Insurance underwriting data science information

Home » Trend » Insurance underwriting data science informationYour Insurance underwriting data science images are available. Insurance underwriting data science are a topic that is being searched for and liked by netizens today. You can Get the Insurance underwriting data science files here. Get all royalty-free photos.

If you’re looking for insurance underwriting data science images information linked to the insurance underwriting data science topic, you have come to the ideal site. Our site frequently provides you with suggestions for viewing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and images that match your interests.

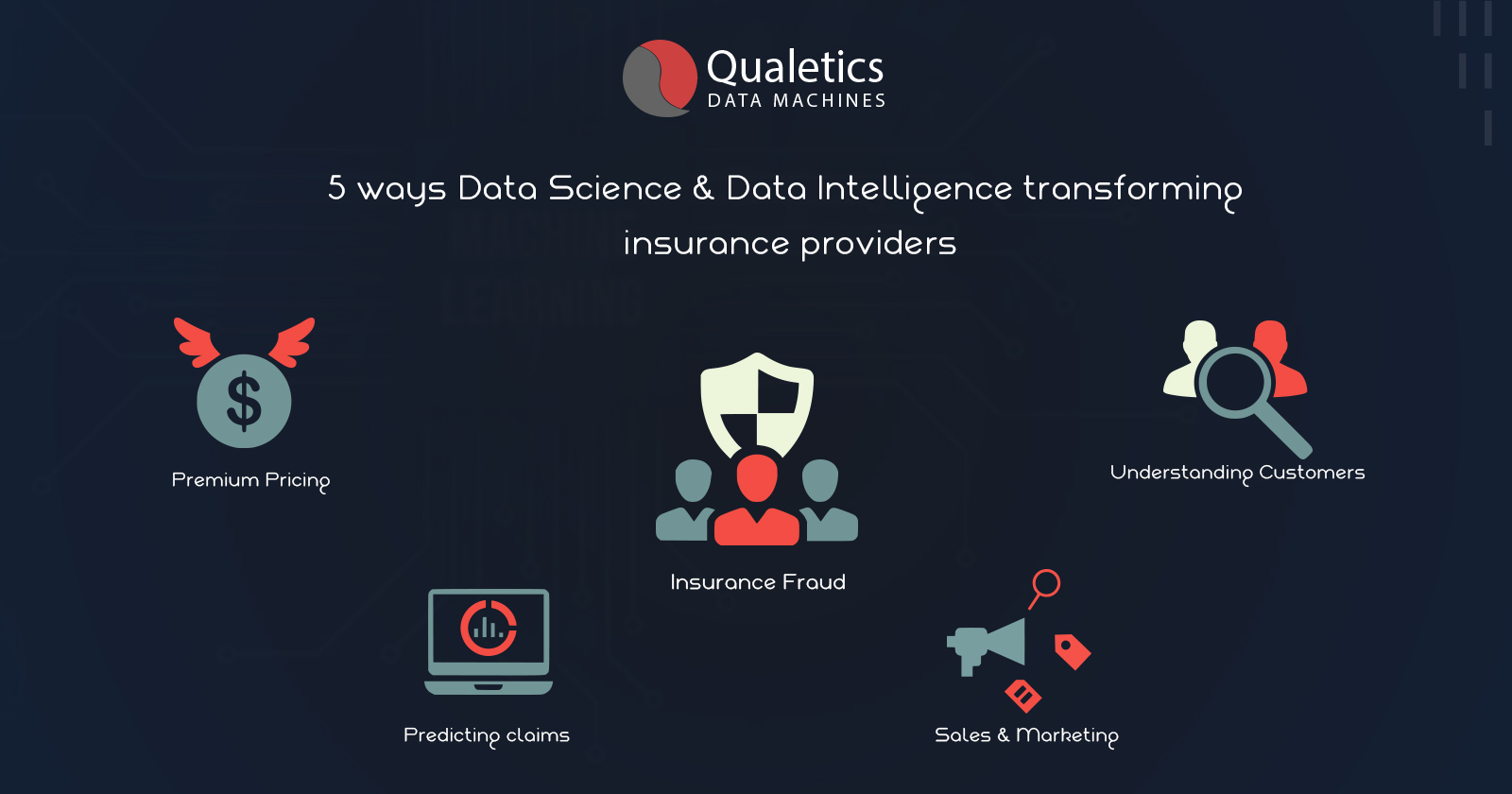

Insurance Underwriting Data Science. By pairing data science with the deep well of an underwriter’s experience and expertise, we can increase underwriter efficiency and confidence, and promote standardization across the firm. Insurance leaders are leveraging intelligent automation to reduce costs, mitigate loss risks, and stay competitive with their peers. After all, if your computers can do all of the underwriting by mining data from a smartphone, you don’t need a human underwriter to make the call. Insurance fraud brings vast financial loss to insurance companies every year.

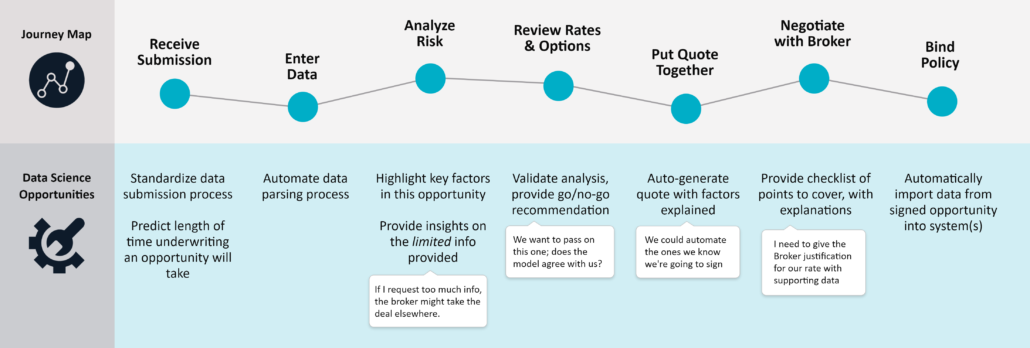

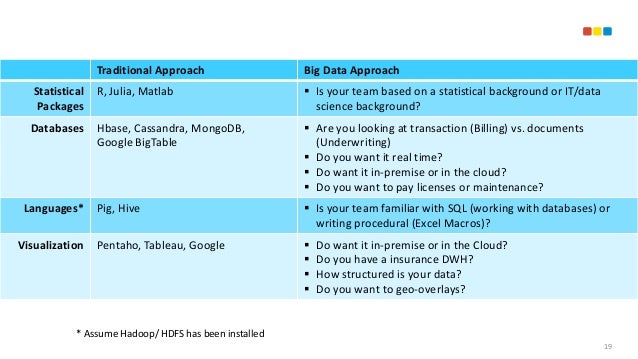

Underwriting Case Study Big data analytics consulting From superiordatascience.com

Underwriting Case Study Big data analytics consulting From superiordatascience.com

Leading insurers develop focused programs and adjust their staffing models to recruit and train analytics talent—developers, architects, data. For example, companies like datacubes and friss are using data science to transform and accelerate core insurance functions such as commercial underwriting and fraud detection. Insurance leaders are leveraging intelligent automation to reduce costs, mitigate loss risks, and stay competitive with their peers. By pairing data science with the deep well of an underwriter’s experience and expertise, we can increase underwriter efficiency and confidence, and promote standardization across the firm. Sponsored [vrs]™ virtual risk space by virtual i technologies is an intelligent platform for insurance underwriting and risk assessment. The insurance industry will likely never get to a state of zero uncertainty in underwriting.

New data and technology is expected to drive underwriting transformation—a likelihood recognized by 200 insurance executives from around the world surveyed for deloitte’s 2021 insurance outlook.

In essence, the aim of applying data science analytics in the insurance is the same as in the other industries — to optimize marketing strategies, to. Data science helps insurance companies to put these data to efficient use to drive more business and refine their product offerings. Leading insurers develop focused programs and adjust their staffing models to recruit and train analytics talent—developers, architects, data. New data and technology is expected to drive underwriting transformation—a likelihood recognized by 200 insurance executives from around the world surveyed for deloitte’s 2021 insurance outlook. For example, companies like datacubes and friss are using data science to transform and accelerate core insurance functions such as commercial underwriting and fraud detection. The insurance industry has a long history of maintaining data for underwriting transactions either in paper files or legacy systems.

Source: guidetoguns.blogspot.com

Source: guidetoguns.blogspot.com

With improvements in technology, there are many. For example, companies like datacubes and friss are using data science to transform and accelerate core insurance functions such as commercial underwriting and fraud detection. Underwriters can save a significant amount of time allocated to data analysis and can make more informed decisions since these models are better than humans at recognizing patterns in large data. Legacy systems had been designed more to connect workflow than to harvest the information surrounding the underwriting transaction, making accessibility to the underwriting data manual and onerous. It has long been the established practice for insurers to gather data on applicants’ (or their property’s) characteristics and use this to assess the likely chance and cost of claims.

Source: blog.appliedis.com

Source: blog.appliedis.com

Data scientists might lack the understanding of insurance value chain and business processes might build models/tools too opaque or unfit for purpose; Underwriters can save a significant amount of time allocated to data analysis and can make more informed decisions since these models are better than humans at recognizing patterns in large data. Conversely, underwriters lack the basic data literacy for meaningful discussions with their data science counterparts who are not subject matter experts Sponsored [vrs]™ virtual risk space by virtual i technologies is an intelligent platform for insurance underwriting and risk assessment. In essence, the aim of applying data science analytics in the insurance is the same as in the other industries — to optimize marketing strategies, to.

Source: guidetoguns.blogspot.com

Source: guidetoguns.blogspot.com

As data increasingly becomes the lifeblood for insurance companies, the combination of big data and analytics is driving a significant shift in insurance underwriting. The availability of data has grown and organizations have built data science teams to work alongside underwriters on risk selection. By pairing data science with the deep well of an underwriter’s experience and expertise, we can increase underwriter efficiency and confidence, and promote standardization across the firm. With improvements in technology, there are many. Automate complex insurance processes like claims processing and underwriting, from input to actionable data.

Source: quantiphi.com

Source: quantiphi.com

Insurance leaders are leveraging intelligent automation to reduce costs, mitigate loss risks, and stay competitive with their peers. Insurance carriers that are on board with the use of. Insurance carriers that are already embracing data science are able to complete the underwriting process 50 percent faster. Insurance fraud brings vast financial loss to insurance companies every year. Leading insurers develop focused programs and adjust their staffing models to recruit and train analytics talent—developers, architects, data.

Source: guidetoguns.blogspot.com

Source: guidetoguns.blogspot.com

New data and technology is expected to drive underwriting transformation—a likelihood recognized by 200 insurance executives from around the world surveyed for deloitte’s 2021 insurance outlook. The ongoing crisis has reinforced the urgency to modernize the underwriting process. Data science helps insurance companies to put these data to efficient use to drive more business and refine their product offerings. Both regulators and academics say that safeguards are necessary. For example, faster processing technologies like hadoop have allowed insurers like allstate to dig through customer information—quotes, policies, claims—to note patterns and.

Source: superiordatascience.com

Source: superiordatascience.com

But machine learning can help us to get a bit closer. The availability of data has grown and organizations have built data science teams to work alongside underwriters on risk selection. Automate complex insurance processes like claims processing and underwriting, from input to actionable data. Companies are rethinking how they source talent so that the next generation of underwriters can handle this expanded, more challenging scope of responsibility. Underwriters can save a significant amount of time allocated to data analysis and can make more informed decisions since these models are better than humans at recognizing patterns in large data.

Source: abiteofculture.com

Source: abiteofculture.com

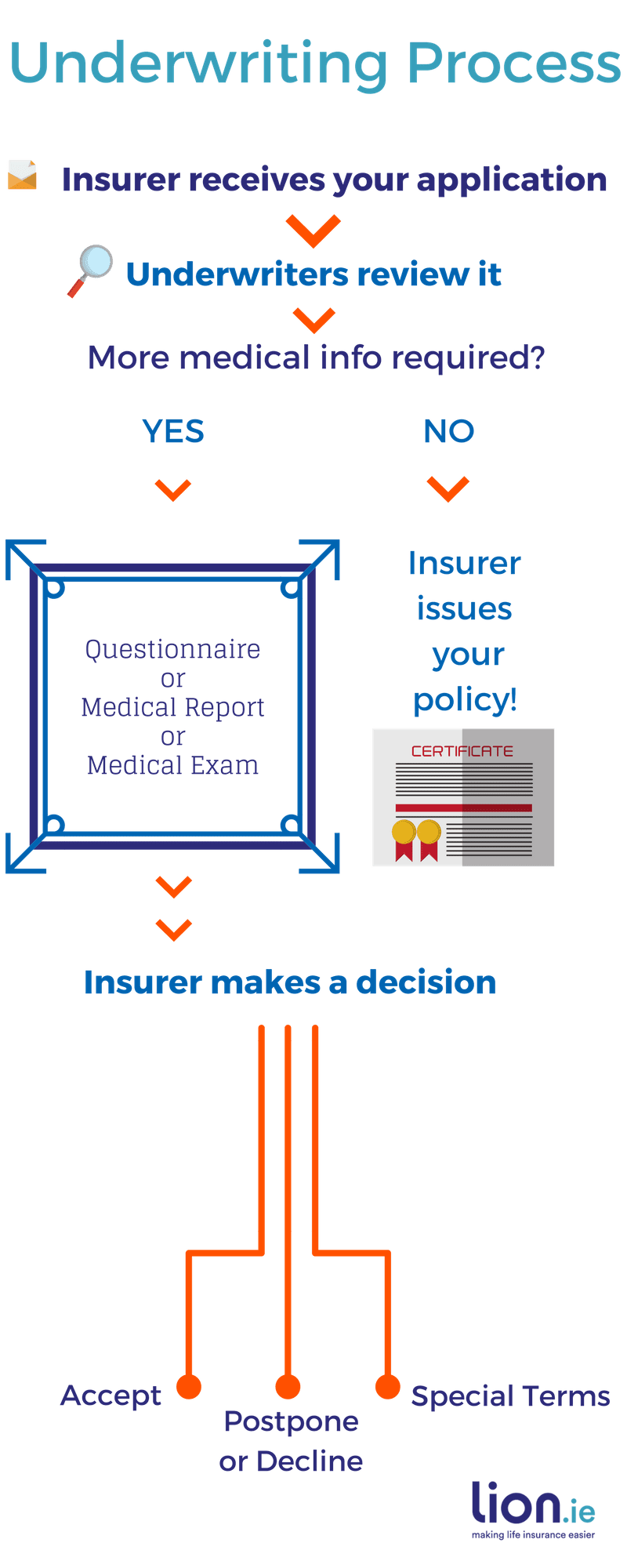

It has long been the established practice for insurers to gather data on applicants’ (or their property’s) characteristics and use this to assess the likely chance and cost of claims. As ml is an integral part of data science, so is underwriting for insurance. The process of underwriting is perhaps the most crucial for the insurance business as its function is to assess the risk involved and classify the risk into various categories. By pairing data science with the deep well of an underwriter’s experience and expertise, we can increase underwriter efficiency and confidence, and promote standardization across the firm. With improvements in technology, there are many.

Source: lion.ie

Source: lion.ie

According to her estimates, a data scientist in insurance could expect a salary of up to £120,000, depending on seniority, responsibilities and technical knowledge. Conversely, underwriters lack the basic data literacy for meaningful discussions with their data science counterparts who are not subject matter experts For example, companies like datacubes and friss are using data science to transform and accelerate core insurance functions such as commercial underwriting and fraud detection. Leading insurers develop focused programs and adjust their staffing models to recruit and train analytics talent—developers, architects, data. The underwriter and translator roles will increasingly become synonymous with underwriters and data scientists working together in agile teams.

Source: genpact.com

Source: genpact.com

The increased efficiency allows underwriters to service more accounts. Companies are rethinking how they source talent so that the next generation of underwriters can handle this expanded, more challenging scope of responsibility. According to her estimates, a data scientist in insurance could expect a salary of up to £120,000, depending on seniority, responsibilities and technical knowledge. As data increasingly becomes the lifeblood for insurance companies, the combination of big data and analytics is driving a significant shift in insurance underwriting. Undoubtedly, the insurance companies benefit from data science application within the spheres of their great interest.

Source: guidetoguns.blogspot.com

Source: guidetoguns.blogspot.com

But it is the combined role of a data scientist and insurance underwriter that would earn the highest pay package. Sponsored [vrs]™ virtual risk space by virtual i technologies is an intelligent platform for insurance underwriting and risk assessment. Insurance carriers that are already embracing data science are able to complete the underwriting process 50 percent faster. Insurance carriers that are on board with the use of. In the last decade, life insurance has seen a swath of data sources, predictive models, and technology become available for underwriting.

Source: qualetics.com

Source: qualetics.com

The insurance industry will likely never get to a state of zero uncertainty in underwriting. By pairing data science with the deep well of an underwriter’s experience and expertise, we can increase underwriter efficiency and confidence, and promote standardization across the firm. The insurance industry will likely never get to a state of zero uncertainty in underwriting. With improvements in technology, there are many. A strong working relationship between the two disciplines is table stakes.

Source: what-is-the-biggestbreaking-new.blogspot.com

Source: what-is-the-biggestbreaking-new.blogspot.com

For example, faster processing technologies like hadoop have allowed insurers like allstate to dig through customer information—quotes, policies, claims—to note patterns and. In the last decade, life insurance has seen a swath of data sources, predictive models, and technology become available for underwriting. Companies are rethinking how they source talent so that the next generation of underwriters can handle this expanded, more challenging scope of responsibility. But it is the combined role of a data scientist and insurance underwriter that would earn the highest pay package. The insurance industry has a long history of maintaining data for underwriting transactions either in paper files or legacy systems.

Source: ironsidegroup.com

Source: ironsidegroup.com

In essence, the aim of applying data science analytics in the insurance is the same as in the other industries — to optimize marketing strategies, to. The increased efficiency allows underwriters to service more accounts. The insurance industry will likely never get to a state of zero uncertainty in underwriting. The hyperscience platform helps you to quickly and accurately parse through unstructured document. Insurance leaders are leveraging intelligent automation to reduce costs, mitigate loss risks, and stay competitive with their peers.

Source: guidetoguns.blogspot.com

Source: guidetoguns.blogspot.com

The increased efficiency allows underwriters to service more accounts. Leading insurers develop focused programs and adjust their staffing models to recruit and train analytics talent—developers, architects, data. Insurance carriers that are already embracing data science are able to complete the underwriting process 50 percent faster. As ml is an integral part of data science, so is underwriting for insurance. For example, faster processing technologies like hadoop have allowed insurers like allstate to dig through customer information—quotes, policies, claims—to note patterns and.

Source: revisi.net

Source: revisi.net

Sponsored [vrs]™ virtual risk space by virtual i technologies is an intelligent platform for insurance underwriting and risk assessment. According to her estimates, a data scientist in insurance could expect a salary of up to £120,000, depending on seniority, responsibilities and technical knowledge. Insurance carriers that are on board with the use of. Conversely, underwriters lack the basic data literacy for meaningful discussions with their data science counterparts who are not subject matter experts In the last decade, life insurance has seen a swath of data sources, predictive models, and technology become available for underwriting.

Source: pinterest.com

Source: pinterest.com

The increased efficiency allows underwriters to service more accounts. For example, companies like datacubes and friss are using data science to transform and accelerate core insurance functions such as commercial underwriting and fraud detection. Underwriters can save a significant amount of time allocated to data analysis and can make more informed decisions since these models are better than humans at recognizing patterns in large data. After all, if your computers can do all of the underwriting by mining data from a smartphone, you don’t need a human underwriter to make the call. The ongoing crisis has reinforced the urgency to modernize the underwriting process.

Source: guidetoguns.blogspot.com

Source: guidetoguns.blogspot.com

After all, if your computers can do all of the underwriting by mining data from a smartphone, you don’t need a human underwriter to make the call. Upskilling and reskilling underwriters is at least as important as attracting new talent. The hyperscience platform helps you to quickly and accurately parse through unstructured document. Underwriting and pricing much of data science’s potential in the insurance world relates to the greater insight possible in the risk assessment process. Insurance fraud brings vast financial loss to insurance companies every year.

Source: revisi.net

Source: revisi.net

Data science can enable insurers to develop effective strategies to acquire new customers, develop personalized products, analyze risks, assist underwriters, implement fraud detection systems, and much more. After all, if your computers can do all of the underwriting by mining data from a smartphone, you don’t need a human underwriter to make the call. A strong working relationship between the two disciplines is table stakes. The process of underwriting is perhaps the most crucial for the insurance business as its function is to assess the risk involved and classify the risk into various categories. It has long been the established practice for insurers to gather data on applicants’ (or their property’s) characteristics and use this to assess the likely chance and cost of claims.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance underwriting data science by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.