Insurance loss runs Idea

Home » Trending » Insurance loss runs IdeaYour Insurance loss runs images are available in this site. Insurance loss runs are a topic that is being searched for and liked by netizens now. You can Download the Insurance loss runs files here. Find and Download all royalty-free photos and vectors.

If you’re looking for insurance loss runs images information connected with to the insurance loss runs topic, you have come to the ideal site. Our site frequently gives you suggestions for seeking the maximum quality video and image content, please kindly search and locate more enlightening video articles and images that fit your interests.

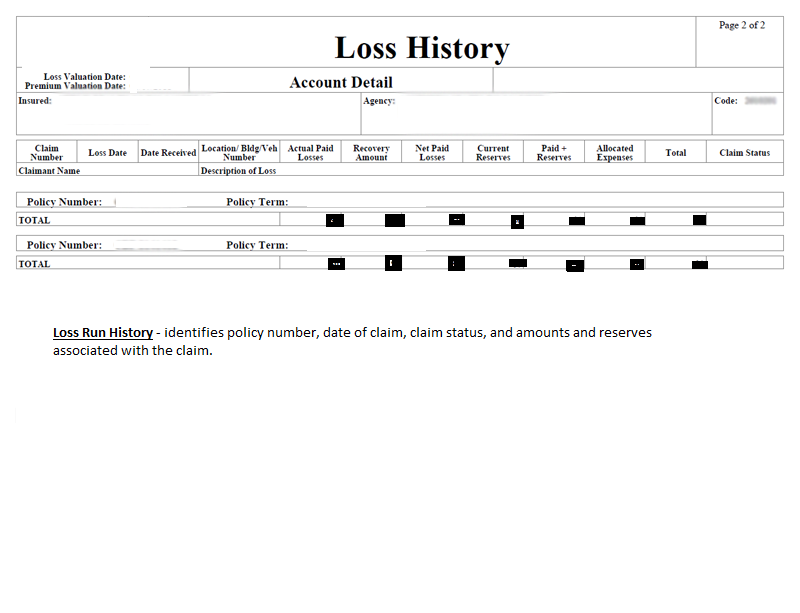

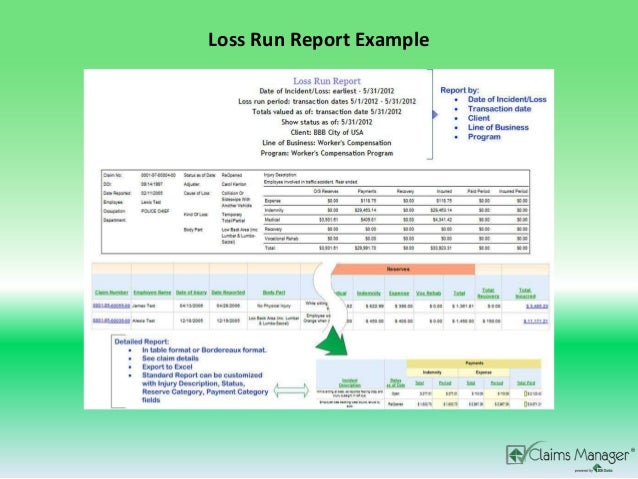

Insurance Loss Runs. Insurance companies use it to analyze how many claims you make, what types of claims, and the financial impact of each. It’s true that you may or may not need to provide loss runs to receive a quote. Insurance loss runs are reports of your business insurance claims history. Your loss runs are a snapshot or a report card from your current carrier, showing who you are currently with, as far as the carrier, the policy number, and the valuation date of the loss runs.

What are Insurance Carrier Loss Runs—Why does agent need From l2insuranceagency.com

That�s why we�ve created a simple tool for organizing a prospect�s carrier history, and easily generate a loss run authorization of release form. As the association�s renewal approaches, our system will prompt you (or another authorized signer if designated) to sign and send a prefilled request for the loss runs directly to the association�s insurance carrier. Loss of use insurance insurance which compensates the policyholder for the inability to use property destroyed or damaged by an insured peril. Let our experienced team of loss run procurement specialists solve those problems for you! Your loss runs are a snapshot or a report card from your current carrier, showing who you are currently with, as far as the carrier, the policy number, and the valuation date of the loss runs. The loss run serves a number of purposes, including the following:

With over a decade of experience in the insurance industry, we understand the minute details that are involved in providing successful insurance.

Insurance companies use it to analyze how many claims you make, what types of claims, and the financial impact of each. Insurance companies use it to analyze how many claims you make, what types of claims, and the financial impact of each. A claims history is one of a number of factors that are taken into consideration when your application is being underwritten. Rod unckles 4 years ago thank you very much for all your efforts in compiling this list! Loss runs will show the insurance company your commitment to minimizing the potential for risk, which they obviously need to see in order to decide what insurance terms they would be willing to offer. What is an insurance loss run?

Source: workcompquotes.com

Source: workcompquotes.com

A loss run is a report that shows the history of claims made against an insurance policy. Depending on the type of insurance three to five years of loss runs will be requested any time you switch insurance providers. A loss run is a report that documents your business’s insurance claims history. With over a decade of experience in the insurance industry, we understand the minute details that are involved in providing successful insurance. Loss runs are reports provided by your existing insurance company.

Source: midwesterninsurance.com

Source: midwesterninsurance.com

Loss runs are generated by your insurance provider. Gives you a detailed account of the claims activity on your policy during a given policy term or terms. A claims history is one of a number of factors that are taken into consideration when your application is being underwritten. The loss run serves a number of purposes, including the following: Sign the loss run request.

Source: floridaconstructionlegalupdates.com

Source: floridaconstructionlegalupdates.com

Insurance loss runs request letter source: It depends on the risk that your insurance company is trying to quote. Looking at a loss runs report, an insurer can see: Gives you a detailed account of the claims activity on your policy during a given policy term or terms. Loss run (report) a report that lists a variety of details on losses experienced.

You can�t sell business insurance without a quote, and you can�t get a quote without loss runs. Loss runs will show the insurance company your commitment to minimizing the potential for risk, which they obviously need to see in order to decide what insurance terms they would be willing to offer. Insurance loss runs are reports that detail insurance claims a person or business has had during their policy period. Essentially, your loss run report is like a report card of your prior claims history. Loss runs allow underwriters to determine how risky your business will be to insure.

Source: idealchoiceinsurance.com

Source: idealchoiceinsurance.com

Looking at a loss runs report, an insurer can see: Loss runs allow underwriters to determine how risky your business will be to insure. Insurance loss runs are reports that detail insurance claims a person or business has had during their policy period. A loss run is a report that shows the history of claims made against an insurance policy. I really appreciate the communication.

Source: workcompprofessionals.com

Source: workcompprofessionals.com

Your loss runs are a snapshot or a report card from your current carrier, showing who you are currently with, as far as the carrier, the policy number, and the valuation date of the loss runs. They’re used both as an update for the insured and as an underwriting tool for insurance companies to decide whether to. That�s why we�ve created a simple tool for organizing a prospect�s carrier history, and easily generate a loss run authorization of release form. A loss run is a report generated by your insurance company showing the claim activity on each of your insurance policies. Loss of use insurance insurance which compensates the policyholder for the inability to use property destroyed or damaged by an insured peril.

Source: simpleartifact.com

Source: simpleartifact.com

Loss runs allow underwriters to determine how risky your business will be to insure. Depending on the type of insurance three to five years of loss runs will be requested any time you switch insurance providers. A claims history is one of a number of factors that are taken into consideration when your application is being underwritten. Looking at a loss runs report, an insurer can see: Praetorian insurance company requests for loss runs relating to deep south business are no longer being handled by qbe.

Source: scientologybollocksa.blogspot.com

Source: scientologybollocksa.blogspot.com

Loss runs are reports about your past. I really appreciate the communication. That�s why we�ve created a simple tool for organizing a prospect�s carrier history, and easily generate a loss run authorization of release form. With over a decade of experience in the insurance industry, we understand the minute details that are involved in providing successful insurance. Loss runs are generated by your insurance provider.

Source: youtube.com

Source: youtube.com

They document incidents that happened, resulting claims, and how those claims were resolved through your insurance company. Loss runs enable insurers to see your insurance claims history report, and know how much of a risk your business will be to insure. Many underwriters ask for three to five years of loss runs when providing a small business quote. Loss runs are reports provided by your existing insurance company. Insurance loss runs request letter source:

Source: embroker.com

Source: embroker.com

Essentially, your loss run report is like a report card of your prior claims history. It depends on the risk that your insurance company is trying to quote. Loss runs are generated by your insurance provider. Insurance loss runs are reports of your business insurance claims history. So what is a loss run report and what does it include?

Source: slideshare.net

Source: slideshare.net

A claims history is one of a number of factors that are taken into consideration when your application is being underwritten. Starting july 30, 2018, please forward your requests to armour risk at: Many underwriters ask for three to five years of loss runs when providing a small business quote. Praetorian insurance company requests for loss runs relating to deep south business are no longer being handled by qbe. The loss run serves a number of purposes, including the following:

Source: autoownersinsuswa.blogspot.com

An insurance loss run is a document that records the history of claims made against a business insurance policy, much akin to an incident report. As the association�s renewal approaches, our system will prompt you (or another authorized signer if designated) to sign and send a prefilled request for the loss runs directly to the association�s insurance carrier. What is an insurance loss run? Why do we need your loss runs? A loss run is a report that shows the history of claims made against an insurance policy.

Source: staffboom.com

Source: staffboom.com

Rod unckles 4 years ago thank you very much for all your efforts in compiling this list! The loss run serves a number of purposes, including the following: What is an insurance loss run? Rod unckles 4 years ago thank you very much for all your efforts in compiling this list! Your loss runs are a snapshot or a report card from your current carrier, showing who you are currently with, as far as the carrier, the policy number, and the valuation date of the loss runs.

Source: insurancebackofficepro.com

Source: insurancebackofficepro.com

Depending on the type of insurance three to five years of loss runs will be requested any time you switch insurance providers. An insurance loss run is a document that records the history of claims made against a business insurance policy, much akin to an incident report. Specifically, they are reports about your past insurance coverage and your claims history. It’s true that you may or may not need to provide loss runs to receive a quote. Fillable online travelers loss run request form.

Source: southernstatesinsurance.com

Source: southernstatesinsurance.com

Loss runs allow underwriters to determine how risky your business will be to insure. Let our experienced team of loss run procurement specialists solve those problems for you! It’s true that you may or may not need to provide loss runs to receive a quote. Loss of use insurance insurance which compensates the policyholder for the inability to use property destroyed or damaged by an insured peril. Specifically, they are reports about your past insurance coverage and your claims history.

Source: federalregister.gov

Source: federalregister.gov

Fillable online travelers loss run request form. A confusing term with a simple definition a credit score allows banks to determine if your business is a good candidate for a bank loan. You can�t sell business insurance without a quote, and you can�t get a quote without loss runs. A loss run is a report that shows the history of claims made against an insurance policy. Let our experienced team of loss run procurement specialists solve those problems for you!

Source: pinterest.com

Source: pinterest.com

Insurance loss runs request letter source: Gives you a detailed account of the claims activity on your policy during a given policy term or terms. Essentially, your loss run report is like a report card of your prior claims history. Loss runs are reports provided by your existing insurance company. That�s why we�ve created a simple tool for organizing a prospect�s carrier history, and easily generate a loss run authorization of release form.

Source: l2insuranceagency.com

Insurance companies use it to analyze how many claims you make, what types of claims, and the financial impact of each. I really appreciate the communication. Typically, an insurance company will request up to five years of history, or for however long coverage has been provided. Loss runs will show the insurance company your commitment to minimizing the potential for risk, which they obviously need to see in order to decide what insurance terms they would be willing to offer. Why do we need your loss runs?

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance loss runs by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.