Insurance model risk information

Home » Trending » Insurance model risk informationYour Insurance model risk images are ready. Insurance model risk are a topic that is being searched for and liked by netizens today. You can Find and Download the Insurance model risk files here. Find and Download all royalty-free vectors.

If you’re searching for insurance model risk images information connected with to the insurance model risk keyword, you have pay a visit to the ideal blog. Our site always gives you hints for seeing the highest quality video and picture content, please kindly search and locate more enlightening video content and graphics that match your interests.

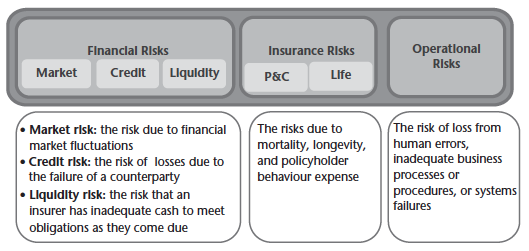

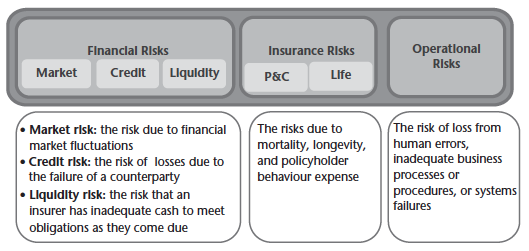

Insurance Model Risk. Model risk is the risk inherent in using models to predict requirements, forecast demand and inform decision making; The federal reserve and the office of the comptroller of the currency (occ) define model risk as the occurrence of fundamental errors in model outputs and the incorrect use of models. These risks can arise in a company’s data, assumptions, methodologies, processes, or model results and how they are used. The insurance market allows agents to cover themselves against risk.

The economics, regulation, and systemic risk of insurance From voxeu.org

The economics, regulation, and systemic risk of insurance From voxeu.org

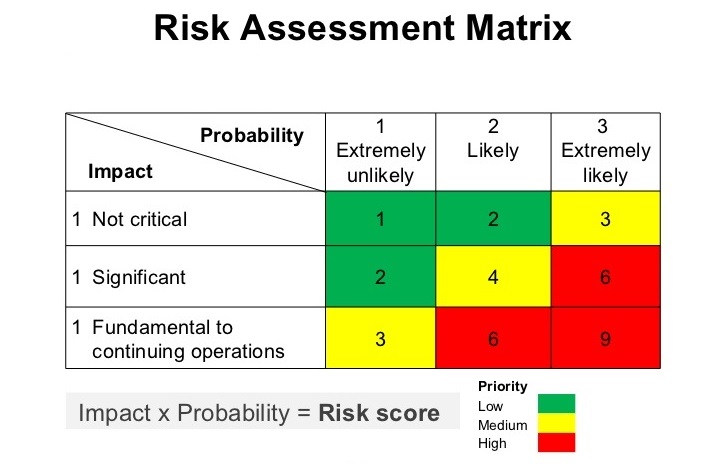

Maximumscore represents the combined largest(=maximum) values horizontally. The insurance market allows agents to cover themselves against risk. N 1g, 0 <t 1 <t 2 < , and counting process fn(t)g, claims against the business occur in the amounts b P&c insurer wanted to improve risk selection and underwriting processes. Internal risk models are widely used by insurance companies and banks in measuring risk, calculating overall capital requirements, and allocating capital for business decisions. The federal reserve and the office of the comptroller of the currency (occ) define model risk as the occurrence of fundamental errors in model outputs and the incorrect use of models.

How individuals perceive insurances depends on their prices, and on the individuals’ preferences and budget constrain.

In particular, the wg focuses on: Risk modelling for insurance instantly harness the power of satellite data without the need to code. The essential insurance model involves pooling risk from individual payers and redistributing it. Vertically risk (=claimed) proportion (in red color) is shown. Among these costs is model risk, understood as the loss (economic, reputational, etc.) arising from decisions based Banks should consider risk from individual models and in the aggregate.

Source: verisk.com

Source: verisk.com

In addition, the valuation and pricing of complex financial and insurance products is regularly carried out using sophisticated A risk averse individual may be willing to assure. In particular, the wg focuses on: Improve insurance risk modeling scale risk management and become more agile by delivering models faster, more efficiently, and cost effectively to. Banks should identify the sources of risk and assess the magnitude.

Source: relakhs.com

Source: relakhs.com

Model risk is the risk inherent in using models to predict requirements, forecast demand and inform decision making; You focus first on the example from rob kaas’ et al. Traditionally insurance models have relied on historical loss and exposure data, and sometimes reflect just the last one or two decades when it comes to financial markets. The insurance industry is an industr y concerned with hedging against the risk of uncertain financial loss, and the business of insurance companies is therefore largely a risk management endeavor. The essential insurance model involves pooling risk from individual payers and redistributing it.

Source: lockton.com

Source: lockton.com

The insurance market allows agents to cover themselves against risk. Insurance companies take advantage of risk averse individuals to charge an extra surcharge to pay costs which are not covered by the premium. Banks should consider risk from individual models and in the aggregate. Insurance companies base their business models around assuming and diversifying risk. Testing predictive insurance risk models requires data visualization tools.

Source: insuranceblog.accenture.com

Source: insuranceblog.accenture.com

The insurance industry is an industr y concerned with hedging against the risk of uncertain financial loss, and the business of insurance companies is therefore largely a risk management endeavor. The possible adverse consequences of decisions based on models that have fundamental errors or the misuse of those models. N 1g, 0 <t 1 <t 2 < , and counting process fn(t)g, claims against the business occur in the amounts b The following histogram shows largest(=maximum) scores and risk distribution in past historical data. Meanwhile, according to a point process with times ft n:

Source: insuranceblog.accenture.com

Source: insuranceblog.accenture.com

The insurance industry is an industr y concerned with hedging against the risk of uncertain financial loss, and the business of insurance companies is therefore largely a risk management endeavor. In addition, the valuation and pricing of complex financial and insurance products is regularly carried out using sophisticated These risks can arise in a company’s data, assumptions, methodologies, processes, or model results and how they are used. Model risk is the risk inherent in using models to predict requirements, forecast demand and inform decision making; The following histogram shows largest(=maximum) scores and risk distribution in past historical data.

Source: blog.etherisc.com

Source: blog.etherisc.com

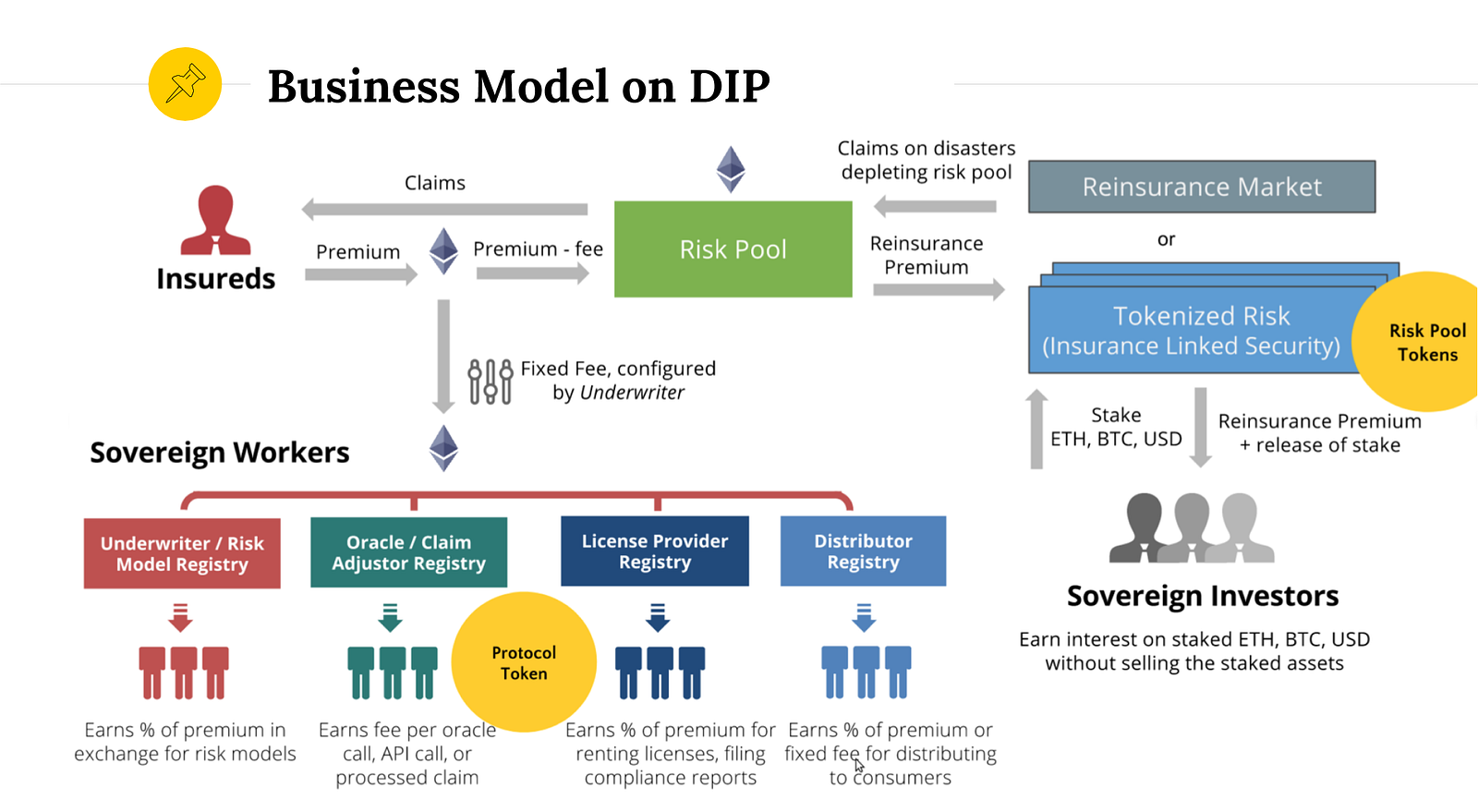

The insured trades future risk with an insurer for a fixed premium through a contract, known as the insurance policy, and if the policy holder is subject to a loss they can. The insurance market allows agents to cover themselves against risk. The design of (re)insurance policies relies on the estimation of risk, which nowadays more and more involves the use of simulation models known as natural catastrophe models. Model risk increases with greater model complexity, higher uncertainty about inputs and assumptions, broader use, and larger potential impact. In addition, the valuation and pricing of complex financial and insurance products is regularly carried out using sophisticated

Source: insuranceblog.accenture.com

Source: insuranceblog.accenture.com

The essential insurance model involves pooling risk from individual payers and redistributing it. The essential insurance model involves pooling risk from individual payers and redistributing it. Use improved predictive modelling to enhance risk management, price policies more effectively, optimise financial positions and achieve faster insurance risk analytics. The use of mathematical models by financial institutions in many areas is rapidly gaining ground. How individuals perceive insurances depends on their prices, and on the individuals’ preferences and budget constrain.

Source: insuranceerm.com

Source: insuranceerm.com

The essential insurance model involves pooling risk from individual payers and redistributing it. The risk management and own risk and solvency assessment (orsa) model act (#505) was published by the national association of insurance commissioners (naic) in 2014 and provides guidance to insurance companies on their internal assessments of. You’ll now study the use of generalized linear models in r for insurance ratemaking. These risks can arise in a company’s data, assumptions, methodologies, processes, or model results and how they are used. A risk averse individual may be willing to assure.

Source: noticiasmodelo.blogspot.com

Source: noticiasmodelo.blogspot.com

Meanwhile, according to a point process with times ft n: The use of credit and other scoring models represents a subtle shift in actuarial practice. And (7) other significant risks (reputational and other). Insurance companies take advantage of risk averse individuals to charge an extra surcharge to pay costs which are not covered by the premium. The possible adverse consequences of decisions based on models that have fundamental errors or the misuse of those models.

Source: gabrielconsultinggroup.com

N 1g, 0 <t 1 <t 2 < , and counting process fn(t)g, claims against the business occur in the amounts b The federal reserve and the office of the comptroller of the currency (occ) define model risk as the occurrence of fundamental errors in model outputs and the incorrect use of models. (2008) modern actuarial risk theory book (see section 9.5 in this book), with simulated claim frequency data. Improve insurance risk modeling scale risk management and become more agile by delivering models faster, more efficiently, and cost effectively to. Model risk should be managed like other types of risk.

Source: insuranceanalytics.graymatter.co.in

Source: insuranceanalytics.graymatter.co.in

A large part of general microeconomic (in insurance) theory has been concerned with devising robust and analytically sound techniques for assessing the risk in insurance premium calculation. These risks can arise in a company’s data, assumptions, methodologies, processes, or model results and how they are used. The risk management and own risk and solvency assessment (orsa) model act (#505) was published by the national association of insurance commissioners (naic) in 2014 and provides guidance to insurance companies on their internal assessments of. Meanwhile, according to a point process with times ft n: A risk averse individual may be willing to assure.

Source: pinterest.es

Source: pinterest.es

Model risk is still nascent within typical banking risk inventories. Insurance companies take advantage of risk averse individuals to charge an extra surcharge to pay costs which are not covered by the premium. (2008) modern actuarial risk theory book (see section 9.5 in this book), with simulated claim frequency data. How individuals perceive insurances depends on their prices, and on the individuals’ preferences and budget constrain. This shift has two related aspects.

Source: nsd.ru

Source: nsd.ru

The insured trades future risk with an insurer for a fixed premium through a contract, known as the insurance policy, and if the policy holder is subject to a loss they can. A risk averse individual may be willing to assure. You focus first on the example from rob kaas’ et al. Model risk increases with greater model complexity, higher uncertainty about inputs and assumptions, broader use, and larger potential impact. You’ll now study the use of generalized linear models in r for insurance ratemaking.

Source: researchgate.net

And (7) other significant risks (reputational and other). The possible adverse consequences of decisions based on models that have fundamental errors or the misuse of those models. The use of mathematical models by financial institutions in many areas is rapidly gaining ground. These risks can arise in a company’s data, assumptions, methodologies, processes, or model results and how they are used. Traditionally insurance models have relied on historical loss and exposure data, and sometimes reflect just the last one or two decades when it comes to financial markets.

Source: brighttalk.com

Source: brighttalk.com

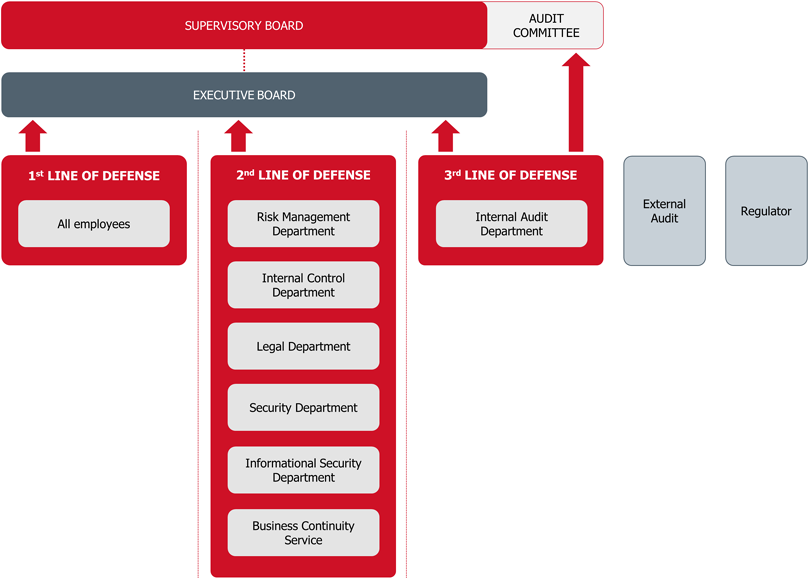

Meanwhile, according to a point process with times ft n: Similarly, model risk management (mrm) has evolved as a clearly defined discipline over the last decade, fueled by spikes of regulatory Banks should identify the sources of risk and assess the magnitude. The essential insurance model involves pooling risk from individual payers and redistributing it. Risk modelling for insurance instantly harness the power of satellite data without the need to code.

Source: voxeu.org

Source: voxeu.org

Model risk definition and regulations 1. Among these costs is model risk, understood as the loss (economic, reputational, etc.) arising from decisions based You’ll now study the use of generalized linear models in r for insurance ratemaking. Model risk is the risk inherent in using models to predict requirements, forecast demand and inform decision making; And (7) other significant risks (reputational and other).

Source: insuranceassetrisk.com

Source: insuranceassetrisk.com

The insurance industry is an industr y concerned with hedging against the risk of uncertain financial loss, and the business of insurance companies is therefore largely a risk management endeavor. P&c insurer wanted to improve risk selection and underwriting processes. You focus first on the example from rob kaas’ et al. The insurance market allows agents to cover themselves against risk. Model risk increases with greater model complexity, higher uncertainty about inputs and assumptions, broader use, and larger potential impact.

Source: slideteam.net

Source: slideteam.net

Model risk definition and regulations 1. P&c insurer wanted to improve risk selection and underwriting processes. The following histogram shows largest(=maximum) scores and risk distribution in past historical data. A large part of general microeconomic (in insurance) theory has been concerned with devising robust and analytically sound techniques for assessing the risk in insurance premium calculation. The use of mathematical models by financial institutions in many areas is rapidly gaining ground.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance model risk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.