Iot insurance data information

Home » Trending » Iot insurance data informationYour Iot insurance data images are available. Iot insurance data are a topic that is being searched for and liked by netizens today. You can Get the Iot insurance data files here. Get all royalty-free photos and vectors.

If you’re searching for iot insurance data pictures information related to the iot insurance data interest, you have visit the ideal site. Our site always provides you with suggestions for refferencing the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and images that match your interests.

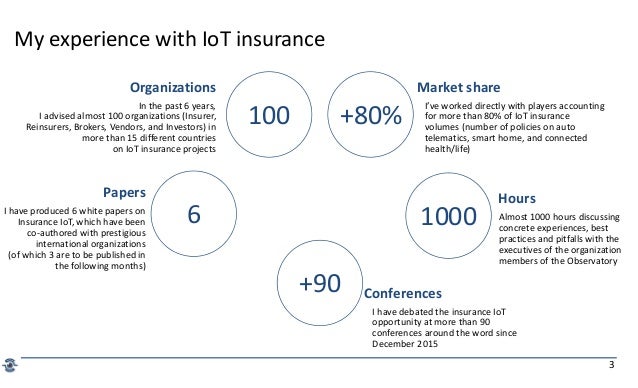

Iot Insurance Data. The data collection ability that iot is bringing will allow insurers to move more quickly, without waiting for years of data and experience to accumulate before being able to successfully model and assess the associated risks. Iot insurance enables insurance companies around the world in transmitting, collecting and sharing critical data of clients. In this article, we assess the six areas where the internet of things (iot) will have a significant impact on the insurance sector to prepare insurance executives for the near future. The internet of things and insurance work together to provide a better customer experience.

Insurance a great opportunity for IoT and data startups From startupbootcamp.org

Insurance a great opportunity for IoT and data startups From startupbootcamp.org

The report covers the market size, recent trends, growth, and competitive analysis. Why does the iot matter in insurance? In turn, this data could be fed into ai algorithms that may allow insurers to. Because this business is predicated on data, and iot provides volumes of data. This will allow them to offer solid products quickly, which will, in turn, allow these industries to grow even more rapidly. With this resulting in copious amounts of data, insurers will look to leverage this to improve how they price risk, rewarding those customers deemed to be ‘safer’ than others.

Define customer needs with exact application areas.

Data collected here are amorphous and vague due to the narrow reach of smart home devices compared to healthcare and vehicle sector. Iot data may also give p&c insurers the opportunity to expand into different markets or create new products. If one were to look closely at the insurance ecosystem from the perspectives of the market, the customers, and the insurers, several data points emerge that give This data management strategy should provide unified solutions, tools, methodologies and workflows for managing iot data as a core asset. In this article, we assess the six areas where the internet of things (iot) will have a significant impact on the insurance sector to prepare insurance executives for the near future. First and foremost, insurers need to ensure the security of customer data across connected devices to prevent potential data breaches.

Source: ibm.com

Source: ibm.com

Define customer needs with exact application areas. Data collected here are amorphous and vague due to the narrow reach of smart home devices compared to healthcare and vehicle sector. If one were to look closely at the insurance ecosystem from the perspectives of the market, the customers, and the insurers, several data points emerge that give Despite the potential challenges of an iot solution when it comes to data, there are numerous benefits for insurers, including: Why does the iot matter in insurance?

Source: pinterest.com

Source: pinterest.com

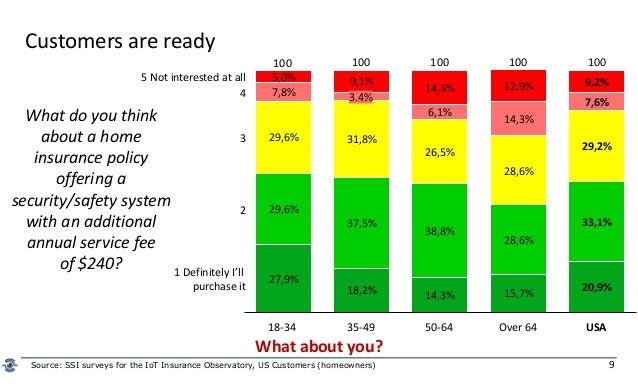

Data collected here are amorphous and vague due to the narrow reach of smart home devices compared to healthcare and vehicle sector. Data collected here are amorphous and vague due to the narrow reach of smart home devices compared to healthcare and vehicle sector. Iot data may also give p&c insurers the opportunity to expand into different markets or create new products. The report covers the market size, recent trends, growth, and competitive analysis. Ssi surveys for the iot insurance observatory, us customers auto telematics insurance (insurance coverage + services) iot home insurance (insurance coverage + services) 13%all the customers:

Source: slideshare.net

Source: slideshare.net

This data management strategy should provide unified solutions, tools, methodologies and workflows for managing iot data as a core asset. With this resulting in copious amounts of data, insurers will look to leverage this to improve how they price risk, rewarding those customers deemed to be ‘safer’ than others. Iot implementation will also help to improve efficiency of systems, improve protection mechanisms and reduce claims, leading to cost efficiency. Positive and negative ways iot. Why does the iot matter in insurance?

Source: slideshare.net

Source: slideshare.net

In this article, we assess the six areas where the internet of things (iot) will have a significant impact on the insurance sector to prepare insurance executives for the near future. Iot insurance enables insurance companies around the world in transmitting, collecting and sharing critical data of clients. If one were to look closely at the insurance ecosystem from the perspectives of the market, the customers, and the insurers, several data points emerge that give Apart from costs and income, parties that use iot devices for insurance can manage risks. But data ownership remains a challenge for many insurers.

Source: slideshare.net

Source: slideshare.net

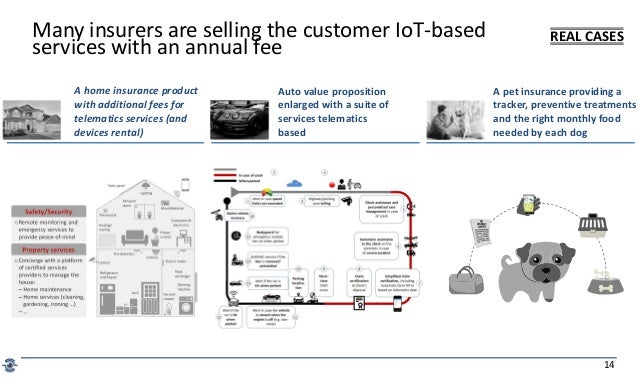

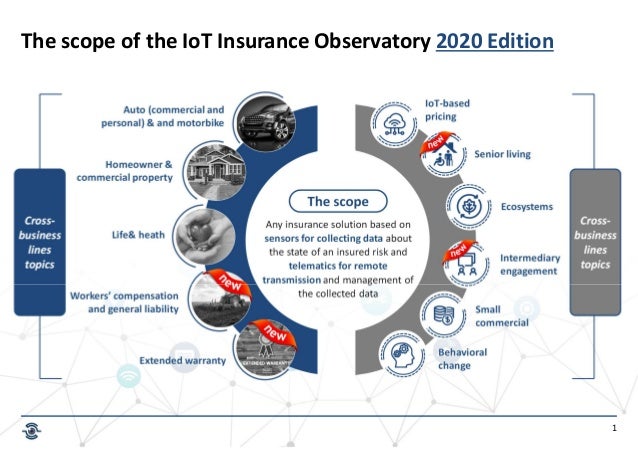

The state of play 36 2.1 automotive 37 2.2 home 49 2.3 health and life 55 2.4 commercial 64 section 3:. A theoretical view of iot in insurance 20 1.1 iot means more data, less claims & less costs 21 1.2 reinventing the customer relationship 26 1.3 new pricing models: The state of play 36 2.1 automotive 37 2.2 home 49 2.3 health and life 55 2.4 commercial 64 section 3:. The auto experience 29 1.4 sharing the value between everyone 31 section 2: Insurers need to define concrete applications that customers in their market are willing to embrace and that are relevant to their business model.

Source: www2.deloitte.com

Source: www2.deloitte.com

Despite the potential challenges of an iot solution when it comes to data, there are numerous benefits for insurers, including: The report covers the market size, recent trends, growth, and competitive analysis. Iot insurance data, just like any other type of data, is susceptible to cyberattacks and fraud, which means insurers need to invest in extremely secure defensive measures and protection. Data created and made available through iot enables insurers to better understand risk. Home insurance iot data usually come from smart home devices like amazon echo, google home, google smart lights, etc.

Source: global.hitachi-solutions.com

Source: global.hitachi-solutions.com

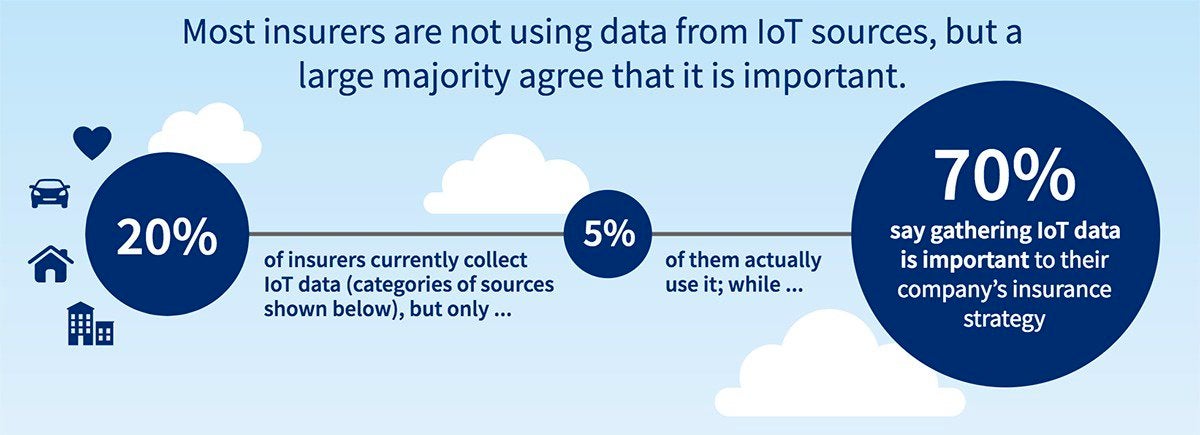

23% 5% 8% 56% 70% 59%50%. Positive and negative ways iot. Iot insurance data, just like any other type of data, is susceptible to cyberattacks and fraud, which means insurers need to invest in extremely secure defensive measures and protection. Apart from costs and income, parties that use iot devices for insurance can manage risks. To start a successful iot product insurance project, it’s not enough to get a reliable solution and connect to sensors.

Source: startupbootcamp.org

Source: startupbootcamp.org

23% 5% 8% 56% 70% 59%50%. According to statista , the projected installed base of iot devices is expected to increase to 30.9 data ecosystems surrounding insurance. Iot implementation will also help to improve efficiency of systems, improve protection mechanisms and reduce claims, leading to cost efficiency. Iot provides the insurance industry with more data than ever before, enabling companies to more effectively determine rates and provide services that keep people and their assets safe. Ssi surveys for the iot insurance observatory, us customers auto telematics insurance (insurance coverage + services) iot home insurance (insurance coverage + services) 13%all the customers:

Source: securityledger.com

Source: securityledger.com

Iot insurance data, just like any other type of data, is susceptible to cyberattacks and fraud, which means insurers need to invest in extremely secure defensive measures and protection. Why does the iot matter in insurance? The state of play 36 2.1 automotive 37 2.2 home 49 2.3 health and life 55 2.4 commercial 64 section 3:. To be successful with digital ecosystems in an iot world and develop an iot strategy, insurers should first tackle five key tasks. Agriculture, transportation, and construction companies have been increasing their use of this type of insurance to.

Source: sam-solutions.com

Source: sam-solutions.com

One such product area involves parametric insurance, which is widely used in industries that face weather threats. In this article, we assess the six areas where the internet of things (iot) will have a significant impact on the insurance sector to prepare insurance executives for the near future. In turn, this data could be fed into ai algorithms that may allow insurers to. With the evolution of the internet of things (iot), however, insurers have the opportunity to assess risk at a more granular level, opening the way to a new class of products and services that take the data produced by iot devices into account. This data management strategy should provide unified solutions, tools, methodologies and workflows for managing iot data as a core asset.

Source: iotnewsportal.com

Source: iotnewsportal.com

Iot provides the insurance industry with more data than ever before, enabling companies to more effectively determine rates and provide services that keep people and their assets safe. The auto experience 29 1.4 sharing the value between everyone 31 section 2: Iot insurance data, just like any other type of data, is susceptible to cyberattacks and fraud, which means insurers need to invest in extremely secure defensive measures and protection. The state of play 36 2.1 automotive 37 2.2 home 49 2.3 health and life 55 2.4 commercial 64 section 3:. With the evolution of the internet of things (iot), however, insurers have the opportunity to assess risk at a more granular level, opening the way to a new class of products and services that take the data produced by iot devices into account.

Source: businessinsider.com

Iot data may also give p&c insurers the opportunity to expand into different markets or create new products. Iot insurance data, just like any other type of data, is susceptible to cyberattacks and fraud, which means insurers need to invest in extremely secure defensive measures and protection. First and foremost, insurers need to ensure the security of customer data across connected devices to prevent potential data breaches. In turn, this data could be fed into ai algorithms that may allow insurers to. To start a successful iot product insurance project, it’s not enough to get a reliable solution and connect to sensors.

Source: theactuarialclub.com

Source: theactuarialclub.com

Despite the potential challenges of an iot solution when it comes to data, there are numerous benefits for insurers, including: To start a successful iot product insurance project, it’s not enough to get a reliable solution and connect to sensors. Because this business is predicated on data, and iot provides volumes of data. The internet of things and insurance work together to provide a better customer experience. Data created and made available through iot enables insurers to better understand risk.

Source: networkworld.com

Source: networkworld.com

With iot, insurance companies get a diversified data collection tool that is applicable for making enhanced analysis with numerous factors — corporate context, client behavior, location, physical condition, health state, etc. But data ownership remains a challenge for many insurers. If one were to look closely at the insurance ecosystem from the perspectives of the market, the customers, and the insurers, several data points emerge that give Home insurance iot data usually come from smart home devices like amazon echo, google home, google smart lights, etc. In turn, this data could be fed into ai algorithms that may allow insurers to.

Source: slideshare.net

Source: slideshare.net

Iot data may also give p&c insurers the opportunity to expand into different markets or create new products. The data collection ability that iot is bringing will allow insurers to move more quickly, without waiting for years of data and experience to accumulate before being able to successfully model and assess the associated risks. Thus, insurance companies looking to implement iot should invest in establishing an enterprise data management strategy that encompasses necessary tools, technologies, and frameworks for securing and managing iot. Ensure that the systems are scalable and can work with big data. The impact of iot on insurance.

Source: medium.com

Source: medium.com

Iot implementation will also help to improve efficiency of systems, improve protection mechanisms and reduce claims, leading to cost efficiency. The data collection ability that iot is bringing will allow insurers to move more quickly, without waiting for years of data and experience to accumulate before being able to successfully model and assess the associated risks. This will allow them to offer solid products quickly, which will, in turn, allow these industries to grow even more rapidly. With this resulting in copious amounts of data, insurers will look to leverage this to improve how they price risk, rewarding those customers deemed to be ‘safer’ than others. The auto experience 29 1.4 sharing the value between everyone 31 section 2:

Source: qwize.com.br

Source: qwize.com.br

Thus, insurance companies looking to implement iot should invest in establishing an enterprise data management strategy that encompasses necessary tools, technologies, and frameworks for securing and managing iot. 23% 5% 8% 56% 70% 59%50%. Despite the potential challenges of an iot solution when it comes to data, there are numerous benefits for insurers, including: All this information can generate useful insights and become the basis for innovative and accurate decisions. With the evolution of the internet of things (iot), however, insurers have the opportunity to assess risk at a more granular level, opening the way to a new class of products and services that take the data produced by iot devices into account.

Source: givesunlight.com

Source: givesunlight.com

Data collected here are amorphous and vague due to the narrow reach of smart home devices compared to healthcare and vehicle sector. One such product area involves parametric insurance, which is widely used in industries that face weather threats. Define customer needs with exact application areas. The internet of things and insurance work together to provide a better customer experience. 23% 5% 8% 56% 70% 59%50%.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title iot insurance data by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.