Is gap insurance required in california information

Home » Trend » Is gap insurance required in california informationYour Is gap insurance required in california images are available in this site. Is gap insurance required in california are a topic that is being searched for and liked by netizens today. You can Download the Is gap insurance required in california files here. Download all royalty-free photos and vectors.

If you’re looking for is gap insurance required in california pictures information related to the is gap insurance required in california topic, you have visit the right blog. Our website always provides you with hints for downloading the highest quality video and image content, please kindly surf and find more informative video articles and graphics that fit your interests.

Is Gap Insurance Required In California. As you are finalizing the details of your purchase contract, the finance manager of the dealership will talk to you about gap insurance, service contracts, and maintenance contracts. Gap insurance is most commonly purchased when you are buying a vehicle at a car dealership. A gap contract should cost between $300 and $800, which will be rolled into your vehicle loan. Otherwise, you probably won�t be forced to obtain the coverage.

Does California Require Health Insurance / Healthy From mymuseandmore.blogspot.com

Does California Require Health Insurance / Healthy From mymuseandmore.blogspot.com

Your loan or lease lender might require gap insurance, but you’ll have to check with your lender to find out. To protect yourself in the case the vehicle is totaled, there is a product called gap insurance. Income is below the tax filing threshold; A gap contract should cost between $300 and $800, which will be rolled into your vehicle loan. Gap insurance is often required as part of a lease contract, and is commonly included in the lease agreement for a fee. Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car�s depreciated value.

If your vehicle is totaled and you still owe a balance, the gap insurance.

Income is below the tax filing threshold; Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car�s depreciated value. Here’s how a typical gap insurance claim works: Urance no longer counts as qualifying coverage. It protects you from financial losses related to damage your car causes to others or their property. Your car dealer might make it sound as though it is mandatory to buy gap insurance through them, but this is not the case.

Source: social-network-daily-journal.com

Source: social-network-daily-journal.com

You may wonder why gap insurance is necessary if you have comprehensive and collision insurance, because these help pay to replace your car. Gap insurance is optional coverage and is not required by any state as part of your car insurance policy. However, just because gap insurance is required does not mean it is automatically included in your lease. However, if you just experienced a sudden change in your insurance needs, you still have options. Short coverage gap of three consecutive months or less;

Source: tamathitakia.blogspot.com

Source: tamathitakia.blogspot.com

Check with your own insurance agent for a quote. The “gap” is the time period between the closing of the sale and purchase transaction when a title commitment is issued to the buyer and the actual recording of the seller’s deed. California gap insurance is not required by california state law. Check with your own insurance agent for a quote. To protect yourself in the case the vehicle is totaled, there is a product called gap insurance.

Source: diminishedvalueofgeorgia.com

Source: diminishedvalueofgeorgia.com

Factors such as vehicle�s age and depreciation rate, the loan term and size of any down payment play a major role in making a wise decision. That doesn’t mean it can’t be required as a condition of your financing, however. Your car dealer might make it sound as though it is mandatory to buy gap insurance through them, but this is not the case. (h)(1) “ guaranteed asset protection ” (gap) insurance means insurance in which a person agrees to indemnify a vehicle purchaser or lessee for some or all of the amount owed on the vehicle at the time of an unrecovered theft or total loss, after credit for money received from the purchaser�s or lessee�s physical damage insurer, pursuant to the terms of a loan, lease. Gap insurance is oftentimes required when financing or leasing a car.

Source: edufisicaaitziber.blogspot.com

Source: edufisicaaitziber.blogspot.com

Under these two insurance types, insurers typically pay out your car’s actual cash value (acv or fair market value) at the time of the incident, up to your policy’s limits. Dealers charge high dollars for gap insurance, so you may be better off looking around. Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car�s depreciated value. The main thrust of the gapa’s model act is to clarify that a gap debt. Gap insurance is oftentimes required when financing or leasing a car.

Source: eho-pirmadienanaujinamai.blogspot.com

Source: eho-pirmadienanaujinamai.blogspot.com

Gap insurance is oftentimes required when financing or leasing a car. The goal of gap insurance is to protect new vehicle owners and lessees from the gap between an outstanding loan or lease balance and a vehicle�s actual value in a total loss accident or a theft situation. Dealers charge high dollars for gap insurance, so you may be better off looking around. Under these two insurance types, insurers typically pay out your car’s actual cash value (acv or fair market value) at the time of the incident, up to your policy’s limits. A gap contract should cost between $300 and $800, which will be rolled into your vehicle loan.

Source: boyergfraya.blogspot.com

Source: boyergfraya.blogspot.com

Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car�s depreciated value. To find out if gap insurance is included in your car lease, you need to read the lease carefully and ask the lessor if gap insurance is required and if so how it is to be handled. Under these two insurance types, insurers typically pay out your car’s actual cash value (acv or fair market value) at the time of the incident, up to your policy’s limits. Is gap insurance required in california? Your car dealer might make it sound as though it is mandatory to buy gap insurance through them, but this is not the case.

Source: thepersonalinjury.com

Source: thepersonalinjury.com

However, lenders might require it as a condition of the loan or lease. Factors such as vehicle�s age and depreciation rate, the loan term and size of any down payment play a major role in making a wise decision. The goal of gap insurance is to protect new vehicle owners and lessees from the gap between an outstanding loan or lease balance and a vehicle�s actual value in a total loss accident or a theft situation. Your loan or lease lender might require gap insurance, but you’ll have to check with your lender to find out. Drivers who own their car outright and drivers who owe less on their car than its current actual cash value (as there is not a gap in value) do not need gap insurance, but will still need car insurance coverage to help keep them and their car protected from the unexpected.

Source: certifiedfed.com

Source: certifiedfed.com

California gap insurance is not required by california state law. Drivers who own their car outright and drivers who owe less on their car than its current actual cash value (as there is not a gap in value) do not need gap insurance, but will still need car insurance coverage to help keep them and their car protected from the unexpected. However, lenders might require it as a condition of the loan or lease. If your vehicle is totaled and you still owe a balance, the gap insurance. In some states, however, an auto dealership is required to offer gap insurance at the point of purchase.

Source: y2kcreditsolutions.com

Source: y2kcreditsolutions.com

Drivers who own their car outright and drivers who owe less on their car than its current actual cash value (as there is not a gap in value) do not need gap insurance, but will still need car insurance coverage to help keep them and their car protected from the unexpected. Short coverage gap of three consecutive months or less; Your car dealer might make it sound as though it is mandatory to buy gap insurance through them, but this is not the case. Gap insurance is optional coverage and is not required by any state as part of your car insurance policy. This is required until the vehicle is paid in full, and then the extra coverage becomes optional.

Source: insurance-canada.ca

Source: insurance-canada.ca

(h)(1) “ guaranteed asset protection ” (gap) insurance means insurance in which a person agrees to indemnify a vehicle purchaser or lessee for some or all of the amount owed on the vehicle at the time of an unrecovered theft or total loss, after credit for money received from the purchaser�s or lessee�s physical damage insurer, pursuant to the terms of a loan, lease. Gap insurance is often required as part of a lease contract, and is commonly included in the lease agreement for a fee. To protect yourself in the case the vehicle is totaled, there is a product called gap insurance. Here’s how a typical gap insurance claim works: Gap insurance is oftentimes required when financing or leasing a car.

Source: blogs.mcgeorge.edu

Source: blogs.mcgeorge.edu

If your vehicle is totaled and you still owe a balance, the gap insurance. The “gap” is the time period between the closing of the sale and purchase transaction when a title commitment is issued to the buyer and the actual recording of the seller’s deed. As you are finalizing the details of your purchase contract, the finance manager of the dealership will talk to you about gap insurance, service contracts, and maintenance contracts. Here’s how a typical gap insurance claim works: To find out if gap insurance is included in your car lease, you need to read the lease carefully and ask the lessor if gap insurance is required and if so how it is to be handled.

Source: ins.jdwinsured.com

Source: ins.jdwinsured.com

Gap insurance is optional coverage and is not required by any state as part of your car insurance policy. Gap insurance is oftentimes required when financing or leasing a car. Drivers who own their car outright and drivers who owe less on their car than its current actual cash value (as there is not a gap in value) do not need gap insurance, but will still need car insurance coverage to help keep them and their car protected from the unexpected. The goal of gap insurance is to protect new vehicle owners and lessees from the gap between an outstanding loan or lease balance and a vehicle�s actual value in a total loss accident or a theft situation. (h)(1) “ guaranteed asset protection ” (gap) insurance means insurance in which a person agrees to indemnify a vehicle purchaser or lessee for some or all of the amount owed on the vehicle at the time of an unrecovered theft or total loss, after credit for money received from the purchaser�s or lessee�s physical damage insurer, pursuant to the terms of a loan, lease.

Source: home-decor-designs.blogspot.com

Source: home-decor-designs.blogspot.com

Gap insurance is often required as part of a lease contract, and is commonly included in the lease agreement for a fee. To protect yourself in the case the vehicle is totaled, there is a product called gap insurance. Under these two insurance types, insurers typically pay out your car’s actual cash value (acv or fair market value) at the time of the incident, up to your policy’s limits. Gap insurance, however, is not required by law. Dealers charge high dollars for gap insurance, so you may be better off looking around.

Source: insurify.com

Source: insurify.com

Otherwise, you may face a tax penalty when you file your tax return. That doesn’t mean it can’t be required as a condition of your financing, however. Drivers who own their car outright and drivers who owe less on their car than its current actual cash value (as there is not a gap in value) do not need gap insurance, but will still need car insurance coverage to help keep them and their car protected from the unexpected. Otherwise, you may face a tax penalty when you file your tax return. Otherwise, you probably won�t be forced to obtain the coverage.

Source: fanni-azenblogom.blogspot.com

Source: fanni-azenblogom.blogspot.com

However, just because gap insurance is required does not mean it is automatically included in your lease. This is required until the vehicle is paid in full, and then the extra coverage becomes optional. Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car�s depreciated value. A gap contract should cost between $300 and $800, which will be rolled into your vehicle loan. Gap insurance makes up the difference between what a person owes on a vehicle and that vehicle’s actual cash value if there’s an accident and.

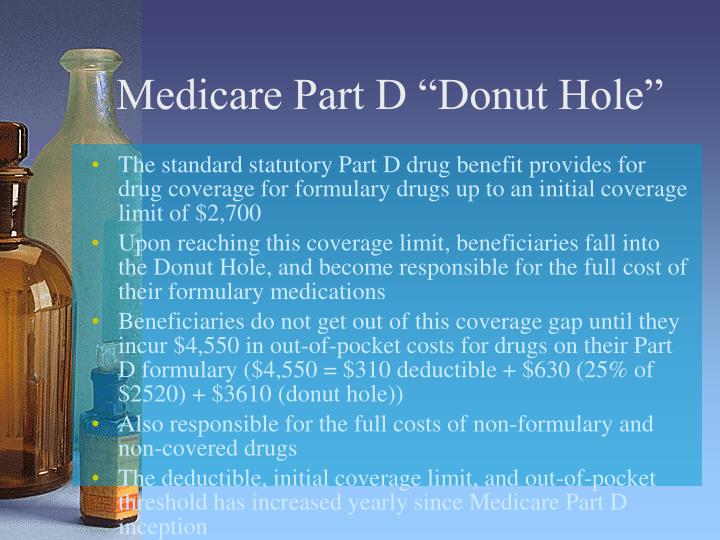

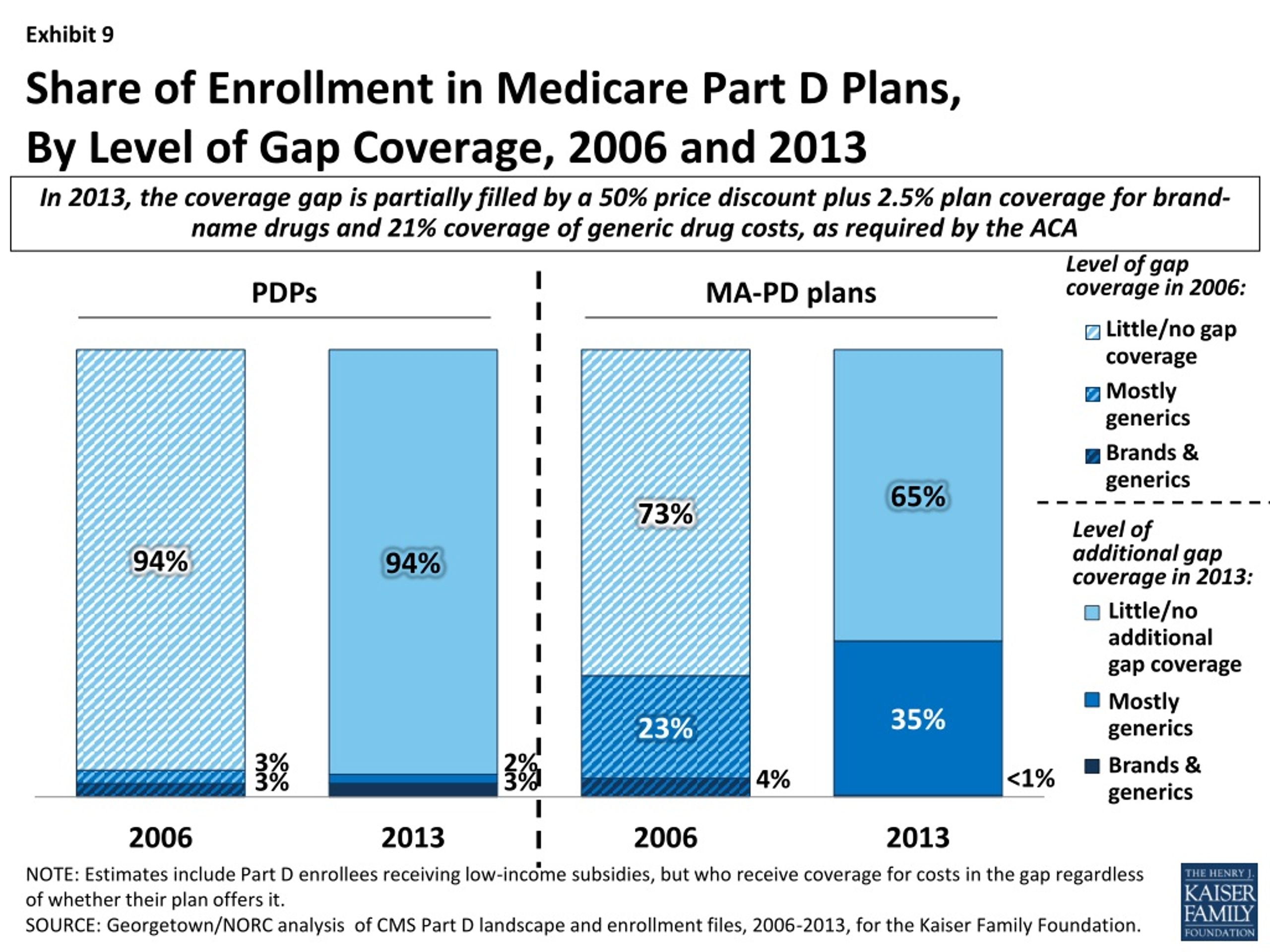

Source: slideserve.com

Source: slideserve.com

Under the affordable care act, this gap ins. Otherwise, you probably won�t be forced to obtain the coverage. When you take out a loan for a car, keep in mind that because you will be receiving a larger loan, the smaller your down payment, the more important gap insurance becomes. It protects you from financial losses related to damage your car causes to others or their property. Check with your own insurance agent for a quote.

Source: marketwatch.com

Source: marketwatch.com

Your loan or lease lender might require gap insurance, but you’ll have to check with your lender to find out. To find out if gap insurance is included in your car lease, you need to read the lease carefully and ask the lessor if gap insurance is required and if so how it is to be handled. To protect yourself in the case the vehicle is totaled, there is a product called gap insurance. Dealers charge high dollars for gap insurance, so you may be better off looking around. Otherwise, you probably won�t be forced to obtain the coverage.

Source: tamathitakia.blogspot.com

Source: tamathitakia.blogspot.com

Check with your own insurance agent for a quote. If your vehicle is totaled and you still owe a balance, the gap insurance. Under the affordable care act, this gap ins. Otherwise, you may face a tax penalty when you file your tax return. That doesn’t mean it can’t be required as a condition of your financing, however.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title is gap insurance required in california by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.