with capital. Ils, both from the life and property/casualty (p/c). This means performance is not correlated with traditional asset classes, whose returns are more closely linked to factors such as economic strength or weakness, a company’s good or bad performance, or geopolitical concerns. They allow investors such as pension funds and hedge funds to take the place of reinsurers on certain classes of business, primarily property catastrophe. Bonds that pay out when catastrophe strikes are rising in popularity,” the economist, october 5, 2013. The catastrophe bond (cat bond) market surpassed 2018 by usd 375m in new issuance in the same period.

January and february were marked by tightening spreads as the sector was flush with capital.

That should be good news for (re)insurers in the developed markets o. Ils, both from the life and property/casualty (p/c). For investors, ils may provide a diversifying source of returns that are unrelated to the financial markets and attractive return potential. Growth of the insurance linked securities (ils) market reached $93 billion in 2018, up from $88 billion during the prior year, according to the new ils January and february were marked by tightening spreads as the sector was flush with capital. That should be good news for (re)insurers in the developed markets o.

Source: gbm.hsbc.com

Source: gbm.hsbc.com

The securitization model has been employed by insurers eager to transfer risk and tap new sources of capital market funding. Growth of the insurance linked securities (ils) market reached $93 billion in 2018, up from $88 billion during the prior year, according to the new ils Catastrophe bond market issuance amounted to approximately usd 8.5bn during 1h21, which demonstrates As one of only a small number of alternative asset managers currently offering ils investment solutions, we have been able to provide access to this rapidly developing asset class. January and february were marked by tightening spreads as the sector was flush with capital.

Source: www2.deloitte.com

Source: www2.deloitte.com

As one of only a small number of alternative asset managers currently offering ils investment solutions, we have been able to provide access to this rapidly developing asset class. They allow investors such as pension funds and hedge funds to take the place of reinsurers on certain classes of business, primarily property catastrophe. Those such instruments that are linked to property losses due to natural catastrophes represent a unique asset class, the return from which is uncorrelated with that of the general financial market. Ils value is influenced by an insured loss event underlying the security. Was it the end of 1992 when the

Source: slideshare.net

Source: slideshare.net

This securitization model was born of efforts by the insurance industry to develop an additional source of insurance and reinsurance capacity by transferring traditionally insurable risks to the capital. The catastrophe bond (cat bond) market surpassed 2018 by usd 375m in new issuance in the same period. This means performance is not correlated with traditional asset classes, whose returns are more closely linked to factors such as economic strength or weakness, a company’s good or bad performance, or geopolitical concerns. Was it the end of 1992 when the Those such instruments that are linked to property losses due to natural catastrophes represent a unique asset class, the return from which is uncorrelated with that of the general financial market.

Source: nasdaq.com

Source: nasdaq.com

Insurance linked securities market looks set for another record year, says fitch tony dowding september 20, 2021 the insurance linked securities (ils) sector is seen as strong and viable according to fitch ratings, despite alternative reinsurance capital remaining flat. The securitization model has been employed by insurers eager to transfer risk and tap new sources of capital market funding. This securitization model was born of efforts by the insurance industry to develop an additional source of insurance and reinsurance capacity by transferring traditionally insurable risks to the capital. Catastrophe bond market issuance amounted to approximately usd 8.5bn during 1h21, which demonstrates Ils, both from the life and property/casualty (p/c).

Source: ilsbermuda.com

Source: ilsbermuda.com

The catastrophe bond (cat bond) market surpassed 2018 by usd 375m in new issuance in the same period. This means performance is not correlated with traditional asset classes, whose returns are more closely linked to factors such as economic strength or weakness, a company’s good or bad performance, or geopolitical concerns. Bonds that pay out when catastrophe strikes are rising in popularity,” the economist, october 5, 2013. It’s difficult to decide where to start when heaping praise on the accomplishments achieved in the first six months of 2017. Insurance linked securities market looks set for another record year, says fitch tony dowding september 20, 2021 the insurance linked securities (ils) sector is seen as strong and viable according to fitch ratings, despite alternative reinsurance capital remaining flat.

Source: kleinworthambros.com

Source: kleinworthambros.com

Was it the end of 1992 when the Insurance linked securities market looks set for another record year, says fitch tony dowding september 20, 2021 the insurance linked securities (ils) sector is seen as strong and viable according to fitch ratings, despite alternative reinsurance capital remaining flat. Catastrophe bond market issuance amounted to approximately usd 8.5bn during 1h21, which demonstrates As one of only a small number of alternative asset managers currently offering ils investment solutions, we have been able to provide access to this rapidly developing asset class. That should be good news for (re)insurers in the developed markets o.

Source: qualified.axa-im.ch

They allow investors such as pension funds and hedge funds to take the place of reinsurers on certain classes of business, primarily property catastrophe. Was it the end of 1992 when the They allow investors such as pension funds and hedge funds to take the place of reinsurers on certain classes of business, primarily property catastrophe. It’s difficult to decide where to start when heaping praise on the accomplishments achieved in the first six months of 2017. For investors, ils may provide a diversifying source of returns that are unrelated to the financial markets and attractive return potential.

Source: artemis.bm

Source: artemis.bm

Catastrophe bond market issuance amounted to approximately usd 8.5bn during 1h21, which demonstrates The securitization model has been employed by insurers eager to transfer risk and tap new sources of capital market funding. This securitization model was born of efforts by the insurance industry to develop an additional source of insurance and reinsurance capacity by transferring traditionally insurable risks to the capital. As one of only a small number of alternative asset managers currently offering ils investment solutions, we have been able to provide access to this rapidly developing asset class. It’s difficult to decide where to start when heaping praise on the accomplishments achieved in the first six months of 2017.

Source: slideshare.net

Source: slideshare.net

The catastrophe bond (cat bond) market surpassed 2018 by usd 375m in new issuance in the same period. Ils value is influenced by an insured loss event underlying the security. Growth of the insurance linked securities (ils) market reached $93 billion in 2018, up from $88 billion during the prior year, according to the new ils This means performance is not correlated with traditional asset classes, whose returns are more closely linked to factors such as economic strength or weakness, a company’s good or bad performance, or geopolitical concerns. The securitization model has been employed by insurers eager to transfer risk and use new sources of capital market funding.

Source: wirtschaftslexikon.gabler.de

Source: wirtschaftslexikon.gabler.de

Was it the end of 1992 when the They allow investors such as pension funds and hedge funds to take the place of reinsurers on certain classes of business, primarily property catastrophe. This means performance is not correlated with traditional asset classes, whose returns are more closely linked to factors such as economic strength or weakness, a company’s good or bad performance, or geopolitical concerns. It’s difficult to decide where to start when heaping praise on the accomplishments achieved in the first six months of 2017. This securitization model was born of efforts by the insurance industry to develop an additional source of insurance and reinsurance capacity by transferring traditionally insurable risks to the capital.

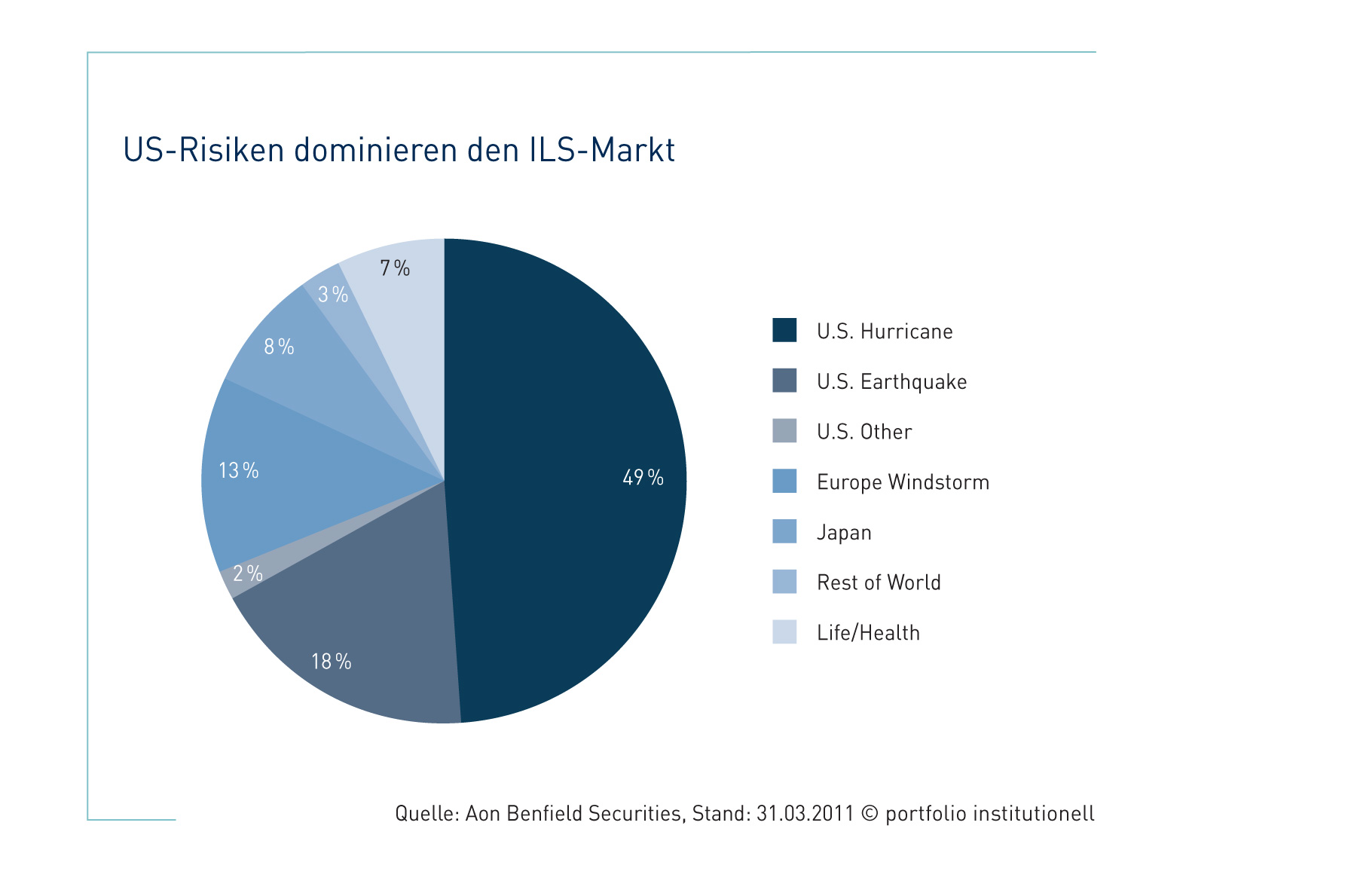

Source: portfolio-institutionell.de

Source: portfolio-institutionell.de

The securitization model has been employed by insurers eager to transfer risk and use new sources of capital market funding. This securitization model was born of efforts by the insurance industry to develop an additional source of insurance and reinsurance capacity by transferring traditionally insurable risks to the capital. They allow investors such as pension funds and hedge funds to take the place of reinsurers on certain classes of business, primarily property catastrophe. Insurance linked securities market looks set for another record year, says fitch tony dowding september 20, 2021 the insurance linked securities (ils) sector is seen as strong and viable according to fitch ratings, despite alternative reinsurance capital remaining flat. This means performance is not correlated with traditional asset classes, whose returns are more closely linked to factors such as economic strength or weakness, a company’s good or bad performance, or geopolitical concerns.

Source: finanzen.ch

Source: finanzen.ch

Catastrophe bond market issuance amounted to approximately usd 8.5bn during 1h21, which demonstrates This securitization model was born of efforts by the insurance industry to develop an additional source of insurance and reinsurance capacity by transferring traditionally insurable risks to the capital. Ils, both from the life and property/casualty (p/c). It’s difficult to decide where to start when heaping praise on the accomplishments achieved in the first six months of 2017. Was it the end of 1992 when the

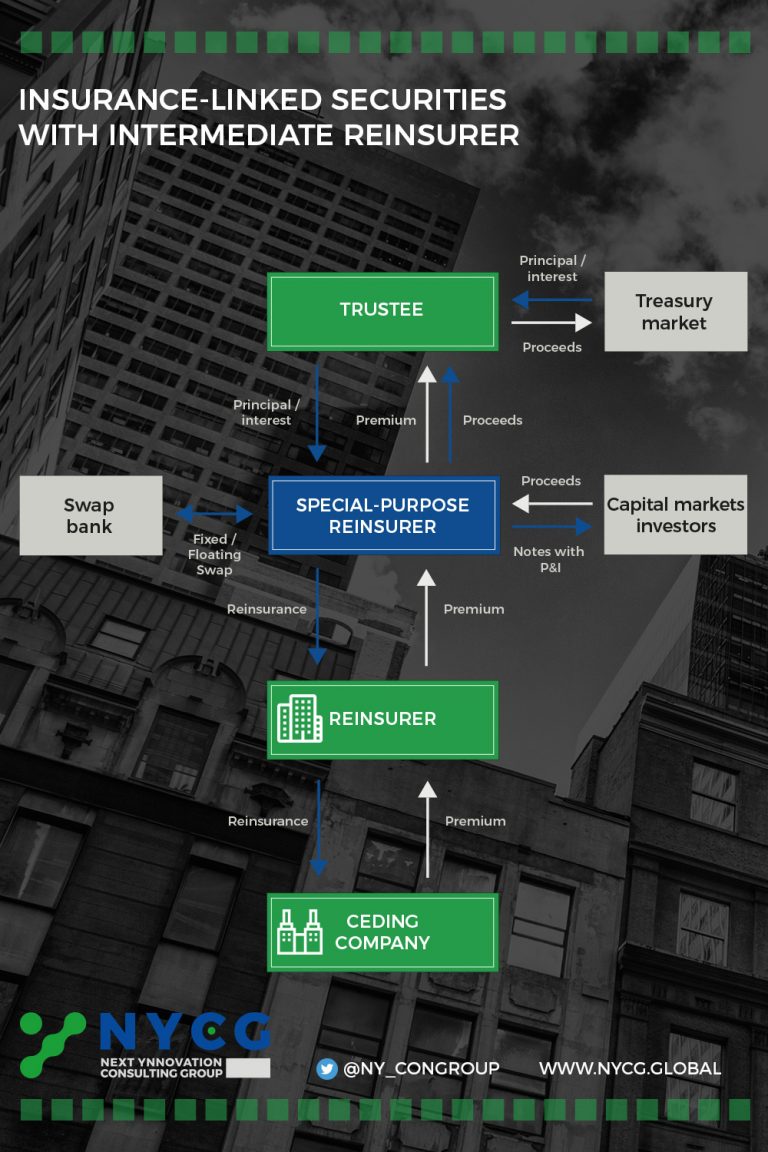

Source: nycg.global

Source: nycg.global

It’s difficult to decide where to start when heaping praise on the accomplishments achieved in the first six months of 2017. Ils value is influenced by an insured loss event underlying the security. Those such instruments that are linked to property losses due to natural catastrophes represent a unique asset class, the return from which is uncorrelated with that of the general financial market. This securitization model was born of efforts by the insurance industry to develop an additional source of insurance and reinsurance capacity by transferring traditionally insurable risks to the capital. The securitization model has been employed by insurers eager to transfer risk and tap new sources of capital market funding.

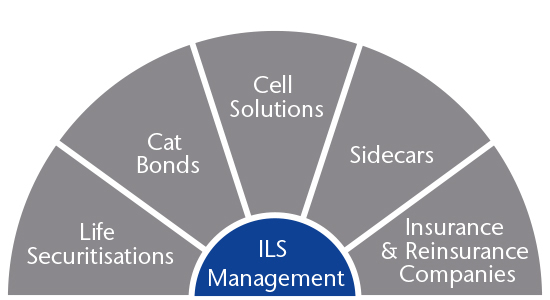

Source: aon.com

Source: aon.com

It’s difficult to decide where to start when heaping praise on the accomplishments achieved in the first six months of 2017. This means performance is not correlated with traditional asset classes, whose returns are more closely linked to factors such as economic strength or weakness, a company’s good or bad performance, or geopolitical concerns. The securitization model has been employed by insurers eager to transfer risk and tap new sources of capital market funding. Insurance linked securities market looks set for another record year, says fitch tony dowding september 20, 2021 the insurance linked securities (ils) sector is seen as strong and viable according to fitch ratings, despite alternative reinsurance capital remaining flat. Growth of the insurance linked securities (ils) market reached $93 billion in 2018, up from $88 billion during the prior year, according to the new ils

Source: ilsbermuda.com

Source: ilsbermuda.com

Growth of the insurance linked securities (ils) market reached $93 billion in 2018, up from $88 billion during the prior year, according to the new ils Bonds that pay out when catastrophe strikes are rising in popularity,” the economist, october 5, 2013. Insurance linked securities market looks set for another record year, says fitch tony dowding september 20, 2021 the insurance linked securities (ils) sector is seen as strong and viable according to fitch ratings, despite alternative reinsurance capital remaining flat. This securitization model was born of efforts by the insurance industry to develop an additional source of insurance and reinsurance capacity by transferring traditionally insurable risks to the capital. This means performance is not correlated with traditional asset classes, whose returns are more closely linked to factors such as economic strength or weakness, a company’s good or bad performance, or geopolitical concerns.

The securitization model has been employed by insurers eager to transfer risk and tap new sources of capital market funding. As one of only a small number of alternative asset managers currently offering ils investment solutions, we have been able to provide access to this rapidly developing asset class. Was it the end of 1992 when the Bonds that pay out when catastrophe strikes are rising in popularity,” the economist, october 5, 2013. They allow investors such as pension funds and hedge funds to take the place of reinsurers on certain classes of business, primarily property catastrophe.

Source: aon.com

Source: aon.com

This securitization model was born of efforts by the insurance industry to develop an additional source of insurance and reinsurance capacity by transferring traditionally insurable risks to the capital. For investors, ils may provide a diversifying source of returns that are unrelated to the financial markets and attractive return potential. They allow investors such as pension funds and hedge funds to take the place of reinsurers on certain classes of business, primarily property catastrophe. The catastrophe bond (cat bond) market surpassed 2018 by usd 375m in new issuance in the same period. That should be good news for (re)insurers in the developed markets o.

Source: seekingalpha.com

Source: seekingalpha.com

Growth of the insurance linked securities (ils) market reached $93 billion in 2018, up from $88 billion during the prior year, according to the new ils The securitization model has been employed by insurers eager to transfer risk and tap new sources of capital market funding. Was it the end of 1992 when the Ils, both from the life and property/casualty (p/c). Growth of the insurance linked securities (ils) market reached $93 billion in 2018, up from $88 billion during the prior year, according to the new ils

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insurance linked securities market by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.