Insurance works on the principle of information

Home » Trending » Insurance works on the principle of informationYour Insurance works on the principle of images are available. Insurance works on the principle of are a topic that is being searched for and liked by netizens now. You can Download the Insurance works on the principle of files here. Get all royalty-free images.

If you’re searching for insurance works on the principle of pictures information related to the insurance works on the principle of interest, you have come to the right blog. Our website always provides you with suggestions for seeking the maximum quality video and image content, please kindly search and locate more informative video content and graphics that fit your interests.

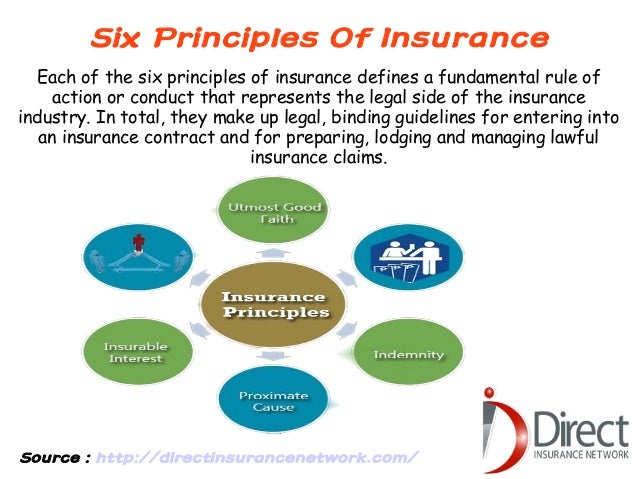

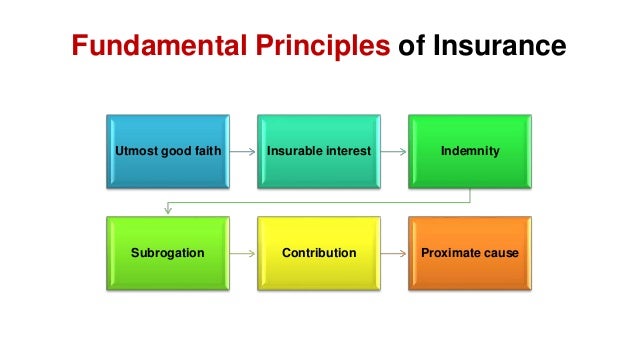

Insurance Works On The Principle Of. There are six principles in insurance: Insurable interest forms the core principle of insurance. This principle says that insurance is done only for the coverage of the loss; It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

Principles of Insurance with example Insuregrams From insuregrams.com

Principles of Insurance with example Insuregrams From insuregrams.com

Nature of contract is a fundamental principle of insurance contract. It is attributed to the insured object since the object’s healthy existence yields benefit to policyholders. All of the above 3. Insurance works on the principle of trust, sharing and randomness. Insurance works on the principle of answer. Preston (1883) in the following way “a contract of insurance is necessarily a contract of indemnity (except life and personal accident insurance) and of indemnity only, and this means that in case of a loss the insured shall be fully indemnified, but shall never be more than fully indemnified.

An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter.a person or entity who buys insurance is known as a policyholder, while a person or entity.

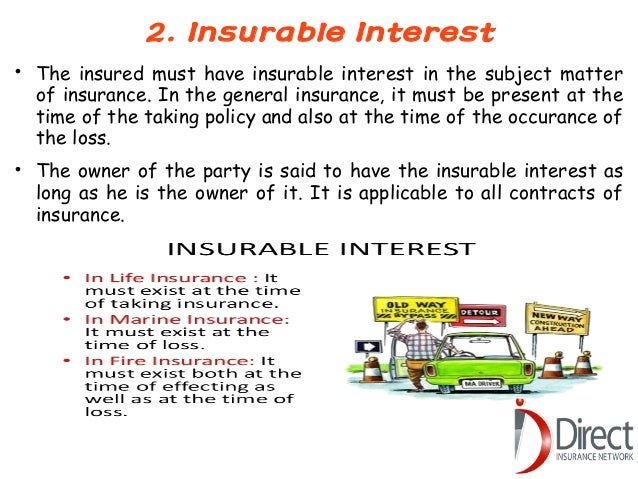

Insurance works on the principle of _____ a. If there is no insurable interest, an insurance company will not issue a policy. Based on this principle, the insured has the right to insure an insured object due to the relationship of financial interest that is legal by law between the insured and the insured object. Absence of insurance makes the contract null and void. According to the principle of indemnity, an insurance contract is signed only for getting protection against unpredicted financial losses arising due to future uncertainties. Insurance is defined as the equitable transfer of risk of loss from one entity to another, in exchange for a premium.

Source: slideshare.net

Source: slideshare.net

Insurance works on the principle of trust, sharing and randomness. Hence insured should not make any profit from the insurance contract. Insurance works on the principle of: Insurance is a method of transferring the gains of a few to the many. All of the above 3.

Source: en.frenchpdf.com

Source: en.frenchpdf.com

It is the motivating factor that makes people take protective measures against unforeseen events damaging the beneficial thing. Insurance is defined as the equitable transfer of risk of loss from one entity to another, in exchange for a premium. The principle of indemnity was well cared for in the leading case of castellain v. Insurance works on the principle of: Under this principle of insurance, the insured must have interest in the subject matter of the insurance.

Source: slideshare.net

Source: slideshare.net

The second basic principle in insurance is insurable interest. According to the principle of indemnity, an insurance contract is signed only for getting protection against unpredicted financial losses arising due to future uncertainties. If the insured claims full insurance from one insurer he losses his right to claim any amount from the other insurers. Insurance works on the principle of answer. An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter.a person or entity who buys insurance is known as a policyholder, while a person or entity.

Source: slideshare.net

Source: slideshare.net

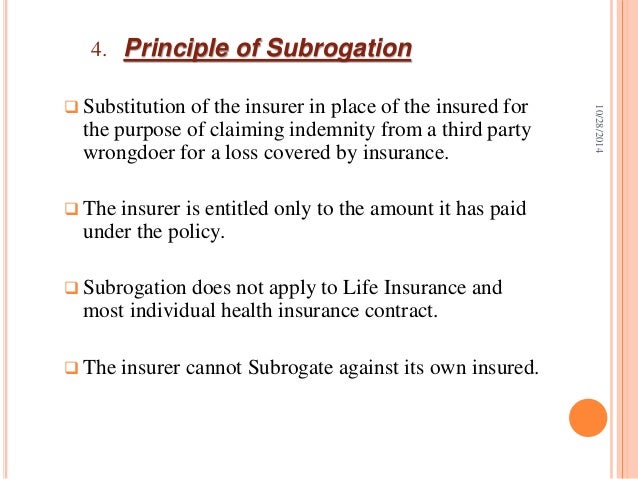

It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. Principle of contribution is implemented when multiple insurance policies are covering the same property or loss, the total payment for actual loss is proportionally divided among all insurance companies. Insurance indemnity allows you to be fairly compensated for a loss, while at the same time ensuring that no one takes advantage of their insurance. If the insured claims full insurance from one insurer he losses his right to claim any amount from the other insurers. How principle of contribution works in insurance.

Source: ipbcustomize.com

Source: ipbcustomize.com

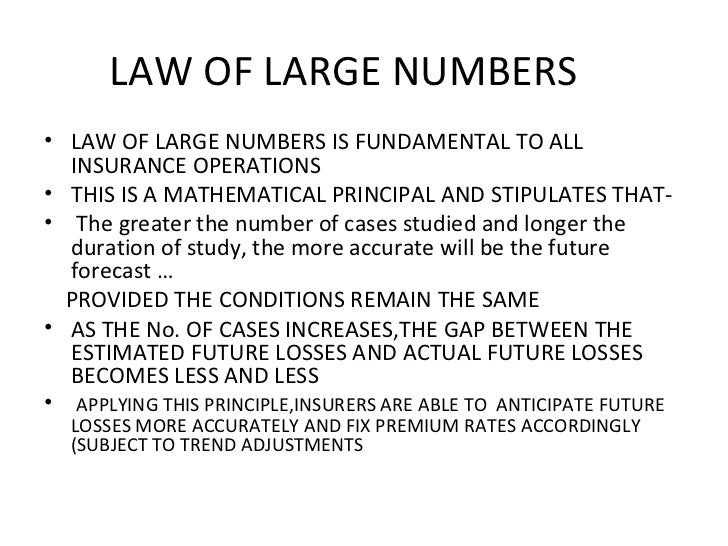

It is the motivating factor that makes people take protective measures against unforeseen events damaging the beneficial thing. To obtain a probability ratio, the number of favorable results in a set is divided by the total number of possible results in the set. This principle says that insurance is done only for the coverage of the loss; B) social insurance, life and health insurance, and general insurance/property and. It is attributed to the insured object since the object’s healthy existence yields benefit to policyholders.

Source: slideshare.net

Source: slideshare.net

Based on this principle, the insured has the right to insure an insured object due to the relationship of financial interest that is legal by law between the insured and the insured object. It is attributed to the insured object since the object’s healthy existence yields benefit to policyholders. Insurance works on the principle of probability. Good faith, is a very basic and first primary. It is the motivating factor that makes people take protective measures against unforeseen events damaging the beneficial thing.

Source: slideshare.net

Source: slideshare.net

Insurable interest forms the core principle of insurance. Insurance works on the principle of: This principle protects companies from insurance fraud and moral hazard. Hence insured should not make any profit from the insurance contract. • this principle applies to life, fire and marine insurance.

Source: slideshare.net

Source: slideshare.net

Insurable interest forms the core principle of insurance. Based on this principle, the insured has the right to insure an insured object due to the relationship of financial interest that is legal by law between the insured and the insured object. Contribution is a principle of insurance which applies if an insured object is insured by two or more insurers. According to the principle of indemnity, an insurance contract is signed only for getting protection against unpredicted financial losses arising due to future uncertainties. All of the above ans:

Source: slideshare.net

Source: slideshare.net

Insurance works on the principle of probability. An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter.a person or entity who buys insurance is known as a policyholder, while a person or entity. The principle of indemnity was well cared for in the leading case of castellain v. Please log in or register to add a comment. If the insured claims full insurance from one insurer he losses his right to claim any amount from the other insurers.

Source: es.slideshare.net

Source: es.slideshare.net

Principle, the insurance contract must be. False, functions of management are not related with principles of management. Preston (1883) in the following way “a contract of insurance is necessarily a contract of indemnity (except life and personal accident insurance) and of indemnity only, and this means that in case of a loss the insured shall be fully indemnified, but shall never be more than fully indemnified. Insurance works on the principle of _____ a. However intangible property such as copyright are not generally insurable under property insurance since this policy caters for property which can experience physical loss or damage by fortuity.

Source: slideshare.net

Source: slideshare.net

Property may be defined as anything which has a value assigned to it, both tangible and intangible. Insurance works on the principle of trust, sharing and randomness. The principle of indemnity was well cared for in the leading case of castellain v. It is the motivating factor that makes people take protective measures against unforeseen events damaging the beneficial thing. Insurance contract is not made for making profit else its sole purpose is to give compensation in case of any damage or loss.

Source: insuregrams.com

Source: insuregrams.com

However intangible property such as copyright are not generally insurable under property insurance since this policy caters for property which can experience physical loss or damage by fortuity. An insurable interest must exist at the time of the purchase of the insurance. This principle protects companies from insurance fraud and moral hazard. Insurance contracts are created solely as a means to provide protection from unexpected events, not as a means to make a profit from a loss. B) social insurance, life and health insurance, and general insurance/property and.

Source: pinterest.com

Source: pinterest.com

According to the principle of indemnity, an insurance contract is signed only for getting protection against unpredicted financial losses arising due to future uncertainties. Insurance is defined as the equitable transfer of risk of loss from one entity to another, in exchange for a premium. How principle of contribution works in insurance. The principle of indemnity was well cared for in the leading case of castellain v. Under this principle of insurance, the insured must have interest in the subject matter of the insurance.

Source: slideshare.net

Source: slideshare.net

Insurance is a method of transferring the gains of a few to the many. Insurance contracts are created solely as a means to provide protection from unexpected events, not as a means to make a profit from a loss. According to the principle of indemnity, an insurance contract is signed only for getting protection against unpredicted financial losses arising due to future uncertainties. Based on this principle, the insured has the right to insure an insured object due to the relationship of financial interest that is legal by law between the insured and the insured object. How principle of contribution works in insurance.

Source: slideshare.net

Source: slideshare.net

• this principle applies to life, fire and marine insurance. Insurance contract is not made for making profit else its sole purpose is to give compensation in case of any damage or loss. The second basic principle in insurance is insurable interest. Insurance is a method of transferring the gains of a few to the many. • this principle applies to life, fire and marine insurance.

Source: slideshare.net

Source: slideshare.net

Insurance works on the principle of answer. According to the principle of indemnity, an insurance contract is signed only for getting protection against unpredicted financial losses arising due to future uncertainties. This principle protects companies from insurance fraud and moral hazard. Therefore, the insured is protected from losses by the principle of indemnity, but through stipulations that keep him or her from being able to scam and make a profit. Insurance indemnity allows you to be fairly compensated for a loss, while at the same time ensuring that no one takes advantage of their insurance.

Source: articles-junction.blogspot.com

Source: articles-junction.blogspot.com

Nature of contract is a fundamental principle of insurance contract. It is attributed to the insured object since the object’s healthy existence yields benefit to policyholders. This principle protects companies from insurance fraud and moral hazard. Principle, the insurance contract must be. In simple english words, the principle of utmost.

Source: ensuresit.com

Source: ensuresit.com

All of the above 3. Some people might deliberately damage their property so that they can collect the insurance money and make a profit. Insurance indemnity allows you to be fairly compensated for a loss, while at the same time ensuring that no one takes advantage of their insurance. Insurance contract is not made for making profit else its sole purpose is to give compensation in case of any damage or loss. Insurance works on the principle of answer.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title insurance works on the principle of by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.