Is earthquake insurance worth it in seattle Idea

Home » Trending » Is earthquake insurance worth it in seattle IdeaYour Is earthquake insurance worth it in seattle images are ready. Is earthquake insurance worth it in seattle are a topic that is being searched for and liked by netizens now. You can Find and Download the Is earthquake insurance worth it in seattle files here. Get all royalty-free vectors.

If you’re searching for is earthquake insurance worth it in seattle images information related to the is earthquake insurance worth it in seattle topic, you have pay a visit to the ideal blog. Our website always gives you suggestions for seeing the highest quality video and image content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

Is Earthquake Insurance Worth It In Seattle. With no requirement to offer earthquake insurance and little competition in washington state’s regulated market, premiums tend move in one direction: Earthquake would destroy the structure, not the land i would imagine and i am not sure how cost of reconstruction. For a brick home, worth $500,000 the nw insurance council estimates rates could be as low as $3 for each $1,000 of. Start here with our free comparison.

Why it matters that British Columbians buy earthquake From theconversation.com

Why it matters that British Columbians buy earthquake From theconversation.com

2 top twenty earthquake faults in washington state. A majority of homeowners’ insurance policies do not pay for earthquake damage. Earthquake insurance is usually sold with deductibles that equal 10 to 25 percent of a structure’s policy limit. For a brick home, worth $500,000 the nw insurance council estimates rates could be as low as $3 for each $1,000 of. At that price, and given the amount of damage that a 9.0 earthquake could do, skipping the rider would just be silly. Whether earthquake insurance is worth it for you will depend on your situation.

If an earthquake damages your home and you don’t have earthquake insurance, you’ll most likely end up paying out of pocket to make any necessary repairs.

Sometimes the deductible can exceed the amount you are claiming for your loss. In the seattle area over 70% of homeowners, renters, and condo owners do not have earthquake insurance. 6 south whidbey island fault. Earthquake insurance is usually sold with deductibles that equal 10 to 25 percent of a structure’s policy limit. A 15 percent deductible of that is $90,000, a hefty expense for the average person. 2 top twenty earthquake faults in washington state.

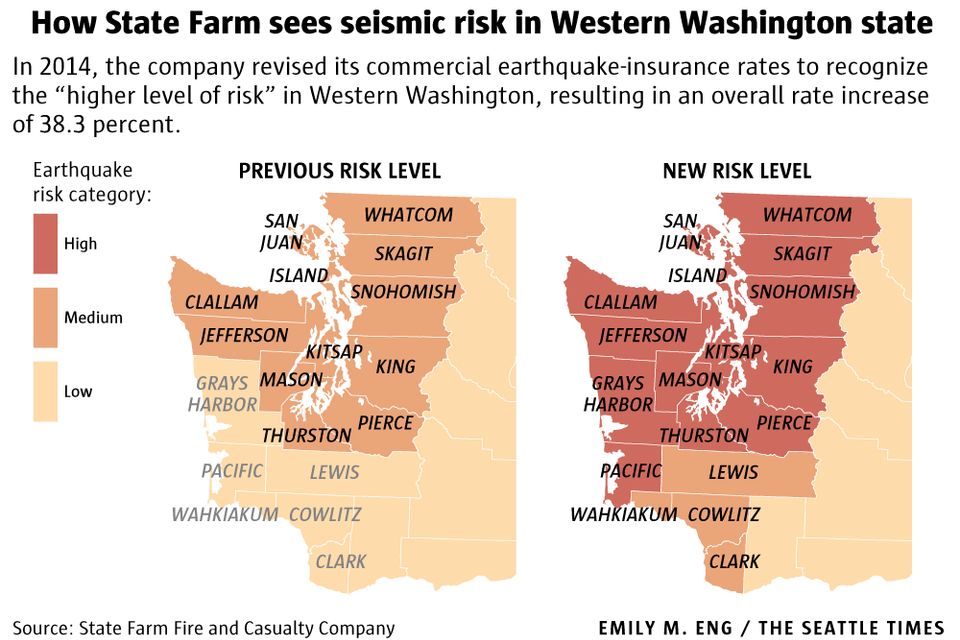

Source: seattletimes.com

Source: seattletimes.com

Most homeowner, condo and rental insurance policies do not cover damage caused by an earthquake, but coverage can be purchased as an endorsement or a separate (7). Earthquake insurance is usually sold with deductibles that equal 10 to 25 percent of a structure’s policy limit. 6 south whidbey island fault. For what it�s worth, we own a fairly cheap condo, so the marginal cost of our earthquake rider is $50/year (out of a total policy cost of $330/year). “only about 11 percent of all people in state have earthquake insurance — it’s not something a lot of people have,” washington state insurance commissioner’s office spokesperson steve.

Source: stateimpact.npr.org

Source: stateimpact.npr.org

A 15 percent deductible of that is $90,000, a hefty expense for the average person. In california, an area of seismic activity, the average annual premium is $707, according to the california earthquake authority, which sells insurance to homeowners there. It is always worth getting a quote so you can make an informed decision. In the seattle area over 70% of homeowners, renters, and condo owners do not have earthquake insurance. In fact, of the 10,000 earthquakes that occur in southern california each year, most are so small that they’re not even felt.

Source: emilyvega.blogspot.com

Source: emilyvega.blogspot.com

The coverage generally pays to repair or replace your home, subject to the deductible, but there are often exclusions, like for patios and detached garages. As of 2018, the median price of a home in california is more than $600,000. For what it�s worth, we own a fairly cheap condo, so the marginal cost of our earthquake rider is $50/year (out of a total policy cost of $330/year). A 15 percent deductible of that is $90,000, a hefty expense for the average person. How to successfully choose earthquake insurance in seattle, washington:

Source: radvirals.com

Source: radvirals.com

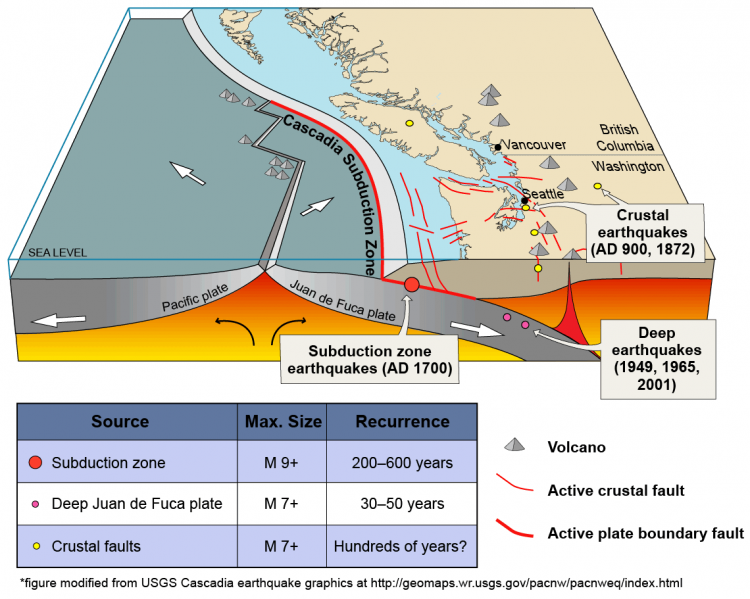

Earthquake insurance in a seismically active state like washington is expensive. 1 earthquake fault map — puget sound. A 15 percent deductible of that is $90,000, a hefty expense for the average person. Is earthquake insurance really worth it. For what it�s worth, we own a fairly cheap condo, so the marginal cost of our earthquake rider is $50/year (out of a total policy cost of $330/year).

Source: retrofittingcalifornia.com

Source: retrofittingcalifornia.com

Earthquake would destroy the structure, not the land i would imagine and i am not sure how cost of reconstruction. 1 earthquake fault map — puget sound. Maybe someone else can give us both better advice. A majority of homeowners’ insurance policies do not pay for earthquake damage. Read over your policy closely and speak with your insurance broker to find out.

Source: pinterest.com

Source: pinterest.com

Temblor repair cost estimator (you�ll need to provide phone number, email, other info) it does give you some risk factors to consider. Sometimes the deductible can exceed the amount you are claiming for your loss. A majority of homeowners’ insurance policies do not pay for earthquake damage. Generally, this coverage isn�t available to buy for a period of time after an earthquake. Read over your policy closely and speak with your insurance broker to find out.

Source: imagen-e-s.blogspot.com

Source: imagen-e-s.blogspot.com

In the seattle area over 70% of homeowners, renters, and condo owners do not have earthquake insurance. This type of insurance is separate from standard homeowners or renters insurance. It indicated that the likely cost of repair is ~$100k for my location (given generic information) for a house not bolted to foundation, and half that amount. Not all earthquakes cause catastrophic damage. Generally, this coverage isn�t available to buy for a period of time after an earthquake.

Source: revisi.net

Source: revisi.net

For a brick home, worth $500,000 the nw insurance council estimates rates could be as low as $3 for each $1,000 of. Supposedly the stats show less than 10% of the residents have earthquake insurance. According to the pacific northwest seismic network (pnsn) there are earthquakes occurring in. Not all earthquakes cause catastrophic damage. Photos from 1949, 1965 & 2001 ]

Source: istateinsurance.com

Source: istateinsurance.com

6 south whidbey island fault. Temblor repair cost estimator (you�ll need to provide phone number, email, other info) it does give you some risk factors to consider. Supposedly the stats show less than 10% of the residents have earthquake insurance. It is always worth getting a quote so you can make an informed decision. A 15 percent deductible of that is $90,000, a hefty expense for the average person.

Source: automoblog.net

Source: automoblog.net

I am a homeowner in the city of seattle, and i have earthquake insurance. At that price, and given the amount of damage that a 9.0 earthquake could do, skipping the rider would just be silly. If you live near an active fault, earthquake insurance could be worth it. Start here with our free comparison. As of 2018, the median price of a home in california is more than $600,000.

Source: goetzinsurance.com

Source: goetzinsurance.com

We�re between the san andreas and hayward faults, but built with a foundation tied into bedrock and shear walls where we could put them on. Is earthquake insurance really worth it. However, the exact price of an earthquake insurance policy will depend on your coverage limits, deductibles, and several other factors, including: You may also think about taking a higher. In the seattle area over 70% of homeowners, renters, and condo owners do not have earthquake insurance.

Source: theconversation.com

Source: theconversation.com

Earthquake would destroy the structure, not the land i would imagine and i am not sure how cost of reconstruction. 6 south whidbey island fault. 3 earthquake fault zones in washington. Generally, this coverage isn�t available to buy for a period of time after an earthquake. We�re between the san andreas and hayward faults, but built with a foundation tied into bedrock and shear walls where we could put them on.

Source: bellinghamherald.com

It indicated that the likely cost of repair is ~$100k for my location (given generic information) for a house not bolted to foundation, and half that amount. We�re between the san andreas and hayward faults, but built with a foundation tied into bedrock and shear walls where we could put them on. There may be a separate deductible for contents, structure and unattached structures like garages, sheds, driveways, or retaining walls. It only pays for damages that exceed the deductible. According to the pacific northwest seismic network (pnsn) there are earthquakes occurring in.

Source: imagen-e-s.blogspot.com

Source: imagen-e-s.blogspot.com

Temblor repair cost estimator (you�ll need to provide phone number, email, other info) it does give you some risk factors to consider. I live in seattle and purchased the attached insurance, but now that i read it more carefully, not sure it is worth it. 6 south whidbey island fault. It indicated that the likely cost of repair is ~$100k for my location (given generic information) for a house not bolted to foundation, and half that amount. We�re between the san andreas and hayward faults, but built with a foundation tied into bedrock and shear walls where we could put them on.

Source: insurancebusinessmag.com

Source: insurancebusinessmag.com

According to the pacific northwest seismic network (pnsn) there are earthquakes occurring in. In the seattle area over 70% of homeowners, renters, and condo owners do not have earthquake insurance. As of 2018, the median price of a home in california is more than $600,000. With no requirement to offer earthquake insurance and little competition in washington state’s regulated market, premiums tend move in one direction: According to the pacific northwest seismic network (pnsn) there are earthquakes occurring in.

Source: issaquahinsuranceagency.com

Source: issaquahinsuranceagency.com

1 earthquake fault map — puget sound. In california, an area of seismic activity, the average annual premium is $707, according to the california earthquake authority, which sells insurance to homeowners there. Generally, this coverage isn�t available to buy for a period of time after an earthquake. 1 earthquake fault map — puget sound. In fact, of the 10,000 earthquakes that occur in southern california each year, most are so small that they’re not even felt.

Source: wfaa.com

Source: wfaa.com

Earthquake would destroy the structure, not the land i would imagine and i am not sure how cost of reconstruction. 3 earthquake fault zones in washington. According to the pacific northwest seismic network (pnsn) there are earthquakes occurring in. If an earthquake damages your home and you don’t have earthquake insurance, you’ll most likely end up paying out of pocket to make any necessary repairs. For what it�s worth, we own a fairly cheap condo, so the marginal cost of our earthquake rider is $50/year (out of a total policy cost of $330/year).

Source: kiro7.com

Source: kiro7.com

Spotlight on the pacific northwest. A majority of homeowners’ insurance policies do not pay for earthquake damage. Start here with our free comparison. The coverage generally pays to repair or replace your home, subject to the deductible, but there are often exclusions, like for patios and detached garages. In the seattle area over 70% of homeowners, renters, and condo owners do not have earthquake insurance.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title is earthquake insurance worth it in seattle by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.