Insurance reserves explained information

Home » Trending » Insurance reserves explained informationYour Insurance reserves explained images are ready. Insurance reserves explained are a topic that is being searched for and liked by netizens today. You can Find and Download the Insurance reserves explained files here. Download all royalty-free images.

If you’re looking for insurance reserves explained pictures information related to the insurance reserves explained keyword, you have come to the ideal site. Our site frequently gives you hints for seeing the maximum quality video and image content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

Insurance Reserves Explained. Loss adjustment reserves are reserves set aside to pay for claims adjusters, legal assistance, investigators and other expenses associated with settling claims. The insurer must be able to quantify this liability if it is A reserve is profits that have been appropriated for a particular purpose. How does an insurance company set reserves?

18 Assurance vie explained A Insurance From philippplein.us

18 Assurance vie explained A Insurance From philippplein.us

Insurers establish unearned premium reserves and loss reserves indicated on their balance sheets. The national association of insurance commissioners (naic) requires insurance companies to maintain an interest maintenance reserve. The most common reason for establishing a. Reserves by an amount greater than that established by the reinsurer. When you buy insurance, you make payments to the insurance company. Funds which are set aside by an insurance company for the purpose of meeting obligations as they fall due.

Insurers establish unearned premium reserves and loss reserves indicated on their balance sheets.

Reserves by an amount greater than that established by the reinsurer. This is done to keep funds from being used for other purposes, such as paying dividends or buying back shares. Accident accounting reported case ending beginning incurred Technical reserves are the amounts insurance companies set aside from profits to cover claims. Reserves by an amount greater than that established by the reinsurer. What are they and what are they designed to do?

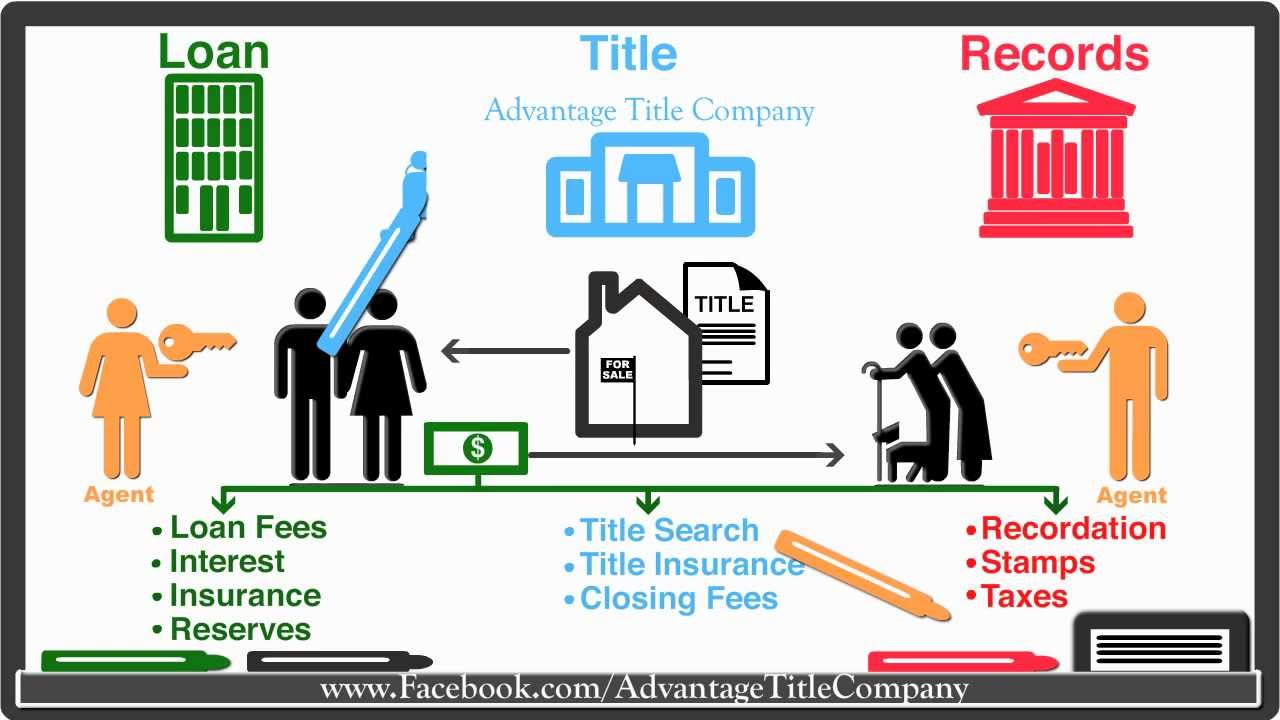

Source: mortgagelab.co.nz

Source: mortgagelab.co.nz

Reserve — an amount of money earmarked for a specific purpose. This is done to keep funds from being used for other purposes, such as paying dividends or buying back shares. When you buy insurance, you make payments to the insurance company. Statutory reserving practices for health insurance in general are governed by the national association of insurance commissioners’ (naic) model minimum reserve standards for individual and group health insurance. Reserves by an amount greater than that established by the reinsurer.

Source: boomlive.in

Source: boomlive.in

That the reinsurer will hold mirror reserves, the reinsurer is under no obligation to hold the higher reserve. The national association of insurance commissioners (naic) requires insurance companies to maintain an interest maintenance reserve. Likewise, the national association of insurance commissioners (naic) requires insurance companies. Reserve — an amount of money earmarked for a specific purpose. Required reserves ensure payment of policyholder benefits a large percentage of each premium dollar calculated by actuaries for each company goes into the policyowner�s reserve fund.

Source: youtube.com

Source: youtube.com

Likewise, the national association of insurance commissioners (naic) requires insurance companies. How does an insurance company set reserves? That the reinsurer will hold mirror reserves, the reinsurer is under no obligation to hold the higher reserve. Any reinsurance receivables will be deducted from the technical reserves, as will deferred acquisition costs (the acquisition or marketing costs relating to policies which have not expired. The purpose of this reserve is to ensure that insurers accumulate enough financial assets to offset some of the losses they incur as a result of changes in the interest rate.

Source: philippplein.us

Source: philippplein.us

1.1.3 claims reserves claims reserves represent estimates of the amounts that the insurer expects to pay in the future Often, this forces the ceding company to either negotiate with its reinsurer that the reinsurer hold the higher reserve, or to take less of a reserve credit than it could justify under its own state’s reserve regulations. Technical reserves are the amounts insurance companies set aside from profits to cover claims. You can buy many types of insurance, including auto, home, life, health, and disability insurance. • case reserves are established at $10 once the claim is reported • the initial ibnr is set based on 30% of earned premium, run off evenly over the following three months.

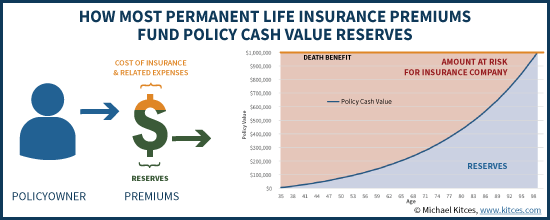

There are many ways to manage such profits, with the insurance regulators, the irs, and fasb all having different goals. One of the primary purposes of life insurance reserves is to manage the timing of profits. Technical reserves include the unearned premium reserve and the outstanding claims reserve. A valuation reserve refers to the assets that life insurance companies. These payments are called premiums. in exchange for paying your premiums, you are covered from certain risks.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

What are they and what are they designed to do? Reserve — an amount of money earmarked for a specific purpose. In this paper, a method for. Loss adjustment reserves are reserves set aside to pay for claims adjusters, legal assistance, investigators and other expenses associated with settling claims. Funds which are set aside by an insurance company for the purpose of meeting obligations as they fall due.

Source: marketcalls.in

Source: marketcalls.in

• case reserves are established at $10 once the claim is reported • the initial ibnr is set based on 30% of earned premium, run off evenly over the following three months. The insurance company agrees to pay you for losses if they occur. Voluntary reserve refers to fiscal reserve or other liquid assets set aside by insurance companies. The reserves required at any time are the resources needed to meet the costs, as they arise, of all claims not finally settled at that time. Insurers establish unearned premium reserves and loss reserves indicated on their balance sheets.

The dictionary of insurance defines a “reserve” as: That the reinsurer will hold mirror reserves, the reinsurer is under no obligation to hold the higher reserve. The purpose of this reserve is to ensure that insurers accumulate enough financial assets to offset some of the losses they incur as a result of changes in the interest rate. Reserves by an amount greater than that established by the reinsurer. Likewise, the national association of insurance commissioners (naic) requires insurance companies.

Source: bankrate.com

Source: bankrate.com

Insurers establish unearned premium reserves and loss reserves indicated on their balance sheets. Workers compensation reserves explained — fee insurance. The insurer must be able to quantify this liability if it is A valuation reserve refers to the assets that life insurance companies. Insurers establish unearned premium reserves and loss reserves indicated on their balance sheets.

Source: thebalance.com

Source: thebalance.com

Voluntary reserve refers to fiscal reserve or other liquid assets set aside by insurance companies. Technical reserves are the amounts insurance companies set aside from profits to cover claims. Required reserves ensure payment of policyholder benefits a large percentage of each premium dollar calculated by actuaries for each company goes into the policyowner�s reserve fund. This policy reserve (legal reserve) fund is a liability to the life insurance company. A valuation reserve refers to the assets that life insurance companies.

Source: sludgeport512.web.fc2.com

Source: sludgeport512.web.fc2.com

These payments are called premiums. in exchange for paying your premiums, you are covered from certain risks. The reserves are funds set aside to pay future obligations. When you buy insurance, you make payments to the insurance company. Workers compensation reserves explained — fee insurance. Insuranceopedia explains asset valuation reserve (avr) banks and other financial institutions are legally mandated to have asset valuation reserve to protect their clients from being disenfranchised should these institutions run into fiscal problems.

Source: npa1.org

Source: npa1.org

Required reserves ensure payment of policyholder benefits a large percentage of each premium dollar calculated by actuaries for each company goes into the policyowner�s reserve fund. This is done to keep funds from being used for other purposes, such as paying dividends or buying back shares. Funds which are set aside by an insurance company for the purpose of meeting obligations as they fall due. Unearned premium reserves show the aggregate amount of premiums that would be returned to policyholders if all policies were canceled on the date the balance sheet was prepared. Technical reserves include the unearned premium reserve and the outstanding claims reserve.

Source: martinlee.sg

Source: martinlee.sg

Funds which are set aside by an insurance company for the purpose of meeting obligations as they fall due. The balance sheet reserves of insurance companies are regulated so that these companies have sufficient reserves to pay client claims. Reserve — an amount of money earmarked for a specific purpose. The next blog will provide spreadsheet demonstrations on how this works. • case reserves are established at $10 once the claim is reported • the initial ibnr is set based on 30% of earned premium, run off evenly over the following three months.

Source: philippplein.us

Source: philippplein.us

The reserves required at any time are the resources needed to meet the costs, as they arise, of all claims not finally settled at that time. • case reserves are established at $10 once the claim is reported • the initial ibnr is set based on 30% of earned premium, run off evenly over the following three months. These payments are called premiums. in exchange for paying your premiums, you are covered from certain risks. Claim reserves the delay between event and settlement dates means that the insurer must set up reserves in respect of those claims still to be settled. Voluntary reserve refers to fiscal reserve or other liquid assets set aside by insurance companies.

Source: tenfreeprintablecalendar.com

Source: tenfreeprintablecalendar.com

This is done to keep funds from being used for other purposes, such as paying dividends or buying back shares. Reserves are sometimes set up to purchase fixed assets, pay an expected legal settlement, pay bonuses, pay off debt, pay for repairs and maintenance, and so forth. Claim reserves the delay between event and settlement dates means that the insurer must set up reserves in respect of those claims still to be settled. The reserves required at any time are the resources needed to meet the costs, as they arise, of all claims not finally settled at that time. Likewise, the national association of insurance commissioners (naic) requires insurance companies.

Source: riskheads.org

Source: riskheads.org

Claim reserves the delay between event and settlement dates means that the insurer must set up reserves in respect of those claims still to be settled. Accident accounting reported case ending beginning incurred The dictionary of insurance defines a “reserve” as: How does an insurance company set reserves? Technical reserves include the unearned premium reserve and the outstanding claims reserve.

Source: brynescapital.com

Source: brynescapital.com

The purpose of this reserve is to ensure that insurers accumulate enough financial assets to offset some of the losses they incur as a result of changes in the interest rate. Funds which are set aside by an insurance company for the purpose of meeting obligations as they fall due. When you buy insurance, you make payments to the insurance company. The purpose of this reserve is to ensure that insurers accumulate enough financial assets to offset some of the losses they incur as a result of changes in the interest rate. A reserve is profits that have been appropriated for a particular purpose.

Source: ognikowy-hotel-panfu.blogspot.com

Source: ognikowy-hotel-panfu.blogspot.com

These payments are called premiums. in exchange for paying your premiums, you are covered from certain risks. Technical reserves are the amounts insurance companies set aside from profits to cover claims. The next blog will provide spreadsheet demonstrations on how this works. How does an insurance company set reserves? How does an insurance company set reserves?

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance reserves explained by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.