Insurance zero or exempt information

Home » Trend » Insurance zero or exempt informationYour Insurance zero or exempt images are ready in this website. Insurance zero or exempt are a topic that is being searched for and liked by netizens today. You can Get the Insurance zero or exempt files here. Download all free photos and vectors.

If you’re looking for insurance zero or exempt images information connected with to the insurance zero or exempt interest, you have come to the ideal blog. Our website frequently provides you with hints for seeing the maximum quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

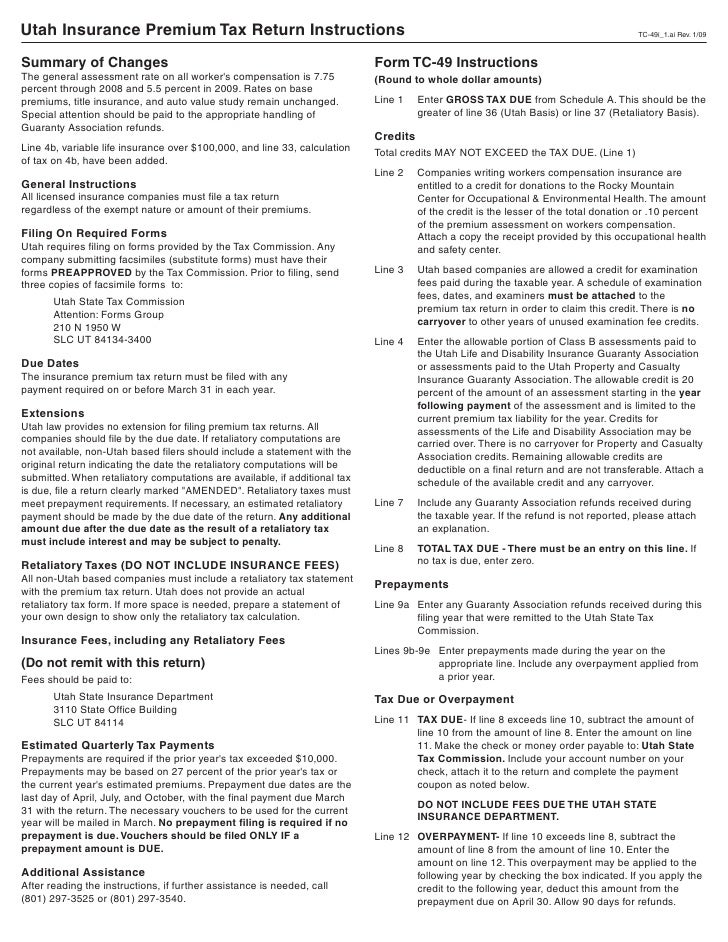

Insurance Zero Or Exempt. Is more from the seller’s point of view. Gst is charged on the insurance premiums at the standard rate2. You may also zero rate certain insurance premiums. Vat has to be charged;

Insurance Zero Or Exempt Fillable Online gdcuk Exempt From esclavamente.blogspot.com

Insurance Zero Or Exempt Fillable Online gdcuk Exempt From esclavamente.blogspot.com

Did you know that generally,vat is levied on the supply of. All insurance entities including exempt insurance companies and qualified insurance companies will be regulated under the insurance act, which will be amended to provide for three classes of licenses, as follows. The section levies vat at the standard rate of vat (currently 15%) unless the supplies qualify to be made at the zero rate of vat or are exempt. Exempt items such items should not be included on the vat return. If you are going to make exempt supplies, you will need to factor in the extra costs of the irrecoverable vat before you start, or else you could be in for a nasty and costly surprise. 3) banking fees, not tax.

Did you know that generally,vat is levied on the supply of.

The government guidance states that “if you supply exempt insurance with goods or services that are liable to tax, you’ll need to determine the correct tax treatment for your supplies.” what follows is a detailed guide for insurers demonstrating how to do just this. For more details on exempt items and services, click here. Is the commission earned by the insurance broker exempt from vat? When to use sales tax e exempt vs z zero rated tax. There are several transactions i�m unclear which sales tax code should be used. The government guidance states that “if you supply exempt insurance with goods or services that are liable to tax, you’ll need to determine the correct tax treatment for your supplies.” what follows is a detailed guide for insurers demonstrating how to do just this.

Source: loanstreet.com.my

Source: loanstreet.com.my

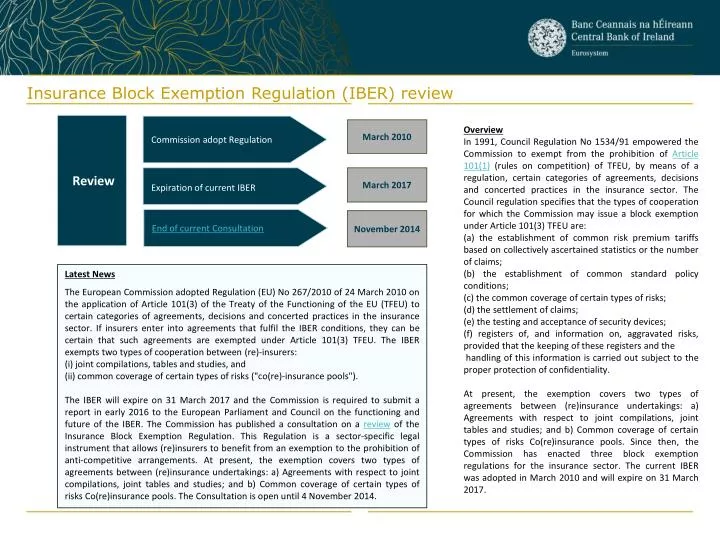

Class 1, which includes captives, will pay a license fee and be zero taxed. Did you know that generally,vat is levied on the supply of. The government guidance states that “if you supply exempt insurance with goods or services that are liable to tax, you’ll need to determine the correct tax treatment for your supplies.” what follows is a detailed guide for insurers demonstrating how to do just this. Producers of exempt supplies are excused from the reporting obligations associated with taxable supplies, but are unable to claim input tax credits for gst/hst incurred in their exempt operations, but are still required to report and. 3) banking fees, not tax.

Source: esclavamente.blogspot.com

Source: esclavamente.blogspot.com

Health services of the doctor; Vat has to be charged; Life insurance and associated reinsurance (exempt)3; While zero rated goods include items such as books, goods sold by charities, equipment such as wheelchairs for the disabled, medicine and water, exempt goods include items such as insurance, certain types of training and education, certain services offered by doctors and dentists, postal services, betting, lotteries, physical education, works of art, etc. Common exempt items are insurance, royal mail postage services, rent (assuming no option to tax), education and vocational training supplied by recognised bodies, bank charges and interest, membership subscriptions to professional bodies, donations, salary payments, payments to hmrc,.

Source: wootic.com

Source: wootic.com

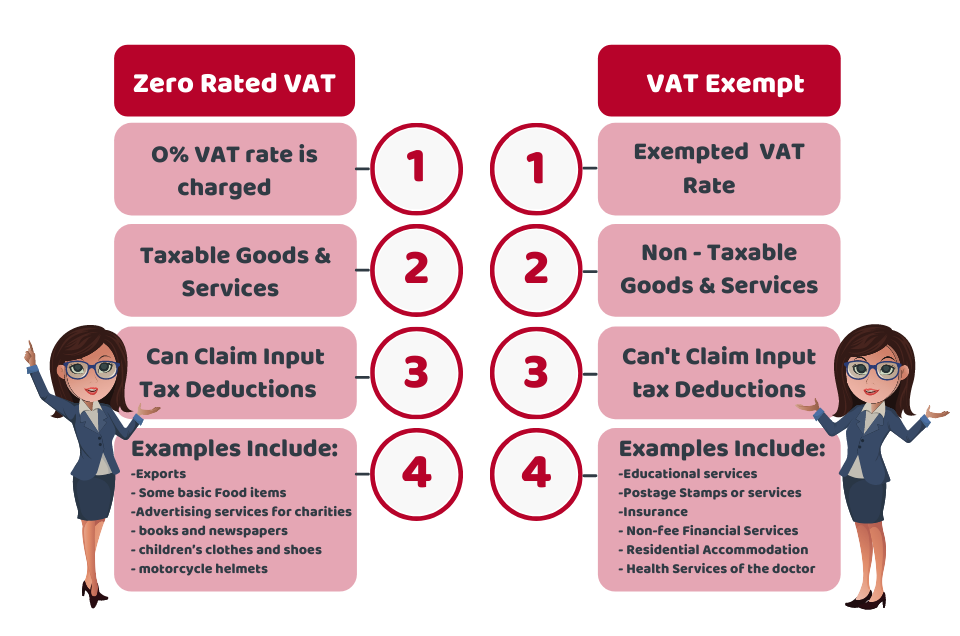

If you are going to make exempt supplies, you will need to factor in the extra costs of the irrecoverable vat before you start, or else you could be in for a nasty and costly surprise. We often deal with businesses that have assumed that commission income they receive in relation to insurance services and financial services is vat exempt. The exempt insurance act will be repealed. You can find the difference between zero rated vat items and exempt vat with the help of this infographic: The main difference between the two is not from the buyer’s perspective;

Source: ourfreakingbudget.com

Source: ourfreakingbudget.com

Is more from the seller’s point of view. Unlike insurance, where obligations of an insurer are usually triggered by a certain Life insurance and associated reinsurance (exempt)3; Section 7(1)(a) of the vat act imposes vat on the supply of taxable goods or services by a vendor to any person. 3) banking fees, not tax.

Source: kianirian6.blogspot.com

Commission relating to insurance is not always exempt. Common exempt items are insurance, royal mail postage services, rent (assuming no option to tax), education and vocational training supplied by recognised bodies, bank charges and interest, membership subscriptions to professional bodies, donations, salary payments, payments to hmrc,. There are some goods and services on which vat is not charged, including: When to use sales tax e exempt vs z zero rated tax. The exempt insurance act will be repealed.

Source: scheatingandair.org

Source: scheatingandair.org

This means you can’t reclaim any vat on your business purchases or expenses. The second exempt implies that the interest earned during the accumulation phase is also exempted. The main difference between the two is not from the buyer’s perspective; Insurance excess zero rated or exempt. If all of the goods and services you sell are exempt, your business is exempt, and you won’t be able to register for vat.

Source: apluspawn.net

Source: apluspawn.net

If all of the goods and services you sell are exempt, your business is exempt, and you won’t be able to register for vat. While zero rated goods include items such as books, goods sold by charities, equipment such as wheelchairs for the disabled, medicine and water, exempt goods include items such as insurance, certain types of training and education, certain services offered by doctors and dentists, postal services, betting, lotteries, physical education, works of art, etc. Difference between vat exempt and zero rated vat items the uk. Vat has to be charged; Unlike insurance, where obligations of an insurer are usually triggered by a certain

Source: academy.tax4wealth.com

As mentioned above, some insurance services which you provide, for example, life insurance will be treated as exempt. All insurance entities including exempt insurance companies and qualified insurance companies will be regulated under the insurance act, which will be amended to provide for three classes of licenses, as follows. There are several transactions i�m unclear which sales tax code should be used. The government guidance states that “if you supply exempt insurance with goods or services that are liable to tax, you’ll need to determine the correct tax treatment for your supplies.” what follows is a detailed guide for insurers demonstrating how to do just this. To the insurance is exempt from vat and the rest of the consideration is liable to tax at the appropriate rate.

Source: hamptonroadslawfirm.com

Source: hamptonroadslawfirm.com

As mentioned above, some insurance services which you provide, for example, life insurance will be treated as exempt. The correct vat classification of your insurance services will be crucial as it will dictate if: This type of insurance is only exempt from vat if insurance is the principle element of the supply. Common exempt items are insurance, royal mail postage services, rent (assuming no option to tax), education and vocational training supplied by recognised bodies, bank charges and interest, membership subscriptions to professional bodies, donations, salary payments, payments to hmrc,. Insurance company in singapore is a taxable supply of services.

Source: aliexpress.com

Source: aliexpress.com

Health services of the doctor; You can find the difference between zero rated vat items and exempt vat with the help of this infographic: Vat has to be charged; We often deal with businesses that have assumed that commission income they receive in relation to insurance services and financial services is vat exempt. Health services of the doctor;

Source: accotax.co.uk

Source: accotax.co.uk

Producers of exempt supplies are excused from the reporting obligations associated with taxable supplies, but are unable to claim input tax credits for gst/hst incurred in their exempt operations, but are still required to report and. Is the commission earned by the insurance broker exempt from vat? We often deal with businesses that have assumed that commission income they receive in relation to insurance services and financial services is vat exempt. The first exempt here means that your investment qualifies for a deduction. For completeness, it should be noted that insurance is different from warranties.

Source: esclavamente.blogspot.com

Source: esclavamente.blogspot.com

Did you know that generally,vat is levied on the supply of. When to use sales tax e exempt vs z zero rated tax. Health services of the doctor; As mentioned above, some insurance services which you provide, for example, life insurance will be treated as exempt. All insurance entities including exempt insurance companies and qualified insurance companies will be regulated under the insurance act, which will be amended to provide for three classes of licenses, as follows.

Source: esclavamente.blogspot.com

Source: esclavamente.blogspot.com

The section levies vat at the standard rate of vat (currently 15%) unless the supplies qualify to be made at the zero rate of vat or are exempt. Insurance excess zero rated or exempt. While zero rated goods include items such as books, goods sold by charities, equipment such as wheelchairs for the disabled, medicine and water, exempt goods include items such as insurance, certain types of training and education, certain services offered by doctors and dentists, postal services, betting, lotteries, physical education, works of art, etc. Vat has to be charged; The second exempt implies that the interest earned during the accumulation phase is also exempted.

Source: esclavamente.blogspot.com

Source: esclavamente.blogspot.com

Class 1, which includes captives, will pay a license fee and be zero taxed. Producers of exempt supplies are excused from the reporting obligations associated with taxable supplies, but are unable to claim input tax credits for gst/hst incurred in their exempt operations, but are still required to report and. Life insurance and associated reinsurance (exempt)3; Gst is charged on the insurance premiums at the standard rate2. 3) banking fees, not tax.

Source: funciogamma.blogspot.com

Source: funciogamma.blogspot.com

Insurance company in singapore is a taxable supply of services. For completeness, it should be noted that insurance is different from warranties. To the insurance is exempt from vat and the rest of the consideration is liable to tax at the appropriate rate. While zero rated goods include items such as books, goods sold by charities, equipment such as wheelchairs for the disabled, medicine and water, exempt goods include items such as insurance, certain types of training and education, certain services offered by doctors and dentists, postal services, betting, lotteries, physical education, works of art, etc. Say bye to your financial stress with accotax.

Source: thebrigadecomic.blogspot.com

Source: thebrigadecomic.blogspot.com

Unfortunately this is not always the case as in order to be vat exempt the commission has to be generated from activities. Section 7(1)(a) of the vat act imposes vat on the supply of taxable goods or services by a vendor to any person. We often deal with businesses that have assumed that commission income they receive in relation to insurance services and financial services is vat exempt. While zero rated goods include items such as books, goods sold by charities, equipment such as wheelchairs for the disabled, medicine and water, exempt goods include items such as insurance, certain types of training and education, certain services offered by doctors and dentists, postal services, betting, lotteries, physical education, works of art, etc. Class 1, which includes captives, will pay a license fee and be zero taxed.

Source: funciogamma.blogspot.com

Source: funciogamma.blogspot.com

Gst is charged on the insurance premiums at the standard rate2. Therefore, part of your salary that is equal to the invested amount is not taxable. Health services of the doctor; You can find the difference between zero rated vat items and exempt vat with the help of this infographic: To the insurance is exempt from vat and the rest of the consideration is liable to tax at the appropriate rate.

Source: chowtoprint.blogspot.com

Source: chowtoprint.blogspot.com

There are several transactions i�m unclear which sales tax code should be used. All insurance entities including exempt insurance companies and qualified insurance companies will be regulated under the insurance act, which will be amended to provide for three classes of licenses, as follows. Unfortunately this is not always the case as in order to be vat exempt the commission has to be generated from activities. The government guidance states that “if you supply exempt insurance with goods or services that are liable to tax, you’ll need to determine the correct tax treatment for your supplies.” what follows is a detailed guide for insurers demonstrating how to do just this. 3) banking fees, not tax.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insurance zero or exempt by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.