Insurance settlement check Idea

Home » Trending » Insurance settlement check IdeaYour Insurance settlement check images are available. Insurance settlement check are a topic that is being searched for and liked by netizens now. You can Download the Insurance settlement check files here. Get all royalty-free photos and vectors.

If you’re searching for insurance settlement check images information connected with to the insurance settlement check interest, you have come to the right site. Our site always gives you suggestions for downloading the highest quality video and image content, please kindly hunt and find more informative video content and images that fit your interests.

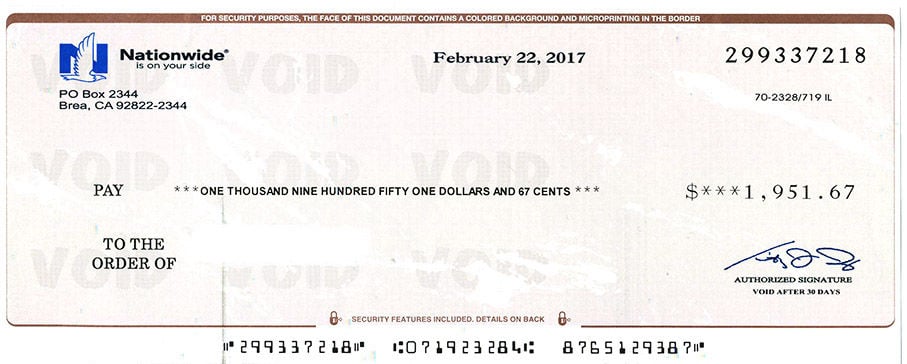

Insurance Settlement Check. Later, if you find other damage, you can reopen the claim and file for an additional amount. Particularly if the settlement check is large the mortgage company needs to be involved. When an insurance company sends a settlement check to us, they are obligated to notify you that they are sending the check to us. While many factors can affect the disbursement of the settlement, generally speaking, the timeline to do so remains consistent.

WHY DOES IT TAKE SO LONG TO SETTLE YOUR PERSONAL INJURY From jupiterlegaladvocates.com

WHY DOES IT TAKE SO LONG TO SETTLE YOUR PERSONAL INJURY From jupiterlegaladvocates.com

The answer is that a private insurance company has three weeks to send you your settlement check, provided your attorney has sent them all the appropriate copies of the closing documents. What happens if you want to keep your totaled car What happens when the settlement check arrives at your lawyer’s office? Settlement checks are received after being awarded compensation for a personal injury claim, whether that compensation is by verdict or settlement. The insurance company releases the check. This insurance company has a legal obligation to write the check as soon as it receives your release, but internal issues may slow this process.

Settlement checks are received after being awarded compensation for a personal injury claim, whether that compensation is by verdict or settlement.

This way you know that your check was sent out. For example, when a person files a lawsuit for personal injury claiming damages, the case may eventually settle where the defendant (or insurance company) agrees to pay a certain amount of money to. Homeowners have discovered that mortgage companies have a great deal of power over their insurance settlement money. In the case of larger settlements, however, every party involved in the process has incentive to delay payment. Because the mortgage company can refuse to release funds and leave home repair plans up in the air, it is important to understand the mortgage check process for homeowner’s insurance settlement claims. Later, if you find other damage, you can reopen the claim and file for an additional amount.

Source: insuranceclaimszoekiya.blogspot.com

Source: insuranceclaimszoekiya.blogspot.com

Otherwise, you�d be waiting, wondering when you�re going to get your money. In the case of larger settlements, however, every party involved in the process has incentive to delay payment. Once the check is received, your attorney will deposit it into a. At some point after your accident, the insurance adjuster will reach out and give you an offer. Particularly if the settlement check is large the mortgage company needs to be involved.

Source: advokatandrosenberg.com

Source: advokatandrosenberg.com

Once you and the insurance company arrive at a suitable number, the rest of the process should be fairly quick. The typical timeline for the settlement process is four to six weeks. What happens if you want to keep your totaled car Particularly if the settlement check is large the mortgage company needs to be involved. After you’ve signed your own release form in cases involving estates, the defendant�s insurance company receives the document and then issues a fair settlement check.

Source: deseret.com

Source: deseret.com

When the insurance company has received all the required paperwork, including the signed release form, they must process, issue, and mail your check on time. Otherwise, you�d be waiting, wondering when you�re going to get your money. This insurance company has a legal obligation to write the check as soon as it receives your release, but internal issues may slow this process. In most personal injury cases that involve a settlement check, the defendant’s insurance company writes a check to your attorney. Ask to speak in court about.

Source: canonprintermx410.blogspot.com

The first step on the way to settlement is to submit a demand letter to the responsible party’s insurance company. What happens when the settlement check arrives at your lawyer’s office? The majority of injury claims should be resolved in less than three weeks. Your lawyer receives the check and then deducts the percentage of money agreed upon before sending you the balance in the form of another check. Your demand letter should include how the accident happened, how the defendant is responsible for the accident, the extent of your injuries and damages, and how you have suffered because of these damages.

Source: rgisblog.blogspot.com

Source: rgisblog.blogspot.com

This way you know that your check was sent out. The first check you get from your insurance company is often an advance against the total settlement amount, not the final payment. These adjusters will use all kinds of negotiation tactics to try to get you to accept. While many factors can affect the disbursement of the settlement, generally speaking, the timeline to do so remains consistent. In the case of larger settlements, however, every party involved in the process has incentive to delay payment.

Source: zadishqr.blogspot.com

Source: zadishqr.blogspot.com

Otherwise, you�d be waiting, wondering when you�re going to get your money. At some point after your accident, the insurance adjuster will reach out and give you an offer. Cashing an insurance settlement check requires a joint effort among all parties that have a stake in having the insurance settlement check cashed. Your demand letter should include how the accident happened, how the defendant is responsible for the accident, the extent of your injuries and damages, and how you have suffered because of these damages. However, this is where checks can get held up.

Source: intolaw.com

At some point after your accident, the insurance adjuster will reach out and give you an offer. Settlement checks are received after being awarded compensation for a personal injury claim, whether that compensation is by verdict or settlement. The time it takes to collect a settlement payout depends on a number of factors, including the nature of your accident claim and the size of the insurance settlement check. However, the largest delay in receiving your settlement check is the negotiation phase. At some point after your accident, the insurance adjuster will reach out and give you an offer.

Source: hiphollywood.com

Source: hiphollywood.com

The answer is that a private insurance company has three weeks to send you your settlement check, provided your attorney has sent them all the appropriate copies of the closing documents. When the insurance company for the other party agrees to a settlement, you should receive a check approximately three weeks after the filing of all settlement papers. When the insurance company writes the settlement check they will make it to you and the mortgage company. The first step on the way to settlement is to submit a demand letter to the responsible party’s insurance company. What happens when the settlement check arrives at your lawyer’s office?

Source: islander.org

Source: islander.org

Subject to approval by the court, the settlement agreement will create a $15,000,000.00 settlement fund to make payments or give policy credits to eligible exclude yourself from the settlement: Subject to approval by the court, the settlement agreement will create a $15,000,000.00 settlement fund to make payments or give policy credits to eligible exclude yourself from the settlement: These adjusters will use all kinds of negotiation tactics to try to get you to accept. The majority of injury claims should be resolved in less than three weeks. While many factors can affect the disbursement of the settlement, generally speaking, the timeline to do so remains consistent.

Source: abc7chicago.com

Source: abc7chicago.com

This insurance company has a legal obligation to write the check as soon as it receives your release, but internal issues may slow this process. The insurance company releases the check. It takes time for the insurance company to assess the claim when a settlement demand is made together with any pertinent medical bills and documents and any other information needed to resolve the claim. When the insurance company for the other party agrees to a settlement, you should receive a check approximately three weeks after the filing of all settlement papers. What is a personal injury settlement check?

Source: annistonstar.com

Source: annistonstar.com

For example, when a person files a lawsuit for personal injury claiming damages, the case may eventually settle where the defendant (or insurance company) agrees to pay a certain amount of money to. For example, when a person files a lawsuit for personal injury claiming damages, the case may eventually settle where the defendant (or insurance company) agrees to pay a certain amount of money to. The typical timeline for the settlement process is four to six weeks. This means that the other party has essentially accepted responsibility for. Do not accept an insurance settlement check immediately.

Source: advokatandrosenberg.com

Source: advokatandrosenberg.com

Subject to approval by the court, the settlement agreement will create a $15,000,000.00 settlement fund to make payments or give policy credits to eligible exclude yourself from the settlement: The typical timeline for the settlement process is four to six weeks. Your demand letter should include how the accident happened, how the defendant is responsible for the accident, the extent of your injuries and damages, and how you have suffered because of these damages. Homeowners have discovered that mortgage companies have a great deal of power over their insurance settlement money. In the case of larger settlements, however, every party involved in the process has incentive to delay payment.

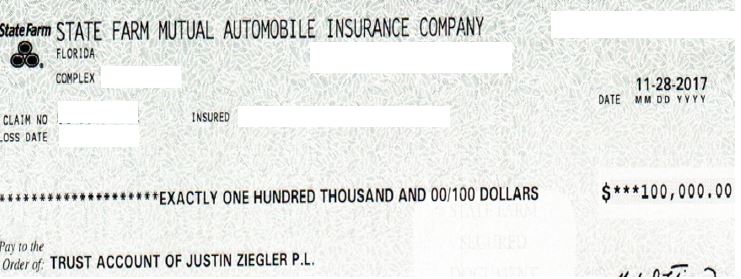

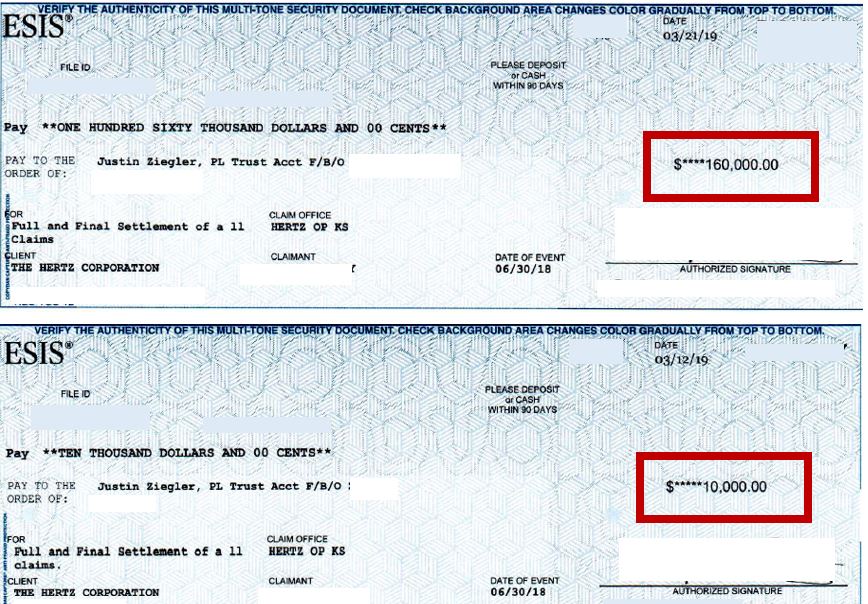

Source: justinziegler.net

Source: justinziegler.net

This means that the other party has essentially accepted responsibility for. Once the check is received, your attorney will deposit it into a. When the settlement amount is relatively low, a check could be issued the very next day. Whether you get a partial or full payment from the company, you’ll receive a check from the car insurance company claiming a “property damage settlement,” along with the claim number and other relevant details associated with your car. After you’ve reached a settlement agreement with the defendant or their insurance company, it usually takes between two and six weeks for your settlement check to arrive.

Source: sudimage.org

Source: sudimage.org

Whether you get a partial or full payment from the company, you’ll receive a check from the car insurance company claiming a “property damage settlement,” along with the claim number and other relevant details associated with your car. These adjusters will use all kinds of negotiation tactics to try to get you to accept. What is a personal injury settlement check? Reasons for a check getting stuck at the insurance company can include incorrectly signed paperwork. Your lawyer receives the check and then deducts the percentage of money agreed upon before sending you the balance in the form of another check.

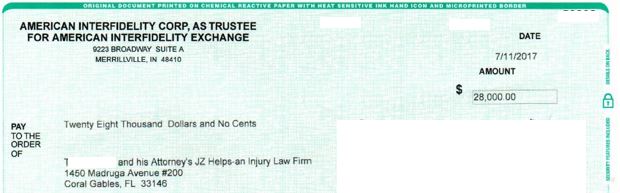

Source: justinziegler.net

Source: justinziegler.net

What is a personal injury settlement check? Once the check is received, your attorney will deposit it into a. Whether you get a partial or full payment from the company, you’ll receive a check from the car insurance company claiming a “property damage settlement,” along with the claim number and other relevant details associated with your car. While many factors can affect the disbursement of the settlement, generally speaking, the timeline to do so remains consistent. You know when the insurance company has mailed your check.

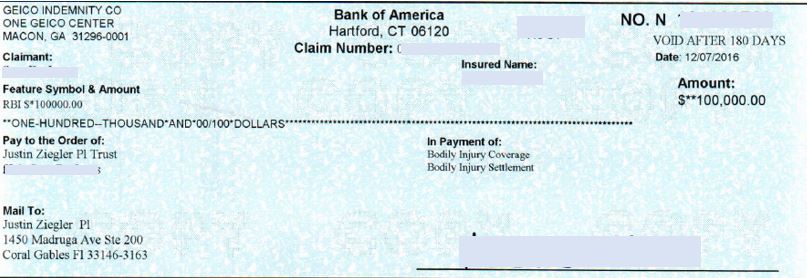

Source: justinziegler.net

Source: justinziegler.net

Ask to speak in court about. Cashing an insurance settlement check requires a joint effort among all parties that have a stake in having the insurance settlement check cashed. Ask to speak in court about. Do not accept an insurance settlement check immediately. However, the largest delay in receiving your settlement check is the negotiation phase.

Source: rgisblog.blogspot.com

Source: rgisblog.blogspot.com

When the insurance company for the other party agrees to a settlement, you should receive a check approximately three weeks after the filing of all settlement papers. The majority of injury claims should be resolved in less than three weeks. When an insurance company sends a settlement check to us, they are obligated to notify you that they are sending the check to us. The insurance company releases the check. What is a personal injury settlement check?

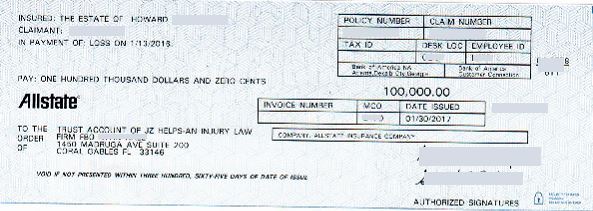

Source: justinziegler.net

Source: justinziegler.net

The first step on the way to settlement is to submit a demand letter to the responsible party’s insurance company. Subject to approval by the court, the settlement agreement will create a $15,000,000.00 settlement fund to make payments or give policy credits to eligible exclude yourself from the settlement: When the settlement amount is relatively low, a check could be issued the very next day. The typical timeline for the settlement process is four to six weeks. After you’ve signed your own release form in cases involving estates, the defendant�s insurance company receives the document and then issues a fair settlement check.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance settlement check by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.