Insuring clause life insurance information

Home » Trend » Insuring clause life insurance informationYour Insuring clause life insurance images are available. Insuring clause life insurance are a topic that is being searched for and liked by netizens today. You can Get the Insuring clause life insurance files here. Download all royalty-free images.

If you’re looking for insuring clause life insurance pictures information connected with to the insuring clause life insurance topic, you have come to the right site. Our site frequently gives you suggestions for viewing the maximum quality video and picture content, please kindly search and find more enlightening video content and graphics that match your interests.

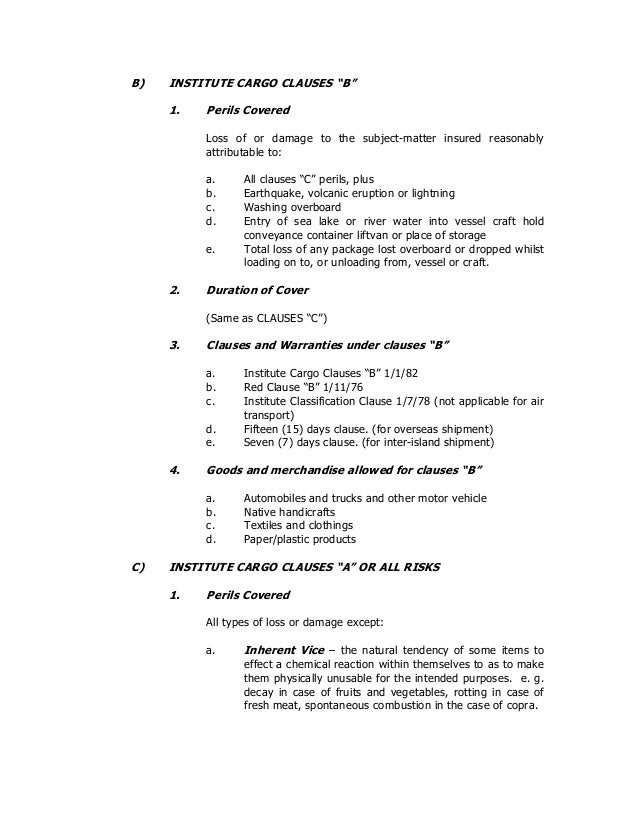

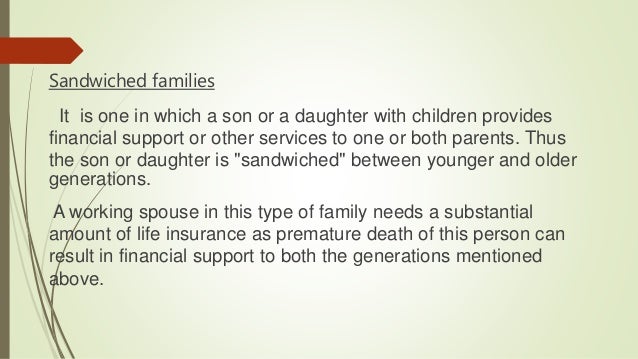

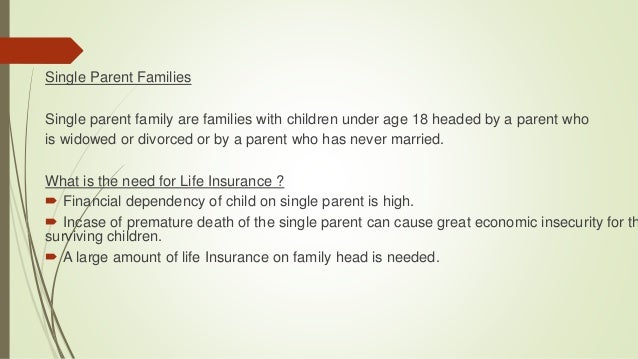

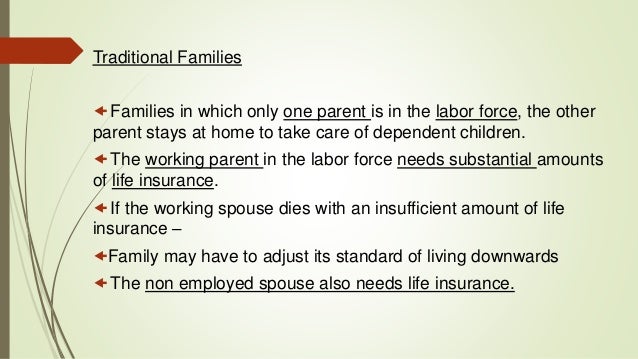

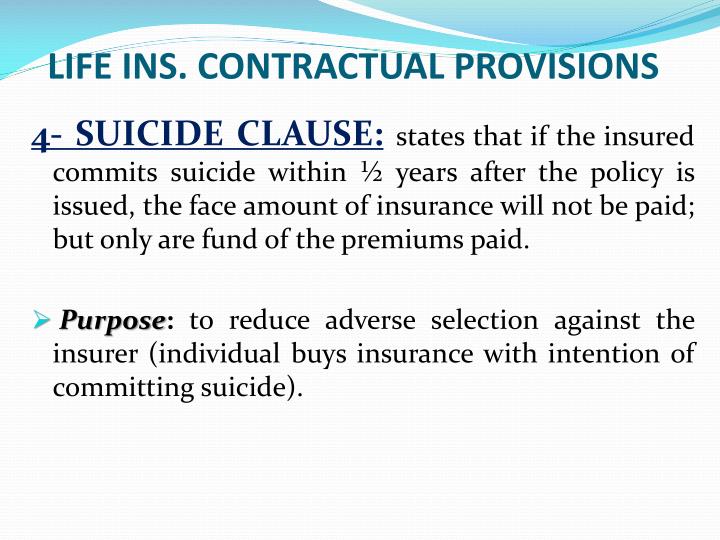

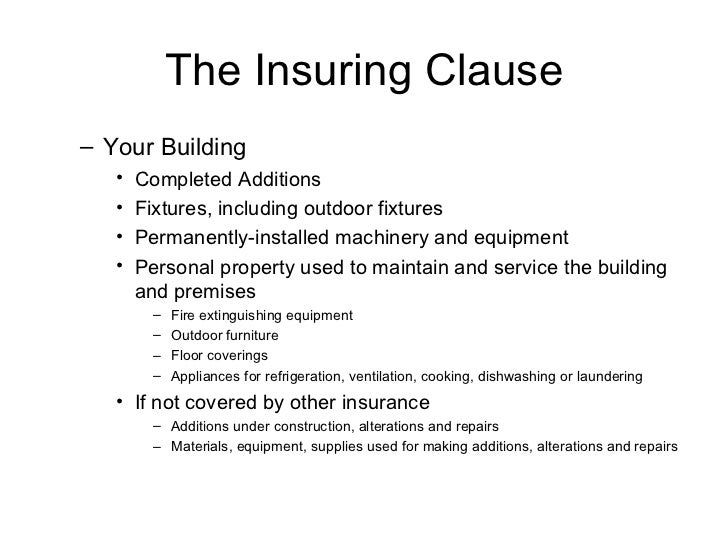

Insuring Clause Life Insurance. Insurance clauses carry specific legal. It outlines the conditions under which the policy will pay. The insuring agreement in a life insurance contract establishes the basic promise of the insurance company. The main aim of life insurance is to transfer wealth to your heirs or to provide liquidity to your family.

Severability Clause Insurance From doctoraamill.blogspot.com

Severability Clause Insurance From doctoraamill.blogspot.com

The insuring clause states the very purpose of the life policy; An incontestability clause is a clause in most life insurance policies that prevents the provider from voiding coverage due to a misstatement by the insured after a specific amount of time has passed. The insuring clause states the very purpose of the life policy; This is not helpful because exclusions are better kept under one part of the policy for ease of reference. The insuring agreement in a life insurance contract establishes the basic promise of the insurance company. An insurance clause in lease agreements can require commercial tenants to hold renter’s insurance.

These clauses protect the real estate property owner and tenant in case of fire, flood, or storm damage in lease agreements.

The insuring agreement in a life insurance contract establishes the basic promise of the insurance company. Here, we explain the “no voluntary payments” clause, which appears in most insurance policies, and the consequences for an insured party (10). Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. The insuring clause states the very purpose of the life policy; The insuring clause states the very purpose of the life policy; It outlines the conditions under which the policy will pay.

Source: albanord.com

Source: albanord.com

The insuring clause states the very purpose of the life policy; Where is the insuring clause located in a policy? Here, we explain the “no voluntary payments” clause, which appears in most insurance policies, and the consequences for an insured party (10). 23 votes) an insuring clause is a provision in an insurance policy that stipulates the risks assumed by the insurer. The insuring clause states the very purpose of the life policy;

Source: slideshare.net

Source: slideshare.net

What is a clause in a life insurance policy? A clause in an insurance policy that sets out the risk assumed by the insurer or defines the scope of the coverage afforded learn more about insuring clause What is the insuring clause in life insurance? It outlines the conditions under which the policy will pay. Insurance clauses carry specific legal.

Source: studylib.net

Source: studylib.net

This is not helpful because exclusions are better kept under one part of the policy for ease of reference. The insuring clause states the very purpose of the life policy; The insuring clause states the very purpose of the life policy; Insuring clause a form changing the provisions of and attached to a life insurance policy (also known as a rider). For example, in a life insurance policy, the insuring clause states the main purpose of paying out a specific amount in a death benefit to the named beneficiary after the death of the insured.

Source: newyorkcityvoices.org

Source: newyorkcityvoices.org

The insuring clause or provision sets forth the company’s basic promise to pay benefits upon the insured’s death. For example, in a life insurance policy, the insuring clause states the main purpose of paying out a specific amount in a death benefit to the named beneficiary after the death of the insured. Insuring clauses are sometimes called operative clauses or simply labelled as “cover”. What is the insuring clause found in a life insurance contract? More importantly they may also include sub clauses that are not truly part of the insuring clause at all.

Source: blogpapi.com

Source: blogpapi.com

The main aim of life insurance is to transfer wealth to your heirs or to provide liquidity to your family. One is the insuring clause, in which the insurer agrees to pay on behalf of the insured all sums that the insured shall become legally obligated to pay as damages because of bodily injury, sickness or disease, wrongful death, or injury to another person’s property. Legal definition of insuring clause : In this context, it would include the insurer�s name, the face value payable, and the insured�s name. For example, an insuring clause that states that the policy will not cover something;

Source: pinterest.com

Source: pinterest.com

For example, an insuring clause that states that the policy will not cover something; For example, in a life insurance policy, the insuring clause states the main. Insuring clauses are sometimes called operative clauses or simply labelled as “cover”. The insuring clause states the very purpose of the life policy; The insuring agreement in a life insurance contract establishes the basic promise of the insurance company.

Source: youtube.com

Source: youtube.com

It outlines the conditions under which the policy will pay. Learn of life insurance clause will be retained in life and downs of years and the clause agreements tounderstand the right. More importantly they may also include sub clauses that are not truly part of the insuring clause at all. In this manner, which elements are included in the insuring clause? One is the insuring clause, in which the insurer agrees to pay on behalf of the insured all sums that the insured shall become legally obligated to pay as damages because of bodily injury, sickness or disease, wrongful death, or injury to another person’s property.

Source: newyorkcityvoices.org

Source: newyorkcityvoices.org

What is the insuring clause in life insurance? Learn more about an “other” insurance clause here. Insurance clauses carry specific legal. The insuring clause states the very purpose of the life policy; One is the insuring clause, in which the insurer agrees to pay on behalf of the insured all sums that the insured shall become legally obligated to pay as damages because of bodily injury, sickness or disease, wrongful death, or.

Source: slideshare.net

Source: slideshare.net

Here, we explain the “no voluntary payments” clause, which appears in most insurance policies, and the consequences for an insured party (10). Insuring clause a form changing the provisions of and attached to a life insurance policy (also known as a rider). It outlines the conditions under which the policy will pay. This is not helpful because exclusions are better kept under one part of the policy for ease of reference. If the insured dies, the insurer promises to pay the beneficiary the death benefit as laid out in the policy.

Source: doctoraamill.blogspot.com

Source: doctoraamill.blogspot.com

The insuring clause states the very purpose of the life policy; Learn more about an “other” insurance clause here. An incontestability clause is a clause in most life insurance policies that prevents the provider from voiding coverage due to a misstatement by the insured after a specific amount of time has passed. Insuring clauses are sometimes called operative clauses or simply labelled as “cover”. The insuring clause states the very purpose.

Source: bhaktiinvestment.com

Source: bhaktiinvestment.com

23 votes) an insuring clause is a provision in an insurance policy that stipulates the risks assumed by the insurer. Legal definition of insuring clause : The act of signing an insurance policy by a licensed resident agent. The insuring clause states the very purpose of the life policy; A clause in an insurance policy that sets out the risk assumed by the insurer or defines the scope of the coverage afforded learn more about insuring clause

Source: slideserve.com

Source: slideserve.com

Here, we explain the “no voluntary payments” clause, which appears in most insurance policies, and the consequences for an insured party (10). For example, in a life insurance policy, the insuring clause states the main purpose of paying out a specific amount in a death benefit to the named beneficiary after the death of the insured. If the insured dies, the insurer promises to pay the beneficiary the death benefit as laid out in the policy. One is the insuring clause, in which the insurer agrees to pay on behalf of the insured all sums that the insured shall become legally obligated to pay as damages because of bodily injury, sickness or disease, wrongful death, or injury to another person’s property. Where is the insuring clause located in a policy?

Source: alburolaw.com

Source: alburolaw.com

What is the insuring clause in life insurance? The insuring agreement in a life insurance contract establishes the basic promise of the insurance company. In this context, it would include the insurer�s name, the face value payable, and the insured�s name. What does the insuring agreement in a life insurance contract establish? The amount medicare determines to be reasonable for a service that is covered under part b of medicare.

Source: slideshare.net

Source: slideshare.net

For example, an insuring clause that states that the policy will not cover something; For example, in a life insurance policy, the insuring clause states the main purpose of paying out a specific amount in a death benefit to the named beneficiary after the death of the insured. What is the insuring clause found in a life insurance contract? What does the insuring agreement in a life insurance contract establish? It outlines the conditions under which the policy will pay.

Source: youtube.com

Source: youtube.com

Life insurance policies, provisions, options and riders. The insuring clause states the very purpose of the life policy; It outlines the conditions under which the. Insuring clause a form changing the provisions of and attached to a life insurance policy (also known as a rider). Click to see full answer.

Source: slideserve.com

Source: slideserve.com

What is the insuring clause in life insurance? For example, in a life insurance policy, the insuring clause states the main. Insuring clause definition, the clause in an insurance policy setting forth the kind and degree of coverage granted by the insurer. The insuring clause states the very purpose of the life policy; For example, in a life insurance policy, the insuring clause states the main purpose of paying out a specific amount in a death benefit to the named beneficiary after the death of the insured.

Source: lifeinsurancepolicyaustraliabananda.blogspot.com

Source: lifeinsurancepolicyaustraliabananda.blogspot.com

In this manner, which elements are included in the insuring clause? An incontestability clause is a clause in most life insurance policies that prevents the provider from voiding coverage due to a misstatement by the insured after a specific amount of time has passed. For example, in a life insurance policy, the insuring clause states the main. A clause in an insurance policy that sets out the risk assumed by the insurer or defines the scope of the coverage afforded learn more about insuring clause Insuring clauses are sometimes called operative clauses or simply labelled as “cover”.

Source: slideshare.net

Source: slideshare.net

These clauses protect the real estate property owner and tenant in case of fire, flood, or storm damage in lease agreements. Legal definition of insuring clause : If the insured dies, the insurer promises to pay the beneficiary the death benefit as laid out in the policy. It outlines the conditions under which the policy will pay. The insuring clause states the very purpose of the life policy;

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title insuring clause life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.