Insurance proceeds in excess of repairs information

Home » Trend » Insurance proceeds in excess of repairs informationYour Insurance proceeds in excess of repairs images are available. Insurance proceeds in excess of repairs are a topic that is being searched for and liked by netizens now. You can Download the Insurance proceeds in excess of repairs files here. Download all royalty-free vectors.

If you’re searching for insurance proceeds in excess of repairs pictures information connected with to the insurance proceeds in excess of repairs keyword, you have come to the right site. Our site frequently gives you hints for seeking the maximum quality video and image content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

Insurance Proceeds In Excess Of Repairs. Ordinarily, you’re liable for an immediate tax on any excess over the cost basis of your property. In this way, most property insurance proceeds are not taxable. Therefore i think it is more realistic to figure loss or gain through this route, when money is being spent to get property in original shape what it was before it is getting its lost value back on top of that owners received more than what they spent to repair, therefore it is gain. The value of the property after the repairs is not, due to the repairs, more than its value immediately before the casualty.

earners offered cheap car insurance under new From newshub.co.nz

earners offered cheap car insurance under new From newshub.co.nz

When this occurs, the owner can generally exclude up to $250,000 ($500,000 if the owner is married and filing a joint return) of conversion gain. 26 a taxpayer must also reduce its basis by the amount of any insurance reimbursement, even if no deduction is claimed for the casualty loss. In this way, most property insurance proceeds are not taxable. Debit repairs for damaged property: Insurance claim received in for replacement value in excess of written down value. Sole trader client had a workshop badly damaged by flood.

If a taxpayer claims a casualty loss, the taxpayer must reduce the basis of the property by the amount of the casualty loss.

This reinvestment, if timely, will satisfy the $ 4,500.00 what is spent to get its value back and $ 400.00 is gain because owners got paid $. Taxpayer intends to use part of the casualty insurance proceeds to acquire qualifying replacement property to the extent the proceeds exceeded the amount used for the demolition of the destroyed buildings and the repair of the damaged property. Advertisement step 4 record a loss on the insurance settlement. Taxpayers who have insurance must file a timely formal claim with their insurance providers, regardless of whether or not it puts them at risk of increased premiums or dropped coverage in the future. If the total conversion gain exceeds this exclusion amount, the owner may defer.

Source: newshub.co.nz

Source: newshub.co.nz

By doing so, there is no risk of recording a gain related to a payment that is never received. The remaining amount, also known as the excess proceeds, can be legally kept as long as it is the actual cash value component of the claim. Plant and equipment lost in fire. The casualty loss is based on reduction of fmv. The taxpayer must still report the actual reinvestment of.

Source: confused.com

Source: confused.com

Insurance proceeds under § 1033(a)(1). Insurance is the most common way to be reimbursed for a casualty loss. This reinvestment, if timely, will satisfy the Plant and equipment lost in fire. The first part is the initial reporting of the insurance proceeds, the irs has provided relief here with the “deemed election.” but the second is where the taxpayer gets into trouble.

Source: icbc.com

Source: icbc.com

If the total conversion gain exceeds this exclusion amount, the owner may defer. Insurance is the most common way to be reimbursed for a casualty loss. Special rules apply when insurance proceeds are received because of damage or destruction to a principal residence. The taxpayer must still report the actual reinvestment of. Insurance proceeds in excess of repairs.

Source: insuremekevin.com

Source: insuremekevin.com

The most reasonable approach to recording these proceeds is to wait until they have been received by the company. $ 4,500.00 what is spent to get its value back and $ 400.00 is gain because owners got paid $. Taxpayers can, however, defer any gain by complying with the rules in irc section 1033. It also is important to evaluate whether any losses related to property damage have been properly recorded. This might occur when the insurance company acknowledges that a specified payment is due, at which time the recovery would be represented by a valid receivable, rather than a contingent asset.

Source: clubsat.com.ar

Source: clubsat.com.ar

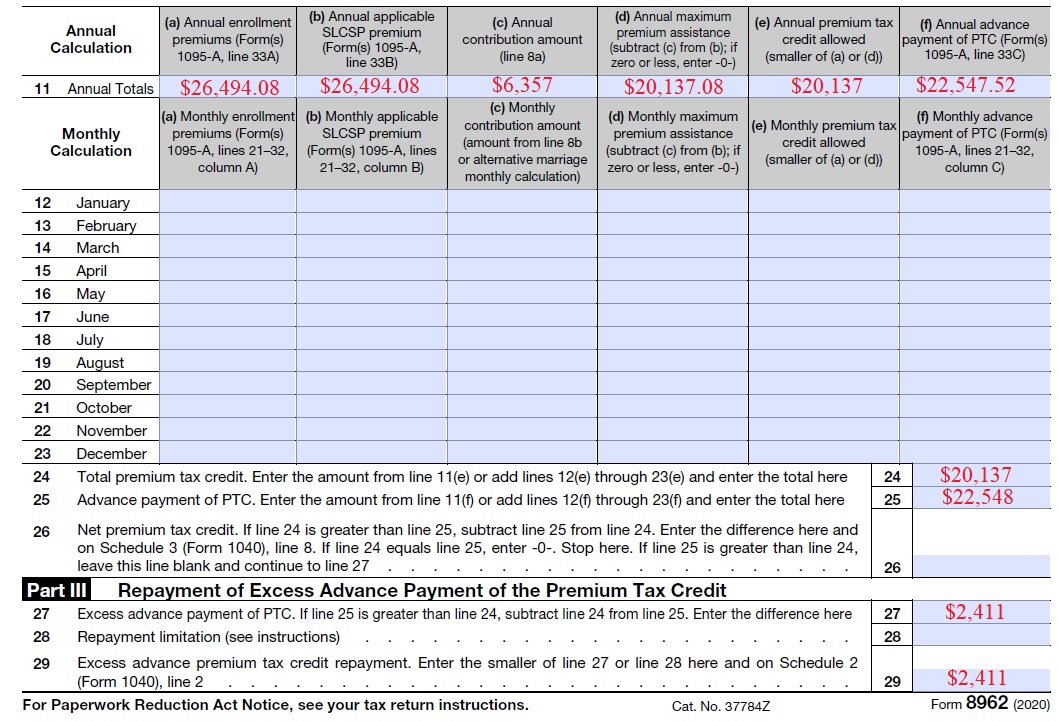

There are two parts to the reporting process. 27 where a taxpayer recovers insurance proceeds that exceed the taxpayer�s basis in the property,. Debit repairs for damaged property: $ 4,500.00 what is spent to get its value back and $ 400.00 is gain because owners got paid $. The law authorizes an important tax break for a property owner who collects insurance (or other compensation) for property lost due to fire, theft or condemnation by a governmental authority.

Source: everydayhealth.com

Source: everydayhealth.com

Advertisement step 4 record a loss on the insurance settlement. Because the internal revenue service does not have any interest in your money unless you have a financial gain, indemnity usually keeps the tax man away. When a business suffers a loss that is covered by an insurance policy, it recognizes a gain in the amount of the insurance proceeds received. Insurance proceeds under § 1033(a)(1). This results in a net nil position for income tax purposes.

Source: insurance-resource.ca

Source: insurance-resource.ca

How do i account for insurance claim in excess of original cost and actual repairs carried out. As a starting point, proceeds will always be taxable to the extent of the cost of repairs. How do i account for insurance claim in excess of original cost and actual repairs carried out. Rather, you simply return to where you were before the loss. $ 4,500.00 what is spent to get its value back and $ 400.00 is gain because owners got paid $.

Source: aami.com.au

Source: aami.com.au

How do i account for insurance claim in excess of original cost and actual repairs carried out. The law authorizes an important tax break for a property owner who collects insurance (or other compensation) for property lost due to fire, theft or condemnation by a governmental authority. It also is important to evaluate whether any losses related to property damage have been properly recorded. Insurance payments are to restore the property to the condition before the event.cash outlay more than the insurance payout is either expense as a repair or improvement., insurance payout more than the expense outlay you have a taxable gain. Rather, you simply return to where you were before the loss.

Source: itrtoday.com

Source: itrtoday.com

The insurance proceeds received are greater than the cost of the repairs. When you repair your vehicle, for example, you do not gain from the claim; Because the internal revenue service does not have any interest in your money unless you have a financial gain, indemnity usually keeps the tax man away. Insurance claim received in for replacement value in excess of written down value. Insurance is the most common way to be reimbursed for a casualty loss.

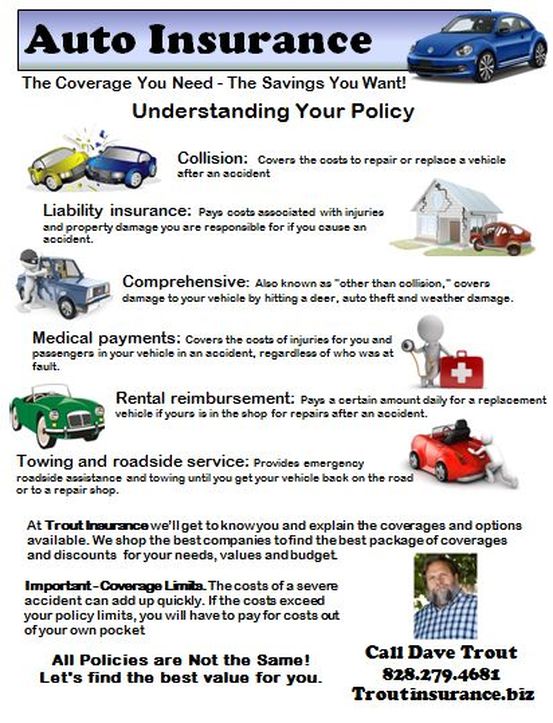

Source: troutinsurance.com

Source: troutinsurance.com

The remaining amount, also known as the excess proceeds, can be legally kept as long as it is the actual cash value component of the claim. The cost of the workshop, many years ago, was £20k.this is the book value in the accounts. If the total conversion gain exceeds this exclusion amount, the owner may defer. Advertisement step 4 record a loss on the insurance settlement. Debit insurance proceeds to the repairs account.

Source: firstireland.ie

Source: firstireland.ie

Taxpayer intends to use part of the casualty insurance proceeds to acquire qualifying replacement property to the extent the proceeds exceeded the amount used for the demolition of the destroyed buildings and the repair of the damaged property. This reinvestment, if timely, will satisfy the Insurance proceeds from property losses are gains to the extent the proceeds exceed the adjusted basis in the property. Insurance proceeds in excess of repairs. Sometimes the insurance company will pay you less than the amount you paid.

The remaining amount, also known as the excess proceeds, can be legally kept as long as it is the actual cash value component of the claim. Plant and equipment lost in fire. Where proceeds exceed the cost of repairs (“the excess”), the tax treatment will depend on whether the property is deemed “repairable” or “irreparably damaged”. Debit insurance proceeds to the repairs account. You must ensure that you understand what that amount is, and you must be able to complete the repairs or rebuilding for that amount.

Source: toppers4u.com

Source: toppers4u.com

$ 4,500.00 what is spent to get its value back and $ 400.00 is gain because owners got paid $. Plant and equipment lost in fire. Because the internal revenue service does not have any interest in your money unless you have a financial gain, indemnity usually keeps the tax man away. However, homeowners may choose to have the work completed for less than the amount. Insurance claim received in for replacement value in excess of written down value.

Source: accountingweb.com

Source: accountingweb.com

The most reasonable approach to recording these proceeds is to wait until they have been received by the company. You must ensure that you understand what that amount is, and you must be able to complete the repairs or rebuilding for that amount. Taxpayers can, however, defer any gain by complying with the rules in irc section 1033. As a starting point, proceeds will always be taxable to the extent of the cost of repairs. When this occurs, the owner can generally exclude up to $250,000 ($500,000 if the owner is married and filing a joint return) of conversion gain.

Source: cheapsr22.us

Source: cheapsr22.us

Sole trader client had a workshop badly damaged by flood. The value of the property after the repairs is not, due to the repairs, more than its value immediately before the casualty. 26 a taxpayer must also reduce its basis by the amount of any insurance reimbursement, even if no deduction is claimed for the casualty loss. Where proceeds exceed the cost of repairs (“the excess”), the tax treatment will depend on whether the property is deemed “repairable” or “irreparably damaged”. Advertisement step 4 record a loss on the insurance settlement.

Source: smart-sure.com

Source: smart-sure.com

The money received from the insurance provider is often enough to cover the cost of repair or replacement. When a business suffers a loss that is covered by an insurance policy, it recognizes a gain in the amount of the insurance proceeds received. The casualty loss is based on reduction of fmv. However, homeowners may choose to have the work completed for less than the amount. In this way, most property insurance proceeds are not taxable.

Source: sec.gov

Source: sec.gov

Plant and equipment lost in fire. The cost of the workshop, many years ago, was £20k.this is the book value in the accounts. If the insurance payment is short of the costs of repairs, you report the shortage as repairs and maintenance. Plant and equipment lost in fire. This results in a net nil position for income tax purposes.

Source: clubsat.com.ar

Source: clubsat.com.ar

The money received from the insurance provider is often enough to cover the cost of repair or replacement. If the insurance payment is short of the costs of repairs, you report the shortage as repairs and maintenance. Taxpayers who have insurance must file a timely formal claim with their insurance providers, regardless of whether or not it puts them at risk of increased premiums or dropped coverage in the future. Debit insurance proceeds to the repairs account. The value of the property after the repairs is not, due to the repairs, more than its value immediately before the casualty.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance proceeds in excess of repairs by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.