Insurance market share 2016 Idea

Home » Trending » Insurance market share 2016 IdeaYour Insurance market share 2016 images are ready. Insurance market share 2016 are a topic that is being searched for and liked by netizens now. You can Download the Insurance market share 2016 files here. Find and Download all free photos.

If you’re looking for insurance market share 2016 images information connected with to the insurance market share 2016 keyword, you have pay a visit to the ideal site. Our site frequently gives you hints for refferencing the highest quality video and image content, please kindly search and locate more enlightening video content and graphics that fit your interests.

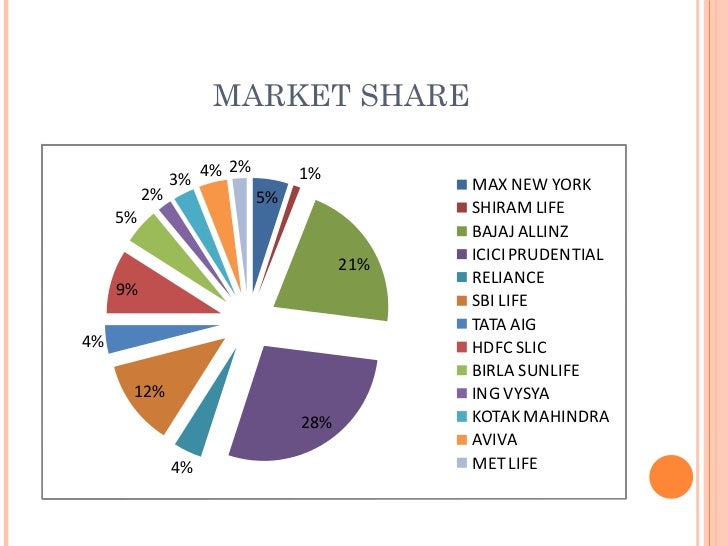

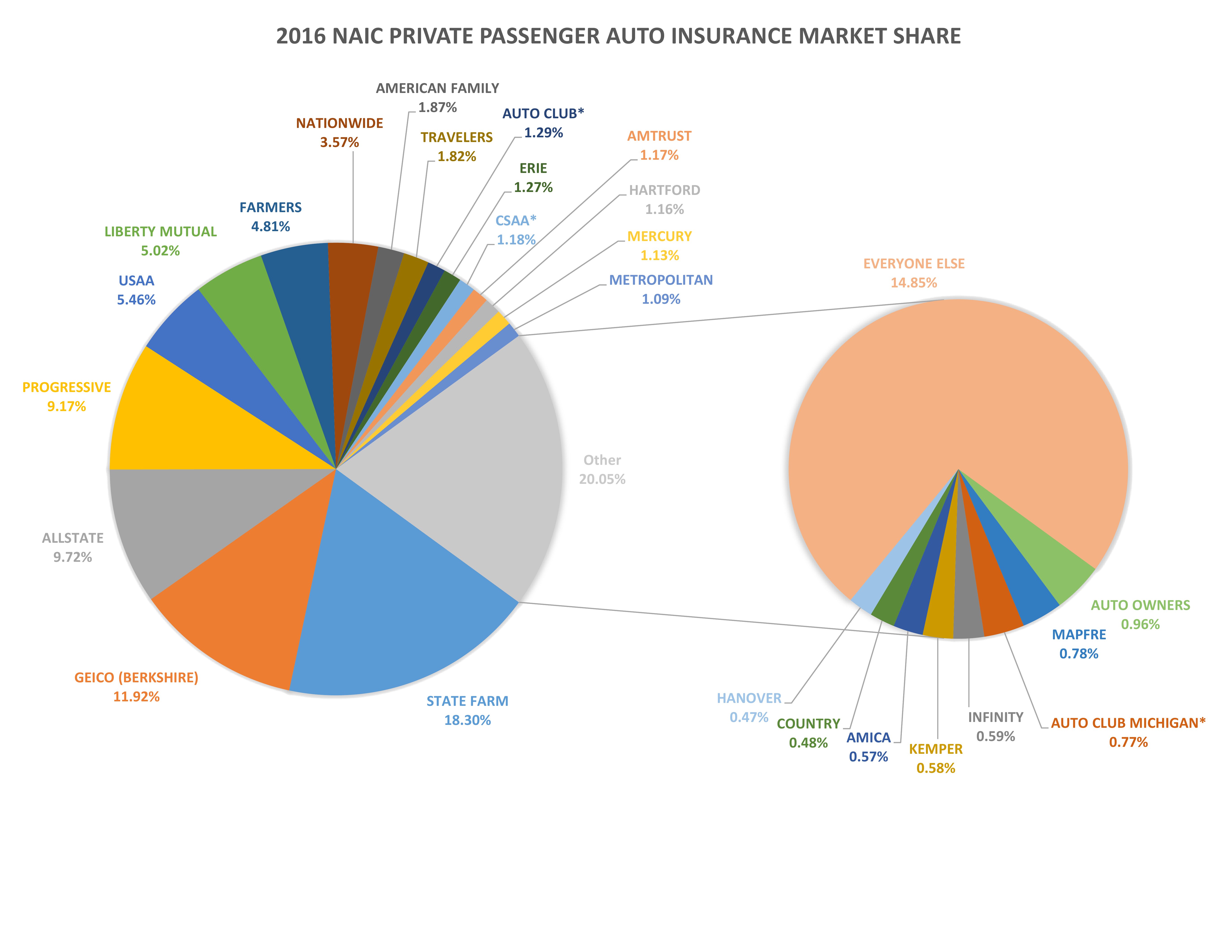

Insurance Market Share 2016. Market share cumulative market share direct premiums earned direct losses incurred pure direct loss ratio 140 42587 depositors ins co ia 97,331 1.4991% 75.0323% 106,898 6,552 6.1292% 175 25135 state automobile mut ins co oh 97,196 1.4971% 76.5293% 97,338 23 0.0236% 309 15377 western natl mut ins co mn 96,258 1.4826% 78.0119% 94,543 40,236 42. The market share of private sector companies in the general and health insurance market increased from 47.97% in fy19 to 48.03% in fy20. Across the industry revenue has grown, for some through acquisition and others through the provision This statistic illustrates the share of the motor insurance market attributable to the young loyalist* market segment, as defined by the study, in.

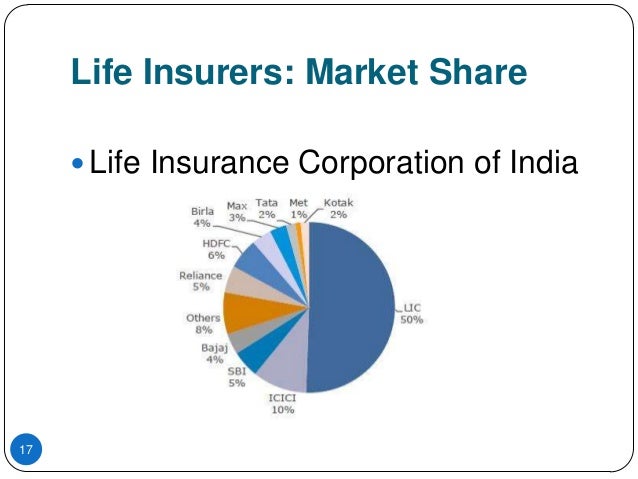

FUNCTIONS OF INSURANCE From slideshare.net

FUNCTIONS OF INSURANCE From slideshare.net

History shareholders, 1q 2016 (share in %) background • 1991: In 2020, the market share for the orient insurance company in the united arab emirates (uae) insurance market was estimated to be about 17.4 percent. Best and used with its permission. Life and non life premiums (2016): Travel insurance is designed to provide financial protection for unexpected events during travelling. Premium rates are likely to continue to fall in 2016 although there are signs of this slowing significantly with some insurers looking to draw a line in the sand.

This statistic illustrates the share of the motor insurance market attributable to the young loyalist* market segment, as defined by the study, in.

Life and non life premiums (2017): Life and non life premiums (2016): Insurance market has been gradually eroding over time but this process has been reversed in 2014. Premium but a decline in market share. Premium market share 2016 4 progressive grp 5.8%908,861,083 progressive specialty ins co 401,961,081 2.6% progressive direct ins co 381,091,434 2.4% progressive preferred ins co 89,060,130 0.6% progressive cas ins co 18,979,487 0.1% american strategic ins corp 10,961,907 0.1% united financial cas co 4,563,274 0.0% national continental ins co 2,301,000 0.0% In the life insurance segment, private players held a market share of 33.78% in premium underwritten services in fy20.

Source: slideshare.net

Source: slideshare.net

Association of cameroon’s insurance companies (asac) This statistic illustrates the share of the motor insurance market attributable to the young loyalist* market segment, as defined by the study, in. Insurance market has been gradually eroding over time but this process has been reversed in 2014. Premium market share 2016 4 progressive grp 5.8%908,861,083 progressive specialty ins co 401,961,081 2.6% progressive direct ins co 381,091,434 2.4% progressive preferred ins co 89,060,130 0.6% progressive cas ins co 18,979,487 0.1% american strategic ins corp 10,961,907 0.1% united financial cas co 4,563,274 0.0% national continental ins co 2,301,000 0.0% Across the industry revenue has grown, for some through acquisition and others through the provision

Source: slideshare.net

Source: slideshare.net

Life and non life premiums (2017): Skandia, sweden�s leading provider of health insurance had a market share of over 20.2 percent in 2016. Premium rates are likely to continue to fall in 2016 although there are signs of this slowing significantly with some insurers looking to draw a line in the sand. By the end of 2016, this had increased more than a percentage point to 85.15 percent. All data used in this report is the property of a.m.

Source: livemint.com

Source: livemint.com

London in the past, this tends to be quota share capacity. If you saw a few fewer customers from smaller carriers last year, that’s why. By the end of 2016, this had increased more than a percentage point to 85.15 percent. This statistic illustrates the share of the motor insurance market attributable to the premium market* market segment in europe as of 2016, broken down by country. The ia channel held on to 35.5% of the market, while seeing approximately 9% growth in premium.

Source: slideshare.net

Source: slideshare.net

The ia channel held on to 35.5% of the market, while seeing approximately 9% growth in premium. If you saw a few fewer customers from smaller carriers last year, that’s why. In ghs (1) in usd. Best and used with its permission. History shareholders, 1q 2016 (share in %) background • 1991:

Source: repairerdrivennews.com

Source: repairerdrivennews.com

Association of cameroon’s insurance companies (asac) If you saw a few fewer customers from smaller carriers last year, that’s why. Market share cumulative market share direct premiums earned direct losses incurred pure direct loss ratio 140 42587 depositors ins co ia 97,331 1.4991% 75.0323% 106,898 6,552 6.1292% 175 25135 state automobile mut ins co oh 97,196 1.4971% 76.5293% 97,338 23 0.0236% 309 15377 western natl mut ins co mn 96,258 1.4826% 78.0119% 94,543 40,236 42. By the end of 2016, this had increased more than a percentage point to 85.15 percent. Skandia, sweden�s leading provider of health insurance had a market share of over 20.2 percent in 2016.

Source: businessinsider.com.au

Source: businessinsider.com.au

London in the past, this tends to be quota share capacity. Premium market share 2016 4 progressive grp 5.8%908,861,083 progressive specialty ins co 401,961,081 2.6% progressive direct ins co 381,091,434 2.4% progressive preferred ins co 89,060,130 0.6% progressive cas ins co 18,979,487 0.1% american strategic ins corp 10,961,907 0.1% united financial cas co 4,563,274 0.0% national continental ins co 2,301,000 0.0% Travel insurance is designed to provide financial protection for unexpected events during travelling. The ia channel held on to 35.5% of the market, while seeing approximately 9% growth in premium. History shareholders, 1q 2016 (share in %) background • 1991:

Source: slideshare.net

Source: slideshare.net

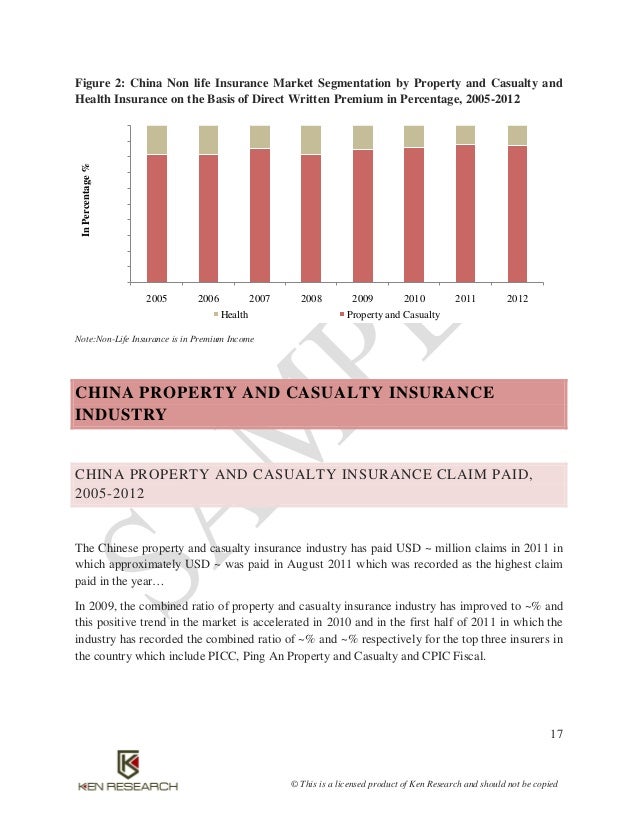

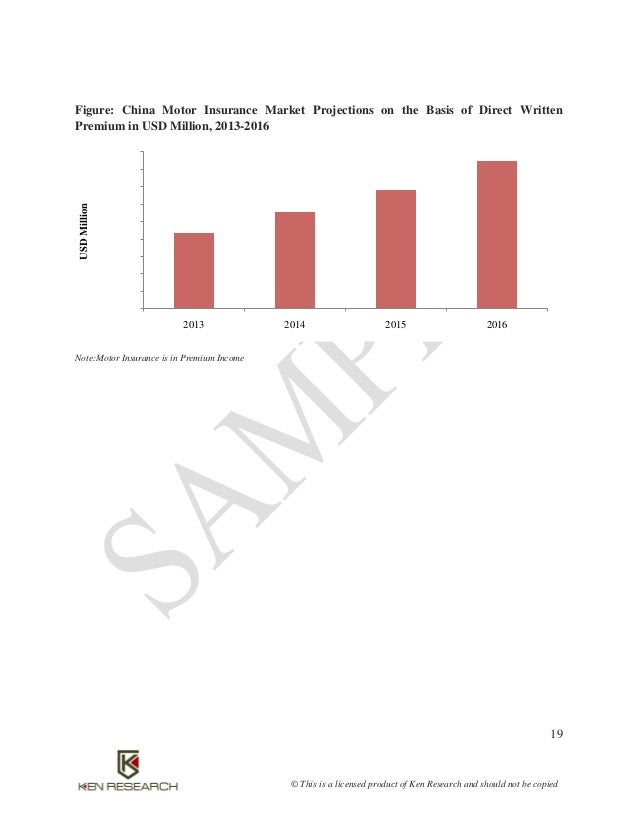

This statistic illustrates the share of the motor insurance market attributable to the premium market* market segment in europe as of 2016, broken down by country. Life and non life premiums (2017): Association of cameroon’s insurance companies (asac) This statistic illustrates the leading insurance markets worldwide in 2016, by market share. Across the industry revenue has grown, for some through acquisition and others through the provision

Source: xprimm.com

Source: xprimm.com

This statistic illustrates the leading insurance markets worldwide in 2016, by market share. Market share % cumulative market share %³ 1 176 state farm grp 17,516,715,113 17,473,823,115 47.97 49.21 19.66 19.66 2 8 allstate ins grp 7,926,983,689 7,819,876,000 45.98 47.52 8.90 28.56 3 111 liberty mut grp 5,993,803,392 5,835,219,513 53.34 54.65 6.73 35.29 4 69 farmers ins grp 5,284,510,883 5,200,725,102 50.49 51.60 5.93 41.22 Insurance intermediaries insurance intermediaries are operating in a very challenging environment where the maintenance of market share and profitability is no longer assumed. Skandia, sweden�s leading provider of health insurance had a market share of over 20.2 percent in 2016. Across the industry revenue has grown, for some through acquisition and others through the provision

Source: pinterest.com

Source: pinterest.com

Best and used with its permission. Best and used with its permission. The market share of private sector companies in the general and health insurance market increased from 47.97% in fy19 to 48.03% in fy20. Premium rates are likely to continue to fall in 2016 although there are signs of this slowing significantly with some insurers looking to draw a line in the sand. Market share cumulative market share direct premiums earned direct losses incurred pure direct loss ratio 140 42587 depositors ins co ia 97,331 1.4991% 75.0323% 106,898 6,552 6.1292% 175 25135 state automobile mut ins co oh 97,196 1.4971% 76.5293% 97,338 23 0.0236% 309 15377 western natl mut ins co mn 96,258 1.4826% 78.0119% 94,543 40,236 42.

Source: slideshare.net

Source: slideshare.net

Market share cumulative market share direct premiums earned direct losses incurred pure direct loss ratio 140 42587 depositors ins co ia 97,331 1.4991% 75.0323% 106,898 6,552 6.1292% 175 25135 state automobile mut ins co oh 97,196 1.4971% 76.5293% 97,338 23 0.0236% 309 15377 western natl mut ins co mn 96,258 1.4826% 78.0119% 94,543 40,236 42. Association of cameroon’s insurance companies (asac) Despite the recent withdrawal of axis from the australian market, we expect market conditions to remain soft in the year ahead. Premium but a decline in market share. Market shares per class of business in 2016 (1) including third party liabiliy, other non life risks, acceptances, credit and bond (2) including group life policies, individual life insurance and acceptances source:

Source: slideshare.net

Source: slideshare.net

By the end of 2016, this had increased more than a percentage point to 85.15 percent. In ghs (1) in usd. History shareholders, 1q 2016 (share in %) background • 1991: The global insurance market is expected to generate total gross written premiums of $5,825.4bn in 2020, representing a compound annual growth rate (cagr) of. Market share % cumulative market share %³ 1 176 state farm grp 17,516,715,113 17,473,823,115 47.97 49.21 19.66 19.66 2 8 allstate ins grp 7,926,983,689 7,819,876,000 45.98 47.52 8.90 28.56 3 111 liberty mut grp 5,993,803,392 5,835,219,513 53.34 54.65 6.73 35.29 4 69 farmers ins grp 5,284,510,883 5,200,725,102 50.49 51.60 5.93 41.22

Source: slideshare.net

Source: slideshare.net

The global travel insurance market is valued at usd 1.63 billion in 2016 and is expected to reach usd 3.89 billion by the end of 2026, growing at a cagr of 9.1 % between 2017 and 2025. (1) the gwp is the total of accounted premiums for domestic insurance and reinsurance companies. This statistic illustrates the leading insurance markets worldwide in 2016, by market share. This statistic illustrates the share of the motor insurance market attributable to the premium market* market segment in europe as of 2016, broken down by country. All data used in this report is the property of a.m.

Source: collisionweek.com

Source: collisionweek.com

Life and non life premiums (2017): 2016 direct premiums written ($) market share % 1: Best and used with its permission. Across the industry revenue has grown, for some through acquisition and others through the provision Association of cameroon’s insurance companies (asac)

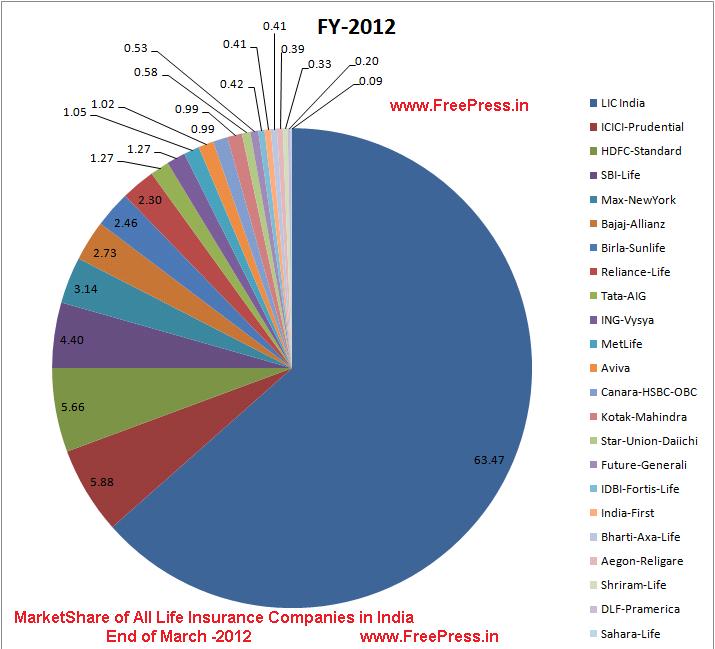

Source: freepress.in

Source: freepress.in

Premium but a decline in market share. Premium but a decline in market share. Life and non life premiums (2016): Premium rates are likely to continue to fall in 2016 although there are signs of this slowing significantly with some insurers looking to draw a line in the sand. 1 010 408 km 2.

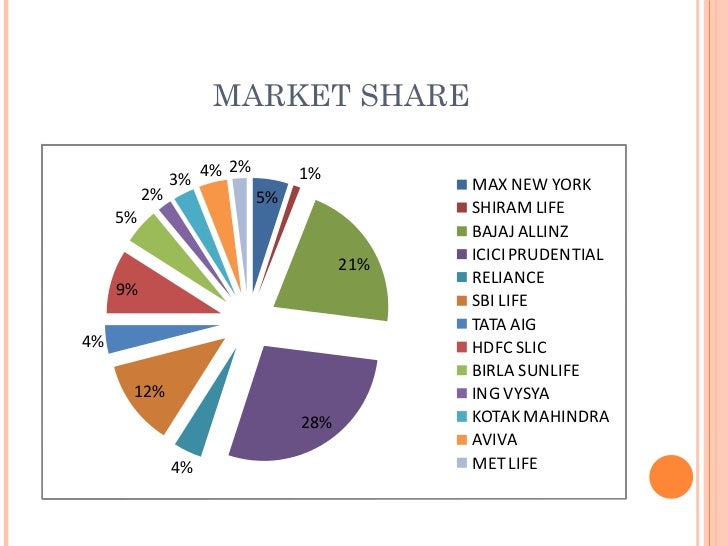

Source: slideshare.net

Source: slideshare.net

Travel insurance is designed to provide financial protection for unexpected events during travelling. Premium but a decline in market share. Market share % cumulative market share %³ 1 176 state farm grp 17,516,715,113 17,473,823,115 47.97 49.21 19.66 19.66 2 8 allstate ins grp 7,926,983,689 7,819,876,000 45.98 47.52 8.90 28.56 3 111 liberty mut grp 5,993,803,392 5,835,219,513 53.34 54.65 6.73 35.29 4 69 farmers ins grp 5,284,510,883 5,200,725,102 50.49 51.60 5.93 41.22 Insurance market has been gradually eroding over time but this process has been reversed in 2014. Despite the recent withdrawal of axis from the australian market, we expect market conditions to remain soft in the year ahead.

Source: researchgate.net

Source: researchgate.net

The global insurance market is expected to generate total gross written premiums of $5,825.4bn in 2020, representing a compound annual growth rate (cagr) of. Insurance market has been gradually eroding over time but this process has been reversed in 2014. Premium rates are likely to continue to fall in 2016 although there are signs of this slowing significantly with some insurers looking to draw a line in the sand. Market share cumulative market share direct premiums earned direct losses incurred pure direct loss ratio 140 42587 depositors ins co ia 97,331 1.4991% 75.0323% 106,898 6,552 6.1292% 175 25135 state automobile mut ins co oh 97,196 1.4971% 76.5293% 97,338 23 0.0236% 309 15377 western natl mut ins co mn 96,258 1.4826% 78.0119% 94,543 40,236 42. Insurance intermediaries insurance intermediaries are operating in a very challenging environment where the maintenance of market share and profitability is no longer assumed.

Source: appsruntheworld.com

Source: appsruntheworld.com

Association of cameroon’s insurance companies (asac) The global insurance market is expected to generate total gross written premiums of $5,825.4bn in 2020, representing a compound annual growth rate (cagr) of. Premium market share 2016 4 progressive grp 5.8%908,861,083 progressive specialty ins co 401,961,081 2.6% progressive direct ins co 381,091,434 2.4% progressive preferred ins co 89,060,130 0.6% progressive cas ins co 18,979,487 0.1% american strategic ins corp 10,961,907 0.1% united financial cas co 4,563,274 0.0% national continental ins co 2,301,000 0.0% Premium rates are likely to continue to fall in 2016 although there are signs of this slowing significantly with some insurers looking to draw a line in the sand. 2016 direct premiums written ($) market share % 1:

Source: slideshare.net

Source: slideshare.net

This statistic illustrates the leading insurance markets worldwide in 2016, by market share. London in the past, this tends to be quota share capacity. By the end of 2016, this had increased more than a percentage point to 85.15 percent. This statistic illustrates the leading insurance markets worldwide in 2016, by market share. Premium rates are likely to continue to fall in 2016 although there are signs of this slowing significantly with some insurers looking to draw a line in the sand.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insurance market share 2016 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.