Insurance sublimits Idea

Home » Trending » Insurance sublimits IdeaYour Insurance sublimits images are ready in this website. Insurance sublimits are a topic that is being searched for and liked by netizens now. You can Find and Download the Insurance sublimits files here. Get all royalty-free images.

If you’re searching for insurance sublimits pictures information connected with to the insurance sublimits interest, you have pay a visit to the right site. Our website always gives you hints for seeing the maximum quality video and image content, please kindly hunt and find more informative video articles and graphics that fit your interests.

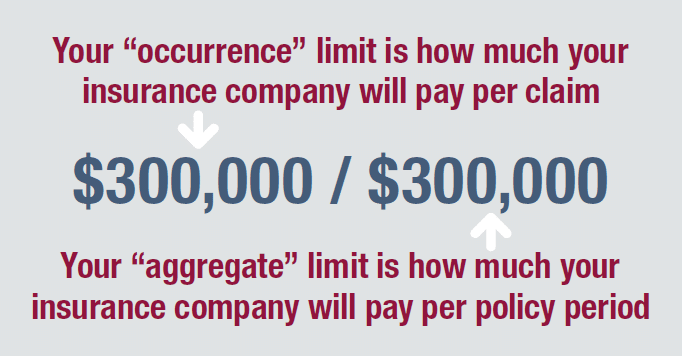

Insurance Sublimits. So what are insurance policy sublimits? But many property insurance policies include “sublimits” that provide a lower limit for particular losses. Sublimits can sneak up on unaware policyholders. Limitations on how much coverage is available for a specific type of loss.

Avemco Aircraft Insurance Organigramme Avemco Insurance From imsguenstony.blogspot.com

Avemco Aircraft Insurance Organigramme Avemco Insurance From imsguenstony.blogspot.com

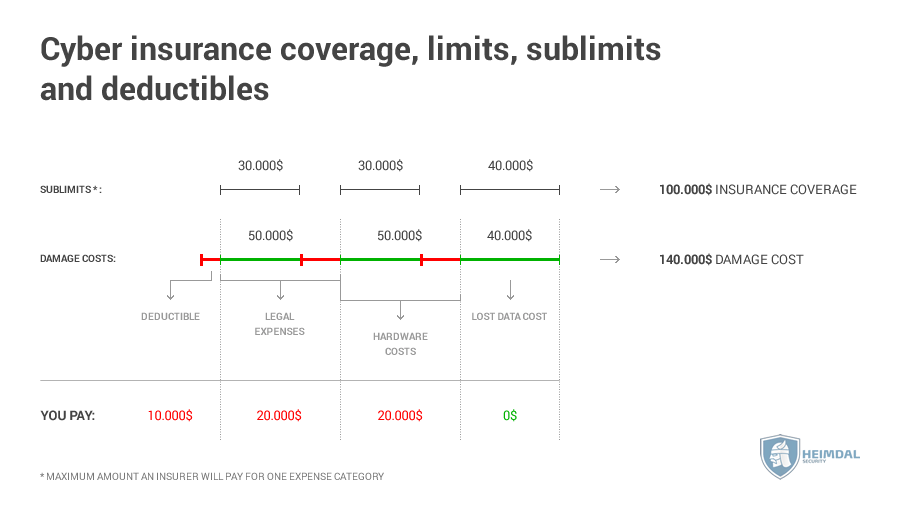

Sublimits can be expressed as a dollar amount or as a percentage of the coverage available. Make your insurance coverage review a standard part of your. Sublimits are limitations on coverage for specific items. Larry bache provides a good industry definition in his post, are you covered? In q1 2020, data destruction, business interruption, hacking, extortion and threat rounded out the top five risks or exposures cyber insurance covers, according to rsm. Sublimits are written as a dollar amount or as a percentage of the coverage.

In q1 2020, data destruction, business interruption, hacking, extortion and threat rounded out the top five risks or exposures cyber insurance covers, according to rsm.

A critical component of any insurance policy is of course its limit, which is usually the most an insurance company must pay for a loss. A sublimit also may apply to a type of damage. Sublimits are one of the most common sources of consternation for our business clients. Sublimits are limitations on coverage for specific items. Sublimits can sneak up on unaware policyholders. A “sublimit” is a lesser insurance limit of liability that applies to a specific type of loss and is included within the larger, generally applicable, limit.

Source: inspectorproinsurance.com

Source: inspectorproinsurance.com

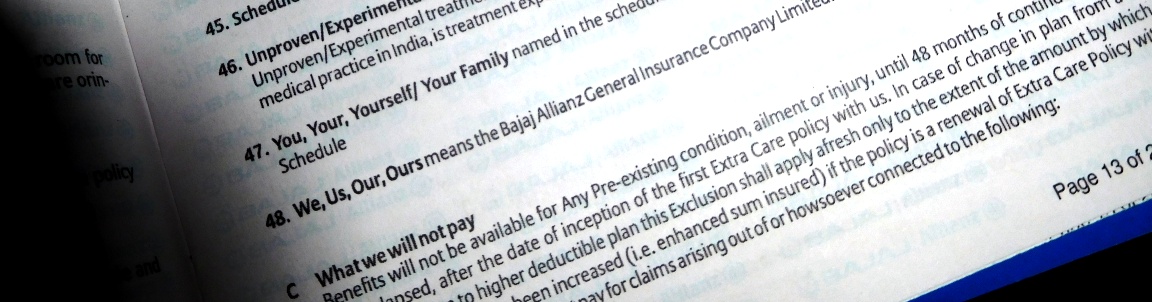

Businesses can miss sublimits, or limits on loss coverage for a specified risk, in contracts, especially after the binder letter is sent. Sublimits are specific constraints or limits in indian visitor travel insurance policy�s cover for certain losses or medical expenses. Sublimits are specific constraints or limits in indian visitor travel insurance policy�s cover for certain losses or medical expenses. It is important to note that, being part of the coverage limit of the original policy, these claims include the sum insured. A sublimit also may apply to a type of damage or cost, such as debris removal, or an item, such as jewelry.

Source: warhurstlaw.com

Source: warhurstlaw.com

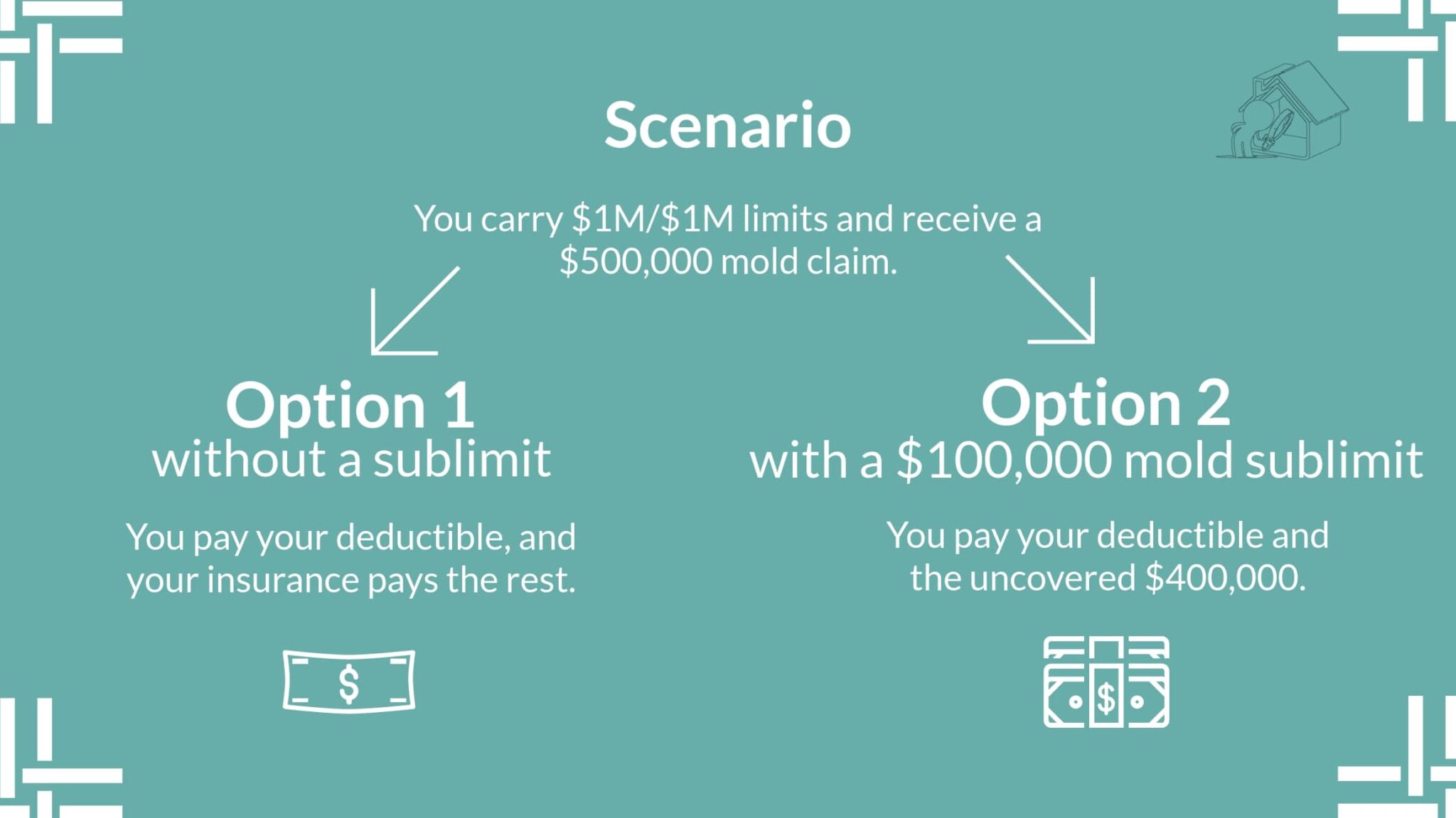

Let’s look at an example of sublimits. They are part of the original limit. Businesses can miss sublimits, or limits on loss coverage for a specified risk, in contracts, especially after the binder letter is sent. But many property insurance policies include “sublimits” that provide a lower limit for particular losses. A sublimit also may apply to a type of damage.

Source: everquote.com

Source: everquote.com

Sublimits can sneak up on unaware policyholders. Sublimits are extra limitations in an insurance policy�s coverage of certain losses. Sublimits reduce the amount of coverage in a typical homeowners policy, your personal property in your home, like your clothes, furniture, and other belongings (noted in coverage c of the policy) is usually covered at 50 to 75 percent of the dwelling limit (which is noted in coverage a). Here are some common examples: A sublimit also may apply to a type of damage.

Source: inspectorproinsurance.com

Source: inspectorproinsurance.com

Sublimits reduce the amount of coverage in a typical homeowners policy, your personal property in your home, like your clothes, furniture, and other belongings (noted in coverage c of the policy) is usually covered at 50 to 75 percent of the dwelling limit (which is noted in coverage a). A sublimit also may apply to a type of damage. Sublimits in an insurance policy are the maximum amount of coverage available for a specific peril, such as a storm. A fiduciary liability policy may read more Sublimits are written as a dollar amount or as a percentage of the coverage.

Source: heimdalsecurity.com

Source: heimdalsecurity.com

A critical component of any insurance policy is of course its limit, which is usually the most an insurance company must pay for a loss. Sublimits are written as a dollar amount or as a percentage of the coverage. Due to these, a policyholder may not be allowed to apply for a full claim amount against the health insurance policy. Here are some common examples: Right now in the cyber industry, that’s often coverage for ransomware and cyber extortion.

Source: mediclaimcentral.in

Source: mediclaimcentral.in

A sublimit also may apply to a type of damage. It’s common to see them in areas where expenses for a claim may be extensive. That is, they do not provide extra coverage, but set a maximum to cover a specific loss. Sublimits are extra limitations in an insurance policy�s coverage of certain losses. An insurance policy “sublimit” is:

Source: procorllc.com

Source: procorllc.com

Let’s look at an example of sublimits. A limitation in an insurance policy on the amount of coverage available to cover a specific type of loss. Sublimits are limitations on coverage for specific items. Right now in the cyber industry, that’s often coverage for ransomware and cyber extortion. A sublimit also may apply to a type of damage or cost, such as debris removal, or an item, such as jewelry.

Source: mytxpa.com

Source: mytxpa.com

Let’s look at an example of sublimits. In q1 2020, data destruction, business interruption, hacking, extortion and threat rounded out the top five risks or exposures cyber insurance covers, according to rsm. A sublimit also may apply to a type of damage or cost, such as debris removal, or an item, such as jewelry. Here are some common examples: Let’s look at an example of sublimits.

Source: liveinsurancenews.com

Source: liveinsurancenews.com

A critical component of any insurance policy is of course its limit, which is usually the most an insurance company must pay for a loss. A fiduciary liability policy may read more In q1 2020, data destruction, business interruption, hacking, extortion and threat rounded out the top five risks or exposures cyber insurance covers, according to rsm. Sublimits can be expressed as a dollar amount or as a percentage of the coverage available. It’s common to see them in areas where expenses for a claim may be extensive.

Source: insuranceopedia.com

Source: insuranceopedia.com

A limitation in an insurance policy on the amount of coverage available to cover a specific type of loss. Sublimits in an insurance policy are the maximum amount of coverage available for a specific peril, such as a storm. A limitation in an insurance policy on the amount of coverage available to cover a specific type of loss. A sublimit also may apply to a type of damage. They are part of the original limit.

Source: mediclaimcentral.in

Source: mediclaimcentral.in

Sublimits reduce the amount of coverage in a typical homeowners policy, your personal property in your home, like your clothes, furniture, and other belongings (noted in coverage c of the policy) is usually covered at 50 to 75 percent of the dwelling limit (which is noted in coverage a). A fiduciary liability policy may read more Sublimits can be expressed as a dollar amount or as a percentage of the coverage available. Sublimits in an insurance policy are the maximum amount of coverage available for a specific peril, such as a storm. It’s common to see them in areas where expenses for a claim may be extensive.

Source: rmmagazine.com

Source: rmmagazine.com

An insurance policy “sublimit” is: Sublimits can be expressed as a dollar amount or as a percentage of the coverage available. Sublimits are limitations on coverage for specific items. A fiduciary liability policy may read more Due to these, a policyholder may not be allowed to apply for a full claim amount against the health insurance policy.

Source: imsguenstony.blogspot.com

Source: imsguenstony.blogspot.com

Let’s look at an example of sublimits. Make your insurance coverage review a standard part of your. Sublimits are one of the most common sources of consternation for our business clients. A “sublimit” is a lesser insurance limit of liability that applies to a specific type of loss and is included within the larger, generally applicable, limit. It is important to note that, being part of the coverage limit of the original policy, these claims include the sum insured.

Source: youtube.com

Source: youtube.com

Due to these, a policyholder may not be allowed to apply for a full claim amount against the health insurance policy. It’s common to see them in areas where expenses for a claim may be extensive. When you are renewing or buying a liability insurance policy such as a professional liability policy, a general liability policy, a cyber liability policy, or any other insurance policy for that matter, we recommend that you read and review your coverage. It is important to note that, being part of the coverage limit of the original policy, these claims include the sum insured. A sublimit also may apply to a type of damage.

Source: moranfinancialsolutions.com

Source: moranfinancialsolutions.com

It is important to note that, being part of the coverage limit of the original policy, these claims include the sum insured. Let’s look at an example of sublimits. Identifying the sublimits in a policy is usually straightforward since they typically appear in a list or. In q1 2020, data destruction, business interruption, hacking, extortion and threat rounded out the top five risks or exposures cyber insurance covers, according to rsm. An insurance policy “sublimit” is:

Source: quora.com

A sublimit also may apply to a type of damage or cost, such as debris removal, or an item, such as jewelry. Sublimits are extra limitations in an insurance policy�s coverage of certain losses. It’s common to see them in areas where expenses for a claim may be extensive. Limitations on how much coverage is available for a specific type of loss. A critical component of any insurance policy is of course its limit, which is usually the most an insurance company must pay for a loss.

![]() Source: beaconprotects.com

Source: beaconprotects.com

A limitation in an insurance policy on the amount of coverage available to cover a specific type of loss. When you are renewing or buying a liability insurance policy such as a professional liability policy, a general liability policy, a cyber liability policy, or any other insurance policy for that matter, we recommend that you read and review your coverage. A “sublimit” is a lesser insurance limit of liability that applies to a specific type of loss and is included within the larger, generally applicable, limit. Sublimits are extra limitations in an insurance policy�s coverage of certain losses. They are part of the original limit.

Source: mediclaimcentral.in

Source: mediclaimcentral.in

Sublimits are specific constraints or limits in indian visitor travel insurance policy�s cover for certain losses or medical expenses. They are part of the original limit. Let’s look at an example of sublimits. When you are renewing or buying a liability insurance policy such as a professional liability policy, a general liability policy, a cyber liability policy, or any other insurance policy for that matter, we recommend that you read and review your coverage. Sublimits can be expressed as a dollar amount or as a percentage of the coverage available.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insurance sublimits by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.