Insurance premium tax by state Idea

Home » Trend » Insurance premium tax by state IdeaYour Insurance premium tax by state images are ready in this website. Insurance premium tax by state are a topic that is being searched for and liked by netizens now. You can Get the Insurance premium tax by state files here. Get all free photos.

If you’re searching for insurance premium tax by state pictures information linked to the insurance premium tax by state keyword, you have pay a visit to the ideal site. Our site always provides you with suggestions for refferencing the highest quality video and image content, please kindly search and locate more enlightening video content and images that fit your interests.

Insurance Premium Tax By State. Laws 1945, chapter 100 extended the 2% premium tax to cover domestic insurance companies (insurance companies organized under the laws of the state of arizona). Section 76.67 reciprocity wisconsin will not charge foreign insurers more than that insurer�s state charges wisconsin subject to an aggregate minimum of 2% of fire dues, 2% on life insurance, and.375% on fire and marine insurance. Look up an insurance company or agent to find licensing, complaint, and financial information; Hile not the most visible of taxes, the state insurance premium tax is levied on insurance companies by every state, generally as a substitute for the state corporate income tax being imposed on insurance companies.

insurancepremium Charity Tax Group From charitytaxgroup.org.uk

insurancepremium Charity Tax Group From charitytaxgroup.org.uk

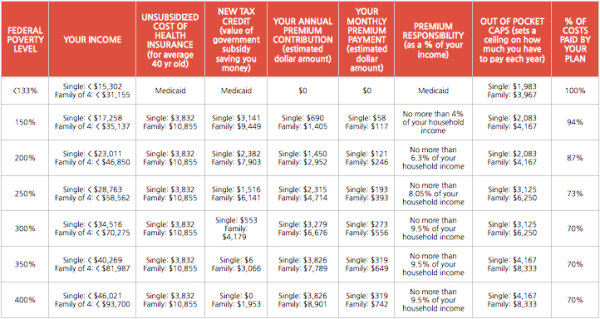

Download full summary of state insurance premium tax rates books pdf, epub, tuebl, textbook, mobi or read online summary of state insurance premium tax rates anytime and anywhere on any device. The florida office of insurance regulation (oir) regulates the business of insurance in. A premium tax is a tax that insurers often have to pay on the premiums that they receive from their policyholders. Because annuities are insurance products, they are regulated by the insurance commissions in each state. State tax on life insurance and annuity premium as of october 10, 2015; Township mutual insurance companies, the rate is 1 percent.

A half tax rate of.875 percent is due on the first $450,000 of life insurance or hmo premium.

A premium tax is a tax that insurers often have to pay on the premiums that they receive from their policyholders. If you reported under $2000 in tax last year you do not need to file this form. What must be submitted with the missouri premium tax return? In 2004, $14 billion in taxes on insurance premiums were collected on $960 billion worth of insurance Life insurers, the rate is 2 percent on accident and health premiums, and 1.5 percent on life insurance premiums. In addition to premium taxes, insurance companies are obligated to pay certain statutory fees for services performed by state insurance departments.

Source: deacon.co.uk

Source: deacon.co.uk

The tax is assessed on each insurer transacting insurance business in this state on net direct premiums and considerations at a rate of 3.5 percent. Download full summary of state insurance premium tax rates books pdf, epub, tuebl, textbook, mobi or read online summary of state insurance premium tax rates anytime and anywhere on any device. We cannot guarantee that every book is in the library. Township mutual insurance companies, the rate is 1 percent. In 2004, $14 billion in taxes on insurance premiums were collected on $960 billion worth of insurance

Source: youtube.com

Source: youtube.com

State premium taxes are sales taxes assessed on insurance premiums. Life, accident and health insurers, including health maintenance organizations (hmo): Payment of premium tax for nonadmitted insurance. The insurance premium tax was enacted in 1933 and is authorized by nevada revised statutes section 680b. An insurance premium tax is a form of gross receipts or excise tax;

Source: personalfinanceplan.in

Source: personalfinanceplan.in

State insurance premium and other insurance taxes. Section 76.67 reciprocity wisconsin will not charge foreign insurers more than that insurer�s state charges wisconsin subject to an aggregate minimum of 2% of fire dues, 2% on life insurance, and.375% on fire and marine insurance. Description title insurance companies are exempt from the 2.0 percent insurance premiums tax. However, they do pay b&o tax under the 0.471 percent retailing classification Payment of premium tax for nonadmitted insurance.

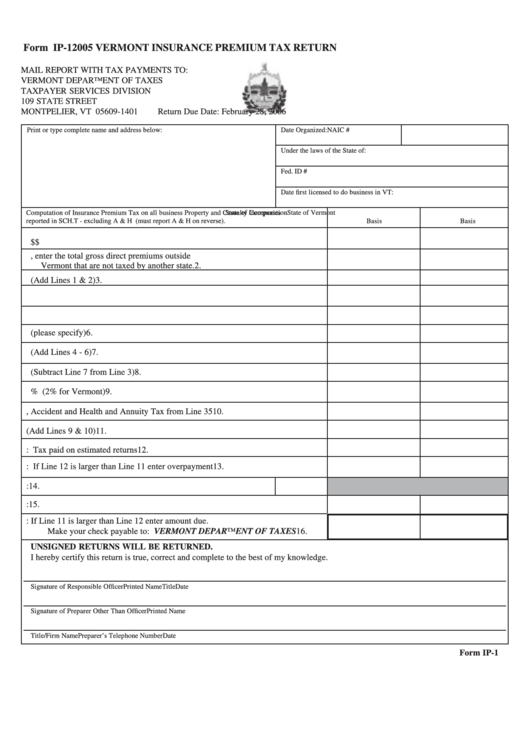

Source: formsbank.com

Source: formsbank.com

Property/casualty insurance companies are subject to state premium taxes. In addition to premium taxes, insurance companies are obligated to pay certain statutory fees for services performed by state insurance departments. Property/casualty insurance companies are subject to state premium taxes. A half tax rate of.875 percent is due on the first $450,000 of life insurance or hmo premium. Section 76.67 reciprocity wisconsin will not charge foreign insurers more than that insurer�s state charges wisconsin subject to an aggregate minimum of 2% of fire dues, 2% on life insurance, and.375% on fire and marine insurance.

Source: einsurance.com

Source: einsurance.com

Description title insurance companies are exempt from the 2.0 percent insurance premiums tax. Insurers who have insurance premiums to report will need to use the regular insurance return. Hile not the most visible of taxes, the state insurance premium tax is levied on insurance companies by every state, generally as a substitute for the state corporate income tax being imposed on insurance companies. A half tax rate of.875 percent is due on the first $450,000 of life insurance or hmo premium. Search rate and form filings;

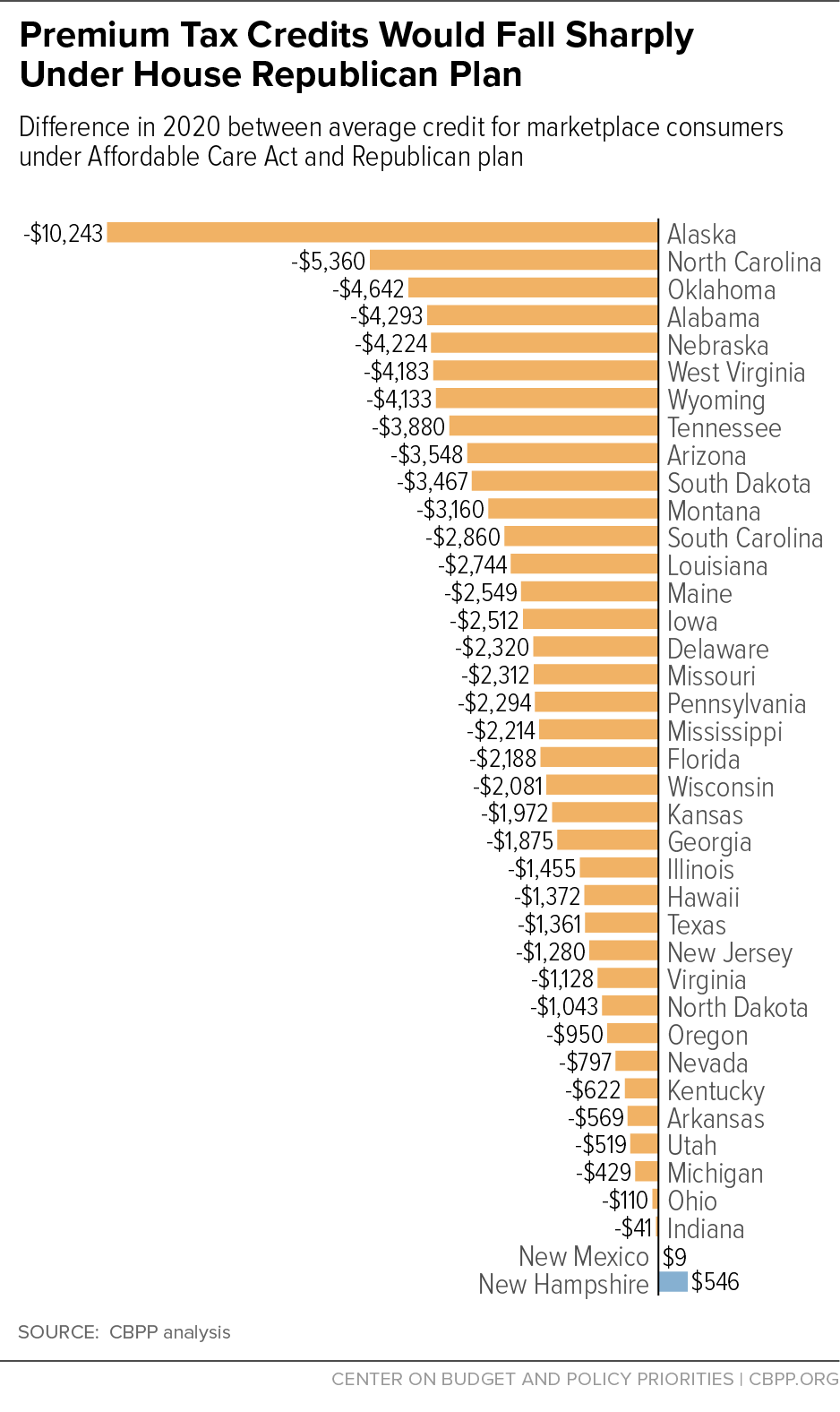

Source: cbpp.org

Source: cbpp.org

State insurance premium and other insurance taxes. The most significant difference is the tax states levy on insurance premiums. Captive insurer premium reporting and tax requirements; An insurance premium tax is a form of gross receipts or excise tax; Designated statistical agents in washington state;

Source: cpapracticeadvisor.com

Source: cpapracticeadvisor.com

Life insurers, the rate is 2 percent on accident and health premiums, and 1.5 percent on life insurance premiums. The most significant difference is the tax states levy on insurance premiums. State tax on life insurance and annuity premium as of october 10, 2015; The tax is assessed on each insurer transacting insurance business in this state on net direct premiums and considerations at a rate of 3.5 percent. A half tax rate of.875 percent is due on the first $450,000 of life insurance or hmo premium.

Source: savingtoinvest.com

Source: savingtoinvest.com

Designated statistical agents in washington state; Search rate and form filings; State premium taxes are sales taxes assessed on insurance premiums. One component of the insurance premium tax involves annuities which are Designated statistical agents in washington state;

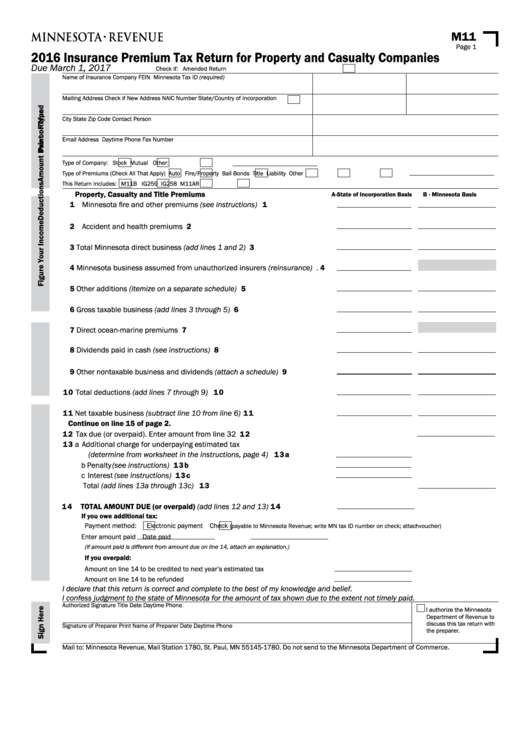

Source: formsbank.com

Source: formsbank.com

- all states (except oregon) and dc subject insurance companies to premium taxes • municipal/local premium taxes are also imposed by 5 states 2) premium taxes are imposed “in lieu” of income taxes in most states • about 10 states impose both premium taxes and income taxes on insurance companies There are eight insurance premium taxes and fees. Taxes defined as general purpose revenue taxes and fire insurance dues less security fund assessment credits. Mutual property and casualty insurance companies, the rate is: A premium tax is a tax that insurers often have to pay on the premiums that they receive from their policyholders.

Source: zanebenefits.com

Source: zanebenefits.com

Laws 1945, chapter 100 extended the 2% premium tax to cover domestic insurance companies (insurance companies organized under the laws of the state of arizona). An insurance premium tax is a form of gross receipts or excise tax; The most significant difference is the tax states levy on insurance premiums. The tax rate for the insurance premium tax depends on the type of insurer and policy. If you reported under $2000 in tax last year you do not need to file this form.

Source: ascentsolutions.in

Source: ascentsolutions.in

Section 76.67 reciprocity wisconsin will not charge foreign insurers more than that insurer�s state charges wisconsin subject to an aggregate minimum of 2% of fire dues, 2% on life insurance, and.375% on fire and marine insurance. Box 690, 301 west high street, rm. Payment of premium tax for nonadmitted insurance. Mutual property and casualty insurance companies, the rate is: Designated statistical agents in washington state;

Source: charitytaxgroup.org.uk

Source: charitytaxgroup.org.uk

Township mutual insurance companies, the rate is 1 percent. A premium tax is a tax that insurers often have to pay on the premiums that they receive from their policyholders. 7, 100% of the gross premiums are taxable in minnesota with no allocation of the tax to other states. Life, accident and health insurers, including health maintenance organizations (hmo): The insurance premium tax was enacted in 1933 and is authorized by nevada revised statutes section 680b.

Source: connect-insurance.uk

Source: connect-insurance.uk

Much of that regulation is relatively uniform, but there are subtle differences. One component of the insurance premium tax involves annuities which are We cannot guarantee that every book is in the library. Hile not the most visible of taxes, the state insurance premium tax is levied on insurance companies by every state, generally as a substitute for the state corporate income tax being imposed on insurance companies. It is not based on profits or earnings, and is not affected by.

Source: personalcapital.com

Source: personalcapital.com

If you reported under $2000 in tax last year you do not need to file this form. Property/casualty insurance companies are subject to state premium taxes. Look up an insurance company or agent to find licensing, complaint, and financial information; Hile not the most visible of taxes, the state insurance premium tax is levied on insurance companies by every state, generally as a substitute for the state corporate income tax being imposed on insurance companies. 1) all states (except oregon) and dc subject insurance companies to premium taxes • municipal/local premium taxes are also imposed by 5 states 2) premium taxes are imposed “in lieu” of income taxes in most states • about 10 states impose both premium taxes and income taxes on insurance companies

Source: packetts.com

Source: packetts.com

Please use this form to report industrial insurance premium tax on a quarterly basis. A half tax rate of.875 percent is due on the first $450,000 of life insurance or hmo premium. Property/casualty insurance companies are subject to state premium taxes. An insurance premium tax is a form of gross receipts or excise tax; Look up an insurance company or agent to find licensing, complaint, and financial information;

Source: sharrockinsurance.co.uk

Source: sharrockinsurance.co.uk

Life insurers, the rate is 2 percent on accident and health premiums, and 1.5 percent on life insurance premiums. Designated statistical agents in washington state; State tax on life insurance and annuity premium as of october 10, 2015; Property/casualty insurance companies are subject to state premium taxes. Description title insurance companies are exempt from the 2.0 percent insurance premiums tax.

Source: peoplekeep.com

Source: peoplekeep.com

Payment of premium tax for nonadmitted insurance. Hile not the most visible of taxes, the state insurance premium tax is levied on insurance companies by every state, generally as a substitute for the state corporate income tax being imposed on insurance companies. Life insurers, the rate is 2 percent on accident and health premiums, and 1.5 percent on life insurance premiums. An insurance premium tax is a form of gross receipts or excise tax; Get free access to the library by create an account, fast download and ads free.

Source: pinterest.com

Source: pinterest.com

Laws 1945, chapter 100 extended the 2% premium tax to cover domestic insurance companies (insurance companies organized under the laws of the state of arizona). Hile not the most visible of taxes, the state insurance premium tax is levied on insurance companies by every state, generally as a substitute for the state corporate income tax being imposed on insurance companies. Life, accident and health insurers, including health maintenance organizations (hmo): Because annuities are insurance products, they are regulated by the insurance commissions in each state. Much of that regulation is relatively uniform, but there are subtle differences.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insurance premium tax by state by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.