Insurance premium finance industry Idea

Home » Trend » Insurance premium finance industry IdeaYour Insurance premium finance industry images are available in this site. Insurance premium finance industry are a topic that is being searched for and liked by netizens now. You can Download the Insurance premium finance industry files here. Download all royalty-free images.

If you’re searching for insurance premium finance industry images information related to the insurance premium finance industry interest, you have pay a visit to the ideal blog. Our website always gives you hints for seeing the maximum quality video and image content, please kindly search and find more enlightening video articles and graphics that match your interests.

Insurance Premium Finance Industry. As we reported in our april 2015 industry commentary, insurance premium finance is a well established, high margin, high growth commercial lending activity that generates low credit quality costs. First insurance funding (first) first is one of the largest premium finance companies in north america. Now that interest rates have hit historic lows in 2021, premium financing is more popular than ever with elite life insurance agents as well as the banks offering premium financing loans. Ideally, a premium finance company loans their insurers the cash to cover the insurance premium as you make pay them over time through monthly installment payments.

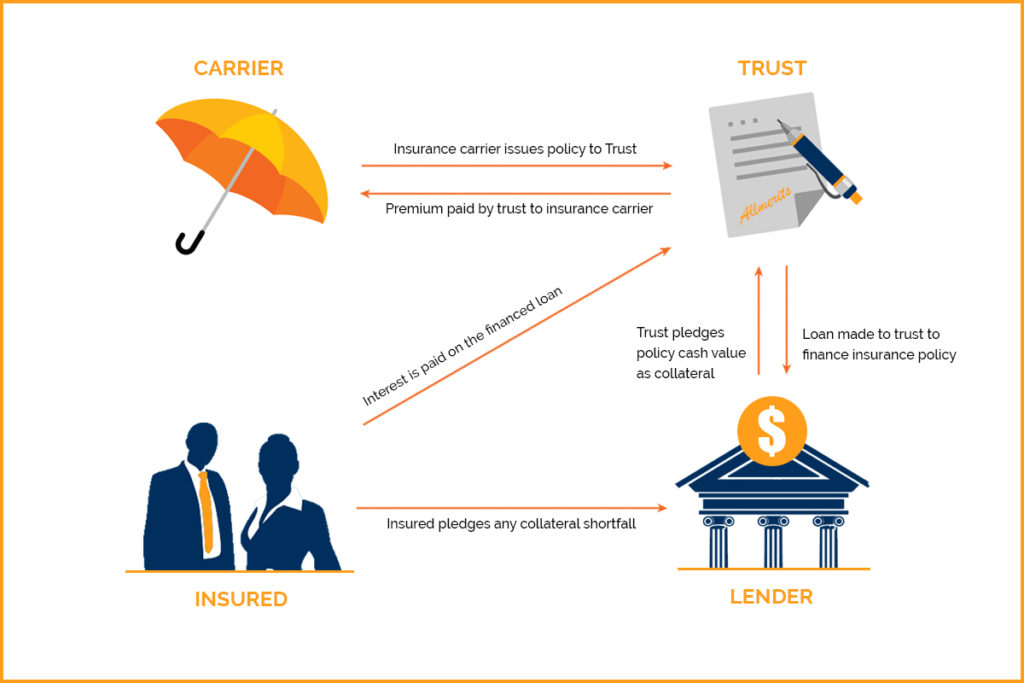

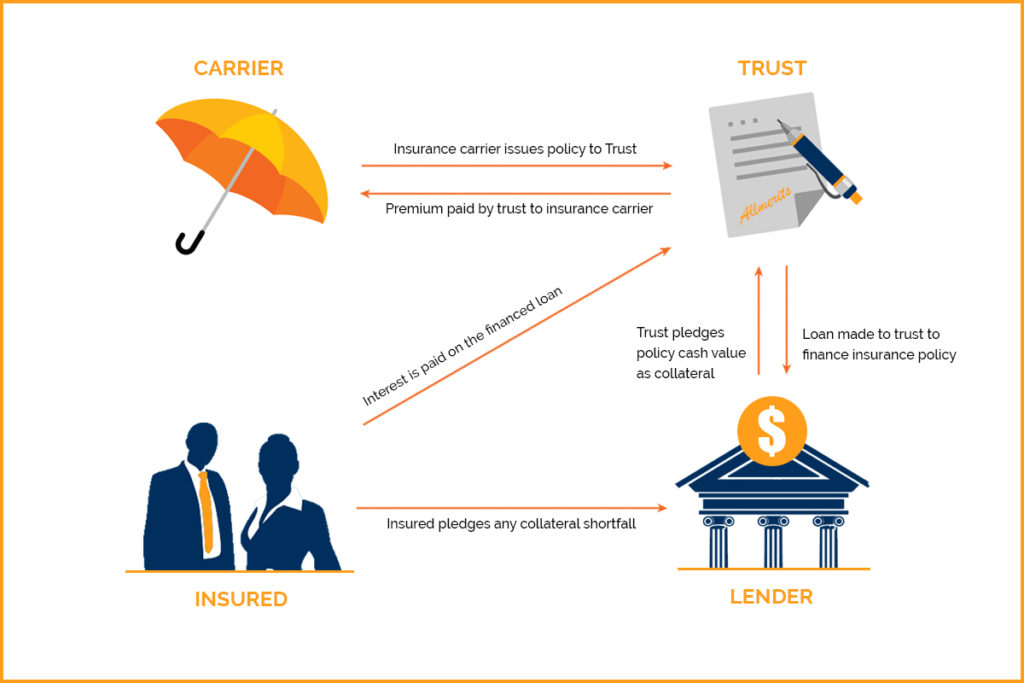

Premium Financing for Life Insurance Altus Insurance From altus-ins.com

Premium Financing for Life Insurance Altus Insurance From altus-ins.com

The insurance industry�s solution to premium financing with over 40 years in the insurance premium finance industry, imperial pfs provides a level of customer service that promotes excellence. Due to the nature of the insurance industry, there are certain unique transactions that need to be accounted for, such as: As a privately held company, we are not constrained by a parent bank or entity, but rather we can offer quicker, customized services to our partner insurance agents, brokers,. Many business owners, cfos and other insureds simply don�t realize the simple, inherent value proposition of premium finance—it enables them to reallocate cash earmarked for insurance. The amount you have been paid as a premium on a policy is accounted for as income. We work with brokers, mgas and insurers to transform the insurance industry via our financial products, digital tools and customised services.

52% of these premiums came from life and health insurance sectors while property and casualty insurers accounted for 48% of the pie.

2021/2022 data, statistics & predictions. Due to the nature of the insurance industry, there are certain unique transactions that need to be accounted for, such as: Winning the race means thriving in the business; Our independence allows us to offer quicker, customized services to our partner insurance companies, general. Independents have the advantage in a changing industry premium content asset managers owned by insurance companies are losing ground to their standalone european rivals save Ideally, a premium finance company loans their insurers the cash to cover the insurance premium as you make pay them over time through monthly installment payments.

Source: capitalpremium.net

Source: capitalpremium.net

Winning the race means thriving in the business; Due to the nature of the insurance industry, there are certain unique transactions that need to be accounted for, such as: 13 top insurance industry trends: The insurance industry is a major component of the economy by virtue of the amount of premiums it collects, the scale of its investment and, more fundamentally, the essential social and economic role it plays by covering personal and business risks. The sustained low interest rate environment continues to affect the insurance industry’s performance.

Source: financeviewer.blogspot.com

Premium financing allows you to pay your insurance company in installments instead of all at once. If you opt for premium financing and you miss a payment, your coverage will lapse and your provider may cancel your. Written by arthur zuckerman may 14, 2020. Winning the race means thriving in the business; Many business owners, cfos and other insureds simply don�t realize the simple, inherent value proposition of premium finance—it enables them to reallocate cash earmarked for insurance.

Source: financemaster.com

Source: financemaster.com

Losing means sinking into obscurity. Home and auto insurance policies often use premium financing and accept a small down payment while we pay the rest in monthly installments. Premium financing has been used in the insurance industry for decades and most experienced underwriters have come across a financed case. As a privately held company, we are not constrained by a parent bank or entity, but rather we can offer quicker, customized services to our partner insurance agents, brokers,. Premium financing allows you to pay your insurance company in installments instead of all at once.

Source: advisorsmagazine.com

Source: advisorsmagazine.com

Now that interest rates have hit historic lows in 2021, premium financing is more popular than ever with elite life insurance agents as well as the banks offering premium financing loans. Premium financing allows you to pay your insurance company in installments instead of all at once. The finance and insurance industry has undeniably seen a turbulent 2020, yet given the underlying conditions many are surprised at how resilient these institutions have been. The insurance industry�s solution to premium financing with over 40 years in the insurance premium finance industry, imperial pfs provides a level of customer service that promotes excellence. We are the industry’s preferred insurance premium finance company.

Source: hklaw.com

Source: hklaw.com

52% of these premiums came from life and health insurance sectors while property and casualty insurers accounted for 48% of the pie. Due to the nature of the insurance industry, there are certain unique transactions that need to be accounted for, such as: Written by arthur zuckerman may 14, 2020. Premium financing has been used in the insurance industry for decades and most experienced underwriters have come across a financed case. We are the industry’s preferred insurance premium finance company.

Source: pagedesignhub.com

Source: pagedesignhub.com

Due to the nature of the insurance industry, there are certain unique transactions that need to be accounted for, such as: We work with brokers, mgas and insurers to transform the insurance industry via our financial products, digital tools and customised services. The insurance industry�s solution to premium financing with over 40 years in the insurance premium finance industry, imperial pfs provides a level of customer service that promotes excellence. Also with commercial insurance premium financing, the business is supposed to put up at least 25% of the total price as deposit on the policy. As a privately held company, we are not constrained by a parent bank or entity, but rather we can offer quicker, customized services to our partner insurance agents, brokers,.

Source: realpeople.co.ke

Source: realpeople.co.ke

Here are some of the key findings from deloitte’s 2022 insurance industry outlook. By arthur zuckerman may 14, 2020. Home and auto insurance policies often use premium financing and accept a small down payment while we pay the rest in monthly installments. In 2017, the industry’s total net premium was $1.2 trillion. Insurance industry was able to maintain its financial health in 2020.

Source: mouselock.co

Source: mouselock.co

Due to the nature of the insurance industry, there are certain unique transactions that need to be accounted for, such as: 52% of these premiums came from life and health insurance sectors while property and casualty insurers accounted for 48% of the pie. Premium financing allows you to pay your insurance company in installments instead of all at once. With more than 40 years in the insurance billing and premium finance industry, imperial pfs is the largest premium finance company in north america. Insurance industry was able to maintain its financial health in 2020.

Source: insurancedoctor.us

Source: insurancedoctor.us

Ideally, a premium finance company loans their insurers the cash to cover the insurance premium as you make pay them over time through monthly installment payments. Ideally, a premium finance company loans their insurers the cash to cover the insurance premium as you make pay them over time through monthly installment payments. Service fees might be added to it, depending on the local insurance laws and the provider of your contract. Is insurance a growing industry? Understanding the risks inherent with the loan designs provides the underwriter the proper tools to uncover potential issues and make a sound underwriting decision.

Source: antliafintech.com

Source: antliafintech.com

2021/2022 data, statistics & predictions. Now that interest rates have hit historic lows in 2021, premium financing is more popular than ever with elite life insurance agents as well as the banks offering premium financing loans. Premium financing allows you to pay your insurance company in installments instead of all at once. Our white glove customer service is. Many business owners, cfos and other insureds simply don�t realize the simple, inherent value proposition of premium finance—it enables them to reallocate cash earmarked for insurance.

Source: chamberlinfinancial.com

Source: chamberlinfinancial.com

13 top insurance industry trends: As we reported in our april 2015 industry commentary, insurance premium finance is a well established, high margin, high growth commercial lending activity that generates low credit quality costs. Our white glove customer service is. Service fees might be added to it, depending on the local insurance laws and the provider of your contract. The sustained low interest rate environment continues to affect the insurance industry’s performance.

Source: financemaster.com

Source: financemaster.com

The finance and insurance industry has undeniably seen a turbulent 2020, yet given the underlying conditions many are surprised at how resilient these institutions have been. We are the industry’s preferred insurance premium finance company. Losing means sinking into obscurity. Credit counselors and loan officers: The insurance industry is a major component of the economy by virtue of the amount of premiums it collects, the scale of its investment and, more fundamentally, the essential social and economic role it plays by covering personal and business risks.

Source: altus-ins.com

Source: altus-ins.com

Is insurance a growing industry? Understanding the risks inherent with the loan designs provides the underwriter the proper tools to uncover potential issues and make a sound underwriting decision. Our white glove customer service is. Premium financing allows you to pay your insurance company in installments instead of all at once. Insurance industry was able to maintain its financial health in 2020.

Source: nfcfinance.com

As we reported in our april 2015 industry commentary, insurance premium finance is a well established, high margin, high growth commercial lending activity that generates low credit quality costs. Our white glove customer service is. Premium financing allows you to pay your insurance company in installments instead of all at once. Home and auto insurance policies often use premium financing and accept a small down payment while we pay the rest in monthly installments. We work with brokers, mgas and insurers to transform the insurance industry via our financial products, digital tools and customised services.

Source: century.co.ke

Source: century.co.ke

Our independence allows us to offer quicker, customized services to our partner insurance companies, general. With more than 40 years in the insurance billing and premium finance industry, imperial pfs is the largest premium finance company in north america. Many business owners, cfos and other insureds simply don�t realize the simple, inherent value proposition of premium finance—it enables them to reallocate cash earmarked for insurance. Here are some of the key findings from deloitte’s 2022 insurance industry outlook. The insurance industry�s solution to premium financing with over 40 years in the insurance premium finance industry, imperial pfs provides a level of customer service that promotes excellence.

Source: bankingtruths.com

Source: bankingtruths.com

The insurance industry�s solution to premium financing with over 40 years in the insurance premium finance industry, imperial pfs provides a level of customer service that promotes excellence. The insurance industry is a major component of the economy by virtue of the amount of premiums it collects, the scale of its investment and, more fundamentally, the essential social and economic role it plays by covering personal and business risks. Here are some of the key findings from deloitte’s 2022 insurance industry outlook. Independents have the advantage in a changing industry premium content asset managers owned by insurance companies are losing ground to their standalone european rivals save Home and auto insurance policies often use premium financing and accept a small down payment while we pay the rest in monthly installments.

![]() Source: ipfs.com

Source: ipfs.com

Premium financing allows you to pay your insurance company in installments instead of all at once. Service fees might be added to it, depending on the local insurance laws and the provider of your contract. Insurance industry was able to maintain its financial health in 2020. Also with commercial insurance premium financing, the business is supposed to put up at least 25% of the total price as deposit on the policy. Premium financing has been used in the insurance industry for decades and most experienced underwriters have come across a financed case.

Source: slideshare.net

Source: slideshare.net

The insurance industry is a major component of the economy by virtue of the amount of premiums it collects, the scale of its investment and, more fundamentally, the essential social and economic role it plays by covering personal and business risks. Home and auto insurance policies often use premium financing and accept a small down payment while we pay the rest in monthly installments. If you opt for premium financing and you miss a payment, your coverage will lapse and your provider may cancel your. Premium financing has been used in the insurance industry for decades and most experienced underwriters have come across a financed case. Losing means sinking into obscurity.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insurance premium finance industry by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.