Insurance policy rescission Idea

Home » Trend » Insurance policy rescission IdeaYour Insurance policy rescission images are available in this site. Insurance policy rescission are a topic that is being searched for and liked by netizens today. You can Download the Insurance policy rescission files here. Download all free photos and vectors.

If you’re searching for insurance policy rescission pictures information related to the insurance policy rescission interest, you have pay a visit to the ideal site. Our website frequently provides you with suggestions for seeking the highest quality video and image content, please kindly hunt and find more enlightening video content and images that fit your interests.

Insurance Policy Rescission. If an insurance policy is rescinded, as opposed to canceled or terminated, it will be as if the agreement made between the policyholder and the insurance company was never made. An action for rescission permits an Essentially, instead of canceling the policy midway, the policyholder will go back and start from the beginning, as if they never had. Rescission of a life insurance policy is used to describe the reversal, or undoing, of a life insurance contract.

Bad Faith Rescission of a Health Insurance Policy From gmlawyers.com

Bad Faith Rescission of a Health Insurance Policy From gmlawyers.com

Rescission is an official declaration by a party in an insurance contract that they no longer acknowledge the contract as legal. Rescission — with respect to a directors and officers (d&o) liability insurance policy, a declaration by an insurer that the policy was never in effect, the result being that coverage for a claim, when tendered by a corporate organization to an insurer, is not covered. If they have failed to do so, then they may lose the right to rescind a contract that was less than complete. Rather than rejecting you as a policyholder at the time of application, the insurance company waits until you make a claim. When an insurance company rescinds a policy, they must inform the policyholder via a rescission notice, in which they must return or offer to return the policy premiums paid. Dallas insurance lawyers and those in mesquite, garland, richardson, and other places in dallas need to know the different ways insurance companies operate.

In addition, as a matter of fairness, policyholders who make intentional or reckless

It is as if the insurance contract never existed. Essentially, instead of canceling the policy midway, the policyholder will go back and start from the beginning, as if they never had. Rescission is an insurance industry practice in which an insurer takes action retroactively to cancel a policy holder�s coverage by citing omissions or errors in the customer�s application, even if the policy holder has been diligently keeping their policy current. Life insurance policy rescission is a strategy used by the life insurance company to avoid paying any policy benefits by claiming that you have no insurance coverage. If they have failed to do so, then they may lose the right to rescind a contract that was less than complete. A) the misrepresentation, omission, concealment, or statement is fraudulent or is material either to the acceptance of the risk or to the hazard assumed by the insurer.

Source: grinsurancecoveragelawblog.com

Source: grinsurancecoveragelawblog.com

If there is a breach of warranty, a material concealment, or a material misrepresentation, rescission is a remedy available for selection by the insurer or the insured. A) the misrepresentation, omission, concealment, or statement is fraudulent or is material either to the acceptance of the risk or to the hazard assumed by the insurer. The rescission of an insurance policy is one of the most underutilized tools in handling insurance claims. If used properly, it unwinds the insurance transaction and the parties are restored to their position prior to the contract; If you are a victim of an insurer’s attempt to rescind your life, health or disability insurance policy, do not cash the.

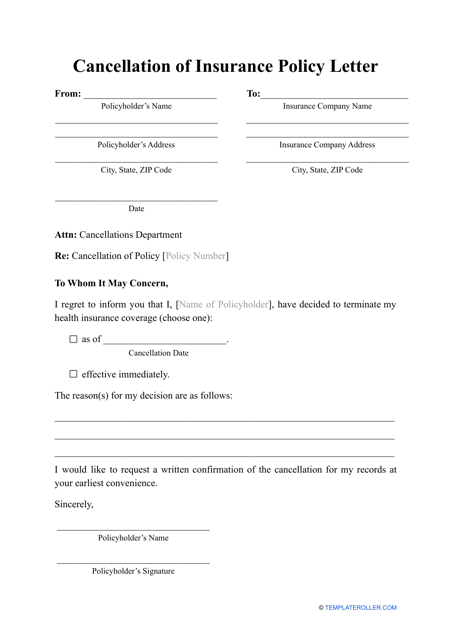

Source: topformtemplates.com

Source: topformtemplates.com

Essentially, instead of canceling the policy midway, the policyholder will go back and start from the beginning, as if they never had. It takes place when a policyholder is found to have given fraudulent information on their application. What does it mean to rescind an insurance policy? Reasons, insurers can price their policies accurately. Although a policy is a contract, an insurance company can legally cancel the policy.

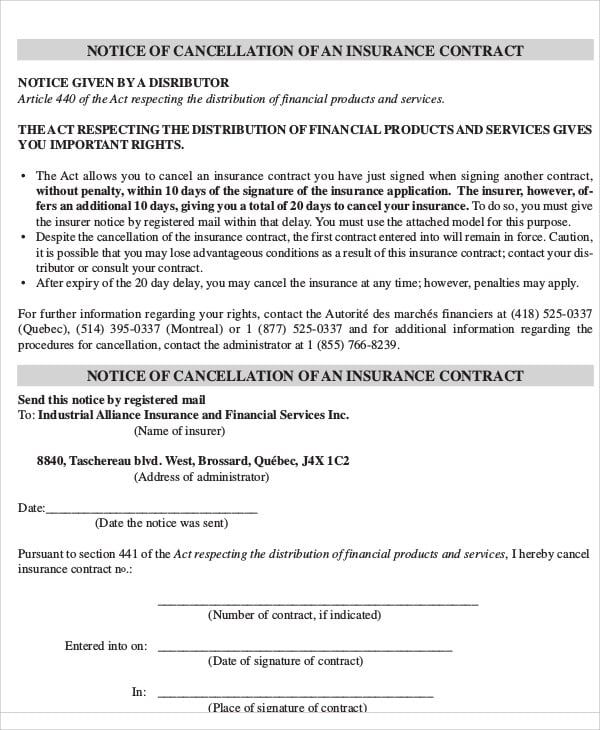

Source: templateroller.com

Source: templateroller.com

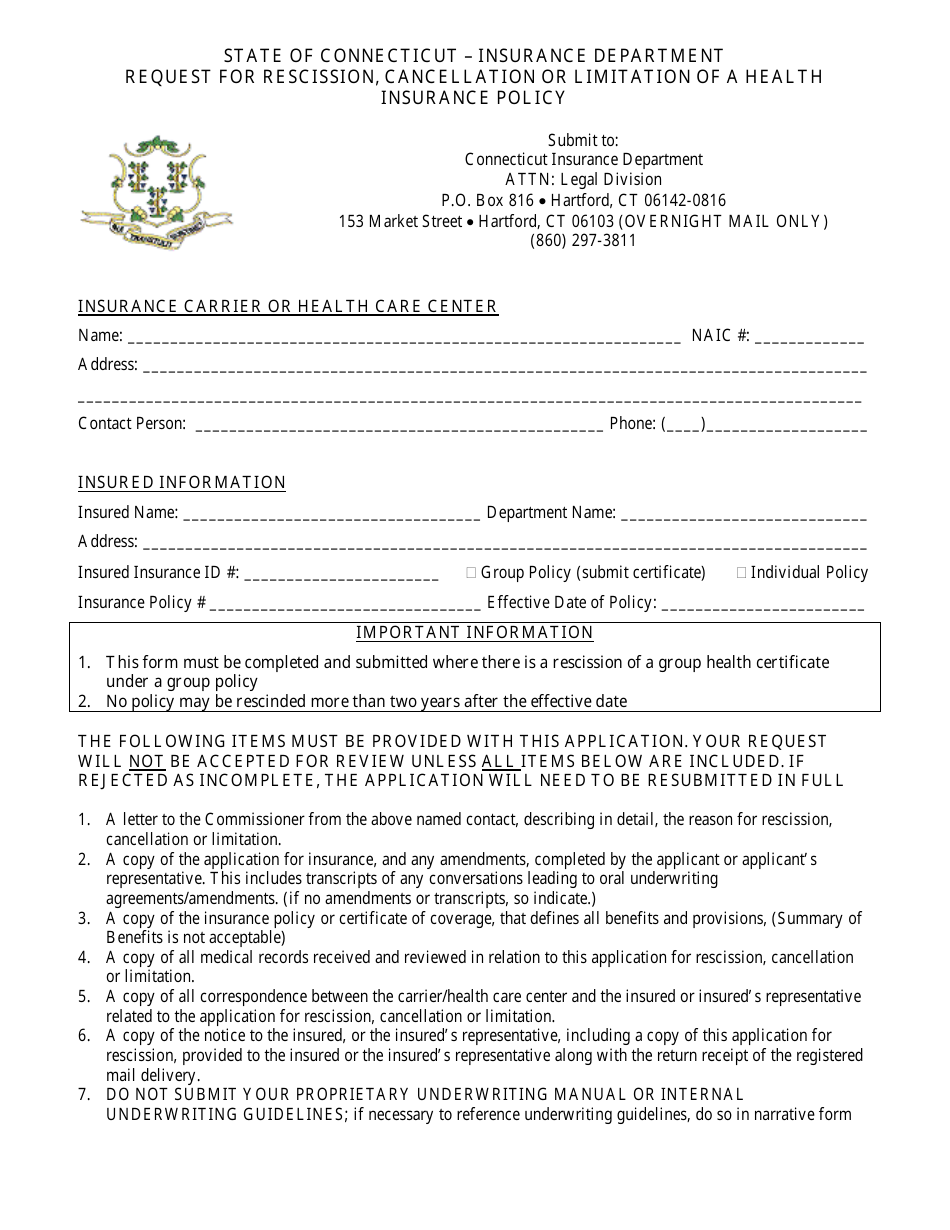

Alaska (pdf) insurance policy rescission compendium: When an insurance company rescinds a policy, they must inform the policyholder via a rescission notice, in which they must return or offer to return the policy premiums paid. Under new york and connecticut law, an insurer must satisfy a significant burden when rescinding an insurance policy “ab initio” (“from the beginning”). Insurers will still often attempt to rescind a policy, sometimes years after they had evidence that something was amiss. Rescission of insurance policy • based upon alleged misrepresentation in an application for policy.

Source: federalregister.gov

Source: federalregister.gov

It was especially common prior to the passage of the federal affordable care act, which outlaws policy cancelations for failure to disclose an existing. If they have failed to do so, then they may lose the right to rescind a contract that was less than complete. It is as if the insurance contract never existed. When an insurance company rescinds a policy, they must inform the policyholder via a rescission notice, in which they must return or offer to return the policy premiums paid. This cle course will discuss the challenges and complications for insurers from rescinding an insurance policy and how a policyholder can effectively respond if the insurer attempts to rescind its policy after a covered claim is made.

Source: gmlawyers.com

Source: gmlawyers.com

Rescission most often occurs under two circumstances: If an insurance policy is rescinded, as opposed to canceled or terminated, it will be as if the agreement made between the policyholder and the insurance company was never made. If you are a victim of an insurer’s attempt to rescind your life, health or disability insurance policy, do not cash the. Essentially, instead of canceling the policy midway, the policyholder will go back and start from the beginning, as if they never had. Reasons, insurers can price their policies accurately.

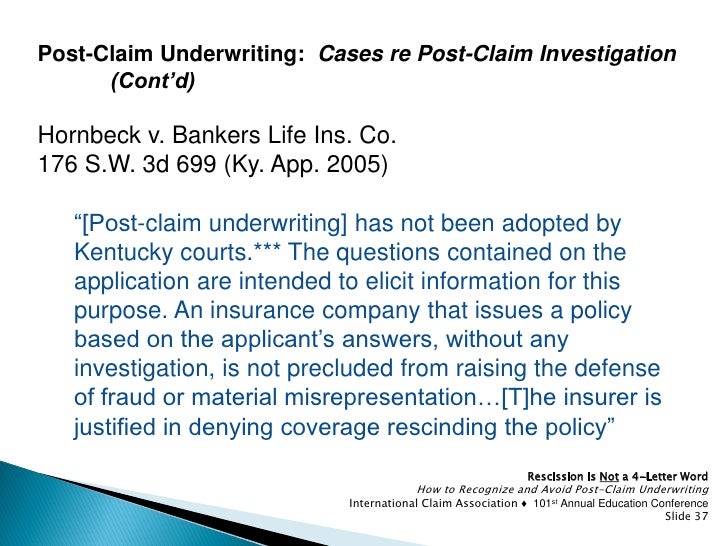

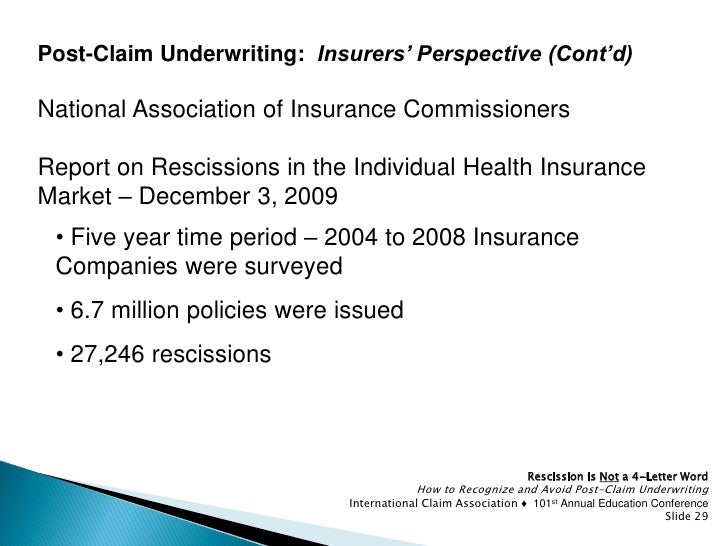

Source: slideshare.net

Source: slideshare.net

If they have failed to do so, then they may lose the right to rescind a contract that was less than complete. Insurance companies have an affirmative duty to investigate the applications submitted to them. Insurers will still often attempt to rescind a policy, sometimes years after they had evidence that something was amiss. Metropolitan life insurance company, 277 u. If there is a breach of warranty, a material concealment, or a material misrepresentation, rescission is a remedy available for selection by the insurer or the insured.

Source: slideshare.net

Source: slideshare.net

Dallas insurance lawyers and those in mesquite, garland, richardson, and other places in dallas need to know the different ways insurance companies operate. Life insurance policy rescission is a strategy used by the life insurance company to avoid paying any policy benefits by claiming that you have no insurance coverage. It takes place when a policyholder is found to have given fraudulent information on their application. Although a policy is a contract, an insurance company can legally cancel the policy. Rescission where the policyholder allegedly made material misrepresentations on its application for property insurance and noting “[e]ven innocent misrepresentations are sufficient to allow an insurer to avoid the contract of insurance or defeat recovery thereunder”) (internal quotation omitted);

Source: detroitbusinesslaw.com

Source: detroitbusinesslaw.com

When an insurance company rescinds a policy, they must inform the policyholder via a rescission notice, in which they must return or offer to return the policy premiums paid. Rescission of a life insurance policy is used to describe the reversal, or undoing, of a life insurance contract. Insurance companies offer policies based on information provided by the consumer, whether regarding age and physical condition. Rescission of an insurance policy is one of the most powerful tools insurers have to combat insurance fraud and avoid unnecessary and unintended risks, and one of the most devastating outcomes to a policyholder seeking coverage for a claim. Nevertheless, especially where new york law is applied, where there are.

Source: goldbergsegalla.com

Source: goldbergsegalla.com

This cle course will discuss the challenges and complications for insurers from rescinding an insurance policy and how a policyholder can effectively respond if the insurer attempts to rescind its policy after a covered claim is made. Rescission is an insurance industry practice in which an insurer takes action retroactively to cancel a policy holder�s coverage by citing omissions or errors in the customer�s application, even if the policy holder has been diligently keeping their policy current. Metropolitan life insurance company, 277 u. An action for rescission permits an Most policyholders do not understand their rights and assume insurers can rescind their policies.

But inaccurate or incomplete responses are fraught with risk that may result in no coverage at all, based on rescission of coverage by an insurer. Life insurance policy rescission is a strategy used by the life insurance company to avoid paying any policy benefits by claiming that you have no insurance coverage. When an insurance company rescinds a policy, they must inform the policyholder via a rescission notice, in which they must return or offer to return the policy premiums paid. One of those is rescinding a policy. An action for rescission permits an

Source: fastcase.com

Source: fastcase.com

Metropolitan life insurance company, 277 u. Nevertheless, especially where new york law is applied, where there are. Rather than rejecting you as a policyholder at the time of application, the insurance company waits until you make a claim. One of those is rescinding a policy. Rescission is an insurance industry practice in which an insurer takes action retroactively to cancel a policy holder�s coverage by citing omissions or errors in the customer�s application, even if the policy holder has been diligently keeping their policy current.

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

When an insurance company rescinds a policy, they must inform the policyholder via a rescission notice, in which they must return or offer to return the policy premiums paid. When an insurance company rescinds a policy, they must inform the policyholder via a rescission notice, in which they must return or offer to return the policy premiums paid. Nevertheless, especially where new york law is applied, where there are. Alabama (pdf) insurance policy rescission compendium: A) the misrepresentation, omission, concealment, or statement is fraudulent or is material either to the acceptance of the risk or to the hazard assumed by the insurer.

Source: sibuna-anubis.blogspot.com

Rather than rejecting you as a policyholder at the time of application, the insurance company waits until you make a claim. Insurance companies have an affirmative duty to investigate the applications submitted to them. Life insurance policy rescission is a strategy used by the life insurance company to avoid paying any policy benefits by claiming that you have no insurance coverage. One of those is rescinding a policy. The rescission of an insurance policy is one of the most underutilized tools in handling insurance claims.

Source: templateroller.com

Source: templateroller.com

When an insurance company rescinds a policy, they must inform the policyholder via a rescission notice, in which they must return or offer to return the policy premiums paid. Rescission where the policyholder allegedly made material misrepresentations on its application for property insurance and noting “[e]ven innocent misrepresentations are sufficient to allow an insurer to avoid the contract of insurance or defeat recovery thereunder”) (internal quotation omitted); Insurers often use rescission of insurance policies to deny insurance claims, especially life, disability and health claims. It can be the most effective remedy depending on the law of the state where the policy was issued or is to be performed. Rescission of insurance policy • based upon alleged misrepresentation in an application for policy.

Source: slideshare.net

Source: slideshare.net

Although a policy is a contract, an insurance company can legally cancel the policy. Life insurance policy rescission is a strategy used by the life insurance company to avoid paying any policy benefits by claiming that you have no insurance coverage. One of those is rescinding a policy. The panel will review addressing rescission for statutorily required coverage, bad faith indicators, and how different courts treat. This cle course will discuss the challenges and complications for insurers from rescinding an insurance policy and how a policyholder can effectively respond if the insurer attempts to rescind its policy after a covered claim is made.

Source: template.net

Source: template.net

If they have failed to do so, then they may lose the right to rescind a contract that was less than complete. Most policyholders do not understand their rights and assume insurers can rescind their policies. If they have failed to do so, then they may lose the right to rescind a contract that was less than complete. It was especially common prior to the passage of the federal affordable care act, which outlaws policy cancelations for failure to disclose an existing. Rescission of an insurance policy is one of the most powerful tools insurers have to combat insurance fraud and avoid unnecessary and unintended risks, and one of the most devastating outcomes to a policyholder seeking coverage for a claim.

Source: researchgate.net

Source: researchgate.net

Rescission of a life insurance policy is used to describe the reversal, or undoing, of a life insurance contract. Insurance companies offer policies based on information provided by the consumer, whether regarding age and physical condition. In addition, as a matter of fairness, policyholders who make intentional or reckless If used properly, it unwinds the insurance transaction and the parties are restored to their position prior to the contract; Rescission most often occurs under two circumstances:

Source: slideshare.net

Source: slideshare.net

The panel will review addressing rescission for statutorily required coverage, bad faith indicators, and how different courts treat. Rescission of insurance policy • based upon alleged misrepresentation in an application for policy. Rescission is an insurance industry practice in which an insurer takes action retroactively to cancel a policy holder�s coverage by citing omissions or errors in the customer�s application, even if the policy holder has been diligently keeping their policy current. Reasons, insurers can price their policies accurately. Rescission is an official declaration by a party in an insurance contract that they no longer acknowledge the contract as legal.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance policy rescission by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.