Is cash value of life insurance taxable in canada information

Home » Trend » Is cash value of life insurance taxable in canada informationYour Is cash value of life insurance taxable in canada images are ready. Is cash value of life insurance taxable in canada are a topic that is being searched for and liked by netizens today. You can Find and Download the Is cash value of life insurance taxable in canada files here. Get all royalty-free images.

If you’re searching for is cash value of life insurance taxable in canada images information linked to the is cash value of life insurance taxable in canada interest, you have visit the right blog. Our website frequently provides you with suggestions for seeing the highest quality video and image content, please kindly surf and locate more enlightening video articles and images that fit your interests.

Is Cash Value Of Life Insurance Taxable In Canada. The policy owner can often access this value via the surrender of the policy, a loan or partial withdraw. If not, your estate will be designated as the beneficiary and your death benefits may be subject to taxation. Is cash value of life insurance taxable in canada? The annual growth of cash values in a life insurance policy is not taxable if the policy is owned by an individual.

Is Life Insurance Cash Value Taxable? YouTube From youtube.com

Is Life Insurance Cash Value Taxable? YouTube From youtube.com

The broad answer to this question is no! Taxable endowment contracts might include this type of loan, but won’t be liable for tax penalties because they are considered modified endowment contracts. Life insurance is a terrific tool. Is the cash value of your life insurance policy taxable? If you have a life insurance policy, you can ensure it is used to cover your final taxes so your heirs can inherit as much as possible. However, the agency requires your representative to file a.

The insured may ask that the beneficiary uses the money in a certain.

If not, your estate will be designated as the beneficiary and your death benefits may be subject to taxation. Is cash value of life insurance taxable in canada? For example, imagine you have taken a $150,000 distribution (sometimes referred to as a cash surrender value) from your whole life policy, and over the years, you have paid $50,000 in. Beneficiaries who are given a lump sum don’t have to pay any kind of income tax on the policy. Is life insurance taxable in canada? The broad answer to this question is no!

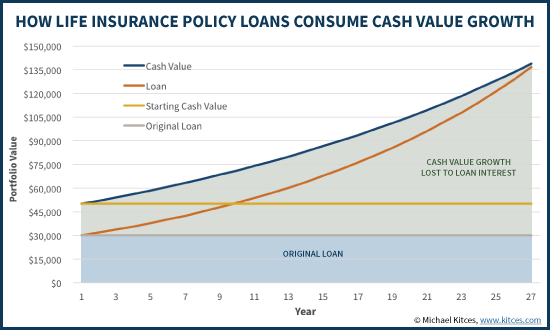

Source: kitces.com

Source: kitces.com

Use a tax calculator to check your withholding, figure out how much money to set aside for taxes, or to check if you need to make an estimated tax payment. Most amounts received from a life insurance policy are not subject to income tax. The policy owner can often access this value via the surrender of the policy, a loan or partial withdraw. It’s not likely the decision you would have made and to top it off this opens up your life insurance proceeds to taxation. Beneficiaries who are given a lump sum don’t have to pay any kind of income tax on the policy.

Source: youtube.com

Source: youtube.com

Is the cash value of your life insurance policy taxable? Annual cash value growth in a life insurance policy is not usually taxable. My policy is about $190,000. Surrender payouts if you decide to cancel your life insurance policy before it matures , you’re eligible to gain access to your accrued cash value minus any surrender fees. If not, your estate will be designated as the beneficiary and your death benefits may be subject to taxation.

Source: youtube.com

Source: youtube.com

Is cash value of life insurance taxable in canada? Is life insurance taxable in canada? The insured may ask that the beneficiary uses the money in a certain. Whoever inherits your estate does not have to pay tax on it. The cash value gains are not subject to any taxation unless the policy is surrendered, or the cash value is accessed or removed from the policy.

Source: revisi.net

The broad answer to this question is no! My policy is about $190,000. Is the cash value of your life insurance policy taxable? The insured may ask that the beneficiary uses the money in a certain. If not, your estate will be designated as the beneficiary and your death benefits may be subject to taxation.

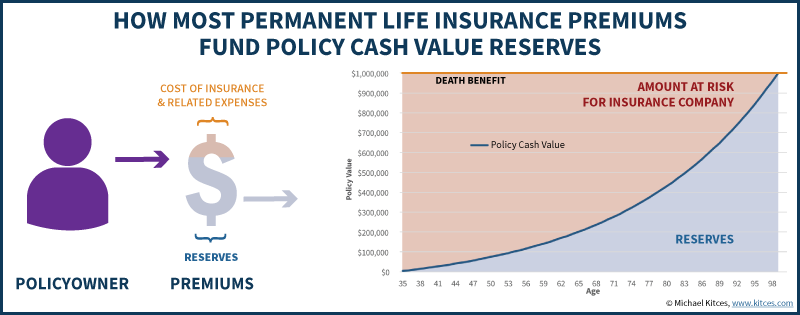

Source: insurance.policyarchitects.com

Source: insurance.policyarchitects.com

Here’s when life insurance benefits are taxable in canada. Note that not all policies offer all the access to cash options, so the policy contract needs to be consulted. If you have a life insurance policy, you can ensure it is used to cover your final taxes so your heirs can inherit as much as possible. Is the cash value of your life insurance policy taxable? The insured may ask that the beneficiary uses the money in a certain.

Source: insuranceandestates.com

Source: insuranceandestates.com

The insured may ask that the beneficiary uses the money in a certain. Here’s when life insurance benefits are taxable in canada. It’s not likely the decision you would have made and to top it off this opens up your life insurance proceeds to taxation. You don�t have a beneficiary when setting up your life insurance policy, you should always name a beneficiary. Life insurance proceeds aren’t taxable in canada, with a few exceptions.

Source: revisi.net

Source: revisi.net

Annual cash value growth in a life insurance policy is not usually taxable. Annual cash value growth in a life insurance policy is not usually taxable. This means that as cash value grows inside a life insurance policy, you will not owe taxes on the interest or dividends earned on this cash value. Are proceeds from cashing in a life insurance policy taxable? The cash value of a life insurance policy is value that your policy has accumulated since the policy issue date.

Source: new-generation-of-skijumpers.blogspot.com

Source: new-generation-of-skijumpers.blogspot.com

Is life insurance cash value taxable income? As a general rule of thumb, when cash value remains inside a life insurance contract, it is not taxable. Although this is a different story if you access the cash value built up through your permanent policy during your lifetime. Is cash value of life insurance taxable in canada? Note that not all policies offer all the access to cash options, so the policy contract needs to be consulted.

Source: investopedia.com

Source: investopedia.com

As a general rule of thumb, when cash value remains inside a life insurance contract, it is not taxable. Is life insurance cash value taxable income? Generally, life insurance payouts after the death of someone are not going to be taxed. As a general rule of thumb, when cash value remains inside a life insurance contract, it is not taxable. But while it won’t affect future insurability, there’s a tax hit if a client surrenders his policy prior to death.

Source: ascendantfinancial.ca

Source: ascendantfinancial.ca

In canada, the cash surrender value of a life insurance policy is taxable if the cash value received exceeds the adjusted cost base. Beneficiaries who are given a lump sum don’t have to pay any kind of income tax on the policy. Here’s when life insurance benefits are taxable in canada. Whoever inherits your estate does not have to pay tax on it. There are no tax consequences if the policy has no cash surrender value (csv) — in other words, no proceeds — or.

Source: insurance.policyarchitects.com

Source: insurance.policyarchitects.com

Regardless of the size of the policy, your spouse, child or anyone else you’ve named as a beneficiary would not have to report life insurance proceeds as taxable income on their canadian tax return. The annual growth of cash values in a life insurance policy is not taxable if the policy is owned by an individual. If they have permanent life insurance, one option is cashing out the policy. Use a tax calculator to check your withholding, figure out how much money to set aside for taxes, or to check if you need to make an estimated tax payment. Note that not all policies offer all the access to cash options, so the policy contract needs to be consulted.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

As a general rule of thumb, when cash value remains inside a life insurance contract, it is not taxable. Another reason to call policy architects today! Life insurance taxes in canada if someone gets life insurance, will they be leaving a lump sum and taxes to their loved ones? Regardless of the size of the policy, your spouse, child or anyone else you’ve named as a beneficiary would not have to report life insurance proceeds as taxable income on their canadian tax return. The policy owner can often access this value via the surrender of the policy, a loan or partial withdraw.

Source: looktowink.com

Source: looktowink.com

Taxable endowment contracts might include this type of loan, but won’t be liable for tax penalties because they are considered modified endowment contracts. In canada, the cash surrender value of a life insurance policy is taxable if the cash value received exceeds the adjusted cost base. Are proceeds from cashing in a life insurance policy taxable? This cash surrender value of life insurance is taxable in canada. The insured may ask that the beneficiary uses the money in a certain.

Source: foxbusiness.com

Source: foxbusiness.com

Beneficiaries who are given a lump sum don’t have to pay any kind of income tax on the policy. This means that as cash value grows inside a life insurance policy, you will not owe taxes on the interest or dividends earned on this cash value. This means that as cash value grows inside a life insurance policy, you will not owe taxes on the interest or dividends earned on this cash value. Are proceeds from cashing in a life insurance policy taxable? The annual growth of cash values in a life insurance policy is not taxable if the policy is owned by an individual.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

In canada, the cash surrender value of a life insurance policy is taxable if the cash value received exceeds the adjusted cost base. Cash value inside the life insurance contract as a general rule of thumb, when cash value remains inside a life insurance contract, it is not taxable. Is cash value of life insurance taxable in canada? The annual growth of cash values in a life insurance policy is not taxable if the policy is owned by an individual. But while it won’t affect future insurability, there’s a tax hit if a client surrenders his policy prior to death.

Source: pinterest.com

Source: pinterest.com

The insured may ask that the beneficiary uses the money in a certain. Is the cash value of your life insurance policy taxable? This means that as cash value grows inside a life insurance policy, you will not owe taxes on the interest or dividends earned on this cash value. Generally, life insurance payouts after the death of someone are not going to be taxed. My policy is about $190,000.

Source: revisi.net

Source: revisi.net

If they have permanent life insurance, one option is cashing out the policy. Life insurance proceeds aren’t taxable in canada, with a few exceptions. If they have permanent life insurance, one option is cashing out the policy. Here’s when life insurance benefits are taxable in canada. Annual cash value growth in a life insurance policy is not usually taxable.

Source: verifiablee.com

Source: verifiablee.com

Is the cash value of your life insurance policy taxable? Regardless of the size of the policy, your spouse, child or anyone else you’ve named as a beneficiary would not have to report life insurance proceeds. Is life insurance cash value taxable income? Cash value inside the life insurance contract as a general rule of thumb, when cash value remains inside a life insurance contract, it is not taxable. The cash value gains are not subject to any taxation unless the policy is surrendered, or the cash value is accessed or removed from the policy.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title is cash value of life insurance taxable in canada by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.