Irda car insurance claim settlement ratio Idea

Home » Trending » Irda car insurance claim settlement ratio IdeaYour Irda car insurance claim settlement ratio images are ready. Irda car insurance claim settlement ratio are a topic that is being searched for and liked by netizens today. You can Get the Irda car insurance claim settlement ratio files here. Find and Download all royalty-free vectors.

If you’re looking for irda car insurance claim settlement ratio pictures information linked to the irda car insurance claim settlement ratio interest, you have come to the right blog. Our site always gives you suggestions for seeing the maximum quality video and image content, please kindly surf and find more informative video articles and images that match your interests.

Irda Car Insurance Claim Settlement Ratio. Motor od claim settlement ratio fy20. Max life insurance has the highest claim settlement ratio in. Csr is a good indicator of the claim settlement rate of an insurance company. The claim settlement ratio is the ratio of the number of claims settled to the number of claims made.

Irda Claim Settlement Ratio 2017 18 Car Insurance From classiccarwalls.blogspot.com

Irda Claim Settlement Ratio 2017 18 Car Insurance From classiccarwalls.blogspot.com

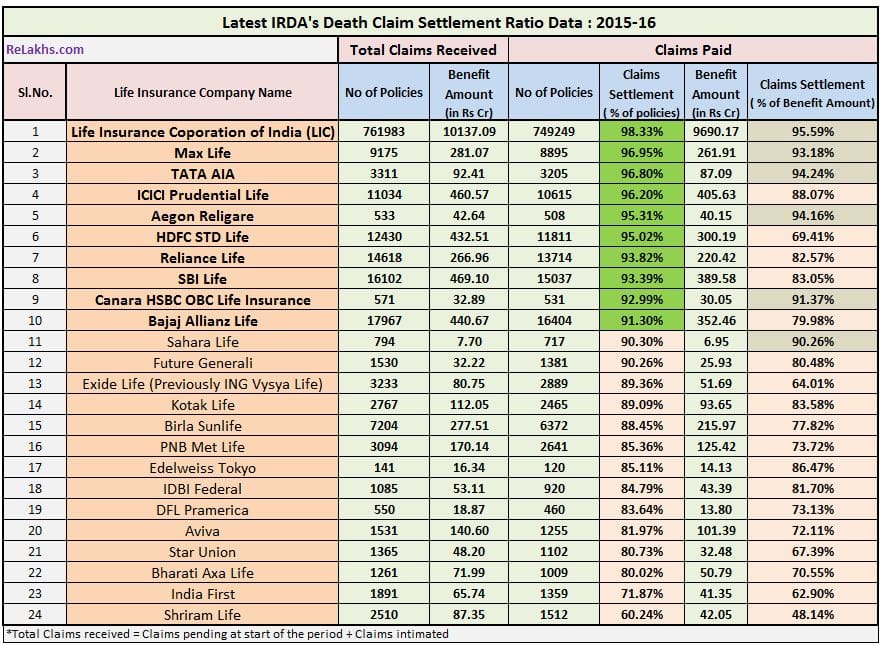

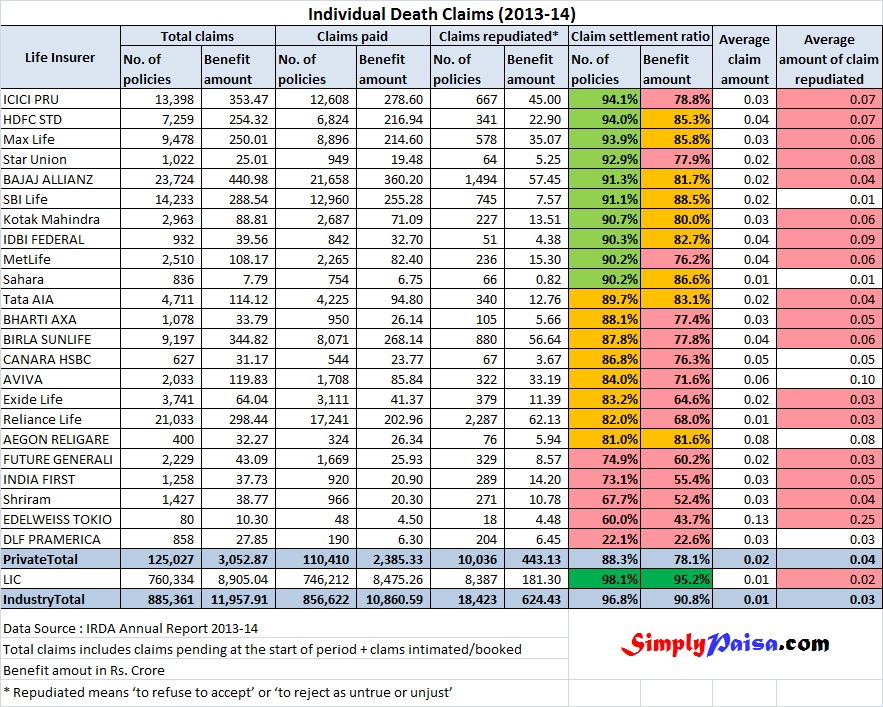

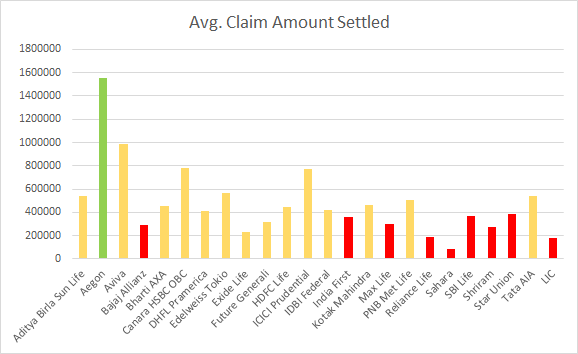

The claim settlement ratio data along with total claims and claims paid is presented in the table below. The main purpose of irda is to safeguard the policyholder’s interest and ensure the insurance sector’s growth in india. Few points to notice from this annual report are as below. Motor od claim settlement ratio fy20. One good parameter to compare. Max life insurance company limited.

The main purpose of irda is to safeguard the policyholder’s interest and ensure the insurance sector’s growth in india.

claim settlement ratio of lic was at 96.69% as at march 31, 2020, when compared to 97.79% as at march 31, 2019. Claim settlement ratio (csr) is the ratio of the total number of claims settled by an insurance company against the total number of claims available for processing for a financial year. Few points to notice from this annual report are as below. One ratio that can help you is the claims settlement ratio; This ratio gives you an idea as to how reliable the health insurance company can be in case you need to make a claim. Claim settlement ratio is the number of claims paid to the total number of claims received during a specific period.

Source: designerjust.blogspot.com

Source: designerjust.blogspot.com

Have a look at the table and know the. This ratio gives you an idea as to how reliable the health insurance company can be in case you need to make a claim. It is calculated as the ratio of total claims settled/total claims incurred. Few points to notice from this annual report are as below. Claim settlement ratio is the number of claims paid to the total number of claims received during a specific period.

Source: relakhs.com

Source: relakhs.com

Each year the irdai (insurance regulatory and development authority of india) releases an annual report. Claim settlement ratio of life insurance companies in india key findings: The ratios are calculated and published at the end of. Here is a list of the car insurance companies with best claim settlement ratio in india for 2022. One good parameter to compare.

Source: relakhs.com

Source: relakhs.com

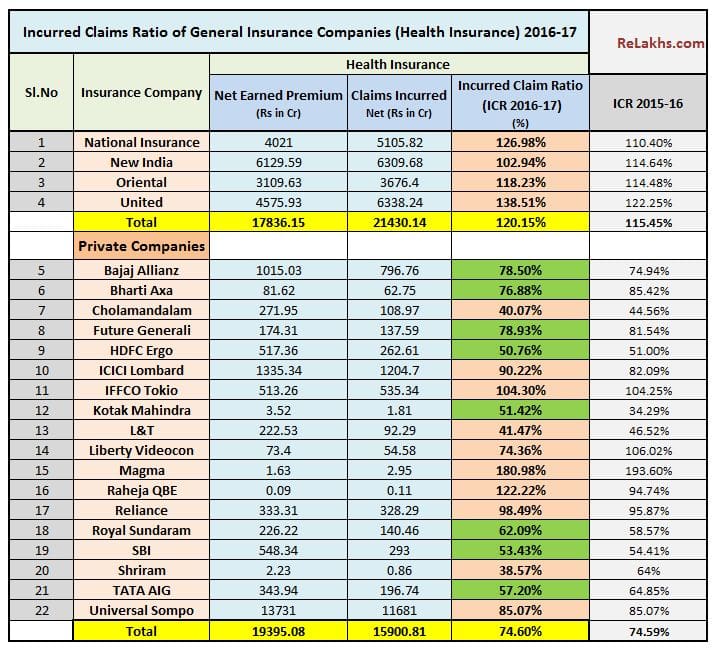

For instance, the insurance company receives 100 claims and pays for 95 claims, the csr here would be 95%. Latest irda claim settlement ratio 2022. The insurance regulatory and development authority of india ( irdai ) has released the claims settlement details of general and health insurance companies for the. Insurance regulatory and development authority. Max life insurance has the highest claim settlement ratio in.

Source: pinterest.com

Source: pinterest.com

For 85% icr, the company is paying rs 850 as claims for every rs 1000 collected as a premium during a financial year. The insurance regulatory and development authority of india ( irdai ) has released the claims settlement details of general and health insurance companies for the. The main purpose of irda is to safeguard the policyholder’s interest and ensure the insurance sector’s growth in india. It is calculated as the ratio of total claims settled/total claims incurred. One good parameter to compare.

Source: simplypaisa.com

Source: simplypaisa.com

Few points to notice from this annual report are as below. Few points to notice from this annual report are as below. Few points to notice from this annual report are as below. This is an extensive report and it covers the entire details and reports related to the indian insurance sector. Max life insurance has the highest claim settlement ratio in.

Source: relakhs.com

Source: relakhs.com

This ratio gives you an idea as to how reliable the health insurance company can be in case you need to make a claim. One ratio that can help you is the claims settlement ratio; Each year the irdai (insurance regulatory and development authority of india) releases an annual report. # claim settlement ratio of lic was at 98.62%% as at march 31, 2021, when compared to 96.69% as at march 31, 2020. Max life insurance has the highest claim settlement ratio in.

Source: weightlossmaintain.blogspot.com

Source: weightlossmaintain.blogspot.com

Why it is important to. Few points to notice from this annual report are as below. Latest irda claim settlement ratio 2022. For instance, the insurance company receives 100 claims and pays for 95 claims, the csr here would be 95%. The ratios are calculated and published at the end of.

Source: brendathemusic.blogspot.com

Source: brendathemusic.blogspot.com

A life insurance policy ensures financial security for your family and loved ones in your absence. Considering the wide array of available car insurance policies, it is often a challenging task to choose the best car insurance policy. A life insurance policy ensures financial security for your family and loved ones in your absence. Insurance companies claim settlement ratio. The insurance regulatory and development authority of india ( irdai ) has released the claims settlement details of general and health insurance companies for the.

Source: quora.com

Claim settlement ratio of life insurance companies. Why it is important to. The report also throws light on the “claim settlement ratio” of the insurance companies in india. Here is a list of the car insurance companies with best claim settlement ratio in india for 2022. Csr is a good indicator of the claim settlement rate of an insurance company.

Source: policywala.com

Source: policywala.com

This ratio gives you an idea as to how reliable the health insurance company can be in case you need to make a claim. Why it is important to. Irda mentions details like car insurance claim settlement ratio or motor insurance claim settlement ratio in the annual report. Claim settlement ratio (csr) is the most important factor to access the credibility of the insurer and its capacity to remit claims. Insurance companies claim settlement ratio.

Source: classiccarwalls.blogspot.com

Source: classiccarwalls.blogspot.com

Irda health insurance claim settlement ratio. The claim settlement ratio is the ratio of the number of claims settled to the number of claims made. Few points to notice from this annual report are as below. Max life insurance company limited. Higher the percentage the better are the chances of the claims being settled by the insurance company.

Source: classiccarwalls.blogspot.com

Source: classiccarwalls.blogspot.com

claim settlement ratio of lic was at 98.62%% as at march 31, 2021, when compared to 96.69% as at march 31, 2020. A company with a higher ratio is better compared to the one with a lower ratio. One good parameter to compare. Claims may be rejected by general insurance companies for various reasons such as misrepresentation of facts, fraud, impersonation (acting), hiding. Irda also publishes the claim settlement ratio and incurred claim ratio of health insurance companies.

Source: insurancemining.blogspot.com

Source: insurancemining.blogspot.com

Based on the latest csr data, you can assume the approach of insurance companies while with death claims. Latest irda claim settlement ratio 2022. Irda also publishes the claim settlement ratio and incurred claim ratio of health insurance companies. The insurance regulatory and development authority of india ( irdai ) has released the claims settlement details of general and health insurance companies for the. The report also throws light on the “claim settlement ratio” of the insurance companies in india.

Source: weightlossmaintain.blogspot.com

Source: weightlossmaintain.blogspot.com

Claim settlement ratio is the number of claims paid to the total number of claims received during a specific period. Few points to notice from this annual report are as below. The ratios are calculated and published at the end of. Irda health insurance claim settlement ratio. Why it is important to.

Source: contohdiam.blogspot.com

Source: contohdiam.blogspot.com

If a company has a claim settlement ratio of 99%. The insurance regulatory and development authority of india ( irdai ) has released the claims settlement details of general and health insurance companies for the. The claim settlement ratio is the ratio of the number of claims settled to the number of claims made. Csr is a good indicator of the claim settlement rate of an insurance company. To choose the best life insurance policy, you must check the claim settlement ratio.

Source: classiccarwalls.blogspot.com

Source: classiccarwalls.blogspot.com

Max life insurance has the highest claim settlement ratio in. The ratio is expressed as a percentage. The report also throws light on the “claim settlement ratio” of the insurance companies in india. Insurance companies claim settlement ratio. Life insurance corporation of india.

Source: basunivesh.com

Source: basunivesh.com

Irda car insurance claim settlement ratio simply means the ratio. Table content what is claim settlement ratio (csr)? Insurance companies claim settlement ratio. Claim settlement ratio of life insurance companies in india key findings: One ratio that can help you is the claims settlement ratio;

Source: mintwise.com

Source: mintwise.com

For instance, the insurance company receives 100 claims and pays for 95 claims, the csr here would be 95%. It is calculated as the ratio of total claims settled/total claims incurred. Table content what is claim settlement ratio (csr)? Each year the irdai (insurance regulatory and development authority of india) releases an annual report. Insurance companies claim settlement ratio.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title irda car insurance claim settlement ratio by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.