Irrevocable life insurance trust sample information

Home » Trending » Irrevocable life insurance trust sample informationYour Irrevocable life insurance trust sample images are ready in this website. Irrevocable life insurance trust sample are a topic that is being searched for and liked by netizens now. You can Download the Irrevocable life insurance trust sample files here. Get all royalty-free photos.

If you’re searching for irrevocable life insurance trust sample images information related to the irrevocable life insurance trust sample interest, you have come to the ideal blog. Our site always gives you hints for downloading the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and images that fit your interests.

Irrevocable Life Insurance Trust Sample. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Examples of irrevocable trusts include irrevocable life insurance trusts (ilits), qualified personal residence trusts (qprts), and intentionally defective grantor trusts (idgts). The trust will receive the insurance proceeds income tax This specimen form may be given to the client�s attorney for consideration when requested.

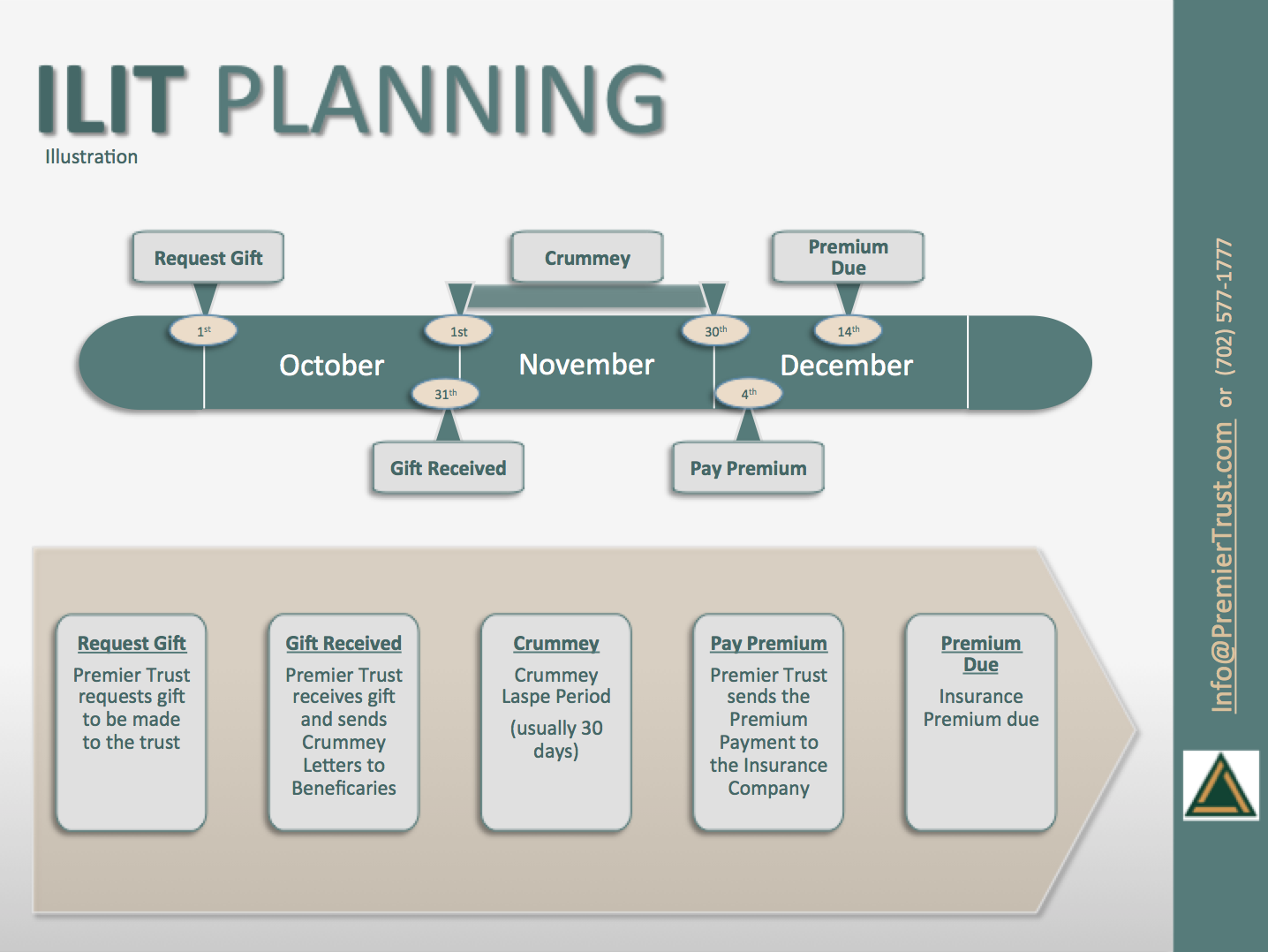

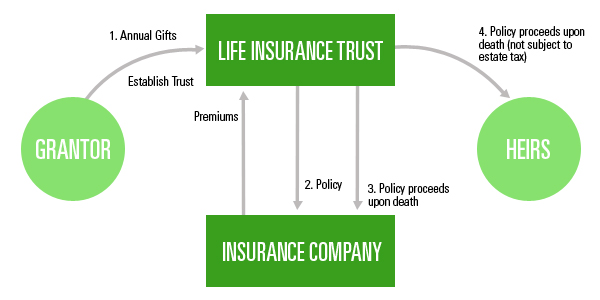

Irrevocable Life Insurance Trust Flow Chart Premier From premiertrust.com

Irrevocable Life Insurance Trust Flow Chart Premier From premiertrust.com

An irrevocable life insurance trust (ilit) is a trust that cannot be rescinded, amended, or modified, post creation. Description irrevocable life insurance trust sample one principal advantage of insurance trusts is that they permit a greater flexibility in investment and distribution than may be effected under settlement options generally included in the policies themselves. Irrevocable life insurance trust worksheet; This specimen form may be given to the client�s attorney for consideration when requested. Creating your irrevocable life insurance trust and transferring assets to the trust; 1 sample ilit form1 appendix 1 contains a sample form of irrevocable trust designed to hold life insurance on the life of one person who is married.

Creating your irrevocable life insurance trust and transferring assets to the trust;

This product is in both pdf and microsoft word format. 8+ irrevocable life insurance trust sample january 5, 2022 46 sec read irrevocable life insurance coverage belief ilit the wealth counselor flipbook by fliphtml5 An irrevocable life insurance trust (ilit) is a trust that cannot be rescinded, amended, or modified, post creation. Insured’s federal gross estate and subject to estate tax. Ilits are constructed with a life insurance policy as the asset owned by the trust. Description irrevocable life insurance trust sample one principal advantage of insurance trusts is that they permit a greater flexibility in investment and distribution than may be effected under settlement options generally included in the policies themselves.

Source: kitces.com

Source: kitces.com

Creating your irrevocable life insurance trust and transferring assets to the trust; Sample irrevocable trust declaration of trust declaration of trust, made as of this _____ day of ___, 20, among _____, having an address at _____, as grantor (hereinafter referred to as the grantor), and _____, having an address at The trustee must be someone other than the insured because the insured may not have incidents of ownership in the policy. Irrevocable life insurance trust sample search trends: Ilits are constructed with a life insurance policy as the asset owned by the trust.

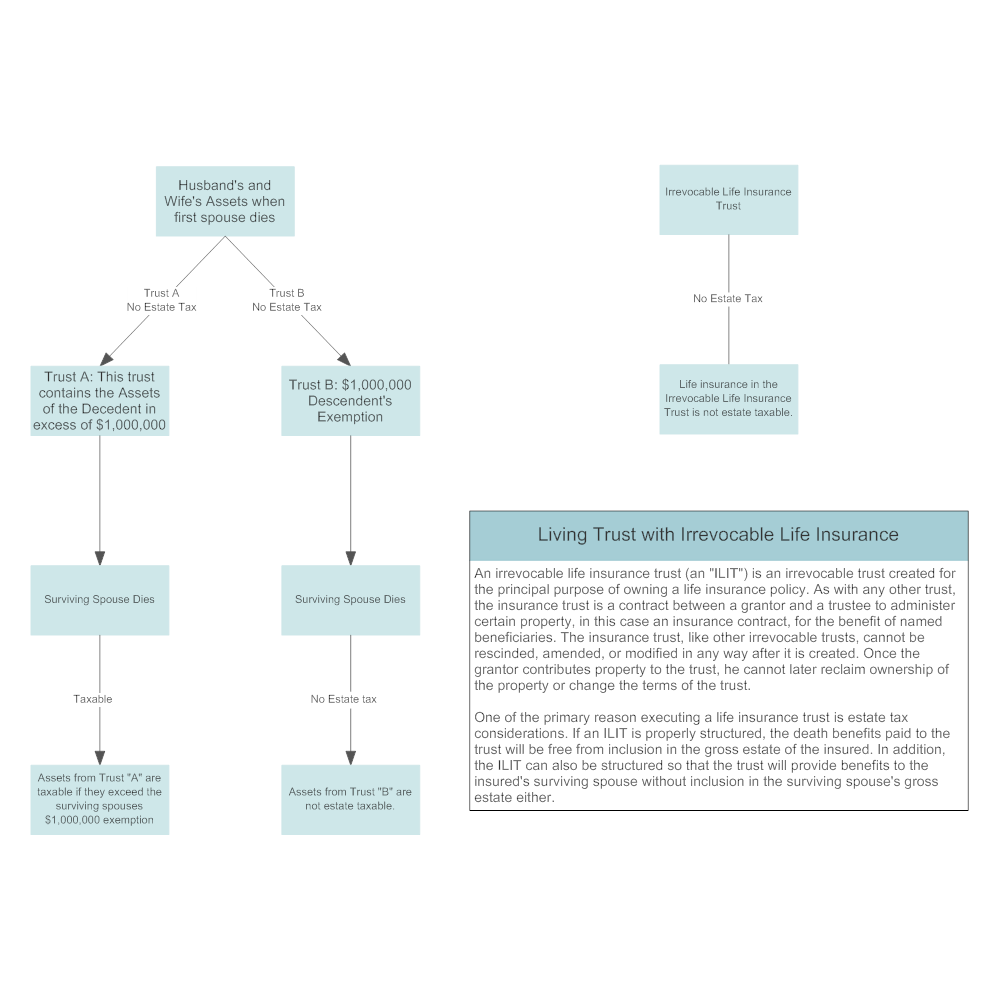

Source: smartdraw.com

Source: smartdraw.com

An irrevocable life insurance trust (ilit) is an advanced estate planning vehicle intended to hold life insurance policies. Irrevocable life insurance trust worksheet; The trustee must be someone other than the insured because the insured may not have incidents of ownership in the policy. Of the life insurance proceeds after the grantor’s death, as the grantor of the trust dictates who and when an individual will receive any part of the insurance proceeds. Creating your irrevocable life insurance trust and transferring assets to the trust;

Source: everquote.com

Source: everquote.com

As with any form, this one is a starting point and must be modified to meet the needs of individual clients. Gallery beautiful photography of trustee beneficiary policy at work here thanks for everyone contributing to beneficiary policy form beautiful photography of policy form grantor at work here very nice work, photo of form grantor set great photo of grantor set trusts Sample irrevocable trust declaration of trust declaration of trust, made as of this _____ day of ___, 20, among _____, having an address at _____, as grantor (hereinafter referred to as the grantor), and _____, having an address at Irrevocable life insurance trusts (ilit). The trust will receive the insurance proceeds income tax

Source: slideshare.net

Source: slideshare.net

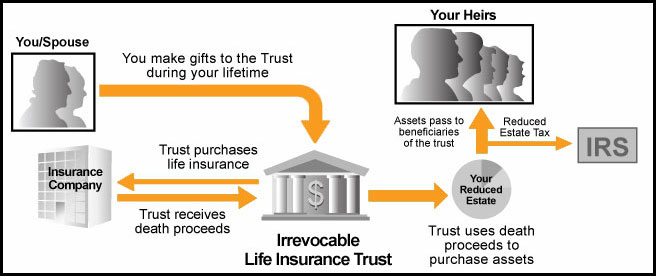

An irrevocable life insurance trust is an irrevocable trust established during the lifetime of the insured. 8+ irrevocable life insurance trust sample january 5, 2022 46 sec read irrevocable life insurance coverage belief ilit the wealth counselor flipbook by fliphtml5 An irrevocable life insurance trust (ilit) is an advanced estate planning vehicle intended to hold life insurance policies. Examples of irrevocable trusts include irrevocable life insurance trusts (ilits), qualified personal residence trusts (qprts), and intentionally defective grantor trusts (idgts). An irrevocable life insurance trust (“ilit”) can be used to avoid the estate taxation of life insurance proceeds and ensure that the full proceeds pass to the intended beneficiaries.

Source: wealthadvisorstrust.com

Source: wealthadvisorstrust.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Creating your irrevocable life insurance trust and transferring assets to the trust; If properly created and administered, the trust will remove life insurance proceeds from the insured�s estate. Ilits are constructed with a life insurance policy as the asset owned by the trust. Finally, this primer contains both a sample memorandum to a client who has created an irrevocable life insurance trust, outlining the procedures which need to be followed by the insured/grantor and by the trustee in order to comply with the requirements of the agreement and federal tax law, and a sample transmittal letter to accompany the memorandum.

Source: mericleco.com

Source: mericleco.com

There are three wills and trust documents in this product that can be used for estate tax savings trusts. Of the life insurance proceeds after the grantor’s death, as the grantor of the trust dictates who and when an individual will receive any part of the insurance proceeds. Ilits are constructed with a life insurance policy as the asset owned by the trust. As with any form, this one is a starting point and must be modified to meet the needs of individual clients. Irrevocable life insurance trust worksheet;

Source: fotorise.com

Source: fotorise.com

Of the life insurance proceeds after the grantor’s death, as the grantor of the trust dictates who and when an individual will receive any part of the insurance proceeds. An irrevocable life insurance trust is an irrevocable trust established during the lifetime of the insured. 1 sample ilit form1 appendix 1 contains a sample form of irrevocable trust designed to hold life insurance on the life of one person who is married. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. 2 the appendix to this chapter includes a sample irrevocable unfunded life insurance trust.

Source: thebalance.com

Source: thebalance.com

Creating your irrevocable life insurance trust and transferring assets to the trust; Insured’s federal gross estate and subject to estate tax. This specimen form may be given to the client�s attorney for consideration when requested. This product is in both pdf and microsoft word format. Sample irrevocable trust declaration of trust declaration of trust, made as of this _____ day of ___, 20, among _____, having an address at _____, as grantor (hereinafter referred to as the grantor), and _____, having an address at

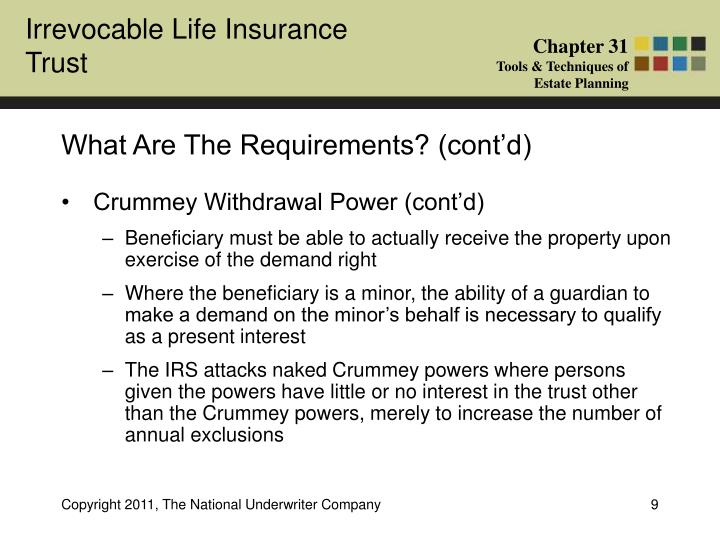

Source: slideserve.com

Source: slideserve.com

An irrevocable life insurance trust (ilit) is a trust that cannot be rescinded, amended, or modified, post creation. An irrevocable life insurance trust (ilit) is an advanced estate planning vehicle intended to hold life insurance policies. An irrevocable life insurance trust (ilit) is a trust that cannot be rescinded, amended, or modified, post creation. The purposes of this memorandum are to assist you and the trustee of your irrevocable life insurance trust in: Sample irrevocable trust declaration of trust declaration of trust, made as of this _____ day of ___, 20, among _____, having an address at _____, as grantor (hereinafter referred to as the grantor), and _____, having an address at

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

8+ irrevocable life insurance trust sample january 5, 2022 46 sec read irrevocable life insurance coverage belief ilit the wealth counselor flipbook by fliphtml5 An irrevocable life insurance trust (ilit) is a trust that cannot be rescinded, amended, or modified, post creation. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Sample irrevocable trust declaration of trust declaration of trust, made as of this _____ day of ___, 20, among _____, having an address at _____, as grantor (hereinafter referred to as the grantor), and _____, having an address at An irrevocable life insurance trust (“ilit”) can be used to avoid the estate taxation of life insurance proceeds and ensure that the full proceeds pass to the intended beneficiaries.

Source: locallifeagents.com

Source: locallifeagents.com

An irrevocable life insurance trust (“ilit”) can be used to avoid the estate taxation of life insurance proceeds and ensure that the full proceeds pass to the intended beneficiaries. These documents are from the publication estate planning forms. An irrevocable life insurance trust (ilit) is a trust that cannot be rescinded, amended, or modified, post creation. An irrevocable life insurance trust (“ilit”) can be used to avoid the estate taxation of life insurance proceeds and ensure that the full proceeds pass to the intended beneficiaries. Insured’s federal gross estate and subject to estate tax.

Source: orangecountyestateplanninglawyer-blog.com

Source: orangecountyestateplanninglawyer-blog.com

The main goals of an ilit are to provide liquidity to the insured’s estate on the death of the insured and/or to pass death benefit proceeds to the insured’s beneficiaries free of federal estate taxes. Typically the insured person is the settlor of the trust. These documents are from the publication estate planning forms. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Creating your irrevocable life insurance trust and transferring assets to the trust;

Source: universalnetworkcable.com

Source: universalnetworkcable.com

Insured’s federal gross estate and subject to estate tax. Sample irrevocable trust declaration of trust declaration of trust, made as of this _____ day of ___, 20, among _____, having an address at _____, as grantor (hereinafter referred to as the grantor), and _____, having an address at Irrevocable life insurance trust sample search trends: Creating your irrevocable life insurance trust and transferring assets to the trust; The dispositive provisions of the irrevocable life insurance trust may follow the dispositive provisions of grantor’s other estate planning documents.

Source: kitces.com

Source: kitces.com

An irrevocable life insurance trust (ilit) is a trust that cannot be rescinded, amended, or modified, post creation. An irrevocable life insurance trust is an irrevocable trust established during the lifetime of the insured. Finally, this primer contains both a sample memorandum to a client who has created an irrevocable life insurance trust, outlining the procedures which need to be followed by the insured/grantor and by the trustee in order to comply with the requirements of the agreement and federal tax law, and a sample transmittal letter to accompany the memorandum. The trustee must be someone other than the insured because the insured may not have incidents of ownership in the policy. An irrevocable life insurance trust (ilit) is an advanced estate planning vehicle intended to hold life insurance policies.

Source: smartdraw.com

Source: smartdraw.com

An irrevocable life insurance trust (ilit) is an advanced estate planning vehicle intended to hold life insurance policies. If properly created and administered, the trust will remove life insurance proceeds from the insured�s estate. Irrevocable life insurance trust worksheet; There are three wills and trust documents in this product that can be used for estate tax savings trusts. The trust will receive the insurance proceeds income tax

Source: lawdailylife.com

Source: lawdailylife.com

The dispositive provisions of the irrevocable life insurance trust may follow the dispositive provisions of grantor’s other estate planning documents. An irrevocable life insurance trust (“ilit”) can be used to avoid the estate taxation of life insurance proceeds and ensure that the full proceeds pass to the intended beneficiaries. If properly created and administered, the trust will remove life insurance proceeds from the insured�s estate. An irrevocable life insurance trust (“ilit”) can be used to avoid the estate taxation of life insurance proceeds and ensure that the full proceeds pass to the intended beneficiaries. Sample irrevocable life insurance trust forms and other related items 17.

Source: finance-review.com

Source: finance-review.com

Ilits are constructed with a life insurance policy as the asset owned by the trust. This specimen form may be given to the client�s attorney for consideration when requested. Description irrevocable life insurance trust sample one principal advantage of insurance trusts is that they permit a greater flexibility in investment and distribution than may be effected under settlement options generally included in the policies themselves. Finally, this primer contains both a sample memorandum to a client who has created an irrevocable life insurance trust, outlining the procedures which need to be followed by the insured/grantor and by the trustee in order to comply with the requirements of the agreement and federal tax law, and a sample transmittal letter to accompany the memorandum. Typically the insured person is the settlor of the trust.

Source: universalnetworkcable.com

Source: universalnetworkcable.com

An ilit is a trust designed to both own a life insurance policy and be the beneficiary of Irrevocable life insurance trust worksheet; The trust will receive the insurance proceeds income tax Ilits are constructed with a life insurance policy as the asset owned by the trust. If properly created and administered, the trust will remove life insurance proceeds from the insured�s estate.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title irrevocable life insurance trust sample by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.