Insurance value chain information

Home » Trending » Insurance value chain informationYour Insurance value chain images are available in this site. Insurance value chain are a topic that is being searched for and liked by netizens today. You can Download the Insurance value chain files here. Get all royalty-free photos and vectors.

If you’re searching for insurance value chain pictures information connected with to the insurance value chain topic, you have visit the right site. Our site frequently gives you suggestions for viewing the highest quality video and image content, please kindly search and locate more informative video content and graphics that match your interests.

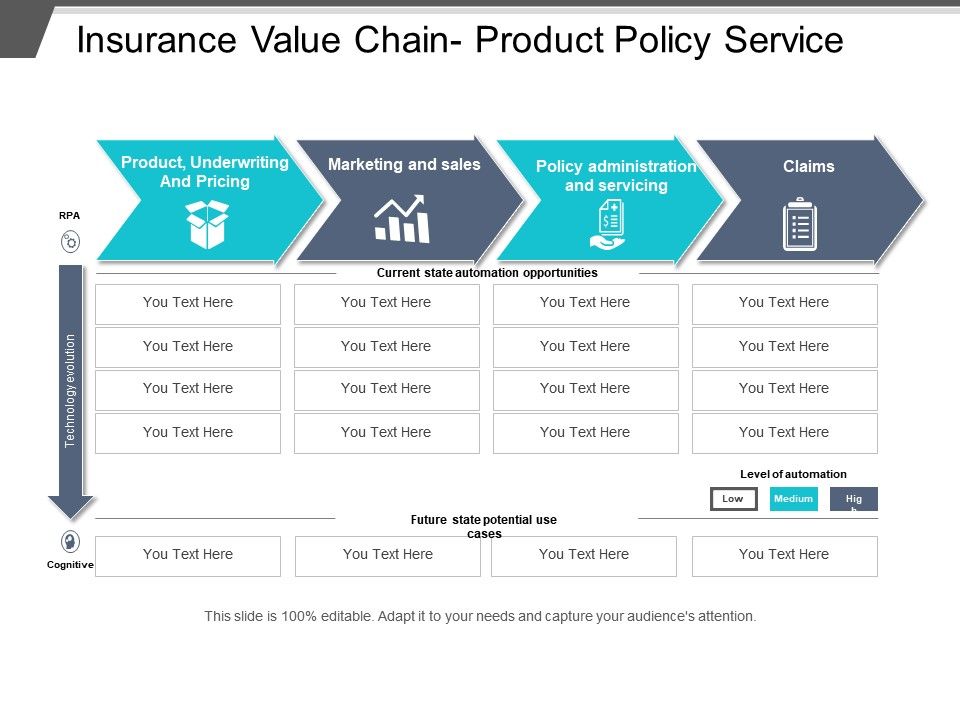

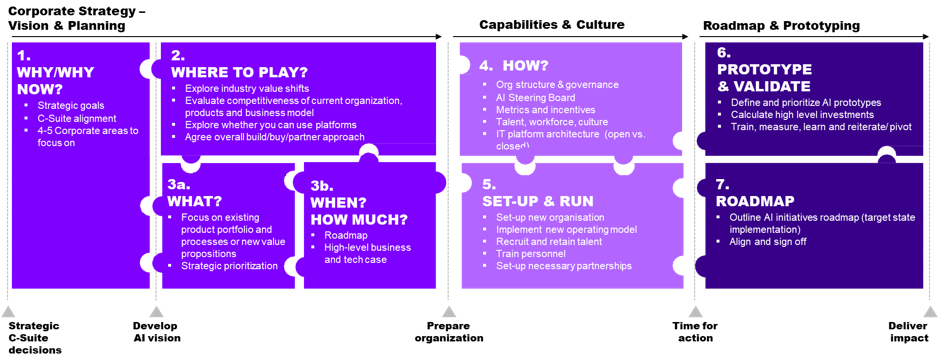

Insurance Value Chain. Leverage our insurance value chain ppt template to exhibit how technology has transformed the operations of the entire insurance industry. The insurance value chain across different market participants is becoming increasingly blurry, in s&p global ratings’ view. The insurance intervention in the health care transaction generates another value delivery chain that is markedly different than the chains described above. Thus supporting the client in their pursuit.

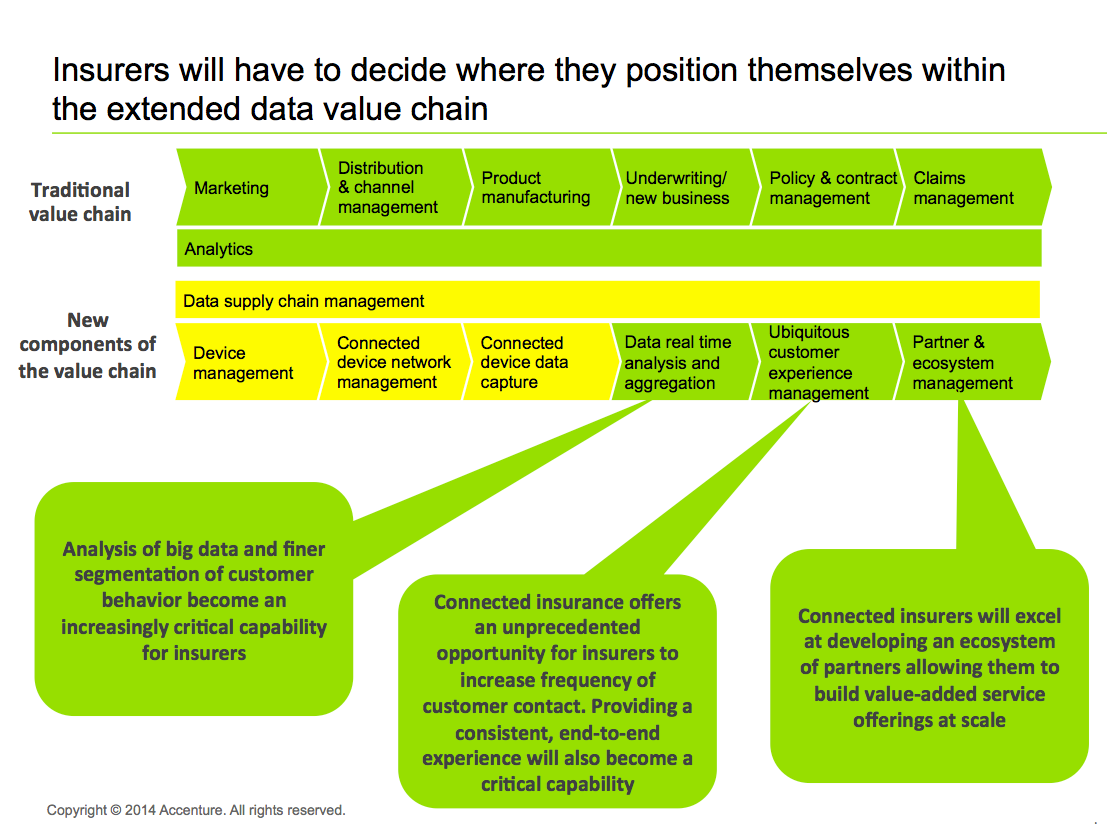

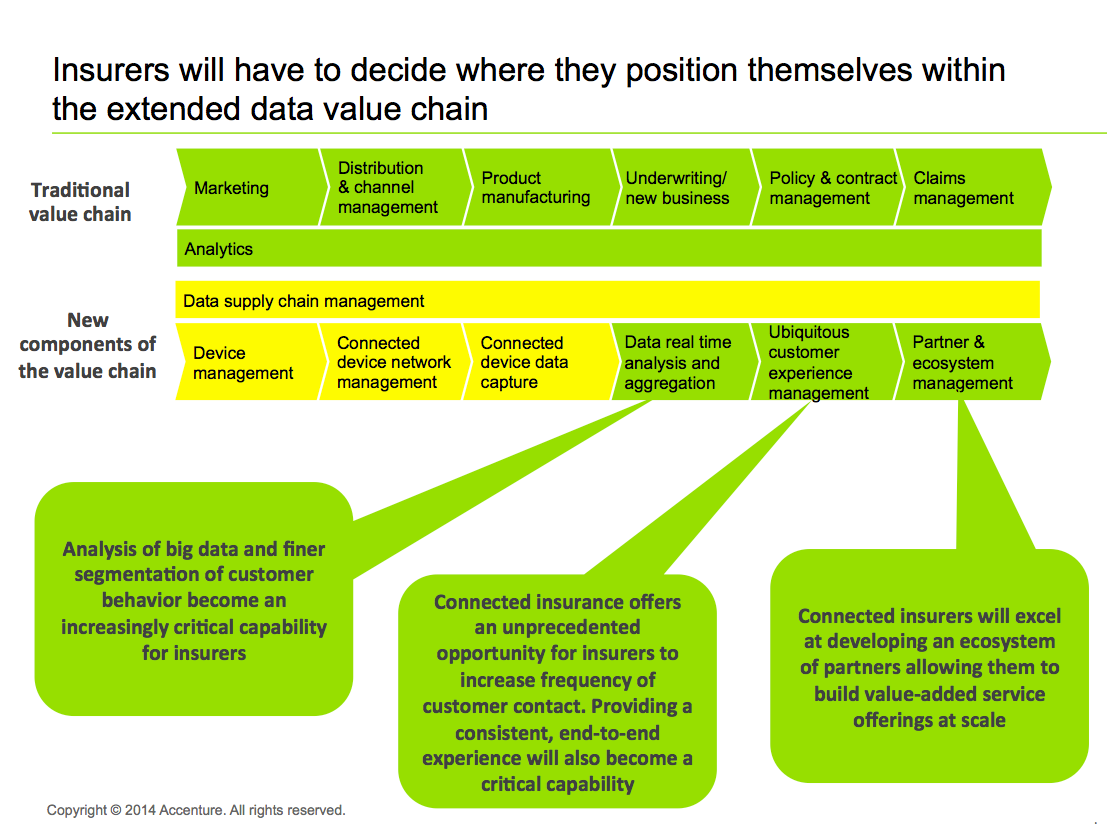

Data, data, everywhere—but how to use it? Accenture From insuranceblog.accenture.com

Data, data, everywhere—but how to use it? Accenture From insuranceblog.accenture.com

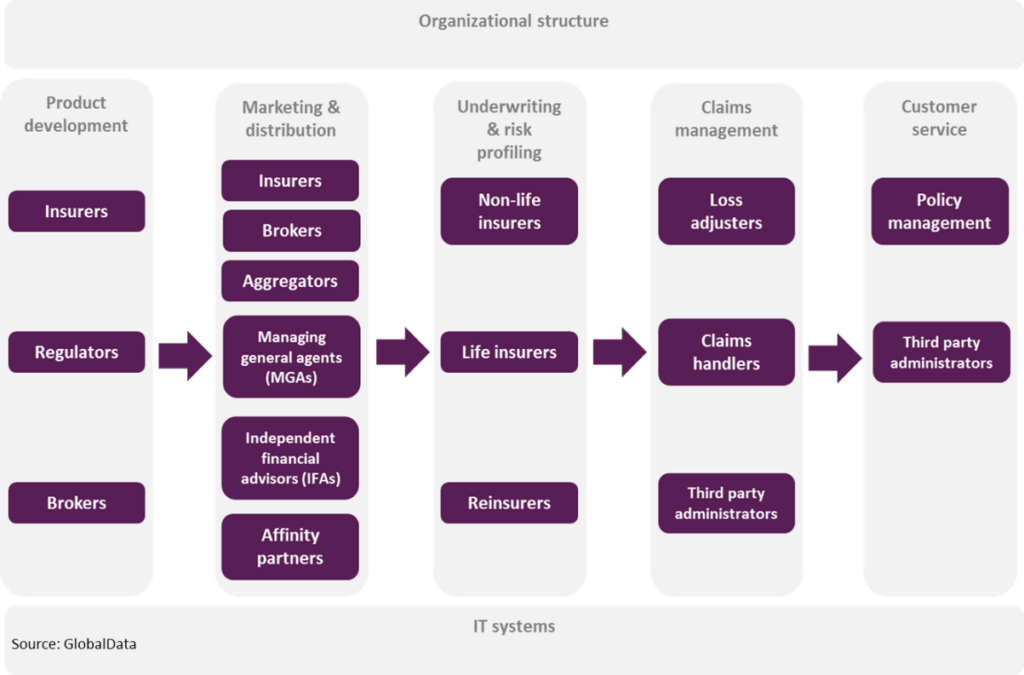

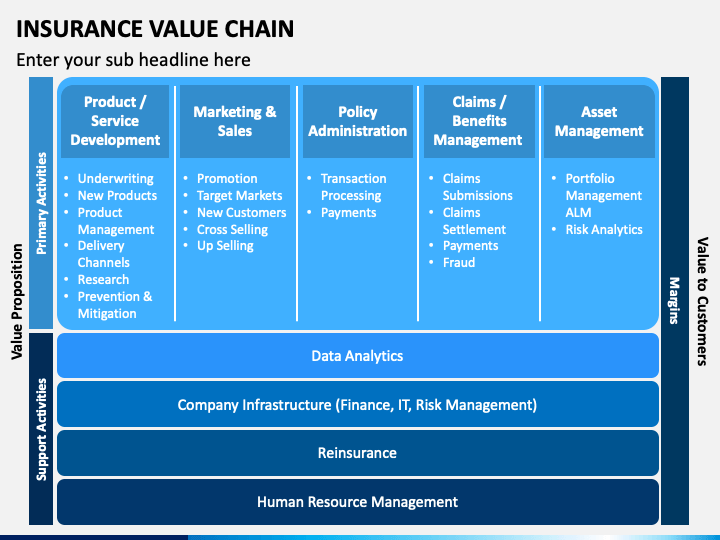

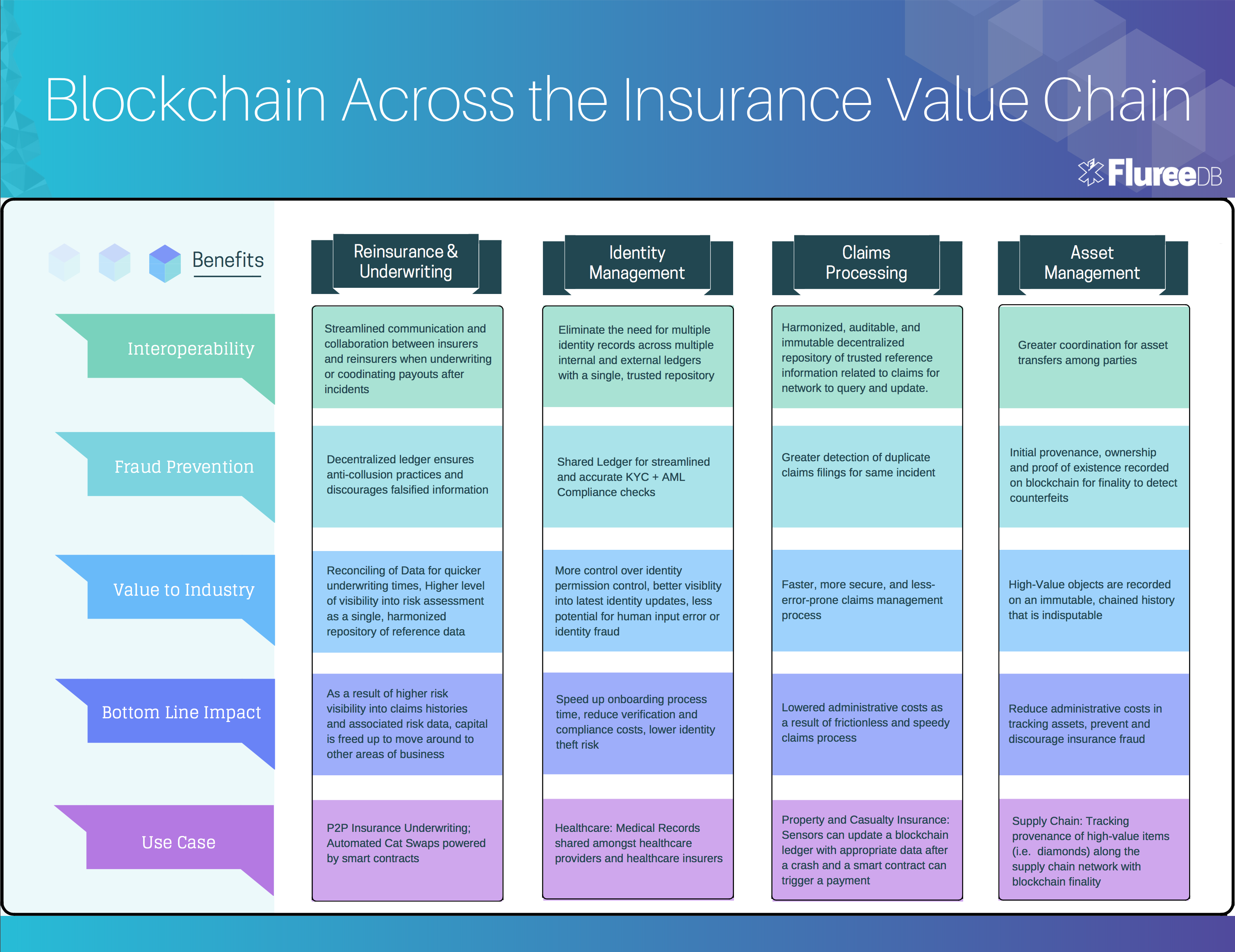

Managing the value chain was discussed. Product management marketing sales and distribution policy administration and servicing claims management new business underwriting and risk management finance and accounting Thus supporting the client in their pursuit. More than three quarters of respondents to ibv agree that blockchain platforms are disrupting the traditional insurance value chain. Product management, sales & distribution, new business underwriting, claims, payments and customer service in the insurance industry. The insurance industry is one that is desperate for innovation.

The ability to pay out of pocket for.

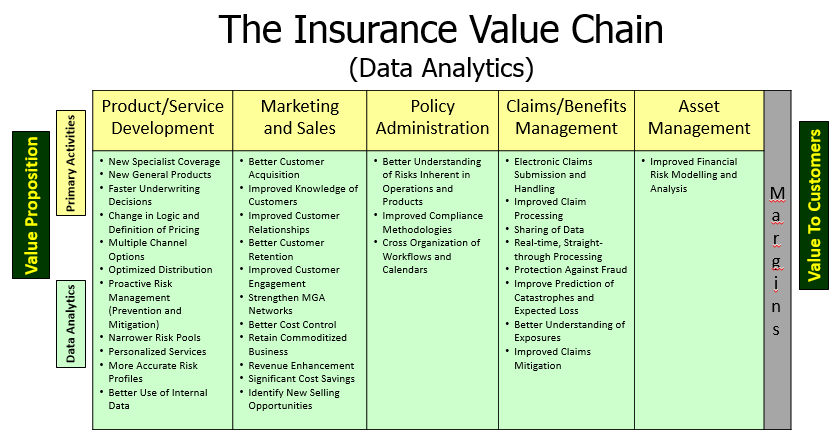

What do insurers need to consider when delegating ownership of their value chain elements? How to build analytics into the insurance value chain undiscovered opportunities insurance | analytics 2. More than three quarters of respondents to ibv agree that blockchain platforms are disrupting the traditional insurance value chain. The products marked with a * are currently on sale. In this context, a possible fragmentation of the insurance value chain could occur, including, most pertinently, a potential for a reduced regulatory and supervisory ‘grip’ on the relevant activities in the value chain, or ways in which the ‘lengthening’ of the value chain ‘stresses’ existing regulatory and supervisory oversight. While technology may make our industry more efficient, nimble, and accurate, the reality is that customer care and concern is not going away.

Source: agenciademodelospontealta.blogspot.com

Insurance industry value chain by professor festus. What do insurers need to consider when delegating ownership of their value chain elements? You can also explain the role of ai, iot, robotics, blockchain, and machine learning in the value chain, from sales to claims and payments. The new reality and actionable insights across the value chain. Thus supporting the client in their pursuit.

Source: lifeinsuranceinternational.com

Source: lifeinsuranceinternational.com

Insurance value chain modern digital engineering can provide a competitive advantage on any or all parts of the value chain. It was concluded that the insurance industry must work on minimizing cost, differentiation of product and be focused if they are to make a reasonable margin in their. Unlock value profitable growth deep experience innovation insight we work with insurers to find opportunities that deliver profitable growth while protecting and optimising their enterprise. The new reality and actionable insights across the value chain. In this context, a possible fragmentation of the insurance value chain could occur, including, most pertinently, a potential for a reduced regulatory and supervisory ‘grip’ on the relevant activities in the value chain, or ways in which the ‘lengthening’ of the value chain ‘stresses’ existing regulatory and supervisory oversight.

Source: twitter.com

Source: twitter.com

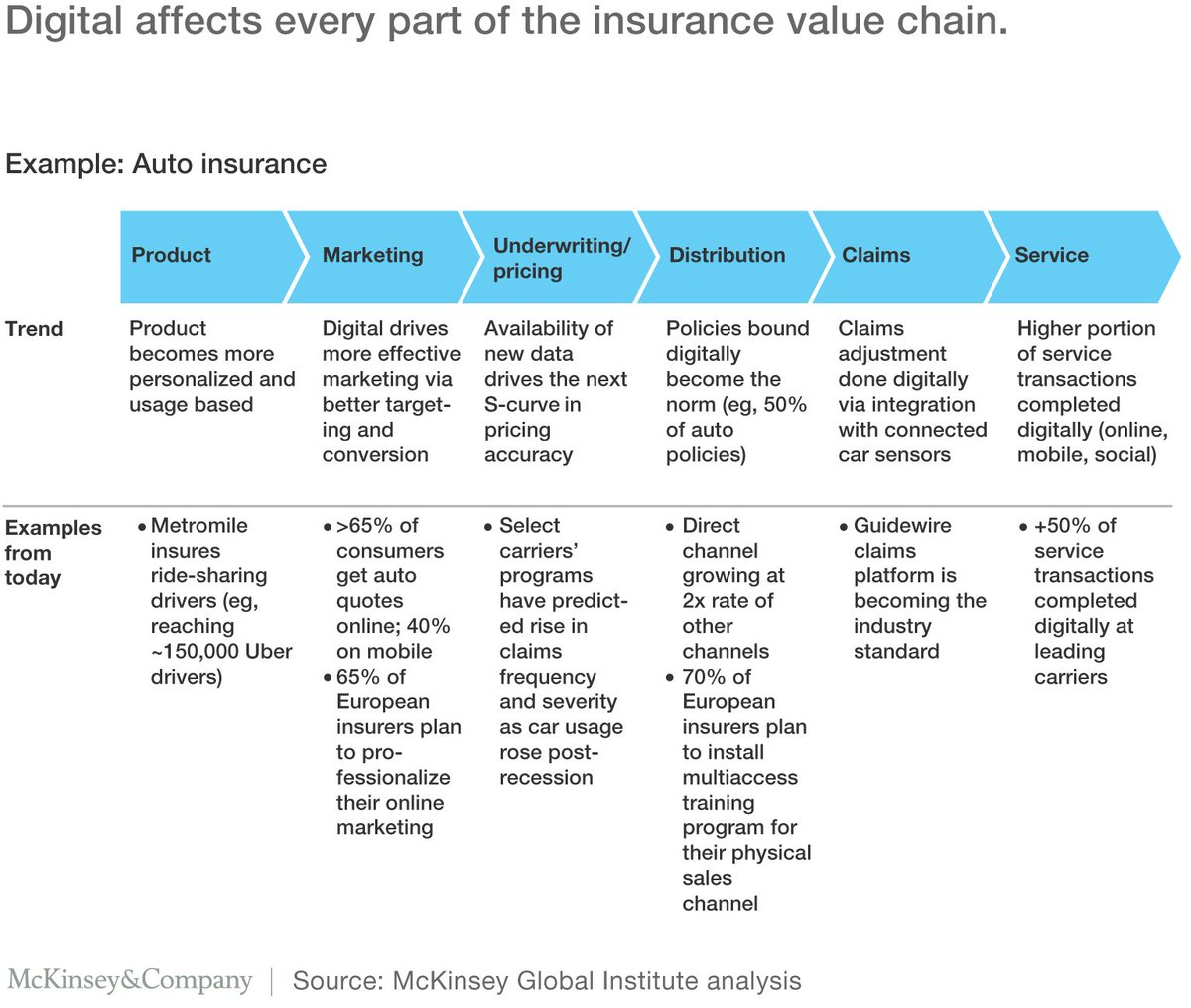

Insurance professionals have set out the eleven key components of the insurance value chain and offer insights on the actions that insurers should be contemplating. Across property and auto insurance, image analytics enables insurance companies to remotely and more effectively assess the loss and identify possible fraudulent claims. Thus supporting the client in their pursuit. You can also explain the role of ai, iot, robotics, blockchain, and machine learning in the value chain, from sales to claims and payments. Data has to take a detour off the value chain to go there, as well, and the data needs to be clean and accurate.

Source: sandeepbhowmick.blogspot.com

Source: sandeepbhowmick.blogspot.com

However, adopters of new technology are steadily improving operations in all areas of the insurance value chain. Another important branch is regulatory reporting. In preparing for the new reality, kpmg insurance professionals have set out the eleven key components of the insurance value chain and we offer our insights on the actions that insurers should be contemplating. By f epetimehin · 2017 — a value chain is a set of activities that a firm operating in a specific industry performs in order to deliver a valuable product or service for the market. The ability to pay out of pocket for.

Source: slidemembers.com

Source: slidemembers.com

Unlock value profitable growth deep experience innovation insight we work with insurers to find opportunities that deliver profitable growth while protecting and optimising their enterprise. They can also improve the cost side by shifting away from legacy. However, adopters of new technology are steadily improving operations in all areas of the insurance value chain. • more and more insurance will be ‘bought’ by customers as opposed to being ‘sold’ by agents destroying the age old wisdom of ‘insurance is sold and not bought’. You can also explain the role of ai, iot, robotics, blockchain, and machine learning in the value chain, from sales to claims and payments.

Source: slideteam.net

Source: slideteam.net

Product management, sales & distribution, new business underwriting, claims, payments and customer service in the insurance industry. The insurance industry is one that is desperate for innovation. Insurance industry value chain by professor festus. The insurance value chain across different market participants is becoming increasingly blurry, in s&p global ratings’ view. In this context, a possible fragmentation of the insurance value chain could occur, including, most pertinently, a potential for a reduced regulatory and supervisory ‘grip’ on the relevant activities in the value chain, or ways in which the ‘lengthening’ of the value chain ‘stresses’ existing regulatory and supervisory oversight.

Source: insurtech.oliverwyman.com

The new reality and actionable insights across the value chain. You can also explain the role of ai, iot, robotics, blockchain, and machine learning in the value chain, from sales to claims and payments. This data may come from. Managing the value chain was discussed. The insurance value chain is built upon trusted relationships.

Source: insuranceblog.accenture.com

Source: insuranceblog.accenture.com

Whereas the other two branches offer monetary value, this one offers evidentiary value that you can present to regulators. The paper reviewed the importance of value chain in the insurance industry and how to use it effectively for competitive advantage. By f epetimehin · 2017 — a value chain is a set of activities that a firm operating in a specific industry performs in order to deliver a valuable product or service for the market. Another value chain analysis example is using the value chain information to make modest advertising budget that can reduce marketing costs and offer. Product management, sales & distribution, new business underwriting, claims, payments and customer service in the insurance industry.

Source: sketchbubble.com

Source: sketchbubble.com

However, adopters of new technology are steadily improving operations in all areas of the insurance value chain. The insurance value chain is built upon trusted relationships. Defining the tariff* market based pricing* market based pricing* who (department) product development and management (includes actuarial dpt) why (benefits) determine forward cost. Insurance industry value chain by professor festus. They can also improve the cost side by shifting away from legacy.

Source: globalriskinsights.com

Source: globalriskinsights.com

More than three quarters of respondents to ibv agree that blockchain platforms are disrupting the traditional insurance value chain. While technology may make our industry more efficient, nimble, and accurate, the reality is that customer care and concern is not going away. Leverage our insurance value chain ppt template to exhibit how technology has transformed the operations of the entire insurance industry. The paper reviewed the importance of value chain in the insurance industry and how to use it effectively for competitive advantage. The ability to pay out of pocket for.

Source: slideteam.net

Source: slideteam.net

However, adopters of new technology are steadily improving operations in all areas of the insurance value chain. By f epetimehin · 2017 — a value chain is a set of activities that a firm operating in a specific industry performs in order to deliver a valuable product or service for the market. Insurance value chain modern digital engineering can provide a competitive advantage on any or all parts of the value chain. Another important branch is regulatory reporting. The insurance intervention in the health care transaction generates another value delivery chain that is markedly different than the chains described above.

Source: jonsabes.com

Source: jonsabes.com

Product management marketing sales and distribution policy administration and servicing claims management new business underwriting and risk management finance and accounting Product management marketing sales and distribution policy administration and servicing claims management new business underwriting and risk management finance and accounting The insurance value chain is built upon trusted relationships. What do insurers need to consider when delegating ownership of their value chain elements? In this context, a possible fragmentation of the insurance value chain could occur, including, most pertinently, a potential for a reduced regulatory and supervisory ‘grip’ on the relevant activities in the value chain, or ways in which the ‘lengthening’ of the value chain ‘stresses’ existing regulatory and supervisory oversight.

Source: nitrobots.ai

Source: nitrobots.ai

The insurance industry is one that is desperate for innovation. Thus supporting the client in their pursuit. The insurance intervention in the health care transaction generates another value delivery chain that is markedly different than the chains described above. While technology may make our industry more efficient, nimble, and accurate, the reality is that customer care and concern is not going away. It was concluded that the insurance industry must work on minimizing cost, differentiation of product and be focused if they are to make a reasonable margin in their.

Source: skan.ai

Product management, sales & distribution, new business underwriting, claims, payments and customer service in the insurance industry. The insurance value chain across different market participants is becoming increasingly blurry, in s&p global ratings’ view. Defining the tariff* market based pricing* market based pricing* who (department) product development and management (includes actuarial dpt) why (benefits) determine forward cost. Infosys bpo optimized the client’s business, in varied areas like indexing support, underwriting and claims, analytics in workers compensation etc. Insurance value chain modern digital engineering can provide a competitive advantage on any or all parts of the value chain.

Source: researchgate.net

It was concluded that the insurance industry must work on minimizing cost, differentiation of product and be focused if they are to make a reasonable margin in their. A third branch off the data value chain is the forensic chain. In preparing for the new reality, kpmg insurance professionals have set out the eleven key components of the insurance value chain and we offer our insights on the actions that insurers should be contemplating. The insurance intervention in the health care transaction generates another value delivery chain that is markedly different than the chains described above. In this context, a possible fragmentation of the insurance value chain could occur, including, most pertinently, a potential for a reduced regulatory and supervisory ‘grip’ on the relevant activities in the value chain, or ways in which the ‘lengthening’ of the value chain ‘stresses’ existing regulatory and supervisory oversight.

Source: insurtechnews.com

Source: insurtechnews.com

More than three quarters of respondents to ibv agree that blockchain platforms are disrupting the traditional insurance value chain. More than three quarters of respondents to ibv agree that blockchain platforms are disrupting the traditional insurance value chain. Unlock value profitable growth deep experience innovation insight we work with insurers to find opportunities that deliver profitable growth while protecting and optimising their enterprise. Another important branch is regulatory reporting. The paper reviewed the importance of value chain in the insurance industry and how to use it effectively for competitive advantage.

Source: twitter.com

Source: twitter.com

The new reality and actionable insights across the value chain. In this context, a possible fragmentation of the insurance value chain could occur, including, most pertinently, a potential for a reduced regulatory and supervisory ‘grip’ on the relevant activities in the value chain, or ways in which the ‘lengthening’ of the value chain ‘stresses’ existing regulatory and supervisory oversight. Insurance value chain modern digital engineering can provide a competitive advantage on any or all parts of the value chain. The products marked with a * are currently on sale. The insurance intervention in the health care transaction generates another value delivery chain that is markedly different than the chains described above.

Source: globalriskinsights.com

Source: globalriskinsights.com

Unlock value profitable growth deep experience innovation insight we work with insurers to find opportunities that deliver profitable growth while protecting and optimising their enterprise. Another important branch is regulatory reporting. You can also explain the role of ai, iot, robotics, blockchain, and machine learning in the value chain, from sales to claims and payments. Product management marketing sales and distribution policy administration and servicing claims management new business underwriting and risk management finance and accounting In preparing for the new reality, kpmg insurance professionals have set out the eleven key components of the insurance value chain and we offer our insights on the actions that insurers should be contemplating.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance value chain by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.