Is insurance higher on a lease Idea

Home » Trend » Is insurance higher on a lease IdeaYour Is insurance higher on a lease images are ready. Is insurance higher on a lease are a topic that is being searched for and liked by netizens today. You can Get the Is insurance higher on a lease files here. Find and Download all free images.

If you’re searching for is insurance higher on a lease images information connected with to the is insurance higher on a lease interest, you have visit the right blog. Our website always gives you hints for refferencing the highest quality video and picture content, please kindly surf and locate more informative video content and images that match your interests.

Is Insurance Higher On A Lease. Ground rent this is a fee you pay to your freeholder as a condition of the lease for the land your home is on. The best place to get affordable car insurance is with allstate. With various good driver and loyalty discounts,. With allstate, you’re in good hands.

Lease vs Rent What�s the Difference? SmartAsset From smartasset.com

Lease vs Rent What�s the Difference? SmartAsset From smartasset.com

So, if you intend to lease and the insurance coverage requirements are higher than you currently have, you can nearly always get the higher level of insurance at about the same rate as you are currently paying by simply investing a little time shopping and comparing quotes from a few other insurance companies, asking for discounts that you already qualify for, and. Gap insurance helps pay off your auto loan if you�re under water on the loan and the car you�re leasing is totaled. Ground rent this is a fee you pay to your freeholder as a condition of the lease for the land your home is on. The best place to get affordable car insurance is with allstate. Depending on what is required, the cost of insurance for a leased car may be noticeably higher than the cost to insure a car that you own. Options for getting out of a car lease.

With various good driver and loyalty discounts,.

But before you take out a new policy, it’s worth checking if you can transfer any insurance from a previous lease car. Each car is assigned an insurance group number (the lowest being 1 and highest being 50) which depicts the cost of insuring the vehicle. What insurance coverage amounts are required for my leased vehicle? Carsdirect also notes that insurance companies don�t tend to change your rate depending on whether you purchase or lease your vehicle. Some insurers may consider a leased car to be a higher risk than a purchased car. With various good driver and loyalty discounts,.

Source: dallasnews.com

Source: dallasnews.com

Either way, you will have to pay for a full coverage policy. Options for getting out of a car lease. Leasing a vehicle usually costs more to insure than a vehicle you own lease car insurance requirements state that when you lease a vehicle you need to carry at least $100k per person bodily injury liability coverage, $300k total bodily injury liability coverage if multiple people are injured, and$50k property damage liability. Although the cost of insurance for a leased vehicle may be higher, you could qualify for discounts through your insurance provider. Insurance requirements for a leased car.

Source: allanblockinsurance.com

Source: allanblockinsurance.com

These additional requirements can make leasing a car more costly than you expected. While your car insurance quote won�t differ based on whether you are leasing or buying, the leasing company may require you to include collision and comprehensive coverage.these coverages are optional, but if you lease a vehicle, the company you lease from remains the titleholder, and it. Each car is assigned an insurance group number (the lowest being 1 and highest being 50) which depicts the cost of insuring the vehicle. This could be a factor in the decision you make about the car. Ground rent this is a fee you pay to your freeholder as a condition of the lease for the land your home is on.

Source: autoleasecompare.com

Source: autoleasecompare.com

So, if you intend to lease and the insurance coverage requirements are higher than you currently have, you can nearly always get the higher level of insurance at about the same rate as you are currently paying by simply investing a little time shopping and comparing quotes from a few other insurance companies, asking for discounts that you already qualify for, and. Some companies offer discounts for loyal customers, good drivers. So if you drive your camaro zl1 through a brick outhouse, they’ll get a check from the insurance company within days. Every car lease deal on our website has its insurance group listed as shown below, so you can get a quick idea of insurance costs when comparing models. By law, you must have car insurance in place for your leased car before you drive it away from the dealership or leasing office.

Source: dreamstime.com

Source: dreamstime.com

If you lease a vehicle, you will need collision and comprehensive coverage. If you lease a vehicle, you will need collision and comprehensive coverage. Though it may cost more to insure a leased car because of more coverage requirements, you may be eligible for car insurance discounts. Because most leasing companies will require you to purchase a comprehensive auto insurance policy, insuring a leased car is often more expensive than insuring a car you own outright. How much is insurance on a leased car?

Source: vampiria-bride.blogspot.com

Source: vampiria-bride.blogspot.com

Most auto leasing companies require higher levels of insurance coverage, with averages of: If you lease a vehicle, you will need collision and comprehensive coverage. While your car insurance quote won�t differ based on whether you are leasing or buying, the leasing company may require you to include collision and comprehensive coverage.these coverages are optional, but if you lease a vehicle, the company you lease from remains the titleholder, and it. Instead, leasing companies require higher insurance on the front end, with them listed as the payee. Typically, ground rent can be up to around £400 a year, but it could be more depending on the terms of your lease.

Source: cars.usnews.com

Source: cars.usnews.com

Higher insurance for leased cars isn’t just about protecting the value of the car, either. Either way, you will have to pay for a full coverage policy. Combined single limit of $500,000 for bodily injury and property damage for any one accident. Although the cost of insurance for a leased vehicle may be higher, you could qualify for discounts through your insurance provider. With various good driver and loyalty discounts,.

Source: gardenstateloans.com

Source: gardenstateloans.com

If you lease a vehicle, you will need collision and comprehensive coverage. Most will have insurance pay you the difference but some (usually higher end cars) will keep it for themselves. Most auto leasing companies require higher levels of insurance coverage, with averages of: Typically, ground rent can be up to around £400 a year, but it could be more depending on the terms of your lease. That’s because you need to meet minimum auto insurance standards wherever you’re leasing as well as any additional requirements your lessor has, like comprehensive and collision coverage.

Source: leaselock.com

Source: leaselock.com

When you lease, you�re typically required to pay for high levels of insurance coverage. These additional requirements can make leasing a car more costly than you expected. Insurance coverages may be included with your car lease many leasing companies automatically include gap coverage in your lease payments, says the iii. A car lease will allow you to buy more car than you can afford. On a lease its up to your lease company on if they will keep the extra over the value or if its due to you.

Source: revisi.net

Source: revisi.net

How much is insurance on a leased car? Because most leasing companies will require you to purchase a comprehensive auto insurance policy, insuring a leased car is often more expensive than insuring a car you own outright. While your car insurance quote won�t differ based on whether you are leasing or buying, the leasing company may require you to include collision and comprehensive coverage.these coverages are optional, but if you lease a vehicle, the company you lease from remains the titleholder, and it. Generally, insurance providers see the insurance of a landlord’s property which he intends to rent as a higher risk because the policy holder does not intend to reside at the property. Every car lease deal on our website has its insurance group listed as shown below, so you can get a quick idea of insurance costs when comparing models.

Source: smartasset.com

Source: smartasset.com

A car lease will allow you to buy more car than you can afford. Is car insurance higher for leased cars? By law, you must have car insurance in place for your leased car before you drive it away from the dealership or leasing office. Every car lease deal on our website has its insurance group listed as shown below, so you can get a quick idea of insurance costs when comparing models. Do i need car insurance for my leased car?

Source: carleasetips.com

Source: carleasetips.com

Put an additional driver on the policy. Instead, leasing companies require higher insurance on the front end, with them listed as the payee. Either way, you will have to pay for a full coverage policy. Every car lease deal on our website has its insurance group listed as shown below, so you can get a quick idea of insurance costs when comparing models. If you lease a vehicle, you will need collision and comprehensive coverage.

Source: carsplan.com

Source: carsplan.com

What insurance coverage amounts are required for my leased vehicle? Carsdirect also notes that insurance companies don�t tend to change your rate depending on whether you purchase or lease your vehicle. Some insurers may consider a leased car to be a higher risk than a purchased car. But before you take out a new policy, it’s worth checking if you can transfer any insurance from a previous lease car. Because most leasing companies will require you to purchase a comprehensive auto insurance policy, insuring a leased car is often more expensive than insuring a car you own outright.

Source: fnb-online.com

Source: fnb-online.com

How much is insurance on a leased car? Typically, ground rent can be up to around £400 a year, but it could be more depending on the terms of your lease. If you lease a vehicle, you will need collision and comprehensive coverage. Although the cost of insurance for a leased vehicle may be higher, you could qualify for discounts through your insurance provider. When you lease, you�re typically required to pay for high levels of insurance coverage.

Source: carretro.blogspot.com

Source: carretro.blogspot.com

Gap insurance helps pay off your auto loan if you�re under water on the loan and the car you�re leasing is totaled. Some insurers may consider a leased car to be a higher risk than a purchased car. So if you drive your camaro zl1 through a brick outhouse, they’ll get a check from the insurance company within days. So, if you intend to lease and the insurance coverage requirements are higher than you currently have, you can nearly always get the higher level of insurance at about the same rate as you are currently paying by simply investing a little time shopping and comparing quotes from a few other insurance companies, asking for discounts that you already qualify for, and. Whether you’re driving a leased or bought car, you still need car insurance.

Source: businesslease.ro

Source: businesslease.ro

Cars in a lower group will be cheaper to insure than models that are more powerful, are larger in size, and higher in value. Put an additional driver on the policy. But before you take out a new policy, it’s worth checking if you can transfer any insurance from a previous lease car. Whether you’re driving a leased or bought car, you still need car insurance. Insurance options for bought vs.

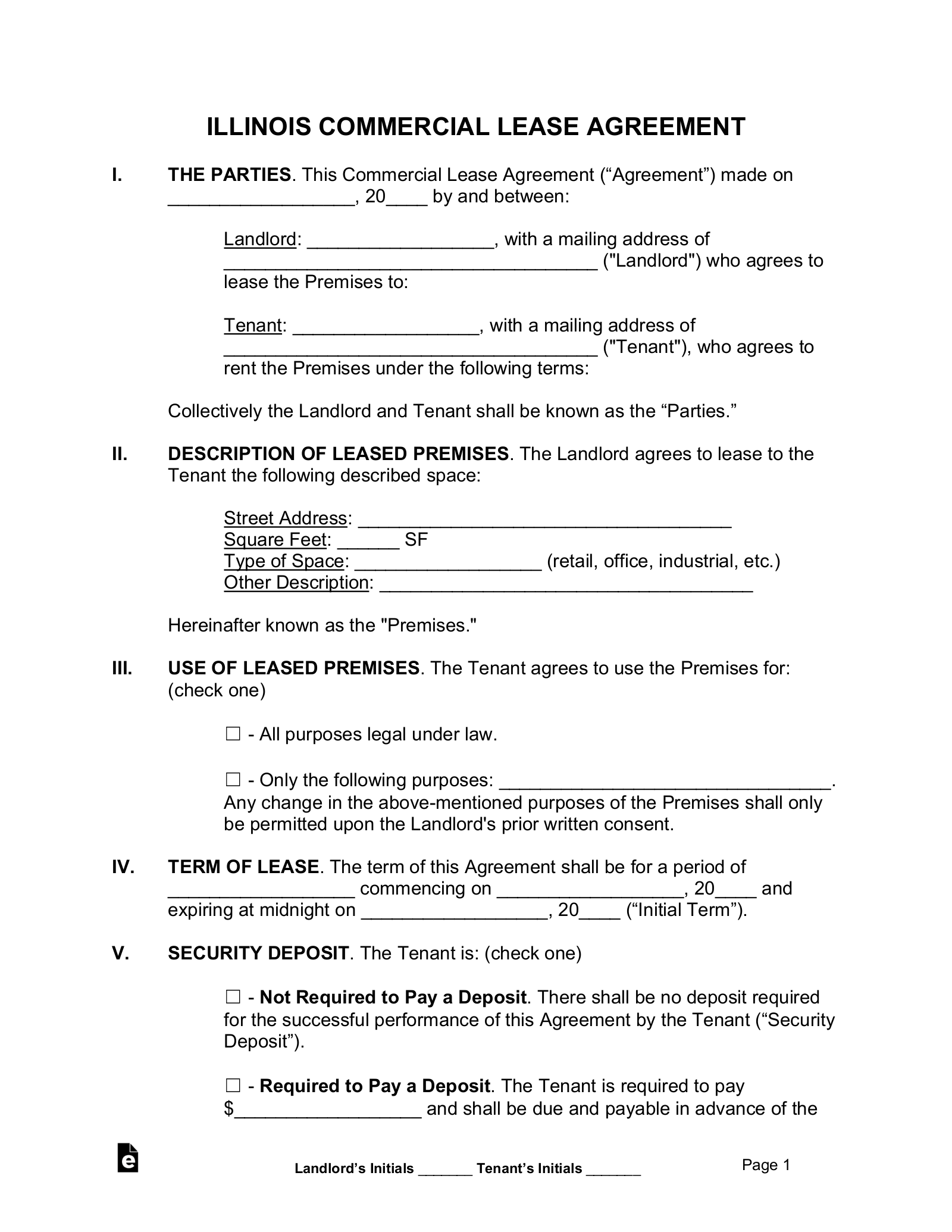

Source: eforms.com

Source: eforms.com

Once you get the demand for ground rent, you must pay it, otherwise your freeholder could take legal action against you. This could be a factor in the decision you make about the car. With various good driver and loyalty discounts,. Depending on what is required, the cost of insurance for a leased car may be noticeably higher than the cost to insure a car that you own. Instead, leasing companies require higher insurance on the front end, with them listed as the payee.

Source: vampiria-bride.blogspot.com

Source: vampiria-bride.blogspot.com

So if you drive your camaro zl1 through a brick outhouse, they’ll get a check from the insurance company within days. By law, you must have car insurance in place for your leased car before you drive it away from the dealership or leasing office. So if you drive your camaro zl1 through a brick outhouse, they’ll get a check from the insurance company within days. With various good driver and loyalty discounts,. While your car insurance quote won�t differ based on whether you are leasing or buying, the leasing company may require you to include collision and comprehensive coverage.these coverages are optional, but if you lease a vehicle, the company you lease from remains the titleholder, and it.

Source: quotewizard.com

Source: quotewizard.com

Insurance options for bought vs. Insurance requirements for a leased car. Most states require you to have liability insurance at a minimum (that’s the coverage that protects you if you damage someone else’s property or cause injuries with your car). Though it may cost more to insure a leased car because of more coverage requirements, you may be eligible for car insurance discounts. If you lease a vehicle, you will need collision and comprehensive coverage.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title is insurance higher on a lease by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.