Irr in insurance Idea

Home » Trending » Irr in insurance IdeaYour Irr in insurance images are ready. Irr in insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Irr in insurance files here. Get all free vectors.

If you’re searching for irr in insurance pictures information connected with to the irr in insurance keyword, you have visit the ideal blog. Our site frequently gives you hints for seeing the highest quality video and picture content, please kindly search and find more informative video content and graphics that fit your interests.

Irr In Insurance. You will get the required irr value and this is the return which you look for. In financial modeling, as it helps calculate the return an. As the savings portion premium in the above mentioned example is just rs. Do remember, for excel irr you would need to denote the premiums as negative cash flows.

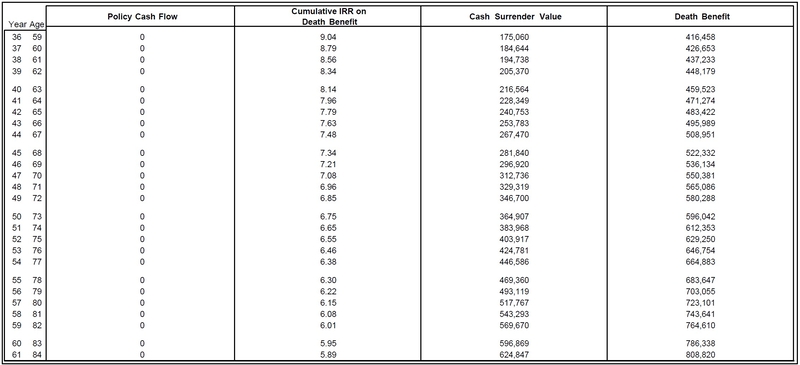

Selling Life Insurance Using the Internal Rate of Return From compreplan.com

Selling Life Insurance Using the Internal Rate of Return From compreplan.com

In technical terms, irr can be defined as the interest rate that makes the net present value (npv) of all cash flows from the investment equal to zero. The internal rate of return (irr) is the discount rate that makes the net present value (npv) net present value (npv) net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. 26,50,000 , we can calculate the internal rate of return (irr) using these. How to calculate your insurance policies returns through irr. You will get the required irr value and this is the return which you look for. How to calculate rate of return on maturity from an endowment life insurance policy?

That answer, while very simple, satisfies the curiosity of most.

The irr model is used extensively by the national council on compensation insurance and by various private carriers for workers’ compensation rate filings and internal profitability analyses. Irr or the internal rate of return is the interest rate or sometimes discount rate making the net present value of all cash flows in an investment equal to zero. How to calculate your insurance policies returns through irr. Almost every proposal can illustrate internal rate of return for both benefits and should be requested. This irr is very high during the early days of the policy because if you made only one monthly premium payment, and then suddenly. You’ll get the required irr worth and that is the return which you search for.

Source: relakhs.com

Source: relakhs.com

The irr model is used extensively by the national council on compensation insurance and by various private carriers for workers’ compensation rate filings and internal profitability analyses. Irr will return the internal rate of return for a given cash flow, that is, the initial investment value and a series of net income values. The two benefits measured are accumulated cash values and/or death benefit in any one year. Applying the irr concept to evaluating insurance plans in insurance plans, the premiums you pay become negative cash flows and the. In technical terms, irr can be defined as the interest rate that makes the net present value (npv) of all cash flows from the investment equal to zero.

Source: svtuition.org

This irr is very high during the early days of the policy because if you made only one monthly premium payment, and then suddenly. The irr model is used extensively by the national council on compensation insurance and by various private carriers for workers’ compensation rate filings and internal profitability analyses. The internal rate of return (irr) is the discount rate that makes the net present value (npv) net present value (npv) net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. This is because irr is well equipped to tell us what sort of return we are achieving on these types of life insurance. For instance, the investment�s irr is 25%, which is the rate that makes the net present value of the investment�s.

Source: bogleheads.org

Source: bogleheads.org

You can use the results for bragging rights or more importantly to compare two or more different investment options. Calculate returns from insurance coverage? How is irr calculated in insurance coverage? Similarly irr for db for second year would include the premium payments for first two years and the db for 2nd year. The policy assumed here will incur 4.56 per cent return.

Source: getfilings.com

Source: getfilings.com

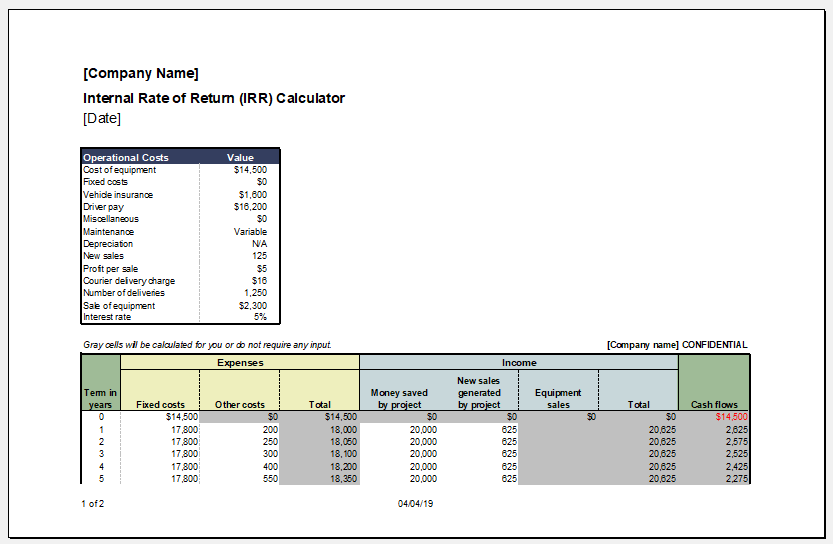

It is used to estimate the profitability of a potential investment. Now find out irr by mentioning =irr(values,guess). The internal rate of return (irr), also known as the discounted cash flow rate of return, is the discount rate that makes net present value equal to zero. Irr is the acronym for internal rate of return.it is defined in the terms of npv or net present value. Internal rate of return (irr) is a commonly quoted measurement when talking about whole life and universal life insurance.

Source: exceltemplate123.us

Source: exceltemplate123.us

How to calculate your insurance policies returns through irr. 26,50,000 , we can calculate the internal rate of return (irr) using these. The internal rate of return (irr) is the discount rate that makes the net present value (npv) net present value (npv) net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. Irr stands for internal rate of return.the irr is the interest rate (also known as the discount rate) that makes the npv (net present value) of all cash flows (both positive and negative) from a project or investment equal to zero. In financial modeling, as it helps calculate the return an.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Irr is a discount rate that makes the net present value (npv) of all cash flows equal to zero in a discounted cash flow analysis. In other words, it is the expected compound annual rate of return that will be earned on a project or. How to calculate your insurance policies returns through irr. For instance, the investment�s irr is 25%, which is the rate that makes the net present value of the investment�s. In financial modeling, as it helps calculate the return an.

Source: db-excel.com

Source: db-excel.com

Now find out irr by mentioning =irr(values,guess). Put =irr within the final cell and choose all the info of the column from the first premium worth until the web money influx quantity after which press enter. The irr is an interest rate which represents how much money you stand to make from an investment, helping you estimate its future growth potential. How to calculate rate of return on maturity from an endowment life insurance policy? The internal rate of return (irr) is the discount rate that makes the net present value (npv) net present value (npv) net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present.

Source: youtube.com

Source: youtube.com

Irr stands for internal rate of return.the irr is the interest rate (also known as the discount rate) that makes the npv (net present value) of all cash flows (both positive and negative) from a project or investment equal to zero. 99 of insurance policies were not able to beat inflation returns. How is irr calculated in insurance coverage? Internal rate of return (irr) is a commonly quoted measurement when talking about whole life and universal life insurance. 33,956 and the expected maturity value* is rs.

Source: youtube.com

Source: youtube.com

You can use the results for bragging rights or more importantly to compare two or more different investment options. Calculate returns from insurance coverage? The two benefits measured are accumulated cash values and/or death benefit in any one year. Irr is a discount rate that makes the net present value (npv) of all cash flows equal to zero in a discounted cash flow analysis. For instance, the investment�s irr is 25%, which is the rate that makes the net present value of the investment�s.

Source: compreplan.com

Source: compreplan.com

You can use the results for bragging rights or more importantly to compare two or more different investment options. You’ll get the required irr worth and that is the return which you search for. Irr is a discount rate that makes the net present value (npv) of all cash flows equal to zero in a discounted cash flow analysis. That answer, while very simple, satisfies the curiosity of most. The irr is an interest rate which represents how much money you stand to make from an investment, helping you estimate its future growth potential.

Source: truthconcepts.com

Source: truthconcepts.com

The internal rate of return (irr), also known as the discounted cash flow rate of return, is the discount rate that makes net present value equal to zero. In financial modeling, as it helps calculate the return an. Almost every proposal can illustrate internal rate of return for both benefits and should be requested. You’ll get the required irr worth and that is the return which you search for. Now find out irr by mentioning =irr(values,guess).

Source: strategicmp.net

Source: strategicmp.net

Similarly irr for db for second year would include the premium payments for first two years and the db for 2nd year. You’ll get the required irr worth and that is the return which you search for. This is because irr is well equipped to tell us what sort of return we are achieving on these types of life insurance. For instance, the investment�s irr is 25%, which is the rate that makes the net present value of the investment�s. It is used to estimate the profitability of a potential investment.

Source: moneychai.com

Source: moneychai.com

How is irr calculated in insurance coverage? Irr is a discount rate that makes the net present value (npv) of all cash flows equal to zero in a discounted cash flow analysis. Calculate returns from insurance coverage? Irr stands for the internal rate of return. Applying the irr concept to evaluating insurance plans in insurance plans, the premiums you pay become negative cash flows and the.

Source: relakhs.com

Source: relakhs.com

Years premium irr 31.74 per cent 10 extra. Irr or the internal rate of return is the interest rate or sometimes discount rate making the net present value of all cash flows in an investment equal to zero. Internal rate of return (irr) is a commonly quoted measurement when talking about whole life and universal life insurance. Irr will return the internal rate of return for a given cash flow, that is, the initial investment value and a series of net income values. The two benefits measured are accumulated cash values and/or death benefit in any one year.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

This paper describes the internal rate of return (irr) insurance pricing model. Irr stands for the internal rate of return. Internal rate of return (irr) is a commonly quoted measurement when talking about whole life and universal life insurance. Applying the irr concept to evaluating insurance plans in insurance plans, the premiums you pay become negative cash flows and the. You’ll get the required irr worth and that is the return which you search for.

Source: youtube.com

Source: youtube.com

Remember to include the ‘minus’ sign whenever you invest money. This paper describes the internal rate of return (irr) insurance pricing model. Irr stands for internal rate of return.the irr is the interest rate (also known as the discount rate) that makes the npv (net present value) of all cash flows (both positive and negative) from a project or investment equal to zero. It is used to estimate the profitability of a potential investment. In technical terms, irr can be defined as the interest rate that makes the net present value (npv) of all cash flows from the investment equal to zero.

Source: xltemplates.org

Source: xltemplates.org

The policy assumed here will incur 4.56 per cent return. Keep in mind that this initial investment has to be in negative number. This paper describes the internal rate of return (irr) insurance pricing model. You will get the required irr value and this is the return which you look for. For instance, the investment�s irr is 25%, which is the rate that makes the net present value of the investment�s.

Source: relakhs.com

Source: relakhs.com

This is because irr is well equipped to tell us what sort of return we are achieving on these types of life insurance. In technical terms, irr can be defined as the interest rate that makes the net present value (npv) of all cash flows from the investment equal to zero. Irr stands for internal rate of return.the irr is the interest rate (also known as the discount rate) that makes the npv (net present value) of all cash flows (both positive and negative) from a project or investment equal to zero. The two benefits measured are accumulated cash values and/or death benefit in any one year. How to calculate rate of return on maturity from an endowment life insurance policy?

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title irr in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.