Insured retirement plan information

Home » Trending » Insured retirement plan informationYour Insured retirement plan images are available in this site. Insured retirement plan are a topic that is being searched for and liked by netizens today. You can Get the Insured retirement plan files here. Find and Download all free photos and vectors.

If you’re looking for insured retirement plan pictures information linked to the insured retirement plan interest, you have come to the right blog. Our site always provides you with suggestions for seeing the maximum quality video and picture content, please kindly surf and find more enlightening video articles and images that fit your interests.

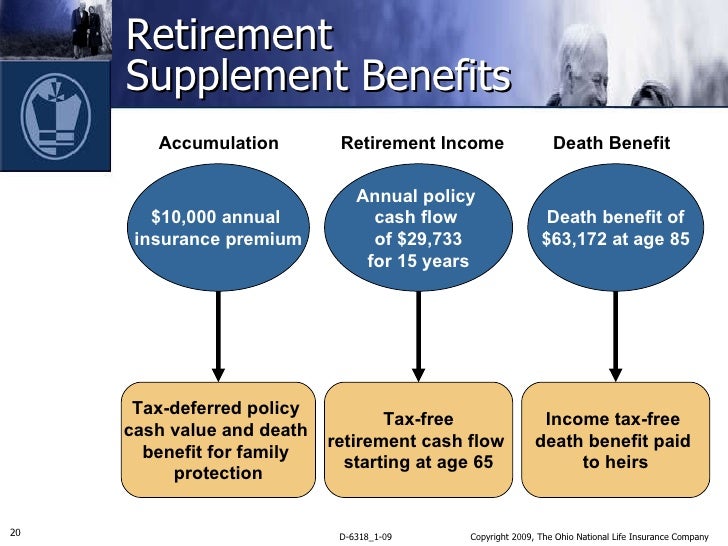

Insured Retirement Plan. An insured retirement plan or irp is a financial concept wherein a permanent life insurance policy, usually, universal lifeis utilized as a vehicle to save up and build wealth for retirement. At retirement, an annual credit line is developed against the policy. Depending on the profile of your client, the bmo insurance insured retirement plan may be an ideal opportunity to generate this required income in a tax efficient environment with the added benefit of permanent life insurance. The differences are the potential tax consequences.

A Guide To Life Insurance Retirement Plan (LIRP) Learn From wealthnation.io

A Guide To Life Insurance Retirement Plan (LIRP) Learn From wealthnation.io

In the past, the irp was only available to clients who owned manulife life. An irp allows individuals to fund a permanent life insurance policy over its base premium. The insured retirement plan is a financial strategy that provides clients with permanent life insurance coverage and the opportunity to supplement their retirement income. But at least the clients have insurance coverage immediately, they can always lower their contribution momentarily while establishing their economic stability in canada, then later on increased the contribution once. The differences are the potential tax consequences. Who is the insured retirement program best suited to?

This strategy is ideal for clients who have maxed out their rrsp or pension plan contribution limits.

Insured retirement plan (irp) offers an opportunity for life insurance policy owners, as security upon which loan is collateralized. At retirement, an annual line of credit is established against the policy where the. An insured retirement plan or irp is a financial concept wherein a permanent life insurance policy, usually, universal lifeis utilized as a vehicle to save up and build wealth for retirement. What is insured retirement plan? While multiple strategies exist, an insured retirement plan (irp) uses a chance for a life insurance policy to be the security upon which a loan is collateralized. An insured retirement plan (or irp) can take place either personally or from a business.

![]() Source: dreamstime.com

Source: dreamstime.com

What is insured retirement plan? At retirement, an annual line of credit is established against the policy where the. A retirement and an annual maximum loan percentage are linked to within the policy investment, for example, universal life policy. There is absolutely nothing wrong with this strategy, but it can have a lot of moving parts and is certainly not for everybody. It allows individuals to fund a permanent life insurance policy over its base premium.

Source: lifehealthinvest.com

Source: lifehealthinvest.com

Insured retirement program (irp) this program is now available to whole life insurance clients at all major providers! When you retire, instead of withdrawing these funds directly from the life insurance policy, you use the policy as collateral on a loan. A retirement and an annual maximum loan percentage are linked to within the policy investment, for example, universal life policy. What is insured retirement plan? This strategy is ideal for clients who have maxed out their rrsp or pension plan contribution limits.

Source: wealthnation.io

Source: wealthnation.io

Insured retirement program (irp) for years, advisors have been asking manulife bank to make its insured retirement program (irp) available to more clients. Depending on the profile of your client, the bmo insurance insured retirement plan may be an ideal opportunity to generate this required income in a tax efficient environment with the added benefit of permanent life insurance. Irp is insured retirement plan, meaning an insurance plan but can be utilized as well as retirement plan. When you retire, instead of withdrawing these funds directly from the life insurance policy, you use the policy as collateral on a loan. This strategy is ideal for clients who have maxed out their rrsp or pension plan contribution limits.

It allows individuals to fund a permanent life insurance policy over its base premium. A retirement and an annual maximum loan percentage are linked to within the policy investment, for example, universal life policy. What is insured retirement plan? An irp allows individuals to fund a permanent life insurance policy over its base premium. Who is the insured retirement program best suited to?

Source: lifehealthinvest.com

Source: lifehealthinvest.com

The differences are the potential tax consequences. 1) need to replace income or protect the value of an estate*; While multiple strategies exist, an insured retirement plan (irp) offers an opportunity for a life insurance policy to be the security upon which a loan is collateralized. What is insured retirement plan? At retirement, an annual line of credit is established against the policy where the.

![4 Major Benefits of a Personal Retirement Plan [Infographic] 4 Major Benefits of a Personal Retirement Plan [Infographic]](http://blog.highlandbrokerage.com/wp-content/uploads/2015/08/4-Major-Benefits-of-a-Personal-Retirement-Plan-Infographic-Revised.png) Source: blog.highlandbrokerage.com

Source: blog.highlandbrokerage.com

There is absolutely nothing wrong with this strategy, but it can have a lot of moving parts and is certainly not for everybody. Irp is insured retirement plan, meaning an insurance plan but can be utilized as well as retirement plan. The monthly payment is flexible anyways. Who is the insured retirement program best suited to? While multiple strategies exist, an insured retirement plan (irp) offers an opportunity for a life insurance policy to be the security upon which a loan is collateralized.

Source: thefinishlinegroup.com

Source: thefinishlinegroup.com

Irp is insured retirement plan, meaning an insurance plan but can be utilized as well as retirement plan. This strategy is ideal for clients who have maxed out their rrsp or pension plan contribution limits. The insured retirement plan allows you to pay an insurance company a premium and then eventually borrow against the policy cash value. This policy will serve two objectives: An insured retirement plan (irp) is simply a process combined with a product.

Source: ilafp.com

Source: ilafp.com

It allows individuals to fund a permanent life insurance policy over its base premium. 1) need to replace income or protect the value of an estate*; Who is the insured retirement program best suited to? Who should consider insured retirement plan? The differences are the potential tax consequences.

Source: benefitcorp.com

Source: benefitcorp.com

In the past, the irp was only available to clients who owned manulife life. It allows individuals to fund a permanent life insurance policy over its base premium. This policy will serve two objectives: An insurance retirement plan allows permanent policy owners to fund their life insurance policies over their initial base premium (cost of insurance, charges,. An employee is treated as benefiting under irc section 412(e)(3) for a plan year if a premium is paid on behalf of that employee for that plan year.

Source: ascendantfinancial.ca

Source: ascendantfinancial.ca

Depending on the profile of your client, the bmo insurance insured retirement plan may be an ideal opportunity to generate this required income in a tax efficient environment with the added benefit of permanent life insurance. A retirement and an annual maximum loan percentage are linked to within the policy investment, for example, universal life policy. When you retire, instead of withdrawing these funds directly from the life insurance policy, you use the policy as collateral on a loan. An insured retirement plan or irp is a financial concept wherein a permanent life insurance policy, usually, universal lifeis utilized as a vehicle to save up and build wealth for retirement. This policy will serve two objectives:

Source: pinterest.com

Source: pinterest.com

A retirement and an annual maximum loan percentage are linked to within the policy investment, for example, universal life policy. Insured retirement program (irp) for years, advisors have been asking manulife bank to make its insured retirement program (irp) available to more clients. An irp allows individuals to fund a permanent life insurance policy over its base premium. Insured retirement program (irp) this program is now available to whole life insurance clients at all major providers! Target market ideally, the bmo insurance insured retirement plan is targeted at clients with the following profile:

Source: samivalue.com.my

Source: samivalue.com.my

- need to replace income or protect the value of an estate*; An insured retirement plan (irp) is simply a process combined with a product. An insured retirement plan (or irp) can take place either personally or from a business. 1) need to replace income or protect the value of an estate*; An insured retirement plan or irp is a financial concept wherein a permanent life insurance policy, usually, universal lifeis utilized as a vehicle to save up and build wealth for retirement.

Source: gethow.org

Source: gethow.org

But at least the clients have insurance coverage immediately, they can always lower their contribution momentarily while establishing their economic stability in canada, then later on increased the contribution once. The insured retirement plan allows you to pay an insurance company a premium and then eventually borrow against the policy cash value. While multiple strategies exist, an insured retirement plan (irp) offers an opportunity for a life insurance policy to be the security upon which a loan is collateralized. At retirement, an annual line of credit is established against the policy where the. Insured retirement program (irp) this program is now available to whole life insurance clients at all major providers!

Source: lifehealthinvest.com

Source: lifehealthinvest.com

Colin celino april 6, 2021 greatway financial, ivari insurance edmonton, greatway tax services, bmo life insurance advisor login, ivari login, what is an insured retirement plan, financial career institute greatway, bmo, insurance advisor login, greatway webmail, irp investment, greatway financial edmonton office, greatway financial reviews, irp insurance, financial advantage,. There is absolutely nothing wrong with this strategy, but it can have a lot of moving parts and is certainly not for everybody. Irp is insured retirement plan, meaning an insurance plan but can be utilized as well as retirement plan. The monthly payment is flexible anyways. At retirement, an annual credit line is developed against the policy.

Source: pinterest.com

Source: pinterest.com

An insured retirement plan or irp is a financial concept wherein a permanent life insurance policy, usually, universal lifeis utilized as a vehicle to save up and build wealth for retirement. When you retire, instead of withdrawing these funds directly from the life insurance policy, you use the policy as collateral on a loan. 1) need to replace income or protect the value of an estate*; Irp is insured retirement plan, meaning an insurance plan but can be utilized as well as retirement plan. This policy will serve two objectives:

Source: slideshare.net

Source: slideshare.net

While multiple strategies exist, an insured retirement plan (irp) offers an opportunity for a life insurance policy to be the security upon which a loan is collateralized. While multiple strategies exist, an insured retirement plan (irp) uses a chance for a life insurance policy to be the security upon which a loan is collateralized. Target market ideally, the bmo insurance insured retirement plan is targeted at clients with the following profile: Depending on the profile of your client, the bmo insurance insured retirement plan may be an ideal opportunity to generate this required income in a tax efficient environment with the added benefit of permanent life insurance. An irp allows individuals to fund a permanent life insurance policy over its base premium.

Source: slideshare.net

Source: slideshare.net

While multiple strategies exist, an insured retirement plan (irp) offers an opportunity for a life insurance policy to be the security upon which a loan is collateralized. There is absolutely nothing wrong with this strategy, but it can have a lot of moving parts and is certainly not for everybody. An insured retirement plan (or irp) can take place either personally or from a business. The insured retirement plan is a financial strategy that provides clients with permanent life insurance coverage and the opportunity to supplement their retirement income. Insured retirement plan (irp) offers an opportunity for life insurance policy owners, as security upon which loan is collateralized.

Source: blog.moneyfrog.in

Source: blog.moneyfrog.in

The monthly payment is flexible anyways. Insured retirement program (irp) this program is now available to whole life insurance clients at all major providers! The differences are the potential tax consequences. An insured retirement plan (irp) is simply a process combined with a product. The insured retirement program is a financial planning strategy designed to meet your client’s dual need for insurance protection now and a supplement to retirement income in the future.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insured retirement plan by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.