Insurance m a deals Idea

Home » Trend » Insurance m a deals IdeaYour Insurance m a deals images are ready in this website. Insurance m a deals are a topic that is being searched for and liked by netizens now. You can Get the Insurance m a deals files here. Get all royalty-free photos and vectors.

If you’re searching for insurance m a deals pictures information related to the insurance m a deals interest, you have pay a visit to the right site. Our website always provides you with suggestions for seeing the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

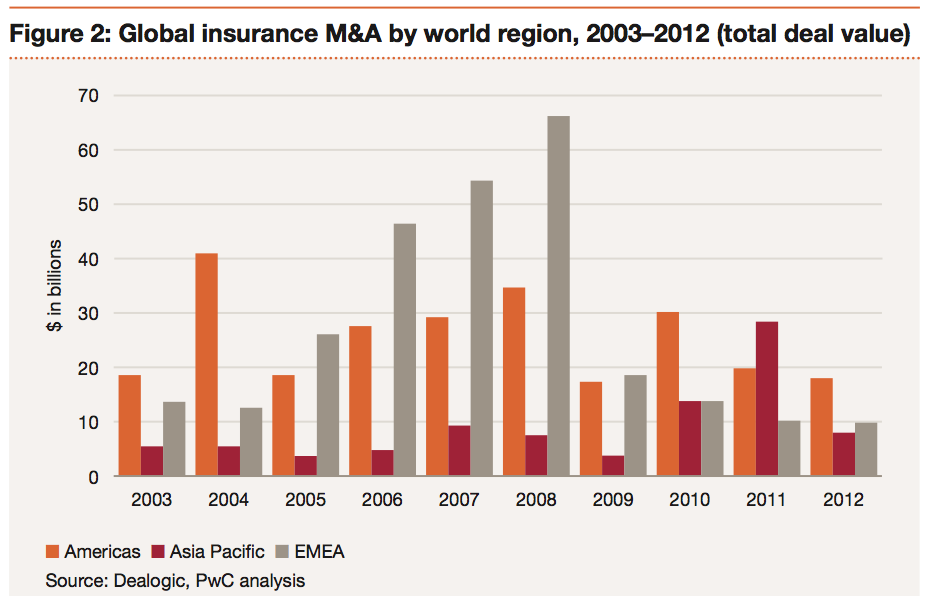

Insurance M A Deals. There are multiple benefits of representations and warranties insurance to the parties to an m&a deal. Worldwide insurance merger and acquisition activity slipped slightly in the first half of 2021 with 197 deals. Mergers and acquisitions in the insurance brokerage sector increased modestly to 754 deals announced in 2020, compared with 744 in 2019, according. At the beginning of 2018, we expected that insurance m&a aggregate deal volume and value would remain consistent with recent history.2 we also anticipated that the deal flow would comprise primarily transactions less than $2 billion, although we did expect to see a handful of transactions greater than $5 billion.3

Insurance M&A deals expected to decline in the second half From xprimm.com

Insurance M&A deals expected to decline in the second half From xprimm.com

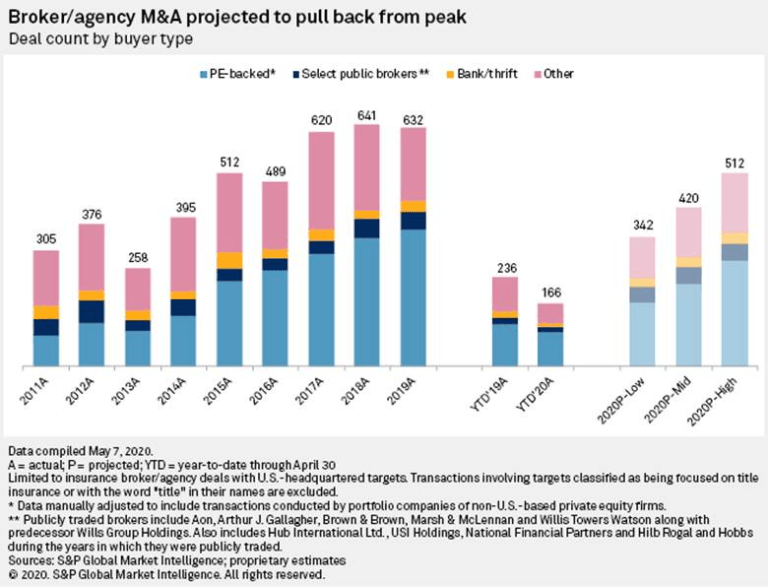

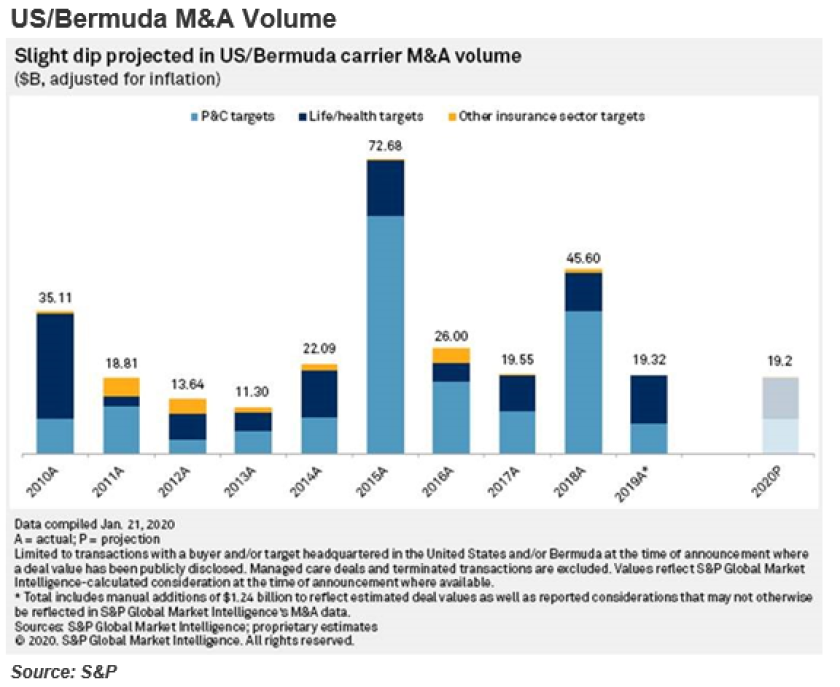

S&p global market intelligence projects a dramatic slowdown in key measures of volume of carrier and broker/agency deals through the balance of 2020. Over 75% of deals done by private equity firms now use rwi and that number is around 50% for deals done by strategic buyers. M&a deals hit £6bn in 2021. For sellers, the benefits of such insurance can include: Insurance deal activity accelerated in the second half of the year, as private equity, asset managers and corporate interest in the sector remained high. Equity and reinsurance deals in the life and annuity space show little sign of slowing, with price competition among reinsurers creating a seller’s market.

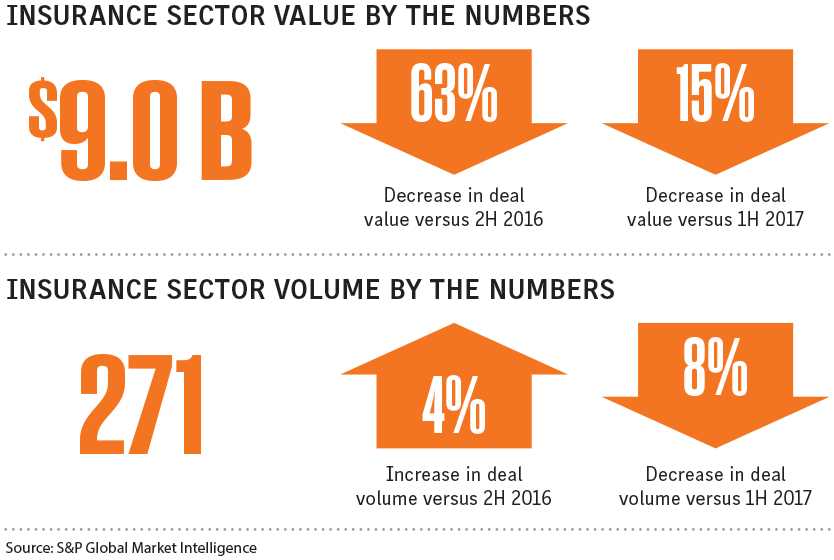

Despite the slight decrease in total deal value, the u.s.

Insurance m&a deals expected to surge in 2021. Where opportunities might lie in insurance m&a. The representations and warranties insurance (rwi) product has become ubiquitous in the m&a world. Over 75% of deals done by private equity firms now use rwi and that number is around 50% for deals done by strategic buyers. Maine senate advances equal rights amendment The rise of transactional insurance in m&a deals explained since founding his first property company in 1993, he has gone on to build companies in the it, renewable energy and now insurance sectors.

Source: valuewalk.com

Source: valuewalk.com

The latest annual review published by imas explains the m&a frenzy and warns of challenges ahead. Some of these include, among many others,. At the beginning of 2018, we expected that insurance m&a aggregate deal volume and value would remain consistent with recent history.2 we also anticipated that the deal flow would comprise primarily transactions less than $2 billion, although we did expect to see a handful of transactions greater than $5 billion.3 This re/insurance mergers and acquisitions (m&a) deal directory provides a simple way to analyse. Over 75% of deals done by private equity firms now use rwi and that number is around 50% for deals done by strategic buyers.

Source: spglobal.com

Source: spglobal.com

- the $265.76m acquisition of associated benefits and risk consulting by usi insurance services Insurance agency m&a deals surged 20% in year of pandemic: Insurance industry still held a 56.6% share of the global insurance industry m&a deal value for the fourth quarter of 2020, which totaled $8 billion at the end of the quarter. For sellers, the benefits of such insurance can include: Social inflation increased commercial auto claim costs by $20b over 10 years;

Source: xprimm.com

Source: xprimm.com

Dual asset was founded in 2013 and is part of dual group and howden group holdings, a global insurance group. There were 265 deals in the insurance brokerage space, up from 206 transactions a year ago. Insurance agency m&a deals surged 20% in year of pandemic: There are multiple benefits of representations and warranties insurance to the parties to an m&a deal. Over 75% of deals done by private equity firms now use rwi and that number is around 50% for deals done by strategic buyers.

Source: imaa-institute.org

Source: imaa-institute.org

Broker m&a activity increases modestly in 2020. Insurance m&a deals edge down in first half. Key drivers in insurance m&a deal activity is being driven by several macro factors, including low interest rates and a nascent trend toward greater specialization. Equity and reinsurance deals in the life and annuity space show little sign of slowing, with price competition among reinsurers creating a seller’s market. 2) the $265.76m acquisition of associated benefits and risk consulting by usi insurance services

Source: businessinsurance.com

Source: businessinsurance.com

S&p global market intelligence projects a dramatic slowdown in key measures of volume of carrier and broker/agency deals through the balance of 2020. 1) sony’s $3.73bn acquisition of sony financial holdings. The reps and warranties insurance policy, if properly negotiated, brings with it several benefits. Over 75% of deals done by private equity firms now use rwi and that number is around 50% for deals done by strategic buyers. Equity and reinsurance deals in the l&a space show little sign of slowing, with price competition among reinsurers creating a seller’s market.

Source: propertycasualty360.com

Source: propertycasualty360.com

66 rows this listing of recent major mergers and acquisitions (m&a) deals in the insurance and reinsurance industry is based on core data on recent re/insurance m&a published by rating agency standard & poor’s and augmented with our own data on m&a transactions. Key drivers in insurance m&a deal activity is being driven by several macro factors, including low interest rates and a nascent trend toward greater specialization. The representations and warranties insurance (rwi) product has become ubiquitous in the m&a world. 1) sony’s $3.73bn acquisition of sony financial holdings. The value available in the insurance sector continues to be remarkable.

Source: insidepandc.com

Source: insidepandc.com

There were 265 deals in the insurance brokerage space, up from 206 transactions a year ago. The rise of transactional insurance in m&a deals explained since founding his first property company in 1993, he has gone on to build companies in the it, renewable energy and now insurance sectors. The report, titled finding opportunity in adversity, tallied a total of 407 completed m&a transactions in the global. Key drivers in insurance m&a deal activity is being driven by several macro factors, including low interest rates and a nascent trend toward greater specialization. Mergers and acquisitions in the insurance brokerage sector increased modestly to 754 deals announced in 2020, compared with 744 in 2019, according.

Source: businessinsurance.com

Source: businessinsurance.com

There were 265 deals in the insurance brokerage space, up from 206 transactions a year ago. There were 265 deals in the insurance brokerage space, up from 206 transactions a year ago. Some of these include, among many others,. Social inflation increased commercial auto claim costs by $20b over 10 years; The report, titled finding opportunity in adversity, tallied a total of 407 completed m&a transactions in the global.

Source: elijahsblog1.blogspot.com

Source: elijahsblog1.blogspot.com

Social inflation increased commercial auto claim costs by $20b over 10 years; The top five insurance industry deals of may 2020 tracked by globaldata were: Over 75% of deals done by private equity firms now use rwi and that number is around 50% for deals done by strategic buyers. At the beginning of 2018, we expected that insurance m&a aggregate deal volume and value would remain consistent with recent history.2 we also anticipated that the deal flow would comprise primarily transactions less than $2 billion, although we did expect to see a handful of transactions greater than $5 billion.3 Insurance m&a deals edge down in first half.

Source: benefitnews.com

Source: benefitnews.com

S&p global market intelligence projects a dramatic slowdown in key measures of volume of carrier and broker/agency deals through the balance of 2020. This re/insurance mergers and acquisitions (m&a) deal directory provides a simple way to analyse. The combined value of the top five insurance m&a deals stood at $4.01bn, against the overall value of $5.01bn recorded for the month. 1) sony’s $3.73bn acquisition of sony financial holdings. At the beginning of 2018, we expected that insurance m&a aggregate deal volume and value would remain consistent with recent history.2 we also anticipated that the deal flow would comprise primarily transactions less than $2 billion, although we did expect to see a handful of transactions greater than $5 billion.3

Source: emergingrisks.co.uk

Source: emergingrisks.co.uk

There are multiple benefits of representations and warranties insurance to the parties to an m&a deal. 2) the $265.76m acquisition of associated benefits and risk consulting by usi insurance services The combined value of the top five insurance m&a deals stood at $4.01bn, against the overall value of $5.01bn recorded for the month. Over 75% of deals done by private equity firms now use rwi and that number is around 50% for deals done by strategic buyers. Despite the slight decrease in total deal value, the u.s.

Source: mazars.co.uk

Source: mazars.co.uk

Equity and reinsurance deals in the l&a space show little sign of slowing, with price competition among reinsurers creating a seller’s market. S&p global market intelligence projects a dramatic slowdown in key measures of volume of carrier and broker/agency deals through the balance of 2020. 2) the $265.76m acquisition of associated benefits and risk consulting by usi insurance services Equity and reinsurance deals in the life and annuity space show little sign of slowing, with price competition among reinsurers creating a seller’s market. The reps and warranties insurance policy, if properly negotiated, brings with it several benefits.

Source: employeebenefitadviser.com

Source: employeebenefitadviser.com

S&p global market intelligence projects a dramatic slowdown in key measures of volume of carrier and broker/agency deals through the balance of 2020. The representations and warranties insurance (rwi) product has become ubiquitous in the m&a world. Insurance industry still held a 56.6% share of the global insurance industry m&a deal value for the fourth quarter of 2020, which totaled $8 billion at the end of the quarter. M&a deals hit £6bn in 2021. This re/insurance mergers and acquisitions (m&a) deal directory provides a simple way to analyse.

![]() Source: businessinsurance.com

Source: businessinsurance.com

The top five insurance industry deals of may 2020 tracked by globaldata were: Key drivers in insurance m&a deal activity is being driven by several macro factors, including low interest rates and a nascent trend toward greater specialization. Dual asset was founded in 2013 and is part of dual group and howden group holdings, a global insurance group. Some of these include, among many others,. The reps and warranties insurance policy, if properly negotiated, brings with it several benefits.

Source: elijahsblog1.blogspot.com

Source: elijahsblog1.blogspot.com

Insurance m&a deals edge down in first half. Social inflation increased commercial auto claim costs by $20b over 10 years; The report, titled finding opportunity in adversity, tallied a total of 407 completed m&a transactions in the global. Insurance industry still held a 56.6% share of the global insurance industry m&a deal value for the fourth quarter of 2020, which totaled $8 billion at the end of the quarter. For sellers, the benefits of such insurance can include:

Source: carriermanagement.com

Source: carriermanagement.com

Despite the slight decrease in total deal value, the u.s. For sellers, the benefits of such insurance can include: The reps and warranties insurance policy, if properly negotiated, brings with it several benefits. This re/insurance mergers and acquisitions (m&a) deal directory provides a simple way to analyse. Key drivers in insurance m&a deal activity is being driven by several macro factors, including low interest rates and a nascent trend toward greater specialization.

Source: prnewswire.com

Source: prnewswire.com

Insurance m&a deals edge down in first half. 2) the $265.76m acquisition of associated benefits and risk consulting by usi insurance services The report, titled finding opportunity in adversity, tallied a total of 407 completed m&a transactions in the global. Dual asset was founded in 2013 and is part of dual group and howden group holdings, a global insurance group. S&p global market intelligence projects a dramatic slowdown in key measures of volume of carrier and broker/agency deals through the balance of 2020.

Source: entreaspas-pi.blogspot.com

Source: entreaspas-pi.blogspot.com

M&a deals hit £6bn in 2021. Insurance m&a deals edge down in first half. Over 75% of deals done by private equity firms now use rwi and that number is around 50% for deals done by strategic buyers. Some of these include, among many others,. Social inflation increased commercial auto claim costs by $20b over 10 years;

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance m a deals by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.