Insurance modeling software information

Home » Trend » Insurance modeling software informationYour Insurance modeling software images are available in this site. Insurance modeling software are a topic that is being searched for and liked by netizens now. You can Get the Insurance modeling software files here. Get all royalty-free photos.

If you’re searching for insurance modeling software pictures information linked to the insurance modeling software keyword, you have pay a visit to the right blog. Our site frequently provides you with hints for viewing the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

Insurance Modeling Software. It is also a community that seeks to unlock and change the world around catastrophe modelling to better understand risk in insurance and beyond. Simple modeling technique to forecast sales for a limited market size 1 banking and finance , business , energy , engineering and construction , health and epidemiology , insurance and reinsurance , pharmaceutical , retail , statistical techniques , technology , utilities Sis.net is the result of over four decades of experience in the insurance and technology fields. Fis, prophet prophet has long been a market leader in actuarial modelling solutions, particularly in the life and health markets, boasting more than 10,000 users across nearly 1,000 sites in over 70 countries.

How Insurance Technology Trends Impact Customer Expectations From softwareadvice.com

How Insurance Technology Trends Impact Customer Expectations From softwareadvice.com

Fis, prophet prophet has long been a market leader in actuarial modelling solutions, particularly in the life and health markets, boasting more than 10,000 users across nearly 1,000 sites in over 70 countries. Agencybloc is an agency management software for life and health insurance agencies looking for a more effective way to increase company�s profitability, enhancing customer satisfaction and controlling costs in today�s competitive. First we have a look at the data at hand, the number of claims is our dependent variable, we visualize it through a histogram to see what distribution it follows and to get an overview of the problem: Modeling the insurance enterprise boundaryless information flow™ achieved through global interoperability in a secure, reliable, and timely manner executive summary insurance companies can use togaf® and the archimate® language to manage their enterprise architectures while using the acord® framework and standards to standardize their. Users can develop insurance claims prediction models with the help of intuitive model visualization tools. Predictive risk modeling refers to the use of predictive modeling techniques to determine the risk level of financial portfolios.

It is also a community that seeks to unlock and change the world around catastrophe modelling to better understand risk in insurance and beyond.

Application and deployment of insurance risk models is also very simple. But there’s also no let up in the pressure to prepare for ifrs 17, ldti and new solvency regimes. Fis, prophet prophet has long been a market leader in actuarial modelling solutions, particularly in the life and health markets, boasting more than 10,000 users across nearly 1,000 sites in over 70 countries. Users can develop insurance claims prediction models with the help of intuitive model visualization tools. For the personal auto, homeowners, businessowners, and commercial auto lines of business, we offer a suite of predictive models that examine the interactive effects of hundreds of rating variables to predict expected losses at. A predictive model is a system created and used to perform prediction.

Source: diceus.com

Source: diceus.com

(99 reviews) compare learn more. But there’s also no let up in the pressure to prepare for ifrs 17, ldti and new solvency regimes. Explore insurance risk modeling and management solutions azure for risk modeling milliman willis towers watson risk agility moody’s axis actuarial system azure for risk modeling Predictive models can predict or forecast variety of things and events. Simple modeling technique to forecast sales for a limited market size 1 banking and finance , business , energy , engineering and construction , health and epidemiology , insurance and reinsurance , pharmaceutical , retail , statistical techniques , technology , utilities

Source: databaseanswers.org

Source: databaseanswers.org

Users can develop insurance claims prediction models with the help of intuitive model visualization tools. First we have a look at the data at hand, the number of claims is our dependent variable, we visualize it through a histogram to see what distribution it follows and to get an overview of the problem: Predictive modeling for life insurance ways life insurers can participate in the business analytics revolution abstract the use of advanced data mining techniques to improve decision making has already taken root in property and casualty insurance as well as in many other industries [1, 2]. The axis actuarial system is a single comprehensive actuarial software solution for modeling of insurance and annuity products with unparalleled flexibility. Cmsr supports the following predictive modeling tools;

Source: softwareadvice.com

Source: softwareadvice.com

The axis actuarial system is a single comprehensive actuarial software solution for modeling of insurance and annuity products with unparalleled flexibility. 4.79 ( 105 reviews) compare. Modeling the insurance enterprise boundaryless information flow™ achieved through global interoperability in a secure, reliable, and timely manner executive summary insurance companies can use togaf® and the archimate® language to manage their enterprise architectures while using the acord® framework and standards to standardize their. Predictive models can predict or forecast variety of things and events. First we have a look at the data at hand, the number of claims is our dependent variable, we visualize it through a histogram to see what distribution it follows and to get an overview of the problem:

Source: nowcerts.com

Source: nowcerts.com

Application and deployment of insurance risk models is also very simple. Predictive models can predict or forecast variety of things and events. Simple modeling technique to forecast sales for a limited market size 1 banking and finance , business , energy , engineering and construction , health and epidemiology , insurance and reinsurance , pharmaceutical , retail , statistical techniques , technology , utilities First we have a look at the data at hand, the number of claims is our dependent variable, we visualize it through a histogram to see what distribution it follows and to get an overview of the problem: Insurance risk management has a packed agenda.

Source: elalmadeunlobo.blogspot.com

Source: elalmadeunlobo.blogspot.com

Users can develop insurance claims prediction models with the help of intuitive model visualization tools. It is widely used by life insurers, reinsurers, and consulting firms around the globe for pricing, reserving, asset and liability management (alm), financial modeling, capital calculations. Fis, prophet prophet has long been a market leader in actuarial modelling solutions, particularly in the life and health markets, boasting more than 10,000 users across nearly 1,000 sites in over 70 countries. First we have a look at the data at hand, the number of claims is our dependent variable, we visualize it through a histogram to see what distribution it follows and to get an overview of the problem: The axis actuarial system is a single comprehensive actuarial software solution for modeling of insurance and annuity products with unparalleled flexibility.

.png “Manthra Software Services”) Source: manthrasoft.com

Different modeling tasks require different risk modeling techniques. Predictive risk modeling refers to the use of predictive modeling techniques to determine the risk level of financial portfolios. But there’s also no let up in the pressure to prepare for ifrs 17, ldti and new solvency regimes. Modeling the insurance enterprise boundaryless information flow™ achieved through global interoperability in a secure, reliable, and timely manner executive summary insurance companies can use togaf® and the archimate® language to manage their enterprise architectures while using the acord® framework and standards to standardize their. Insurance risk management has a packed agenda.

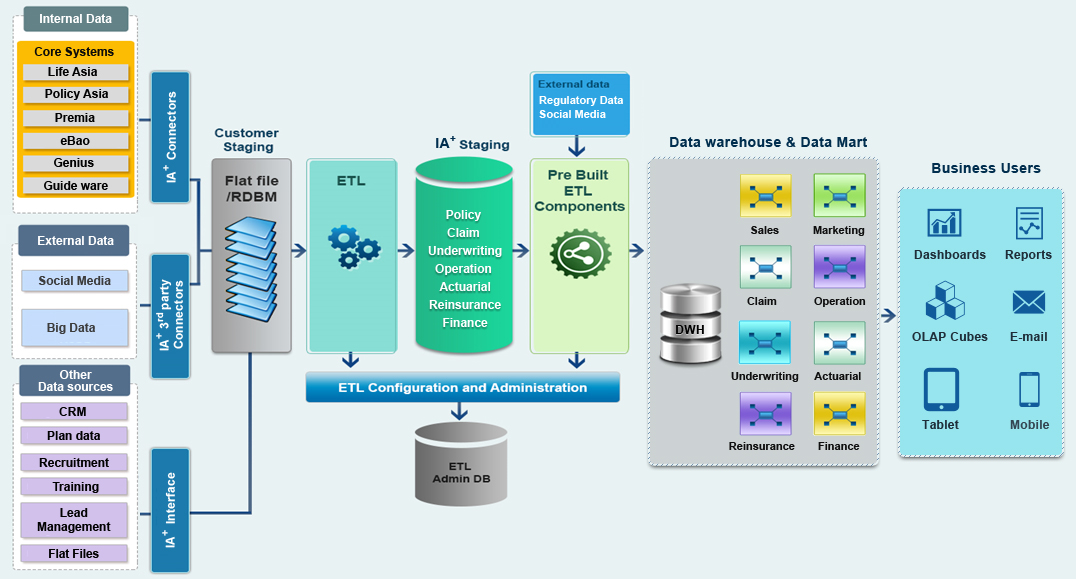

Source: insuranceanalytics.graymatter.co.in

Source: insuranceanalytics.graymatter.co.in

Arius® is a complete solution for analyzing casualty reserves and estimating ultimate loss costs. But there’s also no let up in the pressure to prepare for ifrs 17, ldti and new solvency regimes. Simple modeling technique to forecast sales for a limited market size 1 banking and finance , business , energy , engineering and construction , health and epidemiology , insurance and reinsurance , pharmaceutical , retail , statistical techniques , technology , utilities It is also a community that seeks to unlock and change the world around catastrophe modelling to better understand risk in insurance and beyond. Arius® is a complete solution for analyzing casualty reserves and estimating ultimate loss costs.

Source: abiteofculture.com

Source: abiteofculture.com

For the personal auto, homeowners, businessowners, and commercial auto lines of business, we offer a suite of predictive models that examine the interactive effects of hundreds of rating variables to predict expected losses at. Insurance is a contract between the insurer and the insured person or a group.insured person means the person who is covered by the insurance policy or the one who avails the benefit of the policy and the insurer is the insurance company. Sis.net is the result of over four decades of experience in the insurance and technology fields. Predictive models can predict or forecast variety of things and events. The axis actuarial system is a single comprehensive actuarial software solution for modeling of insurance and annuity products with unparalleled flexibility.

Source: nuvento.com

Source: nuvento.com

Verisk has long been a leader in the use of predictive analytics and modeling to help insurers improve their bottom line. But there’s also no let up in the pressure to prepare for ifrs 17, ldti and new solvency regimes. Simple modeling technique to forecast sales for a limited market size 1 banking and finance , business , energy , engineering and construction , health and epidemiology , insurance and reinsurance , pharmaceutical , retail , statistical techniques , technology , utilities Explore insurance risk modeling and management solutions azure for risk modeling milliman willis towers watson risk agility moody’s axis actuarial system azure for risk modeling Insurance companies are at varying degrees of adopting predictive modeling into their standard practices, making it a good time to pull together experiences of some who are further on that journey.

Source: iireporter.com

Source: iireporter.com

Explore insurance risk modeling and management solutions azure for risk modeling milliman willis towers watson risk agility moody’s axis actuarial system azure for risk modeling It is also important to provide lessons learned in other industries and applications and to identify areas where actuaries can improve their methods. Verisk has long been a leader in the use of predictive analytics and modeling to help insurers improve their bottom line. 4.79 ( 105 reviews) compare. Insurance companies are at varying degrees of adopting predictive modeling into their standard practices, making it a good time to pull together experiences of some who are further on that journey.

Source: maktechsystems.com

Source: maktechsystems.com

Arius provides sophisticated analyses without formulas or programming hassles. Sis.net is the result of over four decades of experience in the insurance and technology fields. A predictive model is a system created and used to perform prediction. Insurance risk management has a packed agenda. Insurance companies are at varying degrees of adopting predictive modeling into their standard practices, making it a good time to pull together experiences of some who are further on that journey.

Source: q-perior.com

Source: q-perior.com

Application and deployment of insurance risk models is also very simple. Arius® is a complete solution for analyzing casualty reserves and estimating ultimate loss costs. Arius is a complete framework for your entire insurance reserve analysis. Simple modeling technique to forecast sales for a limited market size 1 banking and finance , business , energy , engineering and construction , health and epidemiology , insurance and reinsurance , pharmaceutical , retail , statistical techniques , technology , utilities Arius adds reliability and efficiency to your analysis process, so your team can focus on the.

Source: duckcreek.com

Source: duckcreek.com

Arius is a complete framework for your entire insurance reserve analysis. Cmsr supports the following predictive modeling tools; But there’s also no let up in the pressure to prepare for ifrs 17, ldti and new solvency regimes. Different modeling tasks require different risk modeling techniques. Insurance is a contract between the insurer and the insured person or a group.insured person means the person who is covered by the insurance policy or the one who avails the benefit of the policy and the insurer is the insurance company.

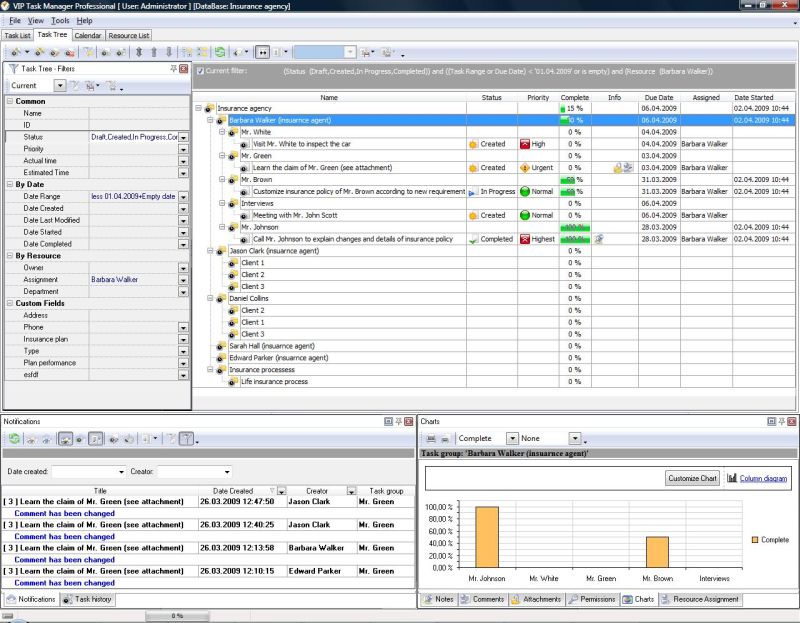

Source: taskmanagementguide.com

Source: taskmanagementguide.com

For the personal auto, homeowners, businessowners, and commercial auto lines of business, we offer a suite of predictive models that examine the interactive effects of hundreds of rating variables to predict expected losses at. It is also a community that seeks to unlock and change the world around catastrophe modelling to better understand risk in insurance and beyond. Fis, prophet prophet has long been a market leader in actuarial modelling solutions, particularly in the life and health markets, boasting more than 10,000 users across nearly 1,000 sites in over 70 countries. 4.79 ( 105 reviews) compare. Arius® is a complete solution for analyzing casualty reserves and estimating ultimate loss costs.

Source: legiasquad.com

Source: legiasquad.com

Simple modeling technique to forecast sales for a limited market size 1 banking and finance , business , energy , engineering and construction , health and epidemiology , insurance and reinsurance , pharmaceutical , retail , statistical techniques , technology , utilities Insurance domain knowledge and basics. Different modeling tasks require different risk modeling techniques. Arius® is a complete solution for analyzing casualty reserves and estimating ultimate loss costs. Modeling the insurance enterprise boundaryless information flow™ achieved through global interoperability in a secure, reliable, and timely manner executive summary insurance companies can use togaf® and the archimate® language to manage their enterprise architectures while using the acord® framework and standards to standardize their.

Source: opservices.com

Source: opservices.com

Application and deployment of insurance risk models is also very simple. Users can develop insurance claims prediction models with the help of intuitive model visualization tools. Cmsr supports the following predictive modeling tools; It offers over 40 deterministic reserving methods, more than 10 stochastic reserving models, and more than 200 exhibits and reports, already defined and ready to use. It is also a community that seeks to unlock and change the world around catastrophe modelling to better understand risk in insurance and beyond.

Source: softwareconnect.com

Predictive risk modeling refers to the use of predictive modeling techniques to determine the risk level of financial portfolios. It offers over 40 deterministic reserving methods, more than 10 stochastic reserving models, and more than 200 exhibits and reports, already defined and ready to use. Predictive models can predict or forecast variety of things and events. Modeling the insurance enterprise boundaryless information flow™ achieved through global interoperability in a secure, reliable, and timely manner executive summary insurance companies can use togaf® and the archimate® language to manage their enterprise architectures while using the acord® framework and standards to standardize their. It is widely used by life insurers, reinsurers, and consulting firms around the globe for pricing, reserving, asset and liability management (alm), financial modeling, capital calculations.

Source: q-perior.com

Source: q-perior.com

Different modeling tasks require different risk modeling techniques. It is a full web platform that allows you to support all the insurance company operations, allowing you to replace your legacy systems and transform your business. Users can develop insurance claims prediction models with the help of intuitive model visualization tools. Verisk has long been a leader in the use of predictive analytics and modeling to help insurers improve their bottom line. Arius® is a complete solution for analyzing casualty reserves and estimating ultimate loss costs.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insurance modeling software by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.