Insurance risk manager information

Home » Trend » Insurance risk manager informationYour Insurance risk manager images are ready. Insurance risk manager are a topic that is being searched for and liked by netizens now. You can Get the Insurance risk manager files here. Download all free photos and vectors.

If you’re searching for insurance risk manager images information connected with to the insurance risk manager interest, you have pay a visit to the right site. Our website always gives you suggestions for refferencing the maximum quality video and picture content, please kindly hunt and locate more informative video content and graphics that fit your interests.

Insurance Risk Manager. Are you looking for a job in risk management? Introduction of business course code: How much does a risk and insurance manager make? They recommend and implement precautionary measures for loss prevention and damage and associated cost reduction.

Insurance Risk Management Risk Risk & capital From pwc.com.au

Insurance Risk Management Risk Risk & capital From pwc.com.au

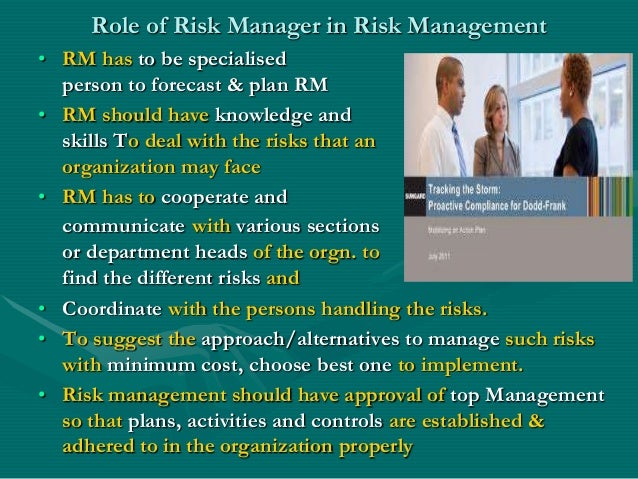

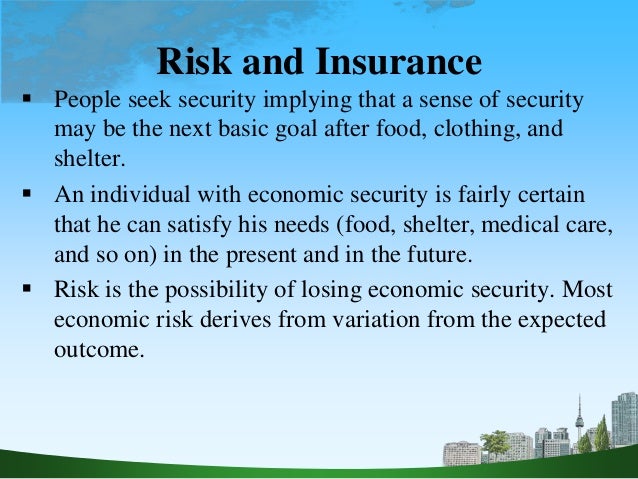

Risk manager — an individual responsible for managing an organization�s risks and minimizing the adverse impact of losses on the achievement of the organization�s objectives. Insurance industry by shriram gokte background insurance companies are in the business of taking risks. In exchange for the payment of a known loss (the premium), insurance transfers the financial consequences of covered loss. As a direct corollary, therefore, insurance companies should be good at managing Insurance risk management — a term for the traditional risk management concept, which focuses primarily on pure risks rather than operational, market, credit, and other types of risk. Risk management work typically involves the application of mathematical and.

Module 2 risk management and insurance.

Additionally, insurance risk manager coordinates policy renewals and applications. An insurance risk manager is responsible for identifying the critical causes of loss and accidents that may result in increased insurance rates or deficiencies in cash flow for insurance companies, agencies, or brokerages. Risk management and insurance course name: This term is frequently used to distinguish between the traditional risk management concept and the newer practice of enterprise risk management (erm). How sas ® supports insurance risk management. A single, integrated framework for both regulatory compliance and business requirements.

Source: intechrisk.com

Source: intechrisk.com

Insurance is one of many tools available to risk managers and only one part of the process. While some duties vary based on employer, these professionals are largely tasked with assessing the risks associated with an organization�s operations and ensuring a company has purchased enough insurance to prevent financial losses in the event a claim does have to be filed. An insurance risk manager is responsible for identifying the critical causes of loss and accidents that may result in increased insurance rates or deficiencies in cash flow for insurance companies, agencies, or brokerages. Insurance risk managers may work for a variety of different business types. Typically reports to a director.

Source: researchgate.net

Source: researchgate.net

An insurance risk manager is responsible for identifying the critical causes of loss and accidents that may result in increased insurance rates or deficiencies in cash flow for insurance companies, agencies, or brokerages. Daily management of company risk portfolio. Insurance industry by shriram gokte background insurance companies are in the business of taking risks. Insurance risk management — a term for the traditional risk management concept, which focuses primarily on pure risks rather than operational, market, credit, and other types of risk. Access the newest and freshest risk management jobs available with insurancejobs.com by searching jobs and signing up for a free seeker account and job alert.

Insurance is one of many tools available to risk managers and only one part of the process. As a direct corollary, therefore, insurance companies should be good at managing It is a form of risk management primarily used to hedge against the risk of a contingent, uncertain loss. Additionally, insurance risk manager coordinates policy renewals and applications. This term is frequently used to distinguish between the traditional risk management concept and the newer practice of enterprise risk management (erm).

Source: kinlochcg.com

Source: kinlochcg.com

Most insurance risk managers work in an office setting. Risk management plans are never finished. This term is frequently used to distinguish between the traditional risk management concept and the newer practice of enterprise risk management (erm). The insurance risk management team works closely with the actuarial and other specialist risk teams, and are market leaders in all aspects of governance, regulatory and risk management, compliance, accountability, conduct and culture. Temporarily remote in toronto, on.

Source: advancedwealth.com

Source: advancedwealth.com

Module 2 risk management and insurance. Risk management and insurance course name: Salary estimates are based on 9 salaries submitted anonymously to glassdoor by risk and insurance manager employees. Introduction of business course code: Module 2 risk management and insurance.

Source: tecnics.com

Source: tecnics.com

Risk management plans are never finished. Filter by location to see risk and insurance manager salaries in your area. 672 insurance risk manager jobs. Insurance risk managers (irm) is a boutique agency focused on providing insurance and risk management solutions to individuals and privately held businesses. Ensure that premiums are allocated and paid in accordance with the financial management processes and within prescribed timeframes;

Source: slideserve.com

Source: slideserve.com

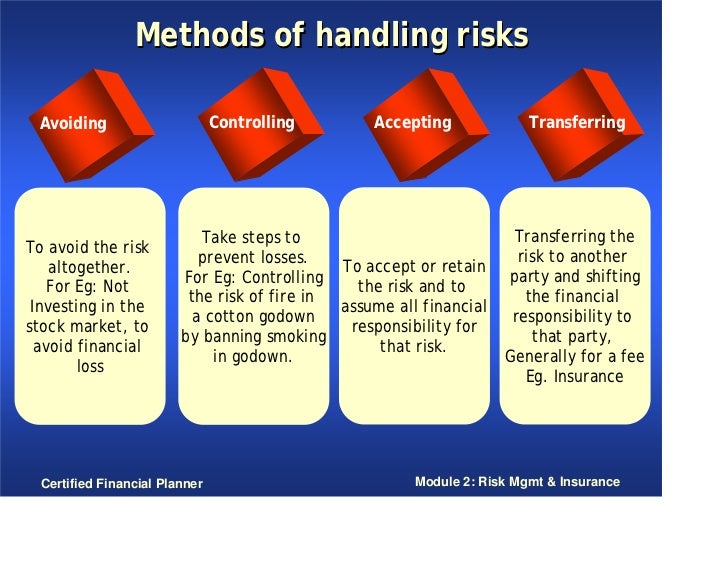

A systematic approach to risk management: Insurance risk managers may work for a variety of different business types. Manage large claims and provide support to the insurance and risk officer where needed on smaller claims; Filter by location to see risk and insurance manager salaries in your area. They recommend and implement precautionary measures for loss prevention and damage and associated cost reduction.

Source: dqindia.com

Source: dqindia.com

In exchange for the payment of a known loss (the premium), insurance transfers the financial consequences of covered loss. Your customised workforce resilience risk management solution with international sos acts a complementary extension of your risk management approach. Insurance is one of many tools available to risk managers and only one part of the process. Insurance risk managers may work for a variety of different business types. This term is frequently used to distinguish between the traditional risk management concept and the newer practice of enterprise risk management (erm).

Source: dreamstime.com

Source: dreamstime.com

They recommend and implement precautionary measures for loss prevention and damage and associated cost reduction. How sas ® supports insurance risk management. In exchange for the payment of a known loss (the premium), insurance transfers the financial consequences of covered loss. This term is frequently used to distinguish between the traditional risk management concept and the newer practice of enterprise risk management (erm). Including a deep understanding of customer operations and industry exposures in order to develop strategies to mitigate risk.….

Source: slideshare.net

Source: slideshare.net

Additionally, insurance risk manager coordinates policy renewals and applications. The insurance risk management team works closely with the actuarial and other specialist risk teams, and are market leaders in all aspects of governance, regulatory and risk management, compliance, accountability, conduct and culture. An insurance risk manager is responsible for identifying the critical causes of loss and accidents that may result in increased insurance rates or deficiencies in cash flow for insurance companies, agencies, or brokerages. 672 insurance risk manager jobs. Ensure that premiums are allocated and paid in accordance with the financial management processes and within prescribed timeframes;

Source: pdilms.com

Source: pdilms.com

The role of insurance in risk management is this: You’ll have access to risk management jobs from the top corporations, risk organizations, brokers, insurance companies, consulting firms, and more. And the ability to spread the risk of these events occurring across other insurance underwriter�s in the market. Are you looking for a job in risk management? While some duties vary based on employer, these professionals are largely tasked with assessing the risks associated with an organization�s operations and ensuring a company has purchased enough insurance to prevent financial losses in the event a claim does have to be filed.

Source: slideshare.net

Source: slideshare.net

Filter by location to see risk and insurance manager salaries in your area. Typically reports to a director. Insurance is one of many tools available to risk managers and only one part of the process. And the ability to spread the risk of these events occurring across other insurance underwriter�s in the market. Senior manager, insurance & risk.

Source: pwc.com.au

Source: pwc.com.au

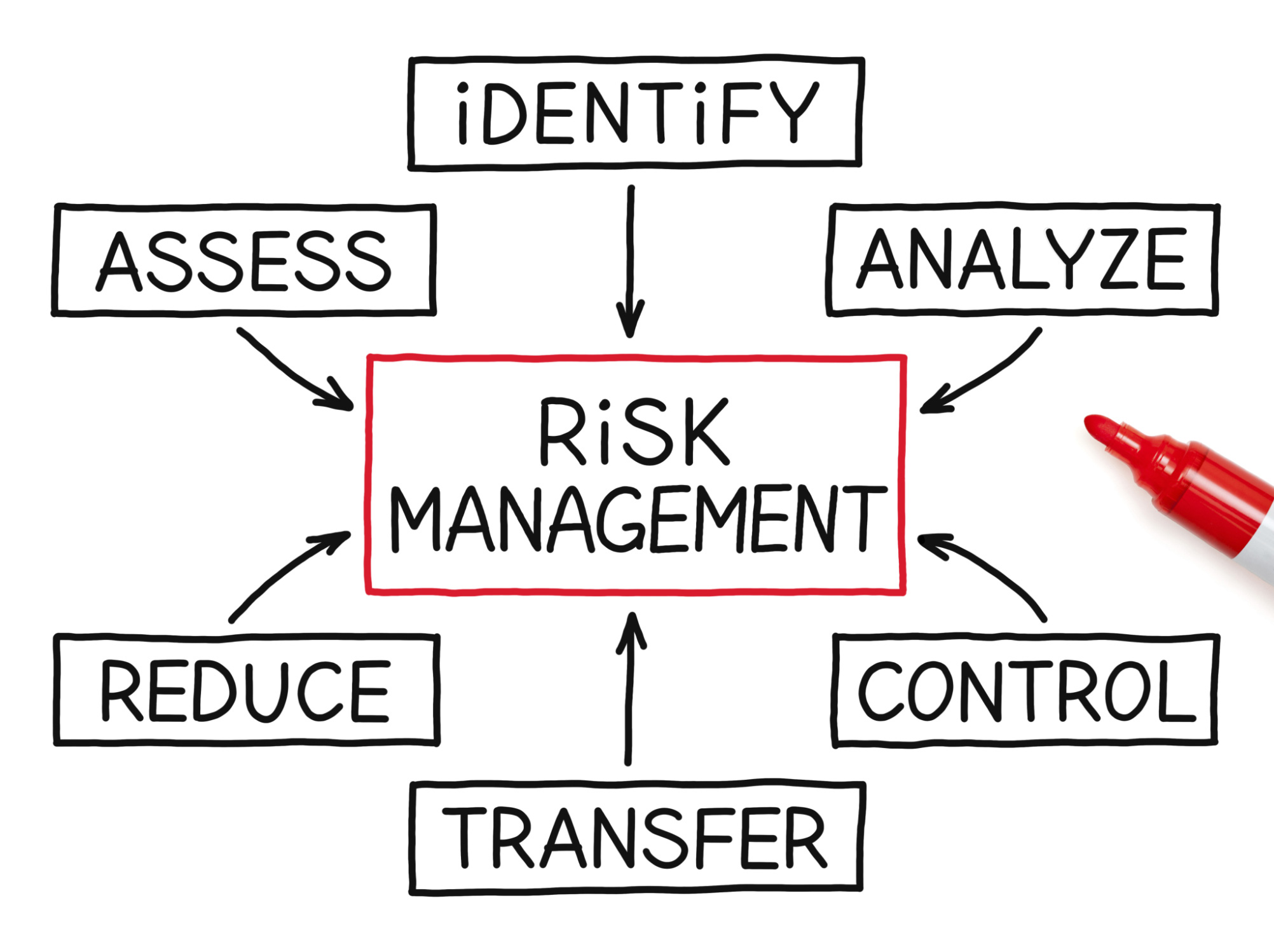

As a direct corollary, therefore, insurance companies should be good at managing Risk management involves five basic steps: Salary estimates are based on 9 salaries submitted anonymously to glassdoor by risk and insurance manager employees. Leads the delivery of “best in class” insurance services to the sector guided by effective risk management practices. Daily management of company risk portfolio.

Source: fiduciawealth.ca

Source: fiduciawealth.ca

Risk management plans are never finished. Typically reports to a director. Risk manager — an individual responsible for managing an organization�s risks and minimizing the adverse impact of losses on the achievement of the organization�s objectives. Insurance industry by shriram gokte background insurance companies are in the business of taking risks. They must be revised periodically because risk, risk control, and risk transfer methods change constantly.

Source: divres.com

Source: divres.com

Salary estimates are based on 9 salaries submitted anonymously to glassdoor by risk and insurance manager employees. Module 2 risk management and insurance. Are you looking for a job in risk management? A systematic approach to risk management: Insurance is one of many tools available to risk managers and only one part of the process.

Source: pwc.com.au

Source: pwc.com.au

Temporarily remote in toronto, on. An insurance risk manager is responsible for identifying the critical causes of loss and accidents that may result in increased insurance rates or deficiencies in cash flow for insurance companies, agencies, or brokerages. Risk manager — an individual responsible for managing an organization�s risks and minimizing the adverse impact of losses on the achievement of the organization�s objectives. This term is frequently used to distinguish between the traditional risk management concept and the newer practice of enterprise risk management (erm). Insurance is one of many tools available to risk managers and only one part of the process.

Source: kopykitab.com

Source: kopykitab.com

(1) traditionally, risk managers have focused on event risks, but some organizations have broadened the role to include other types of risk (e.g., operational risks). Insurance is a component of risk management, not a substitute for it. Filter by location to see risk and insurance manager salaries in your area. Ensure that premiums are allocated and paid in accordance with the financial management processes and within prescribed timeframes; Your customised workforce resilience risk management solution with international sos acts a complementary extension of your risk management approach.

Source: slideshare.net

Source: slideshare.net

Risk management and insurance course name: Insurance risk managers may work for a variety of different business types. Insurance risk management is the assessment and quantification of the likelihood and financial impact of events that may occur in the customer�s world that require settlement by the insurer; Insurance risk managers (irm) is a boutique agency focused on providing insurance and risk management solutions to individuals and privately held businesses. How much does a risk and insurance manager make?

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance risk manager by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.