Insurance score codes information

Home » Trending » Insurance score codes informationYour Insurance score codes images are ready. Insurance score codes are a topic that is being searched for and liked by netizens now. You can Find and Download the Insurance score codes files here. Find and Download all free photos.

If you’re looking for insurance score codes pictures information linked to the insurance score codes topic, you have visit the ideal site. Our site always gives you hints for seeing the highest quality video and image content, please kindly hunt and find more informative video content and images that fit your interests.

Insurance Score Codes. Planning for your future means managing your present, building a secure foundation to support you, rain or shine. Are insurance companies authorized to obtain a copy of the consumer’s credit report? Listed below are the naic codes for our top 12 best car insurance providers for your convenience: Believes information regarding insurance scores and reason codes is valuable to consumers and offers our lexisnexis risk solutions inc.

Anchor Insurance Reviews at Insurance From revisi.net

Anchor Insurance Reviews at Insurance From revisi.net

Is the leading provider of insurance scores. Part of managing your life is managing your credit; Find more information about how you can improve insurance score. An insurance score is a score calculated from information on your credit report. Credit information is very predictive of future accidents or insurance claims, which is why progressive, and most insurers, uses this information to help develop more accurate rates. An insurance score, reason codes, a customized message based on the credit data and the carrier’s underwriting guidelines, or a combination of these information products.

The reason codes will identify up to four principal factors that most greatly influenced the score.

These lists may be used as a reference when taking adverse action or in customer service when responding to consumers’ inquiries as to the reasons for declination. An insurance score is a number that the insurance industry comes up with, to determine whether you’re going to have a high monthly premium, a low one, or something in between. An insurance score is a credit rating used by insurance companies to assess a potential insured consumer�s level of risk. Part of managing your life is managing your credit; These lists may be used as a reference when taking adverse action or in customer service when responding to consumers’ inquiries as to the reasons for declination. Transunion groups its insurance risk score reason codes into four categories:

Source: classcodes.com

Source: classcodes.com

Insurance scores can help insurers assess risk when writing and rating policies—a fact that often works to the advantage of consumers with good credit histories. General codes (g) provide a picture of your credit profile. Planning for your future means managing your present, building a secure foundation to support you, rain or shine. Most scoring systems generate “reason codes” in addition to the numeric score. Your insurance company assigns you a score based on factors that reveal how good you are with money, much like those that make up your credit score.

Source: classcodes.net

Source: classcodes.net

This means paying your bills on time and maintaining low balances. A good insurance score is roughly 700 or higher, though it differs by company. You can improve your auto insurance score by checking your credit reports for errors, managing credit responsibly, and building a long credit history. Find more information about how you can improve insurance score. This means paying your bills on time and maintaining low balances.

Source: npa1.org

Source: npa1.org

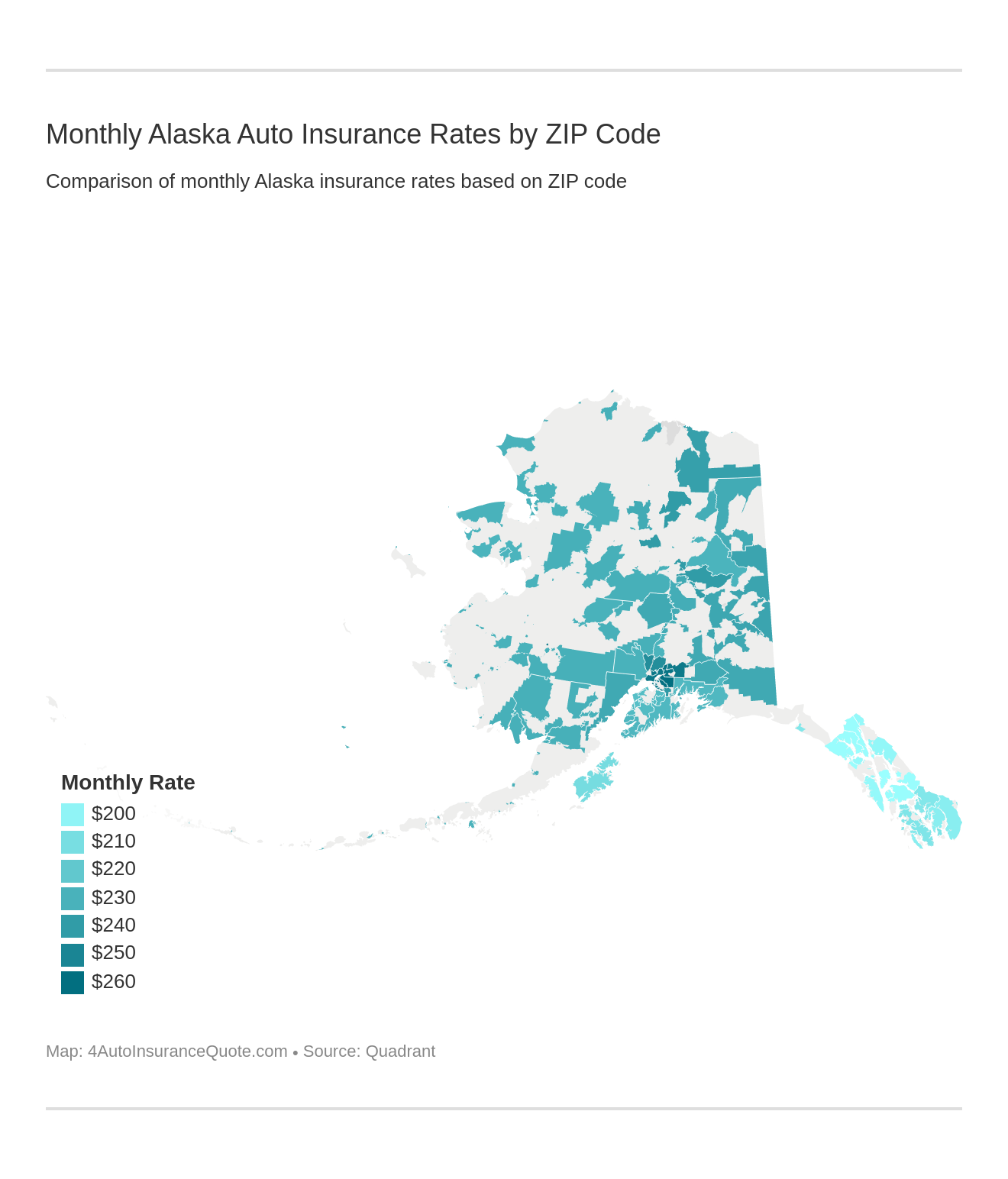

There is no direct relationship to financial credit scores used in lending decisions, as insurance scores are not intended to measure creditworthiness, but rather to predict risk.insurance companies use insurance scores for underwriting decisions,. Underwriters use this score, along with a few other factors, such as your past claims and zip code, to assign your risk level and set your premium. Transunion groups its insurance risk score reason codes into four categories: For instance, with auto insurance, if the predictors indicate there is an. Examples include length of credit history, number of credit lines and good payment history.

Source: generalliabilityshop.com

Source: generalliabilityshop.com

For instance, with auto insurance, if the predictors indicate there is an. Lexisnexis is considered a consumer reporting agency under the federal fair credit reporting act and i. An insurance score is a credit rating used by insurance companies to assess a potential insured consumer�s level of risk. It’s mostly calculated from your claims history and your credit score, so it’s also referred to as a “credit insurance score.”. The insurance score code is used to underwrite or rate the policy, but is only one of many different factors that are considered.

Source: thepinkhot.blogspot.com

Source: thepinkhot.blogspot.com

Score, which is a predictor of future insurance loss, could have an adverse impact on some other score, such as one used for mortgage or auto fi nance purposes. An insurance score is a credit rating used by insurance companies to assess a potential insured consumer�s level of risk. These lists may be used as a reference when taking adverse action or in customer service when responding to consumers’ inquiries as to the reasons for declination. Are insurance companies authorized to obtain a copy of the consumer’s credit report? Reason codes fall into five major buckets, and each can offer advice about building your scores:

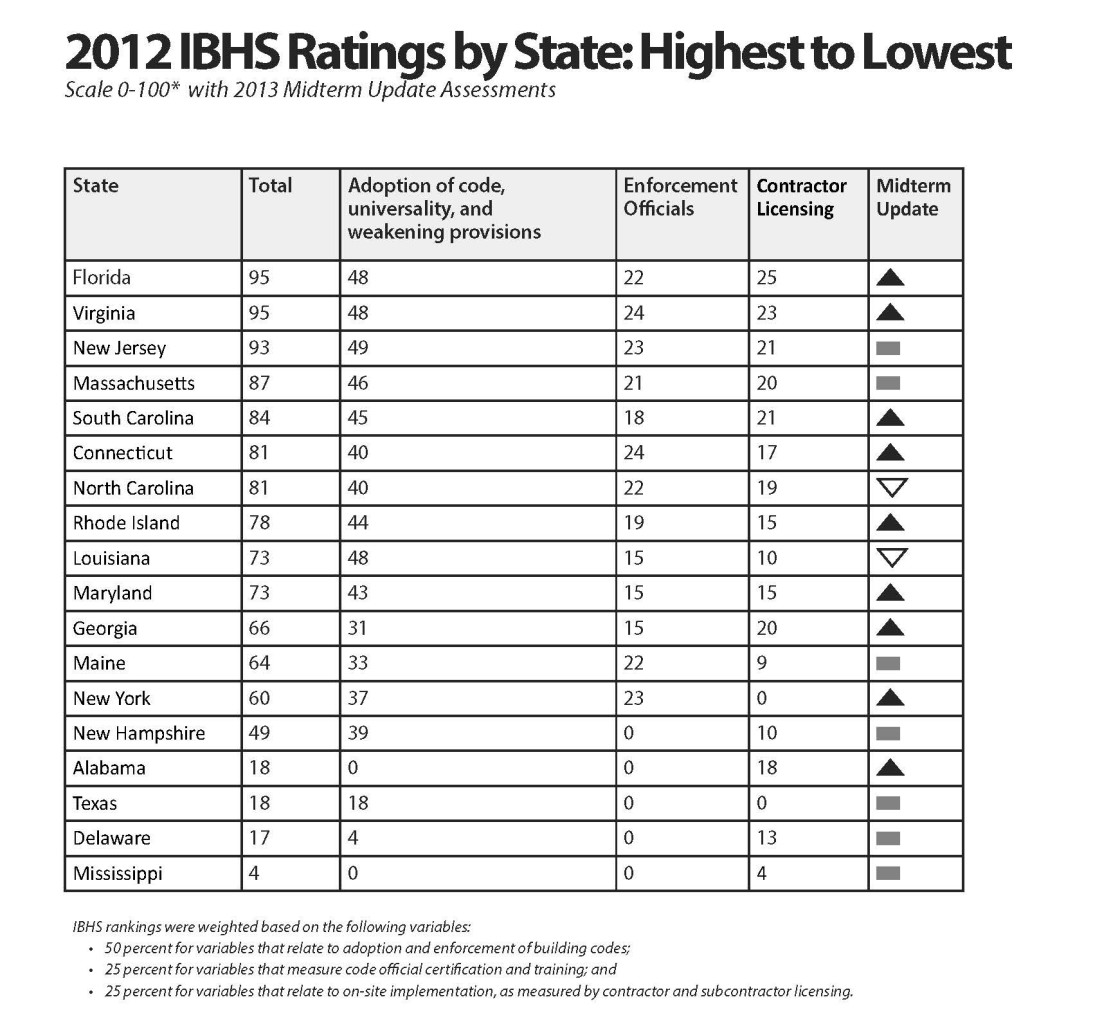

Source: constructionspecifier.com

Source: constructionspecifier.com

Part of managing your life is managing your credit; What your credit score reason code means. However, this does not include mortgage accounts or installment accounts with a credit limit of $50,000 or. The following lists display the score reason codes and associated reason statements for fico scores across the major us credit reporting agencies. Most scoring systems generate “reason codes” in addition to the numeric score.

Source: individuals.healthreformquotes.com

Source: individuals.healthreformquotes.com

The naic is an authoritative source for insurance information. They assign unique codes to each carrier group and to each carrier. Is the leading provider of insurance scores. However, lexisnexis risk solutions inc. The naic is an authoritative source for insurance information.

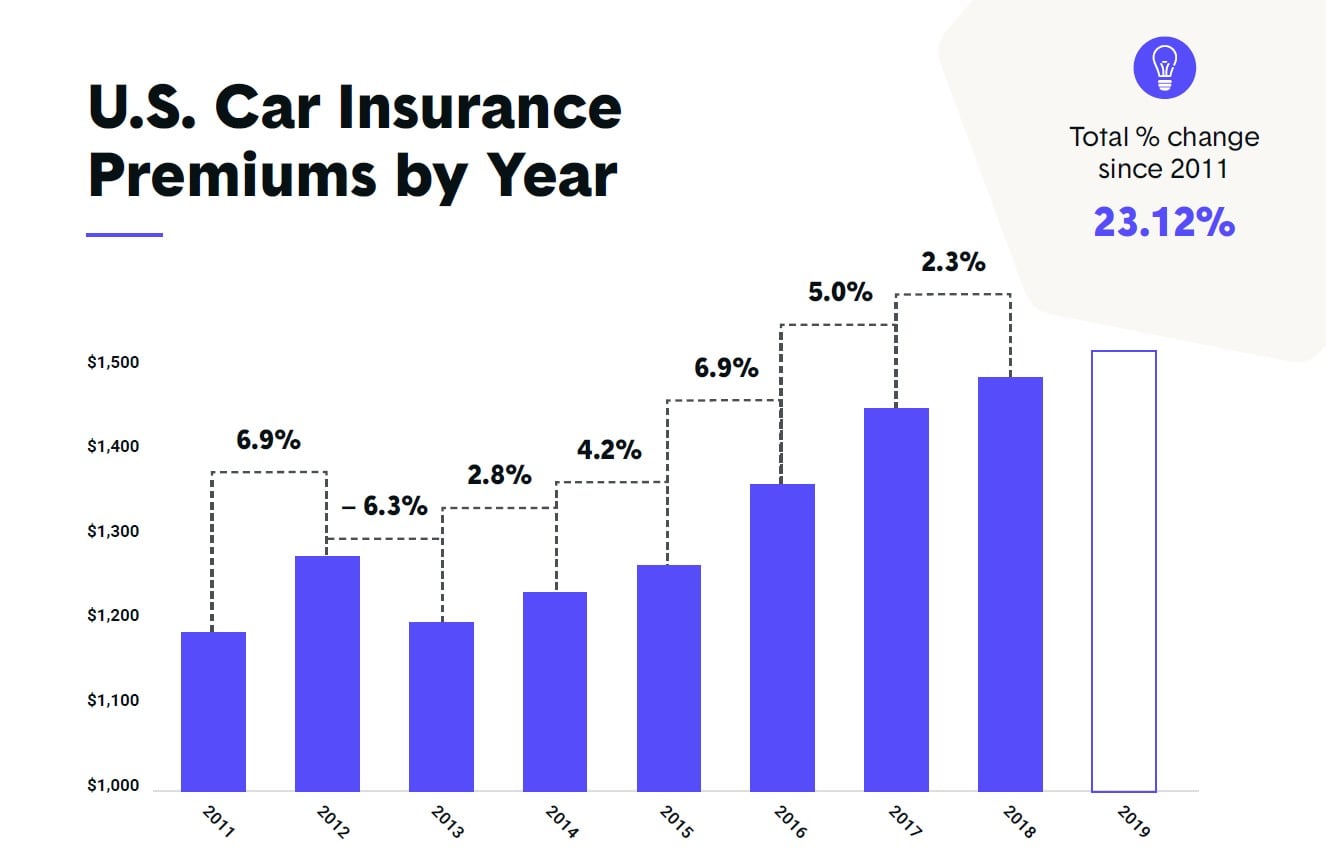

Source: autoguide.com

Source: autoguide.com

The insurance score is one of the primary determinants in how much monthly. Attracttm insurance score, along with a credit report, on www.choicetrust.com at a charge. General codes (g) provide a picture of your credit profile. Credit information can be very predictive of future accidents and claims which is why. This means paying your bills on time and maintaining low balances.

Source: valuewalk.com

Source: valuewalk.com

Examples include length of credit history, number of credit lines and good payment history. The insurance score code is used to underwrite or rate the policy, but is only one of many different factors that are considered. Underwriters use this score, along with a few other factors, such as your past claims and zip code, to assign your risk level and set your premium. Reason codes fall into five major buckets, and each can offer advice about building your scores: Planning for your future means managing your present, building a secure foundation to support you, rain or shine.

Source: thepinkhot.blogspot.com

Source: thepinkhot.blogspot.com

The naic is an authoritative source for insurance information. Here is an example of scores and rankings from the lexisnexis. The score predicts the likelihood of certain events occurring. Is the leading provider of insurance scores. Underwriters use this score, along with a few other factors, such as your past claims and zip code, to assign your risk level and set your premium.

Source: thepinkhot.blogspot.com

Source: thepinkhot.blogspot.com

Is the leading provider of insurance scores. This means paying your bills on time and maintaining low balances. Credit information is very predictive of future accidents or insurance claims, which is why progressive, and most insurers, uses this information to help develop more accurate rates. Reason codes fall into five major buckets, and each can offer advice about building your scores: Delinquent accounts or derogatory public records:

Source: mlive.com

Source: mlive.com

Score, which is a predictor of future insurance loss, could have an adverse impact on some other score, such as one used for mortgage or auto fi nance purposes. Part of managing your life is managing your credit; Insurance scores usually come from fair isaac corporation (fico), lexisnexis, and transunion. Accounts considered include credit cards as well as installment loans. However, this does not include mortgage accounts or installment accounts with a credit limit of $50,000 or.

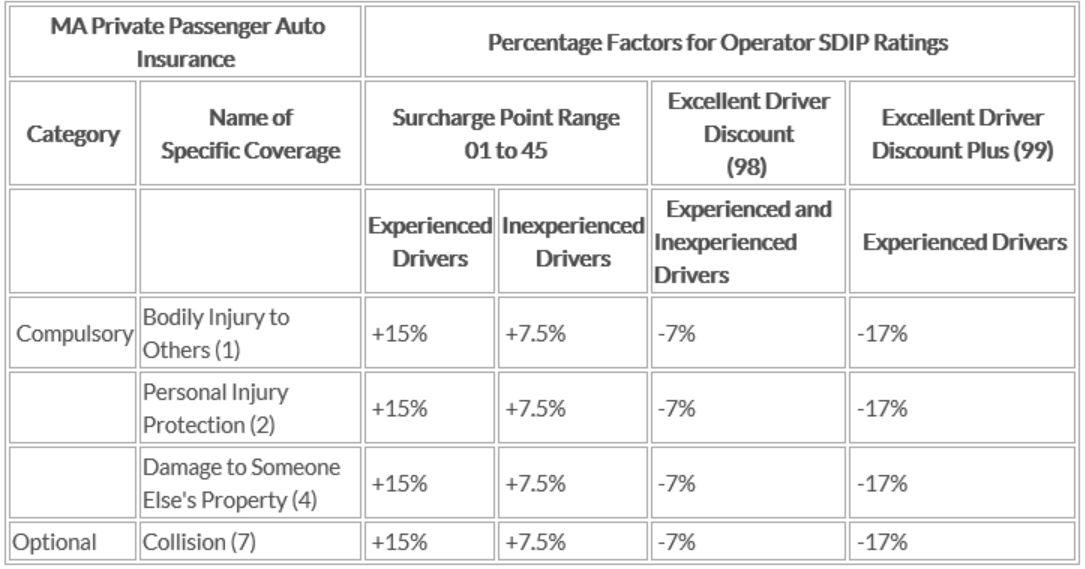

Source: mass.gov

Source: mass.gov

An insurance score is a credit rating used by insurance companies to assess a potential insured consumer�s level of risk. For example, your driving record, coverage limits, vehicle type, and years of driving experience (along with several other factors) are evaluated along with your insurance score code in determining your auto. The insurance score is one of the primary determinants in how much monthly. Insurance scores usually come from fair isaac corporation (fico), lexisnexis, and transunion. Planning for your future means managing your present, building a secure foundation to support you, rain or shine.

Source: verisk.com

Source: verisk.com

For instance, with auto insurance, if the predictors indicate there is an. Attracttm insurance score, along with a credit report, on www.choicetrust.com at a charge. Insurance scores are numerical ratings that are based on a range of factors, including your credit history. How does this affect my insurance score? What your credit score reason code means.

Source: revisi.net

Source: revisi.net

These lists may be used as a reference when taking adverse action or in customer service when responding to consumers’ inquiries as to the reasons for declination. These lists may be used as a reference when taking adverse action or in customer service when responding to consumers’ inquiries as to the reasons for declination. Naic carrier codes are assigned by the national association of insurance commissioners (naic). Reserved space for future use 6206 standardized industry classification has an adverse impact on the score Each insurer has its own method for evaluating this credit information.

Source: freetolearnsite.com

Source: freetolearnsite.com

Most scoring systems generate “reason codes” in addition to the numeric score. Find more information about how you can improve insurance score. Are insurance companies authorized to obtain a copy of the consumer’s credit report? Is the leading provider of insurance scores. Credit information can be very predictive of future accidents and claims which is why.

Source: npa1.org

Source: npa1.org

An insurance score is a credit rating used by insurance companies to assess a potential insured consumer�s level of risk. The reason codes will identify up to four principal factors that most greatly influenced the score. An insurance score is a credit rating used by insurance companies to assess a potential insured consumer�s level of risk. For instance, with auto insurance, if the predictors indicate there is an. Believes information regarding insurance scores and reason codes is valuable to consumers and offers our lexisnexis risk solutions inc.

Source: thepinkhot.blogspot.com

Source: thepinkhot.blogspot.com

They assign unique codes to each carrier group and to each carrier. Is the leading provider of insurance scores. Examples include length of credit history, number of credit lines and good payment history. Score, which is a predictor of future insurance loss, could have an adverse impact on some other score, such as one used for mortgage or auto fi nance purposes. The following lists display the score reason codes and associated reason statements for fico scores across the major us credit reporting agencies.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insurance score codes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.