Is acorns fdic insured Idea

Home » Trending » Is acorns fdic insured IdeaYour Is acorns fdic insured images are ready in this website. Is acorns fdic insured are a topic that is being searched for and liked by netizens now. You can Download the Is acorns fdic insured files here. Find and Download all royalty-free images.

If you’re searching for is acorns fdic insured images information connected with to the is acorns fdic insured topic, you have visit the ideal blog. Our website always gives you suggestions for seeking the highest quality video and image content, please kindly search and locate more informative video content and images that match your interests.

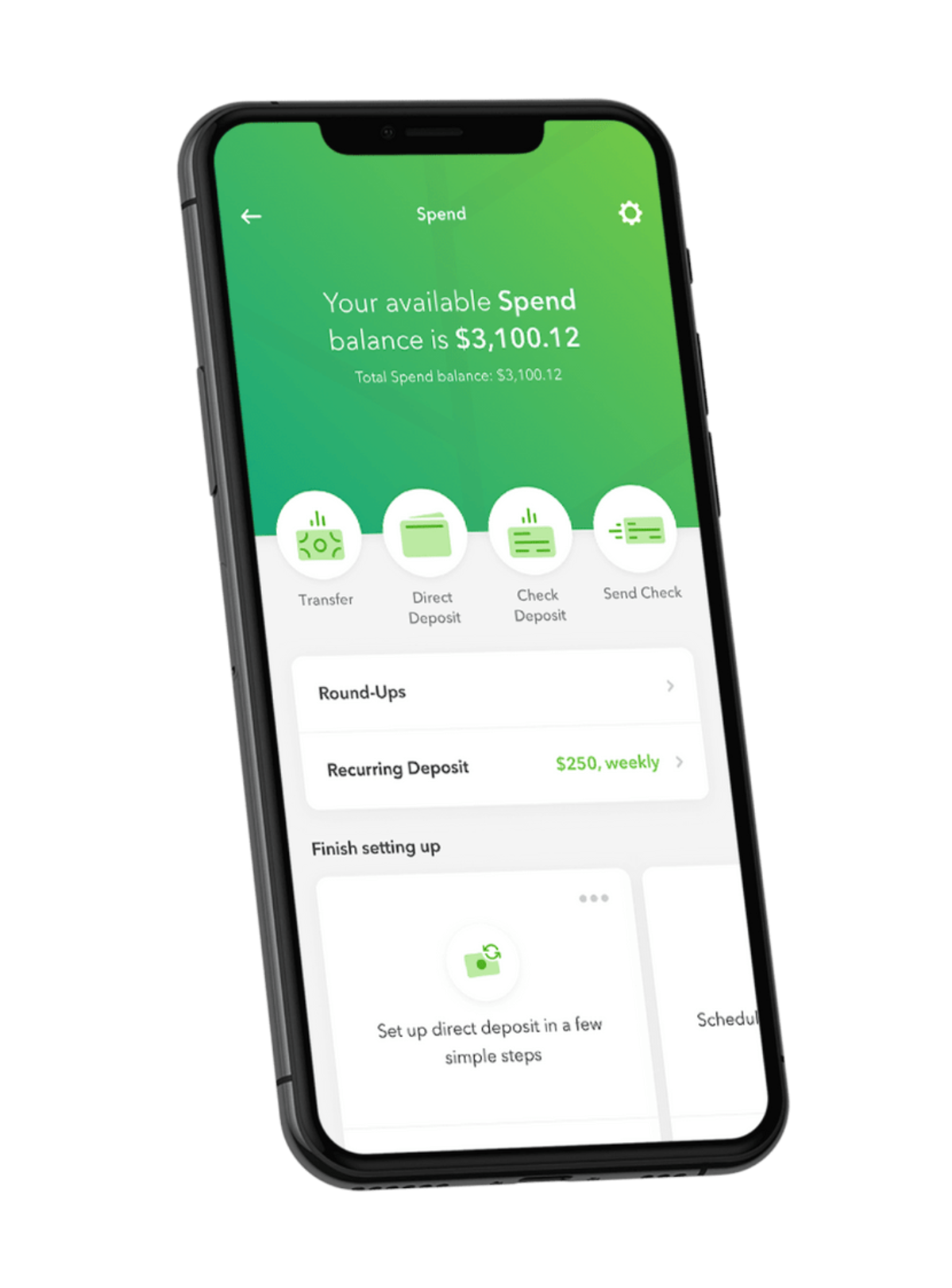

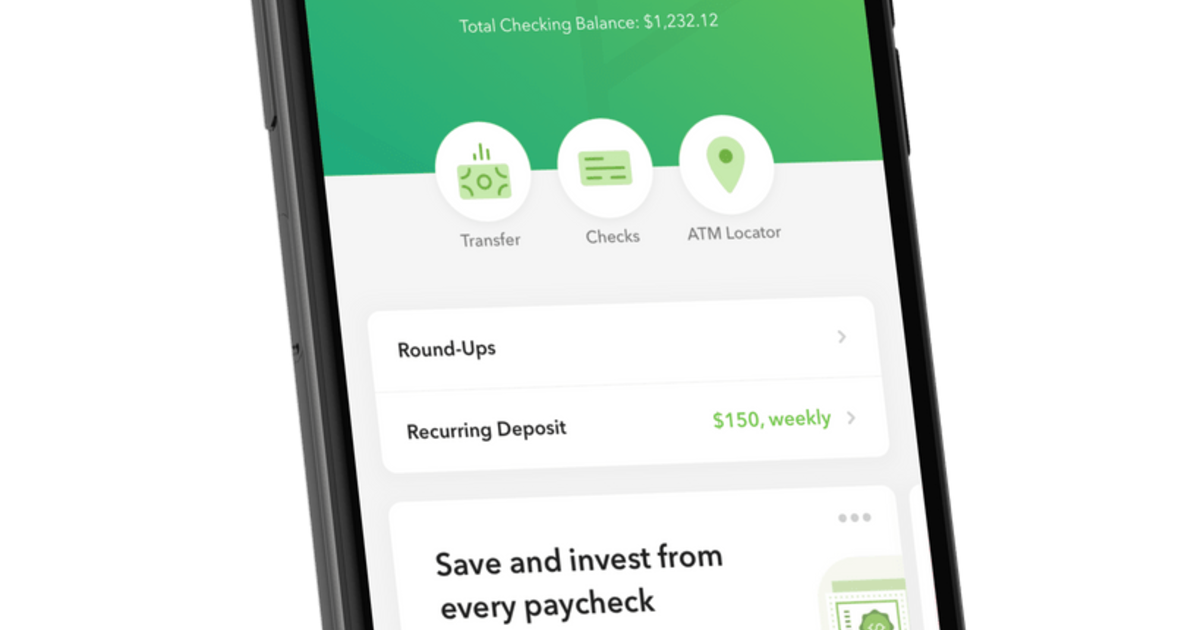

Is Acorns Fdic Insured. This is basic coverage that every solid brokerage should provide. Is my acorns checking account fdic insured? Spend accounts are included with the family account. They select the right ira for you based on questions you answer when you set up your profile.

Acorns An Honest Review of the Investing Tool Self From selfgeneratedincome.com

Acorns An Honest Review of the Investing Tool Self From selfgeneratedincome.com

Invested money is, of course, not protected by the fdic. Acorns checking accounts are fdic insured up to $250,000. This article contains the current opinions of the author, but not necessarily those of acorns. That means you earn a few percent on purchases from popular retailers. There’s no minimum balance required to open an account. Acorns is a member of the securities investor protection corporation (sipc).

Acorns checking accounts are fdic insured up to $250,000.

Fdic insurance applies only to accounts held in the united states and its territories and possessions. Securities investor protection corporation (sipc): However, instead of getting cash back, acorns invests the money instead. Acorns visa™ debit cards are issued by lincoln savings bank, member fdic for acorns checking account holders. Invested money is, of course, not protected by the fdic. That means you earn a few percent on purchases from popular retailers.

Source: acorns.com

Source: acorns.com

Fdic insured acorns checking accounts deposits in your acorns checking account is insured up to at least $250,000. Acorns checking accounts are issued by lincoln savings bank, member fdic, and are fdic insured up to $250,000. Fdic insurance applies only to accounts held in the united states and its territories and possessions. Does acorns count as a brokerage account? Acorns checking accounts are issued by lincoln savings bank, member fdic, and are fdic insured up to $250,000.

Source: acorns.com

Source: acorns.com

Is my acorns checking account fdic insured? The bank is a member of the fdic, which insures your deposits. It comes with a robust digital app that notifies you each time you make a purchase with your card, so you always know how much you’ve spent. 2 acorns also offers an acorns checking deposit account. Acorns visa™ debit cards are issued by lincoln savings bank, member fdic for acorns checking account holders.

Source: fififinance.com

Source: fififinance.com

2 acorns also offers an acorns checking deposit account. For details, please refer to the brochure published by the fdic or visit the fdic website at www.fdic.gov. The bank is a member of the fdic, which insures your deposits. Acorns visa™ debit cards are issued by lincoln savings bank, member fdic for acorns checking account holders. Acorns later (retirement account) acorns later has 3 individual retirement account (ira) options:

Source: acorns.com

Source: acorns.com

Is my acorns checking account fdic insured? Acorns visa™ debit cards are issued by lincoln savings bank, member fdic for acorns checking account holders. But acorns is a member of the securities investor protection corp. Acorns checking accounts are fdic insured up to $250,000. Acorns offers clients acorns visa debit cards issued by lincoln savings bank.

Source: nullguild.com

Source: nullguild.com

Acorns checking accounts are fdic insured up to $250,000. The fdic covers your deposits up to $250,000. All acorns checking accounts are insured by the fdic up to at least $250,000 per depositor, per ownership category. The acorns spend account is fdic insured through lincoln savings bank. 2 acorns also offers an acorns checking deposit account.

Source: acorns.com

Source: acorns.com

Acorns visa™ debit cards are issued by lincoln savings bank, member fdic for acorns checking account holders. Acorns visa™ debit cards are issued by lincoln savings bank, member fdic for acorns spend account holders. Acorns is a member of the securities investor protection corporation (sipc). Acorns offers clients acorns visa debit cards issued by lincoln savings bank. Fdic insured acorns checking accounts:

Source: acorns.com

Source: acorns.com

That means you earn a few percent on purchases from popular retailers. Fdic insured acorns checking accounts deposits in your acorns checking account is insured up to at least $250,000. Acorns later (retirement account) acorns later has 3 individual retirement account (ira) options: They select the right ira for you based on questions you answer when you set up your profile. The acorns spend account is fdic insured through lincoln savings bank.

Source: daytradereview.com

Source: daytradereview.com

Acorns visa™ debit cards are issued by lincoln savings bank, member fdic for acorns checking account holders. 2 acorns also offers an acorns checking deposit account. For details, please see www.fdic.gov. 2 acorns also offers an acorns checking deposit account. 2 acorns also offers an acorns checking deposit account.

Source: acorns.com

Source: acorns.com

Acorns checking accounts are issued by lincoln savings bank, member fdic, and are fdic insured up to $250,000. Acorns visa™ debit cards are issued by lincoln savings bank, member fdic for acorns checking account holders. Acorns visa™ debit cards are issued by lincoln savings bank, member fdic for acorns spend account holders. Acorns later (retirement account) acorns later has 3 individual retirement account (ira) options: Does acorns count as a brokerage account?

Source: bystaks.com

Source: bystaks.com

Acorns checking accounts are issued by lincoln savings bank, member fdic, and are fdic insured up to $250,000. (sipc) which protects your non. The bank is a member of the fdic, which insures your deposits. Acorns later — acorns users can invest in a specially designed individual retirement account (ira. All acorns checking accounts are insured by the fdic up to at least $250,000 per depositor, per ownership category.

Source: romneymakes.com

Source: romneymakes.com

2 acorns also offers an acorns checking deposit account. Acorns spend is an online checking account. Smart deposit — with acorns spend, you can automatically allocate a portion of your paycheck into your invest, later, or both accounts. Your account is fdic insured up to $250,000. 2 acorns also offers an acorns checking deposit account.

Source: millennialmoneyman.com

Source: millennialmoneyman.com

For details, please refer to the brochure published by the fdic or visit the fdic website at www.fdic.gov. But acorns is a member of the securities investor protection corp. The bank is a member of the fdic, which insures your deposits. Acorns also offers an acorns checking deposit account. It comes with a robust digital app that notifies you each time you make a purchase with your card, so you always know how much you’ve spent.

Source: ptmoney.com

Source: ptmoney.com

Fdic insurance applies only to accounts held in the united states and its territories and possessions. 2 acorns also offers an acorns checking deposit account. Acorns checking accounts are fdic insured up to $250,000. You’ll also enjoy these perks. Does acorns count as a brokerage account?

Source: selfgeneratedincome.com

Source: selfgeneratedincome.com

Is my acorns checking account fdic insured? Investing involves risk including loss of principal. Spend accounts are fdic insured up to $250,000. All acorns checking accounts are insured by the fdic up to at least $250,000 per depositor, per ownership category. All acorns checking accounts are insured by the fdic up to at least $250,000 per depositor, per ownership category.

Source: listenmoneymatters.com

Source: listenmoneymatters.com

Investing involves risk including loss of principal. No, its monthly membership fees range from $1. Fdic insurance applies only to accounts held in the united states and its territories and possessions. Acorns later — acorns users can invest in a specially designed individual retirement account (ira. For details, please see www.fdic.gov.

Source: acorns.com

Source: acorns.com

Investing involves risk including loss of principal. All acorns checking accounts are insured by the fdic up to at least $250,000 per depositor, per ownership category. Fdic insured acorns checking accounts: Acorns checking accounts are issued by lincoln savings bank, member fdic, and are fdic insured up to $250,000. Acorns visa™ debit cards are issued by lincoln savings bank, member fdic for acorns checking account holders.

Source: acorns.com

Source: acorns.com

Acorns spend is an online checking account. That means you earn a few percent on purchases from popular retailers. Fdic insurance applies only to accounts held in the united states and its territories and possessions. There’s no minimum balance required to open an account. Acorns visa™ debit cards are issued by lincoln savings bank, member fdic for acorns spend account holders.

Source: millennialmoneyman.com

Source: millennialmoneyman.com

Fdic insured acorns checking accounts: Acorns later — acorns users can invest in a specially designed individual retirement account (ira. All acorns checking accounts are insured by the fdic up to at least $250,000 per depositor, per ownership category. With acorns, for example, you can set up a brokerage account and link it with a funding source (like a checking account) and the debit or credit cards you often use for everyday purchases. All acorns checking accounts are insured by the fdic up to at least $250,000 per depositor, per ownership category.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title is acorns fdic insured by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.