Irs audit health insurance Idea

Home » Trending » Irs audit health insurance IdeaYour Irs audit health insurance images are available in this site. Irs audit health insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Irs audit health insurance files here. Get all royalty-free photos.

If you’re searching for irs audit health insurance pictures information related to the irs audit health insurance topic, you have pay a visit to the ideal blog. Our website always provides you with suggestions for downloading the highest quality video and picture content, please kindly surf and find more informative video articles and graphics that fit your interests.

Irs Audit Health Insurance. A family of four that goes uninsured for the whole year would face a. These are the only income ranges that were subject to more than a 1% chance of an audit in 2018 (the lastest data available). Audit defense only available in turbotax max bundle. In 2019, there will be no more penalty.

Irs Audit Irs Audit Health Insurance From irsauditwarishiki.blogspot.com

Irs Audit Irs Audit Health Insurance From irsauditwarishiki.blogspot.com

Claiming deductions for things like charitable donations or medical expenses to lower your tax bill doesn’t in itself make you prime audit material. Erie® insurance services are provided by one or more of the following insurers: An insurance audit is the carrier’s way of determining how much risk they actually insured over the past year. The company could’ve undergone a drastic change over that whole year your policy was in effect. For 2018 taxes, the most recent data from the irs, the audit rate was 5.3% for returns that reported income of $10 million or more, 1% for returns with income between $5 million and $10 million, and 0.6% for returns with income between $1 million and $5 million. According to irs statistics, you’re safest if you report income in the neighborhood of $25,000 to $200,000.

Insurance deductions questioned by irs auditors, such as:

The dreaded words irs audit can mean a headache for many u.s. Health risk with net premiums written during the calendar year that exceed $25 million. For example, if you reported income of $50,000 and charitable donations of $25,000 it might raise an eyebrow with the irs. The interview may be at an irs office (office audit) or at the taxpayer�s home, place of business, or accountant�s office (field audit). These taxpayers were audited the least in. Erie® insurance services are provided by one or more of the following insurers:

Source: retireenews.org

Source: retireenews.org

Erie® insurance services are provided by one or more of the following insurers: Several factors determine the premium carriers charge for general liability (gl) and workers comp insurance. Gao uncovered one instance of $3.2 million the irs. A round of irs letters have been mailed out to employers, signifying the start of the irs’s affordable care act audit process. Insurance deductions questioned by irs auditors, such as:

Section 105(e) of the code provides that amounts received under an accident or health plan for employees will be treated as amounts received through accident or health insurance for purposes of sections 104 and 105. Claiming deductions for things like charitable donations or medical expenses to lower your tax bill doesn’t in itself make you prime audit material. These are the only income ranges that were subject to more than a 1% chance of an audit in 2018 (the lastest data available). The penalty for not having coverage the entire year will be at least $800 per adult and $400 per dependent child under 18 in the household when you file your 2021 state income tax return in 2022. But even 0.5% is still one out of every 200 taxpayers, which might have you sweating over your chances of being audited.

Source: americanthinker.com

Gao uncovered one instance of $3.2 million the irs. The interview may be at an irs office (office audit) or at the taxpayer�s home, place of business, or accountant�s office (field audit). For 2018 taxes, the most recent data from the irs, the audit rate was 5.3% for returns that reported income of $10 million or more, 1% for returns with income between $5 million and $10 million, and 0.6% for returns with income between $1 million and $5 million. Health insurance, life insurance, audit insurance, auto insurance, homeowners insurance, business owner policy, workman’s compensation insurance, negligence policies, dental insurance, medical insurance, theft insurance, fire insurance, flood insurance, risk pool, catastrophe insurance, car or. An insurance audit is the carrier’s way of determining how much risk they actually insured over the past year.

Source: northtexascpas.net

Source: northtexascpas.net

Section 104(a)(3) of the code provides that, except in the case of amounts attributable The interview may be at an irs office (office audit) or at the taxpayer�s home, place of business, or accountant�s office (field audit). Audit defense only available in turbotax max bundle. According to irs statistics, you’re safest if you report income in the neighborhood of $25,000 to $200,000. The irs sent letter 6002 to inform you that you must file an amended return to address your health coverage.

Internal revenue service will not audit individuals to make sure they have health insurance as part of the sweeping system overhaul just signed by president barack obama, the u.s. Typically, the tax agency will audit less than 1% of all tax returns. A round of irs letters have been mailed out to employers, signifying the start of the irs’s affordable care act audit process. If you have health insurance premiums and/or medical fees that surpass 7.5% of your gross income, you will be eligible to write that off on your taxes. Section 105(e) of the code provides that amounts received under an accident or health plan for employees will be treated as amounts received through accident or health insurance for purposes of sections 104 and 105.

Source: signnow.com

Source: signnow.com

Section 105(e) of the code provides that amounts received under an accident or health plan for employees will be treated as amounts received through accident or health insurance for purposes of sections 104 and 105. Internal revenue service will not audit individuals to make sure they have health insurance as part of the sweeping system overhaul just signed by president barack obama, the u.s. These taxpayers were audited the least in. Section 105(e) of the code provides that amounts received under an accident or health plan for employees will be treated as amounts received through accident or health insurance for purposes of sections 104 and 105. Typically, the tax agency will audit less than 1% of all tax returns.

The audit risk assessment is not a guarantee you will not be audited. The penalty for not having coverage the entire year will be at least $800 per adult and $400 per dependent child under 18 in the household when you file your 2021 state income tax return in 2022. Insurance deductions questioned by irs auditors, such as: Article first time published on askingthelot. Adjusted gross income appears on irs form 1040, line 11.

Source: doeren.com

Source: doeren.com

The irs sent letter 6002 to inform you that you must file an amended return to address your health coverage. The irs will provide all contact information and instructions in. Audit defense only available in turbotax max bundle. Remember, you will be contacted initially by mail. For 2018 taxes, the most recent data from the irs, the audit rate was 5.3% for returns that reported income of $10 million or more, 1% for returns with income between $5 million and $10 million, and 0.6% for returns with income between $1 million and $5 million.

Source: irsauditwarishiki.blogspot.com

Source: irsauditwarishiki.blogspot.com

A family of four that goes uninsured for the whole year would face a. The penalty for not having coverage the entire year will be at least $800 per adult and $400 per dependent child under 18 in the household when you file your 2021 state income tax return in 2022. Does the irs audit medical expenses? The dreaded words irs audit can mean a headache for many u.s. Health insurers, employers that sponsor health plans and agencies that administer government health plans will file annual reports to the irs about who is covered under their plans.

Source: irsauditwarishiki.blogspot.com

Source: irsauditwarishiki.blogspot.com

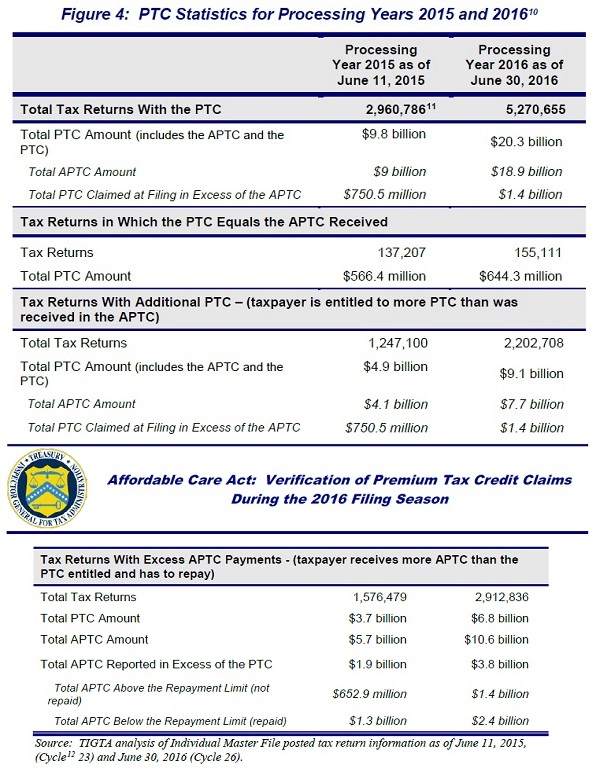

Insurance deductions questioned by irs auditors, such as: Gao uncovered one instance of $3.2 million the irs. It lists the amount of premium assistance you received in the form of advance payments of the premium tax credit that were paid directly to your insurance company, if any. A government accountability office ( gao) audit found that the irs, by failing to properly identify its expenses, “risks being unaware of the true costs of its [health care law] activities.”. For example, if you reported income of $50,000 and charitable donations of $25,000 it might raise an eyebrow with the irs.

Source: acatimes.com

Source: acatimes.com

Typically, the tax agency will audit less than 1% of all tax returns. These are the only income ranges that were subject to more than a 1% chance of an audit in 2018 (the lastest data available). Adjusted gross income appears on irs form 1040, line 11. If you have health insurance premiums and/or medical fees that surpass 7.5% of your gross income, you will be eligible to write that off on your taxes. For example, if you reported income of $50,000 and charitable donations of $25,000 it might raise an eyebrow with the irs.

Source: ioausa.us

Source: ioausa.us

Insurance deductions questioned by irs auditors, such as: A government accountability office ( gao) audit found that the irs, by failing to properly identify its expenses, “risks being unaware of the true costs of its [health care law] activities.”. But even 0.5% is still one out of every 200 taxpayers, which might have you sweating over your chances of being audited. Health insurance, life insurance, audit insurance, auto insurance, homeowners insurance, business owner policy, workman’s compensation insurance, negligence policies, dental insurance, medical insurance, theft insurance, fire insurance, flood insurance, risk pool, catastrophe insurance, car or. Allows the deduction for retiree prescription drug expenses only after the deduction amount is reduced by the amount of the excludable subsidy payments received.

Source: insuremekevin.com

Source: insuremekevin.com

The company could’ve undergone a drastic change over that whole year your policy was in effect. The audit risk assessment is not a guarantee you will not be audited. Section 105(e) of the code provides that amounts received under an accident or health plan for employees will be treated as amounts received through accident or health insurance for purposes of sections 104 and 105. Imposes an annual fee on any entity that provides health insurance for any u.s. Section 104(a)(3) of the code provides that, except in the case of amounts attributable

Source: thriftyfun.com

Source: thriftyfun.com

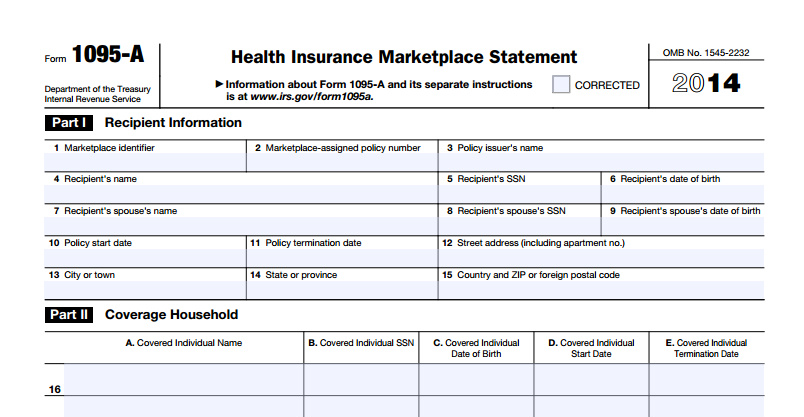

It lists the amount of premium assistance you received in the form of advance payments of the premium tax credit that were paid directly to your insurance company, if any. If you have health insurance premiums and/or medical fees that surpass 7.5% of your gross income, you will be eligible to write that off on your taxes. Erie insurance exchange, erie insurance company, erie insurance property &. An insurance audit is the carrier’s way of determining how much risk they actually insured over the past year. It lists the amount of premium assistance you received in the form of advance payments of the premium tax credit that were paid directly to your insurance company, if any.

Source: taxaudit.com

It lists the amount of premium assistance you received in the form of advance payments of the premium tax credit that were paid directly to your insurance company, if any. Adjusted gross income appears on irs form 1040, line 11. Does the irs audit medical expenses? Typically, the tax agency will audit less than 1% of all tax returns. A round of irs letters have been mailed out to employers, signifying the start of the irs’s affordable care act audit process.

Source: taxaudit.com

It lists the amount of premium assistance you received in the form of advance payments of the premium tax credit that were paid directly to your insurance company, if any. Article first time published on askingthelot. The company could’ve undergone a drastic change over that whole year your policy was in effect. Health risk with net premiums written during the calendar year that exceed $25 million. The interview may be at an irs office (office audit) or at the taxpayer�s home, place of business, or accountant�s office (field audit).

Source: cpapracticeadvisor.com

Source: cpapracticeadvisor.com

The irs will provide all contact information and instructions in. Section 104(a)(3) of the code provides that, except in the case of amounts attributable It lists the amount of premium assistance you received in the form of advance payments of the premium tax credit that were paid directly to your insurance company, if any. A government accountability office ( gao) audit found that the irs, by failing to properly identify its expenses, “risks being unaware of the true costs of its [health care law] activities.”. For example, if you reported income of $50,000 and charitable donations of $25,000 it might raise an eyebrow with the irs.

Source: savingadvice.com

Source: savingadvice.com

These are the only income ranges that were subject to more than a 1% chance of an audit in 2018 (the lastest data available). Health risk with net premiums written during the calendar year that exceed $25 million. According to irs statistics, you’re safest if you report income in the neighborhood of $25,000 to $200,000. Adjusted gross income appears on irs form 1040, line 11. A family of four that goes uninsured for the whole year would face a.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title irs audit health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.