Insurance underwriter job profile Idea

Home » Trending » Insurance underwriter job profile IdeaYour Insurance underwriter job profile images are available in this site. Insurance underwriter job profile are a topic that is being searched for and liked by netizens now. You can Download the Insurance underwriter job profile files here. Download all royalty-free photos.

If you’re searching for insurance underwriter job profile pictures information related to the insurance underwriter job profile keyword, you have pay a visit to the ideal site. Our website always provides you with suggestions for downloading the highest quality video and image content, please kindly hunt and find more informative video content and graphics that fit your interests.

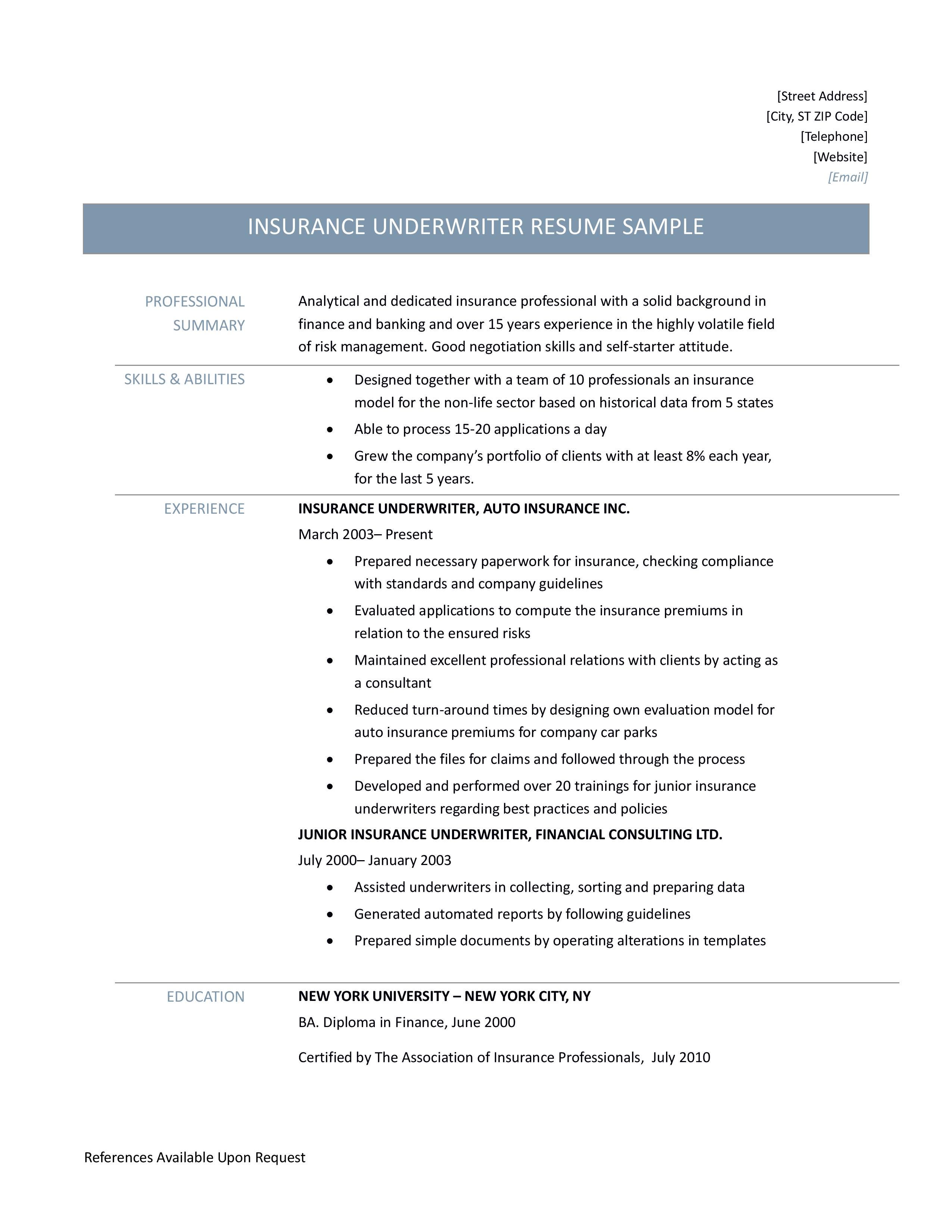

Insurance Underwriter Job Profile. Leverage underwriting software to identify insurance coverage recommendations for. An underwriter will analyze statistical data and decide who can be covered through the company and who is not eligible. Preparing and writing insurance policies, and calculating the premiums (price), based on the information you have gathered It is the responsibility of insurance underwriters to decide whether to extend insurance coverage to potential clients, determine the conditions of individual policies, and set insurance premiums.

Associate Underwriter Resume Samples QwikResume From qwikresume.com

Associate Underwriter Resume Samples QwikResume From qwikresume.com

Insurance underwriters typically do the following: Assessing clients’ background information and financial status. Serving as the link between insurance companies and agents, they must collect accurate customer information to enter into computer software programs. Compared to most people, those working as an insurance underwriter tend to value independence, relationships, and support. They are found in insurance agencies of all kinds, from general to life insurance. Liaising with specialists to gather information and opinions.

Use our career test report to get your career on track and keep it there.

Insurance underwriters typically do the following: Liaising with specialists to gather information and opinions. Bachelor degree in computer or allied subjects is much preferred as the job profile includes enormous operation of computers. They read each application to determine if an applicant qualifies for a loan or an insurance policy, confirming that all of the information on the applicant accurately reflects their risk level. They are found in insurance agencies of all kinds, from general to life insurance. Review policy applications based on the previous loss records, age, medical report, credit ratings and driving records.

Source: qwikresume.com

Source: qwikresume.com

Review policy applications based on the previous loss records, age, medical report, credit ratings and driving records. Determine the risk involved in insuring a client An underwriter will analyze statistical data and decide who can be covered through the company and who is not eligible. They evaluate insurance applications, analyze, and process this information using computer software to determine the recommended coverage amount and premium. The underwriter reviews the data associated with the applicant, assesses the risk, determines if.

Source: integratedlearning.net

Source: integratedlearning.net

Reviewing insurance applications for compliance and adherence. Liaising with specialists to gather information and opinions. Evaluating information about the potential client (i.e., age, marital status, medical history, driving record, etc.) using underwriting software to analyze the risk profile of the potential client; Preparing and writing insurance policies, and calculating the premiums (price), based on the information you have gathered They evaluate insurance applications, analyze, and process this information using computer software to determine the recommended coverage amount and premium.

Source: qwikresume.com

Source: qwikresume.com

Job description and duties for insurance underwriter. An underwriter will analyze statistical data and decide who can be covered through the company and who is not eligible. The role of an insurance underwriter includes responsibilities such as: They read each application to determine if an applicant qualifies for a loan or an insurance policy, confirming that all of the information on the applicant accurately reflects their risk level. Bachelor degree in computer or allied subjects is much preferred as the job profile includes enormous operation of computers.

Source: master-of-finance.org

Source: master-of-finance.org

Compared to most people, those working as an insurance underwriter tend to value independence, relationships, and support. Collect and analyze insurance applicant information to screen each client and conduct insurance policy risk assessments; Use our job search tool to sort through over 2 million real jobs. Job description and duties for insurance underwriter. Insurance underwriters typically do the following:

Source: hot-news-update33.blogspot.com

Source: hot-news-update33.blogspot.com

Evaluating information about the potential client (i.e., age, marital status, medical history, driving record, etc.) using underwriting software to analyze the risk profile of the potential client; Determine the risk involved in insuring a client Collect appropriate and accurate information required to assess potential clients and decide on the acceptable risk for a policy. It is the responsibility of insurance underwriters to decide whether to extend insurance coverage to potential clients, determine the conditions of individual policies, and set insurance premiums. The underwriter reviews the data associated with the applicant, assesses the risk, determines if.

Source: onlinedegree.com

Source: onlinedegree.com

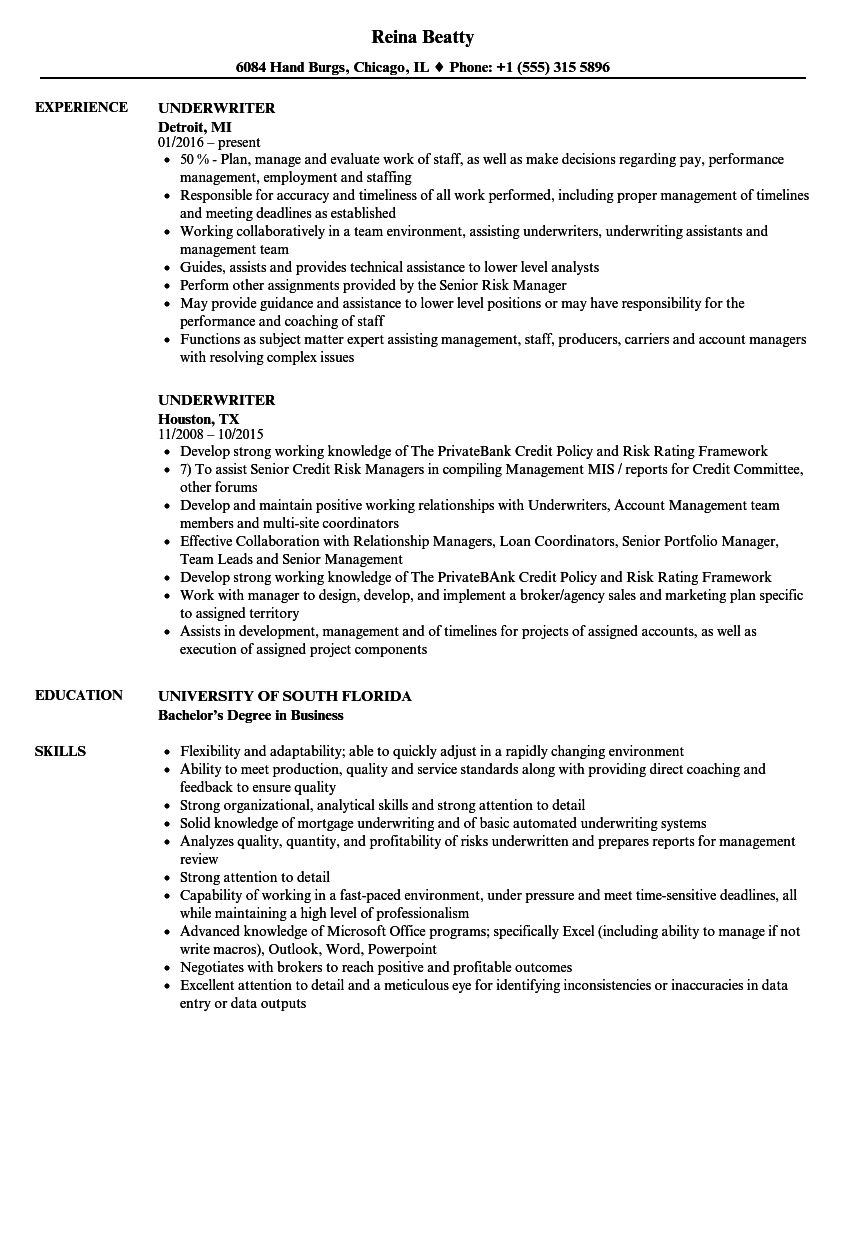

Determine the risk involved in insuring a client Review and evaluate insurance applications and related documents, including inspection reports, financial statements, loss data, mvr’s, and other information needed to properly evaluate and classify the degree of risk in relation to proposed coverage limits. Insurance underwriter resume examples & samples. Occupations that satisfy this work value allow employees to work on their own and make decisions. Average salary (a year) £18,000 starter

Source: voleyball-games.blogspot.com

Source: voleyball-games.blogspot.com

Occupations that satisfy this work value allow employees to work on their own and make decisions. Insurance underwriters typically do the following: Liaising with specialists to gather information and opinions. Occupations that satisfy this work value allow employees to work on their own and make decisions. Use our career test report to get your career on track and keep it there.

Source: calgary-broker.blogspot.com

Source: calgary-broker.blogspot.com

Reviewing insurance applications for compliance and adherence. An insurance underwriter works closely with insurance agents to leverage their direct communication with prospective, new, and existing clients. Analyze information stated on insurance applications; What does an insurance underwriter do? Use our career test report to get your career on track and keep it there.

Source: pinterest.ca

Source: pinterest.ca

An insurance underwriter?s job is to assess the risks associated with insuring a person or property and approve or reject applications based on the risks involved. Job description and duties for insurance underwriter. An underwriter�s job is difficult since insuring too much risk can result in large claims and assuming too little can result in fewer clients. Leverage underwriting software to identify insurance coverage recommendations for. Collect appropriate and accurate information required to assess potential clients and decide on the acceptable risk for a policy.

Source: ziprecruiter.com

Source: ziprecruiter.com

Average salary (a year) £18,000 starter Insurance underwriter resume examples & samples. Review and evaluate insurance applications and related documents, including inspection reports, financial statements, loss data, mvr’s, and other information needed to properly evaluate and classify the degree of risk in relation to proposed coverage limits. Preparing and writing insurance policies, and calculating the premiums (price), based on the information you have gathered Then, based on statistics and other decision making processes, the underwriter will either reject the application or draw up a quote for the insurance premium that should be paid if the application.

Source: businessadministrationinformation.com

Source: businessadministrationinformation.com

Then, based on statistics and other decision making processes, the underwriter will either reject the application or draw up a quote for the insurance premium that should be paid if the application. Insurance underwriters typically do the following: The role of an insurance underwriter includes responsibilities such as: Review and evaluate insurance applications and related documents, including inspection reports, financial statements, loss data, mvr’s, and other information needed to properly evaluate and classify the degree of risk in relation to proposed coverage limits. Insurance underwriters decide whether to provide insurance, and under what terms.

![]() Source: bridgepersonnel.com

Source: bridgepersonnel.com

Collect and analyze insurance applicant information to screen each client and conduct insurance policy risk assessments; Compared to most people, those working as an insurance underwriter tend to value independence, relationships, and support. They read each application to determine if an applicant qualifies for a loan or an insurance policy, confirming that all of the information on the applicant accurately reflects their risk level. Underwriters typically work at insurance agencies, banks and other financial institutions to approve insurance plans and loans for clients. Use our job description tool to sort through over 13,000 other job titles and careers.

Source: thebalancecareers.com

Source: thebalancecareers.com

An underwriter will analyze statistical data and decide who can be covered through the company and who is not eligible. An underwriter works in insurance agencies utilizing data to determine the risks in creating insurance policies. A person seeking coverage typically will apply through a salesperson who refers the application to an underwriter. Bachelor degree in computer or allied subjects is much preferred as the job profile includes enormous operation of computers. Deciding whether or not insurance coverage should be offered to an individual

Source: pinterest.com

Source: pinterest.com

Bachelor degree in computer or allied subjects is much preferred as the job profile includes enormous operation of computers. What does an insurance underwriter do? Assessing clients’ background information and financial status. They evaluate insurance applications, analyze, and process this information using computer software to determine the recommended coverage amount and premium. Evaluating information about the potential client (i.e., age, marital status, medical history, driving record, etc.) using underwriting software to analyze the risk profile of the potential client;

Source: abinsura.blogspot.com

Source: abinsura.blogspot.com

Insurance underwriters decide whether to insure a person or company, and set out the details of insurance policies. A person seeking coverage typically will apply through a salesperson who refers the application to an underwriter. An underwriter will analyze statistical data and decide who can be covered through the company and who is not eligible. Use our job search tool to sort through over 2 million real jobs. Insurance underwriters decide whether to insure a person or company, and set out the details of insurance policies.

Source: hot-news-update33.blogspot.com

Source: hot-news-update33.blogspot.com

Determine the risk involved in insuring a client An insurance underwriter?s job is to assess the risks associated with insuring a person or property and approve or reject applications based on the risks involved. Taking advice from specialists such as insurance surveyors (for buildings insurance) or doctors (for life or health insurance) assessing background information, statistics and risk assessments to make a decision; Insurance underwriters decide whether to insure a person or company, and set out the details of insurance policies. Deciding whether applications for insurance should be accepted.

Source: medium.com

Source: medium.com

Reviewing insurance applications for compliance and adherence. Assessing clients’ background information and financial status. Underwriters typically work at insurance agencies, banks and other financial institutions to approve insurance plans and loans for clients. Review policy applications based on the previous loss records, age, medical report, credit ratings and driving records. The role of an insurance underwriter includes responsibilities such as:

Source: hot-news-update33.blogspot.com

Source: hot-news-update33.blogspot.com

Taking advice from specialists such as insurance surveyors (for buildings insurance) or doctors (for life or health insurance) assessing background information, statistics and risk assessments to make a decision; Underwriters typically work at insurance agencies, banks and other financial institutions to approve insurance plans and loans for clients. An underwriter will analyze statistical data and decide who can be covered through the company and who is not eligible. A person seeking coverage typically will apply through a salesperson who refers the application to an underwriter. Reviewing insurance applications for compliance and adherence.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insurance underwriter job profile by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.