Is a broken boiler covered by home insurance Idea

Home » Trend » Is a broken boiler covered by home insurance IdeaYour Is a broken boiler covered by home insurance images are available in this site. Is a broken boiler covered by home insurance are a topic that is being searched for and liked by netizens now. You can Download the Is a broken boiler covered by home insurance files here. Find and Download all free photos.

If you’re looking for is a broken boiler covered by home insurance pictures information connected with to the is a broken boiler covered by home insurance interest, you have come to the right blog. Our site frequently gives you suggestions for refferencing the maximum quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

Is A Broken Boiler Covered By Home Insurance. A common condition of home emergency cover is regular maintenance of your boiler. Fortunately, it often doesn’t cost much, perhaps. Fixing a broken boiler can get expensive quickly, so it�s important to make sure you�re covered or can afford repairs having a boiler you can rely on is extremely important for homeowners in the uk; Your boiler could also be excluded if it hasn’t been regularly serviced by a gas safe registered engineer.

Do Home Warranties Cover Furnace Replacement How to From e.sleepnebraska.org

Do Home Warranties Cover Furnace Replacement How to From e.sleepnebraska.org

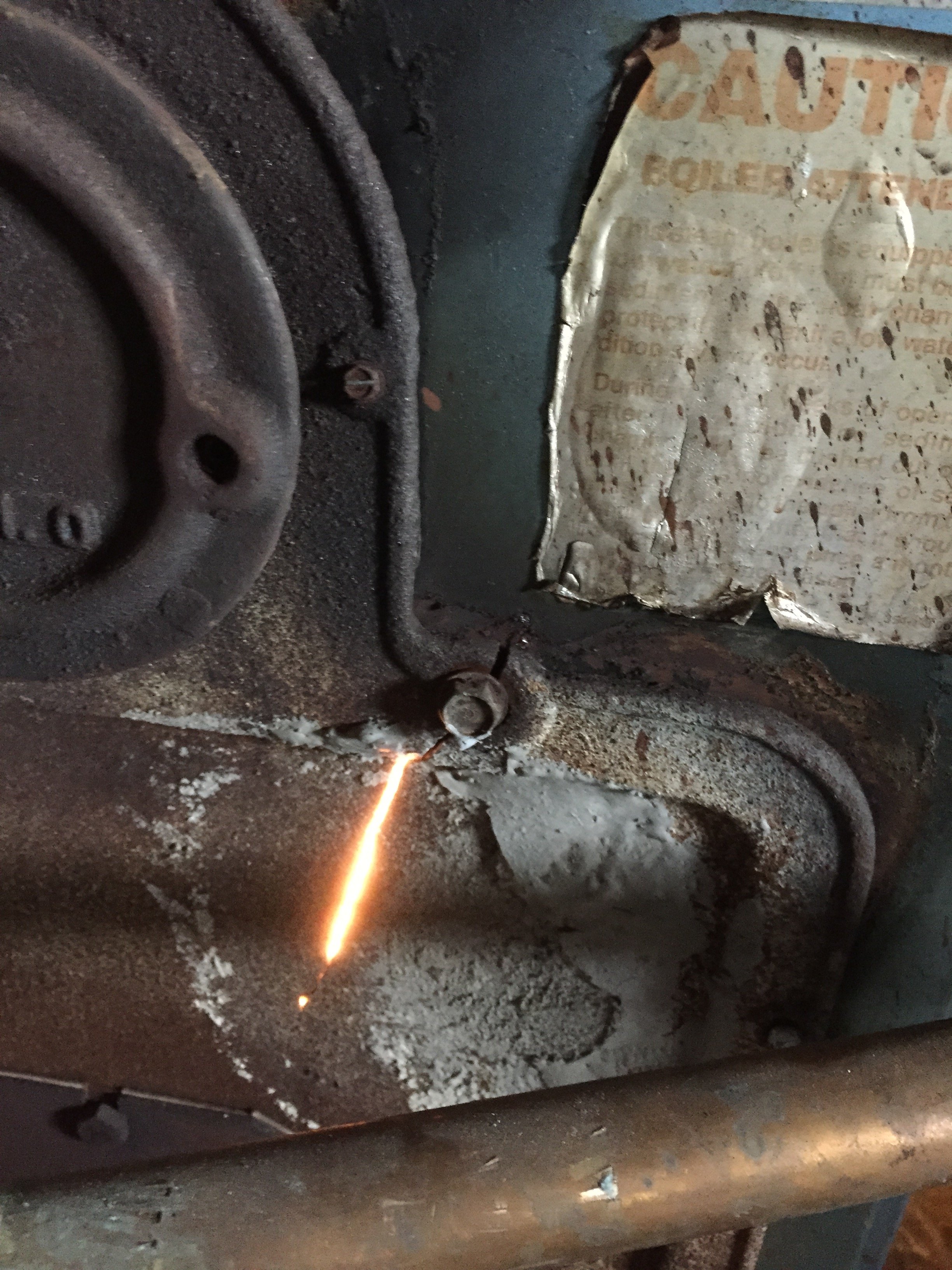

Some companies might even specify that breakdown is only covered if your boiler has been serviced in the last 12 months. A crack in the boiler is a hazard covered under the warranty of the company that made the boiler (not likely by then), so it comes under normal wear and tear of the house and appliances that you are responsible for. If you do not, and your boiler breaks down, it won’t be covered by your insurance. Is a boiler breakdown covered on home insurance? Boiler and machinery insurance (bm) provides coverage for physical damage to and financial loss from equipment breakdown. We use our heating systems heavily during our wet and cold winters.

The homeowner’s policy will cover a loss that results from a sudden release of water or steam.

Some companies might even specify that breakdown is only covered if your boiler has been serviced in the last 12 months. Boiler and machinery insurance (bm) provides coverage for physical damage to and financial loss from equipment breakdown. You may be covered for boiler breakdowns on your home insurance or a specific boiler policy most policies will also not pay out or pay out a limited amount of money if the boiler is over a certain. So if your dwelling coverage includes risks like theft, fire, falling objects and vandalism, your fence would likely be covered for those, too,” according to allstate. The “vessel” is the issue here and a homeowner’s policy does not cover the boiler. This is insurance fraud, and it’s illegal.

Source: youtube.com

Source: youtube.com

In most cases, standard home insurance will not cover the cost of fixing or replacing a broken boiler. Another expensive part of your home that may break, but isn’t covered by a standard home insurance policy, is your boiler. Policies that cover the cost of repairing a boiler if it suddenly fails. The simple answer is probably not. You can speak to your home insurance provider to see if they offer boiler cover as an extra.

Source: e.sleepnebraska.org

Source: e.sleepnebraska.org

Home insurance covers your property, your belongings, and… some other things as well. The homeowner’s policy will cover a loss that results from a sudden release of water or steam. Fences are covered under the other structures part of a home insurance policy. It’s an insurance that protects your home’s appliances, electronics and equipment if they should be damaged or destroyed due to a covered sudden and accidental mechanical breakdown, power surge or electrical breakdown. Boilers are a specialized form of insurance and include inspection services.

Source: contractortalk.com

Source: contractortalk.com

In most cases, standard home insurance will not cover the cost of fixing or replacing a broken boiler. How to get boiler cover. While it’s not essential, it could be worth considering if you’d be left in the lurch after. Home insurance odd things covered by home insurance. With equipment breakdown coverage, your furnace is protected against several causes of loss that aren’t covered under a standard policy, including mechanical.

Source: e.sleepnebraska.org

Source: e.sleepnebraska.org

Home insurance covers your property, your belongings, and… some other things as well. You may be covered for boiler breakdowns on your home insurance or a specific boiler policy most policies will also not pay out or pay out a limited amount of money if the boiler is over a certain. Similarly, if you intentionally damage or neglect your boiler to try and get your insurance to pay for it, you won’t be eligible for a claim. Older boilers might not be covered, so check with your provider before signing up for a policy. The simple answer is probably not.

Source: cel-uk.com

Source: cel-uk.com

If you do not, and your boiler breaks down, it won’t be covered by your insurance. “other structures on your property are typically covered for the same perils as your home. Another expensive part of your home that may break, but isn’t covered by a standard home insurance policy, is your boiler. How to get boiler cover. Doing so is part of taking responsibility for the house you own.

Source: diyshop.com

Source: diyshop.com

The “vessel” is the issue here and a homeowner’s policy does not cover the boiler. This means that if your furnace broke due to age and wear, insurance will not cover it. This is insurance fraud, and it’s illegal. Boiler and machinery insurance covers the cost of repairing or replacing. Boiler failure is widespread and it’s usually caused by a lack of proper maintenance or regular servicing, so home insurance companies are naturally hesitant to cover it.

Source: pinterest.com

Source: pinterest.com

Doing so is part of taking responsibility for the house you own. You may be covered for boiler breakdowns on your home insurance or a specific boiler policy most policies will also not pay out or pay out a limited amount of money if the boiler is over a certain. Is a broken boiler covered by home emergency insurance? Fixing or replacing a broken boiler can cost thousands,. Your boiler could also be excluded if it hasn’t been regularly serviced by a gas safe registered engineer.

Source: delaneyplumbing.co.uk

Source: delaneyplumbing.co.uk

Policies that cover the cost of repairing a boiler if it suddenly fails. While it’s not essential, it could be worth considering if you’d be left in the lurch after. So check carefully before you buy. If your boiler is still within the warranty period, you�ll need to get in touch with the manufacturer. We use our heating systems heavily during our wet and cold winters.

Source: trusteyman.com

Source: trusteyman.com

Some companies might even specify that breakdown is only covered if your boiler has been serviced in the last 12 months. But the boiler would probably be depreciated down to nothing, being 21 years old. Similarly, if you intentionally damage or neglect your boiler to try and get your insurance to pay for it, you won’t be eligible for a claim. This means that if your furnace broke due to age and wear, insurance will not cover it. A common condition of home emergency cover is regular maintenance of your boiler.

Source: which.co.uk

Source: which.co.uk

Home insurance odd things covered by home insurance. You may be covered for boiler breakdowns on your home insurance or a specific boiler policy most policies will also not pay out or pay out a limited amount of money if the boiler is over a certain. Or if it’s over a certain age. This is insurance fraud, and it’s illegal. Home insurance odd things covered by home insurance.

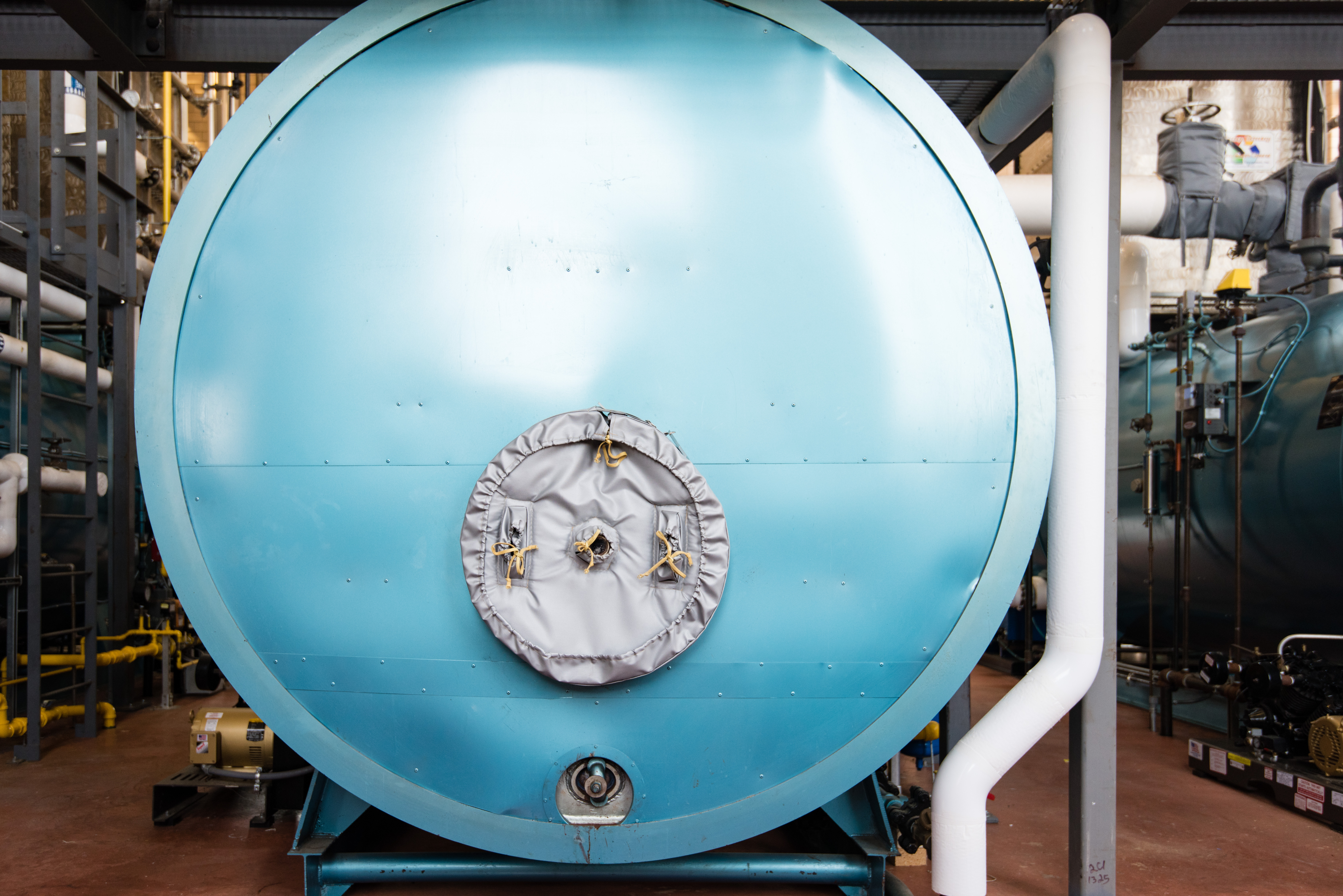

Source: thermaxxjackets.com

Source: thermaxxjackets.com

Fortunately, it often doesn’t cost much, perhaps. “other structures on your property are typically covered for the same perils as your home. With equipment breakdown coverage, your furnace is protected against several causes of loss that aren’t covered under a standard policy, including mechanical. (1) freezing of a plumbing, heating, air conditioning or automatic fire protective sprinkler system or of a household appliance, or by discharge, leakage or overflow from within the system or appliance caused by freezing. Home insurance covers your property, your belongings, and… some other things as well.

Source: n-gas.co.uk

Source: n-gas.co.uk

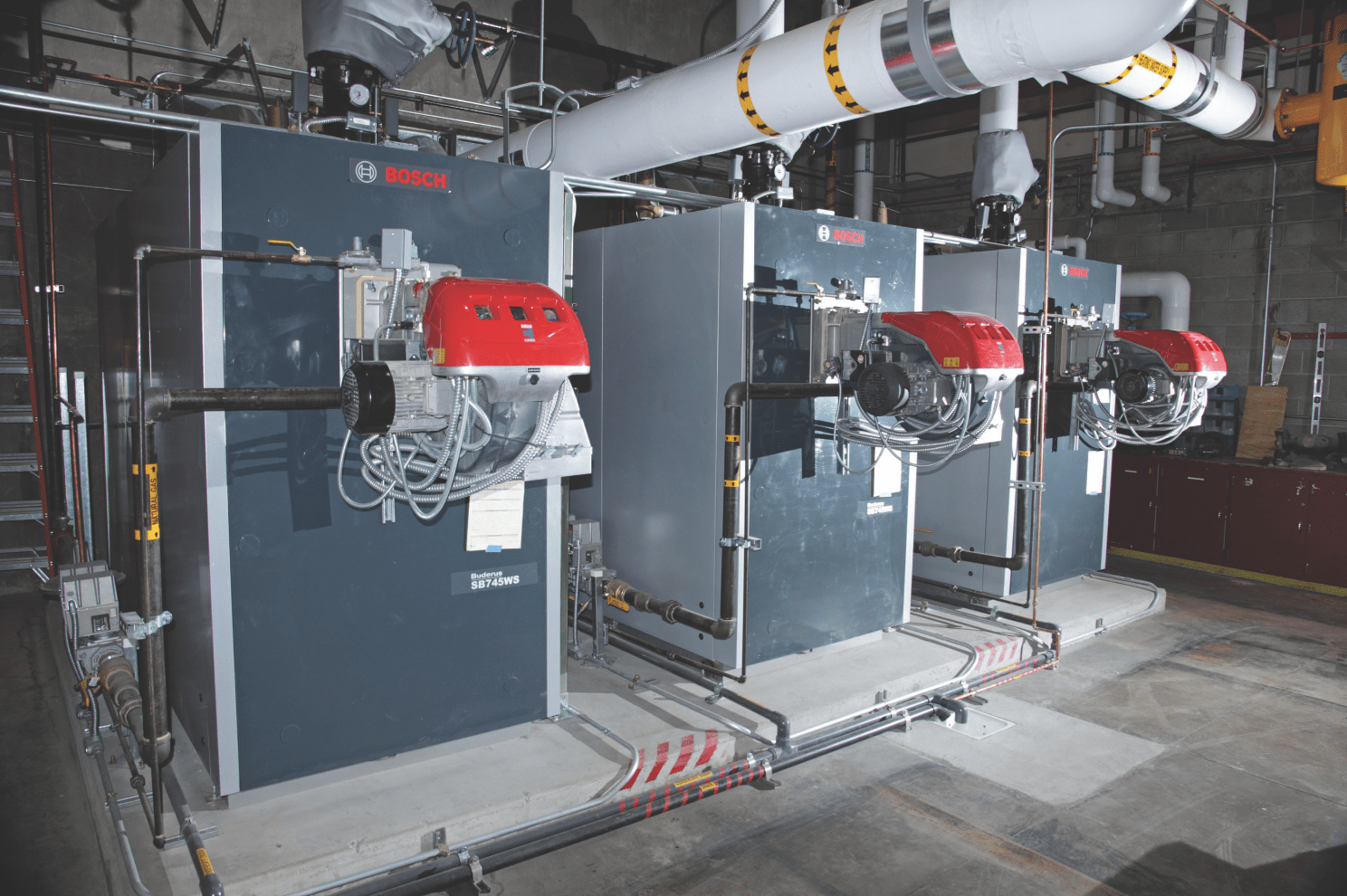

How to get boiler cover. How to get boiler cover. Boiler and machinery insurance covers the cost of repairing or replacing. Equipment breakdown coverage for furnaces & boilers. In most cases, standard home insurance will not cover the cost of fixing or replacing a broken boiler.

Source: entrepreneurhandbook.co.uk

Source: entrepreneurhandbook.co.uk

So if your dwelling coverage includes risks like theft, fire, falling objects and vandalism, your fence would likely be covered for those, too,” according to allstate. Is a broken boiler covered by home emergency insurance? Fences are covered under the other structures part of a home insurance policy. While it’s not essential, it could be worth considering if you’d be left in the lurch after. We use our heating systems heavily during our wet and cold winters.

Source: pinterest.com

Source: pinterest.com

Or if it’s over a certain age. We do not insure, however, for loss: In most cases, standard home insurance will not cover the cost of fixing or replacing a broken boiler. Much like home insurance, home emergency cover is designed to protect against the unexpected. If you’re a homeowner, you may want to look into boiler cover.

Source: forum.heatinghelp.com

Source: forum.heatinghelp.com

It’s an insurance that protects your home’s appliances, electronics and equipment if they should be damaged or destroyed due to a covered sudden and accidental mechanical breakdown, power surge or electrical breakdown. With equipment breakdown coverage, your furnace is protected against several causes of loss that aren’t covered under a standard policy, including mechanical. Home insurance covers your property, your belongings, and… some other things as well. (1) freezing of a plumbing, heating, air conditioning or automatic fire protective sprinkler system or of a household appliance, or by discharge, leakage or overflow from within the system or appliance caused by freezing. It’s the kind of policy you hope you never have to use.

Source: mechanical-hub.com

Source: mechanical-hub.com

Fixing or replacing a broken boiler can cost thousands,. Or if it’s over a certain age. Similarly, if you intentionally damage or neglect your boiler to try and get your insurance to pay for it, you won’t be eligible for a claim. Doing so is part of taking responsibility for the house you own. This is because the risk of damage and/or theft goes way.

Source: periodterrace.com

Source: periodterrace.com

Similarly, if you intentionally damage or neglect your boiler to try and get your insurance to pay for it, you won’t be eligible for a claim. Some companies might even specify that breakdown is only covered if your boiler has been serviced in the last 12 months. Fixing a broken boiler can get expensive quickly, so it�s important to make sure you�re covered or can afford repairs having a boiler you can rely on is extremely important for homeowners in the uk; This means that if your furnace broke due to age and wear, insurance will not cover it. While it’s not essential, it could be worth considering if you’d be left in the lurch after.

Source: boilercoversukuburi.blogspot.com

Source: boilercoversukuburi.blogspot.com

(1) freezing of a plumbing, heating, air conditioning or automatic fire protective sprinkler system or of a household appliance, or by discharge, leakage or overflow from within the system or appliance caused by freezing. We do not insure, however, for loss: Boiler breakdown is common and it’s most often caused by lack of good maintenance or regular servicing, so home insurance providers are understandably wary about offering cover for. Equipment breakdown coverage for furnaces & boilers. Home insurance odd things covered by home insurance.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title is a broken boiler covered by home insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.