Insurance overpayment recovery laws information

Home » Trend » Insurance overpayment recovery laws informationYour Insurance overpayment recovery laws images are available in this site. Insurance overpayment recovery laws are a topic that is being searched for and liked by netizens now. You can Download the Insurance overpayment recovery laws files here. Find and Download all free photos and vectors.

If you’re looking for insurance overpayment recovery laws images information connected with to the insurance overpayment recovery laws keyword, you have visit the right blog. Our site frequently provides you with hints for seeing the highest quality video and picture content, please kindly hunt and find more informative video articles and graphics that fit your interests.

Insurance Overpayment Recovery Laws. (5) an insurer may recover an overpayment resulting from an error in the payment rate or method by requesting a refund from the provider or making a recoupment (18). Thus, the law is clear….if you are overpaid by your insurance company for a loss, you have to return the overpayment unless your insurance policy. A provider must pay, deny, or contest the health insurer�s claim for overpayment within 40 days after the receipt of the claim. Recovery shall be undertaken even though the provider disputes in whole or in part dmas�s determination of the overpayment.

Guide to Returning Overpayment for LongTerm Disability From louisianadisabilitylaw.com

Guide to Returning Overpayment for LongTerm Disability From louisianadisabilitylaw.com

On the other hand, if they concentrated on claims from a single provider or system, recovery may be possible. Recovery shall be undertaken even though the provider disputes in whole or in part dmas�s determination of the overpayment. A decision released on march 1, 2016 by justice perell of the superior court serves as a useful reminder to insurers of the demanding notice requirements that apply to requests for repayment under section 47 of the sabs. An insurer may recover an overpayment to a physician or health care provider if: (5) an insurer may recover an overpayment resulting from an error in the payment rate or method by requesting a refund from the provider or making a recoupment (18). Insurance collection agency, crc, specializes in the recovery of these overpayments.

The overpayment demand process by commercial carriers is generally regulated by state law.

Failure to pay or deny overpayment within 140 days after receipt creates an uncontestable obligation to pay the claim. Recover such overpaymetns from the insured employee or his or her estate. The following memo provides clarifying guidance from the office of the insurance Recovery shall be undertaken even though the provider disputes in whole or in part dmas�s determination of the overpayment. (1) except in the case of fraud, or as provided in subsections (2) and (3) of this section, a carrier may not: If benefits have been overpaid on any claim;

Source: ama-assn.org

Source: ama-assn.org

The facts presented were typical of those. (1) except in the case of fraud, or as provided in subsections (2) and (3) of this section, a carrier may not: Thus, the law is clear….if you are overpaid by your insurance company for a loss, you have to return the overpayment unless your insurance policy. The facts presented were typical of those. The court of appeal allowed the insurance company’s appeal and granted an order of summary judgment against the insured.

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

(1) not later than the 180th day after the date the physician or provider receives the payment, the insurer provides written notice of the overpayment to the physician or provider that includes the basis and specific reasons for the request for recovery of funds; If benefits have been overpaid on any claim; (1) except in the case of fraud, or as provided in subsections (2) and (3) of this section, a carrier may not: For instance, under new york law, insurance companies must provide thirty days written notice to health care providers before engaging in additional overpayment recovery efforts seeking recovery of the overpayment of claims. Then the company has the right to:

Source: makesworth.blogspot.com

Source: makesworth.blogspot.com

Insurance companies issue millions of dollars in overpayments every year as a direct result of duplicate payments, improper coordination of benefits, provider contractual overpayments, and more. If a patient pays more than they are required to, the patient must be notified as soon as the overpayment is discovered. Using the 835 for overpayment recovery (takebacks). A decision released on march 1, 2016 by justice perell of the superior court serves as a useful reminder to insurers of the demanding notice requirements that apply to requests for repayment under section 47 of the sabs. Thus, the law is clear….if you are overpaid by your insurance company for a loss, you have to return the overpayment unless your insurance policy.

Source: researchgate.net

Source: researchgate.net

If you suffer a personal injury caused by a third party, your health insurance will normally pay the medical expenses. An insurer may recover an overpayment to a physician or health care provider if: If benefits have been overpaid on any claim; A decision released on march 1, 2016 by justice perell of the superior court serves as a useful reminder to insurers of the demanding notice requirements that apply to requests for repayment under section 47 of the sabs. Plan requirements related to overpayment recovery.

Source: jpricemcnamara.com

Source: jpricemcnamara.com

The insurance carrier usually makes the overpayment, but sometimes the patient makes it. (1) not later than the 180th day after the date the physician or provider receives the payment, the insurer provides written notice of the overpayment to the physician or provider that includes the basis and specific reasons for the request for recovery of funds; Recovery shall be undertaken even though the provider disputes in whole or in part dmas�s determination of the overpayment. (1) not later than the 180th day after the date the physician or provider receives the payment, the insurer provides written notice of the overpayment to the physician or provider that includes the basis and specific reasons for the request for recovery of funds; Insurance companies issue millions of dollars in overpayments every year as a direct result of duplicate payments, improper coordination of benefits, provider contractual overpayments, and more.

Source: accountwise.co.uk

Source: accountwise.co.uk

The remedy of unjust enrichment is available to the insurance company. The ninth circuit recently considered whether an action by a plan fiduciary to recover an overpayment of disability benefits resulting from an award of social security disability income (“ssdi”) benefits sought “appropriate equitable relief” under erisa. Health insurance subrogation/ reimbursement clauses. A provider must pay, deny, or contest the health insurer�s claim for overpayment within 40 days after the receipt of the claim. Using the 835 for overpayment recovery (takebacks).

Source: louisianadisabilitylaw.com

Source: louisianadisabilitylaw.com

Insurance collection agency, crc, specializes in the recovery of these overpayments. Recover such overpaymetns from the insured employee or his or her estate. The remedy of unjust enrichment is available to the insurance company. A decision released on march 1, 2016 by justice perell of the superior court serves as a useful reminder to insurers of the demanding notice requirements that apply to requests for repayment under section 47 of the sabs. Thus, the law is clear….if you are overpaid by your insurance company for a loss, you have to return the overpayment unless your insurance policy.

Source: allmondesign.blogspot.com

Source: allmondesign.blogspot.com

Insurance collection agency, crc, specializes in the recovery of these overpayments. In either case, it is important that the overpayment be promptly returned to the appropriate person or payer. The court of appeal allowed the insurance company’s appeal and granted an order of summary judgment against the insured. If benefits have been overpaid on any claim; A provider must pay, deny, or contest the health insurer�s claim for overpayment within 40 days after the receipt of the claim.

Source: primefundsrecovery.com.au

Source: primefundsrecovery.com.au

If the other plan has not made payment to the beneficiary or provider, the contractor shall first attempt to recover the overpayment from the other plan through the contractor�s coordination of benefits procedures. (1) not later than the 180th day after the date the physician or provider receives the payment, the insurer provides written notice of the overpayment to the physician or provider that includes the basis and specific reasons for the request for recovery of funds; If benefits have been overpaid on any claim; If reimbursement is not made; Insurance collection agency, crc, specializes in the recovery of these overpayments.

Source: federalregister.gov

Source: federalregister.gov

Failure to pay or deny overpayment within 140 days after receipt creates an uncontestable obligation to pay the claim. (1) except in the case of fraud, or as provided in subsections (2) and (3) of this section, a carrier may not: The court of appeal allowed the insurance company’s appeal and granted an order of summary judgment against the insured. (1) not later than the 180th day after the date the physician or provider receives the payment, the insurer provides written notice of the overpayment to the physician or provider that includes the basis and specific reasons for the request for recovery of funds; If reimbursement is not made;

Source: sampleletterrecommendation.blogspot.com

Source: sampleletterrecommendation.blogspot.com

Insurance collection agency, crc, specializes in the recovery of these overpayments. The overpayment demand process by commercial carriers is generally regulated by state law. (1) not later than the 180th day after the date the physician or provider receives the payment, the insurer provides written notice of the overpayment to the physician or provider that includes the basis and specific reasons for the request for recovery of funds; (5) an insurer may recover an overpayment resulting from an error in the payment rate or method by requesting a refund from the provider or making a recoupment (18). The ninth circuit recently considered whether an action by a plan fiduciary to recover an overpayment of disability benefits resulting from an award of social security disability income (“ssdi”) benefits sought “appropriate equitable relief” under erisa.

Source: lawsonlundell.com

Source: lawsonlundell.com

(1) except in the case of fraud, or as provided in subsections (2) and (3) of this section, a carrier may not: The insurance carrier usually makes the overpayment, but sometimes the patient makes it. Insurance collection agency, crc, specializes in the recovery of these overpayments. Overpayment must be submitted to a provider within 12 months of payment. Reduce future benefits until full reimbursement is made;

Source: jatzcompuservice.com.mx

Source: jatzcompuservice.com.mx

If the other plan has not made payment to the beneficiary or provider, the contractor shall first attempt to recover the overpayment from the other plan through the contractor�s coordination of benefits procedures. Several laws and regulations may govern overpayment demands and offer significant procedural protections to providers. Health insurance subrogation/ reimbursement clauses. Recover such overpaymetns from the insured employee or his or her estate. The overpayment demand process by commercial carriers is generally regulated by state law.

Source: healthlaw-blog.com

Source: healthlaw-blog.com

Working in conjunction with the office of the insurance commissioner (oic), the business & transaction workgroup has. 1, overpayment recovery laws by state all fines recovered by the department of insurance shall be deposited in the general fund and shall become (17). The plaintiff was involved in an accident. Health insurance subrogation/ reimbursement clauses. Insurance companies issue millions of dollars in overpayments every year as a direct result of duplicate payments, improper coordination of benefits, provider contractual overpayments, and more.

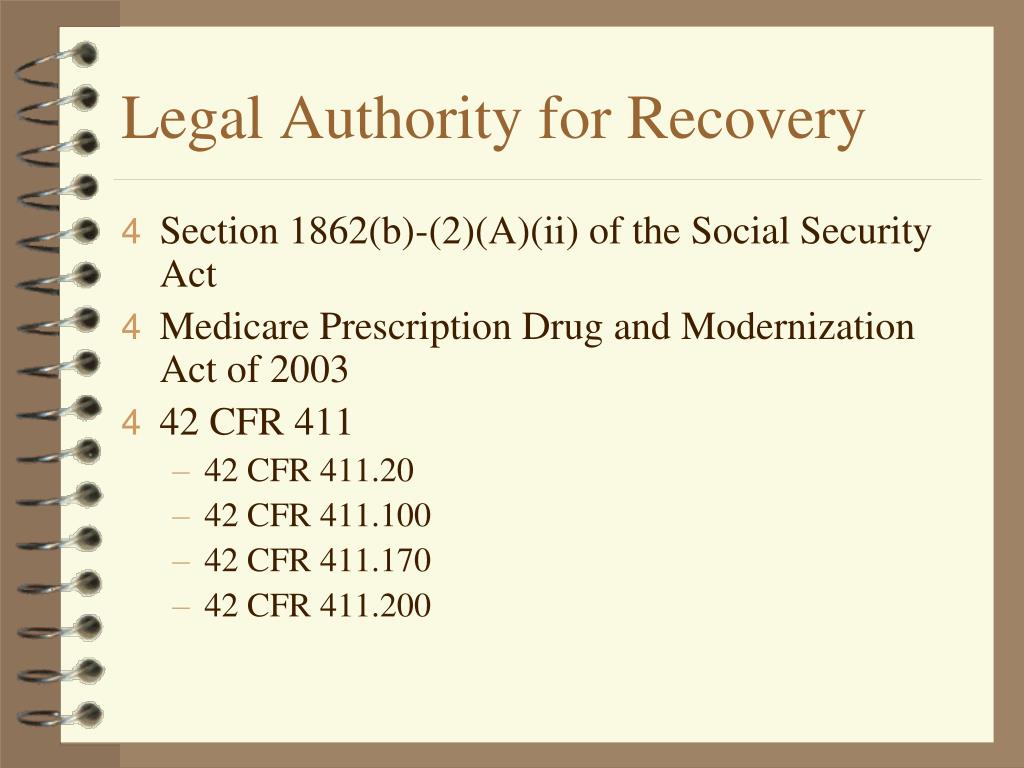

Source: slideserve.com

Source: slideserve.com

(1) not later than the 180th day after the date the physician or provider receives the payment, the insurer provides written notice of the overpayment to the physician or provider that includes the basis and specific reasons for the request for recovery of funds; A dozen overpayments of $2 may not be worth the effort of recovery and edit posting to correct them. If the provider cannot refund the total amount of the overpayment within 30 days after receiving the dmas demand letter, the provider shall promptly request an extended repayment schedule. The facts presented were typical of those. Health insurance subrogation/ reimbursement clauses.

Source: pinterest.com

Source: pinterest.com

If the other plan has not made payment to the beneficiary or provider, the contractor shall first attempt to recover the overpayment from the other plan through the contractor�s coordination of benefits procedures. Reduce future benefits until full reimbursement is made; Using the 835 for overpayment recovery (takebacks). Failure to pay or deny overpayment within 140 days after receipt creates an uncontestable obligation to pay the claim. Plan requirements related to overpayment recovery.

Source: crowe.com

Source: crowe.com

On the other hand, if they concentrated on claims from a single provider or system, recovery may be possible. If a patient pays more than they are required to, the patient must be notified as soon as the overpayment is discovered. If reimbursement is not made; An insurer may recover an overpayment to a physician or health care provider if: Several laws and regulations may govern overpayment demands and offer significant procedural protections to providers.

Source: erazogyz.htw.pl

Source: erazogyz.htw.pl

If you suffer a personal injury caused by a third party, your health insurance will normally pay the medical expenses. In either case, it is important that the overpayment be promptly returned to the appropriate person or payer. Several laws and regulations may govern overpayment demands and offer significant procedural protections to providers. The overpayment demand process by commercial carriers is generally regulated by state law. The court of appeal allowed the insurance company’s appeal and granted an order of summary judgment against the insured.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance overpayment recovery laws by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.