Insurance to value information

Home » Trend » Insurance to value informationYour Insurance to value images are ready. Insurance to value are a topic that is being searched for and liked by netizens today. You can Find and Download the Insurance to value files here. Find and Download all royalty-free photos and vectors.

If you’re looking for insurance to value images information related to the insurance to value interest, you have pay a visit to the ideal blog. Our site always provides you with hints for viewing the maximum quality video and image content, please kindly surf and locate more informative video articles and images that fit your interests.

Insurance To Value. We suggest you insure your home for at least the minimum estimated rebuilding cost. Insurance mobile apps market shaping from growth to value | salesforce, microsoft, sap Insurance to value means insurance to full value only if 100% coverage is assumed in the rate computation. Market values vary based on many regional and economic factors.

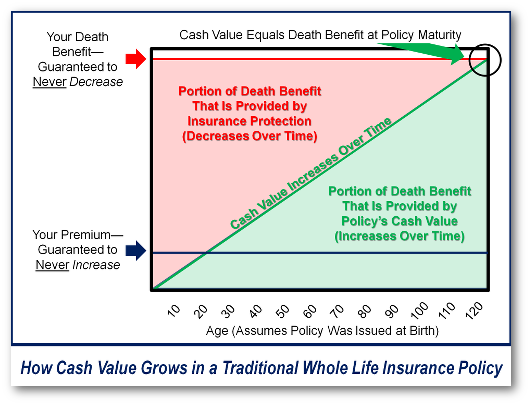

How Whole Life Insurance Works Bank On Yourself From bankonyourself.com

How Whole Life Insurance Works Bank On Yourself From bankonyourself.com

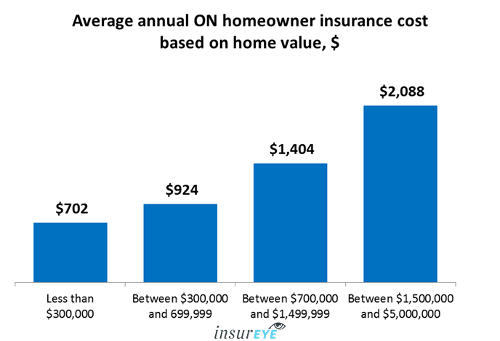

Cash value life insurance refers to a form of life insurance that functions a little bit like a savings account. So, my friend’s agency isn’t really worth $1.5 million on a $1 million commission income. Cash value life insurance policies typically have a level premium, meaning that a higher percentage of your premium payments goes toward the cash value. Insurance professionals have set out the eleven key components of the insurance value chain and offer insights on the actions that insurers should be contemplating. Replacement cost continually increases because the cost of materials and labor continually increase. Insurance to value means insurance to full value only if 100% coverage is assumed in the rate computation.

The insurance industry value chain.

Market values vary based on many regional and economic factors. Insurers seeking to optimise value creation by increasing their numbers of insurtech partnerships and broadening insurtech use across the value chain need to address the following success factors. As the concept of insurance to value is. More than 40 percent of insurtechs are focused on the marketing and distribution segments of the insurance value chain (exhibit 3), enabling them to solve customer pain points through a digitally enhanced client experience that could pose a competitive threat to incumbents. Your insurance calculates the value of your car by determining how much it would take for you to replace it or buy it. Cash value life insurance policies typically have a level premium, meaning that a higher percentage of your premium payments goes toward the cash value.

Source: bankonyourself.com

Source: bankonyourself.com

The insurance industry value chain. Market values vary based on many regional and economic factors. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. Because this cash value account earns some interest (and the taxes are deferred), the cash value will. In general, insureds are required to have coverage in an amount that is at least 80% as much as the value of their home.

Source: events.ibx.com

Source: events.ibx.com

Insurance mobile apps market shaping from growth to value | salesforce, microsoft, sap Insurance mobile apps market shaping from growth to value | salesforce, microsoft, sap Insurers seeking to optimise value creation by increasing their numbers of insurtech partnerships and broadening insurtech use across the value chain need to address the following success factors. How much coverage do i need on my home? Because this cash value account earns some interest (and the taxes are deferred), the cash value will.

It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. Underinsurance is coverage less than that assumed, and overinsurance is coverage beyond that assumed. Market values vary based on many regional and economic factors. Your insurance company pays for your car�s retail value. Over time, the cash accumulation slows down and more of your payment goes toward the cost of your insurance, since it is generally more expensive to insure an older person.

Source: sappscarpetcare.com

Source: sappscarpetcare.com

An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter.a person or entity who buys insurance is known as a policyholder, while a person or entity. Insurance to value means insurance to full value only if 100% coverage is assumed in the rate computation. In general, insureds are required to have coverage in an amount that is at least 80% as much as the value of their home. So, my friend’s agency isn’t really worth $1.5 million on a $1 million commission income. Insurance to value — insurance written in an amount approximating the value of the subject of insurance or that meets coinsurance requirements.

Source: peer2peerinsurance.net

Source: peer2peerinsurance.net

Insurance is a means of protection from financial loss. Every additional $100 value over $100. Over time, the cash accumulation slows down and more of your payment goes toward the cost of your insurance, since it is generally more expensive to insure an older person. Haggerty says that the only caveat to this value is that the insurance company can still choose to pay for either the “stated value” of the car or the “actual cash value,” whichever one is less. Insurance to value is a concept used by insurers to determine how much to pay for losses are covered under homeowners� policies.

Source: ehealthinsurance.com

Source: ehealthinsurance.com

Insurance mobile apps market shaping from growth to value | salesforce, microsoft, sap Insurance to value is a concept used by insurers to determine how much to pay for losses are covered under homeowners� policies. Cash value life insurance refers to a form of life insurance that functions a little bit like a savings account. Insurance to value means insurance to full value only if 100% coverage is assumed in the rate computation. Itv is insurance to value which refers to the amount of dwelling coverage afforded under your homeowners insurance policy.

Source: insuranceblog.accenture.com

Source: insuranceblog.accenture.com

To build value while maintaining income, pay yourself a smaller salary and take a distribution of profits. More than 40 percent of insurtechs are focused on the marketing and distribution segments of the insurance value chain (exhibit 3), enabling them to solve customer pain points through a digitally enhanced client experience that could pose a competitive threat to incumbents. This estimate is the minimum amount needed to rebuild your home and is based on the current costs for materials, labor and other associated charges. Insurers are highly aware of the importance of a focused insurtech strategy, as part of their digital and innovation strategy. Because this cash value account earns some interest (and the taxes are deferred), the cash value will.

Source: hfsresearch.com

It is essential that the coverage amount is sufficient to rebuild the home following a covered event involving complete destruction. The dwelling coverage may also be referred to as ‘coverage a’. Insurers are highly aware of the importance of a focused insurtech strategy, as part of their digital and innovation strategy. Insurance is a means of protection from financial loss. Itv is insurance to value which refers to the amount of dwelling coverage afforded under your homeowners insurance policy.

Source: slidemembers.com

Source: slidemembers.com

Market values vary based on many regional and economic factors. We suggest you insure your home for at least the minimum estimated rebuilding cost. Insurance to value — insurance written in an amount approximating the value of the subject of insurance or that meets coinsurance requirements. Every insurance provider providing a product or service along the supply chain seeks to gain ‘competitive’ advantage with the end customer. To build value while maintaining income, pay yourself a smaller salary and take a distribution of profits.

Source: twitter.com

Source: twitter.com

Market values vary based on many regional and economic factors. Insurance is a means of protection from financial loss. An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter.a person or entity who buys insurance is known as a policyholder, while a person or entity. Insurance to value means insurance to full value only if 100% coverage is assumed in the rate computation. Every insurance provider providing a product or service along the supply chain seeks to gain ‘competitive’ advantage with the end customer.

Source: moneygoody.com

Source: moneygoody.com

Itv is insurance to value which refers to the amount of dwelling coverage afforded under your homeowners insurance policy. Haggerty says that the only caveat to this value is that the insurance company can still choose to pay for either the “stated value” of the car or the “actual cash value,” whichever one is less. Your insurance company pays for your car�s retail value. In general, insureds are required to have coverage in an amount that is at least 80% as much as the value of their home. It is essential that the coverage amount is sufficient to rebuild the home following a covered event involving complete destruction.

Source: sandeepbhowmick.blogspot.com

Source: sandeepbhowmick.blogspot.com

How much coverage do i need on my home? Ups has a $2.70 insurance minimum, so the value of the shipped product must be at least $300 to qualify for ups shipping insurance. Itv is insurance to value which refers to the amount of dwelling coverage afforded under your homeowners insurance policy. Your insurance calculates the value of your car by determining how much it would take for you to replace it or buy it. Underinsurance is coverage less than that assumed, and overinsurance is coverage beyond that assumed.

Source: researchgate.net

Source: researchgate.net

Insurers are highly aware of the importance of a focused insurtech strategy, as part of their digital and innovation strategy. Cash value life insurance refers to a form of life insurance that functions a little bit like a savings account. This estimate is the minimum amount needed to rebuild your home and is based on the current costs for materials, labor and other associated charges. The premium itself is finite. Underinsurance is coverage less than that assumed, and overinsurance is coverage beyond that assumed.

Source: insurance.com

Your insurance company pays for your car�s retail value. A quick rule of thumb for insurance firms (and again, for financial stocks in general) is that they are worth buying at a p/b level of 1 and are on the pricey side at. Insurance professionals have set out the eleven key components of the insurance value chain and offer insights on the actions that insurers should be contemplating. “insurance to value” does not refer to the market value of your home, it refers specifically to the cost to replace or repair your home. Your insurance calculates the value of your car by determining how much it would take for you to replace it or buy it.

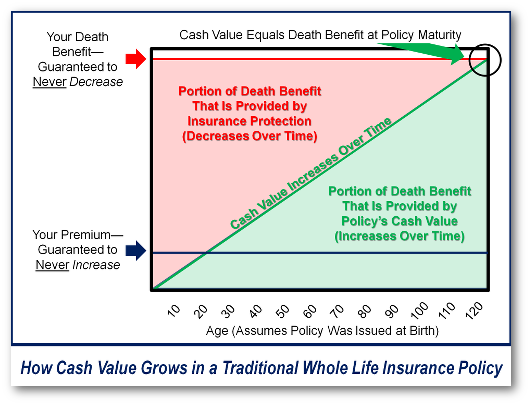

Source: insureye.com

Source: insureye.com

Insurance mobile apps market shaping from growth to value | salesforce, microsoft, sap Market values vary based on many regional and economic factors. It is essential that the coverage amount is sufficient to rebuild the home following a covered event involving complete destruction. Insurance mobile apps market shaping from growth to value | salesforce, microsoft, sap The premium itself is finite.

Source: sproutt.com

Source: sproutt.com

This value refers to the amount that is stated when you take on the insurance policy. Agencies in the insurance industry today tend to actually sell for somewhere between an 8 percent return and a 12.5 percent return. Insurers seeking to optimise value creation by increasing their numbers of insurtech partnerships and broadening insurtech use across the value chain need to address the following success factors. Every insurance provider providing a product or service along the supply chain seeks to gain ‘competitive’ advantage with the end customer. Every additional $100 value over $100.

Source: summerlinbenefitsconsulting.com

Source: summerlinbenefitsconsulting.com

Market values vary based on many regional and economic factors. Replacement cost continually increases because the cost of materials and labor continually increase. The premium itself is finite. Insurers are highly aware of the importance of a focused insurtech strategy, as part of their digital and innovation strategy. Insurance is a means of protection from financial loss.

Source: globalriskinsights.com

Source: globalriskinsights.com

A quick rule of thumb for insurance firms (and again, for financial stocks in general) is that they are worth buying at a p/b level of 1 and are on the pricey side at. The premium itself is finite. Insurance to value — insurance written in an amount approximating the value of the subject of insurance or that meets coinsurance requirements. Every insurance provider providing a product or service along the supply chain seeks to gain ‘competitive’ advantage with the end customer. Your insurance company pays for your car�s retail value.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance to value by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.