Insurance policy life cycle information

Home » Trending » Insurance policy life cycle informationYour Insurance policy life cycle images are ready. Insurance policy life cycle are a topic that is being searched for and liked by netizens now. You can Download the Insurance policy life cycle files here. Find and Download all free photos.

If you’re searching for insurance policy life cycle images information connected with to the insurance policy life cycle interest, you have come to the ideal site. Our site always provides you with hints for viewing the highest quality video and image content, please kindly search and find more enlightening video articles and images that match your interests.

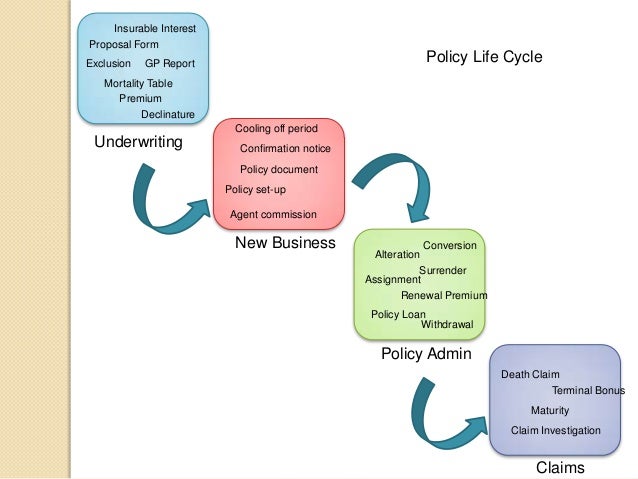

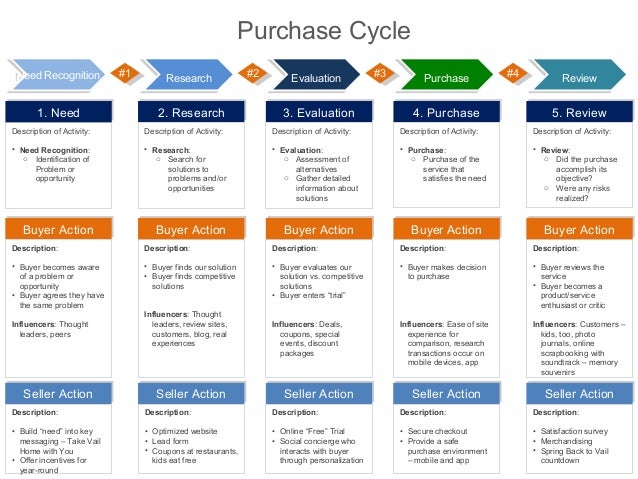

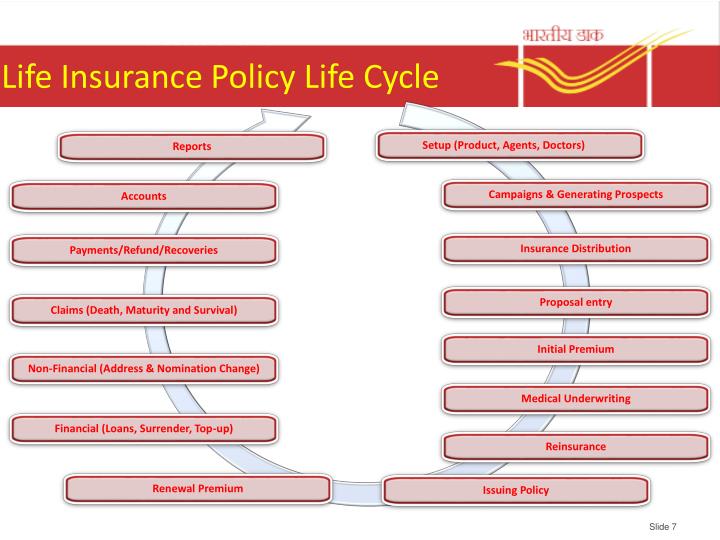

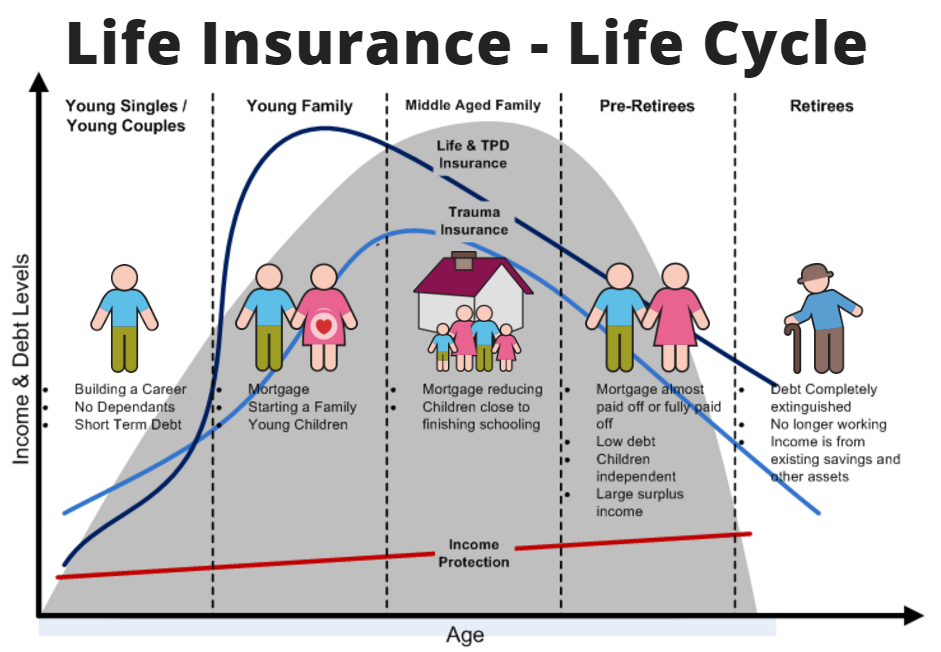

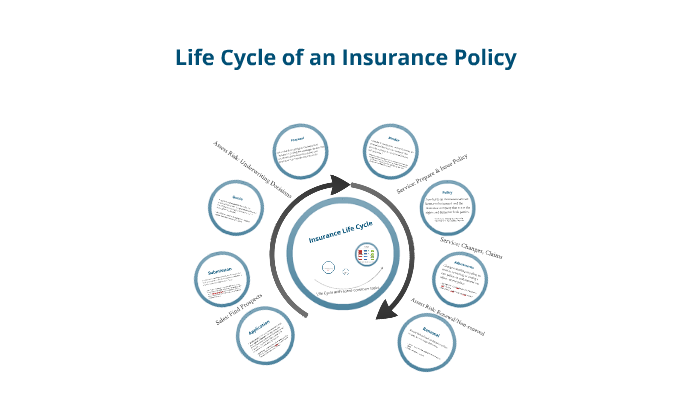

Insurance Policy Life Cycle. Claimants, features and transactions can be made toward it including, assigning adjusters or making payments. In a nutshell, it starts with a potential application and grows into a life insurance policy that is complete and goes around a repetitive schedule on premium, gets processed and may be even modified as time goes by, and eventually becomes a claim that is payable against a certain. Different policies will have different life cycles. The example here will also illustrate the impact of nonpolicy status changes on a policy.

Term Policy Life Cycle From docs.oracle.com

Term Policy Life Cycle From docs.oracle.com

Life insurance new policy issue cycle time measures the average amount of time required for a policyholder�s coverage to become active following the submission of an insurance application. Particularly for life insurance policies, there are several steps that must be completed prior to policy issuance, including application data input and. Then, you trade your car in for a new one. Based on analysis of a wide spectrum of insurance agencies across the globe and their consistent ability to deliver on client servicing, we identify four stages of policy life cycle maturity, like 1) rudimentary 2) emerging 3) defined and 4) optimized. Do you need one if you. After the policy was issued, john changed address and notified the insurer.

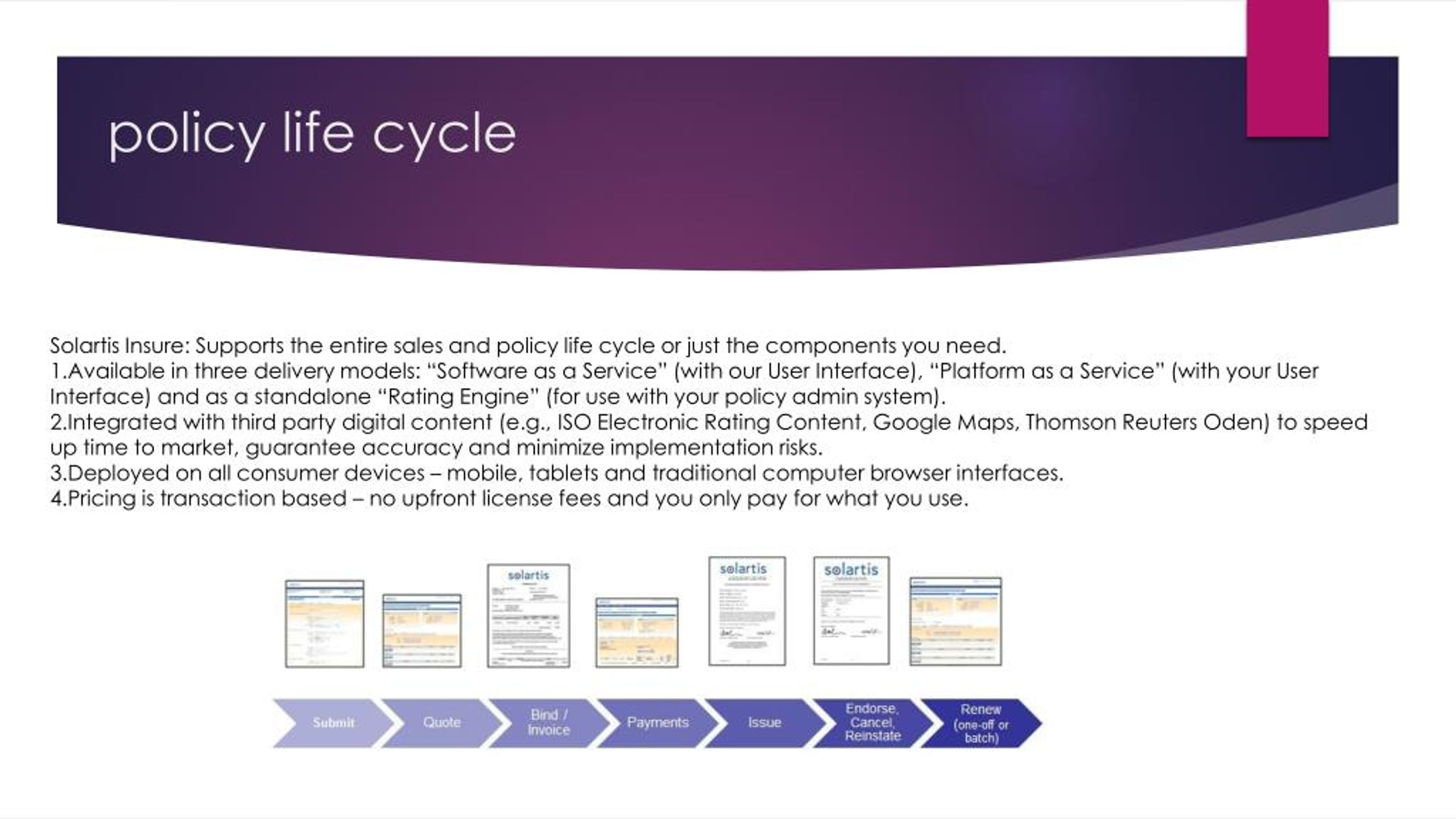

The business requirement is to record the insurance agreement throughout its lifecycle from initial quotation through to policy issuance.

The image below provides a visual representation of the path a term policy travels, beginning with the entry of client information and ending with the policy termination. A general liability insurance policy usually has limits of $1,000,000 per occurrence and $2,000,000 per aggregate. The image below provides a visual representation of the path a term policy travels, beginning with the entry of client information and ending with the policy termination. Phases of insurance policy life cycle. For example, say you have insurance on your car. Then, you trade your car in for a new one.

Source: whatisinsurancepolicy10.blogspot.com

Source: whatisinsurancepolicy10.blogspot.com

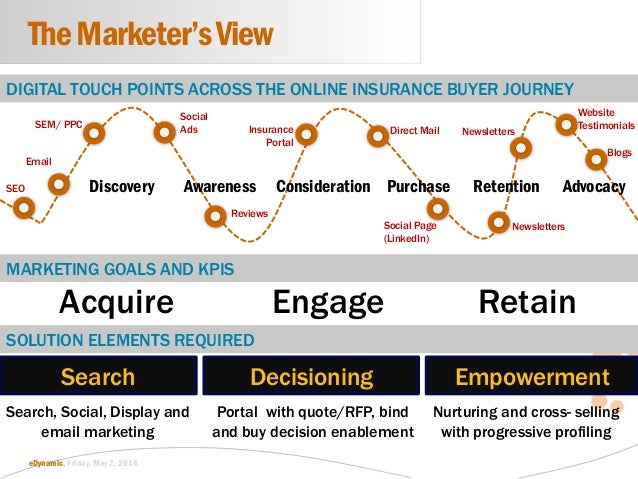

These web services span the entire sales and policy lifecycle process from initial rating and quoting to policy issuance and ongoing servicing. These web services span the entire sales and policy lifecycle process from initial rating and quoting to policy issuance and ongoing servicing. The fourth stage of the life cycle is the maturity stage where the industry is now more stable and established companies remain strong. ?insurance product life cycle management shedding light on product life cycle management for the insurance industry it used to be that managing the life cycle of an insurance product meant getting the policy issued, storing it in a dark closet and processing periodic premium checks until the term expired. With lawsuits growing in popularity and numbers, these limits just may not be enough.

Source: hamiltonleigh.com

Source: hamiltonleigh.com

Based on analysis of a wide spectrum of insurance agencies across the globe and their consistent ability to deliver on client servicing, we identify four stages of policy life cycle maturity, like 1) rudimentary 2) emerging 3) defined and 4) optimized. Throughout the policy administration process, the customer is asked to complete applications, submit payment, and wait for review by an underwriter to bind the policy to the carrier. Particularly for life insurance policies, there are several steps that must be completed prior to policy issuance, including application data input and. Not sure you can afford your life insurance anymore, but still want to protect your family? With lawsuits growing in popularity and numbers, these limits just may not be enough.

Source: theasianread.com

Source: theasianread.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. The fourth stage of the life cycle is the maturity stage where the industry is now more stable and established companies remain strong. Phases of insurance policy life cycle. A commercial umbrella policy is recommended for all businesses. For example, say you have insurance on your car.

Source: insurancepoliciesmushikin.blogspot.com

Source: insurancepoliciesmushikin.blogspot.com

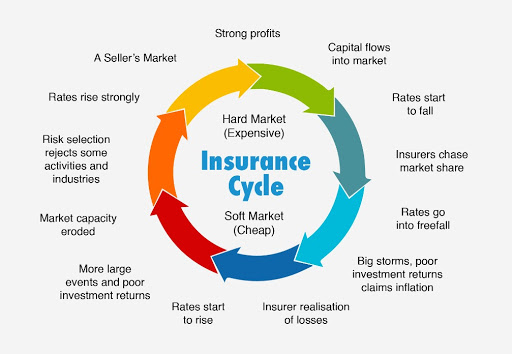

The fourth stage of the life cycle is the maturity stage where the industry is now more stable and established companies remain strong. Then, you trade your car in for a new one. Policy maintenance wraps the policy change and endorsement steps and extends to renewal, cancellation,. The insurance cycle affects all areas of insurance except life insurance, where there is enough data and a large base of similar risks (i.e., people) to accurately predict claims, and therefore minimise the risk that the cycle poses to business. P&c insurance software catalogues this information in a simple and retrievable way.

Source: insurancepolicynukiseki.blogspot.com

Source: insurancepolicynukiseki.blogspot.com

Term life insurance is a popular option for many, mainly because it’s affordable and uncomplicated. In this way, the firms can increase their market share and their dominance. The main aims of stage 2 of the process evaluation are as follows: Policy maintenance wraps the policy change and endorsement steps and extends to renewal, cancellation,. In this stage, firms are bound to change their business strategy to reflect personalized customer service.

Source: whatisinsurancepolicy10.blogspot.com

Source: whatisinsurancepolicy10.blogspot.com

The insurance cycle affects all areas of insurance except life insurance, where there is enough data and a large base of similar risks (i.e., people) to accurately predict claims, and therefore minimise the risk that the cycle poses to business. The business requirement is to record the insurance agreement throughout its lifecycle from initial quotation through to policy issuance. Figure 1 presents the four maturity stages of policy life cycle management in insurance agencies Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. The insurance cycle is a phenomenon that has been understood since at least the 1920s.

Source: insurancepolicynukiseki.blogspot.com

Source: insurancepolicynukiseki.blogspot.com

In this way, the firms can increase their market share and their dominance. Policy maintenance wraps the policy change and endorsement steps and extends to renewal, cancellation,. Here, new policy processing includes all functions from new policy data capture, through underwriting and rating to policy issue. Life insurance new policy issue cycle time measures the average amount of time required for a policyholder�s coverage to become active following the submission of an insurance application. Systems, processes and procedures are all used by the staff responsible for policy processing.

Source: insurancepoliciesmushikin.blogspot.com

Source: insurancepoliciesmushikin.blogspot.com

Figure 1 presents the four maturity stages of policy life cycle management in insurance agencies A proposal submission of a policy a change, or an endorsement, can be made to a policy at any time. Thus, according to lenox advisors, there are the following stages of life insurance cycle. The insurance policy life cycle. For example, say you have insurance on your car.

Source: slideserve.com

Source: slideserve.com

Insurance cycle is the term that refers to insurance policies up and down period.insurance cycles tend to go through periods of profitability that are followed by the period of losses (and vice versa). With lawsuits growing in popularity and numbers, these limits just may not be enough. Particularly for life insurance policies, there are several steps that must be completed prior to policy issuance, including application data input and. Insurance cycle is the term that refers to insurance policies up and down period.insurance cycles tend to go through periods of profitability that are followed by the period of losses (and vice versa). Term life insurance is a popular option for many, mainly because it’s affordable and uncomplicated.

Source: pinterest.com

Source: pinterest.com

A policy’s life cycle is also said to be applied to the processing end of a certain life insurance policy. Then, you trade your car in for a new one. In this stage, firms are bound to change their business strategy to reflect personalized customer service. Thus, according to lenox advisors, there are the following stages of life insurance cycle. ?insurance product life cycle management shedding light on product life cycle management for the insurance industry it used to be that managing the life cycle of an insurance product meant getting the policy issued, storing it in a dark closet and processing periodic premium checks until the term expired.

Source: raggeduniversity.co.uk

Source: raggeduniversity.co.uk

Phases of insurance policy life cycle. Thus, according to lenox advisors, there are the following stages of life insurance cycle. Insurance cycle is the term that refers to insurance policies up and down period.insurance cycles tend to go through periods of profitability that are followed by the period of losses (and vice versa). Life insurance new policy issue cycle time measures the average amount of time required for a policyholder�s coverage to become active following the submission of an insurance application. The main aims of stage 2 of the process evaluation are as follows:

Source: slideserve.com

Source: slideserve.com

A proposal submission of a policy a change, or an endorsement, can be made to a policy at any time. Throughout the policy administration process, the customer is asked to complete applications, submit payment, and wait for review by an underwriter to bind the policy to the carrier. After the policy was issued, john changed address and notified the insurer. Policy maintenance wraps the policy change and endorsement steps and extends to renewal, cancellation,. A general liability insurance policy usually has limits of $1,000,000 per occurrence and $2,000,000 per aggregate.

Source: docs.oracle.com

Source: docs.oracle.com

The options for canceling a life insurance policy depend on your age, how long you’ve had the coverage and the type of life insurance — term or permanent. Here, new policy processing includes all functions from new policy data capture, through underwriting and rating to policy issue. Do you need one if you. The insurance cycle is a phenomenon that has been understood since at least the 1920s. Claimants, features and transactions can be made toward it including, assigning adjusters or making payments.

Source: whatisinsurancepolicy10.blogspot.com

Source: whatisinsurancepolicy10.blogspot.com

Obstacles in the process of establishing sustainable national health insurance scheme:. Obstacles in the process of establishing sustainable national health insurance scheme:. Figure 1 presents the four maturity stages of policy life cycle management in insurance agencies The insurance cycle is a phenomenon that has been understood since at least the 1920s. With lawsuits growing in popularity and numbers, these limits just may not be enough.

Source: insurancepolicynukiseki.blogspot.com

Source: insurancepolicynukiseki.blogspot.com

The insurance cycle affects all areas of insurance except life insurance, where there is enough data and a large base of similar risks (i.e., people) to accurately predict claims, and therefore minimise the risk that the cycle poses to business. The options for canceling a life insurance policy depend on your age, how long you’ve had the coverage and the type of life insurance — term or permanent. Phases of insurance policy life cycle. During the course of a policy’s life cycle, a claim can be submitted any time. Policy maintenance wraps the policy change and endorsement steps and extends to renewal, cancellation,.

Source: whatisinsurancepolicy10.blogspot.com

Source: whatisinsurancepolicy10.blogspot.com

Policy maintenance wraps the policy change and endorsement steps and extends to renewal, cancellation,. Policy maintenance wraps the policy change and endorsement steps and extends to renewal, cancellation,. Particularly for life insurance policies, there are several steps that must be completed prior to policy issuance, including application data input and. The insurance policy life cycle. Not sure you can afford your life insurance anymore, but still want to protect your family?

Source: prezi.com

Source: prezi.com

Term policy life cycle example. Insurance cycle is the term that refers to insurance policies up and down period.insurance cycles tend to go through periods of profitability that are followed by the period of losses (and vice versa). Thus, according to lenox advisors, there are the following stages of life insurance cycle. Throughout the policy administration process, the customer is asked to complete applications, submit payment, and wait for review by an underwriter to bind the policy to the carrier. A general liability insurance policy usually has limits of $1,000,000 per occurrence and $2,000,000 per aggregate.

Source: eprnews.com

Source: eprnews.com

Life cycle of an insurance policy. The insurance cycle affects all areas of insurance except life insurance, where there is enough data and a large base of similar risks (i.e., people) to accurately predict claims, and therefore minimise the risk that the cycle poses to business. Term life insurance is a popular option for many, mainly because it’s affordable and uncomplicated. In a nutshell, it starts with a potential application and grows into a life insurance policy that is complete and goes around a repetitive schedule on premium, gets processed and may be even modified as time goes by, and eventually becomes a claim that is payable against a certain. Term policy life cycle example.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance policy life cycle by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.